How much money do you get back on taxes for one child

The Child Tax Credit - The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

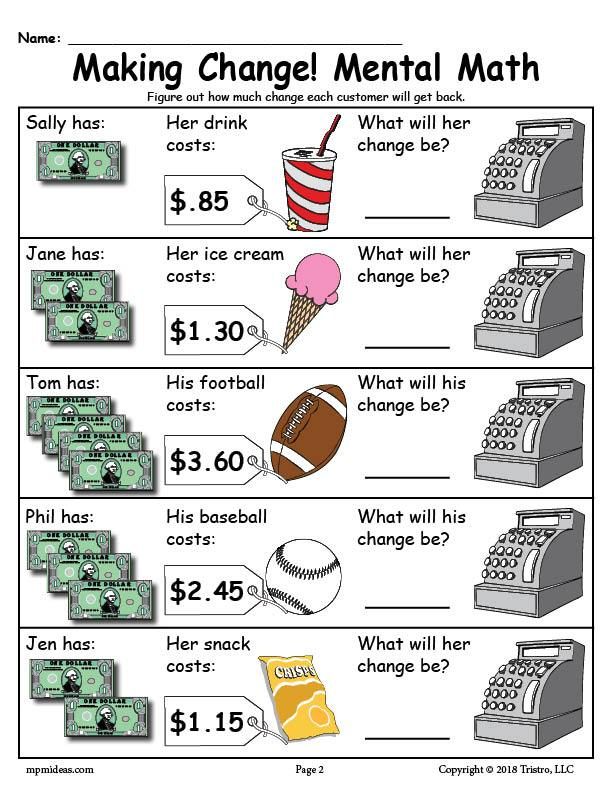

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required). - Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

How much money can be transferred to relatives and friends?

Do I need to report money transfers sent to friends, family and colleagues on my income tax return? And in what cases is it necessary to pay income tax from the population?

When filing an income tax return, questions often arise as to whether remittances received from relatives, friends and acquaintances need to be declared. In what cases should you not worry about this, and in which incomes should you not only declare, but also pay personal income tax for them? We propose to consider different situations and sort them out together with the head of the Swedbank Institute of Finance Reinis Jansons and tax consultants of the State Revenue Service.

In what cases should you not worry about this, and in which incomes should you not only declare, but also pay personal income tax for them? We propose to consider different situations and sort them out together with the head of the Swedbank Institute of Finance Reinis Jansons and tax consultants of the State Revenue Service.

Situation: My friends and I are raising money for a joint trip, using my account for this, since it is much more profitable to buy tickets for a group at once than separately. Do I have to declare this amount and pay personal income tax on it?

As the head of the Swedbank Institute of Finance Reinis Jansons explains, the basis for the application of personal income tax is a transaction that brings a certain income. If friends chip in for something and one of them buys the thing, there is no income, unless the payer decides to keep the interest on the deal. “I can also advise you to make all transactions electronically and not throw away receipts for purchases, so that in case of questions you can confirm that the money was really collected and spent on the trip,” says Reinis Jansons. At the same time, the expert emphasizes that one private person, without any explanation, can transfer up to 1,425 euros per year to another person, unless this money is transferred as a reward for services rendered or economic activity.

At the same time, the expert emphasizes that one private person, without any explanation, can transfer up to 1,425 euros per year to another person, unless this money is transferred as a reward for services rendered or economic activity.

Situation: My account collects money for the class fund, from which we buy drinking water for children, purchase stationery for children and pay for extracurricular activities. Do I need to declare this amount?

State Revenue Service consultants explain that a private person only has to declare his income. In turn, if money intended for certain purposes is transferred to his account, and the account holder cannot use it for his personal needs, then this is not considered a way to generate income.

Situation: I borrowed 1,000 euros from a friend. Do I have to declare this amount?

A loan received from another person must be declared only if the loan amount exceeds 15,000 euros and the borrower is not related to this person by marriage or kinship up to the third generation. However, you do not have to pay tax on the declared loan. In this particular case, a loan in the amount of 1,000 euros does not need to be declared, and no tax needs to be paid on it either.

However, you do not have to pay tax on the declared loan. In this particular case, a loan in the amount of 1,000 euros does not need to be declared, and no tax needs to be paid on it either.

Situation: My life partner and I are not officially scheduled, but we regularly transfer large sums of money to each other, the total amount of which exceeds 1425 euros per year. Do we need to declare this money?

If the sender and the recipient of money are not married or related to the third generation * and this money is not used to pay for treatment or education, then they must be declared and personal income tax in the amount of 23% (from amounts exceeding 1425 euros).

True, the law provides for exceptions in which cases this amount does not need to be declared. In particular, if the sender and recipient of money are not connected by marriage or kinship (for example, neighbors, friends, etc.) and the money is transferred to pay for treatment and / or education. However, in this case, the recipient of the money must have documents proving that the money was spent specifically for these purposes.

However, in this case, the recipient of the money must have documents proving that the money was spent specifically for these purposes.

Situation: The husband works abroad and transfers part of his income to his wife every month. Should the wife declare these incomes?

As experts of the State Revenue Service explained, there is no need to pay tax if the sender and recipient of money are married or related to the third generation and the money is intended for household maintenance (for example, to pay utility bills, buy food and other goods, support children and etc.).

Money must be declared, but no tax must be paid if the amount of money transfers from one person exceeds 10,000 euros and the sender and recipient of money are related to the third generation in the understanding of the Civil Law, but they do not have a common household. Shared household means that all family members live together and jointly cover the costs associated with maintaining the respective housing.

* Parents, grandparents, great-grandparents, children, grandchildren, sisters, brothers, aunts, uncles and children of sisters/brothers).

Large family allowance - frequently asked questions

1. Which families will receive the large family allowance?

The right to receive the allowance for a large family is one of the parents, guardian or caregiver who brings up three or more children in the family who meet the conditions for receiving child allowance. Children under the age of 16 are entitled to receive child allowance, and in the case of a child studying - until he reaches 19years. If the child turns 19 in the current school year, the child allowance is paid until the end of the school year.

2. Is the allowance for a large family paid monthly or only once?

The allowance for a large family is paid monthly.

3. If our family already has three children, will our family receive this benefit?

Yes, one of the parents, a guardian or trustee who is raising three or more children in a family who receives child allowance as of 07/01/2017 has the right to receive benefits for a large family

4.

No, one of the parents, a guardian or trustee who is already raising three or more children in the family receiving child allowance as of 01.07.2017 has the right to receive the allowance for a large family. Is the allowance for a large family paid automatically, or will it be necessary to apply?

If before 01.07.2017 the family has three or more children for whom one person receives child allowance, no application is required.

If the third child is born in the family after 01.07.2017, in this case, it is required to submit an application for family benefit for the newborn and at the same time indicate the desire to receive the allowance for a large family.

The application can be submitted on the self-service portal of the Social Insurance Board. Application for parental benefit, family benefits and supplementary contributions to the mandatory funded pension.

6. To whose current account and on what date is the money transferred?

The money is paid automatically on the 8th day of each month to the person to whose current account child allowances have been transferred so far.

If you want to change the beneficiary of benefits, another person submits an application for granting benefits. The person who has received benefits so far gives his or her consent to withdraw from receiving benefits.

7. Are beneficiaries of parental benefit also entitled to family allowance?

Yes, receiving parental benefit does not limit the right to receive benefits for a large family.

8. If my spouse and I have 2 children from a joint marriage, and at the same time the spouse has one child from a previous life together, are we entitled to receive benefits for a large family?

The purpose of family allowances is to partially cover the costs associated with raising a child, so the allowance is paid to the parent who takes care of the child on a daily basis. Thus, it is important here that these parents bring up all three children on a daily basis. If there is a situation in which the same parent receives child allowance for a child from a previous marriage and for two children born in a new marriage, that parent will automatically receive the allowance for a large family.

Thus, it is important here that these parents bring up all three children on a daily basis. If there is a situation in which the same parent receives child allowance for a child from a previous marriage and for two children born in a new marriage, that parent will automatically receive the allowance for a large family.

It is important that the child allowances for all three children are issued to the same person.

9. Mother and father have 2 children in common. In addition, the mother / father has a child from a previous life together, who lives half the time in one family and half in another, while his hobby groups / clothes, etc. paid equally by parents. At the same time, the mother's/father's previous life partner(s) has two more children. What will happen in such a situation?

When determining family allowances, all children brought up in a family who are entitled to receive child allowance are taken into account. The family does not include children who live separately from this particular family with the other parent.

An exception is the situation in which, when the parents separate, the child lives equally in two families. In this case, the parents agree on which family the child is included in.

The Social Insurance Board does not have the authority to decide which family a child should be included in.

The right to receive the allowance for a large family is one of the parents who brings up three or more children in the family who meet the conditions for receiving child allowance. Children under the age of 16 are entitled to receive child allowance, and in the case of a child studying, up to the age of 19. If the child turns 19 in the current school year, the child allowance is paid until the end of the school year.

10. Is it possible to share between parents the receipt of child allowance and allowance for a large family?

No, the recipient of the child allowance and the family allowance must be the same person. The payment of child allowances and allowances for a large family is made to one current account chosen by the person.

11. Is it possible for one parent to receive child benefits for three or more children, and the other parent to receive benefits for a large family?

No, a parent, guardian or custodian, or other person who is eligible for child benefits for three or more children is eligible for Large Family Allowance.

12. If the third child is born, for example, on July 15, 2017, from what time does the right to receive benefits for a large family arise?

The right to receive benefits for a large family will arise from the moment of the birth of the third child, i.e. from 07/15/2017

13. Will the large family allowance affect the payment of the subsistence allowance paid by the social welfare department at the place of residence?

Yes, it will. The allowance for a large family is included in the family income when calculating the subsistence allowance. Therefore, in the future, this family may not qualify as a recipient of a subsistence allowance, or the amount of the assigned subsistence allowance may decrease.

14. If my husband and I have 3 children for two, while the spouse has 2 children from a previous life together, and I have 1 child. We do not have common children. All three children live with us, which means daily expenses on our part. Are we eligible for family allowance?

If the parents are legally married, then one of the spouses will be entitled to receive the large family allowance, despite the fact that there are no common children in the family.

15. If there are three children in a family and one of them, aged sixteen, has graduated from basic school and is going to study at a gymnasium in the fall, will the payment of benefits for a large family begin in July or in autumn? If the child is studying at a gymnasium, is there information about this or is special confirmation required?

In this case, the payment of the allowance for a large family will begin in July. Children under the age of 16 are entitled to receive child allowance, and in the case of a child studying, up to the age of 19. If the child turns 19 in the current academic year, the child allowance is paid until the end of the academic year. The beginning of the academic year is considered September 1st, and the end is August 31st, in case of graduation from the gymnasium - June 30th.

If the child turns 19 in the current academic year, the child allowance is paid until the end of the academic year. The beginning of the academic year is considered September 1st, and the end is August 31st, in case of graduation from the gymnasium - June 30th.

If the child is studying in Estonia, a study certificate is not required. We obtain information about studies from the Estonian Education Information System (EHIS). If the child is studying abroad, a certificate of study must be submitted annually to the Social Insurance Board.

16. My husband works in Finland and receives child benefits there for our children. I am a housewife, I live with children in Estonia. When will the allowance for a large family begin to be paid, how will our family allowances be paid in the future?

If the total amount of family benefits in Finland is less than the total family benefits in Estonia, Estonia will have to pay an additional benefit equal to the difference between the family benefits in Estonia and Finland.