How much money do you get for each child on taxes

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

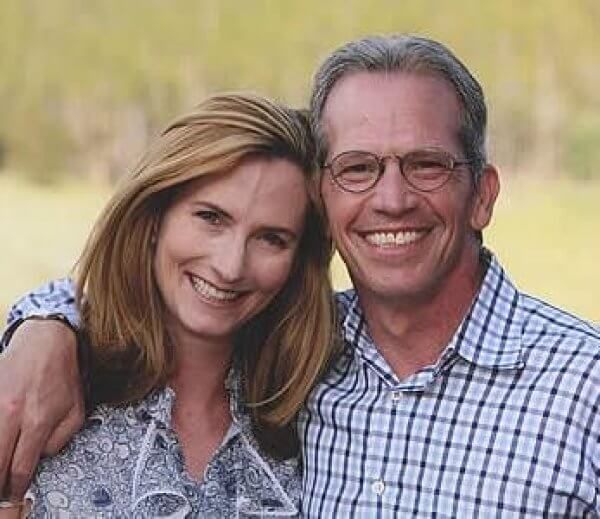

Alex & Casey

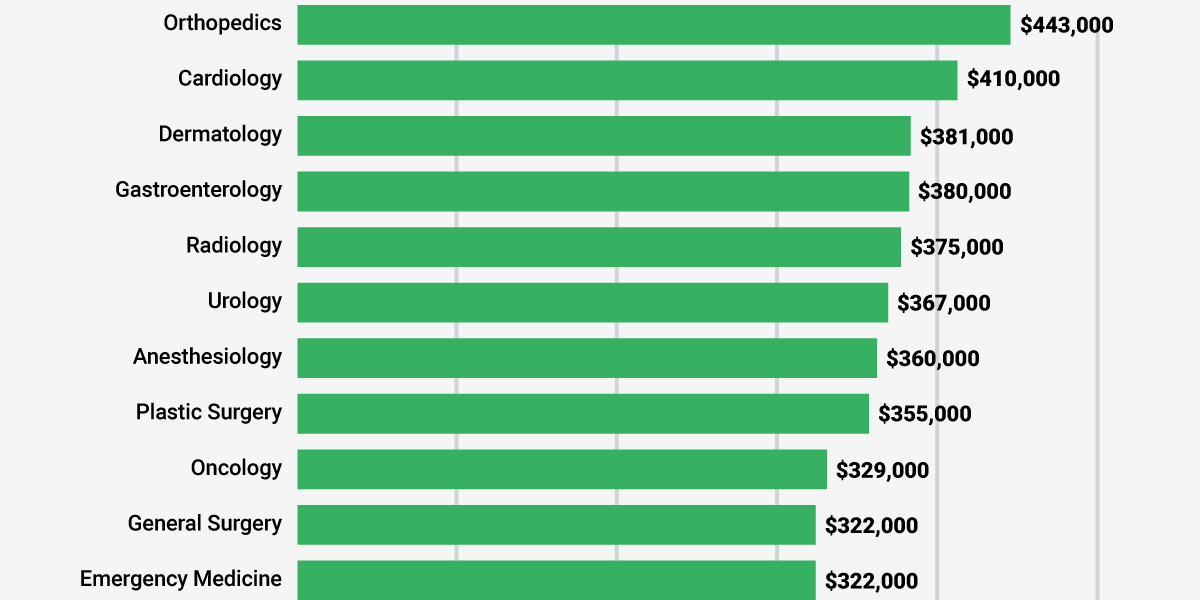

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $2,000 for each qualifying child. To get a Child Tax Credit refund, you must earn more than $2,500.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. Eligible parents and caregivers can claim a credit up to $2,000 for each child under 17 on their tax return.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

- Can I still get the 2021 Expanded Child Tax Credit?

Depending on your income and family size, the CTC is worth up to $2,000 per qualifying child. Up to $1,500 is refundable. CTC amounts start to phase-out when you make $200,000 (head of household) or $400,000 (married couples). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

Up to $1,500 is refundable. CTC amounts start to phase-out when you make $200,000 (head of household) or $400,000 (married couples). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you can get up to $1,500 back in your tax refund.

There are three main requirements to claim the CTC:

- Income: You need to have more than $2,500 in earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be under 17 on December 31, 2022.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be continuous. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an ITIN who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

File a 2022 tax return with Schedule 8812 “Additional Child Tax Credit.”

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. These include Volunteer Income Tax Assistance (VITA), GetYourRefund.org and MyFreeTaxes.com.

Yes. It’s not too late to claim your 2021 Expanded Child Tax Credit if you haven’t already. To claim your 2021 Child Tax Credit, you must file a 2021 tax return by April 18, 2025. If you filed a 2021 tax return but didn’t get the Child Tax Credit and were eligible for it, you can amend your tax return.

Contact your local Volunteer Income Tax Assistance (VITA) site to see if they file 2021 tax returns. You can also use GetYourRefund.org.

Learn more about filing prior year tax returns.

The latest

By Tatiana Johnson Friday, January 27, 2023, marks the 17th annual Earned Income…

By Tatiana Johnson To provide on-going relief due to COVID, the government passed…

Yes, you can still file taxes without a W-2 or 1099. Here's how.

Here's how.

Taxation

In Finland, taxes are withheld from wages and other income. The amount of taxes depends on the amount of your income. If you come to work in Finland from abroad, the form of taxation depends on how long you stay in Finland and whether your employer is a Finnish or foreign company.

- Form of taxation if you come to Finland to work

Taxes are charged on both the income of an individual (ansiotulo) and capital income (pääomatulo). Personal income tax and capital income tax are paid differently. Capital income refers to income that is based on the accumulation of wealth. Other income refers to the income of an individual. nine0003

In Finland, it is necessary to pay taxes not only when receiving wages, but also, for example, in connection with the receipt of the following income:

- compensation for work

- corporate income

- various social benefits, such as unemployment allowance, parental support and study allowance

- pensions

- income from capital, such as income from rent or transfer of property

State and municipalities finance, for example, from taxes:

- healthcare

- education

- pre-school education

- national defense.

Finland uses progressive income taxation. This means that higher wages are taxed more than lower wages. The tax rate (veroprosentti) determines the amount of tax on your income. In Finland, the tax rate is calculated for each individual. Your marriage partner's income does not affect your tax rate. You can calculate your tax rate using the IRS calculator. nine0003

If you receive wages, your employer withholds tax directly from your wages and pays it to the tax authority. To do this, the employer needs your tax card. A tax card (verokortti) is a document that shows your tax rate. At the end of each year, the Tax Administration checks whether you have paid enough income tax. If you have paid more taxes than were actually due, you will receive a tax refund (veronpalautus). If you have not paid the tax amount, you will need to pay the residual tax (jäännösvero). nine0003

For more information, see Tax Return and Notice of Tax Due.

Check your payslip (palkkalaskelma) and tax return (veroilmoitus) to see if your employer withheld tax from your salary and transferred it to the tax authority. Save the payslip.

Save the payslip.

In addition to tax, your employer deducts compulsory insurance contributions from your wages, for example in case of unemployment or sickness.

If you stay in Finland for a maximum of six months and your employer is a foreign company, you do not normally have to pay taxes in Finland. If your employer is a Finnish company or a foreign company with a Finnish branch, you must pay taxes in Finland. You can apply for progressive tax treatment if you live in a country in the European Economic Area, or in a country with which Finland has a tax treaty. Otherwise, you will pay non-resident income tax (lähdevero) of 35% from your salary, for which you need a non-resident tax card. nine0003

If you are health insured in Finland, the Tax Administration will collect the employee's health insurance premium from you. You do not need to pay health insurance premiums in Finland if you have an A1 certificate or other similar certificate that proves that you are insured in your country of residence.

If you move from Finland, you must apply for a change of address to the Digital Information and Population Records Agency within a week of moving. The move must also be separately notified to the Tax Administration. nine0002 Finnish English

Link to the external resourceposti

Mistress on the external resource

Finnish English English

Local information

View information about their municipality

Tax deduction-Raiffeisenbank Blog Returns the part of the Updissens. tax. Every child under 18 is entitled to a standard tax deduction. For the first and second child - 1400 ₽ per month, for subsequent children - 3000 ₽. Article 218 of the Tax Code of the Russian Federation

If, after the age of majority, the child studies full-time as a student, graduate student, resident, intern or cadet, then he can receive a deduction for him until he turns 24 years old.

By law, older children are counted on a priority basis. For example, you have two older adults and independent children, for whom you no longer receive a deduction, but for a third schoolchild, the deduction will still be 3,000 ₽.

For example, you have two older adults and independent children, for whom you no longer receive a deduction, but for a third schoolchild, the deduction will still be 3,000 ₽.

If the spouses have a child from early marriages, then their joint child will be considered the third. nine0003

Who is entitled to the deduction

Citizens who officially support children can receive a tax deduction:

- blood parents,

- stepfather / stepmother,

- adoptive parents,

- guardians,

- trustees,

- parents deprived of parental rights if they continue to participate in the maintenance of the child - letter of the Federal Tax Service dated 13.01.2014 No. BS-2-11/13@.

Each parent can exercise the right to the deduction. A necessary condition for this is official income, from which 13% income tax is paid. nine0003

Non-working mothers, students, pensioners, individual entrepreneurs on the simplified tax system, UTII or patent do not pay income tax, therefore they will not be able to use the tax deduction. And individual entrepreneurs on the general taxation system pay personal income tax, therefore they have the right to a deduction.

And individual entrepreneurs on the general taxation system pay personal income tax, therefore they have the right to a deduction.

Double deduction

Single parent, guardian, adoptive parent, custodian or adoptive parent receives double the deduction. The basis for double deduction will be:

- death of a parent;

- legal fact of missing;

- the actual absence of the father from the birth of the child: a dash in the column "father" in the birth certificate or an entry from the words of the mother;

- deprivation of the second parent of parental rights if he does not participate in the maintenance of the child.

But divorced parents are not entitled to a double deduction even in case of non-payment of alimony.

Deduction for a disabled child

If you are raising a child with a disability of the first or second group, then the amount of the tax deduction is higher:

- 12,000 ₽ - if you are a parent, parent's spouse or adoptive parent;

- 6000 ₽ - if you are a guardian, guardian, foster parent, spouse of a foster parent.

Increased and basic deductions are summed up. This means that if your second child is disabled, then the tax deduction for him will be: 1400 + 12,000 = 13,400 ₽.

If a disabled child was born the third or subsequent, then the amount of the deduction for him: 3,000 ₽ + 12,000 ₽ = 15,000 ₽, and the total deduction for three children will be: 1,400 ₽ + 1,400 ₽ + 15,000 ₽ = 17,800 ₽. nine0003

How much I will save

The law provides not for the return of the indicated amounts, but for the reduction of the taxable base by these amounts. This means that each of the parents can save per month:

- per child: 1 400 × 13% = 182 ₽

- for two children: (1,400 + 1,400) x 13% = 364 ₽

- for three children: (1,400 + 1,400 + 3,000) x 13% = 754 ₽

- for four children: (1,400 + 1,400 + 3,000 + 3,000) x 13% = 1144 ₽

- for the first or second disabled child: (12,000 + 1,400) x 13% = 1,742 ₽

- for a third or subsequent disabled child: (12,000 + 3,000) x 13% = 1,950 ₽

Example.

Evgenia has three children - 11, 8 and 5 years old. Her salary is 40,000 ₽. If she has not filed an application for a tax deduction for children, then the employer calculates personal income tax at 13% of the total amount of income: 40,000 ₽ x 13% = 5,200 ₽, and will pay 34,800 ₽ in her hands.

If Evgenia has submitted an application and documents for a child deduction, then the tax will be calculated not from the entire amount, but minus the tax-free amounts for children:

personal income tax = (40,000 ₽ - 1400 ₽ - 1400 ₽ - 3000 ₽) x 13% = 4446 ₽.

Evgeny will receive 35,554 ₽, which is 754 ₽ more.

How to get a deduction

It's not difficult. Write an application addressed to the employer for a standard tax deduction for children and attach copies of documents for the deduction:

- passport;

- birth or adoption certificate of a child;

- certificate of the child's disability, if necessary;

- certificate from an educational institution stating that the child is a full-time student if the child is a student.

nine0006

nine0006

If you are a single parent:

- death certificate of the other parent;

- extract from the court decision on recognizing the second parent as missing;

- certificate of the birth of a child, compiled from the words of the mother at her request in the form No. 25 - Decree of the Government of the Russian Federation of October 31, 1998 No. 1274.

If you are a guardian or guardian:

- decision of the guardianship or guardianship authority or an extract from the decision to establish guardianship or guardianship over the child; nine0006

- agreement on the implementation of guardianship or guardianship;

- agreement on foster family.

The deduction can only be made with one employer, even if you work at several jobs at the same time. The application is submitted once. Only a certificate of a child's full-time education at an educational institution is updated annually if he is already 18 years old.

Maximum amount for deduction

The law protects the interests of low-income citizens, therefore, it contains a limitation - the deduction for children is provided until the amount of your income for the current year exceeds 350,000 ₽. nine0003

Example.

The amount of 5800 ₽ will be deducted from Evgenia's salary before taxation from January to August inclusive. In August, taxable income for the current year will reach 350,000 ₽, so from September until the end of the year, tax will be calculated on the entire amount. And from the new year, Evgenia will again receive a deduction.[/framegrey]

How to return the deduction if it was not provided

tax return to the tax office at the place of residence, but only for the last three years. nine0003

Submit to the tax authority at the place of residence a completed tax return with an application for a standard tax. At the same time, you need to:

- At the end of the year, fill out a tax return in the form 3-NDFL.