How much is the child tax benefit in canada

What is the Canada Child Benefit?

December 2021 – 15 min read

Key takeaways

What’s in this article?

- An intro to the Canada Child Benefit (CCB)

- Who can claim the CCB?

- CCB payments explained

- How to apply for the CCB

- What's next?

An intro to the Canada Child Benefit (CCB)

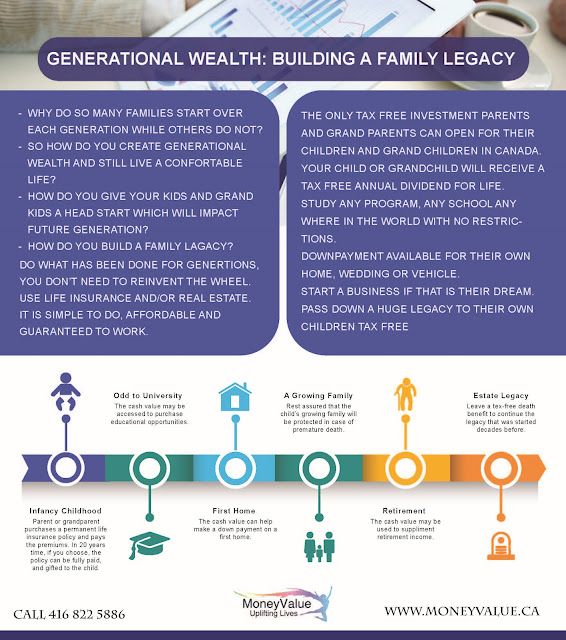

The CCB is a government benefitOpens in a new window that helps families in Canada with the costs of raising children.

Administered by the Canada Revenue Agency (CRA), it was introduced in July 2016 to replace the Universal Child Care Benefit (UCCB). The CCB provides eligible parents with children under the age of 18 a monthly, tax-free payment. The CCB could include the Child Disability Benefit (CDB)Opens in a new window and is payable on top of any other child benefits that might be offered at provincial or municipal level.

Who can claim the CCB?

You could be eligible to receive the CCB if you meet all the following criteria:

- You’re a resident of Canada for tax purposes

- You live with a child under 18 years of age

- You have primary responsibility for the child’s care and upbringing

You could be eligible to receive the CCB if you or your spouse or common-law is:

- A Canadian citizen or permanent resident

- A temporary resident who has lived in Canada for the previous 18 months

- A protected person

- An indigenous person

About primary responsibility

You should apply for the CCB if you’re considered “primarily responsible” for raising your child. That means being responsible for things such as:

- Supervising the child's everyday activities

- Taking care of their daily needs

- Taking care of any medical needs

- Arranging childcareOpens in a new window

Only 1 parent can apply for the CCB, and which parent does so will depend on your own family situation.

CCB payments explained

Based on CCB payments in 2021, you could receive a maximum of:

- $6,833 per year ($569.41 per month) for each eligible child under the age of 6

- $5,765 per year ($480.41 per month) for each eligible child aged 6 to 17

However, the amount you actually receive will depend on several factors, such as whether your child lives with you full or part time, your net family income, and the number of eligible children you have. You can use the government’s CCB calculatorOpens a new website in a new window - Opens in a new window to get an idea of what your payments might be.

Payments are recalculated every July. This is to account for inflation, as well as your family net income from the year before. For example, if there was a change in your income in 2021, this will be reflected in your payments starting in July 2022. If your total benefit amount for the year is less than $240, you’ll receive this as 1 lump sum payment in July instead of receiving it monthly.

This is to account for inflation, as well as your family net income from the year before. For example, if there was a change in your income in 2021, this will be reflected in your payments starting in July 2022. If your total benefit amount for the year is less than $240, you’ll receive this as 1 lump sum payment in July instead of receiving it monthly.

How to apply for the CCB

You should apply for the CCB as soon as any of these events happen:

- Your baby is born

- Your child starts to live with you after a period of living elsewhere

- Your custody arrangements change, or you are granted custody of a child

- You or your spouse or partner start to meet the criteria and become eligible

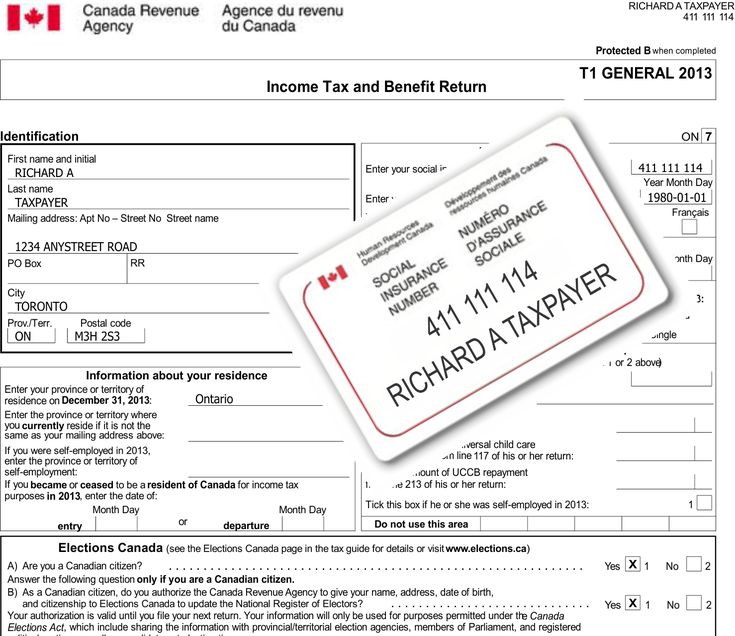

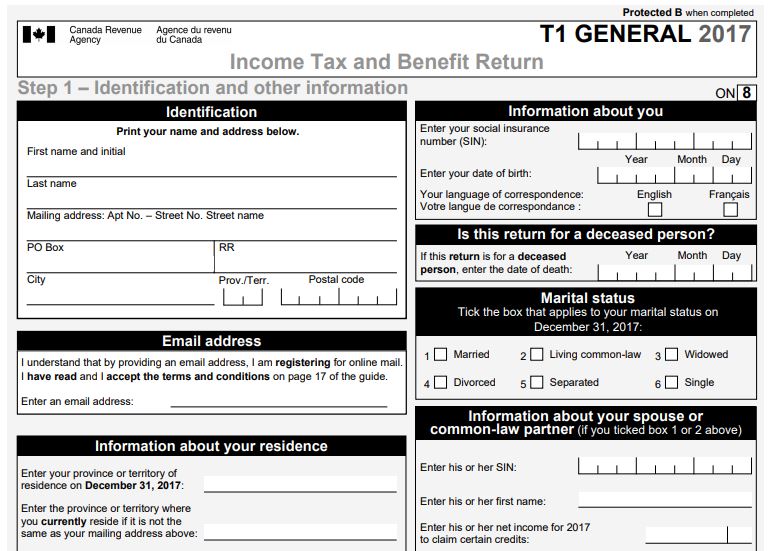

You can apply at the same time you register the birth of your baby with the province or territory, or afterwards using your CRA online account. You can also download and complete Form RC66, Canada Child Benefits ApplicationOpens a new website in a new window - Opens in a new window, and return this via mail along with any additional documents and forms required.

Your payments will start within 8 weeks of the government receiving your online application, or within 11 weeks of sending a paper application through the mail. The payments will stop when your child turns 18, or when your net family income exceeds the threshold of $120,000.

What’s next?

This material is for information purposes only and shouldn’t be construed as providing legal or tax advice. Every effort has been made to ensure its accuracy, but errors and omissions are possible. All comments related to taxation are general in nature and are based on current Canadian tax legislation and interpretations for Canadian residents, which are subject to change. For individual circumstances, consult with your tax, legal or accounting professionals. This information is provided by The Canada Life Assurance Company and is current as of date of publication.

Related articles

How do RESP contributions work?

What is an ETF?

How are RESPs taxed?

Canada Child Benefit: Rules and Payment Amounts

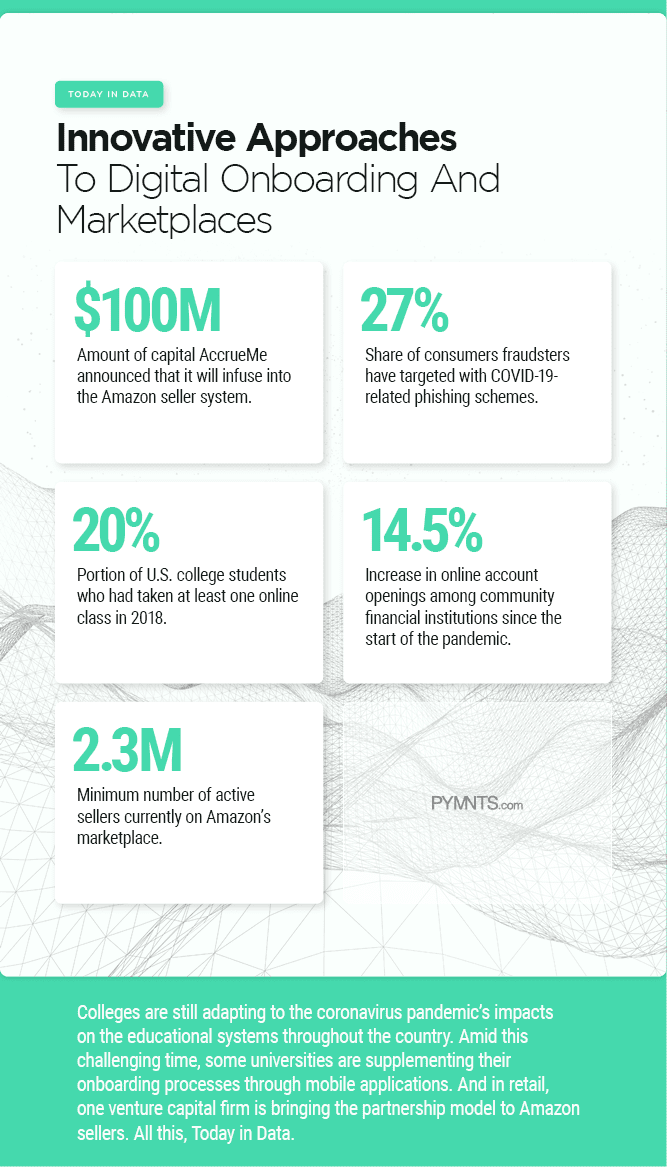

Raising kids can be expensive, but qualifying families can receive tax-free monthly payments from the government to help manage some of the costs.

Known as the Canada Child Benefit, the amount your family receives depends on factors like household income, family size, and your province or territory of residence. Fortunately, the process of applying for this assistance is quick and straightforward.

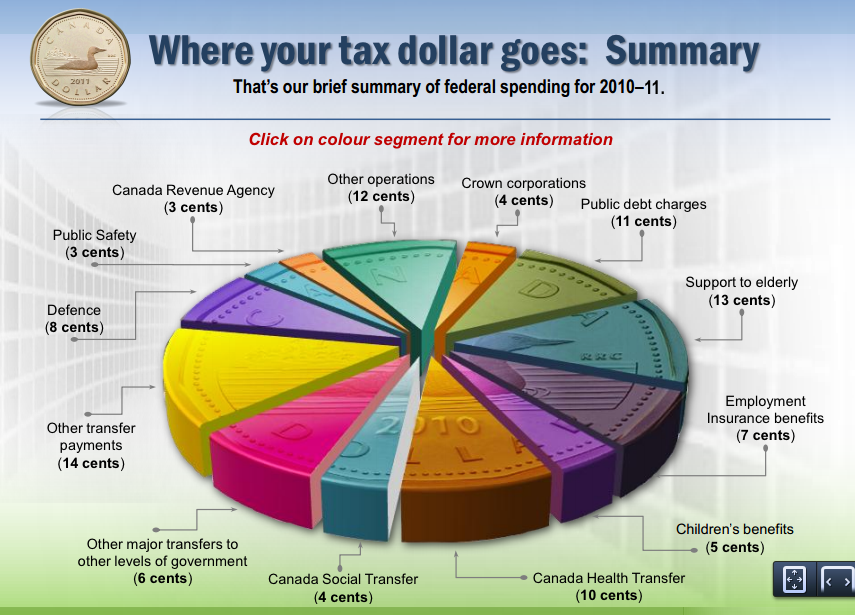

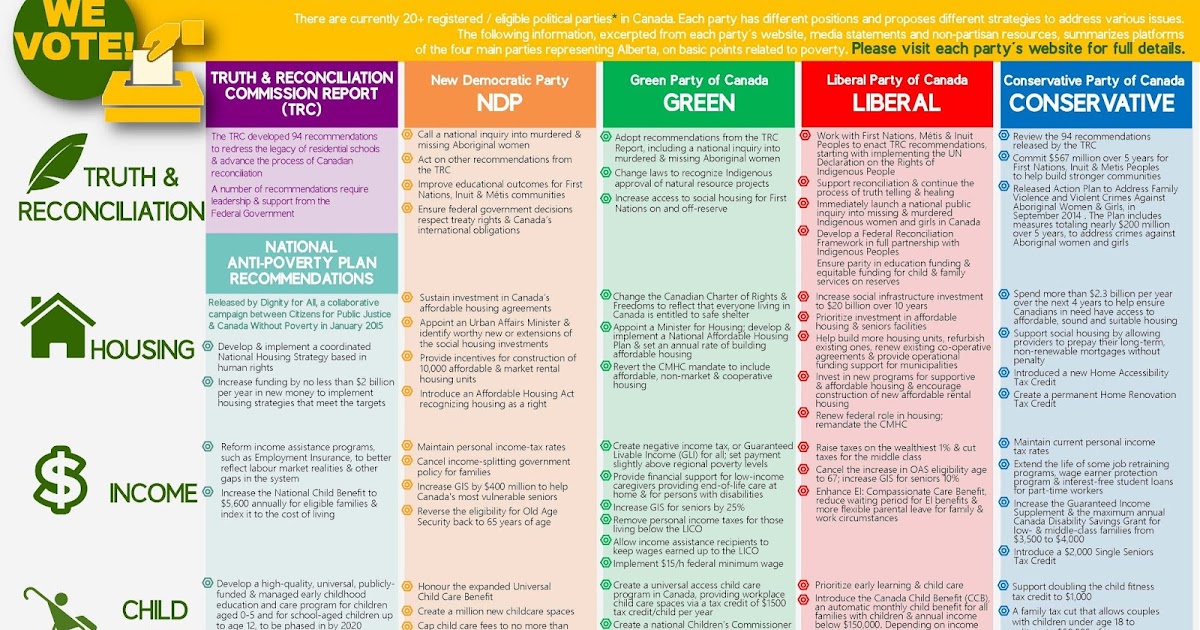

How the Canada Child Benefit worksIn 2016, the Canada Child Benefit, or CCB, replaced the Canada Child Tax Benefit, or CCTB. The government made this change to make more money available to parents with lower incomes.

The CCB is a monthly payment made directly to families with children under 18 years old. As payments are handled by the Canada Revenue Agency (CRA), you’ll need to file your income taxes to be eligible. But you don’t need to include any CCB funds you receive in your taxable income for the year.

If you’re eligible, the CCB payments you receive may include additional benefits for your children, including a child disability benefit and provincial and territorial benefits.

» MORE: What Canadian employees should know about T4 slips

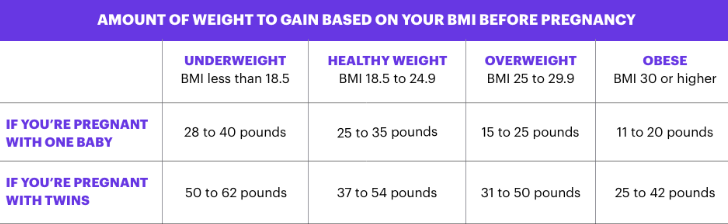

Canada child benefit payment amountsMonthly CCB payments are based on:

- The number of children in your care.

- The age of the children.

- Your marital status.

- Your adjusted family net income (AFNI) from the previous year’s tax return.

If your AFNI is less than $32,797, you can receive up to the following amounts per child:

- Under six years of age: $6,997 per year ($583.08 per month)

- Six to 17 years of age: $5,903 per year ($491.91 per month)

Since the CCB is meant to deliver assistance to lower-income families, payments start to decrease if your AFNI exceeds $32,797. Additionally, if you’re over this income threshold, the CCB is reduced for each additional child you have.

Admittedly, CCB calculations and adjustments can be a bit complicated. However, the Government of Canada has an online CCB calculator that can help you estimate how much CCB you’ll receive each month.

Payments are recalculated every July based on the previous year’s tax return. The government also adjusts the maximum payout for the CCB every year to account for inflation.

If you’re curious what happened to the young child supplement that used to be paid out four times a year to families with children under the age of six, the program was shuttered at the end of 2021 [1].

Canada Child Benefit eligibilityTo qualify for the CCB, you, your spouse, or your common-law partner must be a Canadian citizen, permanent resident, protected person, or an Indigenous person as defined under the Indian Act. You may also qualify as a temporary resident in Canada for the past 18 months who has a valid permit with resident status for the following month.

You must also meet the following conditions:

- You live with at least one child under the age of 18.

- You’re the person primarily responsible for the child’s care.

- You’re a Canadian resident for tax purposes.

If you have a foster child or care for a child under a kinship or close relationship program, you would only get the CCB if you’re not receiving funds from the Children’s Special Allowances, or CSA, program.

Only one person — the individual primarily responsible for the child’s care — should apply for the CCB. To determine who fills that role in a household with two parents or guardians, ask yourself the following:

- Who takes care of the child’s daily activities and needs?

- Who makes sure the child’s medical needs are met?

- Who arranges child care when needed?

If two individuals share the responsibilities equally and one of them is female, the CRA assumes she is primarily responsible for the child’s care. Therefore, the female parent should apply for the CCB. The female parent can sign a letter stating that the other parent is primarily responsible, however, in which case, the other parent would apply for the CCB.

In the case of same-sex parents, one parent should apply for the CCB for all the children.

If you’re in a joint custody situation, the CRA asks that you calculate how much time each parent spends caring for your child and use this information to apply for the CCB separately.

» MORE: How does Canada’s Registered Disability Savings Plan (RDSP) work?

How to claim the Canada Child BenefitYou can apply for the CCB as soon as a child is born or starts to live with you, or you begin to meet the eligibility requirements.

For example, you can apply for the CCB when you register the birth of your newborn child, usually at the hospital or birthing centre. As long as you provide your consent and social insurance number (SIN), the CRA will get your information.

If you didn’t apply when the child was born, you can apply online via My Account (your personal CRA account) or by mail.

CCB payments are made monthly via direct deposit or cheque, typically around the 20th of each month. If your benefits for the year total less than $240, you’ll receive a single lump-sum payment. As long as you file your taxes every year and continue to meet the eligibility requirements, you should keep receiving the CCB.

About the Author

Barry Choi

Barry Choi is a personal finance and travel expert. His website moneywehave.com is one of Canada's most trusted sites when it comes to all things related to money and travel.

His website moneywehave.com is one of Canada's most trusted sites when it comes to all things related to money and travel.

-

Government of Canada, “CCB young child supplement,” accessed Dec. 19, 2022.

DIVE EVEN DEEPER

Canada child and family benefits

Canada child and family benefits include:

- Canada child benefit;

- Goods and services tax/harmonized sales tax (GST/HST) credit;

- Related provincial and territorial programs;

- Tax deduction for working parents;

- Other federal programs.

The purpose of these benefits is to provide financial assistance to individuals and families. Payouts are administered by the Canada Revenue Agency (CRA). nine0017 Are you eligible for benefits and want to apply? Select the link below for more information about the benefit, loan or program.

| Learn whether you have the right to benefit or credit | ||||

| | married or in a civil marriage, there are children under 18 years old | Lonely children, there are children younger than 18 years | Married or cohabiting, no children Goods and services tax/harmonized sales tax (GST/HST) credit The GST/HST credit is a tax-free quarterly payment that helps low-income individuals and families offset some or all of the GST or HST they pay.  Special Children's Allowances This program provides payments to federal and state agencies and agencies that care for children (such as helping children's societies). nine0017 Are you expecting a baby? If you are the birth mother of a newborn, you can use the Automated Benefits Application on the birth registration form when you register your newborn child in your province. This will allow you to apply for your child's assistance under Canada child benefit, GST/HST credit, and similar provincial and territorial programs. How do I get child support for previous years? If you qualify and are raising a child under the age of 18 as of July 2016, you can still apply for these benefits: Special Children's Allowances This program provides payments to federal and state agencies and agencies that care for children (such as helping children's societies). nine0017 Are you expecting a baby? If you are the birth mother of a newborn, you can use the Automated Benefits Application on the birth registration form when you register your newborn child in your province. This will allow you to apply for your child's assistance under Canada child benefit, GST/HST credit, and similar provincial and territorial programs. How do I get child support for previous years? If you qualify and are raising a child under the age of 18 as of July 2016, you can still apply for these benefits:

The last regular payments for these benefits for prior years were made in June 2016. What to do after applying? You do not need to apply for these benefits and loans every year.

How do I find out how much the benefit will be? Use CRA's Child and Family Benefit Calculator to find out the amount of your benefit or loan. nine0003 Related: Vancouver schools or how to choose a school for your child Source: CRA

6 ways to get an additional tax deduction The Canada Revenue Agency (CRA) has shared information about some of the tax deductions that can help Canadians save money when filing their tax return. Here are some tax deductions that can help you save money this year. 1. Canadian Worker Benefit Canada Worker Benefit (CWB) is a refundable tax credit for individuals or families who work and earn a low income. Individuals eligible for CWB may apply for CWB by filing income tax returns. Some families and individuals may also receive half of this benefit in advance. There is also a supplement for people with disabilities. More information on the official website of the Government of Canada 2. Climate Action Incentive Residents of Alberta, Saskatchewan, Manitoba and Ontario may qualify for this tax-free benefit. It consists of a standard amount and a supplement for residents of small or rural areas. To be eligible, you must be over 19 years of age, have (or have previously) a spouse or common-law partner, or be (or have previously been) a parent living with your child. If you have filed a tax return and are eligible, you will automatically receive this payment. More details on the Government of Canada website 3. Home office costs If you worked from home in 2020 or 2021, you may be able to claim some home office expenses. As an employee, you may report items such as "costs for a workplace in the home, office supplies, and some telephone expenses." More information on the official website of the Government of Canada 4. Medical Expenses Eligible medical expenses, which may include, for example, prenatal care, service animals, and laser eye surgery, may be claimed at tax time. Learn more at the Government of Canada website 5. Home Buyer Payment Eligible first home buyers may qualify for this non-refundable tax credit of up to $5,000 if you (or your partner) purchased an eligible home and did not live in real estate owned in the same year or in the previous four years. nine0003 More information on the Government of Canada website 6. Childcare costs Canadian residents who are the sole guardian of a child may claim childcare costs on their tax returns. | |

You no longer need to apply for a GST/HST loan. The Canada Revenue Agency will automatically make you eligible when you declare your income and benefits from tax year 2014 onwards. If you are a new resident of Canada and wish to apply for a GST/HST loan, please complete Form RC151, GST/HST Credit Application for Individuals Who Become Residents of Canada for the year you became a resident of Canada. If you have a spouse or common-law partner, only one of you can receive these payments. The loan will be paid to the one of you whose data is processed earlier, but the amount will be the same, regardless of who in the pair will issue payments. nine0017 You may also be eligible for other benefits.

You no longer need to apply for a GST/HST loan. The Canada Revenue Agency will automatically make you eligible when you declare your income and benefits from tax year 2014 onwards. If you are a new resident of Canada and wish to apply for a GST/HST loan, please complete Form RC151, GST/HST Credit Application for Individuals Who Become Residents of Canada for the year you became a resident of Canada. If you have a spouse or common-law partner, only one of you can receive these payments. The loan will be paid to the one of you whose data is processed earlier, but the amount will be the same, regardless of who in the pair will issue payments. nine0017 You may also be eligible for other benefits.  But you must each year:

But you must each year: