How much income tax do you get back per child

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. Sabrina earned a master's degree in publishing at Portland State University.

Learn More

and

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Her work has appeared in a variety of local and national media outlets. Email: <a href="mailto:[email protected]">[email protected]</a>.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:aoshea[email protected]">[email protected]</a>.

She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:aoshea[email protected]">[email protected]</a>.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.g., a grandchild, niece or nephew).

Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

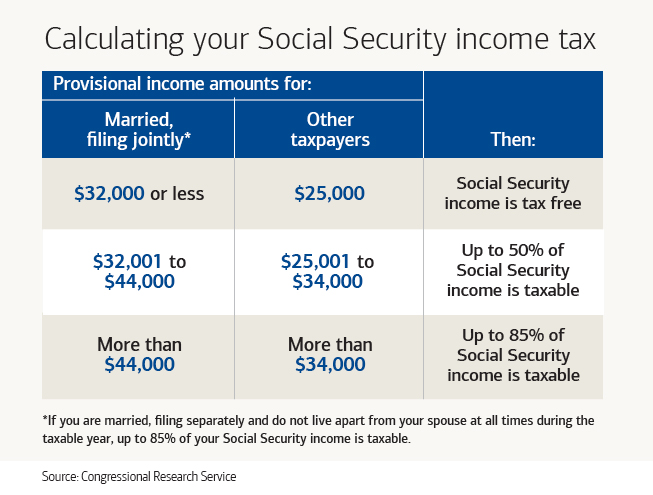

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

How to calculate the child tax credit

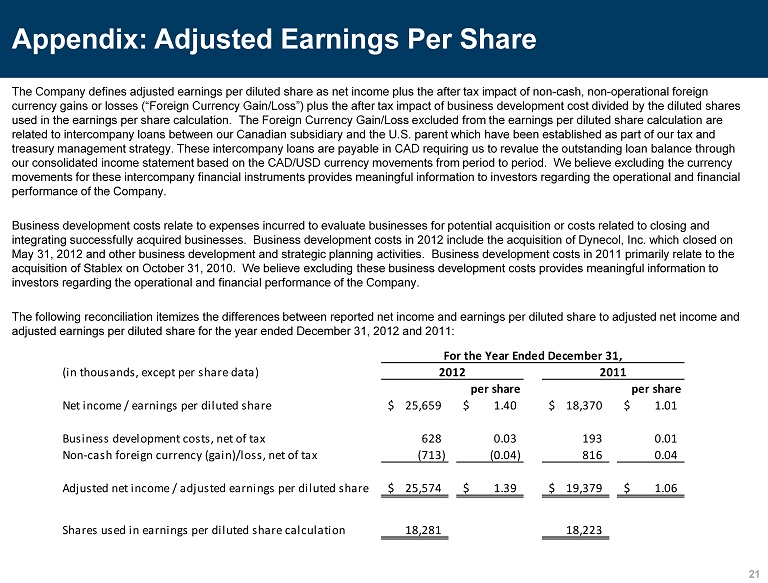

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

How to claim the credit

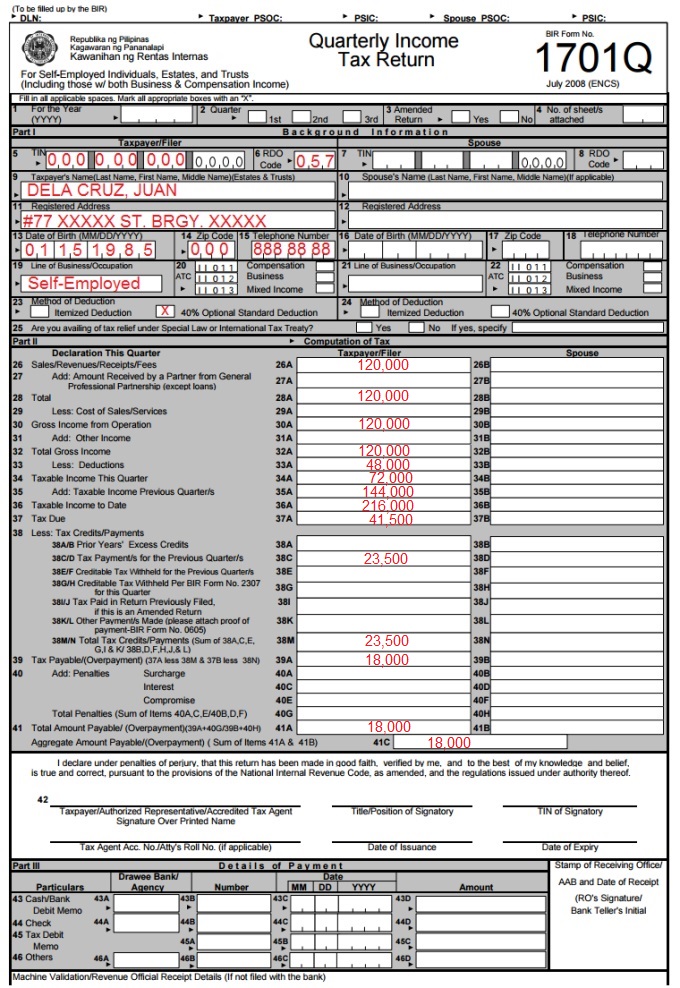

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

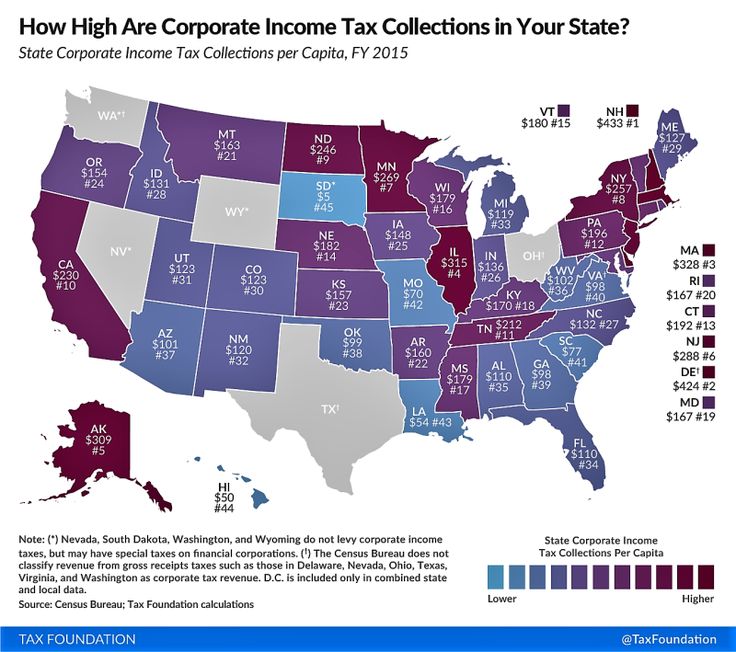

State child tax credits

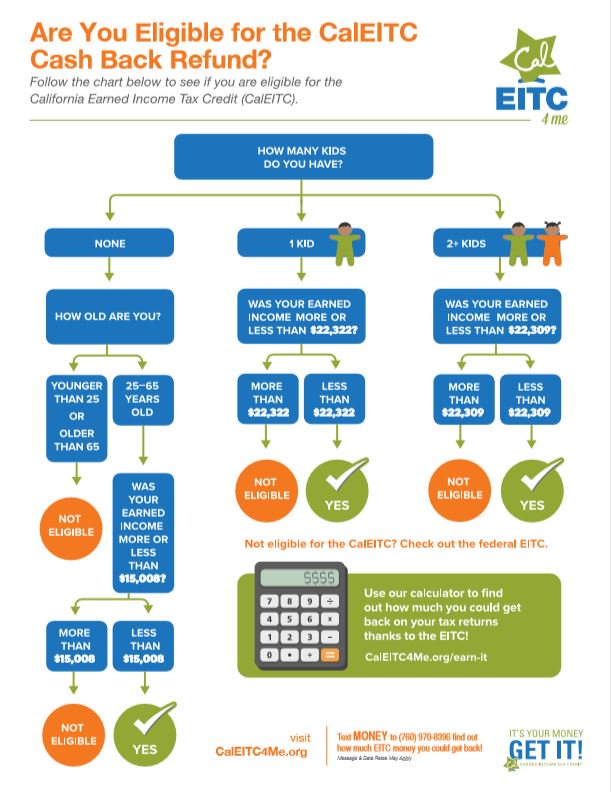

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll likely need to make sure your child has a Social Security number before you apply, though.

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

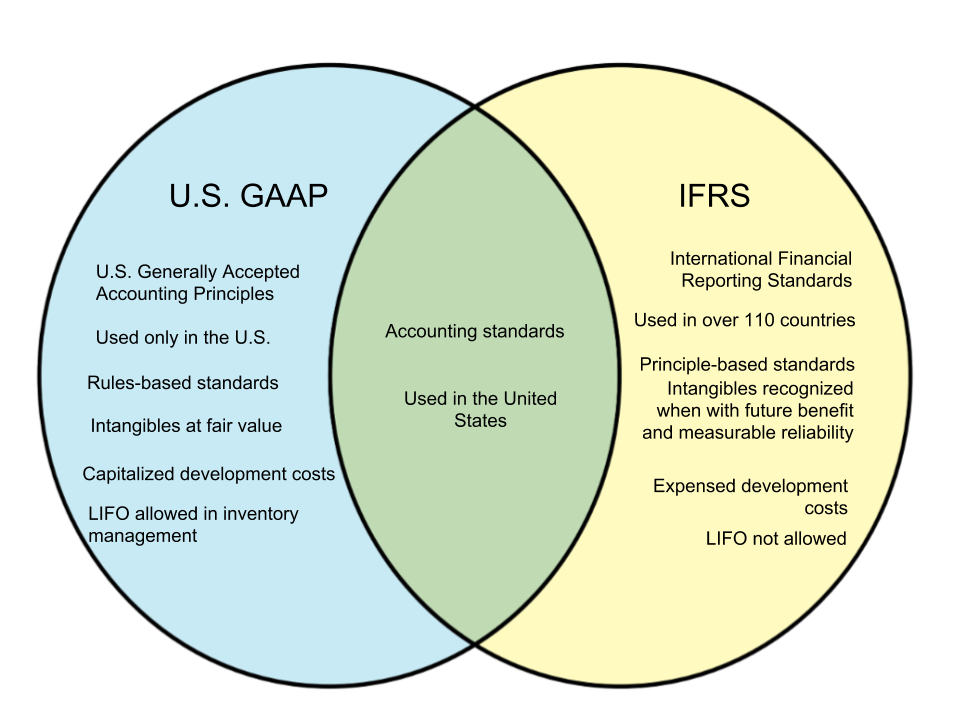

Tax Credits vs. Tax Deductions

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Tax deductions reduce your taxable income, but tax credits reduce your bill dollar for dollar.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

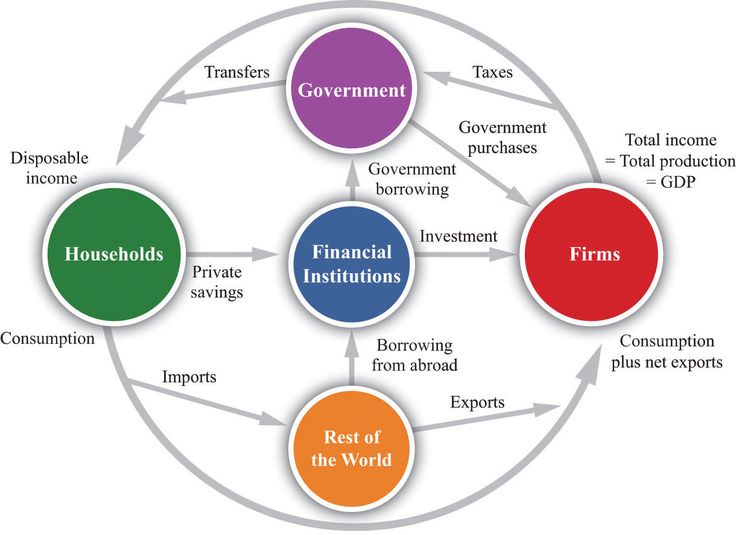

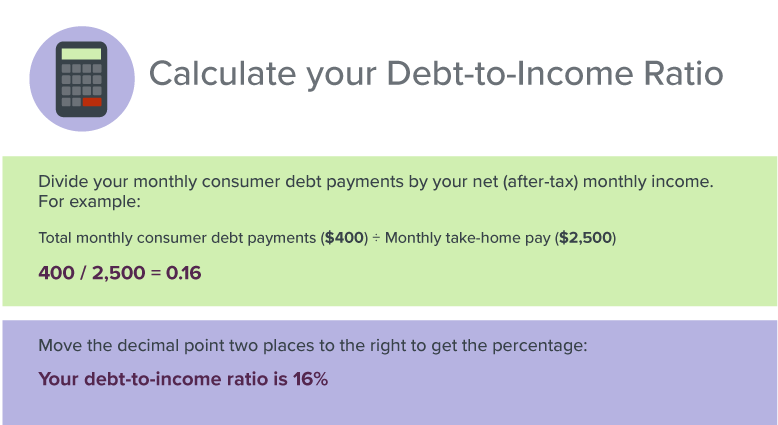

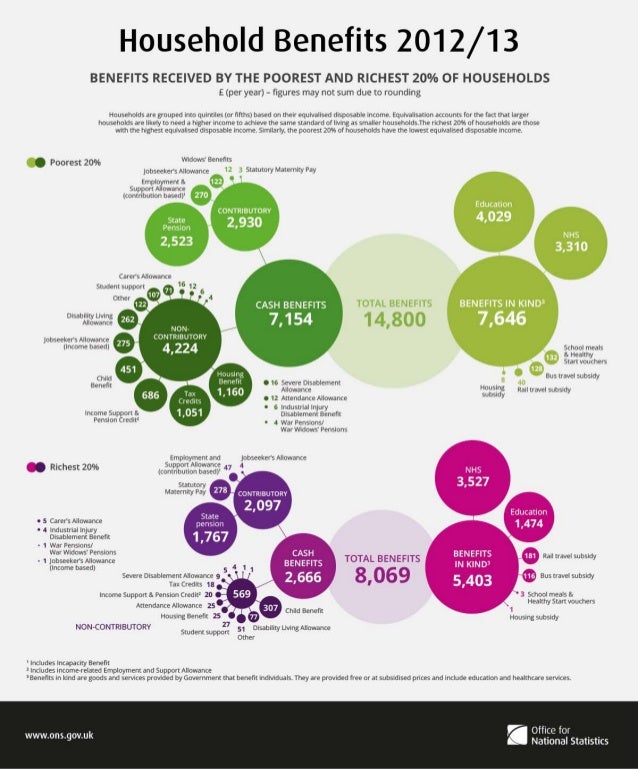

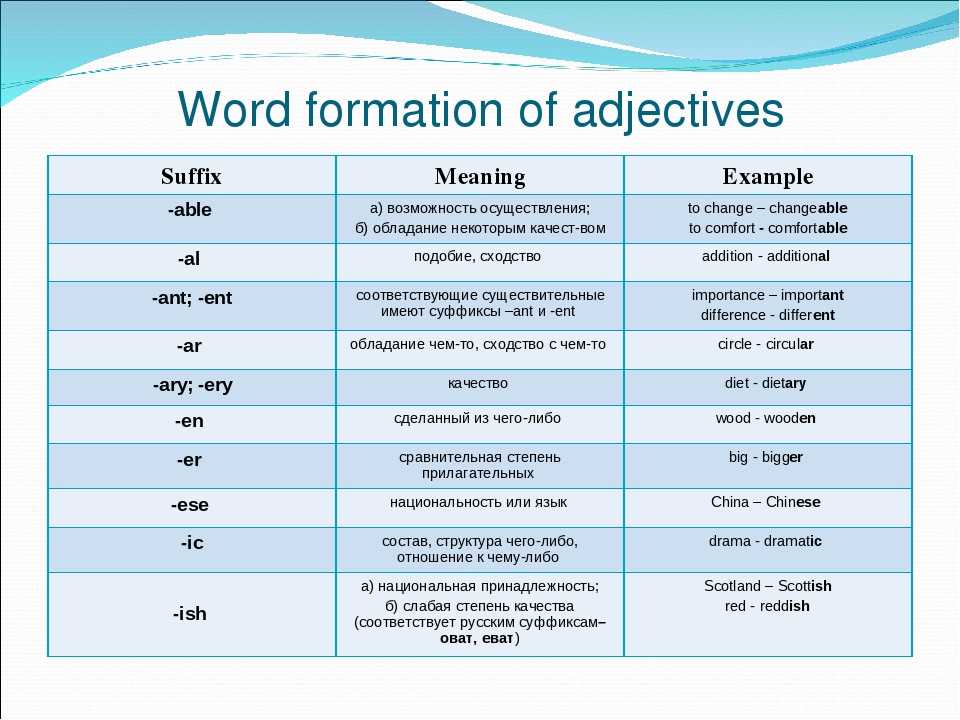

Tax credits and tax deductions may be the most satisfying part of preparing your tax return. Both reduce your tax bill, but in very different ways.

Tax credits directly reduce the amount of tax you owe, giving you a dollar-for-dollar reduction of your tax liability. A tax credit valued at $1,000, for instance, lowers your tax bill by the corresponding $1,000.

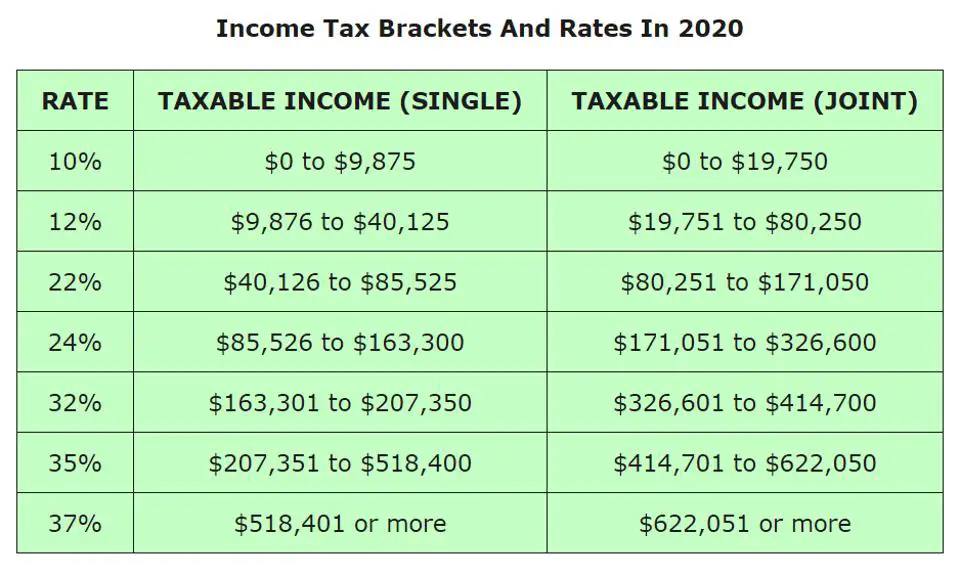

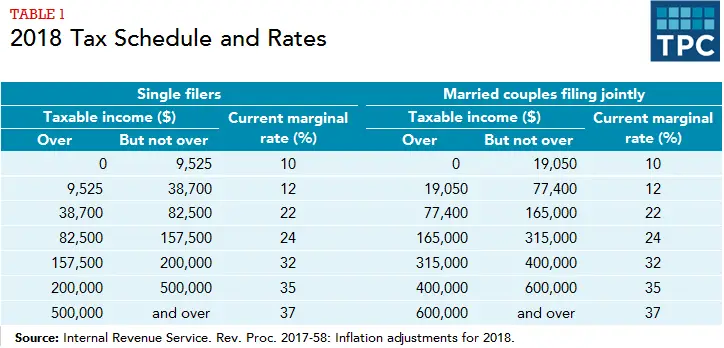

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

Would you rather have: | ||

A $10,000 tax deduction… | …or a $10,000 tax credit? | |

Your AGI | $100,000 | $100,000 |

Less: tax deduction | ($10,000) | |

Taxable income | $90,000 | $100,000 |

Tax rate* | ||

Calculated tax | $22,500 | $25,000 |

Less: tax credit | ($10,000) | |

Your tax bill | $22,500 | $15,000 |

The catch to tax credits

Some tax credits are nonrefundable.

That means that if you don’t owe a lot in taxes to begin with, you don’t get the full value if the credits take your tax bill below zero. In other words, a $600 tax bill combined with a $1,000 nonrefundable credit doesn’t get you a $400 tax refund check.

That means that if you don’t owe a lot in taxes to begin with, you don’t get the full value if the credits take your tax bill below zero. In other words, a $600 tax bill combined with a $1,000 nonrefundable credit doesn’t get you a $400 tax refund check.Some tax credits are refundable. If you qualify to take refundable tax credits — things such as the earned income tax credit or the child tax credit — the value of the credit goes beyond your tax liability and can result in a refund check.

The IRS lays out specific criteria you must meet to qualify for both nonrefundable and refundable credits.

A big decision about tax deductions

There are two types of tax-deduction strategies: taking the standard deduction or itemizing.

The standard deduction

The standard deduction is a one-size-fits-all reduction in the amount of your income that’s subject to tax.

You don’t have to do anything to qualify for the standard deduction or provide any documentation.

You don’t have to do anything to qualify for the standard deduction or provide any documentation.You can claim the standard deduction on Form 1040. The amount varies depending on your filing status.

Filing status | 2021 tax year | 2022 tax year |

|---|---|---|

Single | $12,550 | $12,950 |

Married, filing jointly | $25,100 | $25,900 |

Married, filing separately | $12,550 | $12,950 |

Head of household | $18,800 | $19,400 |

Itemizing

Itemizing allows you to take advantage of deductions such as home mortgage interest, medical expenses or charitable donations. If together your itemized deductions exceed the value of the standard deduction, you'll want to itemize so you pay less tax.

You'll need to use the regular Form 1040 and Schedule A.

You'll need to use the regular Form 1040 and Schedule A.Just as with tax credits, taking certain deductions requires meeting certain qualifications based on your filing status, current life events and the amount of your income that’s taxable. Be sure you meet IRS criteria to qualify for both tax credits and deductions.

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

|

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

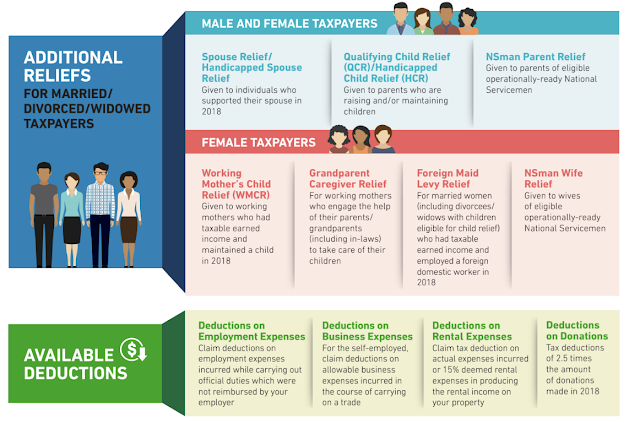

Tax deduction - Medline Clinic in Barnaul

Have you paid taxes? Take them back to the state!

A significant part of the Russian population pays taxes. However, this amount can be reduced. There is a tax deduction for this. What is it? When making such a deduction, the state reduces the amount from which taxes are paid. It is also called the return of a certain part of the previously paid personal income tax (personal income tax) when buying real estate, spending on treatment or training. It is important to note that you can get a tax deduction not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives

It is important to note that you can get a tax deduction not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives

What expenses can be included in the deduction for treatment

The following expenses can be included in the deduction:

- Medical services - tests, examinations, doctor's appointments, procedures in paid clinics. Provided that you paid for it, that is, the services are not under the CHI policy, but at your expense.

- Prescribed medicines. Starting in 2019, you can get a deduction for the cost of any drug, not just those on the government's list. nine0022 Expensive treatment. This is the only type of medical expenses for which there is no limit: any amount is accepted for deduction without restrictions. Types of expensive treatment are in a special list, this is followed by a medical organization when it issues a certificate of the cost of services.

- Contributions under the VHI agreement.

Relatives for which the deduction for treatment is given

The deduction for treatment can be received not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives, but not any, but only from a limited list. nine0004

Here is a complete list of relatives whose treatment can be included in your tax deduction:

- Parents. The deduction will be given only when paying for the treatment of their parents. If you pay for the spouse's parents or adoptive parents, the tax will not be refunded. There are no parental requirements. They can work under an employment contract, or they can be pensioners, unemployed or self-employed individual entrepreneurs.

- Children or wards under 18 years of age. The deduction for treatment is only for your children. If you pay for tests and examinations of your spouse's children, even when they are fully supported, personal income tax cannot be returned.

There is also an important condition regarding age: the child must be no more than 18 years old. Moreover, the fact of studying at a full-time university does not extend this age to 24 years: this is possible with education, but with treatment - only up to 18 years. nine0023

There is also an important condition regarding age: the child must be no more than 18 years old. Moreover, the fact of studying at a full-time university does not extend this age to 24 years: this is possible with education, but with treatment - only up to 18 years. nine0023 - Spouses. If a husband pays for his wife, he can get a deduction. And the wife will return the tax when paying for the treatment of her husband. But the marriage must be officially registered. A certificate of payment for medical services and checks for the purchase of drugs can be issued to any spouse: their expenses are still considered general.

You cannot get a deduction for other relatives. Unlike training, there are no siblings on this list. If you pay for dental treatment or surgery for your sister, you will not receive a deduction. For grandparents, common-law spouse, children of the wife from the first marriage, nephews or mother-in-law, the tax cannot be refunded. nine0004

The list of relatives is closed and there can be no additional conditions.

How to return money for treatment

How much money can be returned when paying for the treatment of relatives

Cost limit. The deduction for treatment has a limit - 120,000 R per year. This is a general limit for several social deductions, for example, it also includes tuition costs. 120,000 R is a restriction not for each type of expense, but for all.

Here are the expenses that will be included in the limit:

- Training.

- Treatment.

- DMS.

- Voluntary contributions to pensions.

- Voluntary life insurance.

- Additional contributions to the funded part of the pension.

- Independent qualification assessment.

When paying for the treatment of relatives, an additional deduction will not be given: both your own and their expenses must be included in this limit.

120,000 R does not include only the cost of educating children - there is a separate limit of 50,000 R for each child - and expensive types of treatment that are accepted for deduction without taking into account the limit. There is also a social deduction for charity, but it has separate conditions and the limit is calculated as a percentage.

There is also a social deduction for charity, but it has separate conditions and the limit is calculated as a percentage.

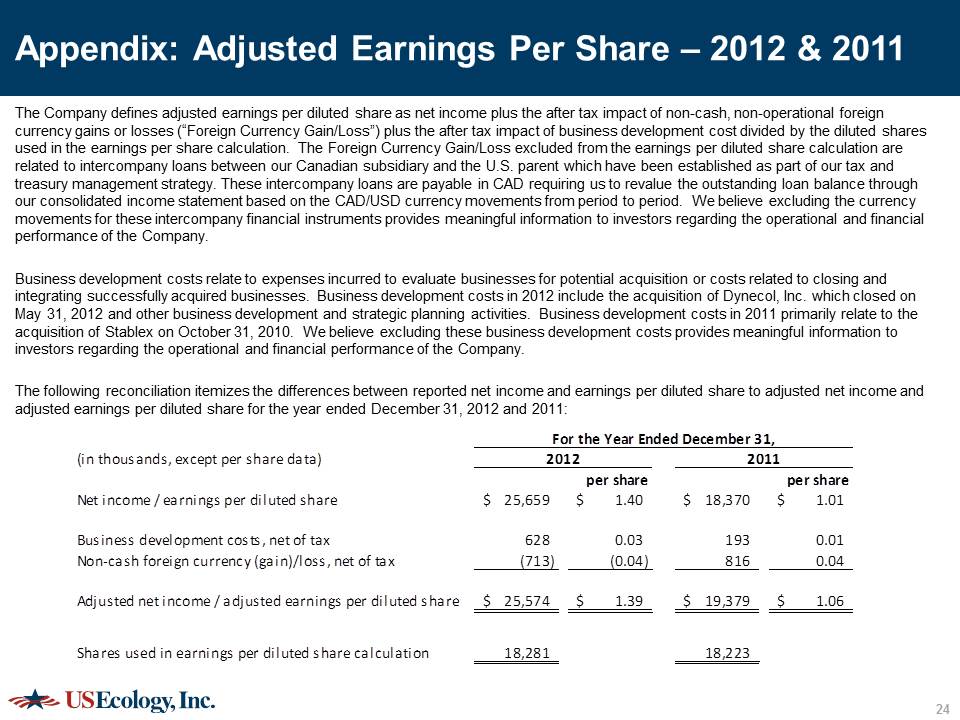

How much money will be returned

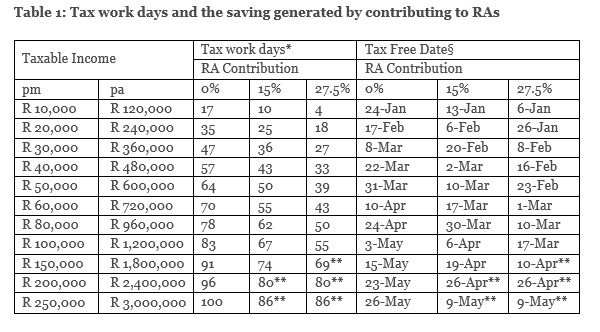

The amount of the deduction depends on your salary and the cost of treatment. In any case, the tax office will not return more money than the personal income tax paid for the year. Let's look at an example:

Vasily works as a manager and receives 40,000 R per month. In a year, he earned 480,000 R. He gives 13% of his salary to the state as a tax (personal income tax). For the year he paid 480,000 × 0.13 = 62,400 R.

In 2015, he spent 80,000 RUR on treatment. Vasily collected documents and applied for a tax deduction. After submitting the application, the tax authority will deduct the amount of treatment from Vasily’s income for the year and recalculate his personal income tax: (480,000 − 80,000) × 0.13 = 52,000 R.

It turns out that Vasily had to pay 52,000 R, but in fact he paid 62,400 R. The tax office will return the overpayment to him: 62,400 − 52,000 = 10,400 R.

The tax office will return the overpayment to him: 62,400 − 52,000 = 10,400 R.

The deduction can be made within three years following the year of treatment payment.

This money will go directly to the card, but you will have to wait.

How to draw up documents if you pay for relatives

- For your spouse. When paying for the treatment of a husband or wife, documents can be issued to anyone. The contract and receipts can be in the name of the husband or wife, it does not matter for the deduction. It is believed that they have everything in common. The same expenses can be deducted by either spouse, but only by one. They can also be divided among themselves, this helps to return more tax, taking into account the limit. nine0023

- For children and parents. Payment documents must be issued to the person who pays and wants to receive a deduction. If receipts and a certificate are issued to the mother, the son will not be given a deduction for these expenses.

Although you can try to resolve this issue with the help of a conventional written power of attorney. The contract for medical services should contain a wording from which it is clear that it is concluded with this person - the one who claims the deduction - for the treatment of this relative. But if this did not work out, this usually does not interfere with the return of the tax. The tax first of all looks at payment documents and a certificate. This is really important. nine0023

Although you can try to resolve this issue with the help of a conventional written power of attorney. The contract for medical services should contain a wording from which it is clear that it is concluded with this person - the one who claims the deduction - for the treatment of this relative. But if this did not work out, this usually does not interfere with the return of the tax. The tax first of all looks at payment documents and a certificate. This is really important. nine0023

How to return personal income tax from the costs of treatment for the past year

For the past year, you can return the tax only on the declaration. Through the employer return only in the current year.

Here is the instruction:

- Get medical bills. This is a special document, it must be issued by the organization to which you paid for the treatment. Now everything is stored electronically, so usually you don’t even need to show receipts. The help will indicate the code - "1" or "2".

If it is "1", then you need to take into account the limit, if "2" - the entire amount will be deducted. nine0023

If it is "1", then you need to take into account the limit, if "2" - the entire amount will be deducted. nine0023 - Make copies of documents that confirm your relationship: birth and marriage certificates.

- Fill out the 3-personal income tax declaration in your personal account on the nalog.ru website. It can be filled out in a special program or handed in on paper, but through the site - this is the easiest, fastest and most convenient way that will insure you against mistakes and speed up the verification. Scans or photographs of documents must be attached to the declaration.

To receive documents for a tax deduction, you can apply to the administrator-cashier at our Center or send a request electronically by filling out the form below. nine0017

Dear patients, when filling out the form, be sure to indicate:

- contact details

- period for which documents must be submitted

- list of required documents

Tax deduction application form

Sergey

Hello, I was treated at the clinic with my own problem, which was helped by a wonderful surgeon, coloproctologist Galyatin Denis Olegovich. Many thanks to the team of the clinic "Medline". All health! nine0004

Many thanks to the team of the clinic "Medline". All health! nine0004

Vladimir

I want to express my gratitude to Denis Olegovich Galyatin for a successful and easy operation and my quick recovery. A very good center and excellent specialists! Thank you all! I recommend 100% to everyone who has a problem in urology and proctology.

all clinic reviews

legalization, taxes, spending — Migration to vc.ru

Aleksey Gerasimovich prepared useful information and advice for dev.by. nine0004

9678 views

Aleksey Gerasimovich moved with his family to Cyprus in 2014 as Deputy Head of Global Development at Wargaming. Now he lives in the center of the island, he works as Chief Production Officer in the game company Eschatology Entertainment. For 8+ years in Cyprus, Alexey has accumulated a decent expertise on the island and shares it on the blog “Notes of a Hamster Gluck” (actually, it is mainly about books and music, but there is also a lot of useful information about life in Cyprus).

Alexey also wrote a guide for relocation to Cyprus. Edition dev.by published a slightly shortened version with the permission of the author. nine0004

How to come to Cyprus for citizens of Belarus

Now you can enter Cyprus on any flight, if you have:

- Double or multiple Schengen visa (single entry is not suitable)

- Double or multiple entry visa for Croatia, Romania or Bulgaria

- Residence permit/permanent residence EU

- Recipient of Cyprus with a stamp (document from the migration department stating that you have applied for a residence permit or other legal status: the very fact of applying is already a sufficient basis for staying on the island)

- National visa of Cyprus.

More information about all types of entry can be found on the website of the Embassy of Cyprus in Minsk.

Since Cyprus is an island, the easiest way to get to it is by plane (another option is by water: this year the ferry service with Greece resumed).

The main hubs that usually fly to Cyprus are London, Athens, Dubai, Cairo, Tel Aviv, Yerevan, Beirut, Frankfurt, Paris, etc.

nine0003 Important! Do not attempt to enter the Republic of Cyprus through Ercan Airport (Erkan) in Northern Cyprus. The Government of the Republic of Cyprus considers this a gross violation of the law. That is, if you decide to fly to Istanbul, and from there to Ercan Airport, in order to then move to the territory of the Republic of Cyprus, you will have big problems: not only will you not be allowed to enter the checkpoint in the buffer zone, but you can get a ban on visiting the Republic of Cyprus and in the future.

nine0003 Restrictions due to COVID-19

As of June 1, 2022, Cyprus has lifted all entry restrictions due to Covid-19. Like mask mode. On the island itself, masks and a vaccination certificate (or test) may be required in certain institutions (for example, in hospitals).

Details about the old rules and their cancellation - on the official website.

Legal ways to reside in Cyprus

In this section, I do not undertake to describe all the possibilities, but only those that are available to almost any specialist. I do not yet consider individual cases with investments, buying real estate and opening a company, since this requires investments, which not every person who wants to come to Cyprus now has. nine0004

Tourist

You can come to the island as a tourist, the entry rules are described above, the time of stay also depends on the country:

- Citizens of Belarus - depends on the visa issued.

- Citizens of Ukraine - up to 90 days.

However, after this period you must leave the island. Also, you are not allowed to work on the island as a tourist.

Work visa

Work visa is the right to live in Cyprus while working as an employee of a specific Cypriot company. That is, you can’t just come and apply for such a visa yourself, this is done by the company hiring you only after receiving a visa permit from the Migration Office, and the request goes to a specific person in a specific company.

That is, you can’t just come and apply for such a visa yourself, this is done by the company hiring you only after receiving a visa permit from the Migration Office, and the request goes to a specific person in a specific company.

Upon receipt of a work visa, family members can obtain visitor visas, a type of non-work visa. Family members include spouse and minor children. Since 2022, spouses have also been able to work by obtaining a Spouse Employee type visa. nine0004

In case you stop working in this company (of your own free will or at the initiative of the company), then you have only one month during which you must either leave Cyprus, or find another job on the island, or do a visitor visa for yourself and your family.

To obtain a visa, the requirements are more for the company than for the applicant, but they are also useful to know:

- The company must have a work permit for third-country nationals. nine0023

- The employee's salary must be at least 2,500 euros before taxes.

- Need a certificate of non-conviction.

- Spouses of a work visa holder can work in Cyprus.

- For family members, it will be necessary to issue a letter of guarantee at the bank (insurance fee of 550 euros per person + cost of the letter of guarantee).

More details about the visa from the director of Consulco. nine0004

Visitor visa

This type of visa allows you to live in Cyprus, but you do not have the right to work on the island. The latter is important, since it is quite possible to work for a company outside of Cyprus. Or to receive income from some of their business abroad.

The visa is issued for the applicant and his family members (spouse and minor children). It is issued for a year and requires an annual renewal.

To obtain a visa, you need:

- Own residence or lease agreement for at least 1 year.

- Submit documents to the Migration Office.

- Open a bank account and put a security deposit of 550 euros for each family member.

- Take out annual medical insurance.

- Transfer to a Cypriot bank account an amount of 10 thousand euros for the applicant and 4.5 thousand euros for each family member (dependant). In the future, this money can be used to live in Cyprus. nine0023

- Police clearance certificate.

Important: the spouses of a visitor visa holder are not allowed to work in Cyprus.

Consideration of an application for a visitor visa takes from 6 to 12 months, however, immediately after submitting the documents, you already have the legal right to live on the island and even leave it and return on the basis of the received coupon from the migration service (on obtaining documents for a visitor visa). True, you cannot leave the island for a period exceeding three months. nine0004

Even if you have not yet been issued a permit, but 11 months have already passed, you need to apply again - already next year.

More details about the visa from the director of Consulco.

IT Nomad visa (digital nomad visa)

This type of visa in Cyprus appeared in the spring of 2022. They can be obtained by IT professionals who wish to work remotely while residing in Cyprus. But the number of such visas is limited: from March 3, 2022, a limit has been set - 500 per year. nine0004

To obtain such a visa, you must:

- Work for a company/client outside of Cyprus, performing your duties through telecommunication technology (read remotely via the Internet).

- Confirm that you will have a stable and sufficient monthly income of at least €3,500 net (that is, after all taxes have been paid).

- Police clearance certificate.

- For family members, it will be necessary to issue a letter of guarantee at the bank (insurance fee of 550 euros per person + cost of the letter of guarantee).

nine0023

nine0023

What this visa gives:

- 1 year of official stay in Cyprus with the possibility of extension for the next 2 years.

- Right of residence for spouse and minor children.

- Spouses cannot work in Cyprus.

- If you reside in Cyprus for more than 183 days in a year, you become tax resident in Cyprus for that year and are liable to pay local income tax (see section below) unless you prove your tax residency status in another country. nine0023

The time to obtain such a visa is now estimated at 5-7 weeks. However, you can officially stay in Cyprus from the moment you apply for such a visa.

More details about the visa from the director of Consulco.

Salaries and expenses in Cyprus

There is not a single source that would give reliable salaries for all possible professions. For the IT industry, more or less relevant data is available here.

But you need to understand that this is also the “average for the hospital”, and each company may have its own rates. Some giants pay much more than average. Also, often the salary level may depend on where the main office of the company is located on the island - for example, the cost of living in Limassol is higher than in Paphos or Larnaca. nine0004

There is also no single universal answer for the cost of living and spending. The most expensive city to live in is Limassol, where the majority of Russian-speaking IT companies are concentrated. Nicosia is cheaper, Larnaca and Paphos are even cheaper. Plus, a young couple can spend less on living than a couple with two children (schools, clubs, etc.).

A very average rating can be obtained on this resource. The information there is approximate, but by comparing it with estimates and real expenses in your current city, you can calculate the coefficient and estimate future expenses based on it. nine0004

There is another site - the largest "flea market" in Cyprus, where you can actually find a place to rent and buy a car. For a starting understanding of the price level is quite a good resource.

For a starting understanding of the price level is quite a good resource.

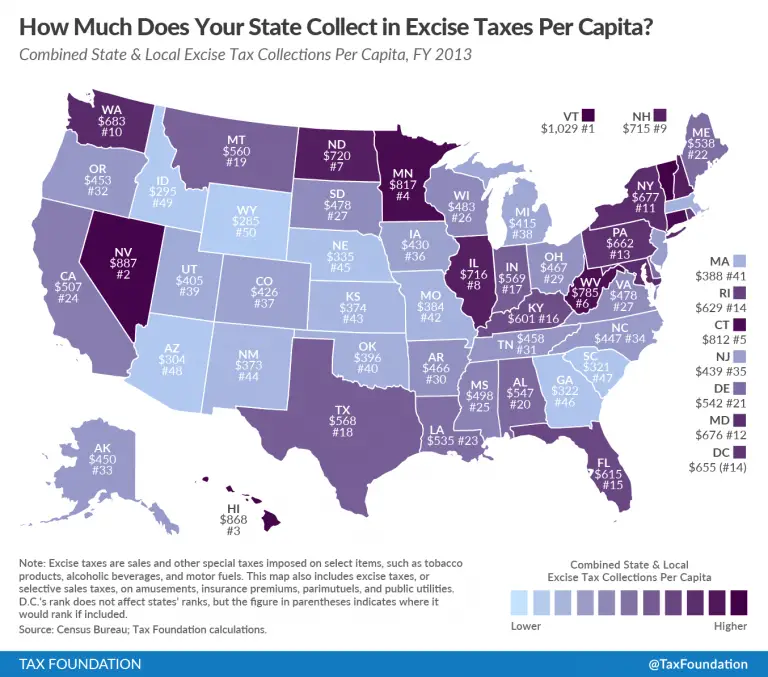

Taxation in Cyprus

If a person lives on the island for at least 183 days a year, he automatically becomes a tax resident of Cyprus, that is, he is obliged to pay income tax on his profits.

Detailed and up-to-date instructions on taxation in Cyprus are available on the PwC website, here in Russian. nine0004

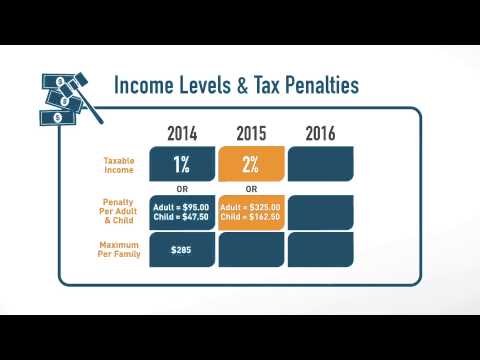

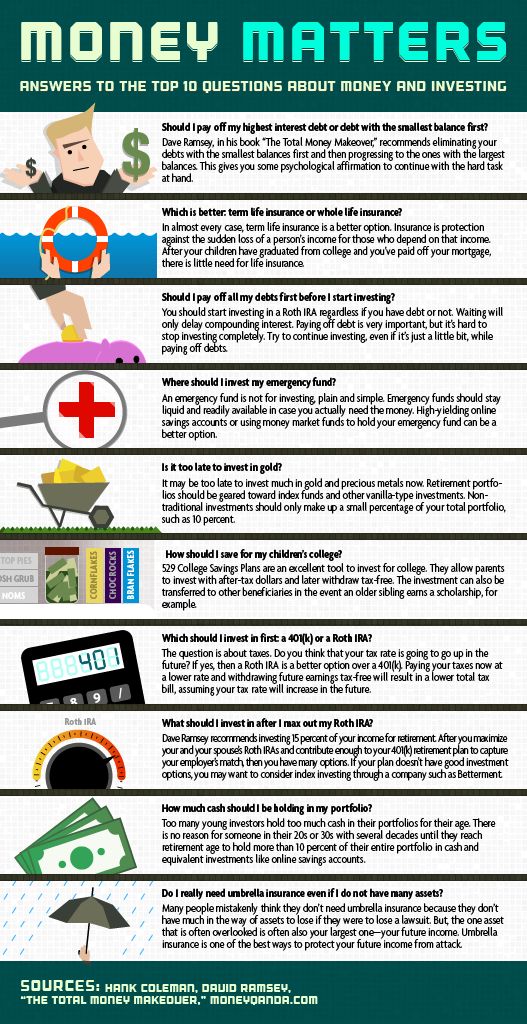

But the most important thing is the personal tax itself. He is progressive in Cyprus:

In addition, there are deductions from taxable income, of which the most significant are:

- no more than 8550 euros) for the first 5 years, starting from the next year in which the work began. Valid until 2030. nine0022 If you were employed in a Cypriot company (work visa) not earlier than 2012 and this is your first job in Cyprus, while your annual income is not less than 55 thousand euros, then you receive a 50% deduction for the first 17 years, starting from the next the year in which the work began.

- They can also deduct contributions for life insurance, pension funds (numbers at the link).

I also wrote more about benefits in my blog.

There are several good online tax calculators:

- Income Tax Calculator - income tax calculation. But it does not take into account the above deductions of 20% and 50%.

- Payroll Cost Calculator - this is rather for companies to understand how much an employee with a certain gross salary will cost a company

- Dividend Tax Calculator - if you open your own company and want to pay dividends to yourself, here you can calculate how much you will receive in your hands, and how much more you will pay in taxes

Features of registration in connection with the "special operation" in Ukraine

- By order of the ECB, from March 9, 2022, citizens of Belarus cannot have more than 100 thousand euros in total on their accounts.

Anything over this amount will either be frozen by the bank or rejected when you try to replenish your account.

Anything over this amount will either be frozen by the bank or rejected when you try to replenish your account. - For Russians, such a restriction was introduced earlier - on February 28, 2022.

- There is no official ban on opening accounts for citizens of Belarus and Russia, but any bank can play it safe. Nevertheless, if you have an official status of residence in Cyprus, banks are unlikely to refuse to open an account for you. nine0023

Useful links

When compiling the document, I used materials prepared in the CypRus_IT community and personally by its creator Oleg Reshetnikov, other chats, as well as my own knowledge and personal recommendations from Cypriot lawyers.

I also advise you to look:

- This article by Oleg Reshetnikov. Some data is outdated, I do not agree with all the points 100%, nevertheless it is quite good material; nine0023

- More information about visas and options for emigrating to Cyprus;

- ReloGame Wiki - a document about relocations to different countries, including Cyprus, created by the community of managers and HR of the GameDev industry;

- Some aspects of life on the island in my blog.