How much is child health insurance

Eligibility and Cost

- Versión en español

To be eligible for either Children's Medicaid or Child Health Plus, children must be under the age of 19 and be residents of New York State. Whether a child qualifies for Children's Medicaid or Child Health Plus depends on gross family income. Children who are not eligible for Medicaid can enroll in Child Health Plus if they don't already have health insurance and are not eligible for coverage under the public employees' state health benefits plan. Check the following income charts to see whether your child qualifies for Child Health Plus or Children's Medicaid.

There is no monthly premium for families whose income is less than 2.2 times the poverty level. That's about $1065 a week for a three-person family, about $1283 a week for a family of four. Families with somewhat higher incomes pay a monthly premium of $15, $30, $45, or $60 per child per month, depending on their income and family size. For larger families, the monthly fee is capped at three children. If the family's income is more than 4 times the poverty level, they pay the full monthly premium charged by the health plan. There are no co-payments for services under Child Health Plus, so you don't have to pay anything when your child receives care through these plans.

To see whether you would have to pay a premium for coverage, consult the Child Health Plus eligibility tables below.

| Family Contributions | Monthly Income by Family Size* | Each Additional Person, Add: |

|||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | ||

| Free Insurance | $2,515 | $3,388 | $4,261 | $5,134 | $6,007 | $6,881 | $7,754 | $8,627 | $874 |

| $15 Per Child Per Month (Maximum of $45 per family) | $2,832 | $3,815 | $4,798 | $5,782 | $6,765 | $7,748 | $8,732 | $9,715 | $984 |

| $30 Per Child Per Month (Maximum of $90 per family) | $3,398 | $4,578 | $5,758 | $6,938 | $8,118 | $9,298 | $10,478 | $11,658 | $1,180 |

| $45 Per Child Per Month (Maximum of $135 per family) | $3,964 | $5,341 | $6,718 | $8,094 | $9,471 | $10,848 | $12,224 | $13,601 | $1,377 |

| $60 Per Child Per Month (Maximum of $180 per family) | $4,530 | $6,104 | $7,677 | $9,250 | $10,824 | $12,397 | $13,970 | $15,544 | $1,574 |

| Full Premium Per Child Per Month | Over $4,530 | Over $6,104 | Over $7,677 | Over $9,250 | Over $10,824 | Over $12,397 | Over $13,970 | Over $15,544 | Over $1,574 |

- *Pregnant Women: Household size calculation includes all expected children.

| Age Categories for Children | Monthly Income by Family Size* | Each Additional Person, Add: |

|||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | ||

| Children Under 1 Year; Pregnant Women* | $2,526 | $3,403 | $4,280 | $5,157 | $6,035 | $6,912 | $7,789 | $8,666 | $878 |

| Children 1 - 18 Years | $1,745 | $2,350 | $2,956 | $3,562 | $4,167 | $4,773 | $5,379 | $5,985 | $606 |

- *Pregnant Women: Household size calculation includes all expected children.

How Much Does Health Insurance for Families Cost?

Individual and Family

BY Sydney Garrow Updated on September 22, 2021

When it comes to providing for your loved ones, family health insurance is something you have likely thought through very carefully. The burden of protecting your families’ health and protecting your finances from unexpected medical bills can be lightened by having a family health insurance policy.

Whether it’s just for you and your partner, or you need health insurance for a family of dependents, eHealth has the tools and variety of options that you need in order to find a family health insurance plan. Our brokers are licensed in every state to help you find the right coverage for your needs and budget, all at no extra cost. You can enroll in one of our plans by phone, on our website, or through our live chat, making it easy and convenient to get the best plan for your family. Contact us for more information today.

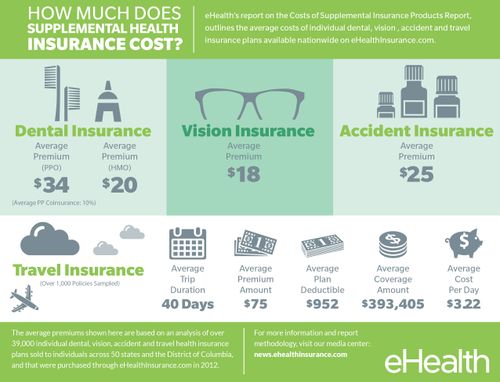

Although health insurance for families will have different price points based on factors like plan type, level of coverage, number of dependents, and where you live, you can look at the average cost of family plans as a useful reference.

As with almost all types of health coverage, there are several different costs associated with family plans, including:

- Premiums– Premiums are monthly payments that you make to remain enrolled in your family health insurance plan. The average premium for major medical health insurance plans for families was $1,152 a month in 2020.

- Deductibles– A deductible is the amount of money you must pay out of pocket for healthcare before your insurance kicks in. For example, if your family health insurance plan has a $10,000 deductible, you’ll need to pay all your medical bills until you’ve spent $10,000; your insurance will then cover much of the remaining care you get that year. On average, health insurance plans for families had deductibles of $8,439 in 2020. Average deductibles have also been rising, though not as rapidly as premiums.

- Various costs- There are other costs associated with health insurance plans like copayments, coinsurance, and out-of-pocket maximums.

You will want to assess your family’s health care needs to determine how these costs will affect you. If you foresee needing a lot of care, then you may want to opt for a plan with a higher premium, but lower costs elsewhere, like your coinsurance, copayment, and deductible.

You will want to assess your family’s health care needs to determine how these costs will affect you. If you foresee needing a lot of care, then you may want to opt for a plan with a higher premium, but lower costs elsewhere, like your coinsurance, copayment, and deductible.

While these are average costs, specific pricing will vary based on the plan you choose, the amount of coverage you receive, and the number of people in your family to be insured.

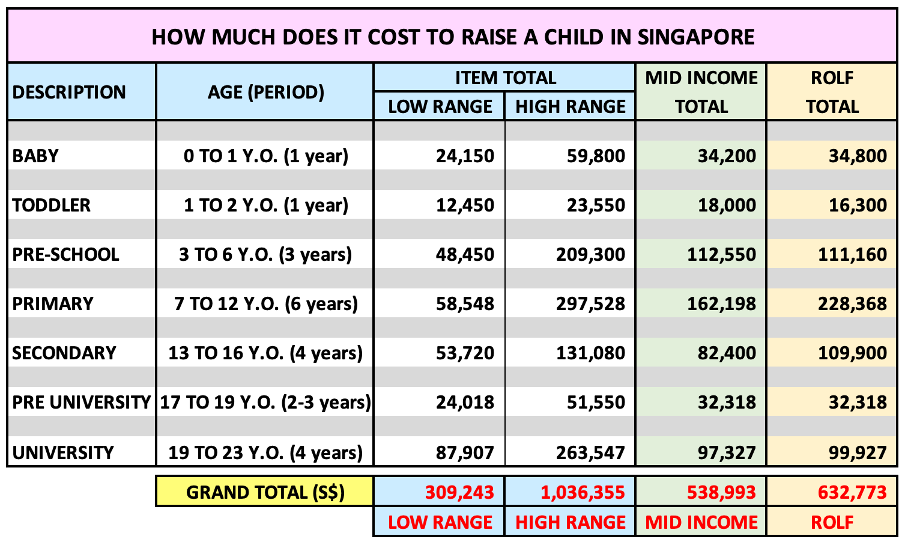

Choosing health Insurance for large familiesChoosing health insurance for large families can be more complex and more expensive. The specific price you pay depends heavily on how many people are in your family and what your specific health needs are. Generally, if everyone in your family is in good health, your premiums and deductibles will be lower. This makes it wise to invest in a family health insurance plan that covers preventative care, as that will help you stay healthy and achieve lower prices over the long haul.

If you are considering health insurance for large families, you’re likely to pay more in total, but less per person. You are also likely to pay less if you get your family health insurance plan from your employer, since employer-sponsored health insurance often covers larger numbers of people and faces less risk per person.

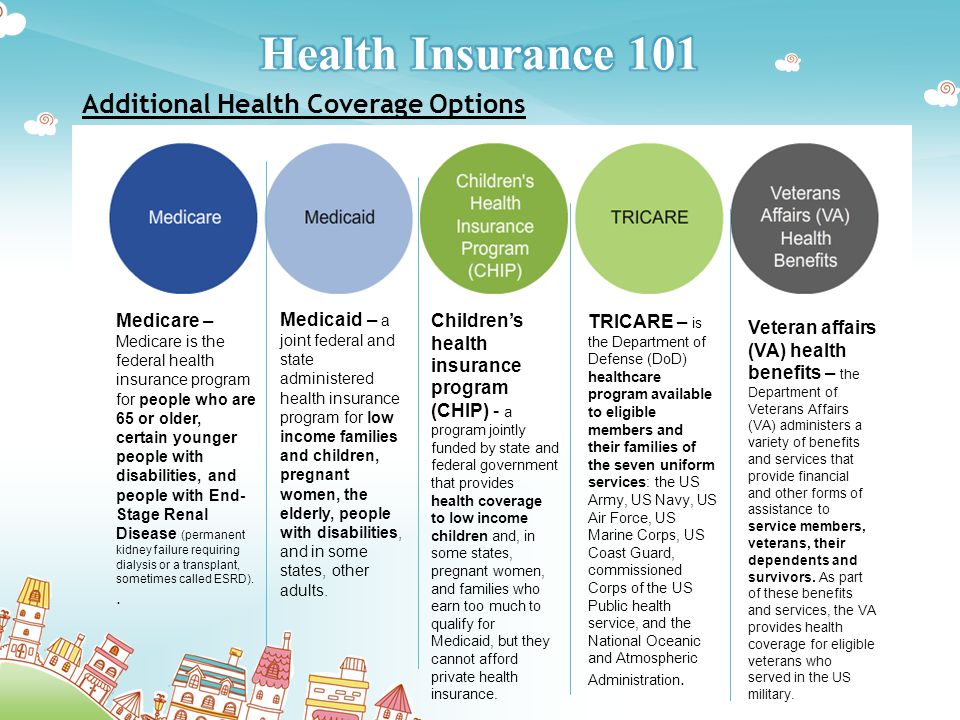

What options do I have to reduce the cost of health insurance plans for families?There are a number of government incentives and other programs that provide or help pay for health insurance plans for families who have trouble affording them. These include:

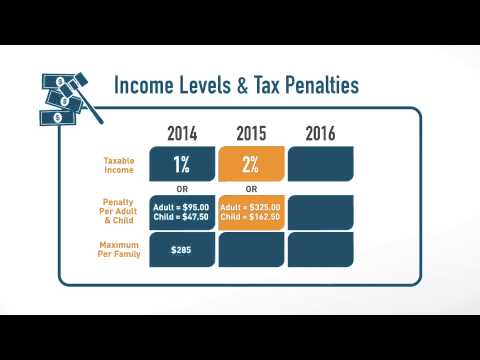

- ACA Subsidies– The Patient Protection and Affordable Care Act, popularly known as Obamacare, provides tax credits to individuals and families who have trouble purchasing health insurance for themselves. Generally speaking, the lower your income and the more family members you have, the larger a subsidy you’ll qualify for. These benefits immediately go toward the cost of purchasing health insurance plans for families.

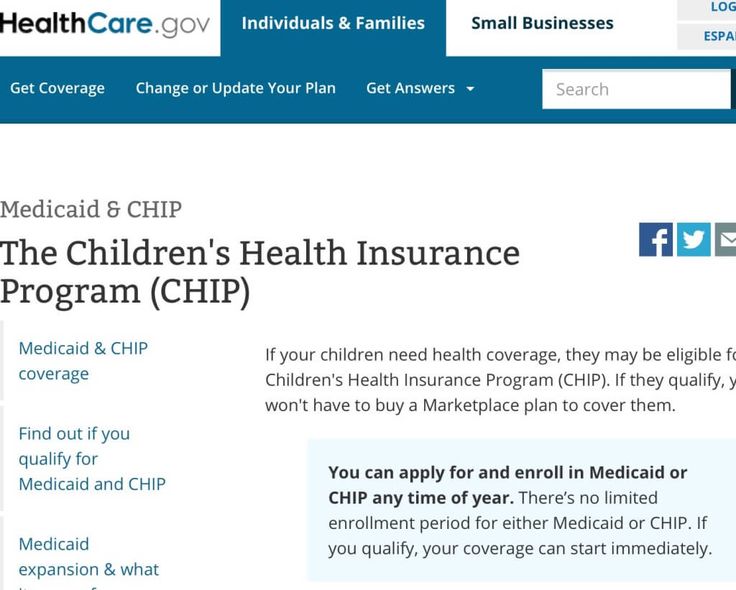

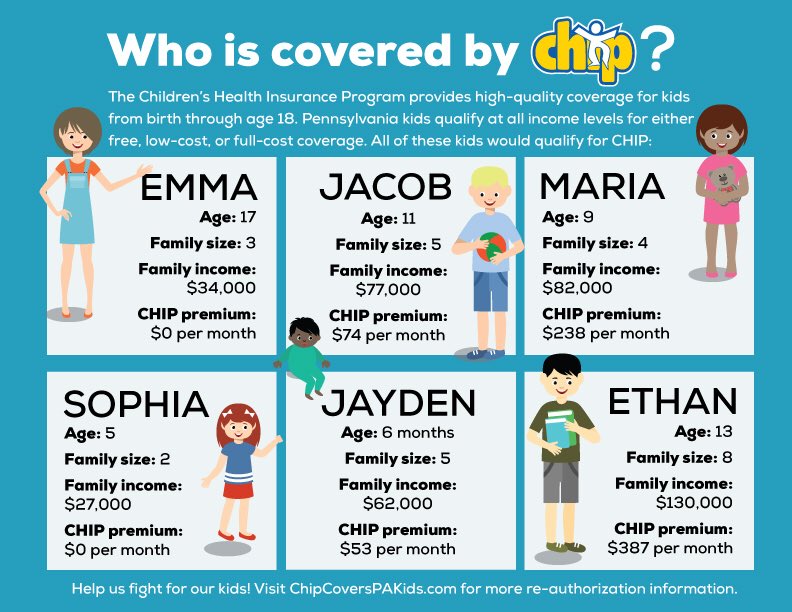

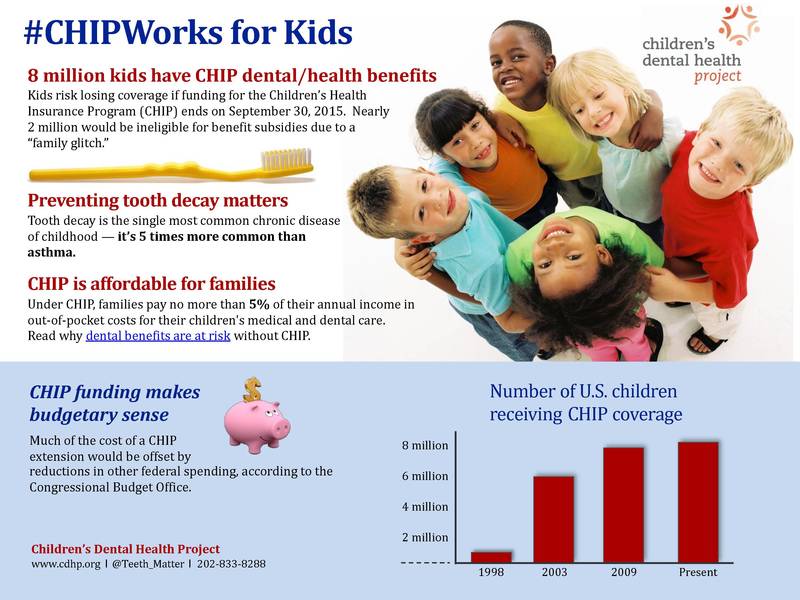

- CHIP Plans– The Children’s Health Insurance Program, or CHIP, is a joint Federal-state effort to provide free or inexpensive insurance to families with children. The specific requirements for this program vary from state to state, but, in general, your family will qualify if you make too much money to qualify for Medicaid but your income is below 200% of the poverty line.

- Other Options– Many states have specific programs designed to help cover the cost of health insurance for large families. Between these state programs and the federal ones listed above, you should qualify for at least some assistance if you have health insurance for a family of four and you make less than $98,400 a year.

If a traditional, major medical family health insurance plan is not what you’re looking for, there are some affordable alternatives that might work better for your family.

One alternative to traditional health insurance plans for families is short term health insurance. Short term plans usually do not have the same level of coverage as major medical plans, and insurance companies can deny short-term coverage based on pre-existing conditions. Although you won’t be receiving the same benefits with short term coverage, you will likely be paying a lot less for your premium, so if affordability is an issue, short term health insurance might be an option for you. Keep in mind that not all states offer options in short-term plans.

Short term plans usually do not have the same level of coverage as major medical plans, and insurance companies can deny short-term coverage based on pre-existing conditions. Although you won’t be receiving the same benefits with short term coverage, you will likely be paying a lot less for your premium, so if affordability is an issue, short term health insurance might be an option for you. Keep in mind that not all states offer options in short-term plans.

If you are in the market for health insurance for your family, eHealth offers access to a wide selection of plans. We know that finding the right plan for an affordable price can be tricky, especially if you have a family of four our more. In order to help you weigh all of your options, we offer 24/7 support and licensed brokers in every state to help you find the best plan for your family. To learn more about selecting and paying for quality family health insurance, begin comparing health insurance plans in your state today.

Join Our Newsletter

Get healthcare news, wellness tips, and coverage resources

Individual & Family

Small Business

Medicare

Dental

Vision

Short-term

Affordable Care Act

How to apply for a VHI policy for a child

Ekaterina Ivanova

issued a VHI policy for a child

Author profile

I became disillusioned with ordinary children's clinics and decided to switch to voluntary medical insurance.

Before the birth of our son, we lived in one of the districts of St. Petersburg, where, by registration, we were served in a private clinic that provides compulsory medical insurance services. It replaced an ordinary state hospital for us, while maintaining all the advantages of private medicine: clean, tidy, polite staff, prompt medical care.

With the advent of the child, we bought a larger apartment in one of the cities of the Leningrad region. Next to it was a state outpatient clinic - a branch of the district hospital. We wanted to be observed there, but faced a number of problems.

Next to it was a state outpatient clinic - a branch of the district hospital. We wanted to be observed there, but faced a number of problems.

For example, the hospital was in poor condition, we had to go to a different place to see narrow specialists, there were huge queues everywhere, and sometimes we waited weeks for an appointment. And most importantly, the district pediatrician: relations with him did not work out from the first minute of our acquaintance, I did not want to torment either the child or myself.

I'll tell you how I took out a children's voluntary health insurance policy, what is included in voluntary health insurance for children and how to choose an insurance company.

Go see a doctor

Our articles are written with love for evidence-based medicine. We refer to authoritative sources and go to doctors with a good reputation for comments. But remember: the responsibility for your health lies with you and your doctor. We don't write prescriptions, we make recommendations. Relying on our point of view or not is up to you.

Relying on our point of view or not is up to you.

Why I decided to take out a VHI policy for my child

After problems at the public clinic, I decided that I would only go to private hospitals with my child. In this case, there are three options.

See a doctor if necessary. That is, do not pay anything in advance, but simply come to the clinic when necessary and pay for the services provided. In this case, I didn’t like that there wouldn’t be one pediatrician who leads the child and knows his medical history.

In addition, it is beneficial for private clinics to prescribe additional, not strictly mandatory examinations and tests. It is difficult for a person who is not versed in medicine to understand which of them are really needed. The last thing in the world I wanted to go to a paid appointment and for my own money to experience distrust of the doctor and anxiety.

/super-dms-pros-cons/

Pros and cons: is it worth being treated under VHI

Buy a subscription. This is similar to voluntary health insurance, but differs from it in a number of ways.

This is similar to voluntary health insurance, but differs from it in a number of ways.

In this case, you pay in advance for a certain set of services. It can be spelled out in detail, or possible services received according to indications can be indicated. For example, a children's program for a year may include monthly consultations with a pediatrician, several consultations of narrow specialists, vaccinations, and a certain number of diagnostic tests. The cost of such programs starts from 50,000 R per year.

What can be included in the simplest basic program for a children's subscription from a private clinic. Source: medi.spb.ru There are extended subscription programs, which may include appointments of various specialists. The more services in the subscription, the more expensive it is. Source: smdoctor.ru VHI policy. This is insurance in case of illness or the need for an examination. That is, you are not buying a subscription to one private clinic with a list of specific services, but access to the services of the clinic for medical reasons.

You can visit clinics for an insured event — specific situations specified in the insurance contract. At the same time, the insurance company tries to ensure that its clients are admitted to partner clinics without queues and other delays.

Most voluntary insurance programs for adults do not include scheduled visits to the doctor, obtaining certificates, check-ups - only visits to the clinic due to diseases, injuries, and the like. VHI programs for children include outpatient monitoring programs, which include scheduled visits to pediatricians and examinations, as well as routine vaccinations.

/dms/

What is VHI

I liked VHI more than a subscription, because insurance companies usually work with different clinics in one region, and not with one. That is, you can choose the one that is more suitable, or visit different ones, taking into account the circumstances: for example, in one clinic there is a good pediatrician, and in another - narrow specialists. And in the event of a disputable situation, the insurance company will join the process and try to resolve the conflict.

And in the event of a disputable situation, the insurance company will join the process and try to resolve the conflict.

On the other hand, a subscription may be more convenient for routine monitoring of a child. As a rule, children's programs include all required medical examinations, vaccinations and examinations.

Comparison of the cost of visits to a private clinic as needed, subscription and VHI policy

| Parameter | Visits to a private clinic when needed | Subscription to a private clinic | Child health insurance policy |

|---|---|---|---|

| Cost | Depends on frequency | On average from 50,000 R per year | On average, from 25,000 R per year, depends, among other things, on the age of the child |

| What's in | One-time visits as needed | Specific services specified in the contract | Possibility to apply for help, when there is a need, within the insurance event |

| Visits to different clinics | Yes | No | Yes, of those that are among the partners of the insurance company |

| Help in conflict situations | No | No | You can contact an insurance agent |

Appeals in private clinico need

Cost

Depends on the incidence of

What includes

,One -time visits, Visiting various clinics

Yes

Subscription to a private clinic

Cost

On average from 50,000 R per year

What includes

specific services specified in the contract

Visiting different clinics

No

Assistance in conflict situations

No

Children's policy of DMS

Cost

on average from 25,000 r per year, depends, among other things, on the age of the child

What is included

The ability to apply for help, when there is a need, within the framework of an insured event

Visits to different clinics

Yes, from those that are among the partners of the insurance company

Help in conflict situations

You can contact an insurance agent

Which VHI policy to choose for a child

VHI policies for children, as well as for adults, are divided into type: with and without a franchise.

Franchise policy. Franchise can be of three types: conditional, unconditional and temporary.

The deductible itself is the amount within which the patient pays for the treatment himself. A conditional deductible means that if the cost of treatment exceeds this amount, the insurance will pay for everything in full.

For example, the deductible is 10,000 R. If the treatment cost 9999 R, it is paid by the patient, and if it costs 10,100 R, the insurance company.

Unconditional deductible means that if the cost of treatment exceeds a set amount, the insurance company will pay only this excess. For example, if the deductible is Rs 10,000 and the treatment cost Rs 15,000, the insurance company will pay only Rs 5,000. For example, after six months.

Most insurances have a two-week “cooling off period”: during this period, the client can return the money if he changes his mind, and many policies do not start working until two weeks later, when a refund is not possible. This does not always happen: I was able to use my child's policy in two days.

This does not always happen: I was able to use my child's policy in two days.

/dms-korporat/

How to competently use corporate VHI

Policy without franchise. This means that the client, upon purchase, pays the cost of the policy and uses all the services included in the contract without paying anything extra to the clinics. You only need to pay extra for what is not included in the insurance program. A VHI policy without a deductible is more expensive, but if there are no serious diseases that increase the price of the service, it can be more profitable.

I did not consider franchise policies. I wanted to pay once and not think about where to urgently look for money for doctors if the child gets sick. In addition, the son is growing up as a relatively healthy child, he does not need expensive treatment. And this means that, most likely, the cost of calling a doctor each time will fit into the size of the deductible, such a policy is useless for me.

How I chose an insurance company

When I was looking for a suitable VHI option, I did not have a list of insurance companies or a specific company that I would like to insure with. I have never come across this area before. Therefore, I searched the same way as any other information on the Internet.

When choosing, I paid attention to the following points.

Reviews. Of course, you cannot rely only on them, since the personal experience of acquaintances can be subjective, and reviews on the Internet can be paid. But if there are a lot of negative reviews, this is a reason to think and bypass the company.

Availability of a license to conduct insurance activities. You can check it in the Unified State Register of Insurance Business Entities.

Date of foundation. Companies that have been on the market for many years are more trustworthy. Although this, of course, does not mean that the young firm will necessarily be worse off.

Although this, of course, does not mean that the young firm will necessarily be worse off.

/turistmod/

How to choose insurance

Prices. Too low cost of insurance may indicate that the policy covers almost nothing.

In principle, not all insurance companies are suitable for applying for children's VHI. Some work only with corporate clients, that is, companies that want to buy VHI for employees, while others have services only for adult patients.

There are also insurance companies that offer only deductible policies, which didn't work for me either. Some insurance companies do not have partner clinics in the Leningrad region. And in a company from one large bank, I was offered to be served in the same district clinic where we went for free.

There are special aggregator sites, such as Sravni-ru, which select VHI policies based on user requests. You can see the ratings of specific insurers on them. For example, there I found a company that worked in my city and offered children's policies. But I didn’t like the overall rating of users, the reviews on the Internet were also negative, so I didn’t take a policy from them.

For example, there I found a company that worked in my city and offered children's policies. But I didn’t like the overall rating of users, the reviews on the Internet were also negative, so I didn’t take a policy from them.

As a result, I chose only between two insurance companies, although at the beginning of the search it seemed that there was a wide choice of VHI programs on the market. I bought a policy where there was the best ratio of price and set of services.

On aggregator sites, you can find offers from insurance companies for various requests. Source: sravni.ru You can also see the rating of insurers on Yandex Maps. Source: Yandex Maps At first, I chose from three insurance companies, but one did not like the large number of negative reviews on the Internet. Source: Yandex MapsHow to choose the right insurance program for your child

Decide what kind of medical care you need. The more services included in the program and the more comfortable the conditions, the more expensive the policy.

For example, it was important for me that the insurance included scheduled medical examinations, that I could get a medical card for the kindergarten and call specialists at home, and that a nurse would come home to take the tests prescribed by the doctor.

To choose the right insurance program, just check two parameters.

What medical services are included in the program. For example, it may include only outpatient treatment or also inpatient treatment. Hospital services increase the cost of the policy. There are programs that include calling a private ambulance, usually they also cost more.

You can visit a doctor at the clinic, or you can call at home - such visits are not included in all insurance programs. It is important to pay attention to the number of consultations: somewhere it is limited, and somewhere you can visit doctors as much as you like, if there is a reason for it.

/save/dms-hack/

How to save money on non-VHI medical services?

VHI for children may include dentistry, routine vaccinations, various examinations, laboratory tests, and other services. Before choosing a program, it is worth making a list of what you will definitely need.

Before choosing a program, it is worth making a list of what you will definitely need.

Usually, each insurance company has several options for insurance programs, depending on the volume of services. Conventionally, they can be called as follows: basic, comfortable and luxury. The names of packages for different insurance companies may differ, but the essence is the same.

The basic set will include a standard set necessary for a relatively healthy person: specialists and tests as in the nearest clinic, a limited number of times. Comfort will contain either a little more services than the basic one, or the same, but more often. A suite usually means that everything is included and in unlimited quantities, including an ambulance with a dentist.

Which clinics are included in the policy. Insurance companies often work with many clinics and divide them into levels or categories. The higher the level, the more expensive the policy.

The difference between the service packages of one insurance company can be in the number of examinations and examinations, as well as in the level of clinics: different categories of insurance include different medical institutions. Source: reso-insurance.ru

Source: reso-insurance.ru The initial state of health of the client also affects the cost of the policy. Before concluding the contract, you need to fill out a detailed questionnaire. If a person hid from the insurance company a chronic disease that he knew about, and then demanded treatment, the company may terminate the contract unilaterally.

In addition, the age of the child affects the price of insurance. The most expensive insurance programs are for children under 3-5 years old, because they need to undergo more routine examinations, visits to doctors for illness are usually required more often.

Sometimes insurance companies allocate programs for children under one year old - these are also expensive, since they may include vaccination and a large number of scheduled visits to the clinic needed to monitor the development of the baby.

When I bought a policy for my child, he was almost two years old - all the services I needed were included in the basic package of one of the insurance companies for children under three years old. The clinic they collaborated with also suited me. The policy cost 56,100 R per year.

The clinic they collaborated with also suited me. The policy cost 56,100 R per year.

56,100 R

cost of an annual policy for a child

How to use the children's VHI policy

Choosing a clinic and doctor. The VHI policy usually provides for a choice of several clinics. In our case, this question did not arise, since we live in a small town where a suitable insurance company cooperated with only one private clinic.

But I could choose a doctor. I was immediately asked if there were any preferences, if I wanted to attach myself to a particular doctor. There was no such thing, but I said that I would like to be observed by a benevolent young woman.

The insurance company consulted with the clinic to find out who is more suitable. Then, even before the conclusion of the contract, a pediatrician came to our house and conducted an initial examination. I liked the doctor, and I signed a contract for a year. If something didn’t work out, the insurance company would have offered another doctor. I can also change the pediatrician at any time until the contract expires.

If something didn’t work out, the insurance company would have offered another doctor. I can also change the pediatrician at any time until the contract expires.

/list/pediatr-deti/

11 important questions for pediatrician Sergei Butriy

Appointment to the clinic. Usually, for adults, there are only two options for interacting with clinics under the VHI policy:

- The patient calls one of the clinics specified in the contract and arranges an appointment, saying that he has insurance. After that, either the clinic or again the patient himself contacts the insurance company, receives consent or refusal to pay for the appointment. Accordingly, the record is either confirmed or canceled.

- The patient is booked through an insurance company. He leaves an application for an appointment by phone or online, and the company itself selects the best option.

Children's voluntary medical insurance may also have such rules, or there may be simpler options - all this is spelled out in the terms of the program.

For example, we have a pediatrician who takes care of a child. You need to sign up for appointments and examinations through it. I write to the doctor on WhatsApp, talk about the problem, and she answers when she can come or what to do if an in-person examination is not needed. It’s more convenient for me to call a pediatrician at home - there is such an opportunity under insurance, so we don’t visit him at the clinic.

I also inform the pediatrician about the desire to visit a narrow specialist or undergo an examination - the doctor herself forms an application and sends it to the database. When the application is approved by the insurance company, they call me back from the clinic and we agree on an appointment.

If I wish, I can make an appointment for any appointment myself by calling the clinic, but doing it through a pediatrician is much more convenient. I make an appointment on my own, only if I need to call a doctor at home on a day off, and not our pediatrician is on duty. When our pediatrician goes on vacation, I am informed in advance - for this time they are assigned to another doctor.

When our pediatrician goes on vacation, I am informed in advance - for this time they are assigned to another doctor.

When visiting the clinic for the first time under the VHI policy, you must go to the reception a few minutes before the appointment. The data of the child and the parent will be recorded there. Theoretically, you may need an individual patient number specified in the contract with the insurance company. But they never asked us for it: we were in three branches of the private clinic to which we are attached, and everywhere it was already in the database.

When a doctor arrives at home for the first time, he knows in advance who he is going to and that the insurance company will pay for the visit, no documents are needed.

/pediatrician/

“I dragged cards home with Ashanov bags”: how much does a district pediatrician earn

We were given such a card for a child when signing a VHI contract. You can put the results of analyzes and surveys there. But I don't use it, because all documents are sent to e-mail

But I don't use it, because all documents are sent to e-mail Disputes. They can occur when an insurance company has not approved a particular procedure, and the patient believes that it is included in the insurance and does not agree with the refusal. It may be that the clinic performed its duties poorly or there was a conflict with the pediatrician and the client wants to change him.

In all these cases, you need to contact the insurance agent with whom the contract was concluded. He must figure it out. For example, one day we had to urgently get to an examination with an ophthalmologist, because the child had conjunctivitis, and the clinic was delaying the appointment. I wrote to the insurance agent, an hour later they contacted me and agreed on an appointment time.

Communication with a doctor by phone. This is a very important point: I can always write to the doctor and ask exciting questions. According to the agreement, there is such an opportunity from 08:00 to 20:00 on any day, except for weekends and holidays. In fact, you can agree with the pediatrician on the possibility of writing at other times. Sometimes it happens that I write in the evening or on weekends, but I try not to abuse it. Judging by the chat on WhatsApp, I write to the doctor about once a month.

In fact, you can agree with the pediatrician on the possibility of writing at other times. Sometimes it happens that I write in the evening or on weekends, but I try not to abuse it. Judging by the chat on WhatsApp, I write to the doctor about once a month.

/list/pediatrics-2/

“Most often, a child does not need medicines”: 10 important questions to pediatrician Fedor Katasonov

How much I saved by taking out a VHI policy

At the time of buying a policy for a child, I was a little embarrassed by the price 56,100 R is a rather large amount. Then I considered that it was only 4675 R per month, which is quite acceptable.

If I paid for all the services myself, I would pay almost 3000 R more and would be left without the support of an insurance agent. I calculated the cost of services separately according to the price list of the clinic where we were observed under the VHI policy.

I never regretted that I took out a children's voluntary medical insurance policy: it saved not only money, but also time - there is no need to wait in lines and worry that there is no appointment with the necessary narrow specialists.

The child does not go to kindergarten yet, so he did not get sick very often. True, just after taking out insurance, he developed rashes on his face, which turned out to be allergies. To find out the diagnosis, I had to go to the doctors more often than usual and take several tests. Perhaps, for frequently ill children, voluntary insurance will be even more profitable.

Community 08/16/22

How to get a certificate for the kindergarten that the child is healthy?

If I went to a private clinic on my own, I would spend 59,070 R for services under the policy

| Pediatrician consultations at home, 6 primary and 1 secondary | 25 650 Р |

| 7 consultations of narrow specialists in the clinic | 13 650 Р |

| 2 home visits of narrow specialists | 7500 Р |

| Nurse home visit + clinical blood test, 2 times | 4160 P |

| Nurse home visit + urinalysis, 2 times | 2620 Р |

| Fecal test for worm eggs at home | 1320 Р |

| Pediatric online consultations | 2300 Р |

| Nasal culture | 1300 Р |

| Scraping for enterobiasis | 360 R |

| Blood sugar test | 210 R |

Consultations of the pediatrician at home, 6 primary and 1 secondary

25 650 R

7 Consultations of narrow specialists in the clinic

13 650 R

2 departures of narrow specialists at home

7500 r

9000 + clinical blood test, 2 times4160 R

Nurse's home visit + urinalysis, 2 times

2620 r

Consultations of the pediatrician online

2300 r

Calais eggs for worms at home

1320 R

Buckpower from

9000 1300 RScrap for enterobiosis

9000 360 R 9000Blood test for sugar

210 R

How to return part of the money for a child's VHI policy using a tax deduction 120,000 R in total with deductions for fitness and training.

Thus, due to the deduction, you can return up to 15,600 R.

Thus, due to the deduction, you can return up to 15,600 R. My husband received the deduction because I am taking care of a child and not working. He submitted an application through his personal account on the website of the tax service, from the documents he needed only a scan of the contract with the insurance company and a document confirming the payment of the policy. As a result, we were returned 7923 R - 13% of 56 100 R. That is, we spent R 48 177 on insurance.

If you visit private clinics on your own, you can also get a deduction. But in this case, it may be more difficult to collect documents: in each clinic you need to get a certificate of payment for services.

What to do? 05/14/19

How to get a tax deduction for VMI expenses?

Remember

- VHI policy for a child can not be issued in every insurance company, especially if you live in a small town.

- VHI for a child may be more convenient than a subscription to a private clinic, as it often involves choosing clinics in the region where the insurance is issued, in addition, there is support from the insurance company in disputable situations.

- If you use the insurance often, it will be more profitable than visiting a private clinic on your own.

- When choosing an insurance program, you need to check that it includes all the necessary services.

- Often, the voluntary health insurance policy provides for the possibility of online consultations with a pediatrician and an appointment with the clinic through the attending physician - this is convenient.

- For a voluntary medical insurance policy, including one purchased for a child, you can return part of the money using a tax deduction.

how to choose child insurance in 2022

Cost nuances and saving secrets

Voluntary medical insurance (hereinafter - VMI) in our country is mainly used by large companies - as a significant motivational component of the social package for their employees, and only some of the employers allocate funds for insurance of the children of these same employees. Often, parents use their own money to purchase medical coverage for their children, and not everyone can afford it. This is due to the fact that tariffs for children exceed tariffs for adults by an average of 1.2-1.6 times. And the same program directly in the UK for one child will cost another 1.3-1.7 times more.

Often, parents use their own money to purchase medical coverage for their children, and not everyone can afford it. This is due to the fact that tariffs for children exceed tariffs for adults by an average of 1.2-1.6 times. And the same program directly in the UK for one child will cost another 1.3-1.7 times more.

As a rule, SCs group children by age, and product prices depend on the group. So, coverage for a child under 3 years old is the most expensive; slightly cheaper for 4-9 year olds and then 10-15 (sometimes 10-17) year olds, close to adult rates.

This is usually explained by the fact that in cases where an adult will endure pain, a child will not. At the slightest complaint of one of the children about feeling unwell, we will immediately call a doctor. Based on personal analytics of children's packages in various insurance companies, we can confidently state that the expenses of the insurance company under such contracts exceed the premiums received by 1. 5-2.5 times. Sometimes at the cost of a children's program of 7 thousand UAH. at the end of the year, the expenses of the insurance company reach 25-30 thousand hryvnias.

5-2.5 times. Sometimes at the cost of a children's program of 7 thousand UAH. at the end of the year, the expenses of the insurance company reach 25-30 thousand hryvnias.

Thus, if you nevertheless decide to insure your child, then it is cheaper to do it under a corporate agreement of your company or join the agreement of one of your relatives or acquaintances in other organizations. You can also team up with colleagues or neighbors, as SCs already provide discounts for 10 or more people. For comparison, if insurance with good coverage for one child in the UK will cost 10 thousand UAH, then for 10 children - you can already count on 8.5-9thousand

The above prices are indicative, since when calculating the cost of the IC program, the number of people, the class of clinics, the location of the insured, the company's brand attractiveness, and many other factors are taken into account.

Advantages and disadvantages

When buying a VHI package for a child, we first of all buy the service of organizing medical care, and then the costs associated with this service, including medicines. In other words, we transfer all our health-related concerns to that “golden” phone number (we consider it the main advantage of VHI), which will always be answered and the right doctor will be appointed at a convenient time, and then the delivery of medicines will be organized. Almost everyone has experienced the “charms” of our medicine: those endless queues, those faces of poor doctors, constantly asking for alms with their eyes; What can we say about the current prices of medicines. It is these problems that the SCs undertake to solve.

In other words, we transfer all our health-related concerns to that “golden” phone number (we consider it the main advantage of VHI), which will always be answered and the right doctor will be appointed at a convenient time, and then the delivery of medicines will be organized. Almost everyone has experienced the “charms” of our medicine: those endless queues, those faces of poor doctors, constantly asking for alms with their eyes; What can we say about the current prices of medicines. It is these problems that the SCs undertake to solve.

The next “plus” of VHI for children, as well as for adults, is that in an assisting company (a service consisting of doctors and coordinating all actions in the “insured-doctor-medications” connection), they will always tell you which clinic is better, which doctor is right for your child. Also, if you need to visit several doctors, they will organize everyone in one place and select the appointment hours so as to save your time as much as possible.

A significant advantage of VHI is also the purchase of medicines, their collection, if necessary, from several pharmacies, and delivery to home or work.

Do not forget that with the cost of medical insurance in 5-10 thousand UAH. – the liability limit of the IC ranges from UAH 100-180 thousand. That is, you can use this amount during the validity of the insurance contract (within the insurance program, of course).

There are very few shortcomings, but for someone they can become a good reason for reconsidering the decision to insure children. The first of the shortcomings may be a poor-quality service, if the promises of the insurance company about excellent service at the stage of concluding an insurance contract later turned out to be completely different from reality. To avoid this, we can recommend the following:

- Be sure to ask colleagues who have experience in insuring children about the quality of service of the insurance company you are interested in: how a trusted doctor takes care of an insured child, how quickly he responds to complaints.

- If you are considering insurance companies in which no one you know has insurance experience yet, we recommend that you take a list of contacts of clients who have insured their children from the company. Believe me, any insured person will very willingly talk about the complaints and shortcomings of the insurance company, if, of course, there are such shortcomings.

- Take the phone number of med. assistance, by which you will call the doctor, and dial yourself several times at different times of the day. This way you will know how you will call in the future.

- Ask to split your insurance payment into 2 or 4 installments. Thus, if you are treated badly, you can always refuse further insurance without paying another payment.

But the main disadvantage of health insurance is not related to insurance itself, but to our attitude towards it. In other words, the number of medical visits of parents whose children are insured significantly exceeds the number of doctor visits of parents whose children are not insured. Without a policy, we treat children with folk remedies or find medicines in the house that are always in the first-aid kit. Another thing is when the child is insured. A little runny nose or stomach pain - we immediately dial the coveted number and are already rushing to the doctor or the clinic sends someone to our home. And then a package of medicines and recommendations for diagnostics and consultations of several more specialists. After a while, we finally realize (this is at best) that we are simply healing our children. Their daily diet sometimes includes 200 grams of various tablets and syrups. And so, when we, having plucked up courage, stop stuffing children with medicines, and let everything take its course, then we notice that even without this mass of medicines that have not been fully studied, our children recover perfectly. Many of the insured begin to do this, while others adhere to the principle “why should someone give their money”, once they brought it, they need to accept it.

Without a policy, we treat children with folk remedies or find medicines in the house that are always in the first-aid kit. Another thing is when the child is insured. A little runny nose or stomach pain - we immediately dial the coveted number and are already rushing to the doctor or the clinic sends someone to our home. And then a package of medicines and recommendations for diagnostics and consultations of several more specialists. After a while, we finally realize (this is at best) that we are simply healing our children. Their daily diet sometimes includes 200 grams of various tablets and syrups. And so, when we, having plucked up courage, stop stuffing children with medicines, and let everything take its course, then we notice that even without this mass of medicines that have not been fully studied, our children recover perfectly. Many of the insured begin to do this, while others adhere to the principle “why should someone give their money”, once they brought it, they need to accept it. It is difficult to say which of the methods is the most correct, it is most rational to find your own middle ground.

It is difficult to say which of the methods is the most correct, it is most rational to find your own middle ground.

Choosing an insurance program

Below are the most important things to consider if you do buy medical coverage for your children.

- Make sure that the insurance program provides specialized children's clinics in your area (for big cities).

- The list of medical institutions (hereinafter - HCI) must necessarily include private clinics (doctors from these clinics arrive faster, are more friendly and always have a supply of necessary medicines with them). There is an opinion that insurance without private clinics is not worth buying at all.

- The program provides consultations of leading experts without any additional payments.

- Specify the possibility of preventive massage at home.

- There should be no limit on medicines per insurance event.

- Herbal medicine, homeopathy (including foreign production) must be included in the program.

- Children are most often prescribed all kinds of bacteria, dietary supplements and probiotics, and these are the standard exceptions. At the stage of concluding the contract, these options can be included for a small surcharge.

- Children under the age of 1 need patronage (doctor visits according to the Ministry of Health calendar), as well as vaccinations, and just mentioning vaccinations does not mean at all that your children will be vaccinated with foreign vaccines (usually domestic vaccines are covered by UK).

- Be sure to specify whether the doctors in charge of your contract themselves call the health facility after the consultation and write down appointments, or you yourself will have to call and dictate recommendations written in a “medical” handwriting, which is not very convenient.

- Review the list of exceptions (what is not covered) for this UK as there may be conditions that your children already have.

If you choose the IC that takes into account all the above wishes, you will be satisfied with the purchased product.