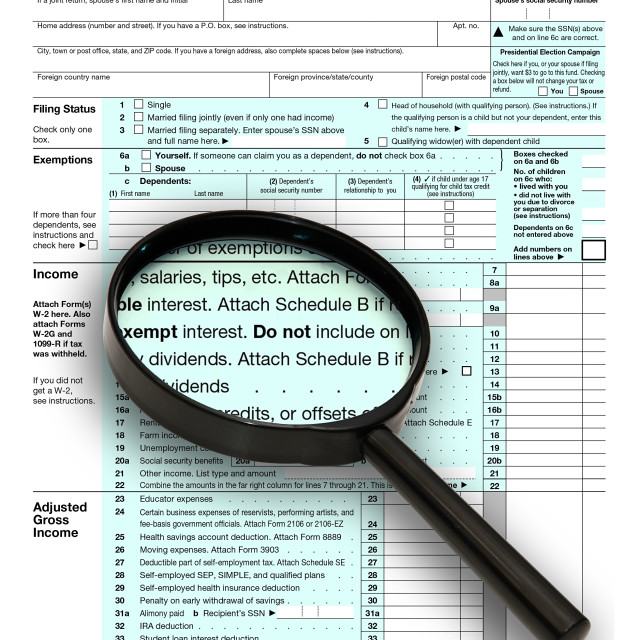

How much is a child tax credit this year

The Child Tax Credit - The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

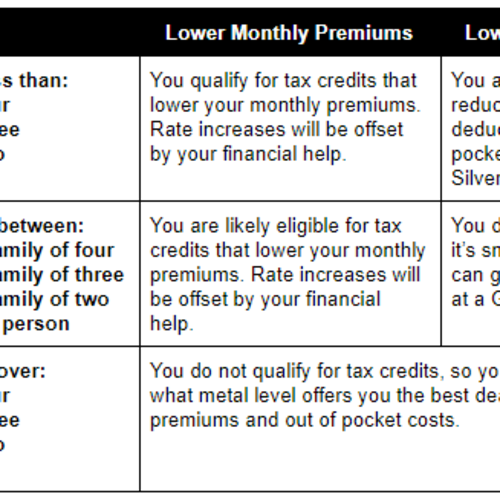

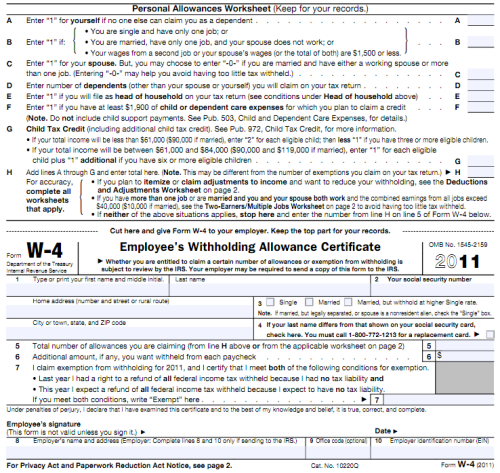

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

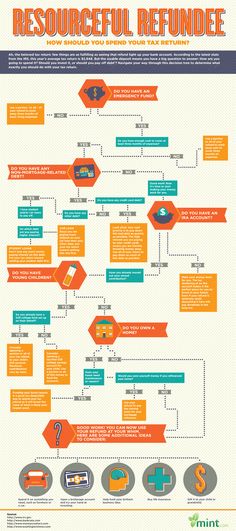

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Child Tax Credit | U.S. Department of the Treasury

The American Rescue Plan increased the Child Tax Credit and expanded its coverage to better assist families who care for children.

Overview

The American Rescue Plan’s expansion of the Child Tax Credit will reduced child poverty by (1) supplementing the earnings of families receiving the tax credit, and (2) making the credit available to a significant number of new families. Specifically, the Child Tax Credit was revised in the following ways for 2021:

- The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under age 18.

- The credit was made fully refundable. By making the Child Tax Credit fully refundable, low- income households will be entitled to receive the full credit benefit, as significantly expanded and increased by the American Rescue Plan.

- The credit’s scope has been expanded. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Previously, only children 16 and younger qualified.

- Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. Families caring for children were able to receive financial assistance on a consistent monthly basis from July to December 2021, instead of waiting until tax filing season to receive all of their Child Tax Credit benefits.

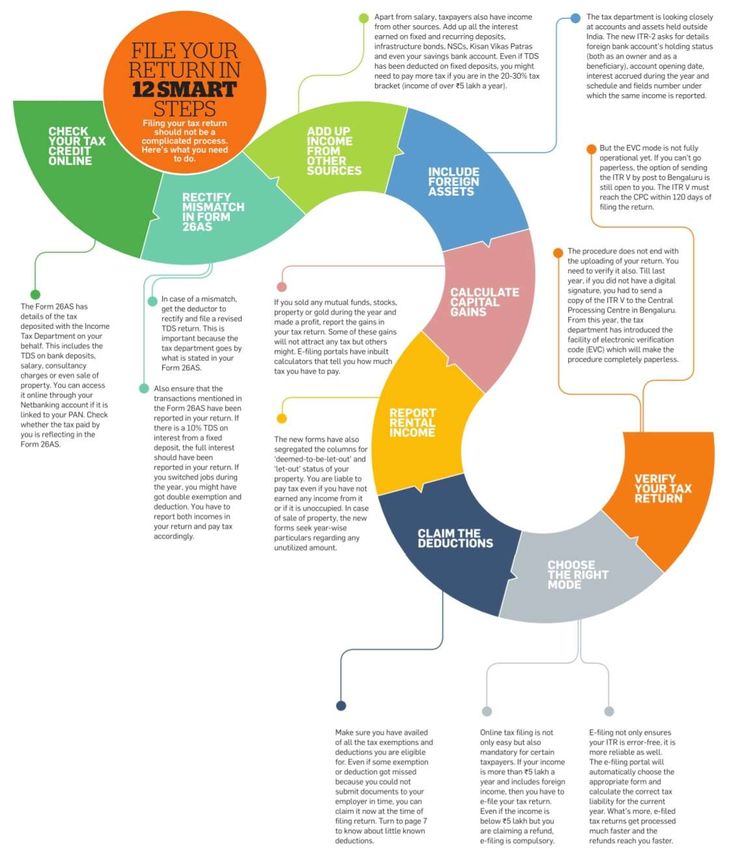

File your taxes to get your full Child Tax Credit — now through April 18, 2022. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition, the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U. S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

Recent Updates

- New and Improved ChildTaxCredit.gov

- This website exists to help people:

- Get the Child Tax Credit

- Understand how the 2021 Child Tax Credit works

- Find out if they are eligible to receive the Child Tax Credit

- Understand that the credit does not affect their federal benefits

- This website provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. Every page includes a table of contents to help you find the information you need.

- This website exists to help people:

- Code for America’s Non-Filer Tool

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- The GetCTC tool is currently closed for the season, but you can access information about the Child Tax Credit on the website.

- Community organizations and volunteer navigators seeking to help hard-to-reach clients access the Child Tax Credit or Economic Impact Payments can access training materials and resources on the navigator website.

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- IRS Non-Filer Tool

- Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th.

- Families who normally aren’t required to file an income tax return should use this Non-Filers Tool to register quickly for the expanded and newly-advanceable Child Tax Credit from the American Rescue Plan.

- Child Tax Credit Portal

- Use this tool to:

- Check if you’re enrolled to receive payments

- Unenroll to stop getting advance payments

- Provide or update your bank account information for monthly payments starting with the August payment

- Use this tool to:

- Child Tax Credit Eligibility Assistant

- Check if you may qualify for advance payments.

- Check if you may qualify for advance payments.

Spread the word

- Key Messaging about the Child Tax Credit

- Child Tax Credit Toolkit: Download all CTC Info Sheets and Social Media slides

- Info Sheet: How Has the CTC Changed This Year

- Info Sheet: How to Make Sure You Get the CTC Payment

- Info Sheet: The Expanded Child Tax Credit: Explained

- Social Media slides: How Has the CTC Changed This Year

- Social Media slides: How to Make Sure You Get the CTC Payment

- Find more information at ChildTaxCredit.gov

RESOURCES

- Child Tax Credit FAQs

- Child Tax Credit Press Release

- Economic Impact Payment Info

- Need to file a tax return? Find free options and information here

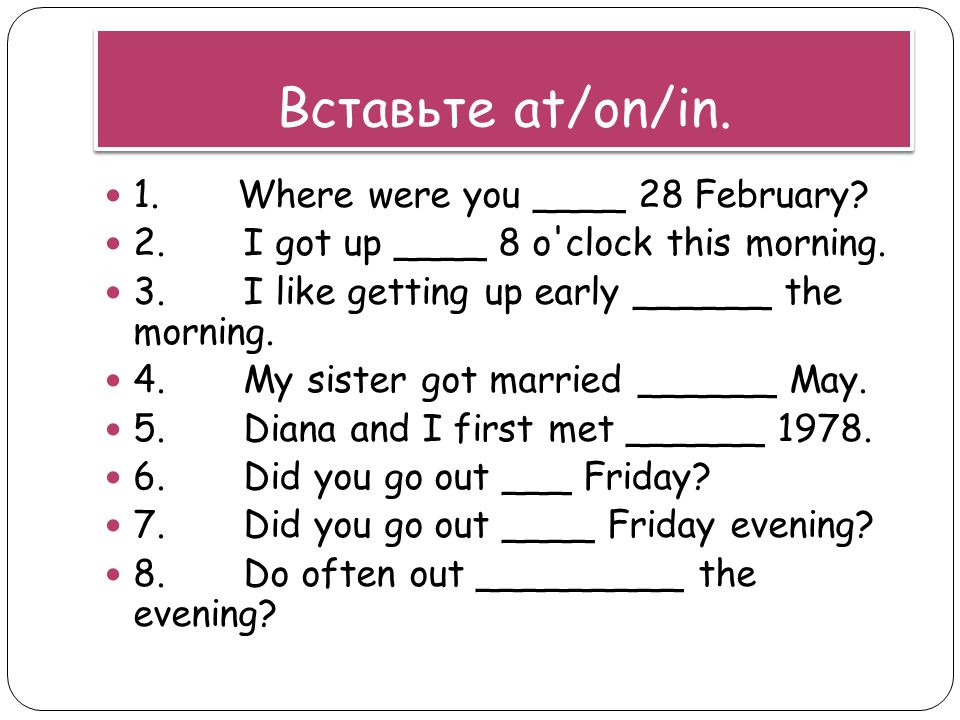

90,000 school English language online - Learning English

adults

Children and adolescents

Meet

with a school for free

We will answer questions and tell you about ourselves

Premium

After the application

- show the platform and give recommendations on the free introductory lesson

- We will give up to 3 lessons and select a teacher for your goals

By leaving an application, you accept the terms of the agreement

Or choose a course for your level of English first - take the test

Or choose a course for your level of English first - take the test

Find out why you should learn English

In 5 minutes you will learn how the most popular language in the world can useful to you in life.

Take the test →

Interactive classes and up-to-date knowledge.

Surround yourself with English

Study at your fingertips

Practice skills, learn words, do homework, watch videos and listen to audio on your phone or computer

Practice

from the first lesson

Communicate in English, listen to speakers from different countries and learn to understand any accent

Track progress

Track your progress in learning all skills: reading, listening and listening letter

Standard

from 790 ₽

per lesson

Lessons of 50 minutes

with a teacher

Russian-speaking teachers

with experience of 1 year or more

Ability to transfer

to 2 lessons per month for free

access to the interactive platform

and all schools of the school

Support in chat and by calling

Popular

Premium

of 990 ₽

Personal approach

and premium teachers

Russian-speaking teachers

with more than 5 years of experience

Ability to transfer lessons

from class to class

Access to the platform, school simulators

and conversational premium clubs

Personal manager 24/7

Neutive

from 1,790 ₽

For a lesson

Lesson at 50 minutes

with a native speaker

Teachers-native speakers

with experience from 1 year

Ability to transfer

2 lessons per month for free

Access to the

interactive platform and all school simulators

Chat and phone support

Strong teachers with different interests.

Find your →

-

Vladislav

Experience 5 years

-

Anna

4 years

-

Lydia

Experiences 3 years

-

oksana

years old

4 9000

Experience 3 years

Running, walking, cycling, scooter, computer games and many other interests that I will talk to you about in English.

Work out with whoever you like best. If a teacher is not suitable for you, you can change it at any time

-

Vladislav

Experience 5 years

Running, walking, cycling, scooter, computer games and many other interests that I will talk to you about in English.

-

Anna

Experience 4 years

In addition to teaching, I also work as an actress and TV presenter, enjoy sports, dance and sing.

If you want to talk in class not only about textbooks, then Skyeng is for you!

If you want to talk in class not only about textbooks, then Skyeng is for you! -

Lydia

Experience 3 years

I am not only a teacher, but also a volunteer, dancer, surfer and a person who loves languages. For me, Skyeng is comfort and lightness. It is comfortable for both students and teachers. Join now!

-

Oksana

Experience 5 years

I love Skyeng because my students are cool and interesting people. I really appreciate that the knowledge that I share with them makes their life better.

-

Ekaterina

Experience 3 years

Hi everybody, my name is Kate and I’ve been a part of Skyeng team for more than 3 years now! Believe me, there is nothing more pleasing than sharing my experiences and knowledge in terms of the English language.

Work out with whoever you like best. If a teacher is not suitable for you, you can change it at any time

We will define goals and select a teacher

By submitting an application, you accept the terms of the agreement

Find out which course suits you

Step 1 of 2

, Why

are you learning English

Select your learning goal so that we can select the most relevant workouts for you

Travel abroad

Communicate freely with foreigners while traveling or move to another country

Work

Interview, communicate with colleagues, speak at conferences

Study

Pass an exam, study abroad 9000

For myself

Watch movies, read books in the original, chat with friends

Let's think in the process

Haven't thought of it yet

With us, students achieve results

at a pace that is comfortable for them

Nadezhda

September 28, 2021

I really like the platform and application In addition to the lessons, you can analyze some topics on your own, there are selections of videos, words, etc. 0003

0003

Vocabulary has become noticeably larger, grammar has improved. I really like my teacher, she is a native speaker. I chose it myself based on the description, greeting and listening to the audio.

Olga

August 12, 2021

I recommend speaking clubs!

This is very useful for testing your speaking and practice level. I really like the classes, the teachers are super! I will definitely continue to do more.

View all reviews →

Didn't find the answer to your question? Write to us on social networks

-

What is an introductory lesson?

At the introductory lesson, the tutor will tell you what an online English school is, introduce you to the platform and help you determine the level and goals. It's free and takes 30-40 minutes.

-

When can I take the introductory lesson?

You can visit the school at any time convenient for you.

To do this, just leave a request and sign up for a lesson.

To do this, just leave a request and sign up for a lesson. -

What do you need to start learning English online?

All you need to study is a computer or phone with a microphone, camera and Internet access. Wherever you are - in Moscow, Kazan, Novosibirsk or Bali - an online English school will be at hand.

-

I can't come to class, what should I do?

It's okay, it happens! Students have the opportunity to cancel a lesson 8 hours before the scheduled time without losing payment. So you can reschedule it for a convenient time, and the teacher will have the opportunity to adjust the schedule.

-

I don't have much free time, will I have time to study?

Learn English at your own pace. We will select a convenient schedule and at any time we will help you change the schedule, take a break or adjust the program.

-

How long does one lesson last?

The introductory meeting is 30-40 minutes long, all other lessons in the adult English course are 50 minutes long.

-

How to become a teacher?

Leave a request on the site and record a short audio interview about your experience. We will contact you by mail and tell you about the upcoming stages. Don't worry, first we will introduce you to our platform, then the facilitator will play the role of a student in your first class. After successfully passing the selection, you will be able to open the schedule and start teaching immediately.

Download the

app and learn English

anywhere

Simulators

and exercises

Classes

with a teacher

Access

to homework

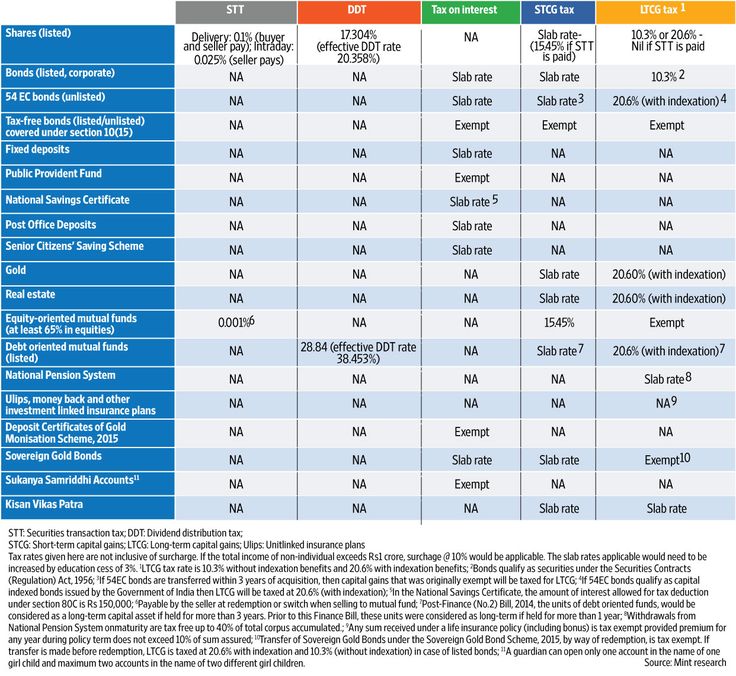

Property taxes for children: do I need to pay

1

My child receives letters from the tax office. This is mistake?

This is mistake?

No, this is not an error. A minor really must pay taxes if he owns a home or a share in it. As well as land and other real estate.

Share

2

Can a child pay taxes himself?

A child has civil rights from the moment of birth. Including the opportunity to be the owner of real estate. And property owners must pay personal property tax.

Parents, guardians, legal representatives of the child have the right to make transactions on their behalf, respectively, and they must also pay taxes for the child.

Share

3

How do I pay tax for a child?

We remind you that there are several ways to pay property taxes. In electronic form: through the website of the Federal Tax Service of Russia using the service "Payment of taxes, insurance premiums for individuals", through the Personal account of the taxpayer for individuals, as well as through the application for mobile devices "Taxes FL". Or according to payment documents: through cash desks, bank terminals, at the offices of Russian Post.

Or according to payment documents: through cash desks, bank terminals, at the offices of Russian Post.

To pay tax for a child in the Taxpayer's Personal Account, you need to open the "Family Sharing" tab. In this tab, click the "Add User" button, then enter the login (TIN) of the Personal Account of a minor child and click the "Send Request" button (there can be no more than two confirmed requests in the Personal Account of a minor child). Then go to the child's Personal Account and confirm your request.

Minors added to this list are automatically removed from the list after the age of 18. This can be done earlier, at the request of any of the parties, for this you need to click the cross of the user added to the list and confirm the exclusion.

In the "Taxes" section, a pop-up list will appear, which includes only the added minor children. By switching users in this list, you can pay taxes in any convenient way: by bank card, through an online bank or by receipt.

By the way, users of the taxpayer's personal accounts will not receive tax notices by mail, except for those taxpayers who have informed the tax office that they want to receive documents in paper form.

Share

4

How can I access my child's personal account?

The ability to connect "Family Access" appears only if the users of personal accounts are both parents and their children.

Access to the child's personal account can be obtained using the login and password specified in the registration card. For a card, parents and legal representatives need to apply personally to any tax office.

Take the identity documents of the parent (legal guardian) and the child with you. Users of the State Services portal can connect to the taxpayer's personal account on their own using a verified portal account.

Share

5

Will I see tax notices on Gosuslugi?

No, tax notices are not posted on the State Services portal. There you can see only the amount of your debt after December 1 - in the event that you did not manage to pay the tax before this date.

There you can see only the amount of your debt after December 1 - in the event that you did not manage to pay the tax before this date.

If you have not received any notifications, but you think that you should, you need to send a statement about this through the taxpayer's personal account. You can also use the service "Contact the Federal Tax Service of Russia" or come to any tax office.

The taxpayer (his legal or authorized representative) has the right to receive a tax notice on paper against receipt at any tax office or through the MFC. To do this, you need to write an appropriate application.

Share

6

Child turns 18, can parent still pay taxes?

Yes, maybe. Taxes can be paid not only for yourself and minor children, but also for other persons, including for three children who are already 18 years old. You can also pay taxes of other relatives through the “Paying taxes for third parties” service.

Share

7

Are there child tax benefits?

Indeed, there are property tax benefits for minors. The list of benefits is available in the "Reference Information on Rates and Benefits for Property Taxes" service on the website of the Federal Tax Service of Russia.

The list of benefits is available in the "Reference Information on Rates and Benefits for Property Taxes" service on the website of the Federal Tax Service of Russia.

Share

8

What happens if you don't pay on time?

The deadline for payment of property taxes by individuals for 2021 expires on December 1, 2022. After that, unpaid taxes become debt, which will grow every day until full repayment.

That is, penalties will be charged on this amount daily, then you will have to pay a state duty for the consideration of the case in court, an enforcement fee, and the costs of enforcement actions.

We recently talked about how to get a tax deduction for children's sections.

Share

Related

-

July 12, 2022, 09:00

Longer, more expensive and riskier: what real estate transactions will be like when Rosreestr closes data -

September 16, 2022, 10:00 am

Parents, return the money! How to force the state to reimburse expenses for mugs and classes -

June 27, 2022, 08:00

Do not give the bank the last thing: what money cannot be written off for debts -

October 13, 2022, 10:00

Are we going to the embassy or going home? How to apply for a passport abroad -

July 27, 2022, 10:00

Keep an eye on your bills: three new fraud schemes that withdraw money from the card

Anna Bogdanova

Crossacler

Chief of the MENTERY TOLNAGNALINAL Inspection

- Laik2

- Laughter

- Surprising0

- Anges0

- sadness0

saw the Nick? Select a fragment and press Ctrl+Enter

COMMENTS4

Read all comments

What can I do if I log in?

COMMENT RULES

0 / 1400 This site is protected by reCAPTCHA and Google.