How much is earned income for a child

Earned Income Credit (EITC): Definition, Who Qualifies

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

In general, the less you earn, the larger the credit. Families with children often qualify for the largest credits.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Learn More

and

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

Reviewed by Lei Han

Lei Han

Professor of accounting

Lei Han, Ph.D., is an associate professor of accounting at Niagara University in Western New York and a New York state-licensed CPA. She obtained her Ph.D. in accounting with a minor in finance from the University of Texas at Arlington. Her teaching expertise is advanced accounting and governmental and nonprofit accounting. She is a member of the American Accounting Association and New York State Society of Certified Public Accountants.

Learn More

At NerdWallet, our content goes through a rigorous

editorial review process. We have such confidence in our accurate and useful content that we let outside experts inspect our work.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

What is the earned income tax credit (EITC)?

The earned income tax credit, also known as the EITC or EIC, is a refundable tax credit for low- and moderate-income workers.

For the 2022 tax year, the earned income credit ranges from $560 to $6,935 depending on tax-filing status, income and number of children. In 2023, the credit will be worth $600 to $7,430. People without children can qualify.

If you fall within the guidelines for the credit, be sure to claim it on your return when you do your taxes. And if you didn’t claim the earned income credit when you filed your taxes in the last three years but think you qualified for it, the IRS encourages you to file an amended tax return so you can get that money back.

Internal Revenue Service

. How to Claim the Earned Income Tax Credit (EITC).

Accessed Oct 20, 2022.

View all sources

How does the earned income tax credit work?

Here are some quick facts about the earned income tax credit:

For the 2022 tax year (the tax return you'll file in 2023), the earned income credit ranges from $560 to $6,935 depending on your filing status and how many children you have.

You don't have to have a child in order to claim the earned income credit.

The earned income tax credit doesn't just cut the amount of tax you owe — the EITC could also score you a refund, and in some cases, a refund that's more than what you actually paid in taxes.

If you claim the EITC, the IRS cannot issue your refund until mid-February by law.

Internal Revenue Service

.

Earned Income Tax Credit (EITC).

Earned Income Tax Credit (EITC).Accessed Oct 20, 2022.

View all sources

Income limit for the earned income tax credit

Below are the maximum earned income tax credit amounts, plus the max you can earn before losing the benefit altogether.

2022 Earned Income Tax Credit

(for taxes due in April 2023)

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$16,480 | $22,610 | ||

$3,733 | $43,492 | $49,622 | |

$6,164 | $49,399 | $55,529 | |

3 or more | $6,935 | $53,057 | $59,187 |

Both your earned income and your adjusted gross income each have to be below the levels in the table.

In general, the less you earn, the larger the earned income credit.

Your earned income usually includes job wages, salary, tips and other taxable pay you get from your employer. Your adjusted gross income is your earned income minus certain deductions.

2023 Earned Income Tax Credit

(for taxes due in April 2024)

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$17,640 | $24,210 | ||

$3,995 | $46,560 | $53,120 | |

$6,604 | $52,918 | $59,478 | |

3 or more | $7,430 | $56,838 | $63,398 |

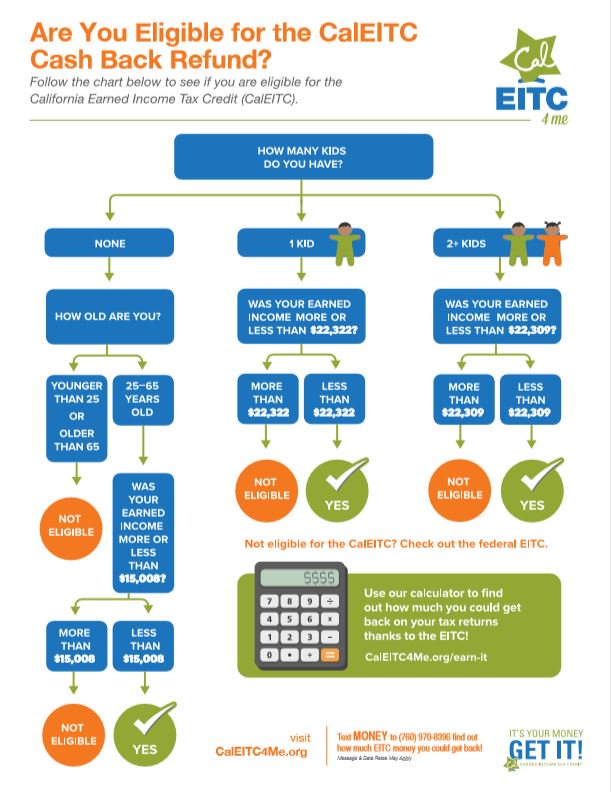

Who qualifies for the earned income tax credit?

Besides staying below the income thresholds noted above, there are other qualification rules and requirements. Here are the big eligibility rules, but you can also check out our quiz below for a quick read on whether you might qualify for the earned income credit.

Here are the big eligibility rules, but you can also check out our quiz below for a quick read on whether you might qualify for the earned income credit.

You must have at least $1 of earned income (pensions and unemployment don't count).

Your investment income must have been $10,300 or less in 2022. In 2023, it can't exceed $11,000.

You can qualify for the EITC if you’re separated but still married. To do so, you can’t file a joint tax return and your child must live with you for more than half the year. You also must not have lived with your spouse during the last six months or you must have a separation agreement or decree.

If you're claiming the EITC without any qualifying children, you must be at least 25 years old but not older than 65. If you're claiming jointly without a child, only one spouse needs to meet the age requirement.

There are special EIC rules for members of the military and the clergy, as well as for people who have disability income or who have children with disabilities.

Kids and the earned income credit

If you claim one or more children as part of your earned income credit, each must pass certain tests to qualify:

The child can be your son, daughter, adopted child, stepchild, foster child or grandchild. The child also can be your brother, sister, half-brother or half-sister, stepbrother or stepsister or any of their children (your niece or nephew).

The child must be under 19 at the end of the year and younger than you or your spouse if you're filing jointly, OR the child must be under 24 if he or she was a full-time student. There's no age limit for kids who are permanently and totally disabled.

The child must have lived with you or your spouse in the United States for more than half the year.

For each child you're claiming with the EITC, you’ll also need:

If you don't have kids

You may be able to get the EITC if you don’t have a qualifying child but meet the income requirements for your filing status. To qualify, you typically must meet three more conditions:

To qualify, you typically must meet three more conditions:

You must have resided in the United States for more than half the year.

No one can claim you as a dependent or qualifying child on their tax return.

You must be at least 25 years old but not older than 64. If married filing jointly, at least one spouse must meet the age requirement.

Consequences of an EIC-related error

Not only does an error on your tax form delay the EIC part of your refund — sometimes for several months — but it also means the IRS could deny the entire earned income credit.

If the IRS denies your whole EIC claim:

You must pay back any EIC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance" before you can claim the EIC again.

You could be banned from claiming EITC for the next two years if the IRS finds you filed your return with “reckless or intentional disregard of the rules.

”

”You could be banned from claiming EITC for the next 10 years if the IRS finds you filed your return fraudulently.

Most tax software walks you through the EITC with a series of interview questions, greatly simplifying the process. (Plus, if you qualify for the EITC, you might be able to get free tax software.) But remember: Even if someone else prepares your return for you, the IRS holds you responsible for all information on any return you submit.

Past years' earned income tax credit

If you need the income thresholds and credit amounts from past years, take a look back.

2020 tax year

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$15,820 | $21,710 | ||

$3,584 | $41,756 | $47,646 | |

$5,920 | $47,440 | $53,330 | |

3 or more | $6,660 | $50,954 | $56,844 |

You can use either your 2019 income or 2020 income to calculate your EITC — you might opt to use whichever number gets you the bigger EITC.

2021 tax year

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$1,502 | $21,430 | $27,380 | |

$3,618 | $42,158 | $48,108 | |

$5,980 | $47,915 | $53,865 | |

3 or more | $6,728 | $51,464 | $57,414 |

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

|

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

What is the Earned Income Tax Credit (EITC)? – Get It Back

What is the Earned Income Tax Credit (EITC)?

The Earned Income Tax Credit (EITC) may lower the taxes you owe and refund you up to $6,935 at tax time.

The Earned Income Tax Credit (EITC) is a tax credit that may give you money back at tax time or lower the federal taxes you owe. You can claim the credit whether you’re single or married, or have children or not. The main requirement is that you must earn money from a job.

The credit can get rid of any federal tax you owe at tax time. If the EITC amount is more than what you owe in taxes, you get the money back in your tax refund. If you qualify for the credit, you can still get a refund even if you do not owe income tax.

You may qualify for the federal EITC if you work in the U.S. or the following U.S. Commonwealths and territories: Puerto Rico, U.S. Virgin Islands, Guam, the Commonwealth of the Northern Marina Islands, or American Samoa.

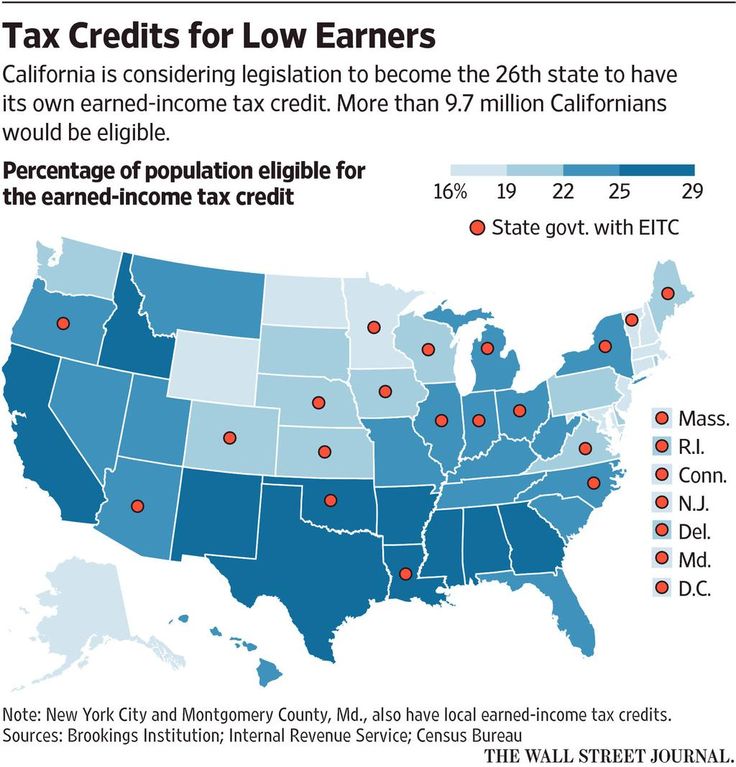

Beyond the federal EITC, 31 states plus D. C. and Puerto Rico have their own state EITCs. Check out the state EITC map to see if your state offers a tax credit.

C. and Puerto Rico have their own state EITCs. Check out the state EITC map to see if your state offers a tax credit.

Click on any of the following links to jump to a section:

-

- How much can I get with the EITC?

- Am I eligible for the EITC?

- Does my child qualify for the EITC?

- How do I claim the EITC?

- Does my state have an EITC?

- Can I still get the 2021 EITC?

The credit amount depends on your income, marital status, and family size. In 2022, the credit is worth up to $6,935. The credit amount rises with earned income until it reaches a maximum amount, then gradually phases out. Families with more children are eligible for higher credit amounts.

The Earned Income Tax Credit in Tax Year 2022

| Number of children: | Single workers with income less than: | Married workers with income less than: | EITC up to: |

| 3 or more children | $53,057 | $59,187 | $6,935 |

| 2 children | $49,399 | $55,529 | $6,164 |

| 1 child | $43,492 | $49,622 | $3,733 |

| No children | $16,480 | $22,610 | $560 |

You cannot get the EITC if you have investment income of more than $10,300 in 2022. Investment income includes taxable interest, tax-exempt interest, and capital gain distributions.

Investment income includes taxable interest, tax-exempt interest, and capital gain distributions.

There are three main requirements to claim the EITC:

- Income: You need to work and earn income. Your work doesn’t have to be year-round. Your earnings cannot be more than the amounts in the chart above, including investment income. Earned income can be from wages, salary, tips, employer-based disability, self-employment income, military pay, or union strike benefits.

- Taxpayer Identification Number: You need to have Social Security numbers that permit work for you, your spouse, and any children claimed for the EITC. You do not need to be a citizen to claim the EITC if you have a Social Security Number. You cannot claim the federal EITC if you file your taxes with an Individual Taxpayer Identification Number (ITIN). For more information, please see Tax Filing with Immigrant or DACA Status. New: if you live in California, Colorado, Maine, Maryland, New Mexico, Oregon, or Washington, you may be able to get the state EITC with an ITIN.

- Qualifying Child: If you claim children for the EITC, they must be a “qualifying child”. See the next section details.

Other eligibility requirements include:

- Qualifying Child Without a Social Security Number: You can claim the EITC for workers without children if you have a qualifying child for the EITC who doesn’t have a Social Security number.

- Married Filing Separately: Generally, you cannot claim the EITC if you are married filing separately. You may still qualify for the EITC if you are married filing separately and:

- Your qualifying child lives with you for more than six months of the year

- You meet at least one of the following requirements:

- You and the qualifying child do not live with your spouse during the last six months of the taxable year

- You and your spouse have a separation decree, instrument, or agreement (not a divorce decree) and do not live together at the end of the year

Note: Filing taxes as married filing separately may affect your eligibility for other tax benefits. Please talk to a tax professional if you need help figuring out your filing status.

Please talk to a tax professional if you need help figuring out your filing status.

If you claim children as part of your EITC, they must pass three tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be under 19, under 24 if a full-time student, or any age if totally and permanently disabled.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be continuous. For example, a qualifying child could live with you January through March, and September through December.

To claim the EITC, you must file a tax return. If you are claiming a child for the EITC, you also need to submit “Schedule EIC”.

Going to a paid tax preparer is expensive and reduces the amount of your tax refund.:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/18305764/4.4.5___figure_1.png) Luckily, there are free options available. You can visit a Volunteer Income Tax Assistance (VITA) site or GetYourRefund.org to have IRS-certified volunteers accurately file your taxes for free. You can also visit MyFreeTaxes.com to file your own taxes for free online if you do not have self-employment income.

Luckily, there are free options available. You can visit a Volunteer Income Tax Assistance (VITA) site or GetYourRefund.org to have IRS-certified volunteers accurately file your taxes for free. You can also visit MyFreeTaxes.com to file your own taxes for free online if you do not have self-employment income.

Many states have their own version of the federal EITC that can add more money to your tax refund. Most states match a percentage of your federal credit amount. Find out if your state has a state-level tax credit.

Yes. It’s not too late to claim your 2021 EITC if you haven’t already. To claim your 2021 EITC, you must file a 2021 tax return by April 18, 2025. If you filed a 2021 tax return but didn’t get the EITC and were eligible for it, you can amend your tax return.

Contact your local Volunteer Income Tax Assistance (VITA) site to see if they file 2021 tax returns. You can also use GetYourRefund.org.

Learn more about filing prior year tax returns.

The 2021 American Rescue Plan included 2 one-year EITC expansions:

- If You Have No Qualifying Children

You may qualify for the EITC if you are 19 years old or older and not a student. There are two exceptions:

There are two exceptions:

-

-

- Workers who are 19-23 and were a full- or part-time student for more than 5 months in 2021 do not qualify.

- Qualified homeless youth or former foster youth who are at least 18 years old and work are eligible even if they are a student.

-

If you are filing taxes for the first time, these resources may be helpful:

- Tax Filing and Tax Credits for Young Adults: John Burton Advocates for Youth have created several resources for young adults, including a guide to tax credits and a tax checklist. Many of these resources are also available in Spanish.

- Earned Income Tax Credit Guide that focuses on former foster and youth experiencing homelessness from SchoolHouse Connection.

- Taxes FAQ for young adults with experience in foster care or homelessness

- If Your 2021 Income is Lower Than Your 2019 Income

If your income in 2021 is less than your 2019 income, you can use your 2019 earned income to calculate your EITC. Choose the year that gives you the bigger refund. If you are married filing jointly, the total earned 2019 income refers to the sum of each spouse’s earned income in 2019.

Choose the year that gives you the bigger refund. If you are married filing jointly, the total earned 2019 income refers to the sum of each spouse’s earned income in 2019.

Recommended for you

The latest

By Tatiana Johnson To provide on-going relief due to COVID, the government passed…

Yes, you can still file taxes without a W-2 or 1099. Here's how.

Here’s a list of documents you need to ensure you file taxes accurately.…

Monthly payment in connection with the birth (adoption) of the first child

The applicant has the right to file a complaint against the decisions and (or) actions (inaction) of the authorized body, its officials in the provision of public services (hereinafter referred to as the complaint), including in the pre-trial (out-of-court) procedure in the following cases:

- violation of the application registration deadline;

- violation of the term for the provision of public services; nine0005 requirement from the applicant of documents not provided for by the regulatory legal acts of the Russian Federation for the provision of public services;

- refusal to provide a public service, if the grounds for refusal are not provided for by federal laws and other regulatory legal acts of the Russian Federation adopted in accordance with them;

- refusal to accept documents, the submission of which is provided for by regulatory legal acts of the Russian Federation for the provision of public services; nine0006

- requesting from the applicant, when providing a public service, a fee not provided for by the regulatory legal acts of the Russian Federation;

- refusal of the authorized body providing the public service, its officials to correct the misprints and errors made by them in the documents issued as a result of the provision of the public service, or violation of the deadline for such corrections;

- violation of the term or procedure for issuing documents based on the results of the provision of public services; nine0006

- suspension of the provision of public services, if the grounds for suspension are not provided for by federal laws and other regulatory legal acts of the Russian Federation adopted in accordance with them, laws and other regulatory legal acts of the constituent entities of the Russian Federation, municipal legal acts.

The subject of the complaint is a violation of the rights and legitimate interests of the applicant, unlawful decisions and (or) actions (inaction) of the authorized body, its officials in the provision of public services, violation of the provisions of the administrative regulations and other regulatory legal acts that establish requirements for the provision of public services. nine0003

The complaint is submitted by the applicant in writing on paper, in electronic form to the authorized body.

Complaints against decisions and actions (inaction) of the head of the authorized body are considered directly by the official of the executive authority of the constituent entity of the Russian Federation authorized to consider complaints.

The complaint must contain:

- name of the authorized body providing the public service, last name, first name, patronymic (if any) of its officials providing the public service and (or) their leaders, decisions and actions (inaction) of which are being appealed; nine0006

- last name, first name, patronymic (if any) of the applicant, information about the place of residence, as well as contact phone number (numbers), e-mail address (s) (if any) and postal address to which the answer should be sent to the applicant;

- information about the appealed decisions and (or) actions (inaction) of the authorized body, an official of the authorized body, its head;

- arguments on the basis of which the applicant does not agree with the decisions and (or) actions (inaction) of the authorized body, an official of the authorized body, its head.

nine0006

nine0006

The applicant shall submit documents (if any) confirming his arguments or copies thereof.

In case of filing a complaint through a multifunctional center, the multifunctional center ensures that the complaint is transferred to the authorized body in the manner and terms established by the cooperation agreement concluded between the multifunctional center and the authorized body providing public services, but no later than the working day following the day the complaint was received . nine0003

Reception of complaints in writing is carried out by the authorized body at the place of provision of the public service (at the place where the applicant applied for the public service, the violation of the procedure for the provision of which is being appealed, or at the place where the applicant received the result of the specified public service or the refusal to provide the public service).

The time for receiving complaints should coincide with the time for the provision of public services. nine0003

nine0003

In case of filing a complaint at a personal reception, the applicant presents an identity document, if the complaint is filed through the representative of the applicant, a document is also submitted confirming the authority of the representative to act on behalf of the applicant. If the complaint is sent by post, a copy of the document confirming the authority of the representative, certified by a notary or other person in the manner prescribed by Article 185.1 of the Civil Code of the Russian Federation, is sent. nine0003

In electronic form, a complaint can be filed by the applicant through the website of the authorized body, the Single portal, the service portal.

When filing a complaint in electronic form, the documents specified in paragraph 100 of the administrative regulations may be submitted in the form of an electronic document signed with an electronic signature, the form of which is provided for by the legislation of the Russian Federation. In this case, an identity document of the applicant is not required. nine0003

In this case, an identity document of the applicant is not required. nine0003

In the authorized body, officials authorized to consider complaints are determined, who ensure:

- receiving and handling complaints;

- sending complaints to the body authorized to consider them.

Complaints against decisions and (or) actions (inaction) of an official of the authorized body are considered by the head of the authorized body or an official of the authorized body authorized to consider complaints. Complaints against decisions and (or) actions (inaction) of the head of the authorized body are considered by an official of the executive authority of the constituent entity of the Russian Federation authorized to consider complaints. nine0003

If the complaint is filed by the applicant with a body whose competence does not include making a decision on the complaint, within 3 working days from the date of its registration, the said body sends the complaint to the body authorized to consider it and informs the complainant in writing about the redirection of the complaint.

The authorized body ensures:

- equipment for receiving complaints;

- informing applicants about the procedure for appealing against decisions and (or) actions (inaction) of the authorized body, officials of the authorized body by posting information on information boards in places where public services are provided, on the website of the authorized body, on the Single portal, service portal; nine0006

- advising applicants on the procedure for appealing against decisions and (or) actions (inaction) of the authorized body, officials of the authorized body at a personal appointment, including by phone, using the website of the authorized body;

- conclusion of agreements on interaction between the multifunctional center and the authorized body in terms of the implementation by the multifunctional center of receiving complaints and issuing the results of consideration of complaints to the applicant; nine0005 formation and quarterly submission to the Federal Service for Labor and Employment of reports on received and considered complaints (including the number of satisfied and unsatisfied complaints).

A complaint received by the authorized body shall be subject to registration no later than the working day following the day of its receipt.

The complaint is subject to consideration within 15 working days from the date of its registration, and in the event of an appeal against the refusal of the authorized body to accept documents from the applicant or to correct misprints and errors, or in the event of an appeal against a violation of the established deadline for such corrections - within 5 working days from the date of its registration. nine0003

The result of the consideration of the complaint is the adoption of one of the following decisions:

- satisfy the complaint, including in the form of cancellation of the decision made by the authorized body, correction of typos and errors in documents issued as a result of the provision of public services, return to the applicant of funds, the collection of which is not provided for by the regulatory legal acts of the Russian Federation, regulatory legal acts of the subjects Russian Federation, municipal legal acts; nine0006

- refuse to satisfy the complaint.

When satisfying the complaint, the authorized body takes comprehensive measures to eliminate the identified violations, including the issuance of the result of the public service to the applicant no later than 5 working days from the date of the relevant decision, unless otherwise provided by the legislation of the Russian Federation.

A complaint may be denied in the following cases:

- availability of a court decision that has entered into legal force on a complaint about the same subject and on the same grounds;

- filing a complaint by a person whose powers have not been confirmed in the manner prescribed by the legislation of the Russian Federation;

- the presence of a decision on a complaint made earlier in accordance with the requirements of the Rules for filing and considering complaints against decisions and actions (inaction) of federal executive bodies and their officials, federal civil servants, officials of state non-budgetary funds of the Russian Federation, state corporations endowed with in accordance with federal laws, the powers to provide public services in the established field of activity, and their officials, organizations provided for by Part 1.

1 of Article 16 of the Federal Law "On the organization of the provision of state and municipal services", and their employees, as well as multifunctional centers for the provision of state and municipal services and their employees, approved by Decree of the Government of the Russian Federation No. 840 dated August 16, 2012, in respect of the same applicant and on the same subject of the complaint. nine0006

1 of Article 16 of the Federal Law "On the organization of the provision of state and municipal services", and their employees, as well as multifunctional centers for the provision of state and municipal services and their employees, approved by Decree of the Government of the Russian Federation No. 840 dated August 16, 2012, in respect of the same applicant and on the same subject of the complaint. nine0006

A complaint may be left unanswered in the following cases:

- presence in the complaint of obscene or offensive expressions, threats to life, health and property of an official of the authorized body, as well as members of his family;

- the inability to read any part of the text of the complaint, the last name, first name, patronymic (if any) and (or) the postal address of the applicant indicated in the complaint.

In response to the results of the consideration of the complaint, the following shall be indicated: nine0003

- name of the public service provider that considered the complaint, position, last name, first name, patronymic (if any) of the official who made the decision on the complaint;

- number, date, place of the decision, including information about the official of the authorized body, the decision and (or) action (omission) of which is being appealed;

- last name, first name, patronymic (if any) of the applicant;

- grounds for making a decision on the complaint; nine0006

- decision made on the complaint;

- if the complaint is found to be justified, the terms for eliminating the identified violations, including the term for providing the result of the public service;

- information on the procedure for appealing against the decision taken on the complaint.

In the event that, during or as a result of consideration of a complaint, signs of an administrative offense or crime are established, an official of the authorized body authorized to consider complaints shall send the available materials to the prosecutor's office. nine0003

A reasoned response based on the results of the consideration of the complaint is signed by the official authorized to consider the complaint and sent to the applicant in writing or, at the request of the applicant, in the form of an electronic document signed by the electronic signature of the official authorized to consider the complaint, the type of which is established by the legislation of the Russian Federation, no later than the day following the day the decision is made on the results of the consideration of the complaint.

The applicant has the right to appeal the decision taken on the complaint by sending it to the Federal Service for Labor and Employment.

If the applicant is not satisfied with the decision made during the consideration of the complaint or the absence of a decision on it, then he has the right to appeal the decision in accordance with the legislation of the Russian Federation.

The applicant has the right to receive comprehensive information and documents necessary to substantiate and consider the complaint. nine0003

Information on the procedure for filing and considering a complaint is posted on information boards in places where public services are provided, on the website of the authorized body, on the Single Portal, Services Portal, and can also be communicated to the applicant orally and (or) in writing.

The procedure for pre-trial (out-of-court) appeals against decisions and actions (inaction) of the body providing the public service, as well as its officials, is regulated by Federal Law No. 210-FZ of July 27, 2010 “On the organization of the provision of state and municipal services” and the Decree of the Government of the Russian Federation of August 16 .2012 No. 840 “On the procedure for filing and considering complaints against decisions and actions (inaction) of federal executive bodies and their officials, federal civil servants, officials of state non-budgetary funds of the Russian Federation, state corporations vested in accordance with federal laws with powers to provision of public services in the established field of activity, and their officials, organizations provided for by Part 1. 1 of Article 16 of the Federal Law "On the organization of the provision of state and municipal services", and their employees, as well as multifunctional centers provided ion of state and municipal services and their employees. nine0003

1 of Article 16 of the Federal Law "On the organization of the provision of state and municipal services", and their employees, as well as multifunctional centers provided ion of state and municipal services and their employees. nine0003

| Per capita | Working population | Child | Base | |

| Altai Territory | 12794 | 13945 | 13373 | Decree of the Government of the Altai Territory dated November 30, 2022 No. 452 |

| Amur region - for the whole region | 17047 | 18581 | 18128 | Decree of the Government of the Amur Region dated December 23, 2022 No. 1277 |

Amur region - in the northern zone: urban districts - Zeya, Tynda; municipal districts - Zeya, Tyndinsky, Selemdzhinsky (with the exception of the village of Murtygit). | 18240 | 19882 | 19397 | Decree of the Government of the Amur Region dated December 23, 2022 No. 1277 |

| Arkhangelsk region* as a whole for the subject | 16675 | 18176 | 16327 | Decree of the Government of the Arkhangelsk region dated 08.12.2022 No. 1024-pp |

| Arkhangelsk region Zone II includes: urban districts of Severodvinsk and Novaya Zemlya; municipal districts Leshukonsky, Mezensky; Pinezhsky municipal district; rural settlement Solovetsky. | 18759 | 20447 | 18948 | Decree of the Government of the Arkhangelsk Region dated 08.12.2022 No. 1024-pp |

Arkhangelsk region Zone VI includes: urban districts of the city of Arkhangelsk, the city of Koryazhma, Kotlas, Mirny, the city of Novodvinsk; municipal districts Velsky, Konoshsky, Krasnoborsky, Lensky, Onega, Primorsky; municipal districts Verkhnetoemsky, Vilegodsky, Vinogradovsky, Kargopolsky, Kotlassky, Nyandoma, Plesetsky, Ustyansky, Kholmogorsky, Shenkursky. | 16141 | 17594 | 15664 | Decree of the Government of the Arkhangelsk Region dated 08.12.2022 No. 1024-pp |

| Nenets Autonomous Okrug | 26817 | 29231 | 28019 | Decree of the Administration of the Nenets Autonomous Okrug dated December 21, 2022 No. 365-p |

| Astrakhan region | 13944 | 15199 | 14638 | Decree of the Government of the Astr. Region of December 20, 22 No. 656-p |

| Belgorod region | 12075 | 13162 | 11713 | nine0151 Decree of the Government of the Belgorod Region dated December 19, 2022 No. 753-pp|

| Bryansk region | 13560 | 14780 | 13472 | Decree of the Government of the Bryansk region dated December 19, 2022 No. 601-p |

| Vladimir region | 13944 | 15199 | 13526 | Decree of the Administration of the Vladimir Region dated December 14, 2022 No. 850 850 |

| Volgograd region | 12363 | 13476 | 12307 | Resolution of the Government dated December 27, 2022 No. 859-p |

| Vologda region | 14519 | 15826 | 14083 | Decree of the Government of December 26, 2022 No. 1534 |

| Voronezh region | 12363 | 13476 | 11992 | Decree of the Government of the Voronezh Region of December 20, 2022 №944 |

| Baikonur* (indicator for Russia as a whole) | 14375 | 15669 | 13944 | Federal Law No. 466-FZ dated 05.12.2022 “On the federal budget for 2023 and for the planned period of 2024 and 2025” |

| Moscow | 21718 | 24801 | 18770 | Decree of the Government of Moscow dated December 20, 2022 No. 2909-PP |

| Moscow region | 17277 | 18832 | 16759 | Decree of the Government of the Moscow Region dated December 21, 2022 No. 1430/46 1430/46 |

| Leningrad region | 14806 | 16139 | 14362 | Decree of the Government of the Leningrad Region dated December 22, 22 No. 952 |

| St. Petersburg | 15094 | 16452 | 14641 | Decree of the Government of St. Petersburg dated December 27, 2022 No. 1336 |

| Sevastopol | 14519 | 15826 | 15560 | Decree of the Government of Sevastopol dated December 26, 2022 No. 709-PP |

| Trans-Baikal Territory | 16819 | 18333 | 17805 | Decree of the Government of the Zab.krai dated December 27, 22 No. 652 |

| Ivanovo region | 13369 | 14572 | 13002 | Decree of the Government of the Ivanovo Region dated December 20, 2022 No. 777p |

| Irkutsk region - for the region as a whole | 15238 | 16609 | 15078 | nine0151 Decree of the Government of the Irkutsk Region of December 16, 2022 No.|

| Irkutsk region - by districts of CS and equated to CS | 18529 | 20197 | 18335 | Decree of the Government of the Irkutsk Region dated December 16, 2022 No. 1016-p |

| Irkutsk region - other areas | 14248 | 15529 | 14098 | Decree of the Government of the Irkutsk Region of December 16, 2022 No. 1016-p |

| Kabardino-Balkar Republic | 15381 | 16765 | 16769 | Decree of the Government of the Kabardino-Balkarian Republic dated December 19, 2022 No. 276-PP |

| Kaliningrad region | 14806 | 16139 | 14362 | Decree of the Rights of December 26, 2022 No. 701 |

| Kaluga region | 13800 | 15042 | 13702 | resolution of the government of December 22, 2022 No. 1003 |

| Kemerovo region - Kuzbass | 13081 | 14258 | 13299 | resolution of the Kemerovo region-Kuzbass dated 12/14/2022 No. 825 825 |

| Kamchatka Territory | 26388 | 28763 | 28105 | Resolution of the government of December 30, 2022 No. 759-p |

| Karachay-Cherkess Republic | 13225 | 14415 | 13673 | Resolution of the Government of the KChR dated December 22, 22 No. 372 |

| Kirov region | 12794 | 13945 | 13439 | Decree of the Government of the Kirov Region dated December 20, 2022 No. 707-P |

| Kostroma region | 13284 | 14494 | 13333 | Decree of the Administration of the Kostroma Region dated December 19, 2022 No. 628-a |

| Krasnodar Territory | 13800 | 15042 | 13386 | Decree of the Governor of Krasnodar.kar dated December 16, 2022 No. 961 |

| Kurgan region | 13513 | 14729 | 13874 | Decree of the Government of the Kurgan Region dated December 14, 2022 No. 381 381 |

| Kursk region | 12506 | 13632 | 12826 | Decree of the Administration of the Kursk region dated December 22, 2022 No. 1546-pa |

| Lipetsk region | 11931 | 13005 | 12364 | Decree of the government of the Lipetsk region. dated December 20, 2022 No. 319 |

| Magadan region | 25013 | 27264 | 28231 | Decree of the Government of the Magadan Region dated December 16, 2022 No. 1011-pp |

| Murmansk region | 23474 | 25587 | 22770 | Decree of the Government of the Murmansk region. dated December 14, 2022 No. 1008-PP |

| Nizhny Novgorod Region | 13513 | 14729 | 13108 | nine0151 Decree of the Government of the Nizhny Novgorod Region dated December 16, 2022 No. 1080|

| Novgorod region | 14088 | 15356 | 13665 | Decree of the Government of the Novgorod Region dated December 22, 2022 No. 694 694 |

| Novosibirsk region | 14728 | 16054 | 15261 | Decree of the Government of the Novosibirsk Region No. 589-p dated December 13, 2022 "On the subsistence minimum in the Novosibirsk Region for 2023" |

| Omsk region | 13195 | 14383 | 13624 | Decree of the Government of the Omsk Region dated December 15, 2022 No. 721-p |

| Orenburg region | 12506 | 13632 | 12572 | Decree of the Government of the Orenburg Region dated December 13, 2022 No. 1353-pp |

| Oryol region | 13369 | 14572 | 12968 | Decree of the Government of the Oryol Region dated December 21, 2022 No. 828 |

| Penza region | 12075 | 13162 | 11820 | Decree of the Government of the Penza Region dated December 20, 2022 No. 1138-pP |

| Perm region | 13225 | 14415 | 13146 | Decree of the Government of the Perm Territory dated December 21, 2022 No. 1106-p 1106-p |

| Primorsky Krai | 17106 | 18646 | 18210 | Decree of the Government of Primorsky Krai dated December 20, 2022 No. 881-pp |

| Pskov region | 14231 | 15512 | 13920 | Decree of the Government of the Pskov Region dated December 22, 2022 No. 352 |

| Republic of Adygea | 12363 | 13476 | 12415 | Decree of the Cabinet of Ministers of the Republic of Adygea dated December 20, 22 No. 342 |

| Republic of Altai | 13513 | 14729 | 13108 | Decree of the Government of the Republic of Altai dated December 22, 2022 No. 452 |

| Republic of Bashkortostan | 12650 | 13789 | 12271 | Decree of the Government of the Republic of Belarus of December 21, 2022 No. 800 |

| Republic of Buryatia | 15669 | 17079 | 16006 | Decree of the Government of the Republic of Belarus dated December 26, 22 No. 819 819 |

| Republic of Dagestan | 13081 | 14258 | 13066 | resolution of the Government of the RD dated December 21, 2022 No. 451 |

| Republic of Ingushetia | 13513 | 14729 | 13851 | Decree of the Government of the Republic of Ingushetia dated December 23, 2022 No. 196 |

| Republic of Kalmykia | 13656 | 14885 | 13484 | Decree of the Government of the Republic of Kalmykia dated December 15, 2022 No. 481 |

| Republic of Karelia as a whole for the subject | 17877 | 19486 | nine0151 17341Decree of the Government of the Republic of Karelia dated November 28, 2022 No. 640-P | |

| Republic of Karelia in the northern part (Belomorsky, Kalevalsky, Kemsky, Loukhsky districts, Kostomuksha) | 18950 | 20655 | 18382 | |

| Republic of Karelia, except for the northern part | 17698 | 19291 | 17167 | |

| Republic of Komi, as a whole for the subject | 17463 | 19035 | 17624 | Decree of the Republic of Komi dated December 20, 2022 No. 630 630 |

| Republic of Komi, northern climatic zone | 20309 | 22137 | 20816 | |

| Republic of Komi, southern climatic zone | 16415 | 17892 | 16383 | |

| Republic of Crimea | 13944 | 15199 | 14846 | Decree of the Council of Ministers of the Republic of Kazakhstan dated December 22, 2022 No. 1218 |

| Republic of Mari El | 12650 | 13789 | 13000 | Decree of the Government of the Republic of Mari El dated December 20, 2022 No. 554 |

| Republic of Mordovia | 12219 | 13319 | 12402 | Decree of the Government of the Republic of Mordovia dated December 12, 2022 No. 781 |

| Republic of Sakha (Yakutia), in general for the subject | 21706 | 23660 | nine0151 22560 Decree of the Government of the Republic of Sakha (Yakutia) dated December 22, 2022 No. 798 798 | |

| Republic of Sakha (Yakutia), zone I: Abyisky, Allaikhovsky, Anabarsky, Bulunsky, Verkhnekolymsky, Verkhoyansky, Zhigansky, Momsky, Nizhnekolymsky, Oymyakonsky, Oleneksky, Srednekolymsky, Ust-Yansky and Eveno-Bytantaysky uluses (districts), as well as Aikhal settlement with settlements and the city of Udachny with settlements of Mirninsky ulus (district) | 25396 | 27682 | 26395 | |

| Republic of Sakha (Yakutia), II zone: Aldansky, Amginsky, Verkhnevilyuisky, Vilyuisky, Gorny, Kobyaysky, Lensky, Megino-Kangalassky, Mirninsky (except for the village of Aikhal with settlements and the city of Udachny with settlements), Namsky, Neryungrinsky, Nyurbinsky, Olekminsky, Suntarsky, Tattinsky, Tomponsky, Ust-Aldansky, Ust-Maysky, Khangalassky, Churapchinsky uluses (districts), as well as the city of republican significance Yakutsk | 21272 | 23187 | 22109 | |

| Republic of North Ossetia-Alania | 12938 | 14102 | 12818 | Decree of the Government of the North Ossetia of December 20, 22 No. 556 556 |

| Republic of Tatarstan | 12219 | 13319 | 11852 | Decree of the Government of the Republic of Tajikistan dated December 29, 22 No. 1433 |

| Tyva Republic | 14519 | 15826 | nine0151 14433Decree of the Government of the Republic of Tyva dated December 21, 2022 No. 834 | |

| Republic of Khakassia | 14663 | 15983 | 14782 | Decree of the Government of the Republic of Khakassia No. 782 dated 12/15/2022 |

| Rostov region | 13513 | 14729 | 13759 | Decree of the Government of Rostov.reg. No. 1113 dated 12/19/2022 |

| Ryazan region | 12794 | 13945 | 13155 | Decree of the Government of the Ryazan region of 20.12. 2022 No. 498 |

| Samara region | 13513 | 14729 | 13108 | Decree of the Government of the Samara Region dated December 21, 2022 No. 1198 1198 |

| Saratov region | 12075 | 13162 | 12576 | Decree of the Government of the Saratov Region dated December 20, 2022 No. 1262-P |

| Sakhalin region | 19550 | 21310 | 20880 | Decree of the Government of the Sakhalin Region dated December 23, 2022 No. 607 |

| Sverdlovsk region | 14088 | 15356 | 14623 | Decree of the Government of the Sverdlovsk Region of December 15, 2022 No. 864-PP |

| Smolensk region | 13944 | 15199 | 13526 | nine0151 Decree of the Administration of the Smolensk Region dated December 15, 2022 No. 955|

| Stavropol Territory | 12938 | 14102 | 12550 | Decree of the Government of the Stavropol Territory dated December 16, 2022 No. 766-p |

| Tambov region | 12796 | 13948 | 12412 | |

| Tver region | 13944 | 15199 | 14055 | nine0151|

| Tomsk region as a whole for the subject | 14466 | 15768 | 15306 | Decree of the Administration of the Tomsk Region dated December 20, 2022 No. 587a 587a |

| Tomsk region, municipalities: City district Strezhevoy, Aleksandrovsky district, Kargasoksky district, Verkhneketsky district, Kolpashevsky district, Parabelsky district, Molchanovsky district, Chainsky district, Teguldetsky district, city of Kedrovy, Krivosheinsky district, Bakcharsky district | 15638 | 17045 | 16546 | Decree of the Administration of the Tomsk Region dated December 20, 2022 No. 587a |

| Tomsk region, municipalities: Pervomaisky district, Asinovsky district, Zyryansky district, Shegarsky district, Tomsk district, City of Tomsk, urban district closed administrative-territorial formation Seversk, Tomsk region, Kozhevnikovsky district | 14220 | 15500 | 15046 | Decree of the Administration of the Tomsk Region dated December 20, 2022 No. 587a |

| Tula region | 14231 | 15512 | 13804 | Resolution of the Government T. o. dated 12/23/22 No. 848 o. dated 12/23/22 No. 848 |

| Tyumen region | 14375 | 15669 | 14176 | Decree of the Government of the Tyumen Region dated December 20, 2022 No. 936-p |

| Udmurt Republic | 12794 | 13945 | 12663 | Decree of the Government of the UR dated 12/23/22 No. 745 |

| Ulyanovsk region | 12794 | 13945 | 12915 | Decree of the Government of the Ulyanovsk Region dated December 21, 2022 No. 778-P |

| Khabarovsk Territory | 19170 | 20895 | 21120 | Decree of the Government of the Khabarovsk Territory dated December 26, 2022 No. 677-pr |

| Jewish Autonomous Region | 19377 | 21121 | 19488 | nine0151 Decree of the Government of the EAO dated December 22, 2022 No. 540-pp|

| Khanty-Mansi Autonomous Okrug - Yugra | 19649 | 21417 | 19680 | Decree of the Government of KhMAO-Yugra dated December 23, 2022 No. 699-p 699-p |

| Chelyabinsk region | 13730 | 14966 | 14140 | Dec. Government of Chelyab.reg. dated 12/21/22 No. 755-P |

| Chechen Republic | 13800 | 15042 | 13386 | Decree of the Government of the Czech Republic of 21.12.22 No. 297 |

| Chuvash Republic-Chuvashia | 12363 | 13476 | 11992 | Decree of the Cabinet of Ministers of the Chuvash Republic dated 12/14/2022 No. 668 |

| Chukotka Autonomous Okrug | 35938 | 39172 | 34859 | Decree of the Government of the Chukotka Autonomous Okrug No. 635 dated 12/21/2022 |

| Yamalo-Nenets Autonomous Okrug | 20923 | 22806 | 20295 | Decree of the Yamalo-Nenets Autonomous Okrug No. 1257-P | dated December 20, 2022

| Yaroslavl region | 13800 | 15042 | 13386 | Decree of the Government of the Yaroslavl Region dated December 20, 2022 No. 1139-p 1139-p |

| Krasnoyarsk region, as a whole along the region | 15956 | 17392 | 16642 | Decree of the Government of the Krasnoyarsk Territory dated December 20, 2022 No. 1124p |

| Krasnoyarsk Territory, 1st group of territories of the region: | ||||

| city of Norilsk | 22522 | 24549 | 23490 | |

| Severo-Yeniseisky district | 22522 | 24549 | 23490 | |

| Turukhansky district | 29195 | 31822 | 30450 | |

| Taimyrsky Dolgano-Nenetsky District (excluding the rural settlement of Khatanga) | 24279 | 26464 | 25322 | |

| rural settlement Khatanga | 40267 | 43890 | 41998 | |

| Evenki district | 24741 | 26968 | 25805 | |

| 2 group of territories of the region: | nine0151 | |||

| city of Yeniseysk | 21052 | 22947 | 21957 | |

| city of Lesosibirsk | 17596 | 19180 | 18353 | |

| Boguchansky district | 22042 | 24025 | 22989 | |

| Yenisei district | 22407 | 24424 | 23370 | |

| Kezhemsky district | 20877 | 22756 | 21774 | |

| Motyginsky district | 21526 | 23464 | 22452 | |

| 3rd group of territories of the region: | ||||

| other territories of the region | 15093 | 16451 | 15742 | |

| Donetsk People's Republic | 11213 | 12222 | 10877 | Decree of the Government of the Russian Federation of December 15, 2022 No. |

1016-p

1016-p