How much money can i get from child support

How much is child support?

If you’re preparing for divorce, you’re probably wondering – “How much is child support?”

If you’re preparing for divorce or merely curious, you want to understand how child support is calculated. You might be surprised by the amount deducted from your paycheck. You may also wonder what a reasonable cost is for monthly payments, and which parent spends the most.

We have answers to those questions here.

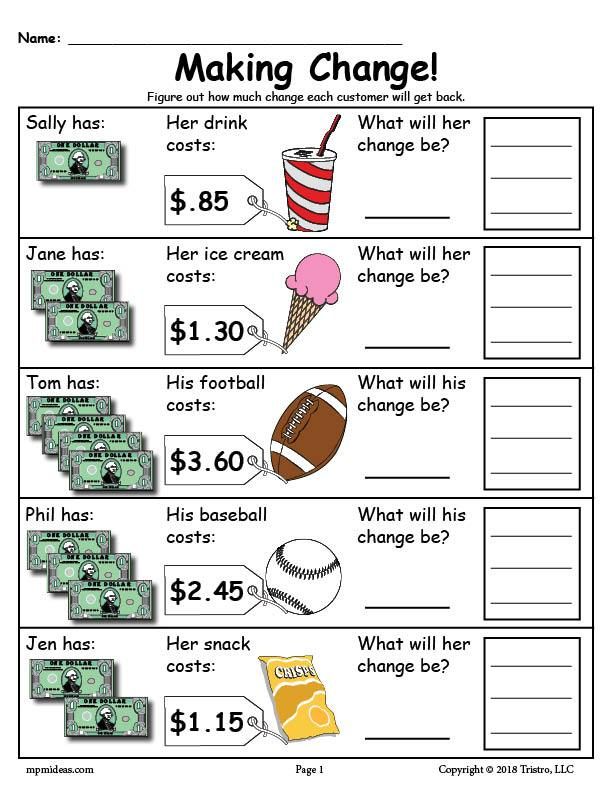

The court will consult the child support guidelines for their state to determine your child support obligation before making an official support order. Like any average, there are quite a few variables. Parents who are in a lower income bracket might not have enough gross income for paying child support, while others who are more well-off end up paying a higher monthly amount. Every state calculation takes into account your total monthly net resources.

Parent’s Pro-Rata Share

How much child support you pay also takes into account whether you are the non-custodial parent, how much income the other parent makes compared to you, and other factors such as whether you or the other parent will provide health insurance coverage for the children, and who will pay for educational expenses and other child care expenses.

The general rule is that the child support obligation is shared by both parents in proportion to their incomes, but there are a lot of other factors that go into how much each parent will actually pay.

Custodial Parent’s Income

In some cases, the custodial parent’s income can be imputed (or assumed) for child support purposes. This usually happens when the custodial parent is not working or is not working to their full potential. The court will look at factors like education and work history to determine how much gross income the custodial parent could be earning, and base child support on that amount.

Other Factors Affecting Child Support

There are other factors that might affect how much child support you pay, such as whether you have other children to support, whether you are paying spousal support (alimony), and your personal expenses. Some states also factor in the cost of living in each parent’s household when determining how much child support to award in a court order.

Example Child Support Calculation

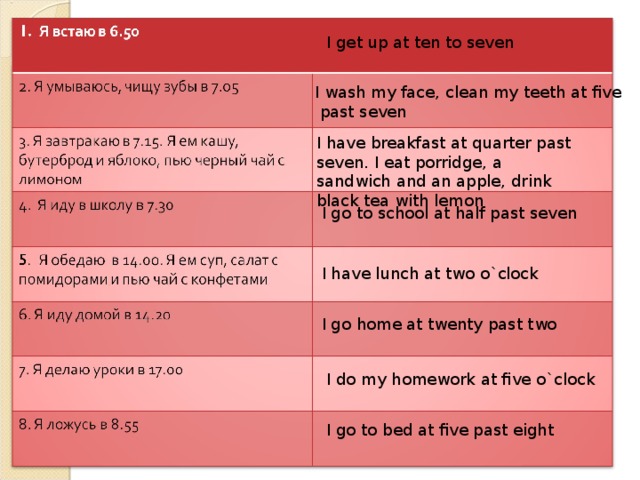

In our example, the court starts by determining your “adjusted” gross income – this is your total income minus deductions for state taxes and business expenses – and multiplies it by the guideline percentage for the number of children involved.

For example: if your yearly salary is $15,000 and you have one child, you would be paying 17% of your income per year in child support–this comes out monthly to $212.50 or annually as $2,550.

Average Child Support Order

We have seen according to the 2010 Census Bureau Reports, the average monthly child support payment is $430. Again, this is just an average of the monthly amount of child support payments across the United States and should only be used as an estimate. Your situation is unique, and the amount the court determines will depend on your circumstances and financial resources.

To get a more accurate estimate of how much you might owe in child support, speak with an experienced family law attorney in your state. They will be familiar with how child support is calculated where you live and can help ensure you are paying (or receiving) the appropriate amount of support for your children.

They will be familiar with how child support is calculated where you live and can help ensure you are paying (or receiving) the appropriate amount of support for your children.

If you’re interested in an estimate of what your support payments should be, use our child support calculator.

And for more information on how you can better understand the child support laws and regulations in your state, visit our state resources section.

The Easiest Massachusetts Child Support Calculator

How many children? i

Your time with children as % i

Your weekly pay i

Other parent's pay i

Child support = $0 weekly i

Not in Massachusetts? Use your location's child support calculator.

Massachusetts child support payments

Child support is designed to ensure both parents contribute financially to their children's care after they separate.

Like all U.S. states, Massachusetts uses a formula to determine how much each parent should contribute, and the result serves as a guideline for the judge who issues the child support order. Use the calculator above to estimate what the formula will produce in your case.

Use the calculator above to estimate what the formula will produce in your case.

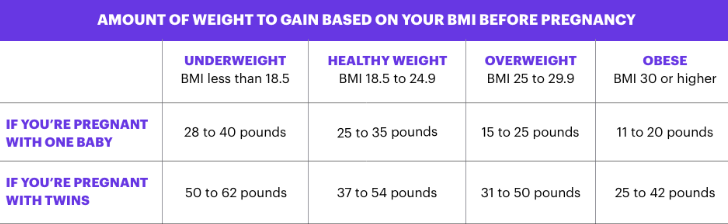

For a typical family, the Massachusetts formula produces the highest payment in the country, according to a 2019 study by Custody X Change. When a parent in the Bay State would pay $1,200 a month in child support, a parent in the same situation elsewhere may pay a third of that.

A judge can deviate from the formula under certain circumstances, such as when a child has special needs or parents agree to an alternate amount.

Estimating parenting time could cost you thousands a year in child support. Let Custody X Change calculate your time.

Calculate My Parenting Time Now

How child support is calculated

In Massachusetts, the parent with less parenting time typically pays child support monthly, though a judge can order weekly payments. If parents have nearly equal time with the children and both contribute financially, the parent with the higher income pays.

To estimate your payment, use the calculator above. To calculate your guideline support amount exactly, fill out the Child Support Guidelines Worksheet.

To calculate your guideline support amount exactly, fill out the Child Support Guidelines Worksheet.

You'll need to enter the number of eligible children you have together, each parent's approximate portion of parenting time and their gross weekly income.

Eligible children are typically under 18 or still in high school. However, support may continue to age 23 if the child still lives with a parent and is financially dependent on them, or until 23 if the same circumstances apply and the child is pursuing an undergraduate degree.

Indicate whether the children live with each parent for nearly equal time (shared physical custody) or with one parent for at least two-thirds of the time (sole physical custody). A third option, for parents who each provide the primary home for a different child (split physical custody), is rare.

Gross weekly income is the amount earned from work, tips and other sources before taxes. Costs for child care, health insurance and other support payments then get subtracted from each parent's total.

Low-income and high-income families

If a parent has a weekly gross income of less than $250, the support guidelines recommend they pay between $12 and $20 a month in child support. A judge can order a lower or higher payment if they think it would better fit the circumstances.

The guidelines cap out at a yearly income of $400,000 for both parents combined. When parents earn more, their support payment is based solely on $400,000 (though the judge can increase the payment if it would benefit the children).

Paying child support

The Massachusetts Department of Revenue has details on how to pay support. The paying parent shouldn't pay the other parent directly, because then the court couldn't track it. In some cases, support is withheld from the paying parent's paycheck.

Modifying child support

You can request a child support modification every three years. You'll need to show the court that your payment differs from the current guideline amount, you've lost or can no longer afford health insurance for the children, or a major change in circumstances has occurred, such as a job loss or a change in parenting time.

If you request a modification before three years have passed, you'll need to prove that a major change in circumstances is impacting your ability to pay.

Enforcing a child support order

If a parent misses child support payments, the Department of Revenue can automatically take actions like suspending their driver's license or placing a lien on their bank account.

When a parent routinely fails to pay support, you may need to bring a contempt of court case against the other parent to have a judge enforce child support orders.

Keeping track of payments and expenses

Remember that a child support order is legally binding and must be taken seriously.

Whether you're paying or receiving support, the Custody X Change app can help you keep track of payments. Log details of every one into your expense tracker to ensure you're sticking to the court order.

You can also track other child-related expenses and print an invoice if the other parent needs to reimburse you.

Custody X Change keeps you on top of all aspects of child custody, including payments and expenses.

Estimating parenting time could cost you thousands a year in child support. Let Custody X Change calculate your time.

Calculate My Parenting Time Now

Estimating parenting time could cost you thousands a year in child support. Let Custody X Change calculate your time.

Calculate My Timewhat moms and dads need to know > Rubric Society in Samara

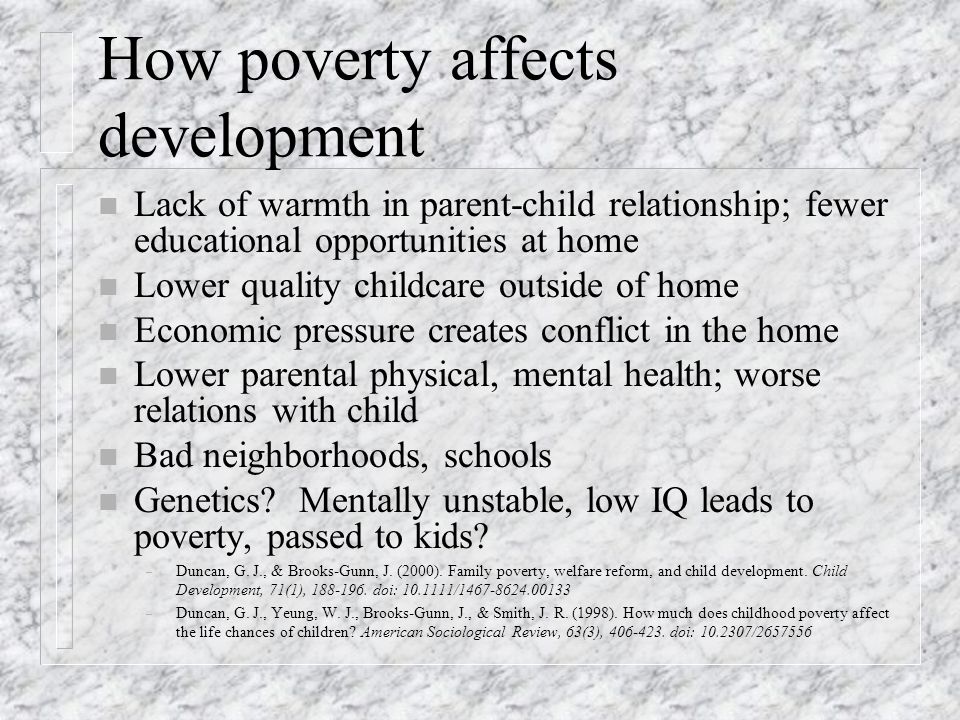

People meet, people fall in love, get married, have children and... get divorced. At the same time, they often forget about their duties to their son or daughter. Sometimes parents are so careless or indifferent that law enforcement and supervisory officials have to intervene in the situation. Kristina Tarasova, Assistant Prosecutor of the Leninsky District of Samara, answers questions from SG readers.

Voluntarily or involuntarily

— I divorced my husband and have a five-year-old son. I work hard to support my child. We are preparing for school, we go to developing classes for an additional fee. The father does not help financially at all. How can I claim money from him?

I work hard to support my child. We are preparing for school, we go to developing classes for an additional fee. The father does not help financially at all. How can I claim money from him?

-In accordance with the norms of family law, alimony - money allocated for the maintenance of minor children, is paid in two ways: voluntarily or involuntarily. If the former spouse does not renounce financial obligations in relation to the child, it is enough to conclude an agreement with him on the payment of alimony and certify it with a notary. It prescribes the procedure, methods of payment and the amount of alimony. Such an agreement has the force of an executive document: if the parent stops paying money voluntarily, it is possible to organize their forced collection. To do this, the agreement must be presented to the place of work or to the bailiff service at the place of residence of the former spouse. nine0009

In your situation, when the father refuses to help, it is more likely that you will have to resort to a forced method of collecting alimony. To do this, you need to go to court. It is worth knowing that in this case you are exempt from paying the state fee. Based on the results of consideration of the application, the court makes a decision determining the terms, procedure, and amount of payment of alimony.

To do this, you need to go to court. It is worth knowing that in this case you are exempt from paying the state fee. Based on the results of consideration of the application, the court makes a decision determining the terms, procedure, and amount of payment of alimony.

According to the Family Code, the amount of alimony depends on the number of children: a quarter of the monthly income must be paid for one child, a third for two or more, and half for three or more. If the person who has to pay child support does not have a regular income, he will have to pay a fixed amount. It is usually calculated on the basis of the living wage for a child in a particular region. The court decision is sent to the bailiff service at the place of residence of the former spouse to organize the enforcement of alimony. nine0009

Not enough money

— Every month I give money to my ex-wife for my daughter. The amounts vary depending on the financial situation and salary. Due to the fact that I have not been working lately, I get little money. My wife threatens to go to court to collect alimony from me, although I pay as much as I can. Can she do that?

Due to the fact that I have not been working lately, I get little money. My wife threatens to go to court to collect alimony from me, although I pay as much as I can. Can she do that?

— The obligation to support a minor child can be performed voluntarily and without agreement, but such financial relations are not recorded anywhere. Based on the norms of family law, funds voluntarily transferred for the maintenance of a minor child in the absence of a notarized agreement on the payment of alimony are not recognized as alimony in court. Therefore, your ex-spouse may well file a lawsuit demanding alimony. To insure yourself against excessive, in your opinion, expenses, I recommend that you and your ex-wife contact a notary public to conclude an agreement on the payment of alimony. nine0009

— My daughter Masha is eight years old. For five years after the divorce, I regularly pay alimony in the amount determined by the court. But grief happened to me: my son from his first marriage, Nikolai, got into an accident and became disabled. Despite the fact that he is already 20 years old, I spend part of my earnings on his maintenance. Therefore, it became difficult to pay alimony to my daughter in the amount of a quarter of my income: there is not enough money for the treatment of my eldest son. What do i do?

But grief happened to me: my son from his first marriage, Nikolai, got into an accident and became disabled. Despite the fact that he is already 20 years old, I spend part of my earnings on his maintenance. Therefore, it became difficult to pay alimony to my daughter in the amount of a quarter of my income: there is not enough money for the treatment of my eldest son. What do i do?

- Based on the norms of part 2 of article 81 of the Family Code of the Russian Federation, the amount of shares determined by the court for the recovery of alimony can be reduced or increased by the court, taking into account your financial or family status and other noteworthy circumstances. Such circumstances include the presence of other minor or disabled adult children in the payer, as well as other persons whom he is obliged by law to support, for example, disabled relatives. It also takes into account low income, the state of health of the payer and the child for whose maintenance alimony is collected, for example, if he has a serious illness that requires long-term treatment. nine0009

nine0009

Therefore, you need to apply to the court at the place of residence of the child support recipient with a claim for a change in the amount of penalties, since you have an adult disabled child as a dependant. Supporting documents must be attached to the application - receipts for medicines, clinic services and other expenses.

Who will help

— After the divorce, my son stayed with me. The former spouse either does not pay alimony at all, or pays at random intervals and not in full. For this, the bailiffs have already brought her to administrative, and then even to criminal liability. Tell me, can I recover any interest for the late payment of alimony in the interests of my son? nine0008

- The right to collect the debt arising from the fault of the debtor on the payment of alimony is regulated by Part 2 of Article 115 of the Family Code of the Russian Federation. When such a debt is formed, the debtor, by a court decision, pays a penalty to the recipient of alimony. Its size is 0.1% of the amount of unpaid alimony for each day of delay.

Its size is 0.1% of the amount of unpaid alimony for each day of delay.

In order to collect a penalty, you need to apply to the Magistrate's Court at the place of residence of the debtor with a corresponding application. To determine the amount of the penalty, you must obtain a copy of the resolution on the calculation of the debt in the department of bailiffs conducting enforcement proceedings for the recovery of alimony. The application must also be accompanied by a copy of the court decision or notarial agreement, which determines the amount and procedure for paying alimony. If the court decision is positive, the writ of execution must be sent for enforcement to bailiffs. In addition, in this case, you have the right to seek help from the prosecutor's office of the Russian Federation. nine0009

- The district bailiffs have a file on the payment of alimony for my children. The debtor does not pay, the bailiffs do nothing in this case. Where to complain?

- If the bailiffs of the district level are inactive, you, in accordance with the requirements of federal legislation on enforcement proceedings, have the right to contact the head of the bailiffs of your district. With his inaction - to the head of the bailiffs at the regional level. In case of inaction of all the designated officials, you can file a complaint with the prosecutor's office. nine0009

With his inaction - to the head of the bailiffs at the regional level. In case of inaction of all the designated officials, you can file a complaint with the prosecutor's office. nine0009

- In 2009, after a divorce, I filed for alimony. The ex-husband regularly paid for some time, but now he has stopped. Communication with him has been lost, where he is now registered, I do not know. In addition, the decision of the court is lost. What to do?

— You have the right to apply to the court for a copy of the judgment. To start the enforcement mechanism, you must send this document to the bailiff service at the last place of residence of the debtor known to you. On this basis, they will initiate enforcement proceedings, establish its current location. If for some reason this is not possible, at your request, the bailiff will announce an executive search for the debtor. nine0009

In accordance with the rules of family law, as well as the law on enforcement proceedings, you can declare your financial claims until the minor reaches the age of 18, and also within three years after. At the same time, it should be borne in mind that alimony for the past period is collected within three years preceding the presentation of the writ of execution. If the alimony was not withheld through the fault of their payer, then they are collected for the entire period.

At the same time, it should be borne in mind that alimony for the past period is collected within three years preceding the presentation of the writ of execution. If the alimony was not withheld through the fault of their payer, then they are collected for the entire period.

Tell your friends

See also:

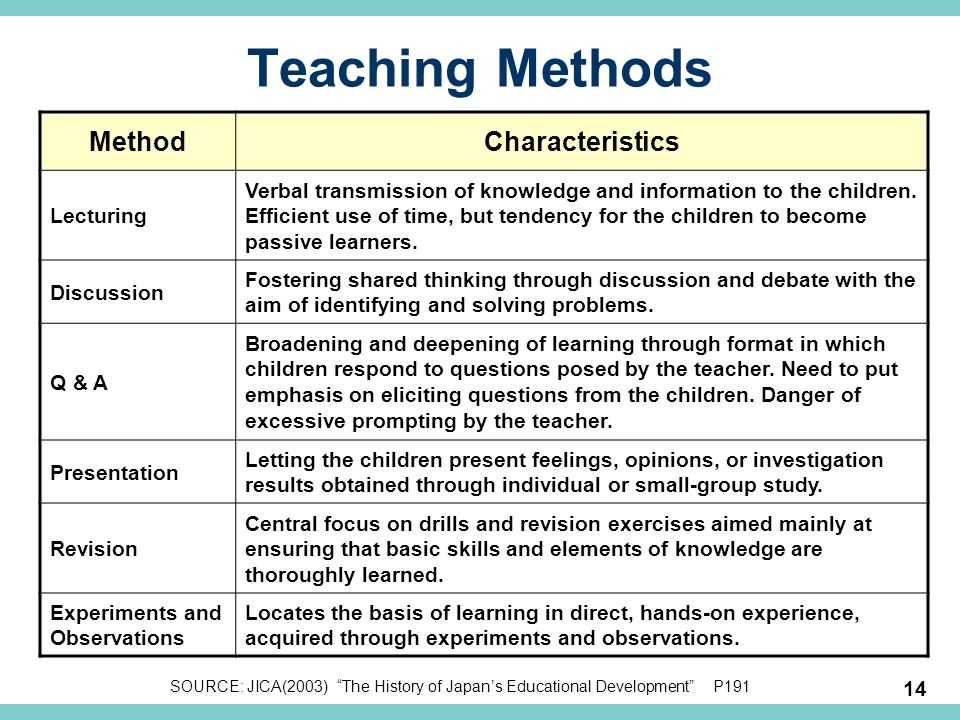

Alimony - Help for paying parents

This guide will answer questions about child support that a non-custodial parent may have. The following information is useful for both custodial parents and non-custodial parents

Definitions of key terms

Custodial Parent (kas-TO-di-al PER-ent): A parent who lives with a child.

Non-custodial parent : Separated parent.

Why did I get documents telling me that I have to appear in court?

Someone filed a petition (pe-ti-shan) to the court to force you to pay child support. A petition is a written appeal to the court.

A petition is a written appeal to the court.

Who is eligible to petition for child support?

Petition for child support can be filed by:

- The person who cares for the child

- New York City if the child is or has received public assistance (welfare)

- Child (however, this usually only applies to adult children)

What happens when I go to court?

On the day of the hearing, you will meet with the welfare magistrate (sup-PORT MAD'J-is-trate) who will hear the case and issue a child support order (OR-der for child sup-PORT) . The court's decision is a piece of paper detailing the amount you owe, how often you must pay, and where to send the money. The welfare magistrate is like a judge and has the power to decide on alimony and paternity (pe-TURN-and-tee) . A paternity case is a case to establish who is the real father of a child.

When does child support end?

In New York State, a child may receive child support until the age of 21. Sometimes child support payments may end earlier; for example, this can happen if the child joins the army or gets married.

Sometimes child support payments may end earlier; for example, this can happen if the child joins the army or gets married.

Can I use a lawyer for my child support case?

In child support cases, the family court is not required to provide a lawyer to the parents, except in cases where the non-custodial parent faces jail time for failure to pay; however, you are free to hire a lawyer if you wish. The welfare magistrate may appoint a lawyer for the child, called a legal guardian or child advocate, to ensure that the best interests of the child are protected. It doesn't happen in every case. nine0009

What happens if I don't show up on court day?

If you do not appear on the day of the hearing, the welfare magistrate may issue a default decision (de-FOLT D'JAD'J-mant) . A default judgment is an order issued if the defendant fails to appear in court. In child support cases, the default decision automatically becomes a child support order against the non-custodial parent. This court decision is based on information provided by the custodial parent. nine0009

This court decision is based on information provided by the custodial parent. nine0009

If you wish to contest this decision, you must file a motion to set aside the default decision (MO-shan tou WEI-cate e de FOLTE D'JAD'J-ment) . This is a written petition to the court asking for the annulment of the decree. You must give the court a good reason for not appearing in court.

How is the amount of maintenance determined?

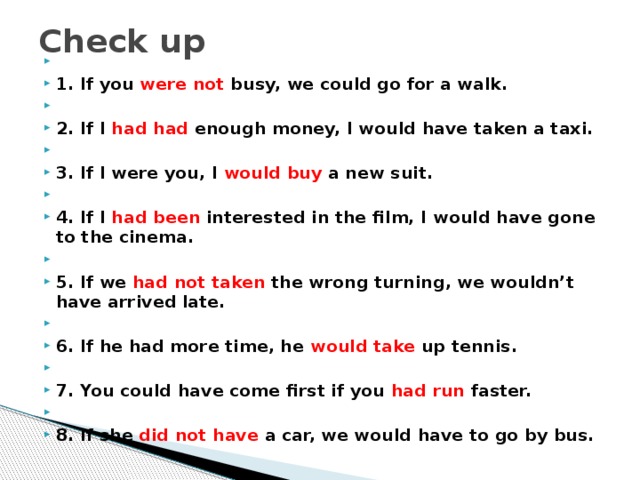

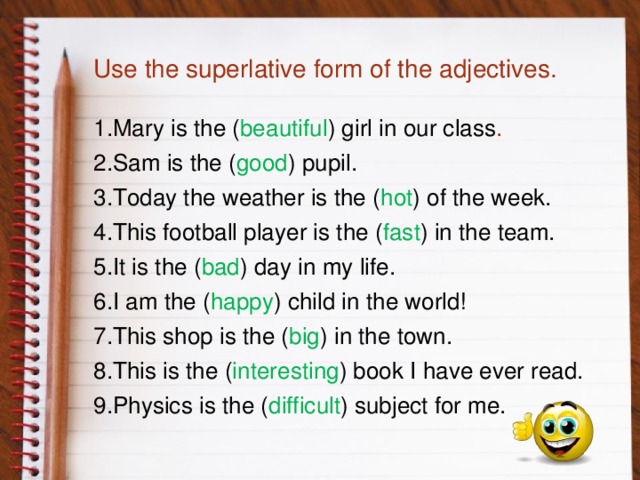

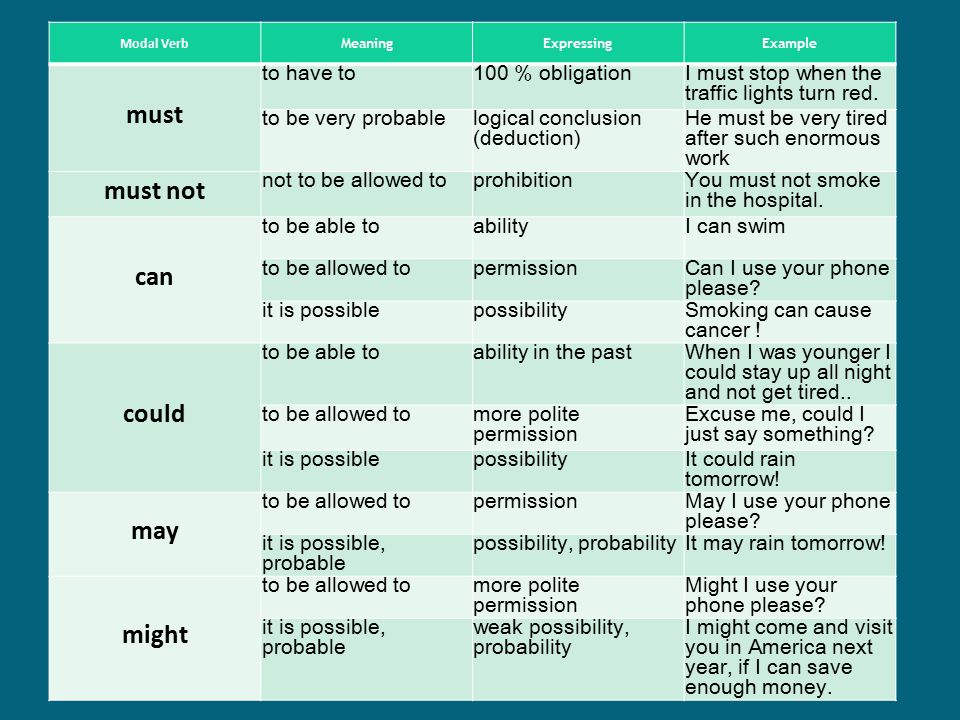

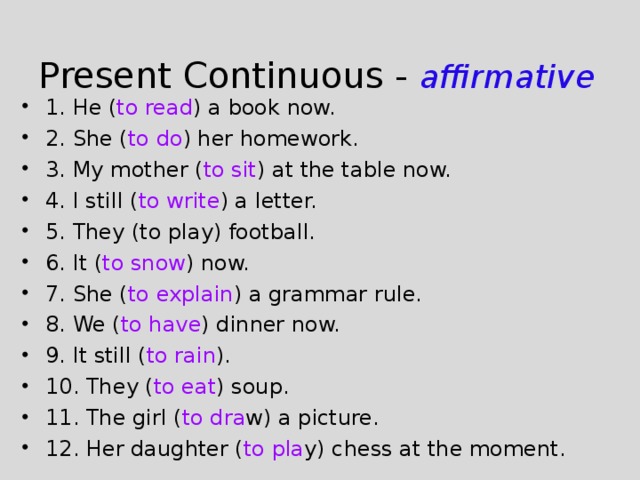

Support is based on Support Standards Act . First, the court establishes 90,007 total combined income of 90,008 for both parents. Total income is the sum of all money earned before taxes. (For incomes of $143,000 or more, the court sometimes applies different rules.) Some special expenses (ex-PEN-ses) will reduce your income for child support. Ordinary expenses are expenses that you pay on a regular basis, such as electricity bills, credit cards, or living expenses. These costs do not reduce your child support income Once the court determines both parents' income, it uses the following formula to determine the amount you need to support a child:

1 child 17% of your income

2 children 25% of your income

3 children 29% of your income

4 children 31% of your income

5 children or more 35% of your income

help.

You may be asked to pay an extra amount for government and child care. Or you may be assigned to include the child in your health insurance.

What if the child support has not yet been paid? nine0005

The court may also order the payment of retroactive child support (re-tro-ek-tiv sup-PORT) for the maintenance of the child. This means that you must pay child support from the time the petition is filed, even if it is long before you appear in court. Retroactive child support usually does not accrue from the date the child was born, but this can happen if the petition was filed as soon as the child was born. Accrual occurs from the time the custodial parent first files a petition for child support. nine0009

If you do not pay child support, you will have debt (e-RIRS) . Debt means non-payment of alimony. If you become indebted, the court may add a set amount to your child support until the entire amount owed is paid.

What if my income is unofficial?

If you work informally or do not receive a stable salary, the court may determine your income based on the following:

- How much did you earn in the past

- How much does the court think you could earn

- What is your family's standard of living

The amount determined by the court is called conditional income (im-PYU-ted In-kam) . The court then uses the amount of conditional income to determine the amount of support you will have to pay.

The court then uses the amount of conditional income to determine the amount of support you will have to pay.

What should I bring to court?

- Carefully completed Financial Disclosure Affidavit

- Proof of your income, such as check stubs from your paycheck

- Documents showing Social Security or disability payments, workers' compensation, unemployment benefits, veterans' benefits, pension funds, investment, bursaries, or annuities.

- Information about the “SSI,” “Medicaid,” “Home Relief,” or “Food Stamps,” you get.

- Proof of expenses such as FICA and city taxes. These expenses will be deducted from your income before the court determines the amount of child support. nine0117

- If you are paying support for another child, bring a copy of the court order and proof of payments you have already made. As proof, you can use money order receipts, voided checks, or paycheck stubs showing support was paid.

What if I am not the father of the child?

If you were married to the mother when the child was born, the law implies that you are the child's father. If you were married to the mother but believe you are NOT the father of the child, notify the benefits magistrate immediately. It's called denial of paternity (con-TEST-ing p-TURN-and-tee) . The court must determine paternity (find out who the real father is) before determining child support. To establish paternity, the court may order a DNA test (DNA test) . If the analysis confirms your paternity, the court will issue Decree of Descent (OR-der of fil-i-EI-shan) . This is an official court document that determines who is the father of a child.

If you were married to the mother but believe you are NOT the father of the child, notify the benefits magistrate immediately. It's called denial of paternity (con-TEST-ing p-TURN-and-tee) . The court must determine paternity (find out who the real father is) before determining child support. To establish paternity, the court may order a DNA test (DNA test) . If the analysis confirms your paternity, the court will issue Decree of Descent (OR-der of fil-i-EI-shan) . This is an official court document that determines who is the father of a child.

Will the court give me a lawyer for my paternity case? nine0005

If someone opens a paternity case against you and you are unable to hire a lawyer, you can ask the magistrate to appoint a lawyer for you free of charge. You can also hire your own lawyer. If you open a paternity case, the court may not provide you with a lawyer, even if you are unable to pay for one.

How can I pay child support?

You can pay directly to the other parent or through Child Support Collection Unit (SCU) at the address below. If the custodial parent receives public assistance, SCU will automatically deduct child support from it. SCU services are free and they will keep track of all payments.

Please remember: Always include the case number on your SCU payments to ensure your payment is recorded. Don't use cash - especially if you're paying directly to the other parent! Always pay by money order or check. nine0008

What if the SCU makes a mistake?

You need to go to the SCU office (located at 151 West Broadway, 4th floor in Manhattan) and speak to a customer service representative. You can also call the Support Enforcement Office at (888) 208-4485.

How long is the benefit order valid?

Once a benefit order is issued, it remains in effect until someone asks the court to reverse it, your child is 21, or your child is independent (e-MAN-C-Pay-ted) . Children are considered independent if they live separately from the custodial parent, are self-supporting, married, or in the military.

Children are considered independent if they live separately from the custodial parent, are self-supporting, married, or in the military.

If you pay through SCU, they automatically review your case every three years. When they review the case, the SCU may add a living wage allowance (COLA). SCU is free to do so without going to court. If they make changes, they will send you an email.

What if I do not agree with the allowance order? nine0005

You have the right to tell the court if you disagree with the order. This is called objection (ob-D' JEK-shan) . If you receive a copy of the order on the day the order was issued, you have 30 days to file a written objection. However, if the order was mailed, you have 35 days (from the date the letter was sent) to file a written objection. You can file an objection through the clerk of the Family Court where the decision was made. The judge will decide on your case. You may not have to go to court for a new hearing, but you must continue to pay child support until the court changes the order. The decision will be mailed to you. For more information, see the Family Legal Care booklet – “How to File an Objection or Rebuttal Against a Child Support Order”

The decision will be mailed to you. For more information, see the Family Legal Care booklet – “How to File an Objection or Rebuttal Against a Child Support Order”

If you lose your job or are unable to pay for any other reason - such as a change in your income or you are sent to prison - the court will not automatically change your child support amount. If you are unable to pay child support, you must immediately tell the Family Court where the decision was made and file a Petition for Change for Deterioration shan) . This is a written request to the court to reduce the amount of your child support. To convince the court to reduce your child support, you must provide to the court evidence of a significant change in circumstances (sig-NIF-i-kant change of ser-kam-STEN-ses) that have occurred in your life since the magistrate on the allowance made the final decision.

- An example of a significant change in circumstances would be imprisonment, provided that the imprisonment is not related to non-payment of support or a crime against the custodial parent or child.

- You can also ask for a change in your child support amount if it has been 3 years since the last order was made. nine0117

- Also, if your or the custodial parent's income has changed (up or down) by 15% or more since the last instruction, you can petition for a change due to the downside.

Learn more about what to do if you can't pay

When you go to court, you must show proof of a significant change in your income. You must ask the court to reduce your child support from the date of the petition. Until the court decides otherwise, you must continue to pay the original amount of support. nine0009

The court may look at your previous earnings and determine that you can earn more than you currently earn. In this case, the court may leave the order unchanged.

What happens if I don't pay?

If there is a court order for child support, you must pay. If you don't pay, your debts will continue to pile up. This debt WILL NOT DISAPPEAR, even if your child turns 21. Declaring bankruptcy will also not cancel the payment of debt. nine0009

Declaring bankruptcy will also not cancel the payment of debt. nine0009

The SCU can force you to pay in a variety of ways.

- SCU can force your employer to calculate child support from your wages/cheque. (Your employer is required by law to do this, but they can't fire you for it.) This is called withholding your paycheck (GAR-nish-ing yor WAID'J-es).

- SCU may collect your federal and state tax refund before you receive it. SCU can also take money directly from your bank account.

- If your debt exceeds a few months, SCU may suspend your driver's license or other professional licenses until you pay off the debt. nine0117

- If you owe a very large amount of money and the SCU or custodial parent asks the court to check for willful violation (WIL-ful-and WAI-0-lay-ting) of child support payments, you may be SENT IN JAIL for up to 6 months. Intentional violation means willful disobedience to a court order.

What if I support my children?

Make sure you keep all receipts for any child support payments. Paying for services or buying gifts is not a substitute for paying child support. You must pay regularly. You are also required to pay any accumulated debt. nine0009

Paying for services or buying gifts is not a substitute for paying child support. You must pay regularly. You are also required to pay any accumulated debt. nine0009

Who gets the money if my children get public assistance and I pay child support?

If the custodial parent receives public assistance, SCU will automatically collect support. If you are not in debt, $100 of your monthly payment will go to the custodial parent. This $100 per month is for the maintenance of the household, not for each child. If you are in debt, the alimony will go towards paying off the debt in the first place. The city will continue to pay child support even if you give money directly to the custodial parent. The city may also reduce the child support budget to account for the extra money received by the family. nine0009

Can I withdraw my child from public assistance?

A non-custodial parent cannot withdraw their child from public assistance. Only the custodial parent who started the public assistance case can do so.

Why might a custodial parent want to remove their child from public assistance?

If your income is high enough, your children may receive more cash assistance from you than from government assistance. For example, if you are the father of all the children in your mother's house, and she can certify that you support them, there should be no problem getting the children off state aid. If a mother has children from other fathers in her public assistance budget, the process will be more complicated. The state wants all children in the home to have the same income. Therefore, it is possible that the mother will not be able to remove only your children from public assistance. nine0009

If I pay child support, can I also get visitation?

Optional. Alimony and visits (vi-zi-TAI-shan) are not related. If you are not allowed to see your children, you must file a petition to visit with the court. Whether you see your child or not, you remain responsible for paying child support.