How much is a child support check

Child Support Calculator - HRA

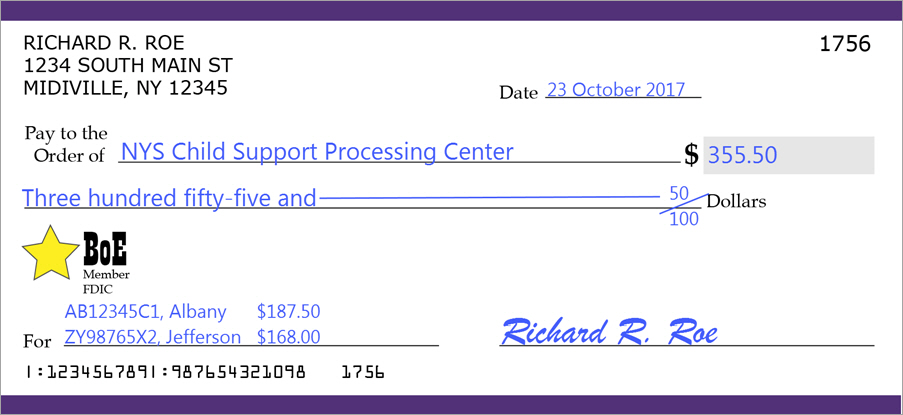

* Orders are paid weekly, biweekly, monthly, or bimonthly. Divide the estimated annual support amount by the frequency that applies to the way the noncustodial parent is paid.

DISCLAIMER: Use the Child Support Calculator to get an idea of how much a noncustodial parent might owe in child support in New York State. It is only an estimate and is adjusted to reduce the gross income by Medicare, FICA and local NYC taxes. The court may, under certain circumstances, deviate from the formula. In addition, other factors are routinely considered in setting the order amount. Read the Child Support Standards Act for more information.

The Child Support Standards Act

The Child Support Standards Act was developed to ensure that child support awards in New York State were fair and consistent. The goal is to give children the same standard of living they would have if their parents were together. For more information on the law call the New York State Child Support Helpline at 888-208-4485.

| Number of Children | % |

|---|---|

| 1 | 17% |

| 2 | 25% |

| 3 | 29% |

| 4 | 31% |

| 5+ | at least 35% |

The law states that the basic support award be set at a fixed percentage of parental income, depending on the number of children for whom an order is being requested:

These percentages are applied to almost all parental earnings up to $163,000, minus Medicare, FICA and NYC tax deductions. Child or spousal support actually paid, based on a court-order or written agreement, may also be deducted before calculating the child support order. Earnings include worker's compensation, disability payments, unemployment insurance, social security, pensions, and many other forms of income. After $163,000, the court can choose whether or not to use the percentage guidelines.

Earnings include worker's compensation, disability payments, unemployment insurance, social security, pensions, and many other forms of income. After $163,000, the court can choose whether or not to use the percentage guidelines.

In addition to the basic support award, the child support order must include medical support, which means health insurance and payments for any out-of-pocket medical expenses for the child. Either parent may be required to provide health insurance coverage for the child, if it is available at a reasonable cost. The basic award may be increased to include a prorated share of child care expenses, if the custodial parent is working or in school. In addition, the court may increase the award to include a prorated share of educational expenses for the child.

For a more in-depth calculation, refer to the Post-Divorce Maintenance/Child Support – Online Calculator, maintained by the New York State Family Court.

New York State laws protect low-income noncustodial parents:

- If the noncustodial parent's income is below the Federal Poverty Level ($12,140 for 2018), the child support order may be established at $25 per month and the amount of arrears will be capped at $500.

- If the noncustodial parent’s income is below the New York State Self-Support Reserve ($18,347), the child support order may be established at $50 per month.

Other Resources

- Office of Child Support Services Home Page

- Information for Custodial Parents

- Information for Noncustodial Parents

- Information for Parents

- Handbook for Custodial Parents

- Handbook for Noncustodial Parents

- OCSS Locations

- New York State Income Withholding Calculator for Employers

How much is child support in your state?

A typical parent's payment can vary by over $700 a month from state to state

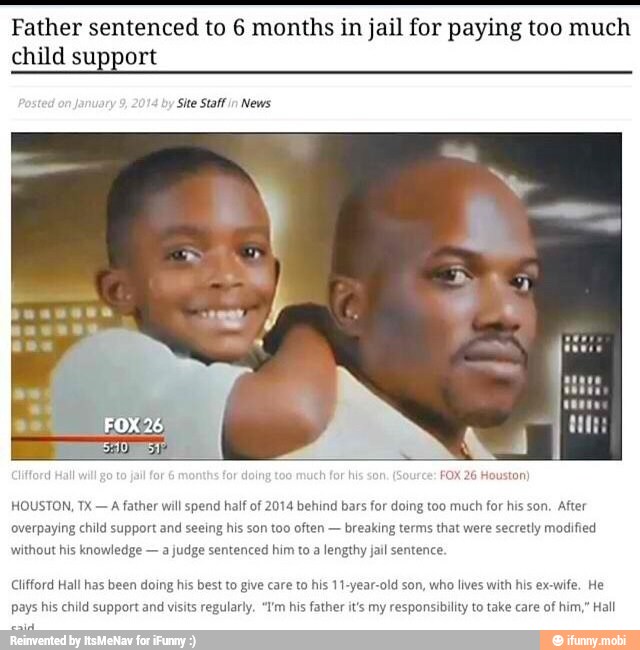

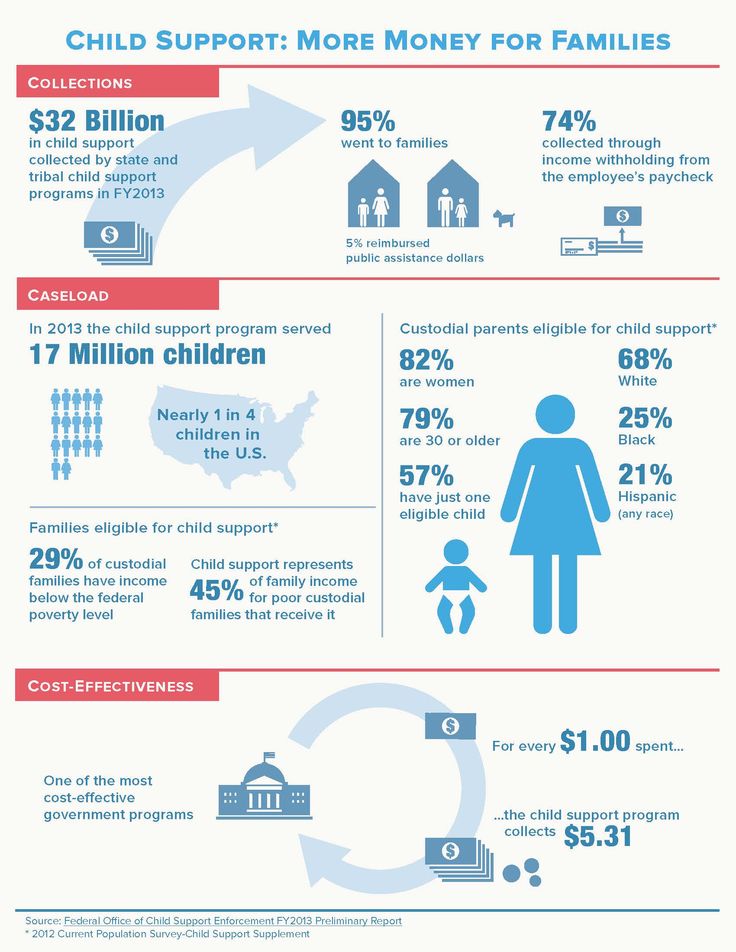

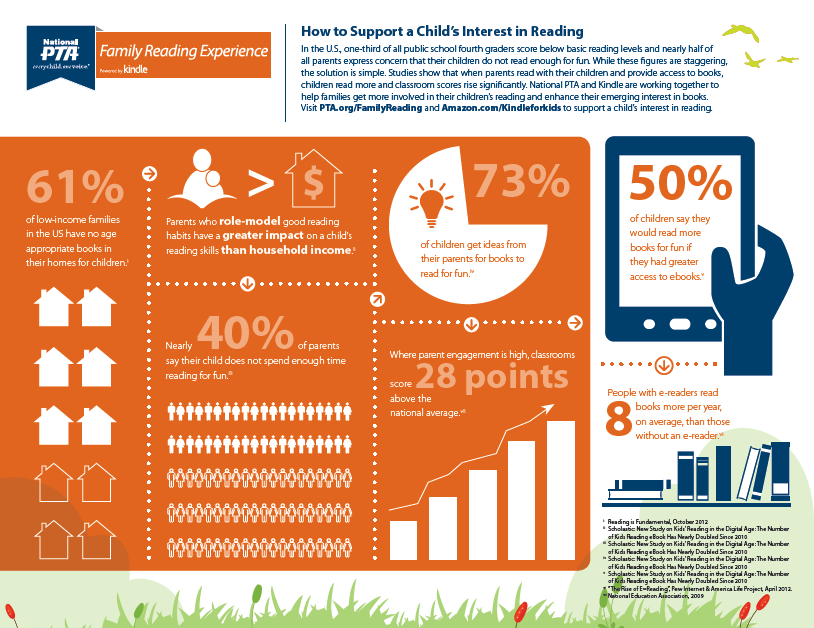

June 10, 2019 — The size of your child support payment depends heavily on where you live, according to research from Custody X Change.

Download high resolution map: PNG | JPG Use image with attribution

A parent can pay three times as much as one who lives in a state just six hours away, despite their circumstances being otherwise equal. When a Virginia parent would pay $400 a month in child support, a Massachusetts parent in the same situation would pay nearly $1,200, per state guidelines.

When a Virginia parent would pay $400 a month in child support, a Massachusetts parent in the same situation would pay nearly $1,200, per state guidelines.

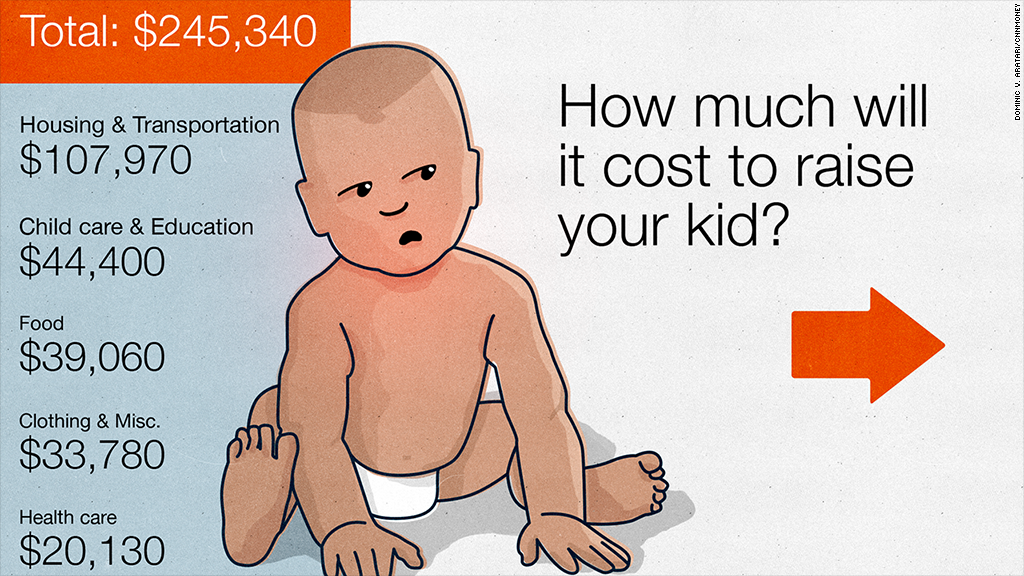

The study looks at a hypothetical family with two children, ages 7 and 10. The mother has 65 percent of parenting time (the most common timeshare awarded to a U.S. mother, according to previous research). She makes $45,000 a year, while the father makes $55,000 (based on data about typical parental incomes from Pew Research Center).

Researchers entered this information into each state's child support formula to discover that the father's payment could range from $402 a month to $1,187 a month. (See the full table of state rankings at the end of this page.) Nationally, he would pay an average of $721 monthly.

These totals reflect how much a state presumes the noncustodial parent should pay (the "guideline" amount), but judges have the discretion to award different amounts based on evidence. In some cases, parents can decide together how much support will be exchanged.

The study does not utilize any data from Custody X Change users.

"Child support is complex," said Ben Coltrin, Custody X Change co-founder and president. "States don't want to set a payment too low, leaving a child's needs unmet. At the same time, they don't want to set a payment so high that the parent can't afford it. We hope this data furthers dialogue about how to determine the right support for each family."

Cost of living, political leaning don't explain the variation

Perhaps surprisingly, the research revealed that child support rates don't significantly correlate with a state's cost of living.

Of the five most expensive states to live in — Hawaii, New York, California, New Jersey and Maryland — one (Hawaii) ranks among the 10 highest child support calculations in the study, but two (New Jersey and Maryland) rank among the lowest 10 calculations.

Meanwhile, Massachusetts, which awards the highest support payment for this family, has the seventh highest cost of living in the nation. Virginia has a comparable cost of living (12th highest in the U.S.), yet awards the least support.

Virginia has a comparable cost of living (12th highest in the U.S.), yet awards the least support.

Download high resolution graph: PNG | JPG Use image with attribution

Political leaning also fails to provide an explanation for the variation in support. Average awards from Republican and Democratic states for this mother are just $13 apart ($702 and $715 a month, respectively).

Four states only consider one parent's income, award $100 more monthly

Only four states don't consider the mother's income when calculating this family's child support:

- Arkansas

- Mississippi

- North Dakota

- Texas

In these states, the family's child support payment is $100 higher than in the rest of the country, on average. Whereas these states award the family an average of $813 monthly, the other 46 states award $713 on average.

Historically, many states calculated child support by taking a percentage of money earned by the parent who spent less time with the child. As the number of working mothers has ballooned in recent decades, most states have moved to formulas that factor in both parents' incomes. Arkansas will become the latest state to make this move, by March.

As the number of working mothers has ballooned in recent decades, most states have moved to formulas that factor in both parents' incomes. Arkansas will become the latest state to make this move, by March.

For the family in the study, formulas that look only at the father's earnings produce high totals. This is because they don't consider that the hypothetical parents have similar income levels.

If the mother's income were to drop, the presumed awards in the same four states could be among the lowest in the country; they would remain static while the awards in other states would increase.

Rocky Mountain region awards the lowest payment, New England the highest

The Rocky Mountain region awards this mother the least child support: $556 a month, on average.

New England awards the most; at $928 a month, its average is 67 percent higher than that of the Rocky Mountain region. Vermont is a New England outlier, with the 12th lowest payment in the nation ($519), but it's not enough to knock New England out of the top spot.

Download high resolution map: PNG | JPG Use image with attribution

For a full breakdown of calculations by region, visit the appendix.

Different approaches to setting guidelines may be behind variation

The federal government requires every state to develop child support guidelines, which help courts determine the appropriate award in any case. The government introduced this requirement in the 1980s after studies showed major inconsistencies in how judges were awarding support, both within and among states.

States choose how to set their guidelines. A few have worked with researchers to measure the cost of raising a child there. Others have used existing research (which may employ data from another state or at the national level), or they haven't referred specifically to any evidence. The difference in approaches likely contributes to the difference in awards across the country.

"We hope this data furthers dialogue about how to determine the right support for each family. "

"

-Ben Coltrin, Custody X Change President

Even among states that point to research, the studies they consult vary in methodology and age. The most common source is the Consumer Expenditure Survey from the U.S. Bureau of Labor Statistics. Since it doesn't offer data at the state level, some states have adjusted its data to try to match their cost of living. Other state-specific modifications to data and models further add to the lack of uniformity in awards across the U.S.

By law, each state must convene a panel to review its guidelines every four years.

Child support debate continues to evolve

Most states have overhauled their child support formulas significantly as American families have changed. Guidelines once assumed mothers worked less than fathers, if at all. In addition, they were often based on the presumption that parents had at one point been married to each other.

Today, much of the debate around child support concentrates on finding an amount that provides for the child without leaving the paying parent destitute. Some states have found that lowering payments or forgiving outstanding payments can increase overall child support collection numbers, as the payers are better able to afford their obligation.

Some states have found that lowering payments or forgiving outstanding payments can increase overall child support collection numbers, as the payers are better able to afford their obligation.

State by state rankings

| Rank | State | Award |

| # 1 | Massachusetts | $1,187 |

| # 2 | Nevada | $1,146 |

| # 3 | New Hampshire | $1,035 |

| # 4 | Rhode Island | $1,014 |

| # 5 | Hawaii | $1,014 |

| # 6 | Connecticut | $987 |

| # 7 | Nebraska | $975 |

| # 8 | Kansas | $955 |

| # 9 | North Dakota | $953 |

| # 10 | Washington | $901 |

| # 11 | New York | $895 |

| # 12 | South Dakota | $890 |

| # 13 | Illinois | $885 |

| # 14 | Pennsylvania | $875 |

| # 15 | Louisiana | $873 |

| # 16 | Georgia | $868 |

| # 17 | North Carolina | $840 |

| Rank | State | Award |

| # 18 | Arkansas | $824 |

| # 19 | Maine | $823 |

| # 20 | Ohio | $774 |

| # 21 | Kentucky | $767 |

| # 22 | South Carolina | $760 |

| # 23 | Texas | $759 |

| # 24 | Alabama | $758 |

| # 25 | New Mexico | $735 |

| # 26 | Iowa | $733 |

| # 27 | Utah | $729 |

| # 28 | Minnesota | $716 |

| # 29 | Mississippi | $715 |

| # 30 | Michigan | $666 |

| # 31 | Wisconsin | $623 |

| # 32 | Montana | $612 |

| # 33 | California | $566 |

| # 34 | Missouri | $556 |

| Rank | State | Award |

| # 35 | Florida | $544 |

| # 36 | Arizona | $534 |

| # 37 | Oklahoma | $532 |

| # 38 | Alaska | $527 |

| # 39 | Vermont | $519 |

| # 40 | Tennessee | $503 |

| # 41 | Colorado | $494 |

| # 42 | Wyoming | $484 |

| # 43 | Maryland | $480 |

| # 44 | Delaware | $463 |

| # 45 | Idaho | $463 |

| # 46 | Indiana | $425 |

| # 47 | New Jersey | $424 |

| # 48 | Oregon | $421 |

| # 49 | West Virginia | $403 |

| # 50 | Virginia | $402 |

*States that round to the same whole number are ranked based on their decimals.

For more information on the study, see the appendix.

Amount of maintenance per child \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Amount of maintenance for one child

A selection of the most important documents upon request The amount of maintenance per child (legal acts, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children to support their parents

- Alimony obligations of spouses

- Alimony in 6-NDFL

- Alimony in a solid amount of

- Alimony of individual entrepreneur

- more ...

Judicial practice : the amount of alimony per child

register and get test access to the survivor system ConsultantPlus free for 2 days

Open the document in your system ConsultantPlus:

Selection of court decisions for 2020: Article 120 "Termination of maintenance obligations" of the RF IC

(R. B. Kasenov) The court satisfied the plaintiff's claims to invalidate the decision of the bailiff on the calculation of alimony arrears. As the court pointed out, by virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority or in the event that minor children acquire full legal capacity before they reach the age of majority. In the case under consideration, one of the two children of the plaintiff, for the maintenance of which alimony was payable, had reached the age of majority. Thus, alimony for the maintenance of one child was subject to withholding, however, the bailiff-executor calculated the amount of alimony based on 1/3 of the plaintiff's earnings, which is not based on the law.

B. Kasenov) The court satisfied the plaintiff's claims to invalidate the decision of the bailiff on the calculation of alimony arrears. As the court pointed out, by virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority or in the event that minor children acquire full legal capacity before they reach the age of majority. In the case under consideration, one of the two children of the plaintiff, for the maintenance of which alimony was payable, had reached the age of majority. Thus, alimony for the maintenance of one child was subject to withholding, however, the bailiff-executor calculated the amount of alimony based on 1/3 of the plaintiff's earnings, which is not based on the law.

Register and get the trial access to the ConsultantPlus system free for 2 days

Open the document in your ConsultantPlus system:

Selection of court decisions for 2019: Article 120 "Continuation of alimony obligations" of the IC of the Russian Federation

(R. B. Kasenov) By virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority. At the same time, the court order of the justice of the peace did not contain information that the collection of alimony in the amount of 1/3 of the share stops when one of the children reaches the age of majority and then the alimony is subject to collection in the amount of 1/4 of the share. To reduce the amount of alimony established by the court, the bailiff-executor is not entitled to reduce. The reference to the fact that the bailiff had to apply to the court for clarification of the court order, but did not do this, does not indicate the illegality of his actions, since this appeal is a right, and not an obligation, of the bailiff. On the contrary, the debtor, being an interested party of enforcement proceedings, being active, was not deprived of the opportunity to resolve this issue. In addition, the court order contained no ambiguities and did not require clarification.

B. Kasenov) By virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority. At the same time, the court order of the justice of the peace did not contain information that the collection of alimony in the amount of 1/3 of the share stops when one of the children reaches the age of majority and then the alimony is subject to collection in the amount of 1/4 of the share. To reduce the amount of alimony established by the court, the bailiff-executor is not entitled to reduce. The reference to the fact that the bailiff had to apply to the court for clarification of the court order, but did not do this, does not indicate the illegality of his actions, since this appeal is a right, and not an obligation, of the bailiff. On the contrary, the debtor, being an interested party of enforcement proceedings, being active, was not deprived of the opportunity to resolve this issue. In addition, the court order contained no ambiguities and did not require clarification. Thus, the court dismissed the claim of the administrative plaintiff to declare illegal the decision on the calculation of the alimony arrears, the obligation to determine the alimony arrears.

Thus, the court dismissed the claim of the administrative plaintiff to declare illegal the decision on the calculation of the alimony arrears, the obligation to determine the alimony arrears.

Articles, comments, answers to questions : the amount of alimony per child

Register and receive trial access to the consultantPlus system free 2 days

Open the Consultant Pluss:

Situation: Whoever Do I have to pay child support and how much?

("Electronic journal "Azbuka Prava", 2022) If an agreement on the payment of alimony for minor children has not been concluded, they can be collected in court. The amount of alimony that must be paid monthly will be determined by the court. As a general rule, the amount of alimony is: for one for a child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other income of the parents. the court may increase or decrease the amount of these shares.

Normative acts : Amount of maintenance per child

how to recover, sample statement of claim, amount of payments

Alisa Markina

lawyer

Author profile - a quarter, for two - a third, for three - half of the income.

With this approach, if one parent has a regular income, then the second one receives the same amount for children every month and can plan spending: on clothes, sections and tutors.

But if a parent is a piece-rate freelancer and gets 200,000 R one month and zero the next, it becomes difficult to predict how much money will come in a given month for a child. Therefore, the family code provides for alimony, the amount of which will not change from month to month. This is alimony in a fixed amount of money.

In the article I will tell you what it is, in what situations alimony is prescribed in a fixed amount of money, how to calculate and collect it.

What is alimony in a fixed amount of money

A fixed amount of money is a fixed, constant amount of alimony, which does not change from month to month, depending on the income of the alimony payer.

Child support can be collected as a share of official income, a fixed amount of money, or a combination of both. By law, children have the right to receive a fixed amount from their parents for maintenance so that their quality of life does not change from month to month. Therefore, alimony in a fixed amount of money is more profitable if the parent does not have a permanent income or he hides it.

/alimony/

How to calculate and pay child support

Also, if there are several children in the family and the child stays with each parent, child support can only be collected from a more affluent parent in a fixed amount of money.

Parents can agree on a permanent amount of child support and fix it in a notary agreement without a court order. The main thing is that the child receives no less than what is required by law. The agreement cannot be terminated unilaterally, it has the force of a writ of execution: if the debtor stops paying, the money under such a document can be forcibly recovered. I will tell you more about how to draw up an alimony agreement in a fixed amount of money below.

I will tell you more about how to draw up an alimony agreement in a fixed amount of money below.

ch. 16 SK RF

You can also ask for a fixed amount of alimony in court, if there are grounds. For example:

- the second parent has a variable income;

- the other parent receives income in foreign currency or in kind;

- the second parent has no official sources of income;

- it is impossible, difficult, or it significantly violates the rights of children to collect alimony in a share. For example, if the official salary of the second parent is equal to the regional minimum wage, and he receives the rest in an envelope.

Art. 83 SK RF

In addition to children, other needy family members can claim child support in their favor. And only in hard cash. Disabled brothers and sisters, grandparents, and grandchildren have this right. Even with stepchildren, stepfathers and stepmothers - if there are no closer wealthy relatives.

/guide/to-file-for-support/

How to apply for child support

Legal framework. All maintenance issues are regulated by the family code - section 5 of the RF IC is devoted to this.

Chapter 13 of the RF IC defines the conditions for the collection of alimony from parents to children - both in shares and in a fixed amount - and from children to parents.

Chapter 14 of the RF IC establishes the conditions for collecting alimony in favor of spouses and former spouses. As a general rule, spouses should help each other. And the former spouse can count on help if he is raising a common child or if he has become disabled.

Chapter 15 of the RF IC is devoted to the issues of alimony to grandparents, brothers, sisters and other relatives.

When the court determines the amount of alimony, it is guided by Chapter 17 of the RF IC. And if relatives agree on alimony without a court - in a notarial agreement, then they should be guided by Chapter 16 of the RF IC: it is devoted to the conclusion, amendment and termination of alimony agreements.

Pros and cons of alimony in a fixed amount of money

There are no pluses or minuses in a fixed amount of alimony for relatives other than children: this is the only possible option.

But child support in a fixed amount of money can sometimes be more profitable, because it guarantees stability: if the parent who pays them earns less than usual in some month, the child will not suffer. This ensures that the child will maintain a normal standard of living in any case.

We told the story of a pilot who wanted to reduce child support for his eldest son. It was about the share of alimony, but it was not possible to reduce them: the mother and her lawyer argued that this would change the child's habitual lifestyle.

It is also more convenient to calculate alimony in a fixed amount of money. For example, when a child stays with each of the parents, but one of the parents is better off.

There is only one minus: if the parent who pays alimony starts earning more, and the other parent does not find out about this and does not demand in court to increase the amount of alimony, then the child will receive less than he could. However, a loving parent, if he has more opportunities, will offer to pay for the child, for example, additional classes or a trip abroad.

However, a loving parent, if he has more opportunities, will offer to pay for the child, for example, additional classes or a trip abroad.

/dolgi-roditelya/

What the other parent of the child owes you

Grounds for setting alimony in a fixed amount of money

Fixed child support the court appoints to ensure a stable quality of life for a child. As I wrote above, this is relevant when a parent has an irregular, changing income, or he receives it in kind or in foreign currency, or he does not have it at all. For example, such alimony is often collected from entrepreneurs.

para. 6 paragraph 3 of section 3 of the review of judicial practice in cases of recovery of child support PDF, 409 KB

Alimony payments to a child with a disability after 18 years are provided if he is unable to work. The Plenum of the Armed Forces of the Russian Federation considers disabled children with any group of disabilities. If children simply cannot find work without education or are busy studying, then they are not considered disabled.

If children simply cannot find work without education or are busy studying, then they are not considered disabled.

item 7, para. 2 p. 38 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 451 KB

Mother and father have equal obligations to support a child with a disability. If the parents and the disabled child do not agree among themselves on the amount of alimony, they will be determined by the court, taking into account the financial and marital status of the child, each of the parents and other noteworthy circumstances. At the same time, the court always appoints alimony for adult disabled children in a fixed amount of money.

st. 85 SK RF

If an adult with a disability is not recognized as incompetent, then he independently applies to the court. If recognized, the guardian applies to the court.

The court takes into account how much the applicant with a disability needs to meet his needs and deducts the state pension from this amount. The court also finds out what other relatives can support him: for example, whether he has a spouse.

The court also finds out what other relatives can support him: for example, whether he has a spouse.

/divorce-deti/

"The child must not be separated from the mother": 10 questions to the lawyer about the rights of parents in a divorce benefit of other relatives, loans, penalties under executive documents. All of these factors will affect the amount that the court will charge. Maybe the court will generally decide that the pension from the state is enough.

For the maintenance of a spouse , alimony is always assigned in a fixed amount of money.

Art. 90 SK RF

The following can claim maintenance for themselves:

- wife during pregnancy and up to the third anniversary of a common child;

- the father of a child under three years of age, if he sits with him, and the mother has withdrawn from education;

- a needy spouse who cares for a common child with a disability up to 18 years of age or a child with a disability from childhood of the first group, regardless of age;

- disabled needy ex-spouse.

paragraph 44 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of December 26, 2017 No. 56PDF, 351 KB

According to the Resolution of the Plenum of the Supreme Court of the Russian Federation of December 26, 2017 No. 56, spouses and former spouses are considered disabled if they have any disability group. Or if they have reached retirement or pre-retirement age - 55 years for women and 60 years for men.

So what? 03/22/19

Alimony for pre-pensioners: who will pay and how to get

A disabled spouse is entitled to apply for maintenance after a divorce if he/she:

- received a disability before the divorce or within a year after it;

- reached retirement age within 5 years of divorce if the marriage was long-term. How long - the family code does not say. So, in each case, it will be up to the court to decide.

At the same time, according to the Supreme Court of the Russian Federation, the former spouse will be entitled to alimony not only if he registered a disability during the marriage, but also if he received a disability earlier. This means that marriage to a person with a disability or a pensioner is a potential risk that in the event of a divorce, you will have to pay alimony. Although if the marriage was short, then the court may refuse to collect alimony.

This means that marriage to a person with a disability or a pensioner is a potential risk that in the event of a divorce, you will have to pay alimony. Although if the marriage was short, then the court may refuse to collect alimony.

paragraph 45 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 351 KB

Payment of alimony to parents from children is possible if the parents:

- are not deprived of parental rights.

- Fulfilled their parental duties, including financial support for their children.

- They need extra money, which they have nowhere else to get, and children can help them financially.

st. 87 SK RF

If the children can prove that the parents once evaded parental responsibilities, the court may refuse to collect child support from the children. But he may not refuse - in such disputes, the question of the amount is more important. For example, if the father demands 20,000 R per month, and the son asks to dismiss the claim because the father disappeared immediately after his birth, then the court may not refuse the claim completely, but collect only 500 or 1000 R per month.

For example, if the father demands 20,000 R per month, and the son asks to dismiss the claim because the father disappeared immediately after his birth, then the court may not refuse the claim completely, but collect only 500 or 1000 R per month.

What to do? 12.04.19

Can biological parents get maintenance from their children?

The court also takes into account the material needs and capabilities of the parent: whether he receives a state pension and other payments, whether he needs housing and expensive treatment or care, whether he has a spouse and other children who are obliged to help, how much money he needs and how much he already receives from other sources.

In the same way, the court takes into account the financial and family situation of children: how much money an adult child has after paying off loans, enforcement orders, paying alimony, is this amount enough for all members of his family.

/list/platite-detishki/

What to do if the children do not help: 5 court cases of child support

but divide the amount needed by the parent, taking into account all the children.

For example, Nikolai Stepanovich has four children, and he only demands money from Masha's daughter. If he lacks 5,000 R per month for treatment, then the court has the right to recover only 1,250 R per month from Masha. At the same time, he does not have the obligation to divide the amount of alimony for all children.

How to calculate maintenance in a fixed amount

The relative who applies for maintenance must justify its amount, and the court must assess whether the plaintiff really needs such an amount and whether the defendant can pay that much. That is, the court always starts from the requested amount - it does not come up with it itself. If the plaintiff does not indicate the amount of alimony in his claims, the claim will not even be considered.

The main task in calculating child support in a fixed amount of money is to maintain the child's previous standard of living to the maximum. Here are the circumstances the court draws attention to:

- How the child was provided for while the parents were married or while the other parent paid child support voluntarily.

- Does the child go to a music or art school, in sports and dance sections, in other additional development institutions - and how much does it all cost.

- How much does a parent living separately earn and what kind of property does he have, through which he can provide for children: real estate, vehicles, bank deposits.

- Whether the second parent provides for other relatives.

Review of judicial practice in cases of recovery of child support PDF, 409 KB

At the same time, child support can be collected simultaneously in shares and in a fixed amount if the parent’s salary is small and he has additional sources of income.

For example, Ivan's salary is 40,000 R, but he earns another 60,000 R as a freelancer. His only child, Pasha, has asthma and needs money for treatment. The court may assign alimony in the amount of 25% of the salary and another 10,000 R on top - for treatment-related expenses.

In this way, two principles are observed: a son will always have money for treatment, regardless of his father’s income, but, like children from a complete family, he can receive a different amount for education, food and clothing, depending on whether his father will work.

Alimony for adults is collected only as assistance, and not as full maintenance. Therefore, when the court calculates their amount, it takes into account whether the alimony recipient has housing and other property. As well as money from other sources - scholarships, pensions, benefits. The court also takes into account whether the alimony payer has other relatives whom he supports, obligations under loans and court decisions.

/prava/soderzhite-detei/

Support rights

An adult applying for support will have to prove the amount of necessary expenses not covered by the state. That is, that he really needs additional treatment, nutrition and care. At the same time, the court may not recover the entire requested amount - it depends on the capabilities of the alimony payer.

For example, a parent is seriously ill. He needs 60,000 R per month for a nurse and medicines, while his pension is only 20,000 R. All expenses are supported by medical documents. But if a child earns only 30,000 R and keeps his children and wife on maternity leave, then he will definitely not be charged the entire amount the parent needs.

But if a child earns only 30,000 R and keeps his children and wife on maternity leave, then he will definitely not be charged the entire amount the parent needs.

How to draw up an agreement on alimony in a fixed amount of money

Any relative can enter into an agreement on the payment of alimony in a fixed amount. But if it is about alimony for children, then in their interests it is signed by a parent, guardian or other legal representative. In the same way, if an incompetent person receives alimony, then the guardian signs the agreement instead.

Any agreement on the payment of alimony is concluded in writing and certified by a notary - no matter how the parties agreed to pay them: in shares or a fixed sum of money.

Art. 100 SK RF

As a rule, an agreement is concluded if there is no dispute between relatives about the amount of alimony. This is faster than going to court, but more expensive: you will have to pay a state fee and pay for notary services. State duty for certifying an agreement on the payment of alimony - 250 R.

State duty for certifying an agreement on the payment of alimony - 250 R.

paragraphs. 9 p. 1 art. 333.24 NK RF

All documents that are subject to certification are drawn up in the notary's office for a fee - this is called legal and technical services. Most likely, it will not work to come with a ready document and not pay for the services of a notary - we wrote about this in another article.

The cost of legal and technical services varies by region. For example, in 2022 in Moscow, the service for drawing up an agreement on the payment of alimony costs 8000 RUR, and in the Orenburg region - 6400 RUR. This means that if a relative stops paying under an agreement, then it is enough to take the agreement to the bailiffs so that they begin to collect money forcibly.

A notarial agreement can be challenged in court if it violates someone's rights.

/prava/poluchite-alimenty/

Rights when receiving alimony

For example, parents from the Nizhny Novgorod region entered into an agreement that a father would pay alimony for two sons. Later, the sons moved in with their dad: one turned 18, and the place of residence of the second with dad was officially determined by the court.

Later, the sons moved in with their dad: one turned 18, and the place of residence of the second with dad was officially determined by the court.

The mother went with an agreement to the bailiffs to collect money in her favor, as if her sons were still living with her. The father asked the court to invalidate the agreement, and the court agreed with him.

How to collect alimony in a fixed amount of money through the court

Until October 1, 2019, justices of the peace dealt with disputes about the recovery of alimony. Now they only issue court orders for the recovery of child support for minor children as a share of income. Therefore, for a decision on the recovery of alimony in a fixed amount of money, you must apply to the district or city court at the place of residence of the plaintiff or defendant. Which court to go to is chosen by the one who applies for alimony.

Art. 23, Art. 29 Code of Civil Procedure of the Russian Federation

Contents of the statement of claim. In the lawsuit, you need to explain how much and why you want to receive from your relative and how you can prove that the relative can pay such an amount, that is, justify your position in detail. But, judging by practice, this can not be done if we are talking about alimony for a minor child in the amount of the subsistence minimum.

In the lawsuit, you need to explain how much and why you want to receive from your relative and how you can prove that the relative can pay such an amount, that is, justify your position in detail. But, judging by practice, this can not be done if we are talking about alimony for a minor child in the amount of the subsistence minimum.

Art. 131 Code of Civil Procedure of the Russian Federation

Sample claim for the recovery of alimony

When applying to the court, you need to provide detailed information about who you are making demands on so that money is not debited by mistake from the debtor's namesake. In addition to the defendant's address, it is worth indicating:

- his date and place of birth;

- place of work;

- details of any document - passport, TIN, SNILS, driver's license, vehicle registration certificate.

If you don’t know any of this, don’t worry: the court will independently request information about the relative.

Documents. A document is attached to the copy of the statement of claim for the court, which confirms the sending of a copy of the claim to the defendant. Usually this is a notice of delivery of a registered letter signed by the defendant. Or the defendant can sign a copy of the claim. The court is obliged to send the defendant only subpoenas and judicial acts.

Art. 132 Code of Civil Procedure of the Russian Federation

It is also necessary to confirm the family relationship between the one who wants to receive alimony and the one from whom they are being collected, because alimony is an obligation of a family legal nature. Suitable for this:

- child's birth certificate, if maintenance is collected from a parent or, conversely, from an adult child for the maintenance of a needy parent;

- marriage certificate, if maintenance is collected from the spouse;

- certificate of divorce, if alimony is collected from the former spouse.

The requested amount of alimony can be confirmed:

- checks for the purchase of clothes, shoes, food and other essential expenses;

- receipts or checks for payment for kindergarten, private school, sections;

- receipts or checks for payment of medicines and medical procedures prescribed by a doctor.

/alimony-stat/

Alimony through the eyes of statistics

An adult disabled person can confirm the need for alimony:

- with a certificate from the PFR stating that he does not have enough pension points for labor pension and / or age for social pension;

- certificate of disability due to a serious illness that requires outside care and expensive medicines that the state does not provide;

- a certificate from the employment center stating that a person cannot be registered as unemployed.

Documents on expenses can be anything. But if a pensioner or a person with a disability already receives a pension from the state in the amount of more than the regional subsistence minimum for pensioners, then in order to assign alimony, the costs must be special. For example, paying for a nurse or rented housing if you don’t have your own, and you can’t live with relatives.

But if a pensioner or a person with a disability already receives a pension from the state in the amount of more than the regional subsistence minimum for pensioners, then in order to assign alimony, the costs must be special. For example, paying for a nurse or rented housing if you don’t have your own, and you can’t live with relatives.

Documents on the property of the defendant can also be attached to the claim, if the plaintiff has them. If not, the plaintiff may file a motion for the court to request documents from the defendant, his employer, Rosreestr or the traffic police.

Art. 57 Code of Civil Procedure of the Russian Federation

If it turns out that the defendant has several apartments and cars, then it can be assumed that he has a stable financial situation and he can pay alimony. The defendant's high position can be confirmed, for example, by a printout from the company's website, where the management team is indicated. And if the defendant is the head or participant of the LLC, then with information from the Unified State Register of Legal Entities from the website of the Federal Tax Service.

If you need to receive alimony for the period before going to court, you will have to prove that you have already tried to receive alimony out of court before.

Art. 107 SK RF

section 6 of the review of judicial practice in cases of recovery of child support PDF, 125 KB

Evidence can be registered letters with notifications, e-mails, canceled court orders for the recovery of child support, documents from law enforcement agencies on the search for the defendant. And the defendant himself can recognize the claim for the recovery of alimony for past periods.

The amount of state duty for filing a claim for the recovery of alimony is 0 R, that is, the plaintiff does not need to pay it. But if the court satisfies the demand for the recovery of alimony, then the state duty will be recovered from the defendant. Then its size is 150 R.

paras. 14 p. 1 art. 333.19

par. 2 p. 1 art. 333.36 Tax Code of the Russian Federation

Art. 154 Code of Civil Procedure of the Russian Federation

154 Code of Civil Procedure of the Russian Federation

Deadlines for consideration of the application. The judge must consider the dispute on the recovery of alimony within a month from the date the claim was received by the court.

These are official dates. They can be influenced by various circumstances. For example, bodies or organizations from which the court has requested information and documents may not provide them on time.

Or if the defendant is already paying alimony to someone, then these people will be involved in the lawsuit as third parties who do not make independent claims. So they are informed that the defendant, after the trial, will be obliged to pay alimony to someone else.

Art. 43 Code of Civil Procedure of the Russian Federation

It is not necessary for third parties to come to court, but if they decide to attend, this may delay the consideration of the case. For example, if the court asks them for some documents

Grounds for refusal of alimony in a fixed amount of money

If the child is already an adult and capable , the court will refuse to collect alimony from the parent.

For example, in 2018 in the Krasnodar Territory, a guardian grandmother demanded that her granddaughter's father reimburse the expenses of his daughter's paid higher education. The courts of first instance and appeals decided that the father deprived of parental rights and the guardian-grandmother, who replaces the mother, bear equal obligations to support the daughter. Therefore, 50% of the tuition fee was collected from the father for the first semester paid by the grandmother, and for the next 5 years of study.

The father complained to the Supreme Court of the Russian Federation, and he canceled the judicial acts for two reasons:

- By the time the lawsuit was filed, the daughter was already 18 years old, that is, the grandmother’s right to act in the interests of her granddaughter as a guardian ceased.

- The Family Code does not require parents to pay for adult children's education, and the court can only force parents to help adult children in exceptional circumstances, such as if they are seriously ill.

Community 09.12.20

Is it possible to renounce paternity in order not to pay alimony?

Once I tried to collect alimony from my father in favor of the adult Elvira, who was a full-time student at a college on a commercial basis. We did not make the first mistake of the grandmother from the story above and filed a lawsuit from the daughter to the father. But the outcome of the case was the same: we went to the Supreme Court and received a decision to dismiss the claim due to the fact that the father is not obliged to help an adult daughter without a disability.

Until 2017, in such disputes, judges sometimes used the term from the law "On Labor Pensions in the Russian Federation" that full-time students under the age of 23 are considered disabled, and collected alimony in their favor. Some of these decisions were even enforced, perhaps because of the unwillingness of parents to appeal against them and sue their own children.

For example, in Krasnodar in 2014, a father asked to be released from paying alimony in favor of his adult son, who is studying at the university. The father pointed out that his son did not have a disability and had a scholarship. But the justice of the peace, and then the district court, which considered the appeal, decided that the father should pay his son 1 minimum wage monthly until the age of 23 or until graduation. The judges considered that the father works and can find additional income, so he must help his son.

But in 2017, the Supreme Court explicitly clarified that full-time, able-bodied adult children are not entitled to child support from their parents.

paragraph 38 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 351 KB

If the amount of alimony is established by the current agreement , the court will not recover them. If the agreement is not fulfilled, first you need to send a claim to the one who promised to pay alimony. If you do not set a deadline for responding to a claim and it is not set by the agreement, you need to wait 30 days for a response.

If you do not set a deadline for responding to a claim and it is not set by the agreement, you need to wait 30 days for a response.

Art. 101 SK RF

Art. 452 of the Civil Code of the Russian Federation

If this does not help, you can go to court at the same time for termination of the agreement and recovery of alimony. You can also ask that the agreement be declared invalid. For example, if it infringes on the rights of children and according to it, alimony is less than according to the law.

If the marriage was short, the other spouse behaved unworthily or received a disability due to his own fault - due to alcohol or chemical addiction or the commission of an intentional crime, the court will not collect alimony in favor of the spouse or former spouse. At the same time, even if the marriage was short, but the wife received a disability due to a difficult birth, this does not deprive her of the right to alimony.

Art. 92 SK RF

paragraph 10 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 351 KB

56PDF, 351 KB

refuses alimony in a fixed sum of money. In this case, alimony will be collected in a share, and not in a fixed amount.

paragraph 3 of section 3 of the review of judicial practice in cases of recovery of child supportPDF, 351 KB

Changing the amount of alimony

You can change the amount of alimony established by the court if the financial or marital status of the person who receives or pays alimony has changed. At the same time, the situation for the alimony payer should not only change, but also not allow paying alimony in the same amount. For example, if he received a disability or lost his job.

Art. 119 SK RF

If an adult capable recipient of alimony has committed a crime against the alimony payer, then the court has the right to refuse to collect alimony. The court has the same right if the alimony recipient abuses alcohol or drugs, psychotropic substances or gambling.

If the alimony payer wants to change their amount, he must apply to the court at the place of residence of the alimony recipient - in this case, he has no right to choose the court.

He must also pay a state duty from the amount that he saves in a year if the court satisfies his requirements. At the same time, even if you need to pay alimony for another 10 years, they consider the amount for only one year. But if you only need to pay child support for six months, then they calculate the amount for 6 months - for the remaining time.

p. 6, 7 Art. 91 Code of Civil Procedure of the Russian Federation

paragraphs. 1 p. 1 art. 333.19 of the Tax Code of the Russian Federation

Let's imagine that by a previous court decision, alimony of 20,000 R per month was collected from the parent, and he wants to pay only 15,000 R. It turns out that the parent wants to sue the right not to pay 60,000 R per year: (20,000 R −15 000 R) × 12 months.

The state duty will be 2000 R: (60,000 R - 20,000 R) × 3% + 800 R.

Or another option. Alimony was collected from an adult child in favor of the parent - 10,000 R per month, but he does not want to pay at all. For the calculation of the state duty, it does not matter whether the child has reasons to refuse obligations.

For the calculation of the state duty, it does not matter whether the child has reasons to refuse obligations.

He has to pay 120,000 R per year: 10,000 R x 12 months. And the state duty in this case will be 3600 R: (120,000 R - 100,000 R) × 2% + 3200 R.

The grounds for increasing the amount of alimony is a change in the financial situation of the payer and recipient of alimony.

A parent with whom children are left can ask for an increase in the amount of support if the payer no longer has the obligation to support other children. For example, because they have become adults. Also, one parent can ask for an increase in alimony if the other has begun to earn more, and the common grown-up children have more material needs.

For example, a mother from the Oryol region asked to increase the amount of alimony for her son from half to one and a half living wages for children. She referred to the fact that the eldest son of her child's father had become of age and that he was no longer being charged alimony.

The court found the argument justified, but increased the amount of alimony to one living wage established in the region, with subsequent indexation.

In addition to income share support, the parent with whom the children live may ask the other parent to contribute to other expenses for the children. For example, if a child is seriously ill or seriously injured and now needs expensive medical care, the parent can be asked to cover some of the unexpected expenses. Or if the mother went on maternity leave with the second child of the same father and now cannot pay for rented housing, the court has the right to award the cost of renting housing in favor of the mother.

Art. 86 SK RF

An elderly relative has the right to ask the court to increase alimony if his health has deteriorated sharply.

Grounds for reducing the amount of alimony

For example, a maintenance payer has the right to ask the court to reduce their amount if he or a member of his family whom he is obliged to support has received a disability. Or if the alimony recipient started working or became an entrepreneur. These facts themselves are not an unconditional reason to reduce alimony, but if disability prevents you from maintaining your previous job and entails high treatment costs, and the alimony recipient's income is constant and substantial, then the court may reduce alimony.

Or if the alimony recipient started working or became an entrepreneur. These facts themselves are not an unconditional reason to reduce alimony, but if disability prevents you from maintaining your previous job and entails high treatment costs, and the alimony recipient's income is constant and substantial, then the court may reduce alimony.

The only reason I had to reduce child support through the courts was the birth of new children with my father. Usually reduce the share of income that is alimony. But if alimony is initially fixed, then new children worsen the financial situation of the father and his ability to help older children.

/alimony-debt/

How to find out child support arrears

At the same time, the Supreme Court, in section 8 of the review of judicial practice, indicates that due to the appearance of new children, child support is not always reduced. For example, if the younger child lives with both parents, the father began to earn more, and the mother of the older child still earns significantly less, then the amount of alimony can be kept.

Also the court will refuse to reduce the amount of child support if it is already less than the subsistence minimum for children in this region , even if the parent brings a certificate of a tiny salary. Courts usually justify such a refusal by the fact that the parent has no evidence that he cannot earn more due to disability or illness.

In a review of court practice on the recovery of child support, the Supreme Court noted that if the child support payer asks to reduce their amount, referring to obligations to other relatives, then it matters whether they have other sources of income. That is, for a fictitious reason, it is difficult to reduce alimony.

section 8 of the review of judicial practice in cases of recovery of alimony for childrenPDF, 409 KB

Registration of a change in the amount of alimony. If the alimony was collected by the court, their amount can also be changed only by the court in a new decision. Based on this new decision, the needy relative receives a writ of execution.

If the relatives agreed on the initial amount of alimony in an agreement with a notary, then the new amount of alimony can also be agreed there. Either terminate the notarial agreement through the court or declare it invalid, so that the court will establish the new amount of alimony.

I find it cheaper to determine and change child support through the courts than by agreement. When applying to the court for alimony, you do not need to pay a state duty - it will be paid by the defendant, and it is much less than the cost of notary services.

How to change the form of alimony

You can change the form of alimony only when collecting them from parents to minor children. The basis for changing the form of alimony is a change in the circumstances due to which such a form was chosen.

From interest to hard cash. If alimony was collected by court order in shares of earnings, and it is not official, then in the interests of the children, a claim must be filed for the recovery of a fixed amount. The lawsuit will protect the rights of children if the parent provides documents with a greatly underestimated amount of income.

The lawsuit will protect the rights of children if the parent provides documents with a greatly underestimated amount of income.

The procedure for substantiating claims is the same as in the case if alimony has not been collected before: you need to prove the needs of the child and the capabilities of the parents.

/less-alimony/

How to collect alimony through the court

With a fixed amount of money in interest. The court orders fixed child support if there is a reason for this, such as an unstable level of parental income. Therefore, you can change the form of alimony if the reason disappears. That is, if the alimony payer finds a permanent job and passes the probationary period, he or the alimony recipient will be able to ask for the replacement of a fixed amount of money with alimony in shares of the salary.

How alimony is indexed in a fixed amount of money

If the parties to the maintenance obligation have entered into an agreement on the payment of alimony, they themselves can agree in it how the amount of payments will change over time and what it will depend on.

Art. 105, Art. 117 SK RF

If the alimony in a fixed amount of money is collected by the court, then the judge sets their amount as a multiple of the regional subsistence level for the category of the population to which the alimony recipient belongs.

Therefore, when the cost of living rises, the bailiff or the employer transferring alimony will also have to index the amount of alimony. Additionally, you do not need to go to court for indexing.

When the payment of alimony in a fixed amount of money stops

The payer no longer has to pay alimony from the moment when:

- the child becomes an adult or emancipated;

- former spouse who receives maintenance remarried;

- child support recipient died;

- minor child was adopted or adopted;

- the adult maintenance recipient has ceased to need support or has regained his ability to work, and this has been recognized by the court.

st. 120 SK RF

120 SK RF

If a child began to live with a parent whom the court ordered to pay alimony, then it is impossible to stop paying just like that. Although this would be logical, it is fraught with the formation of debt. You need to apply to the court with a claim for exemption from the payment of alimony and debt on them.

clause 36 of Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 351 KB

responsibility.

Art. 5.35.1 Administrative Code of the Russian Federation

Art. 157 of the Criminal Code of the Russian Federation

What is the result

- Alimony in a fixed amount of money is collected in favor of adult relatives. And if the parents do not have a permanent income, then in favor of minor children.

- In order to receive support, you must prove that the recipient's important expenses exceed his/her income. If these are alimony for minor children, then it is necessary to prove the amount of expenses only if they exceed the subsistence level and the share of the parents' income set by law.