How can i claim a child on my taxes

How to Claim a Tax Dependent: Rules,Qualifications

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Tax dependents are either qualifying children or qualifying relatives, and they can score you some big tax breaks.

By

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

Edited by Chris Hutchison

Chris Hutchison

Lead Assigning Editor

Chris Hutchison helped build NerdWallet's content team at its outset and went on to work as an assigning editor on banking and investing and oversaw taxes coverage. He now leads a team exploring new markets. Prior to joining NerdWallet, he was an editor and programmer at ESPN and a copy editor at the San Jose Mercury News.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

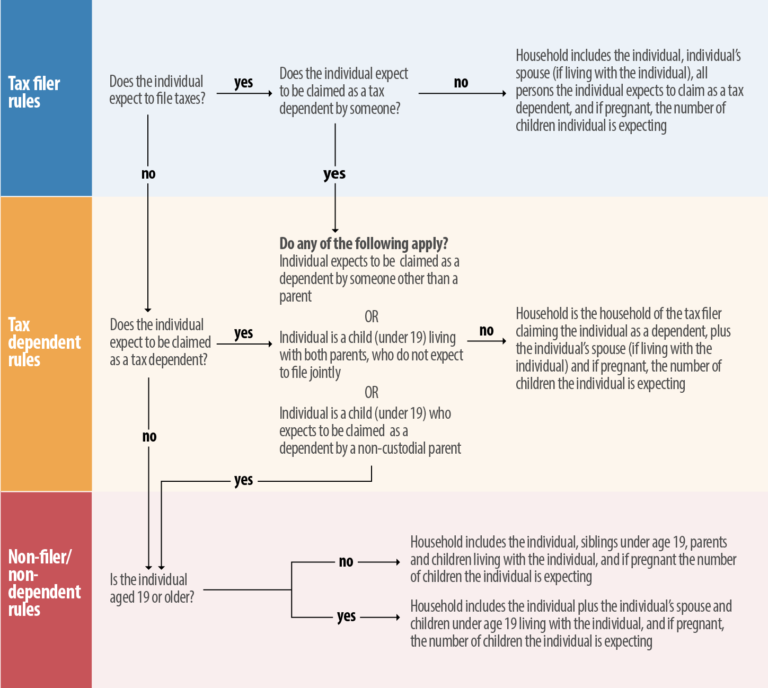

What is a tax dependent?

A tax dependent is a child or relative whose characteristics and relationship to you allow you to claim certain tax deductions and credits, such as head of household filing status, the child tax credit, the earned income tax credit or the child and dependent care credit.

Determining whether someone is a tax dependent can be difficult. Here’s a rundown, but keep in mind that this is a complex area of the tax code and there are exceptions to every rule. For all the details, check out IRS Publication 501.

Who qualifies as a tax dependent?

For tax purposes, there are two kinds of dependents:

Qualifying child

To claim a child as a dependent on your tax return, the child must meet all of the following conditions.

The child has to be part of your family

This is the relationship test. The child must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people.

The child has to be under a certain age

This is the age test. One of these three things has to be true to pass this test:

The child was 18 or younger at the end of the year and younger than you or your spouse (if you're married and filing jointly).

The child was 23 or younger at the end of the year, was a student and was younger than you or your spouse (if you're married and filing jointly). “Student” in this case means the kid was a full-time student for at least five calendar months of the year.

The child is over these age limits but is permanently and totally disabled, as determined by a doctor.

The child has to live with you

This is the residency test. The child must have lived with you for more than half the tax year. There are certain exceptions for temporary absences (such as if the child was away at college, in the hospital or in juvenile detention), for children who were born or died during the tax year, for kids of divorced or separated parents and for kidnapped kids.

The child must have lived with you for more than half the tax year. There are certain exceptions for temporary absences (such as if the child was away at college, in the hospital or in juvenile detention), for children who were born or died during the tax year, for kids of divorced or separated parents and for kidnapped kids.

In cases of divorce or separation, the custodial parent typically gets to claim the child as a dependent. However, sometimes the noncustodial parent can claim a child as a dependent if the custodial parent signs a written declaration that he or she won’t claim the child as a dependent.

The child can't provide more than half of his or her own financial support

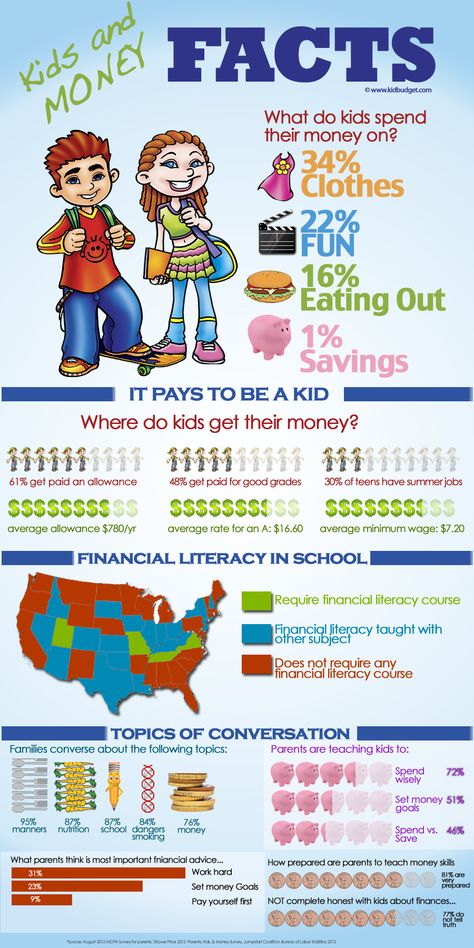

If your child gets a job and provides at least half of her own financial support, you can’t claim the child as a tax dependent. However, support generally includes household expenses such as rent, groceries, utilities, clothing, unreimbursed medical expenses, travel costs and recreation expenses.

The child can’t file a joint tax return with someone

This is the joint return test. There’s an exception here if the child and the child's spouse file a joint return only to claim a refund of income tax withheld or estimated tax paid.

The child has to have a certain residency or citizenship status

This is the citizen or resident test. The child has to be a U.S. citizen, U.S. resident alien, U.S. national or a resident of Canada or Mexico.

Qualifying relative

A qualifying relative can be any age. But to claim a relative as a tax dependent on your tax return, the person must meet all of the following conditions.

The person can’t be anyone else’s qualifying child

You can’t claim someone else’s qualifying child as your qualifying relative. So if your toddler lives with your parents, for example, and he meets all the tests to be their qualifying child, you can’t also claim him as your qualifying relative.

The person has to be related to you or live with you

Only one of these two things has to be true:

The person has one of these relationships to you. He or she is your child, stepchild, legally adopted child, foster child, or a descendant of any of those people (for example, your grandchild) or is your sibling, half sibling, stepsibling, niece or nephew (including the kids of your half siblings), or is your parent or grandparent, stepparent, aunt or uncle, or in-law (but not your foster parent).

The person lived with you all year. There are exceptions for temporary absences (such as if the child was away at college), for children who were born or died during the tax year, for kids of divorced or separated parents and for kidnapped kids.

Note that only one of the two things has to be true in order to get over the hurdle. That means that a person related to you doesn’t necessarily have to live with you in order for you to claim them as a dependent. This can be especially important for people supporting elderly parents who live somewhere else.

This can be especially important for people supporting elderly parents who live somewhere else.

The person’s gross income is below the limit

The person’s gross income for the year can’t be more than $4,400 in the 2022 tax year.

Internal Revenue Service

. Rev. Proc. 2021-45: 24. Gross Income Limitation for a Qualifying Relative.

Accessed Aug 17, 2022.

View all sources

It will rise to $4,700 for the 2023 tax year (taxes filed in 2024).

Internal Revenue Service

. Rev. Proc. 2022-38: .24 Gross Income Limitation for a Qualifying Relative..

Accessed Nov 18, 2022.

View all sources

People who are disabled or have income from a sheltered workshop get an exception.:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png) Gross income includes money from rental properties, business income and taxable unemployment and Social Security benefits.

Gross income includes money from rental properties, business income and taxable unemployment and Social Security benefits.

You have to provide more than half the person’s total financial support for the year

Support generally includes household expenses such as rent, groceries, utilities, clothing, unreimbursed medical expenses, travel costs and recreation expenses. If multiple people provide support for a person and because of that no one person is providing more than 50% of the support, the support providers can sign a Multiple Support Declaration designating who gets to claim the supported person as their tax dependent.

Find more ways to secure your assets and your future

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

|

Who is not a tax dependent

These people generally won’t count as your tax dependents:

Anyone at all, if someone else can claim you as a dependent (in other words, you usually can’t be someone’s dependent and then claim dependents yourself).

Generally, a married person who files a joint tax return (there are some important but complicated exceptions to this; see IRS Publication 501 for the details).

Anybody who is not a U.S. citizen, U.S. resident alien, U.S. national or a resident of Canada or Mexico (there are exceptions here for people adopting children).

People who work for you.

Foreign exchange students.

Tax breaks for claiming a tax dependent

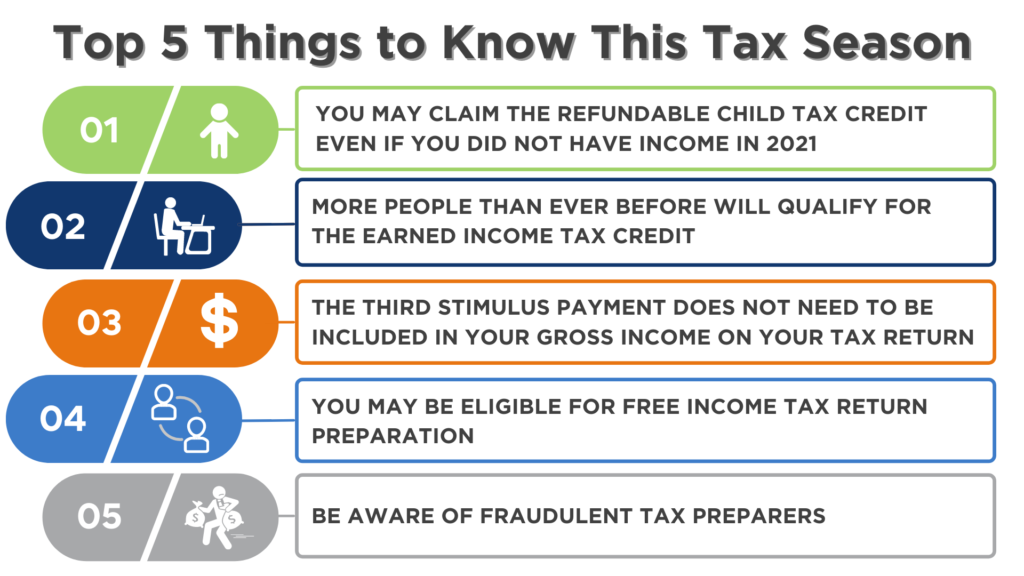

Claiming a dependent can get you some big tax breaks. Good tax software, including providers who participate in IRS Free File, should ask you questions that will help determine whether you qualify.

Head of household filing status. This filing status gets you bigger tax deductions and more favorable tax brackets than if you filed as single. (How it works.)

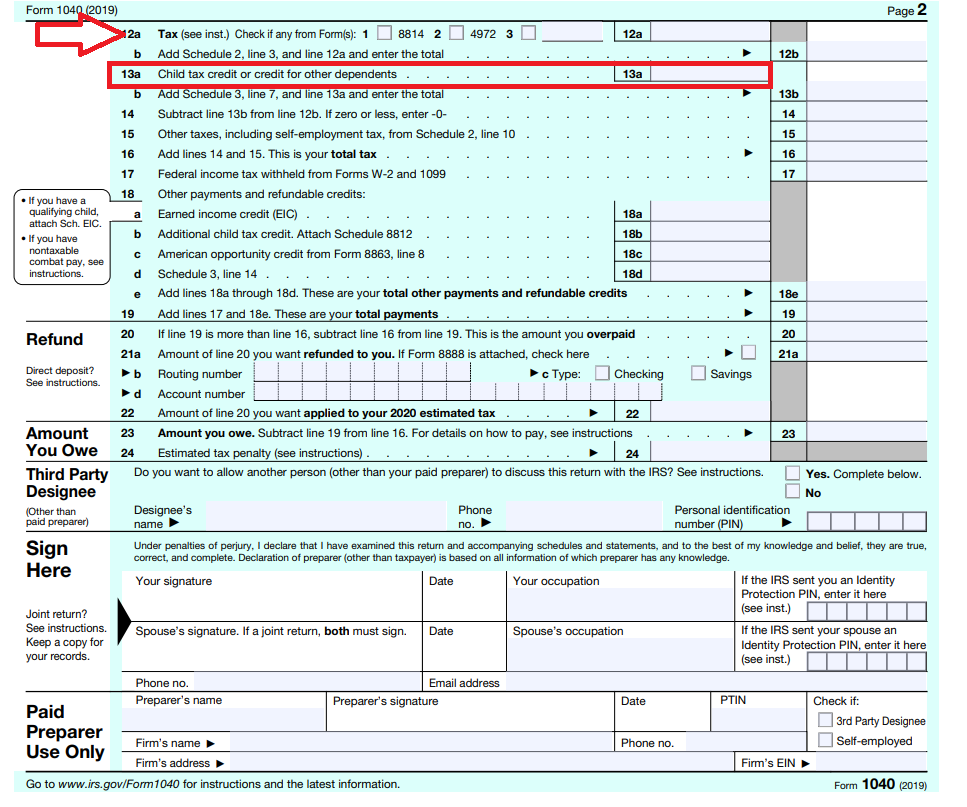

Child tax credit. This could get you up to a $2,000 tax credit (with $1,500 being potentially refundable) for the 2022 tax year. (How it works.)

Child and dependent care tax credit. For the 2022 tax year, it’s 20% to 35% of up to $3,000 (for one qualifying dependent) or $6,000 (for two or more qualifying dependents) to cover day care and similar costs for a child under 13, a spouse or parent unable to care for themselves, or another dependent so you can work.

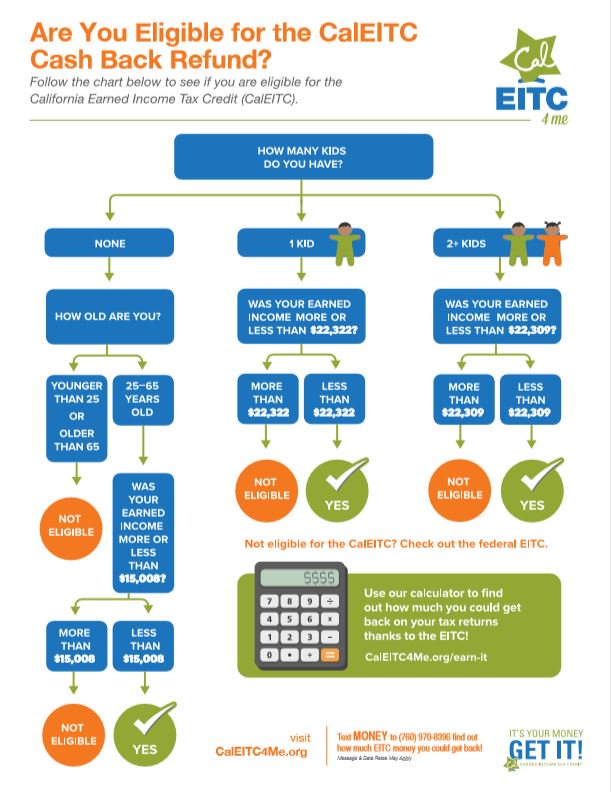

Earned income credit. This credit can get you between $560 to $6,935 for the 2022 tax year depending on how many kids you have, your marital status and how much you make. It’s something to explore if your adjusted gross income is around or less than about $59,000. (How it works.)

Adoption credit. This covers up to $14,890 in adoption costs per child for 2022. (How it works.)

About the author: Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Claiming Dependents As New Parents

First of all: if you recently had a baby, congratulations! You’re in for a lot of changes, and those include changes to the way you file your taxes. Let’s talk about the primary differences you’ll need to be aware of when you file your taxes as a parent for the first time.

Let’s talk about the primary differences you’ll need to be aware of when you file your taxes as a parent for the first time.

First time filing taxes with a child: Dependency requirements

In order to claim a new child as a dependent, your child will have to meet dependency requirements.

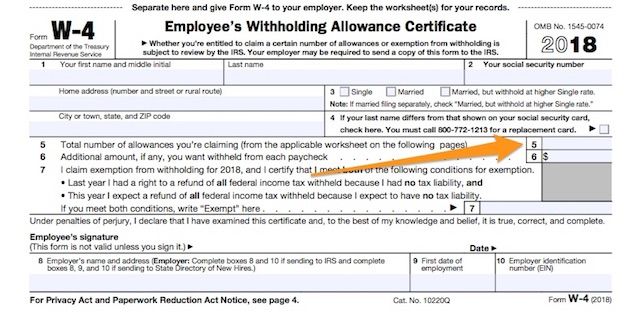

Your first step needs to be applying for your baby’s Social Security Number. You will need this number before doing anything else.

To get the number, visit or contact the Social Security Administration to fill out Form SS5, the Application for a Social Security Card. Once you have applied, it will typically take about two weeks for the number to arrive.

Another requirement is your child must have lived with you for more than half of the year. A dependent child born during the year is treated as having lived with you for more than half of the year if your home was the child’s residence for more than half of the time he or she was alive during the year.

Time the child spent in a hospital after birth won’t count against you.

If you are single, had a baby, and now support that child, your filing status could change to Head of Household (HH).

The HH filing status gives you a larger standard deduction and more favorable tax brackets. That means – thanks to your new bundle of joy – you could be paying less federal tax as HH than you would as single for the same dollar amount of income.

If you are married, having a child will not generally affect your filing status.

Claiming the Child Tax Credit

Sometimes parents with newborn will ask, “how much can you get back on taxes per child?”

One of the best-known tax breaks for parents is the Child Tax Credit. A taxpayer with a new baby may claim the child tax credit, which lowers their tax bill by up to $2,000 per qualifying child if the taxpayer’s income is not too high. In some cases, the credit may even exceed your taxes, allowing you to get extra money back as a refund. Everyone knows children can be expensive and paying less in taxes means better diapers or nicer toys for your little one.

Claiming tax breaks for child care and medical expenses

If you paid someone to care for your child while you worked – like a daycare center – you may be able to claim the Child and Dependent Care Credit on your federal income tax return. It’s based on your amount of earned income and can be up to 35% of your qualifying child care expenses, up to a max expense of $3,000 for one child, and up to a max expense of $6,000 for two or more children.

The Child and Dependent Care Credit may be reduced if you receive tax-free dependent care benefits from your employer.

Medical expenses can be deductible if they exceed 7.5% of your adjusted gross income. The out-of-pocket cost of the hospital stay to birth your baby and related care counts as medical expenses, but mothers are surprised to find out that the cost of breast pumps and lactation supplies are medical expenses as well. These expenses may help you get over that 7.5% hump. To qualify for this deduction, you will need to itemize deductions instead of claiming the standard deduction.

These expenses may help you get over that 7.5% hump. To qualify for this deduction, you will need to itemize deductions instead of claiming the standard deduction.

Working taxpayers with a child can claim a credit for qualified child care expenses.

Other tax breaks for parents

Additional tax breaks can be claimed if the following apply:

- You qualify for the Earned Income Tax Credit.

- Gifts (in money or property) from friends, grandparents and other relatives are income tax free to you and your child.

- You participate in a qualified tuition program (QTP, also called “a 529 plan”) offered by your state. QTPs allow you to set aside money for your child’s future secondary and higher education expenses. While there is no immediate federal tax break, earnings in the account grow tax free, distributions used for education costs are tax-free, and you may get a state deduction or credit for your contributions.

Are you filing as a first-time parent?

The experts at H&R Block can look at your personal situation and help make sure you don’t miss any tax breaks you qualify for as a new parent. And if you’d rather file your taxes yourself, know you are still backed by our 100% accuracy and maximum refund guarantees. In an office or online, don’t just get your taxes done. Get your taxes won with H&R Block.

And if you’d rather file your taxes yourself, know you are still backed by our 100% accuracy and maximum refund guarantees. In an office or online, don’t just get your taxes done. Get your taxes won with H&R Block.

how to pay, how to find out the TIN of a child, make him a personal account in the tax office and link him to your own apartment. Until the tax office sued her daughter.

In 2012, my husband and I bought an apartment in St. Petersburg and, in order to use maternity capital, we registered shares for our daughters. They are twins, and then they were 3.5 years old. nine0003

For the next 8 years, I paid property tax through my personal account on the website of the Federal Tax Service. I thought that I was paying not only for my share, but also for children. I didn’t know that children, it turns out, have their own TIN from birth, and the tax on their shares is calculated separately. I didn't receive any letters from the tax office either.

As a result, in 2021, I myself accidentally reminded the Federal Tax Service of the shares of my daughters. After that, the tax office sued one of them and demanded to pay property tax for the previous three years. I'll tell you how it all happened and how not to turn a child into a debtor. nine0003

After that, the tax office sued one of them and demanded to pay property tax for the previous three years. I'll tell you how it all happened and how not to turn a child into a debtor. nine0003

How the tax office remembered her daughter

In 2021, one of the daughters received a disability. By law, children with disabilities may not pay property tax for one apartment, room, house, garage of any size or for shares in them. I decided to apply for this benefit: I thought that the tax for my daughter's share was included in my amount, and I wanted to reduce it.

sub. 3 p. 1 art. 407 of the Tax Code of the Russian Federation

On August 10, 2021, I wrote an application in the personal account of the Federal Tax Service Inspectorate for a property tax exemption. She attached her daughter's birth certificate and a certificate that she received a disability. nine0003

A few days later I was asked to send a scan of the back of the certificate. And a week later I received an answer: the IFTS refused the benefit, because it is due to children with disabilities, and not to their parents.

/zabral-dengi-za-imuschestvo/

How to save money on property taxes

The response of the IFTS was very brief, and at first I did not understand why my daughter was denied a legal benefitI was indignant - I wrote to the tax appeal and demanded to explain why the daughter cannot receive the benefit. A few days later, they answered me that she was still entitled to the benefit. But since disability appeared in 2021, it means that the benefit will be taken into account when they calculate the tax for 2021, that is, in 2022. nine0003

I decided that the first time the tax office had just made a mistake, and calmed down. And the tax office, apparently, began to check her daughter's taxes.

This is an appeal where I asked to explain why my daughter was denied benefits. I wrote it through the usual form for appeals in the taxpayer's personal account. The answer of the tax inspectorate, which reassured me and lulled my vigilanceHow the Federal Tax Service filed a lawsuit against my daughter

On October 11, 2021, I received a registered letter from the Federal Tax Service. It contained a copy of the application that the tax office had already sent to the justice of the peace. The inspectorate asked for a court order in the name of my daughter to collect tax for 2017, 2018 and 2019years.

It contained a copy of the application that the tax office had already sent to the justice of the peace. The inspectorate asked for a court order in the name of my daughter to collect tax for 2017, 2018 and 2019years.

Taxes for minor children are paid by parents - Federal Tax Service

Meetings are not held in such cases. The tax office submits documents on the debt to the court, the judge considers them without calling the parties and, if he considers them convincing, issues a court order. The taxpayer must fulfill it or demand to cancel it. To do this, it is enough to submit objections to the court within 20 days from the date of receipt of a copy of the order. The judge will cancel it without a trial.

paragraph 1 of Art. 46 Tax Code of the Russian Federation

ch. 11.1, part 3 of Art. 123.5 CAS RF

When the taxpayer is a child, the parents or other legal representatives execute the order or send objections to him. If this is not done, money may be deducted from the accounts.

I still haven't received the order. But initially I planned to object to him: I never received notifications that my daughter should pay tax. Later, I learned that if a taxpayer or his representative - for example, a parent of a child - did not receive a tax notice before December 1, then on December 31 of the same year he is obliged to notify the IFTS about this. I didn't. nine0003

Section 2.1 Art. 23, paragraph 4 of Art. 397 NK RF

I also decided that in 2021 the debt should be considered only for 2018-2020. And according to the law, the tax office is not entitled to claim debts for more than three previous tax periods. Then I realized that three years are counted from the date of non-payment of tax.

Art. 113 NK RF

Let me explain with an example. Until December 1, 2021, I am obliged to pay property tax for 2020. If I do not do this, then from December 1, the countdown on non-payment for 2018, 2019 will beginand 2020 years. Until December 1, 2021 comes, the countdown starts from December 1, 2020. That is, non-payment is considered for the three years before 2020: for 2017, 2018 and 2019. It turns out that the tax office did not violate the law.

That is, non-payment is considered for the three years before 2020: for 2017, 2018 and 2019. It turns out that the tax office did not violate the law.

In addition, I was embarrassed that the tax inspector dated the application to the justice of the peace on April 29, 2020, and sent the letter with the notification only on October 1, 2021. I decided that he also filed an application for a court order retroactively. But then I found out from lawyers I knew that, most likely, the application was filed in April 2020, and they simply forgot to send me a notice. nine0003

/wrong-tax/

The tax office decided that I owe money for someone else's land

The IFTS sent me an application for a court order on October 1, 2021. But the statement itself was dated April 29, 2020. It confused me. At first, I generally decided that the tax office was trying to deceive us and demand tax not for three, but for the previous four years. It would be illegal. Later, I found out that the IFTS did not violate anything - it was I who incorrectly calculated the terms

Later, I found out that the IFTS did not violate anything - it was I who incorrectly calculated the terms The letter from the inspection did not contain any calculations or full details for payment. Therefore, I wrote a new appeal: I requested details and receipts, and at the same time clarified why in October 2021 the IFTS filed an application dated April 2020 with the court.

Two weeks later, I received an answer: I was asked to come to the IFTS branch for receipts and promised to give me access to my daughter's personal account. There was no mention of the application to the court at all.

What to do? 12/18/19

My accounts were frozen, but I don’t know why

As a result, I paid property tax for children for four years: debt for 2017-2019 and accrued tax for 2020. And I figured out how to do it from the very beginning - I share my instructions. nine0003 In a letter to my new appeal, the Federal Tax Service did not answer the question why the application to the court from 2020 was sent in the fall of 2021. But the inspector told me how to get access to the child’s personal account

But the inspector told me how to get access to the child’s personal account

How I paid tax for children’s shares

It turned out that that as soon as I registered the children's shares in Rosreestr and registered my daughters in the apartment, the departments sent information about them to the tax office. And she assigned them a TIN and created personal taxpayer accounts.

p. 3 and 4 art. 85 Tax Code of the Russian Federation

I found out the TIN of my daughters on the website of the Federal Tax Service and then decided to order paper certificates of tax registration from the inspection. How to do this, Tinkoff Magazine has already written.

TIN became the login for entering the taxpayer's personal account. And in order to get the password, I came to the IFTS with a passport and birth certificates of children. The inspectorate immediately generated and printed passwords.

On the same day, I went to my daughters' personal accounts. There was no evidence that they owned any property - for some reason, the information appeared later. But there were five unread tax notices for 2016-2020. I paid the receipts for 2017-2020. nine0003

But there were five unread tax notices for 2016-2020. I paid the receipts for 2017-2020. nine0003

So what? 03.03.17

Tax debts can be collected even from those who owe nothing

To find out the TIN of a child, in the request form on the website of the Federal Tax Service, you must specify his data and the number of the birth certificate. The TIN will appear instantly. Such a sheet with a password was given to me by the tax office. When I came home, I immediately changed it. Here are the taxes that are in my daughter's personal account. I did not receive any email notificationsHow to link personal accounts of children to my

While I was writing this article, functionality has expanded in the taxpayer's personal account. Now children's accounts can be linked to the parent's, and the parent will be able to pay their taxes from their account.

You can now pay taxes for minor children in the personal account of the parent's tax office - the Federal Tax Service

Here's what you need to do:

- Go to your personal taxpayer account.

- Click on your last name, first name and patronymic at the top. The Profile section will open. nine0100

- Find the "Family Sharing" tab there and click on it. A request form to add a child will appear.

- Enter the child's TIN on the form.

- Go to the child's personal account and open "Family Sharing" as well.

- Find a message with a request for access and click the "Confirm" button there.

After that, the child's personal account will be linked to yours, and you can easily and conveniently pay child taxes. To do this, click on the "Taxes" tab and select a child in the drop-down list. nine0003

When the child turns 18, his personal account will be automatically unlinked from the parent account.

Finding the Family Sharing tab is not easy. In the "Profile" section, it is on the far right and is not visible at first - you need to scroll through. And the access request form is quite simple - you only need to enter the child's TIN. A request for access will appear in the child's personal account. It needs to be approved. After that, you will appear on the list of legal representatives of the child. To untie your personal account, just click on the red cross

A request for access will appear in the child's personal account. It needs to be approved. After that, you will appear on the list of legal representatives of the child. To untie your personal account, just click on the red cross What I understand about the tax on children's shares

- The IFTS assigns a TIN to a child from birth and creates a taxpayer's personal account.

- As soon as the child becomes the owner of a share in the apartment, he is charged property tax.

- Parents or other legal representatives must pay property tax for the child. If they do not know about the debt, this does not relieve them of responsibility.

- The tax office may collect the debt at any time, but not more than for three previous tax periods. nine0100

Alimony from self-employed citizens of the Russian Federation in 2022

Alimony from self-employed citizens of the Russian Federation in 2022-2023 is withheld in the manner prescribed by the Family Code. In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

Alimony from the self-employed: what the law says

A self-employed citizen is an individual who is a tax payer on professional income. The essence of self-employment is simple: if the taxpayer has income, he pays tax on it. If there is no income, there is no tax to pay. This tax regime is designed specifically for those who do not have regular customers and receive money irregularly - in case of downtime, you will not have to make mandatory payments from your own pocket. nine0003

The question arises: how can a self-employed person pay child support? He does not have a stable income, which means that it will not be possible to establish alimony as a percentage of the income received - in months without income, the child may be left without money. In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

How the amount of alimony is calculated

The amount of alimony is determined by the court. The basis for the calculation is the subsistence minimum established in the region where the child lives - a certain percentage of this amount will be paid as alimony. nine0003

When calculating, the amount of mandatory expenses for a child is taken into account - they should be indicated in the statement of claim. If the child needs regular expensive treatment or additional education, the court may increase the amount of the payment. In addition, the court takes into account the standard of living of the payer - the higher it is, the greater the alimony will be assigned.

The subsistence minimum is quarterly adjusted by the regional authorities - the amount of alimony for the self-employed changes after it. nine0003

Assignment of child support

ConsultantPlus has many ready-made solutions, including how to collect child support for minor children. If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

Alimony from self-employed citizens in a fixed amount of money is assigned in court (clause 1, article 83 of the RF IC). To do this, the parent with whom the child remains must file a lawsuit with the relevant requirement in court. In it, according to Art. 131 Code of Civil Procedure of the Russian Federation, you must specify:

- name of the court to which the plaintiff applies;

- information about the plaintiff and the defendant - full name, address, contact phone number;

- description of the circumstances of the situation, information about the child, grounds for going to court;

- a request for a fixed amount of support due to the fact that the defendant is self-employed and has irregular, fluctuating earnings;

- list of documents attached to the claim. nine0100

If the parents were able to agree on the amount of alimony

If the parents were able to independently determine the amount that one of them will transfer to the other to meet the needs of the child, you can not go to court. The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must include the following information:

- procedure for calculating the amount of alimony;

- frequency and timing of money transfers;

- enumeration method.

How money is transferred

A self-employed person can transfer money to pay child support in the following ways:

- personally into the hands of the other parent with whom the child lives;

- by transfer to a bank account;

- postal order.

Documents confirming the transfer of money should be kept. If disputes arise in the future, it will be much easier to prove your good faith as a payer of alimony. If the money is transferred in cash, it is worth taking a receipt from the other parent for receiving it. nine0003

nine0003

What to do if a self-employed person does not pay alimony

If the alimony payer refuses to fulfill his obligations, the other parent (with whom the child remains) can apply to the bailiffs or to the bank where the payer has an account. Unpaid money will be forcibly withheld. But to receive payments through the employer (this is often done by bailiffs, sending a writ of execution to the accounting department of the enterprise) will not work, because the self-employed does not have an employer. nine0003

You need to apply to the bailiffs with a writ of execution - it is issued by the court. If there was no court, and the amount of alimony was established by an agreement on the payment of alimony, certified by a notary, submit this agreement to the bailiffs - it also has the force of a writ of execution (clause 2, article 100 of the RF IC).

If the self-employed person has taken up employment

If the self-employed person has entered into an employment contract, but has not ceased to be a payer of professional income tax, the amount of alimony may be recalculated.