How much for each child claimed on taxes

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

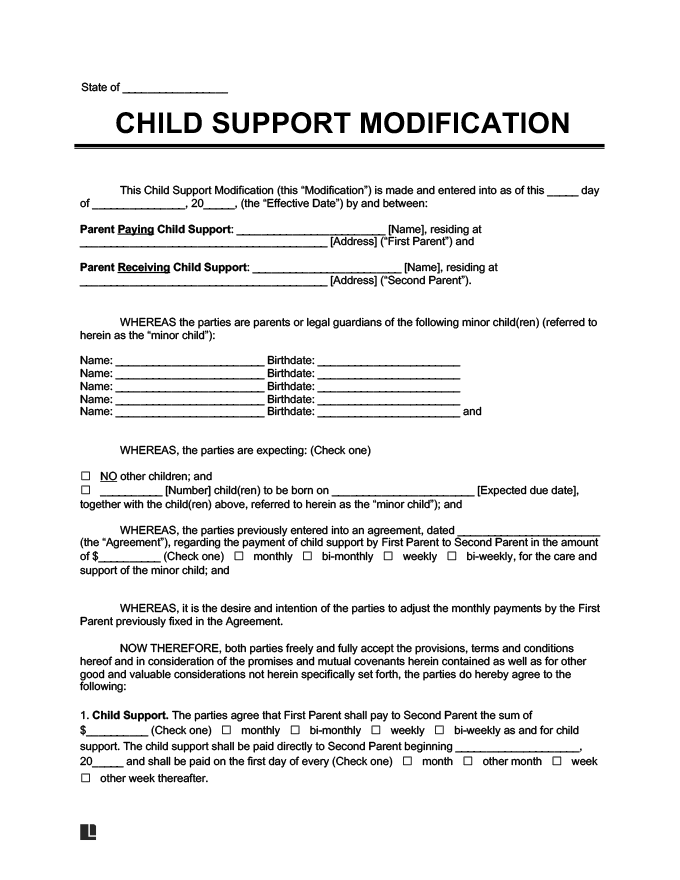

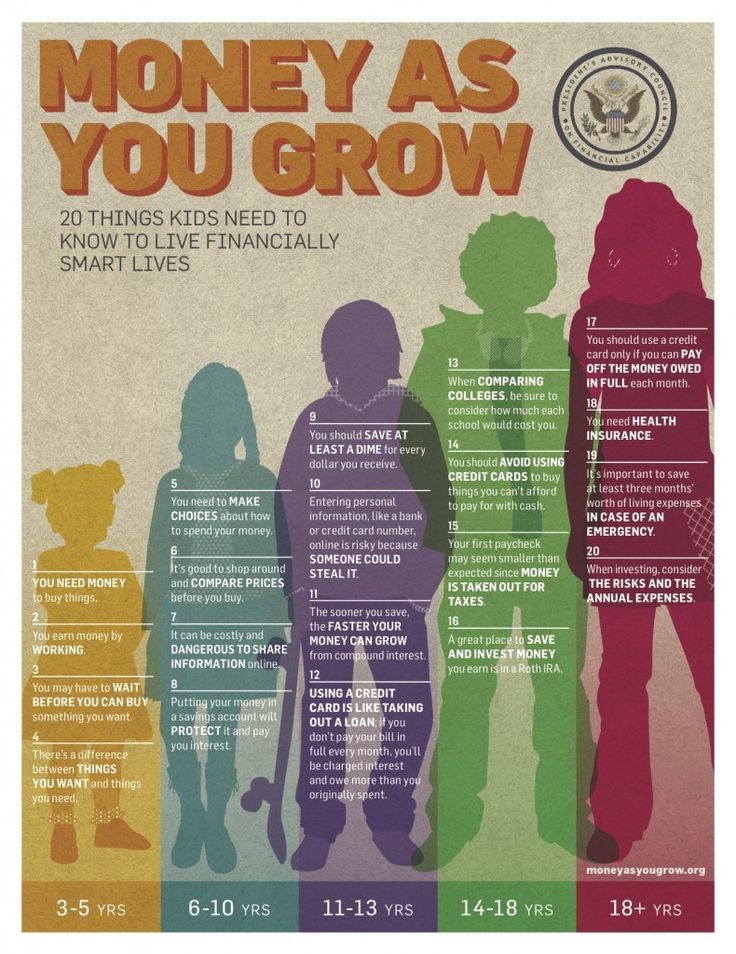

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

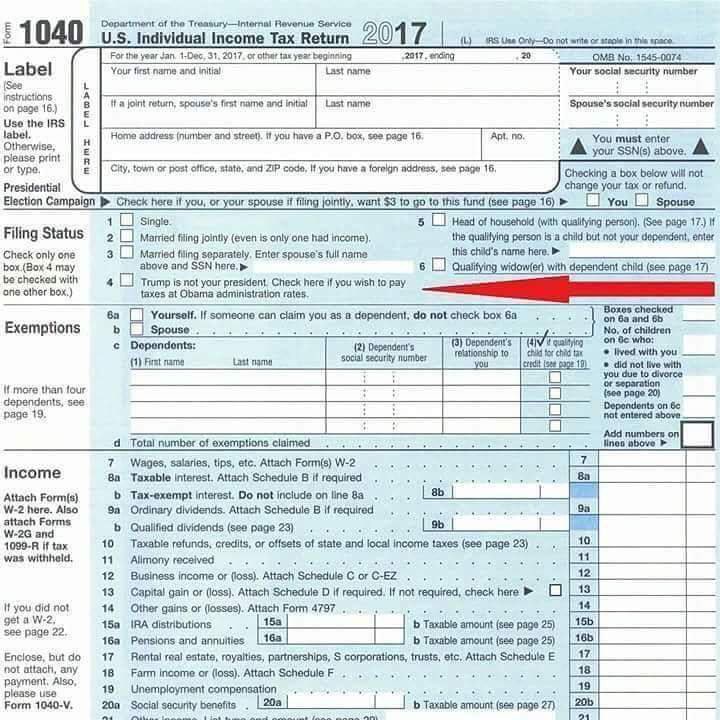

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”.

See below for details.

See below for details. - Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

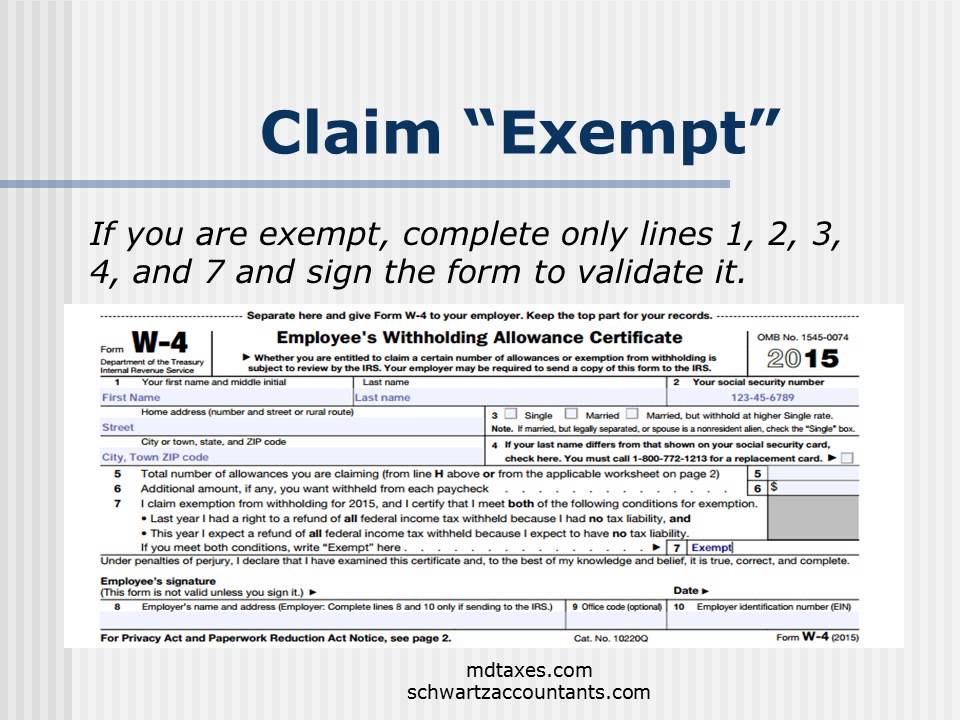

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC. org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

The Child Tax Credit - The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids.

She’ll receive the rest next spring.

She’ll receive the rest next spring.- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so.

As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes. If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes. If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

People's voting for the finalists of the international award #MYVMESTE-2022 continues

The inclusive creative project "Gift", the only one from the Republic of Bashkortostan, entered the final of the international award #MYVMESTE. In total, 31 thousand participants were declared for the contest, 112 reached the decisive vote. The authors of the "DAR" project need help in the popular Internet voting on the link in order to win and continue to give joy to special children.

According to the press service of the Ministry of Culture of the Republic, the DAR project includes inclusive creative activities for children with disabilities in the areas of dance, vocals, music, drawing, hand-made, entertainer, rap, puppet theater. Mentors are outstanding figures of culture and art. The second direction of the project is inclusive joint creativity of special children with healthy children. They immerse themselves in a creative atmosphere, learn art in all its manifestations, and then go on stage with their mentors, demonstrating their success.

Mentors are outstanding figures of culture and art. The second direction of the project is inclusive joint creativity of special children with healthy children. They immerse themselves in a creative atmosphere, learn art in all its manifestations, and then go on stage with their mentors, demonstrating their success.

– The project has been operating since February 2021, about 3,500 children from 36 correctional boarding schools in Bashkortostan took part in it. This influenced the improvement of the psycho-emotional background of children, the enthusiasm for creative interaction, the desire to learn and learn new things, and contributed to social adaptation and emotional recovery. "DAR" means "Children's Applause Day". After each master class, children go on stage with famous figures of culture and art and show their skills. Joy in the eyes of the children gives us the strength to hold new meetings, - says one of the initiators of the project, Honored Artist of Bashkortostan Ramil Badamshin.

The popular vote runs until November 5 and will be an important stage in the finals of the #MYVTOME-2022 international award. Anyone can vote for one of the 112 social projects vying for victory. To be among the best, finalists also need to be highly rated by an expert jury.

Popular voting is open to all residents of Russia. The results will show which projects have received public recognition and massive support from the general public. Thanks to voting, the regions will learn about the best social initiatives that will help citizens make life easier and more comfortable, and project authors will find like-minded people and partners.

Projects with the most votes in the popular vote will receive additional points in the final. They are summed up with the assessment of the federal expert jury. The experience of past years has shown that sometimes it is the results of the popular vote that play a decisive role in determining the winners.

The winners will be announced in December at the international civic participation forum #MYVMESTE, timed to coincide with the International Volunteer Day, which will be held December 5-7, 2022 in Moscow. They will receive public recognition, a grant for the implementation of their project, media support from ANO "National Priorities" in 2023, promotion on forums, posting on the DOBRO.RF platform, on social networks and on other platforms of the award partners.

They will receive public recognition, a grant for the implementation of their project, media support from ANO "National Priorities" in 2023, promotion on forums, posting on the DOBRO.RF platform, on social networks and on other platforms of the award partners.

The idea of justice. The head of Kazakhstan made an election program - FiNE NEWS

Its key message is the construction of a just state. Political experts assessed the initiatives of the head of the Central Asian state.

Fair Kazakhstan for everyone and for everyone

The President presented his pre-election platform called “Fair Kazakhstan. For everyone and for everyone. Now and Forever". He stated that in case of re-election, he would rely on three main principles: a just state, a just economy and a just society.

“Our entire national ideology will be permeated with the idea of justice,” Tokayev said. “Our cultural code should include such qualities as diligence, the pursuit of knowledge, respect for the law and the rule of law, the rejection of ambition, radicalism, aversion to self-interest and wastefulness, dependency and passivity, humane respect, goodwill towards others and mutual assistance. ”

”

In fact, the head of Kazakhstan modernized the philosophical thoughts of the legendary Abai about the “holistic person”. In his “Words of Edification”, the Kazakh public educator, in particular, wrote: “The harmful properties of the mind are carelessness, indifference, a tendency to causeless fun, craving for gloomy thoughts and destructive passions. These four vices can destroy both mind and talent.”

Political scientist Daniyar Ashimbaev believes that Tokayev retold the famous words of Kennedy words Abai : "Do not think about the benefits, think about conscience." The expert recalled that US President John F. Kennedy said in his inaugural speech in 1961: "Ask not what your country can do for you, ask what you can do for your country."

Photo: akorda.kzDevelopment of roads and construction of new housing

The head of Kazakhstan focused on the development of infrastructure in the republic. The construction and reconstruction of 8,000 kilometers of highways of republican significance and 14,000 kilometers of regional and district significance have been announced. The roads will be fully covered by a stable Internet connection. It also announced the construction of 700 primary health care facilities in rural areas. Housewarming will be celebrated by about 40 thousand owners of dilapidated and dilapidated housing. From 2024, the country will begin implementing a new large-scale initiative “National Fund for Children”, within the framework of which an annual transfer to the public fund “Kazakhstan Khalkyna” (“To the People of Kazakhstan”) will be provided at least seven percent of the net income of the national fund “Samruk-Kazyna” .

The roads will be fully covered by a stable Internet connection. It also announced the construction of 700 primary health care facilities in rural areas. Housewarming will be celebrated by about 40 thousand owners of dilapidated and dilapidated housing. From 2024, the country will begin implementing a new large-scale initiative “National Fund for Children”, within the framework of which an annual transfer to the public fund “Kazakhstan Khalkyna” (“To the People of Kazakhstan”) will be provided at least seven percent of the net income of the national fund “Samruk-Kazyna” .

In his program, Tokayev touched on foreign policy topics, saying: “Kazakhstan has always firmly defended its national interests in the international arena and promoted a progressive agenda. Our foreign policy course will be invariably peaceful and constructive, aimed at cooperation with all partners. Therefore, we will help strengthen the global role of the UN and create a more harmonious and fair system of international relations. ”

”

The head of Kazakhstan expressed his confidence that the people of Kazakhstan would together build "a country of free, strong, educated and confident citizens in themselves and in their state." “For me, there is nothing more important than the interests of the state and the well-being of the people. I am absolutely sincerely interested in that my compatriots begin to live better. I am convinced that this desire is shared by the entire nation,” Tokayev said.

Photo: akorda.kzThe program meets the interests of the population

In the opinion of the director of the Analytical Center of the Russian Society of Political Scientists Andrey Serenko , Kassym-Jomart Tokayev's election program can be called a working document of direct action. “We are used to the fact that election programs are always a set of populist stories, far from always mandatory,” the political scientist commented. “The current president of Kazakhstan has not so much an election document as a document of real politics and economics, which will need to be implemented as a direct guide to action. ”

”

Serenko called the theme of fair Kazakhstan “Tokaev's trick”, with which he has already entered the latest Kazakhstani politics and history and predetermined the fate of the country for the coming years. “The request for justice is key not only in Kazakhstan, but also in Russia, Belarus, Ukraine and the Central Asian republics. This is a common request in the post-Soviet space. Tokayev offers to answer it in a meaningful and specific way,” the expert continued.

In general, according to the representative of the Russian Society of Political Scientists, the presidential campaign in Kazakhstan will take place more like a referendum than real competition. “Simply at the moment there is no candidate comparable to Tokayev in terms of power and potential. Therefore, in this case, these elections will be primarily a referendum on confidence in the president. But, despite this, he was very attentive to the formulation of the specific provisions of his program. This suggests that he intends to fulfill all of them, ”summed up Serenko.

According to Director of the Information and Analytical Center for the Study of Socio-Political Processes in the Post-Soviet Space, Daria Chizhova, it is gratifying that it is the economy that has largely come under such close attention of the current program of President Kassym-Jomart Tokayev.

“Undoubtedly, the focus on solving economic problems and reforms is extremely important for the population, because the credit of trust that was given in January allowed for quite a serious political modernization, and now the time has come for major reforms in the economic sphere. It is important to note that the measures proposed by Tokayev are specific and targeted. These are not programs that can be implemented for decades, but specific decisions that need to be made here and now to solve the tasks that require it,” said Daria Chizhova.

Photo: akorda.kz In turn, candidate of political sciences, director of the Institute of Political Studies Sergey Markov predicts that the program of President Tokayev will receive the support of the majority of citizens of Kazakhstan.