How can i claim child benefit

Claim Child Benefit: How to claim

Skip to contents of guide

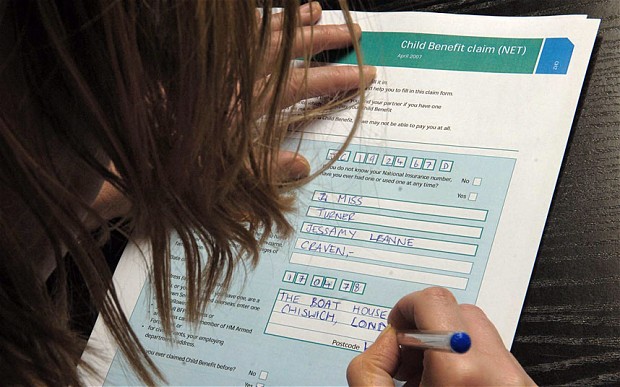

You can claim Child Benefit as soon as you’ve registered the birth of your child, or they come to live with you.

How long it takes

It can take up to 16 weeks to process a new Child Benefit claim (or longer if you’re new to the UK). Child Benefit can be backdated for up to 3 months.

Deciding who should claim

Only one person can get Child Benefit for a child, so you need to decide whether it’s better for you or the other parent to claim. The person who claims will get National Insurance credits towards their state pension if they are not working or earn less than £190 per week.

Make a claim for the first time

Fill in Child Benefit claim form Ch3 and send it to the Child Benefit Office. The address is on the form.

If your child is adopted, send their original adoption certificate with the form. You can order a new adoption certificate if you’ve lost the original.

If you do not have the adoption certificate you need, send your claim form now and send the certificate once you’ve got it.

If your child’s birth was registered outside the UK

When you send your claim form, include your child’s:

- original birth certificate

- passport or travel document used to enter the UK

If you’ve lost the original you can order a new birth certificate.

Your child’s documents will usually be returned within 4 weeks.

Add a child to an existing claim

Call the Child Benefit helpline if all of the following apply:

- your child is under 6 months old and lives with you

- your child was born in the UK

- your child’s birth was registered in England, Scotland or Wales more than 24 hours ago

- you’re a UK or Irish national and you’ve lived in the UK since the start of your claim

When you call, you’ll need your:

- National Insurance number

- child’s birth certificate

Child Benefit helpline

Telephone: 0300 200 3100

Welsh language: 0300 200 1900

Textphone: 0300 200 3103

Outside UK: +44 161 210 3086

Monday to Friday, 8am to 6pm

Find out about call charges

If you do not meet the criteria to add a child by phone

You’ll need to make a new claim by post. Fill in Child Benefit form Ch3 and send it to the Child Benefit Office. The address is on the form.

Fill in Child Benefit form Ch3 and send it to the Child Benefit Office. The address is on the form.

If you’re claiming for more than 2 children, also include the ‘additional children’ form.

If you registered the birth in Northern Ireland

You’ll need to send the birth certificate by post when you have it.

HM Revenue and Customs - Child Benefit Office

PO Box 1

Newcastle Upon Tyne

NE88 1AA

United Kingdom

Claiming Child Benefit for someone else

You may be able to manage someone else’s Child Benefit claim.

View a printable version of the whole guide

Claim Child Benefit for one or more children

-

The link to Claim Child Benefit (form (Ch3) fill in on screen) has been updated.

-

English and Welsh versions of form Ch3, Ch3 Notes and Ch3 (CS) have been updated for the 2022 to 2023 tax year.

-

Guidance has been updated to include English and Welsh versions of form Ch3, Ch3 Notes and Ch3 (CS) have been updated for 2021 to 2022 tax year changes.

-

English and Welsh versions of form Ch3, Ch3 Notes and Ch3 (CS) have been updated for 2020 to 2021 tax year changes.

-

Welsh translation has been added.

-

Address label added to English and Welsh print and post vesion of the form.

-

English and Welsh versions of form Ch3, Ch3 Notes and Ch3 (CS) have been updated for 2019 to 2020 tax year changes.

-

Added translation

-

Guidance on how to access the fill in on screen form has been updated.

-

Added translation

-

A new question 41 has been added and the 'Documents you may need to send us' and 'What you need to do now' sections have been updated on the Ch3 form.

-

This guidance has been updated to reflect 2017 to 2018 forms with new tax year changes effective from 6 April 2017.

-

Address label (Ch4) attached to bottom of Child Benefit claim form (Ch3): print then complete pdf.

-

English and Welsh version of form Ch3 and Ch3 Notes have been updated to reflect new tax year changes.

-

English and Welsh version of form Ch3, Ch3 Notes and Ch3 (CS) have been updated to reflect new tax year changes.

-

The Ch4 address label on the Ch3 has been adjusted so it's now on 1 page.

-

The 2015 to 2016 form has been added to this page.

-

New versions of forms Child Benefit claim form (Ch3): print then complete and Child Benefit: getting your claim right (Ch3 Notes).

-

Added translation

FAQ

Ask your own question

Cannot find 'faq' template with page 'detail'

Enter part of the name or address:

MFC Leninsky district

432017, Ulyanovsk region, Ulyanovsk, Goncharova st., 11MFC Zavolzhsky district

433000, Ulyanovsk region, Ulyanovsk, Sozidateley pr-kt, building 17a MFC Zasviyazhsky district

432013, Ulyanovsk obl. 54GMFC Zheleznodorozhny district (Lokomotivnaya 85)

432012, Ulyanovsk region, Ulyanovsk, Lokomotivnaya st., 85 MFC Zheleznodorozhny district (Minaeva 6)

432017, Ulyanovsk region, Ulyanovsk, Minaeva st. AMFTs of Melekessky district

433505, Ulyanovsk region, Dimitrovgrad, Oktyabrskaya street, 64 MFC of Novomalyklinsky district

433560, Ulyanovsk region, Novomalyklinsky district, Novaya Malykla s, Kooperativnaya street, 26MFC of Staromaynsky district

433460, Ulyanovsk region Staraya Maina rp, Builders street, 3MFC of Cherdaklinsky district

433400, Ulyanovsk region, Cherdaklinsky district, Cherdakly rp, Sovetskaya st. , 7MFTs Novoulyanovsk

, 7MFTs Novoulyanovsk

433300, Ulyanovsk region, Novoulyanovsk, Ulyanovskskaya st. Krasnoarmeyskaya st., 53MFC Ulyanovsky district

433310, Ulyanovsk region, Ulyanovsk district, Isheevka district, Lenina st.0005 433130, Ulyanovsk region, Mainsky district, Maina district, Chapaev street, 1MFC Terengulsky district

433360, Ulyanovsk region, Terengulsky district, Terenga district, Evstifeeva street, 3MFC Bazarnosyzgansky district

433700, Ulyanovsk region, Bazarnosgansky district , Bazarny Syzgan rp, Sovetskaya pl, 1MFC Inzensky district

433030, Ulyanovsk region, Inzensky district, Inza, Truda street, 28 AIFC Baryshsky district

433750, Ulyanovsk region, Barysh, Radishcheva street, 88 VMFTS Sursky district

433240 , Ulyanovsk region, Sursky district, Surskoe district settlement, Sovetskaya st.0005 433210, Ulyanovsk region, Karsunsky district, Karsun rp, Kuibyshev st., 40MFC Veshkaymsky district

433100, Ulyanovsk region, Veshkaimsky district, Veshkayma rp, Komsomolskaya st. , Kuzovatovo rp, Zavodskoy lane, 16MFTs Nikolaevsky district

, Kuzovatovo rp, Zavodskoy lane, 16MFTs Nikolaevsky district

433810, Ulyanovsk region, Nikolaevsky district, Nikolaevka rp, Lenina pl, 3MFC Novospassky district

433870, Ulyanovsk region, Novospassky district, Novospasskoe rp, Dzerzhinsky street, 2 DMFTS Pavlovsky district

433970, Ulyanovsk region, Pavlovsky district, Pavlovka district, Kalinina street, 24MFC of Radishevsky district

433910, Ulyanovsk region, Radishevsky district, Radishchevo district, Sovetskaya street, building 34MFC of Starokulatkinsky district

433940, Ulyanovsk region, Starokulatkinsky district n, Staraya Kulatka rp, Pionerskaya st., 30 OGKU "Government for citizens" (administrative and managerial personnel)

432017, Ulyanovsk region, Ulyanovsk, Goncharova st., 11MFC for business Ulyanovsk

432072, Ulyanovsk region, Ulyanovsk, Maksimova pr -d, 4MFC for business Dimitrovgrad 9Authorized person under the President of the Russian Federation on the rights of the child

The Office of the Commissioner for Children's Rights in the Novosibirsk Region, together with the specialists of the Pension Fund of Russia for NSO, provided clarifications on issues related to monthly allowances for children aged 8 to 17 years.

Question: Who is entitled to the monthly payment?

Answer: The payment is assigned to low-income families that raise children from 8 to 17 years old, subject to the following conditions:

• monthly income per person in the family does not exceed the regional subsistence minimum per capita;

• family property does not exceed the requirements for movable and immovable property;

• The applicant and children are citizens of the Russian Federation permanently residing in the Russian Federation.

One of the parents, adoptive parent or guardian of the child can apply.

Question: What is the procedure for granting benefits? What documents and where should the parent send in order to receive the payment?

Answer: To receive benefits, you only need to submit an electronic application through the State Services portal or contact the client service of the Pension Fund of Russia at the place of residence, you can also apply through the MFC.

You will need to provide additional information about income only if the family has military, rescuers, police officers or employees of another law enforcement agency, as well as if someone receives scholarships, grants or other payments from a scientific or educational institution.

Question: Can I receive benefits only on the Mir card?

Answer: Yes, the new payment will be credited to families only on Mir bank cards. It is important to remember that when filling out applications for payment, it is the details of the applicant's account that are indicated, and not the card number.

Question: How long does it take to receive payment after applying?

Answer: Consideration of the application takes 10 business days. In some cases, the maximum period will be 30 working days (if the Pension Fund has not received information on requests necessary to establish benefits). If the payment is denied, a notification of this is sent within 1 business day.

If the payment is denied, a notification of this is sent within 1 business day.

Funds are paid out within 5 business days after the decision on the purpose of payment is made. In the future, the transfer of funds is carried out from the 1st to the 25th day of the month following the month for which the allowance is paid.

Question: How do I get benefits?

Answer: In most cases, when applying for a payment, you only need to submit an application through your personal account on the State Services portal, in the PFR customer service at the place of residence or at the MFC. The Fund independently collects information about the income of the applicant and his family members as part of the program of interagency cooperation.

You will need to submit documents only if one parent (guardian, trustee) is a military man, rescuer, police officer or employee of another law enforcement agency, as well as if someone in the family receives scholarships, grants and other payments from a scientific or educational institution . When applying in person, you will need to present an identity document.

When applying in person, you will need to present an identity document.

Q: When can I apply for a payment?

Answer: You can apply from May 1, 2022 and onward at any time, but not before the child is 8 years old. For applications received before October 1 of the current year, the payment will be established from April 1. The payment is established for 12 months, but not more than until the child reaches the age of 17 years.

Question: Can I receive payment via Russian Post?

Answer: Yes, you can. To receive money through the post office, you need to mark the appropriate item in the application for payment, as well as indicate the address of the recipient and the number of the post office.

Question: Can I receive a payment if I already receive child support for single parents from 8 to 17 years old?

Answer: Yes, you can apply for a payment if, after calculating the average per capita family income, the new payment turns out to be more profitable in terms of amount, you will be assigned a new payment in an increased amount, that is, 75 or 100% of the regional subsistence minimum, taking into account previously paid benefits. In this case, the payment of the previous benefit will automatically stop.

In this case, the payment of the previous benefit will automatically stop.

Question: Is it possible to receive benefits without Russian citizenship?

Answer: No

Question: What payment details must be provided when submitting an application?

Answer: The application must include the applicant's bank account details: name of the credit institution or BIC of the credit institution, correspondent account, applicant's account number. The payment cannot be transferred to the account of another person. If the application was submitted with another person's bank details, you can submit a new application with your own bank details.

Important!

Payment will be credited only to Mir bank cards.

Question: Is there a monthly allowance for each child?

Answer: Yes, the allowance is paid for each child from 8 to 17 years old in the family.

Question: There are two children aged 8 to 17 in the family. Do I need to write an application for each child?

Answer: No, if there are two or more children from 8 to 17 years old in a family, one general application is filled out for each of them to receive a monthly payment. Two or more applications are not required in this case.

Question: My application was returned for revision, how long will it take to process it?

Answer: The term for consideration of the application is 10 business days. In your case, it has been suspended. If the revised application is received by the Fund within 5 working days, its consideration will be restored from the date of submission.

Question: How can I find out if a payment is due or not?

Answer: When submitting an application through the Public Services Portal, a notification about the status of its consideration will appear there. If the application was submitted personally at the client service of the Pension Fund of Russia or at the MFC, in the event of a positive decision, the funds will be transferred within the period established by law without additional notice to the applicant.

If the application was submitted personally at the client service of the Pension Fund of Russia or at the MFC, in the event of a positive decision, the funds will be transferred within the period established by law without additional notice to the applicant.

In the event of a denial, the applicant will be notified within 1 business day stating the reason for the denial.

Question: How long is the payment?

Answer: The allowance is assigned for one year and extended upon application. Its review takes 10 business days. In some cases, the maximum period will be 30 working days.

In 2022, applicants who lost their jobs after March 1, 2022 and registered with employment centers are subject to a special calculation of average per capita income. Such applicants receive benefits for 6 months. After this period, you can apply for benefits again.

Question: Does the payment depend on family income?

Answer: Yes, the payment is due to families whose monthly income per person does not exceed the subsistence level per capita in the region of residence. To calculate monthly income, you need to divide the annual family income by 12 months and the number of family members. Also, when assessing means, family property is taken into account and the “zero income rule” is used.

To calculate monthly income, you need to divide the annual family income by 12 months and the number of family members. Also, when assessing means, family property is taken into account and the “zero income rule” is used.

Question: What is the zero income rule?

Answer: The "zero income rule" assumes that the allowance is granted if adult family members have earnings (stipends, income from work or business, or pensions) or the lack of income is justified by objective life circumstances.

Question: Will the money be withheld if I have a debt under an executive document?

Answer: No

Question: I receive unemployment benefits. Will it be taken into account when calculating the average per capita income?

Answer: Yes, they will.

Question: Will a car bought on credit be considered when assessing the property?

Answer: Yes.

Question: I am a guardian. Can I receive benefits if the parents of the child have been deprived of parental rights?

Answer: Yes, you can.

Question: In my place of residence there is a local subsistence level. Will it be taken into account when calculating benefits?

Answer: Yes.

Question: How can I verify my actual place of residence if I do not have a residence registration?

Answer: The place of actual residence is determined by the place where the application for the allowance was submitted.

Question: What living wage will my income be calculated on if I have two registrations - at the place of residence and at the place of temporary stay?

Answer: In this situation, the subsistence minimum at the place of temporary stay will be taken into account.