How much earned income tax credit do you get per child

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Learn More

and

Tina Orem

Tina Orem

Assistant Assigning Editor | Taxes, small business, retirement and estate planning

Tina Orem is an editor at NerdWallet. Prior to becoming an editor, she covered small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

Updated

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for over 15 years, and was a senior writer and spokesperson at NerdWallet before becoming an assigning editor. Previously, she was a researcher and reporter for leading personal finance journalist and author Jean Chatzky, a role that included developing financial education programs, interviewing subject matter experts and helping to produce television and radio segments. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. She is based in Charlottesville, Virginia.

She is based in Charlottesville, Virginia.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeaways

For tax returns filed in 2023, the child tax credit is worth up to $2,000 per qualifying dependent under the age of 17.

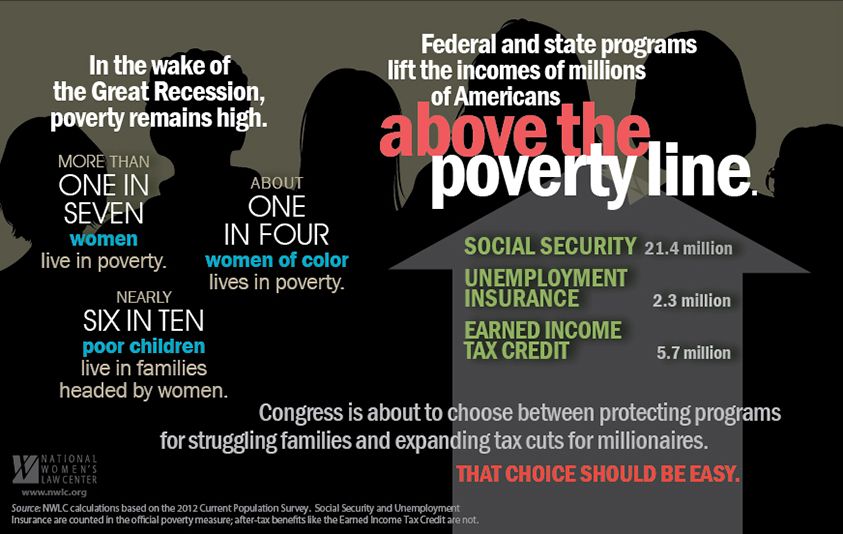

The credit is partially refundable. Some taxpayers may be eligible for a refund of up to $1,500.

The credit amount decreases if your modified adjusted gross income exceeds $400,000 (married filing jointly) or $200,000 (all other filers).

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

$1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

Internal Revenue Service

. Child Tax Credit.

View all sources

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Child tax credit vs. child and dependent care credit

Though similar sounding, the child tax credit and the child and dependent care credit are not the same thing. The child tax credit is a tax incentive for people with children, while the CDCC is another tax credit for working parents or caretakers designed to help offset expenses such as day camp or after-school care. Both credits have different rules and qualifications.

The child tax credit is a tax incentive for people with children, while the CDCC is another tax credit for working parents or caretakers designed to help offset expenses such as day camp or after-school care. Both credits have different rules and qualifications.

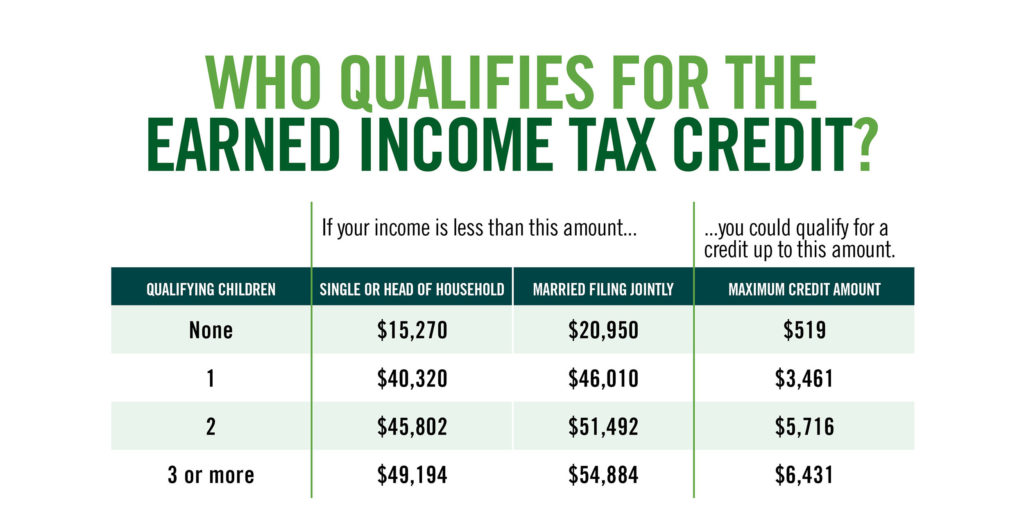

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.g., a grandchild, niece or nephew).

Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

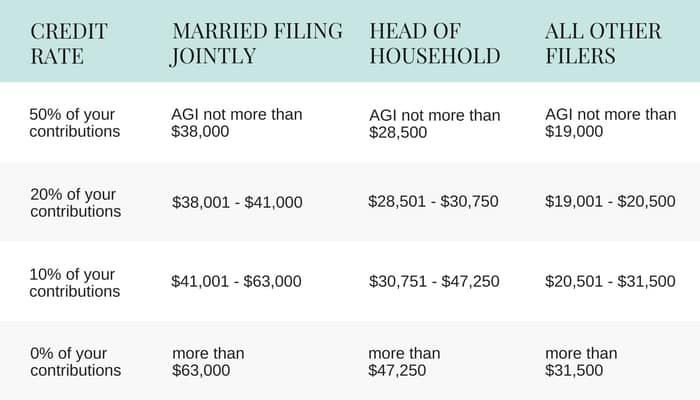

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents. " Check the IRS website for more information.

" Check the IRS website for more information.

Tax Planning Made Easy

Take the stress out of tax season. Find the smartest way to do your taxes with Harness Tax.

Visit Harness Tax

How to calculate the 2022 child tax credit

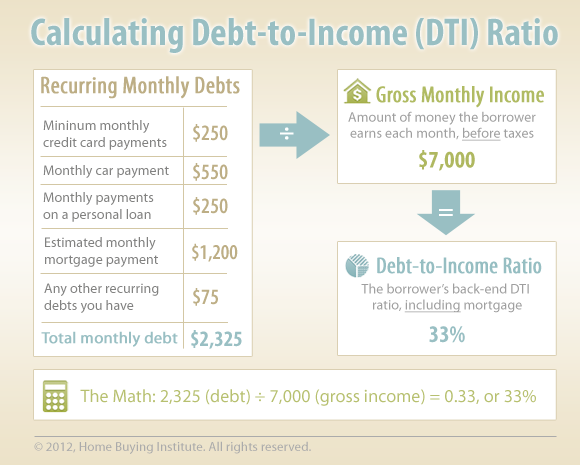

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

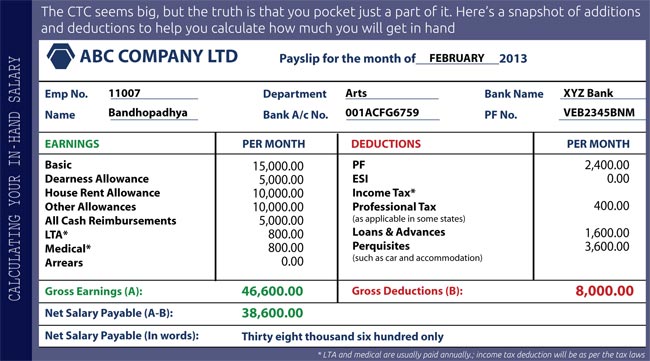

The CTC is also partially refundable tax credit; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

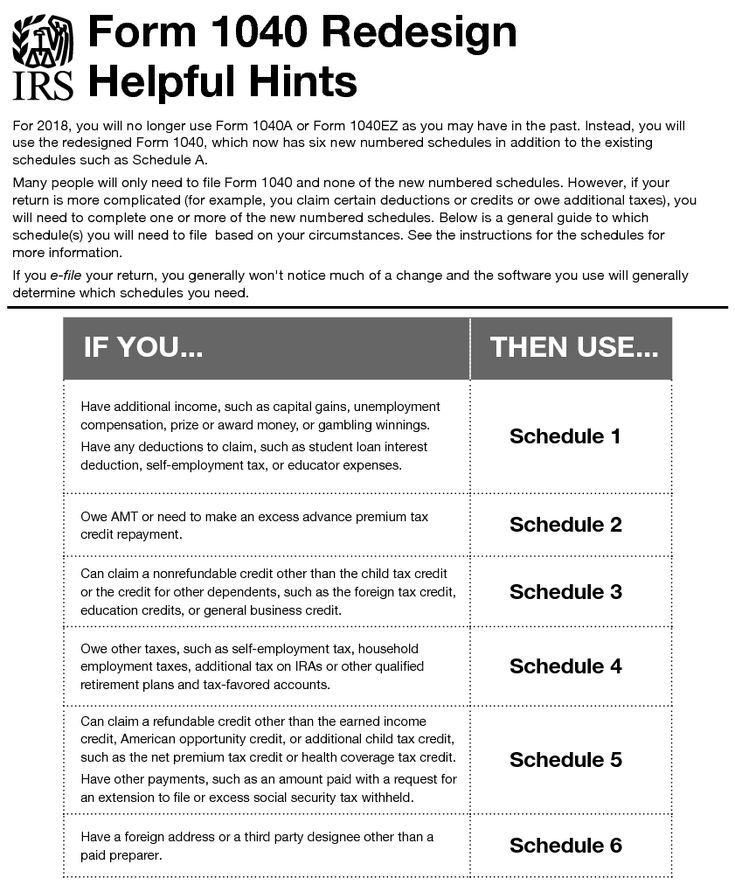

How to claim the credit

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

When to expect your CTC refund

The IRS cannot release an additional child tax credit refund before mid-February. Per the agency, early filers who selected direct deposit as their refund method, e-filed, and submitted an error-free return could have seen refunds hit their accounts around Feb. 28, 2003. If you want to check on the status of your return, you can use the agency's "Where's My Refund" tool.

Internal Revenue Service

. When to Expect Your Refund if You Claimed the Earned Income Tax Credit or Additional Child Tax Credit.

View all sources

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. The child and dependent care credit covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll also need to make sure your child has a Social Security number by the due date of your 2022 return (including extensions).

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Read more

Tina Orem is an editor at NerdWallet. Before becoming an editor, she was NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Tax Credits vs. Tax Deductions

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Tax deductions reduce your taxable income, but tax credits reduce your bill dollar for dollar.

By

Tina Orem

Tina Orem

Assistant Assigning Editor | Taxes, small business, retirement and estate planning

Tina Orem is an editor at NerdWallet. Prior to becoming an editor, she covered small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

Updated

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

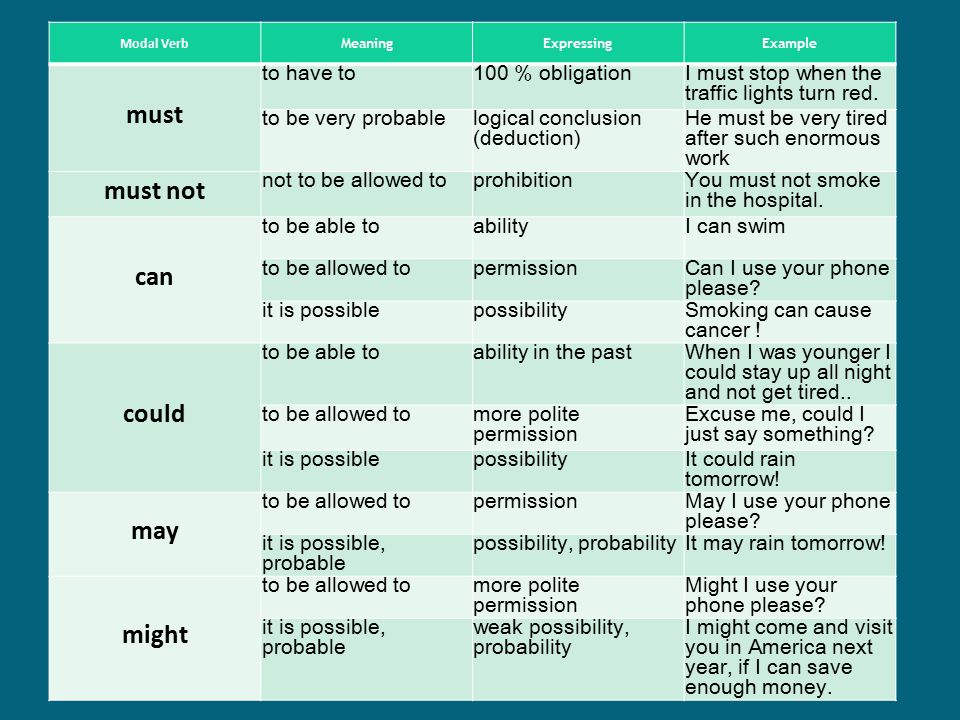

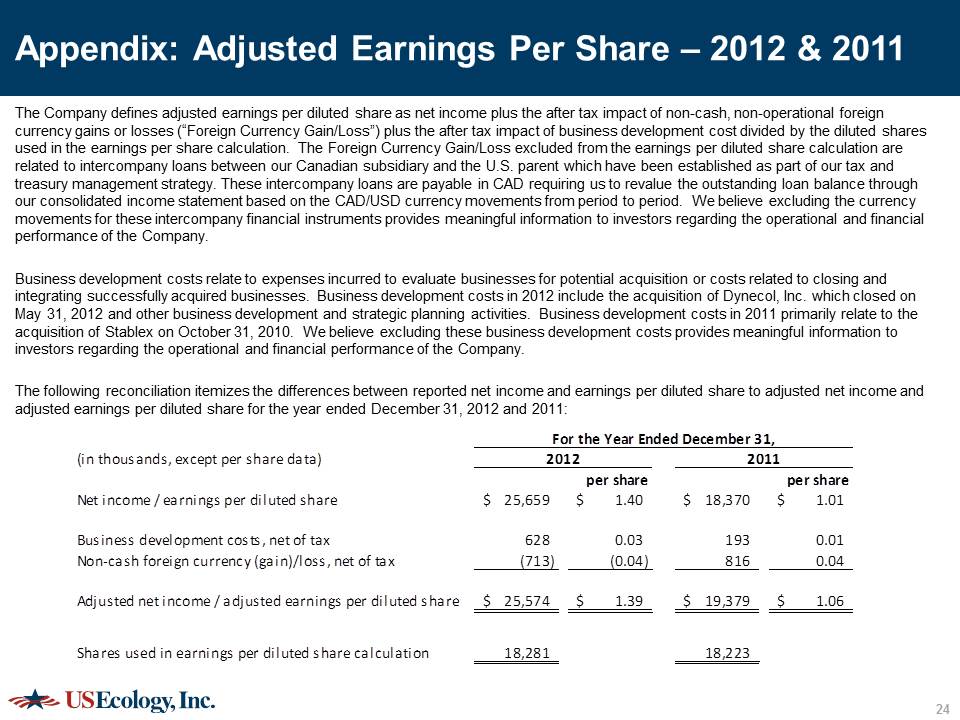

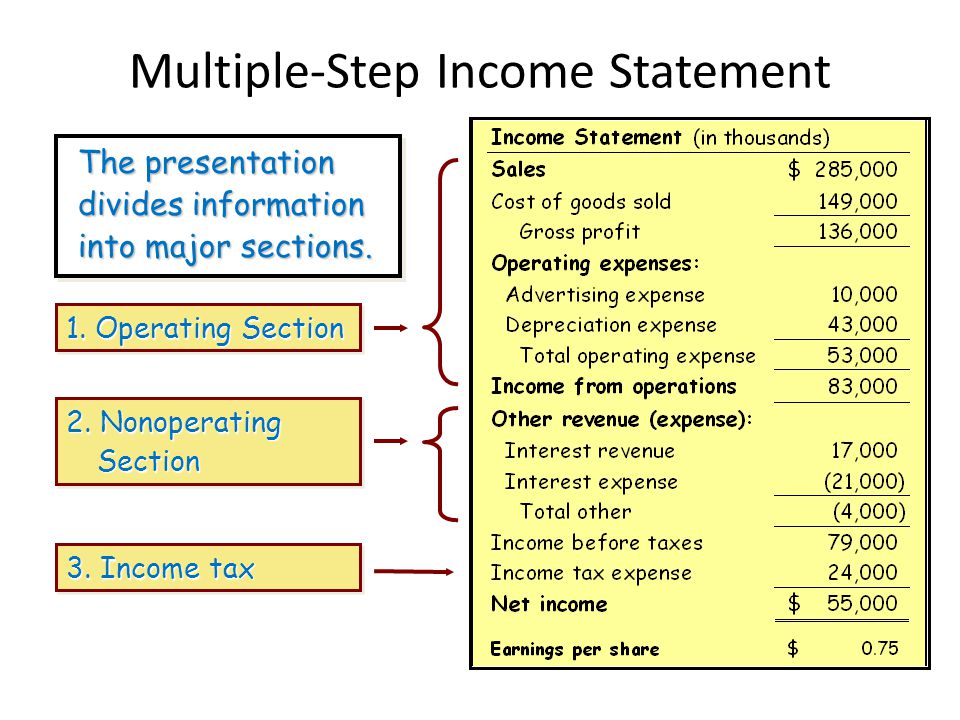

Tax credits and tax deductions may be the most satisfying part of preparing your tax return. Both reduce your tax bill, but in very different ways.

Tax credits directly reduce the amount of tax you owe, giving you a dollar-for-dollar reduction of your tax liability. A tax credit valued at $1,000, for instance, lowers your tax bill by the corresponding $1,000.

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction saves you $220.

Would you rather have: | ||

A $10,000 tax deduction… | …or a $10,000 tax credit? | |

Your AGI | $100,000 | $100,000 |

Less: tax deduction | ($10,000) | |

Taxable income | $90,000 | $100,000 |

Tax rate* | ||

Calculated tax | $22,500 | $25,000 |

Less: tax credit | ($10,000) | |

Your tax bill | $22,500 | $15,000 |

The catch to tax credits

Some tax credits are nonrefundable. That means that if you don’t owe a lot in taxes to begin with, you don’t get the full value if the credits take your tax bill below zero.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16333756/eitc_trapezoid.png) In other words, a $600 tax bill combined with a $1,000 nonrefundable credit doesn’t get you a $400 tax refund check.

In other words, a $600 tax bill combined with a $1,000 nonrefundable credit doesn’t get you a $400 tax refund check.Some tax credits are refundable. If you qualify to take refundable tax credits — things such as the earned income tax credit or the child tax credit — the value of the credit goes beyond your tax liability and can result in a refund check.

The IRS lays out specific criteria you must meet to qualify for both nonrefundable and refundable credits.

A big decision about tax deductions

There are two types of tax-deduction strategies: taking the standard deduction or itemizing.

The standard deduction

The standard deduction is a one-size-fits-all reduction in the amount of your income that’s subject to tax. You don’t have to do anything to qualify for the standard deduction or provide any documentation.

You can claim the standard deduction on Form 1040.

The amount varies depending on your filing status.

The amount varies depending on your filing status.

Filing status | Standard deduction 2022 | Standard deduction 2023 |

|---|---|---|

Single | $12,950. | $13,850. |

Married, filing jointly | $25,900. | $27,700. |

Married, filing separately | $12,950. | $13,850. |

Head of household | $19,400. | $20,800. |

Itemizing

Itemizing allows you to take advantage of deductions such as home mortgage interest, medical expenses or charitable donations. If together your itemized deductions exceed the value of the standard deduction, you'll want to itemize so you pay less tax. You'll need to use the regular Form 1040 and Schedule A.

Just as with tax credits, taking certain deductions requires meeting certain qualifications based on your filing status, current life events and the amount of your income that’s taxable. Be sure you meet IRS criteria to qualify for both tax credits and deductions.

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

| |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

Promotion: NerdWallet users get 30% off federal filing costs. Use code NERD30. |

About the author: Tina Orem is an editor at NerdWallet. Before becoming an editor, she was NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

New York State Additional Payments for Child and Earned Income Tax Credits

New York State's 2022-2023 Budget provides for the following two payments in one check to qualifying taxpayers:

- one for the child tax credit and

- one for the earned income tax credit (or the noncustodial parent's earned income tax credit).

If you qualify for one or both of these tax credits, you do not need to take any action; we will automatically calculate the amount due and send you one check for the entire amount due to you.

Am I entitled to payment?

You are eligible if you received at least $100 in tax year 2021 on any or both of the following New York State tax credits:

- an Empire State child tax credit

- New York State Earned Income Tax Credit (or Noncustodial Parent Earned Income Tax Credit).

Also required is New York State income tax return (Form IT-201) filed no later than April 18, 2022, or a valid extension of the filing deadline.

When will I receive check ?

We will start sending checks in October and most payments will be processed by October 31, 2022.

You will have a check in your mailbox that looks like this:

We cannot specify the exact check distribution schedule, and the operators of our contact center do not have more detailed information.

How much will check be drawn for?

The amount shown on the check is based on your 2021 Empire State Child Tax Credit, New York State Earned Income Tax Credit (or Noncustodial Parent Earned Income Tax Credit), or both.

Empire State child tax credit payment is 25% to 100% of the tax credit you received for 2021. The percentage depends on your income.

Earned income tax credit (or noncustodial parent's earned income tax credit) is 25% of your 2021 tax credit.

If you are eligible for:

- a check for only one tax credit, your check will show that amount;

- check for payment of both tax credits, the check will indicate the amount equal to the result of adding the two amounts.

If you received at least $100 from any of these tax credits, your check will include the amount of that tax credit. For example, if your NYS 2021 earned income tax credit was $80 and your Empire State child tax credit was $200, your check will show only the Empire State child tax credit.

Preliminary Check Amount

You will need information from your 2021 New York State Income Tax Return (Form IT-201) to pre-determine the amount you will receive. If you do not have a copy of your filed tax return, open a copy of your return in the program you used to file your return, or ask a tax preparer (if you have one) for this information.

The actual amount shown on the check may differ from the amount you calculated if adjustments have been made to the amount of any of the credits reported on your tax return.

To protect your information, our contact center operators do not disclose amounts from your tax return.

Empire State child tax credit estimate

- Find the amount on line 63 ( Empire State Child Tax Credit ) on your 2021 tax return. If line 63 is blank, you did not claim this tax credit and are not eligible for the Empire State child tax credit.

- Find the amount shown on line 19a of your tax return.

- Determine the percentage of your amount on line 19a from the table below:

Empire State 9 Child Tax Credit Supplement Calculation Worksheet0100 If the amount specified in line 19a is Empire State child tax credit payment for 2021 will be less than or equal to but less than N/A $10,000 100% of the tax credit received. $10,000 $25,000 75% of the tax credit received. $25,000 $50,000 50% of the tax credit received.

$50,000 N/A 25% of the tax credit received. - Multiply the amount on line 63 by the percentage you determined from the table above to determine the payout you will receive on this tax credit.

Example. Taxpayer B has $18,000 on line 19a and $333 on line 63:

For taxpayer B, the amount on line 19a ($18,000) is between $10,000 and $25,000 in the table, so the payment is 75% of the amount on line 63. Taxpayer B must multiply $333 by 75% ($333 x 0.75 = $250). If Taxpayer B is eligible, they will receive the Empire State Child Tax Credit of $250.

Interactive Calculator

This interactive calculator can help you estimate your Empire State child tax credit.

- In the fields highlighted in yellow, enter the appropriate amounts from your 2021 IT-201 form.

- After you have entered all the data correctly, press Calculation .

- If you also received an earned income tax credit (or a noncustodial parent's earned income tax credit) of at least $100, calculate the amount of the earned income tax credit payment separately. Your check will show the total amount owed to you.

19a Recalculated Federal Adjusted Total Income

Line Amount

% of Offset

63 Empire State Child Tax Credit

Line Amount

Extra Payment Amount

Calculate ESCC

Estimated payment of earned income tax credit

- Find the amount shown on line 65 (or line 66 for the noncustodial parent's earned income tax credit) on your 2021 tax return. If lines 65 and 66 are blank, you have not claimed this tax credit and are not entitled to the earned income tax credit.

- Multiply the amount on line 65 (or 66) by 0.

25 to predetermine the payment amount for this tax credit.

25 to predetermine the payment amount for this tax credit.

Example. The amount on line 65 of taxpayer A's 2021 tax return is $300:

Taxpayer A must multiply $300 by 25% ($300 x 0.25 = $75). If taxpayer A qualifies for the payment, his payment on his earned income tax credit is $75.

Interactive Calculator

This interactive calculator allows you to pre-calculate your earned income tax credit.

Note . If line 65 or line 66 is less than $100, stop . You are not entitled to an additional payment on this tax credit.

- In the fields highlighted in yellow, enter the appropriate amounts from your 2021 IT-201 form.

- After you have entered all the data correctly, press Calculation .

- If you also received an Empire State child tax credit of at least $100, calculate the Empire State child tax credit payment separately.

Your check will show the total amount owed to you.

Your check will show the total amount owed to you.

If your New York State Earned Income Tax Credit (EIC) was $100 or more , enter the amount on line 65.

If your New York State EIC for the noncustodial parent was $100 or more , enter the amount shown on line 66.

Line amount

Calculate line 66

Additional payment amount

Frequently Asked Questions

Do I need to apply to get a check?

No. We will automatically send you a check if you received at least $100 in tax year 2021 on any or both of the following New York State tax credits:

- Empire State child tax credit;

- New York State Earned Income Tax Credit (or Noncustodial Parent Earned Income Tax Credit)

Do I need to report this payment on my New York State income tax return?

You do not need to report this payment on your 2022 New York State income tax return.

Why didn't I receive my check?

If you haven't received your check after October 31, 2022, it may mean that we haven't finished processing your tax return. This may be because your tax return deadline has been extended or we have requested additional information. If you are eligible, we will automatically write you a check after we process your tax return.

However, you will not receive a check if:

- if we denied your New York State Earned Income Tax Credit Claim (or Noncustodial Parent Earned Income Tax Credit) or Empire Child Tax Credit Claim State or

- if we have adjusted your New York State earned income tax credit (or the noncustodial parent's earned income tax credit) or Empire State child tax credit so that the amount is less than $100.

I now live at a different address. How do I update my address so that my receipt is not lost?

- Sign in to your individual Online Services account (or create an account).

- Select menu ≡ Services (Services) in the upper left corner of the main page Account Summary (Summary for the account).

- Select Individual change of address from the drop-down menu.

Why is the amount not shown on the check that I calculated?

The actual amount you receive may differ from the estimated amount in the following cases:

- if we denied one of the tax credits you claimed or

- if we have adjusted the amount of one or both tax credits.

My 2021 tax refund return was charged to outstanding debt. Will this payment apply?

No, this one-time payment will not apply to debts.

I filed Form IT-203, Non-Resident and Resident Income Tax Return for part of the year. Am I eligible to receive this payment?

No, you must have filed a full year income tax return and filed Form IT-201, Full Year Resident Income Tax Return , for tax year 2021 in order to be considered eligible for the lump sum payment.

Page not found - portal Vashifinansy.rf

Moscow

Your city:

Moscow

PartnersFor media

Rus Eng

Financial Literacy Week

2021 Check your financial literacy level

Learn to manage

personal finances Learn

how to protect your

rights Financial

calculators How

to talk to children

about money

From October 1, 2021, you can read up-to-date materials on financial literacy on the website

MOIFINANCE.RF

In this section, you can familiarize yourself with the materials created as part of a joint project of the Russian Ministry of Finance and the World Bank in the period from 2010 to 2020.

Free version available for simple returns only; not all taxpayers qualify.

Free version available for simple returns only; not all taxpayers qualify.