How much is basic child tax credit

The Child Tax Credit | The White House

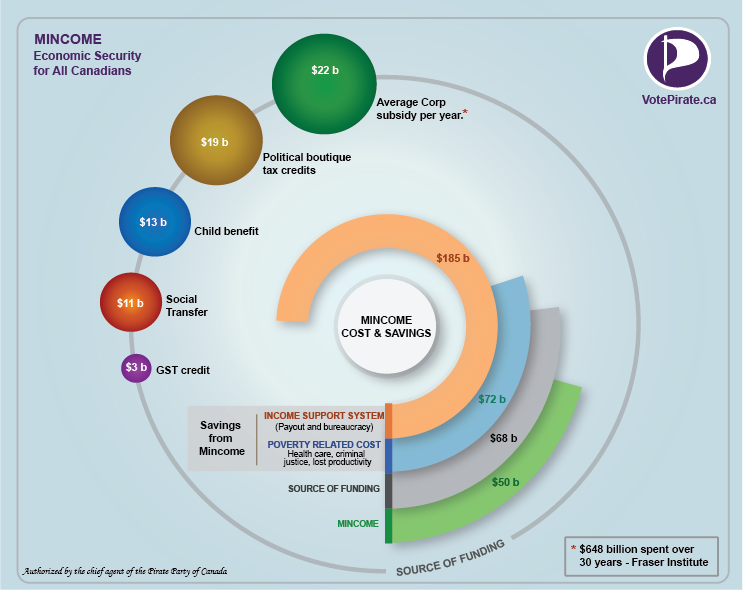

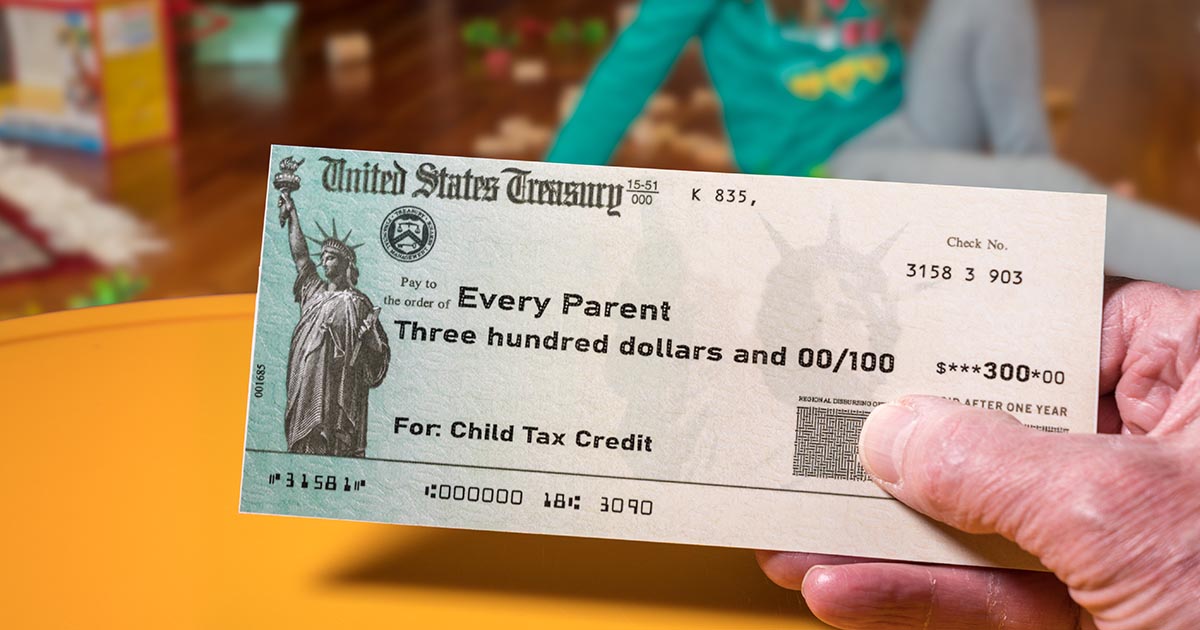

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

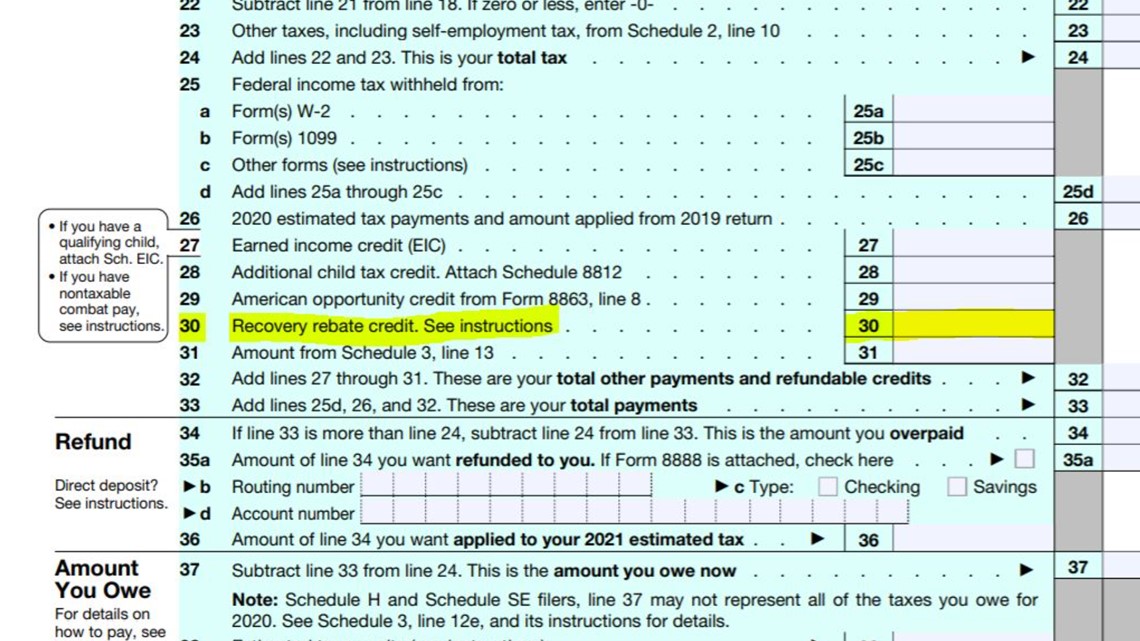

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Learn More

and

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:[email protected]">[email protected]</a>.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

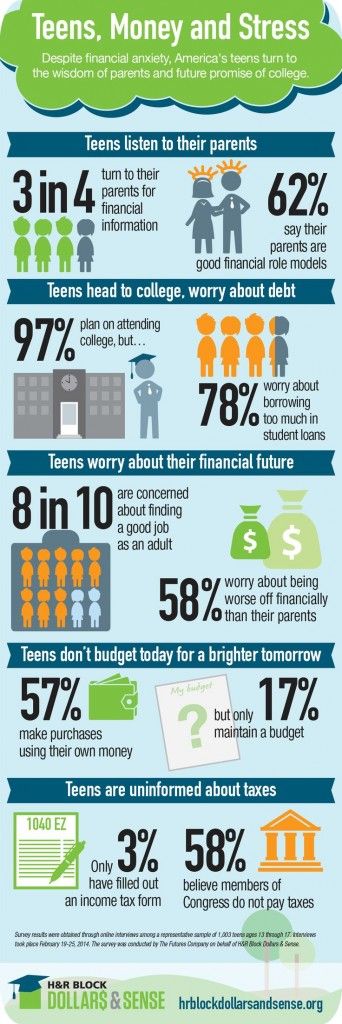

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

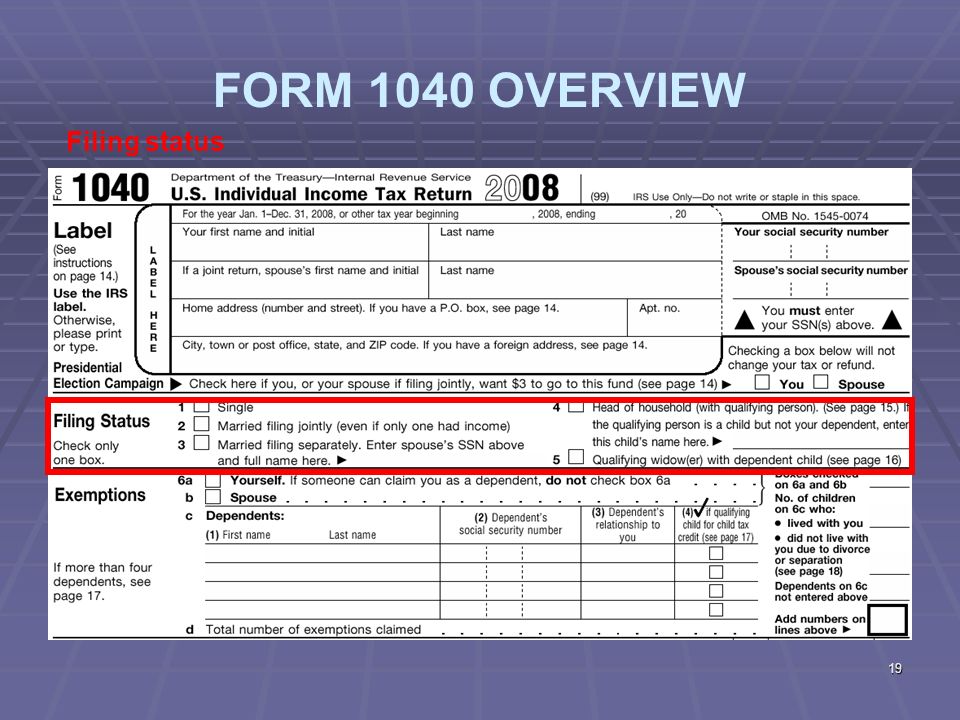

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.

g., a grandchild, niece or nephew).

g., a grandchild, niece or nephew).Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

How to calculate the child tax credit

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

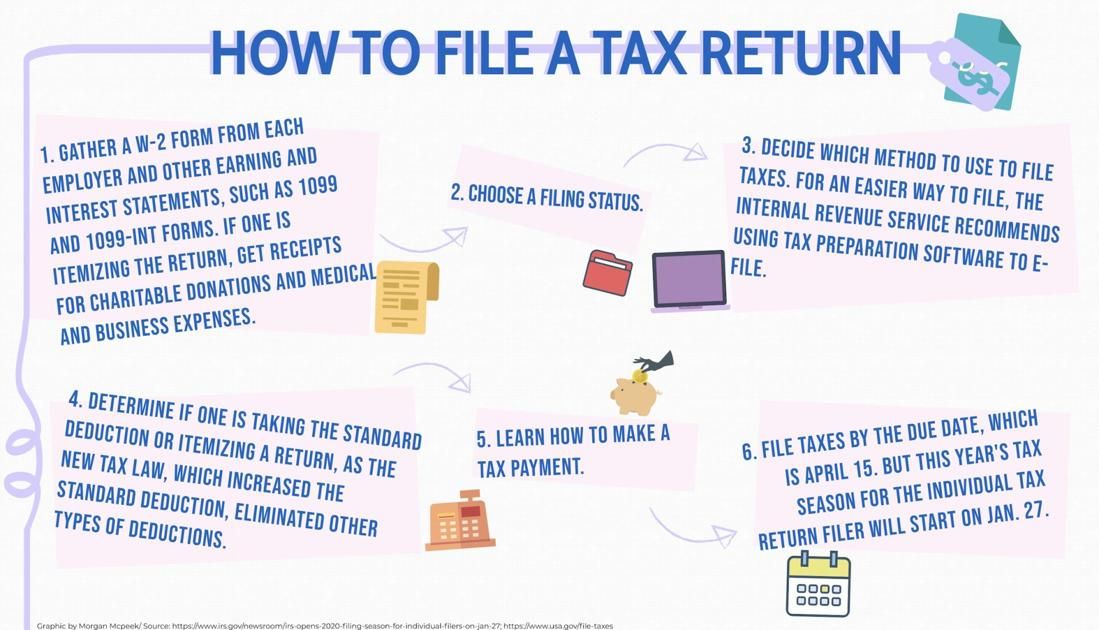

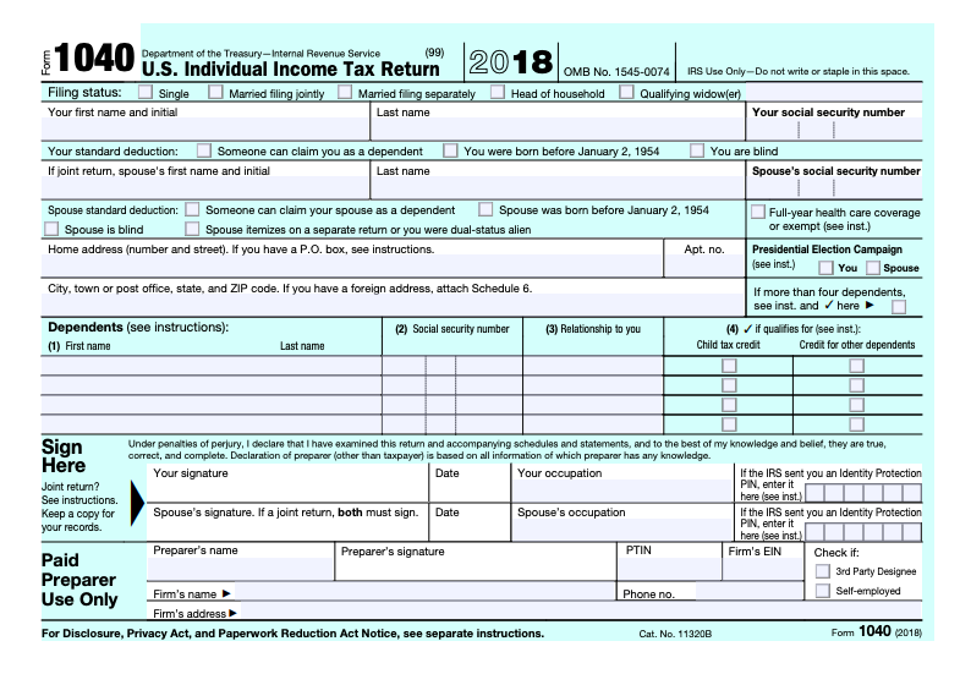

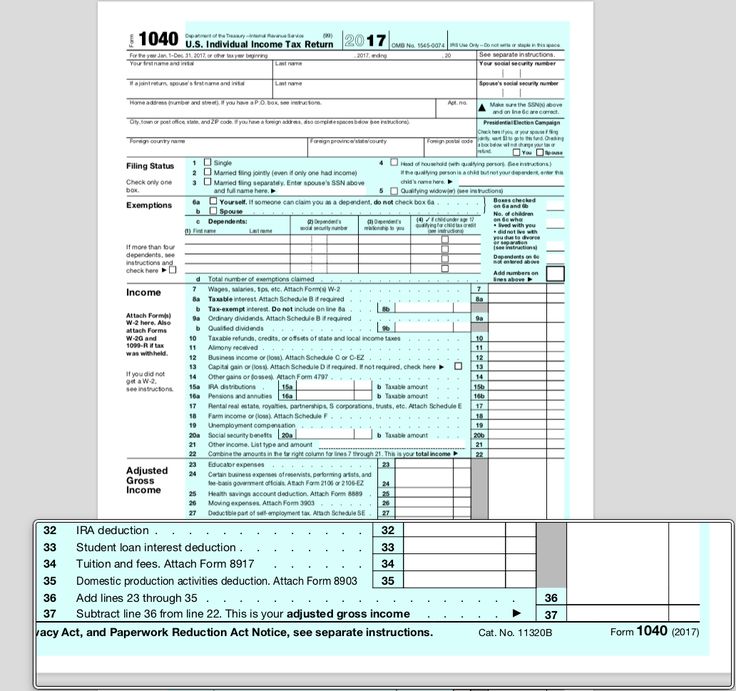

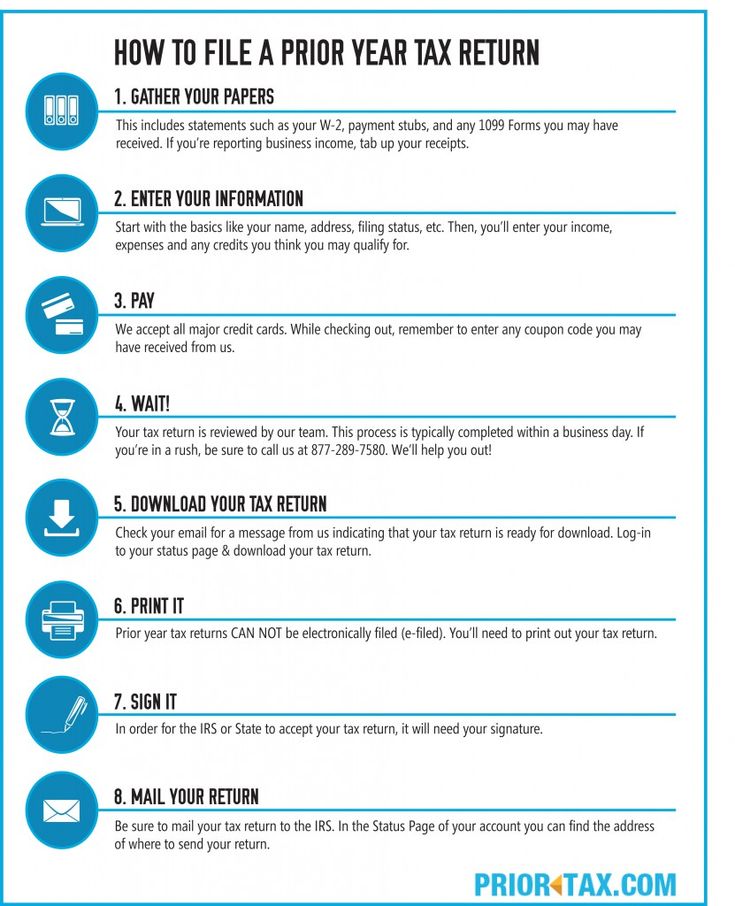

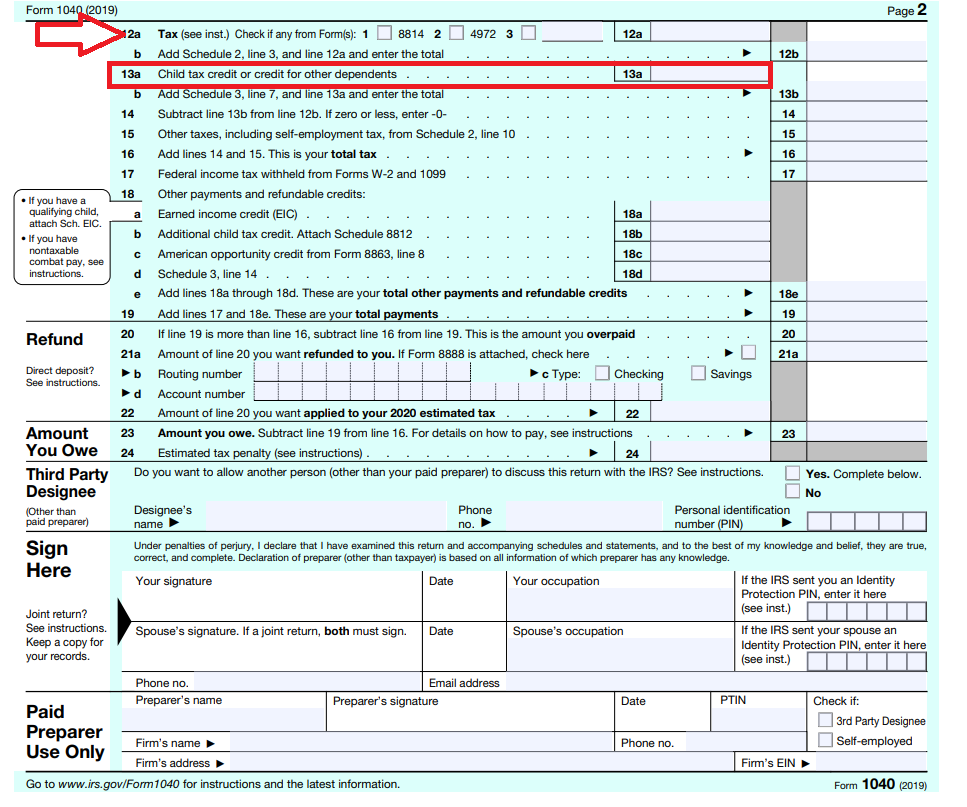

How to claim the credit

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

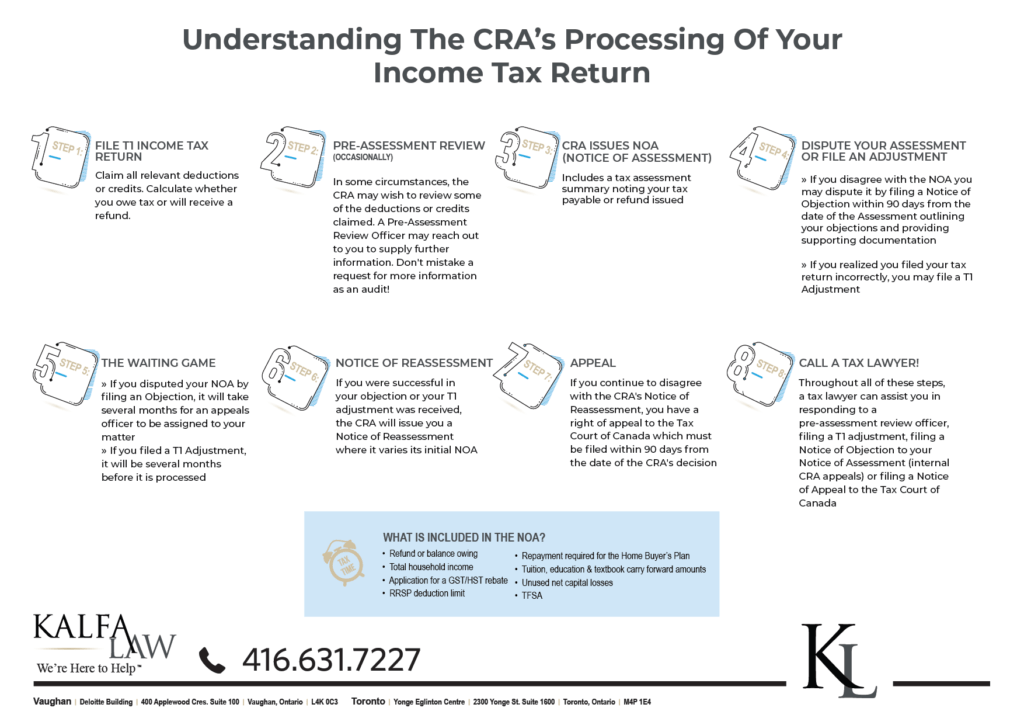

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only.

This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

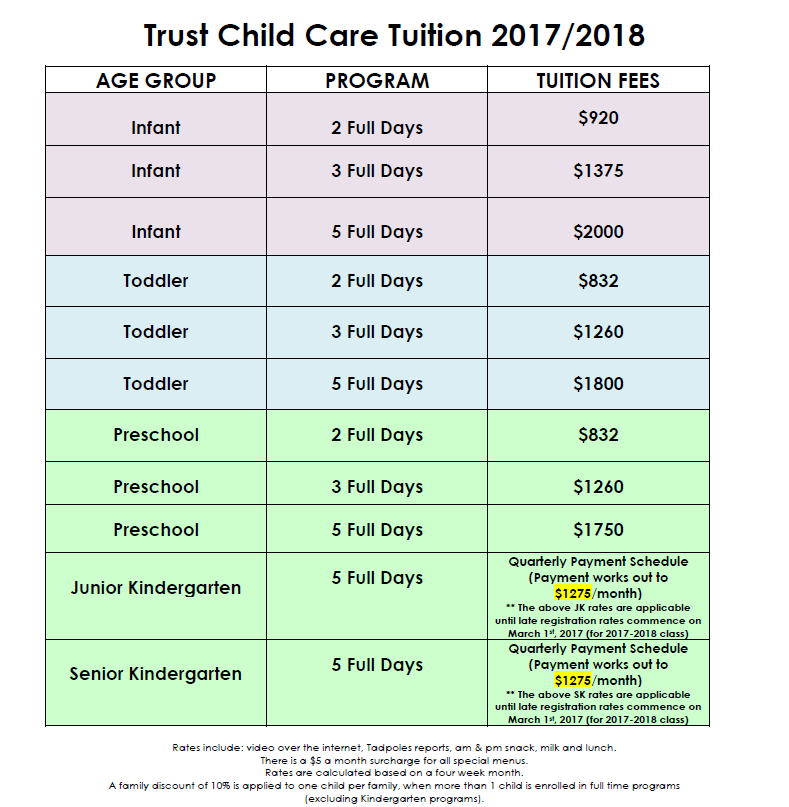

Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll also need to make sure your child has a Social Security number by the due date of your 2022 return (including extensions).

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Income tax - personal income tax [2022] ᐈ Personal income tax

Since 2011, the rates of personal income tax (PIT) are determined in Section IV of the Tax Code of Ukraine (TCU). Note that for the vast majority of fellow citizens and in the vast majority of cases, the personal income tax rate (or, as it is also called, income tax ), since 2016 is 18% .

The revision of the Tax Code of 2011 was not the ultimate truth, it changes periodically (and even more often than we would like). The latest changes came into effect on 29May 2020.

The changes that were made in May 2020 related to the sale of movable and immovable property. For the sale of the third (and subsequent) car during the year, you will have to pay not 5%, but 18%. When selling an object under construction - exemption from payment of 5%. In addition, the section "Pensions" is excluded.

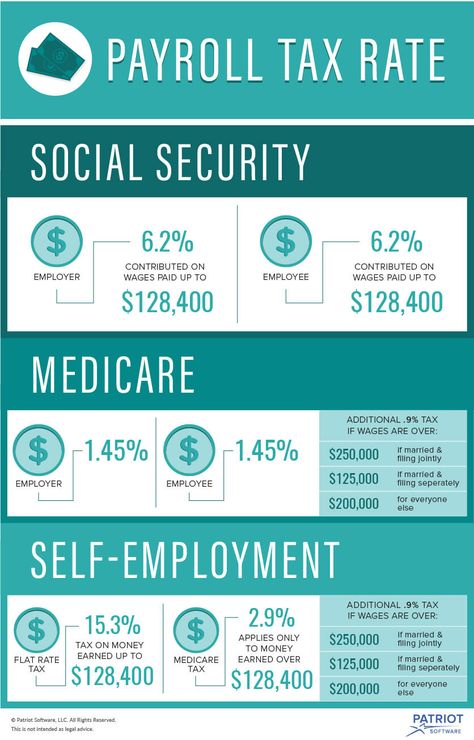

| Type of income | Tax rate | Reference to the Tax Code (Section IV) | ||

|---|---|---|---|---|

| Income received in the form of wages, other incentive and compensation payments or other payments and remuneration paid to the payer in connection with labor relations and under civil law contracts | 18% | item 167.1 | ||

| 18% | p.165.1.26 | |||

| Income received by an individual from economic activity | 18% | p. 177.1 | ||

| Citizens' income received from independent professional activities | 18% | Clause 178. 2 2 | ||

| Amounts of overspent funds received for a business trip or under a report, and not returned within the prescribed period | 18% | p. 170.9 | ||

| Income received from the provision of property to leasing, lease or sublease | 18% | 900.1|||

| Investment income from the taxpayer of securities, discharge and corporate cadial rights issued in forms other than securities (except for income from operations specified in clauses 165.1.2 and 165.1.40 of the TCU) | 18% | clause 170.2 | ||

| life insurance in the event that the insured person reaches a certain age stipulated in the insurance contract, or the expiration of the contract | 18% | p. 170.8.2 | ||

| The redemption amount in case of early termination by the insured with a long -term life insurance contract | 18% | p. 170.8.2 170.8.2 | ||

| The amount of funds from which the tax was not withheld paid to the contributor from his pension deposit or bank management fund participant's account in connection with the early termination of the pension deposit agreement, trust management, or non-state pension provision | 18% | clause 170.8.2 | ||

| Funds provided by the employer as assistance for burial (in the amount of excess over the value of the double subsistence minimum for an able-bodied person, multiplied by 1.4 and rounded to the nearest 10 UAH) | 18% | clause 165.1.22 | ||

| Part of charitable assistance subject to taxation subject to the norms of clause 170.7 of the Tax Code | 18% | clause 170.7 | 18% | p. .h. for the rehabilitation of disabled people, the taxpayer and / or members of his family of the first degree of kinship, provided by his employer - the payer of income tax - free of charge or at a discount (in the amount of such a discount) once a year, (provided that the cost of the tour or discount is not exceeds 5 minimum wages) .h. for the rehabilitation of disabled people, the taxpayer and / or members of his family of the first degree of kinship, provided by his employer - the payer of income tax - free of charge or at a discount (in the amount of such a discount) once a year, (provided that the cost of the tour or discount is not exceeds 5 minimum wages) | is not taxed | , 165.1.35 |

| winnings, prizes, gifts | | |||

| winning or prize (except for winnings and prizes in the lottery) in favor of residents or non -residents | 18% 9003% 9003% 9003% 9003% 9003% .167.1 | |||

| Win or prize in lottery | 18% | p.167.1 | ||

| Other winnings and prizes | 18% | pons 167.1 | ||

| Gifts (as well as prizes to winners and prizes competitions) if their value does not exceed 25% of the minimum wage, with the exception of cash payments in any amount | not taxed | clause 165. 1.39 1.39 | ||

| Monetary winnings in sports competitions (except for remuneration to athletes - champions of Ukraine, prize-winners of international sports competitions, including athletes with disabilities, as defined in clause "b" clause 165.1 .1 TCU) | 18% | clause 167.1 | ||

| Funds, property, property or non-property rights, the cost of works, services donated to the taxpayer are taxed according to the rules for inheritance taxation (see section "Inheritance") nine0030 | 0% 5% 18% | p. 174.6 | ||

| percent | ||||

| percent for the current or deposit bank account | 18% | p.167.5.1 | or discount income on personalized savings (deposit) certificates | 18% | item 167.5.1 |

| Interest on deposit (deposit) in credit unions | 18% | |||

| Fee (percent) that is allocated to share membership fees of members of a credit union | 18% | item 167. 5.1 5.1 | ||

| Income paid by the company managing the assets of a joint investment institution .167.5.1 | ||||

| Income from mortgage-backed securities (mortgage-backed bonds and certificates) | 18% | Clause 167.5.1 | ||

| Income in the form of interest (discount) received by their owner from bonds)0030 | 18% | p.167.5.1 | ||

| Income from real estate fund certificates and income received as a result of redemption (redemption) of real estate fund certificates | 18% | p. | ||

| Interest and discount income accrued to individuals on any other grounds (except those listed in clause 170.4.1 of the Tax Code) | 18% | clause 170.4.3 | ||

| Dividends, royalties | 0018 | |||

| Dividends accrued in the form of shares (parts, shares) issued by a resident legal entity, provided that such accrual does not change the parts of the participation of all shareholders (owners) in the issuer's authorized capital, and as a result of which the issuer's authorized capital increases the total value of accrued dividends | is not subject to | clause 165. 1.18 1.18 | ||

| Dividends on shares and corporate rights accrued by residents - payers of corporate income tax (except for income on shares and / or investment certificates paid by joint investment institutions ) nine0030 | 5% | clause 167.5.2 | ||

| Dividends on shares and/or investment certificates and corporate rights accrued by non-residents, joint investment institutions, as well as business entities – not income tax payers | p. 167.5.4 | |||

| Royalti | 18% | p.170.3.1 | Real estate sale | |

| Income from the sale (exchange) not more than once during the reporting year of a residential building, apartment or part thereof, a room, a garden (country) house, as well as a land plot or an object of construction in progress, and provided that such property is owned by the payer tax over 3 years | not subject to tax | clause 172. 1 1 | ||

| Income from the sale during the reporting year of more than one of the real estate items specified in clause 172.1, as well as income from the sale of a real estate item not specified in clause 172.1 172.1 | 5% | p. 172.2 | ||

| Sale of movable property | | |||

| income from the sale of movable property ( | ||||

| Income from the sale (exchange) during the reporting year of one of the movable property (car, motorcycle, moped), not taxable (as an exception to the previous one) | not taxed | item 173.2 | ||

| Income from the sale (exchange) of the second object of movable property (car, motorcycle, moped) during the reporting year, is taxable | 5% | item 173.2 9022 Income from the sale (exchange) during the reporting year of the third (and subsequent) object of movable property (car, motorcycle, moped) is subject to taxation | 18% | p. 173.2 173.2 |

| Inheritance | | |||

| Value of property inherited by family members of the first degree of kinship | 0% | item 174.2.1 | 0% | Clause 174.2.1 |

| Monetary savings placed before 01/02/1992 in institutions of the USSR Savings Bank and USSR state insurance operating on the territory of Ukraine, or in government securities, and monetary savings of Ukrainian citizens placed to institutions of Oschadbank of Ukraine and the former Ukrgosstrakh during 1992–1994, the repayment of which did not take place | 0% | clause 174. 2.1 2.1 | ||

| The value of any object of inheritance received by heirs who are not members of the family of the testator of the first degree kinship | 5% | p. 174.2.2 | ||

| The inheritance received by any heir from the testator is non -resident, and any object of the inheritance inherited by non -resident | 18% | p. 174.2.3 | ||

| Income of non-residents and foreign income | | |||

| Income originating in Ukraine, which are accrued or paid to non-residents | at rates determined for residents | item 170.10.1 | ||

| Foreign income | 18% | item 170.11.1 | ||

On the financial portal Minfin.com.ua, it is easy to choose a loan online at a bank or microfinance organization. The catalog contains loans for everyone: cash loans in a bank, loans for people with a bad credit history, loans without refusal. You can compare rates for online microloans in different MFOs in Ukraine in the Indices section on Minfin.com.ua.

You can compare rates for online microloans in different MFOs in Ukraine in the Indices section on Minfin.com.ua.

The site collects and regularly updates deposit rates, which will help you compare and choose a deposit in dollars, euros or hryvnias. nine0011

In the "Banks" section, you can study all the information about the operating banks of Ukraine, as well as read or leave information about their products or services.

Personal income tax rates in Ukraine that were in force before:

- from 01/01/2019 to 05/28/2020

- from 01/01/2018 to 12/31/2018

- from 01/01/2017 to 12/31/2017

- from 07/01/2016 to 12/31/2016

- from 01/01/2016 to 06/30/2016

- from 01/01/2015 to 12/31/2015

- from 02.08.2014 to 31.12.2014

- See also:

- Minimum wage in Ukraine

External study and Foxford Home Online School - family education for grades 1-11, online education

C

Apply for trainingTry for free

Watch the video and learn more about the school in 1. 5 minutes

5 minutes

Apply for trainingTry for free

Program

compiled taking into account your interests and goals

Teachers

Only strong teachers in all subjects

Learning

The opportunity to study from anywhere in

Select the class

1- 1- 1- 4th grade

With us, your child will not be overburdened. He will master the basic program, reveal his talents and learn to be independent

5–8 grades

Forget about early rises and giant homework. Choose your start time and study for only 3-4 hours a day

Grades 9-11

You will study with experienced teachers, focus on core subjects and prepare for admission

Choose a class and learn about homeschooling

you will be able to

Study with strong teachers

In an ordinary school, we “get” teachers: some are lucky with a good mathematician, others have to put up with a weak one. nine0011

Everything is different in our school and absolutely all teachers are equally strong

Choose your curriculum

Foxford Home School's program is designed like a "constructor". This means that you yourself choose the format of study and workload.

This means that you yourself choose the format of study and workload.

Find a convenient schedule for your core school subjects - study in depth what is interesting and important to you

Study in a convenient and convenient way

You no longer have to completely adjust your plans to the school year and a fixed school schedule. nine0011

Travel, move or pause your studies at any time - lessons can be viewed in the recording

Get the desired result faster

Effective does not mean much and difficult.

The program of our home school was created by the strongest methodologists. It complies with the GEF and is designed so that you reach your goal without wasting time and effort

Start studying for free

Who will teach you

The strongest teachers

with extensive experience

We have cool teachers from Moscow State University, Moscow Institute of Physics and Technology, Higher School of Economics, as well as authors of Olympiad problems and state exam experts.

They literally make students fall in love with their subject and combine academic material with cool jokes. For this they are loved 💙

Start studying for free

How we teach

Grades 1–4

5–8

9–11

For example, in elementary grades, children learn to think logically. To help them, we build chains, compare objects and teach them to find non-standard solutions

We instill interest in learning

For this we use practical exercises where you can draw, glue

or play.

We form and consolidate a positive learning experience - the child solves a problem and receives a reward instead of an assessment

We take into account the peculiarities of studying in each class

For example, we will teach fifth-graders to cope with homework on their own in order to free their parents from daily “joint learning”.

And we will help eighth graders with the choice of subjects to be taken

at the OGE next year

You will understand the material, not memorize it

There is no senseless rewriting from the textbook in our classes: teachers explain complex things in simple language until you really understand the essence.

And everything you need to remember, we will help you put it in your head easily and quickly with the help of mnemonics ✌️

We guarantee admission

We help you decide on the direction of study at the university and prepare for final exams - without stress. nine0011

Designed the program so that you have more time to calmly prepare.

And for those who want to graduate from school faster, we offer to complete 10th and 11th grades in a year.

Rechecking the results of the exam

In the exam, you can lose points due to the subjectivity of the examiner. Sometimes these points are decisive.

If you were preparing for the USE in Foxford, our teachers and USE experts can double-check your work and explain where points were deducted fairly, and where it is worth filing an appeal. nine0011

Individual educational route

We help you to reveal your strengths

In addition to the basic program, you can choose an individual educational route and upgrade in a specific direction.

How does it work?

For example, you dream of becoming a doctor, you love experiments in chemistry, or you are interested in ecology. To unleash your potential and develop your strengths, choose a natural science educational route.

Now courses in this area are available to you: genetics, botany, anatomy, astronomy, zoology and others. You can choose five of them and get in-depth knowledge in the area you are interested in - and so on for each route. nine0011

Choose a program

Start studying for free right now

If you are in doubt whether studying online is right for you, try it and decide

Try it for free

How the assessment works

We can test your knowledge online

90.0 You don't have to go to school to do thisIn accordance with the curriculum. At the certification you will come across only the familiar and worked out task

Successfully and without problems. nine8% of our students pass the assessment the first time

nine8% of our students pass the assessment the first time

The manual will be in your mailbox soon

But you can read it right now

Open the manual

Oops! Something went wrong while submitting the form.

Personal support

Who helps the child in studies

Psychologist

Adapts to the online learning format, helps to overcome stress and difficult situations with study, psychologically prepares for certification and helps in communication

Mentor

Teach learners, help with navigation on the platform, monitor attendance and keep the parent updated on the child’s progress

Tutor

Will help determine the interests and strengths of the child, choose an individual learning path, set goals and learn how to achieve them

You will have more free time

Removed everything unnecessary and left only important activities so that you can combine studies with circles and hobbies

View an example schedule Class

Monday

Russian language

10:00

10:45

Mathematics MOU

11:00

11:45

Tuesday

The world around

:00

11:45

Literary reading

12:00

12:45

Physics + Chemistry.

Laboratory of young genius

14:00

14:45

Wednesday

Mathematics MOU

10:00

11:45

Russian

12:00

9000 13:45Olympiad mathematics

2:00 pm

2:45 pm

Thursday

Moro Math

10:00 am

10:45 am

Russian language

12:00

12:45

Friday

Literary reading

10:00

10:45

The world around us

12:00

12:45

Geometry. Geometric Laboratory

14:00

14:45

Monday

Literature

10:00

0011

13:00

14:45

Music

15:00

15:45

Tuesday

Biology

10:00

11:45

History

12:00

13,0002 13 : 45

Music

14:00

14:45

Foreign language

15:00

15:45

Physics

10:00

:45

Geography

12:00

12:45

English

13:00

13:45

Physics.

Entertaining astronomy

14:00

15:45

Thursday

Russian language

10:00

11:45

Algebra

12:00

10:00 am

10:45 am

geometry0011

Physics.

Advanced

14:00

15:45

Saturday

Foreign language

11:00

11:45

90.0Preparation

for Olympiads

12:00

13:45

Chemistry.

in -depth level

14:00

15:45

Monday

Russian language

10:00

11:45

Chemistry

12:00

:45

Informatics

14:00

14:45

Programming

15:00

15:45

Tuesday

Algebra

10:00

:45

Biology

9000 13:00 p.m.14:45

Wednesday

History

10:00

11:45

Physics

12:00

Social studies

10:00

11:45

Literature

11:00

12:45

Astronomy

:45

Geometry

12:00

13:45

Mathematics. Programming0018 in Python

Programming0018 in Python

14:00

15:45

How to socialize a child

Don't worry about that! 40 online clubs for different interests, off-site meetings and events - much for free. We offer various opportunities for your child to communicate and find new friends

Tuition from 3350 ₽ per month

Try it for freeMore about the tariffs

The cost is affected by

Personal support

Connect a mentor, class teacher, psychologist and tutor

Program

Study in the core program or make it individual

Format

Attend classes online or watch recorded lessons

Classroom

Study in elementary, middle or high school

Enroll in an unassisted school at home

Log in to your personal account, set up a training program, sign an agreement and get ready for classesclass10 class11 classConvenient way to communicateCall meWrite me an emailWrite me on WhatsApp or TelegramI accept the terms of the agreement and privacy policy

Your application is accepted!

We will contact you within 24 hours

Oops! Something went wrong while submitting the form.

Leave an application for admission

- Leave your contacts for communication

- The manager will contact you and tell you about the training

- You will fill out the contract together and sign it with an electronic signature

Here's what they say about us

Elizaveta Strizh

Why do I love Foxford?

The teachers are very positive. Always trying to make us understand the topic.

Almost every lesson contains theoretical material. It helps a lot.

Electronic textbooks. A big plus is that at any time, even from the phone, you can open and read something.

Homework. Making them is very interesting, even in algebra, geometry and physics that are difficult for me. While doing homework, as well as in the classroom, you learn a lot of new things. nine0011

Read full review

Arkadiy Buiko

Learned about Foxford's Home School and Externship. I was very attracted by the opportunity of family education, teachers of Moscow State University, Moscow Institute of Physics and Technology, Higher School of Economics and courses in preparation for Olympiads in the leading universities of the country. Mom suggested trying this way of learning. I always liked to study next to my parents, and then I also liked the format. In Foxford's online class, you can feel free to ask the teacher for help, and pause while watching the recording. But the most interesting thing is that at Foxford Home School, I forgot about that computer game that began to take up a lot of time in my life. Now I have such busy days that sometimes 24 hours in a day are not enough. nine0018

Mom suggested trying this way of learning. I always liked to study next to my parents, and then I also liked the format. In Foxford's online class, you can feel free to ask the teacher for help, and pause while watching the recording. But the most interesting thing is that at Foxford Home School, I forgot about that computer game that began to take up a lot of time in my life. Now I have such busy days that sometimes 24 hours in a day are not enough. nine0018

Read full review

Sofia Golova

What I like most about Foxford:

Don't get up early!

No need to “work out” and ask classmates for notes if they missed something. I just pressed the button and reviewed the entry, pressed another and read the theoretical material.

The teachers are cheerful and speak clearly.

No one scolds for filling out notebooks incorrectly. Write as you like, but if you want, just fill it out on the computer. nine0011

Read full review

Varya Koroleva

My son finished his 5th grade at your school During my two years at Foxford, I made as many cool acquaintances as I didn't get in nine years at school. And we communicate not only on the Internet. Guys from other cities from time to time come to the capital on business, we will definitely use this opportunity to spend a couple of days together. For example, in March I met a girl from Yekaterinburg, and in December I will see almost all my classmates at the essay. nine0011

And we communicate not only on the Internet. Guys from other cities from time to time come to the capital on business, we will definitely use this opportunity to spend a couple of days together. For example, in March I met a girl from Yekaterinburg, and in December I will see almost all my classmates at the essay. nine0011

Read full review

We have a license

Our educational programs comply with state requirements for additional education and take into account school educational standards.

You can get a tax deduction for educational services and use maternity capital to pay for some educational programs.

Foxford has

Courses

Complete program with online classes, assignments and tutor support

Tutors

One-on-one classes with a convenient schedule and a personal approach

Home school

Completely replaces school with online home learning

Events

Everything that is happening in Foxford now: discounts, games or tests 901

Free materials

Textbook for all subjects

from grades 1 to 11, simulators and tests.

05.2020)

05.2020)