How much does head start pay per child

State(s) of Head Start: Funding, enrollment and quality are all over the map

by Allison Friedman-Krauss, Ph.D.

Topic: Outcomes

Research is clear that developmental trajectories in the first five years profoundly influence later success in school and life. That is why it is so important that every child have access to high-quality early learning experiences, especially those growing up in the most adverse circumstances. Head Start is the nation’s most ambitious effort to support children birth to five and their families, but NIEER’s new report shows just how short it falls state by state.

State(s) of Head Start is the first report to examine Head Start enrollment, quality, duration, and funding state-by-state, focusing on the 2014-2015 program year but also providing historical data back to 2007. As a federal to local program, Head Start programs are required to follow federal performance standards while also meeting local needs. Yet variations revealed in this report cannot be explained by local need alone. Indeed, we find no obvious explanation for the state-by-state differences illustrated by the State(s) of Head Start report.

The report provides a national overview, data on the 50 states, District of Columbia, 6 U.S. territories, and the American Indian and Alaska Native and Migrant and Seasonal Head Start programs. We found large discrepancies between states in key areas including access to Head Start; quality of observed classroom practices; teacher qualifications and salary; duration of Head Start services, and funding. For example:

- Nationally, Head Start served only 10 percent of low-income children (including less than 3 percent of children under age 3 and 20 percent of 3- and 4-year-olds). However, in Nevada, only 7 percent of low-income 3- and 4-year-olds attended Head Start compared to nearly 50% in Turning to children under 3, in Nevada, only 1 percent of low-income children under 3 attended Head Start, compared to almost 8 percent in the District of Columbia.

- Observed classroom quality data came from the Head Start monitoring process through which classrooms were assessed by independent observers on the Classroom Assessment Scoring System (CLASS). On average, in all states, Head Start programs were observed to provide strongly emotionally supportive environments to children, which is vitally important. Half of the states were determined to be statistically above a research-based threshold on classroom organization and only one (South Carolina) was below. However, only two states (Vermont and Kentucky) could be determined to be statistically above a research-based threshold for high-quality instructional practices. Eighteen states were statistically below the research-based threshold.

- The 2007 Head Start Reauthorization required at least 50 percent of teachers in center-based Head Start classrooms have a bachelor’s degree (BA) or higher in ECE. As a result of this policy, the percent of teachers with a BA or higher increased from 44 percent in 2007 to 73 percent in 2015.

Yet while nearly all Head Start teachers in the District of Columbia had a BA or higher, only 36 percent of Head Start teachers in New Mexico Turning to Early Head Start, across the country 30 percent of teachers had a BA or higher and this varied from less than 12 percent in New Mexico to 64 percent in the District of Columbia.

Yet while nearly all Head Start teachers in the District of Columbia had a BA or higher, only 36 percent of Head Start teachers in New Mexico Turning to Early Head Start, across the country 30 percent of teachers had a BA or higher and this varied from less than 12 percent in New Mexico to 64 percent in the District of Columbia. - Early Head Start and Head Start teachers earn substantially less than public elementary school teachers with similar credentials – averaging $29,769 in Early Head Start, $33,387 in Head Start, and $57,092 in public elementary schools. The discrepancy between Head Start and Early Head Start teachers with a BA or higher and their colleagues in public schools surpassed $40,000 in New Jersey (Early Head Start only), Massachusetts, and New York. Only in the District of Columbia are Head Start teachers paid on par with public school teachers.

- New Head Start standards approved in September 2016 call for programs to provide 1,020 hours per year by 2021 to provide children enough time in the program to make strong developmental gains.

Currently only 42 percent of children receive this amount of Head Start, indicating that much progress is needed in the next 5 years to meet this goal. In Nevada and New Hampshire no children receive 1,020 hours (or the equivalent of 6 hours per day for 170 days) while in Georgia, 94 percent of children did.

Currently only 42 percent of children receive this amount of Head Start, indicating that much progress is needed in the next 5 years to meet this goal. In Nevada and New Hampshire no children receive 1,020 hours (or the equivalent of 6 hours per day for 170 days) while in Georgia, 94 percent of children did. - Per child funding was $12,757 for Early Head Start and $8,038 for Head Start nationwide. Adjusting for cost of living differences, per child spending was nearly twice as high in the state with the highest per child spending as in the state with the lowest per child spending, for both Head Start and Early Head Start.

Disparities arise, in part because state allocations were basically set in 1981, and, in part, because local programs have been forced to triage limited funding. State(s) of Head Start clarifies the needs in each state for additional federal, as well as state and local, support for the education of young children in poor and low-income families. This report’s findings underscore the need for greater coordination between Head Start and state and local government agencies to build high-quality early learning programs with widespread reach and adequate funding. However, no amount of coordination or increased local autonomy would make up for the tremendous funding gap posed if the nation seriously addressed the shortfall in access to Head Start quality in each state.

This report’s findings underscore the need for greater coordination between Head Start and state and local government agencies to build high-quality early learning programs with widespread reach and adequate funding. However, no amount of coordination or increased local autonomy would make up for the tremendous funding gap posed if the nation seriously addressed the shortfall in access to Head Start quality in each state.

All eligible children, regardless of geography, should have an equal opportunity to attend a high-quality Head Start where qualified teachers are adequately paid. Unfortunately, this is not the current state of Head Start. Rather, funding allocations are too low and not rationally distributed forcing Head Start programs into tradeoffs between enrolling more children, providing more hours of services, and employing qualified and adequately paid teachers.

State(s) of Head Start is the first report of its kind–but not necessarily the last. Our research sets a benchmark for gauging Head Start progress, especially as leadership changes at the national level. We hope this report spurs conversation about how to improve Head Start within the broader early childhood education community. We call for an independent bipartisan study commission, including policymakers, educators and researchers, to develop an action plan supporting quality education for all young children and their families, particularly the most vulnerable, in every state and territory.

We hope this report spurs conversation about how to improve Head Start within the broader early childhood education community. We call for an independent bipartisan study commission, including policymakers, educators and researchers, to develop an action plan supporting quality education for all young children and their families, particularly the most vulnerable, in every state and territory.

Dr. Friedman-Krauss is an Assistant Research Professor at the National Institute for Early Education Research. Dr. Friedman-Krauss holds a Ph.D. in Developmental Psychology from the Steinhardt School of Culture, Education, and Human Development at NYU. While at NYU, Dr. Friedman-Krauss was part of the Secondary Analysis of Variation in Impacts center that was funded by ACF to reanalyze the Head Start Impact Study.

FY 2021 Head Start Funding Increase

Instruction:

The Consolidated Appropriations Act, 2021 (P.L. 116-260), was signed into law on Dec. 27, 2020. The funding level for programs under the Head Start Act, including Early Head Start-Child Care Partnerships, is $10,748,095,000, an increase of $135 million over fiscal year (FY) 2020. This increase includes funding to provide a 1.22% cost-of-living adjustment (COLA) for all Head Start, Early Head Start, and Early Head Start-Child Care (EHS-CC) Partnership grantees and $10 million for Migrant and Seasonal grantee quality improvement funding. COLA and quality improvement funding announced in this instruction does not apply to new competitive expansion awards issued during FY 2021.

27, 2020. The funding level for programs under the Head Start Act, including Early Head Start-Child Care Partnerships, is $10,748,095,000, an increase of $135 million over fiscal year (FY) 2020. This increase includes funding to provide a 1.22% cost-of-living adjustment (COLA) for all Head Start, Early Head Start, and Early Head Start-Child Care (EHS-CC) Partnership grantees and $10 million for Migrant and Seasonal grantee quality improvement funding. COLA and quality improvement funding announced in this instruction does not apply to new competitive expansion awards issued during FY 2021.

The Consolidated Appropriations Act also includes $250 million in supplemental funds for Head Start programs to continue their response to COVID-19. This is in addition to the $750 million in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, 2020. Funds are made available for the same purpose of preventing, preparing for, and responding to COVID-19. The Office of Head Start (OHS) will again distribute this funding proportionally to all grantees based on funded enrollment levels.

The Office of Head Start (OHS) will again distribute this funding proportionally to all grantees based on funded enrollment levels.

This Program Instruction (PI) provides information about the FY 2021 COLA, quality improvement funding for Migrant and Seasonal grantees, and the supplemental funds available to support grantees’ continued response to COVID-19. It makes brief mention of the application requirements, but more details will be forthcoming.

FY 2021 COLA

All Head Start, Early Head Start, and EHS-CC Partnership grantees are eligible to receive a COLA increase. Grantees subject to competition for continued funding through the Designation Renewal System (DRS) are entitled to COLA funds through the end of their current award.

Each grantee may apply for a COLA increase of 1.22% of the FY 2020 base funding level. Base funding excludes training and technical assistance funds and any one-time funding received during FY 2020. Grantees must use COLA funds to permanently increase the Head Start pay scale by no less than 1.22%. This includes salaries of current staff and the pay range of unfilled vacancies. Grantees must provide an equivalent increase to delegate agencies and other partners to adjust their salaries and scales. Any grantee concerned that they cannot increase salaries for education staff (e.g., classroom teachers, home visitors, and family child care providers) due to wage comparability issues should ensure public school salaries for kindergarten teachers are included in their considerations.

Base funding excludes training and technical assistance funds and any one-time funding received during FY 2020. Grantees must use COLA funds to permanently increase the Head Start pay scale by no less than 1.22%. This includes salaries of current staff and the pay range of unfilled vacancies. Grantees must provide an equivalent increase to delegate agencies and other partners to adjust their salaries and scales. Any grantee concerned that they cannot increase salaries for education staff (e.g., classroom teachers, home visitors, and family child care providers) due to wage comparability issues should ensure public school salaries for kindergarten teachers are included in their considerations.

Sections 653 and 640(j) of the Head Start Act provide further guidance on the uses and limitations of COLA funds. Sec. 653 restricts compensation to a Head Start employee that is higher than the average rate of compensation paid for substantially comparable services in the area where the program is operating. It also prohibits any Head Start employee from being compensated at a rate higher than that of an Executive Schedule Level II position, including employees paid through indirect costs. Sec. 640(j) of the Act requires that the compensation of Head Start employees must be improved regardless of whether the agency has the ability to improve the compensation of staff employed by the agency that do not provide Head Start services.

It also prohibits any Head Start employee from being compensated at a rate higher than that of an Executive Schedule Level II position, including employees paid through indirect costs. Sec. 640(j) of the Act requires that the compensation of Head Start employees must be improved regardless of whether the agency has the ability to improve the compensation of staff employed by the agency that do not provide Head Start services.

Any grantee proposing a COLA percentage less than 1.22% across its pay scale, or differential increases between delegates or partners, must justify its rationale in its budget narrative.

As specified in Personnel policies, 45 CFR §1302.90, each grantee is required to establish written personnel policies and procedures that are approved by the governing body and Policy Council or policy committee. They must be available to all staff. Review your personnel policies and procedures since they may contain information relevant to this COLA.

Any remaining funds may be applied to fringe benefits costs or used to offset increased operating costs in other areas of the budget. This includes increased costs in rent, utilities, facilities maintenance and insurance, contractual arrangements, vehicle fuel and maintenance, and supplies.

FY 2021 Quality Improvement Funds for Migrant and Seasonal Grantees

Each Migrant and Seasonal grantee will receive a proportionate amount of quality improvement funding based on the number of slots the grantee is funded to serve (approximately $370 per slot).

There is flexibility in the use of quality improvement funds to meet Migrant and Seasonal grantees’ most pressing needs. Therefore, a program may apply to use quality improvement funds for activities consistent with Sec. 640(a)(5) of the Act, except that any amount of these funds may be used on any of the activities specified in such section. Programs are not bound by the requirements that at least 50% of the funds be used for staff compensation or that no more than 10% of funds be used on transportation. See Attachment A for the list of activities.

See Attachment A for the list of activities.

The Administration for Children and Families reserves the right to delay decisions on quality improvement funding until the outcomes have been finalized for those Migrant and Seasonal grantees subject to competition for continued funding through the DRS.

Supplemental Funds to Continue Responding to COVID-19

All Head Start, Early Head Start, and EHS-CC Partnership grantees are eligible to receive additional funds to continue responding to COVID-19. Each grantee may apply for a proportionate amount of the $250 million based on their total funded enrollment.

The purpose of these supplemental funds is the same as that of the CARES Act funds: to prevent, prepare for, and respond to COVID-19. Within these parameters, grantees have flexibility to determine which investments best support the needs of children and families while adhering to state and local guidance. Examples of the types of activities include, but are not limited to, the following:

Examples of the types of activities include, but are not limited to, the following:

- Mental health services, supports, crisis response, and intervention services

- Additional classroom staff to meet social distancing requirements, employees or contracted staff to address anticipated health, mental health, and social service needs, or staff to serve as substitutes

- Other personnel costs, including fringe benefits and expanded sick leave

- Coordination, preparedness, and response efforts with state, local, tribal, and territorial public health departments, and other relevant agencies

- Provision of meals and snacks not reimbursed by the U.S. Department of Agriculture (USDA), as well as refrigerators or supplies to support the delivery of meals to children served in a remote/virtual program model

- Training and professional development for staff on infectious disease management, delivery of remote/virtual services, etc.

- Transportation, including the hiring of bus drivers and the purchase of buses and other vehicles that could support the delivery of educational materials, supplies, and meals

- Purchasing necessary supplies and contracted services to sanitize and clean facilities and vehicles

- Renovations or other space modifications, such as room dividers

- Additional weeks of Head Start or Early Head Start programming at the end of the 2020–2021 program year or during the summer to increase the time period children and families can receive services

- Other actions that are necessary to maintain and resume the operation of programs, such as investing in technology infrastructure and upgrades, ventilation systems, or other emergency assistance

The application process for these supplemental funds will be forthcoming.

Waiver of Non-Federal Match

The COVID-19 pandemic, a national emergency, is seriously affecting economic conditions in communities throughout the U.S. The Head Start Act recognizes that lack of resources in a community adversely impacted by a major disaster may prevent Head Start grantees from providing all or a portion of their required non-federal contribution. OHS has determined that the widespread impact of the COVID-19 pandemic adversely impacts all Head Start grantees. Consequently, OHS will approve all requests for waivers of non-federal match associated with the following funds for FY 2021: COLA, quality improvement, and funding associated with COVID-19. To request a waiver of non-federal match, enter $0 in Section C of your SF-424A in your application. No additional justification of the waiver is required. The issuance of a notice of award constitutes approval of the requested waiver.

The issuance of a notice of award constitutes approval of the requested waiver.

Application Requirements

Grantees are required to request COLA funds, and quality improvement funds for Migrant and Seasonal grantees, through a grant application. OHS will soon issue a funding guidance letter to each grantee specifying its funding level and additional instructions on how to apply for these funds. OHS will also provide guidance on how to apply for COVID-19 supplemental funds. All applications must be submitted through the Head Start Enterprise System (HSES). Note that grantees will also be asked to report on the supplemental COVID funds in HSES when they report on their CARES Act spending plans, similar to the fall 2020 data collection.

Additional Information

Additional information and materials related to the pandemic are available on the COVID-19 and the Head Start Community page on the Early Childhood Learning and Knowledge Center (ECLKC) website. This webpage continues to be updated on a regular basis.

This webpage continues to be updated on a regular basis.

Please direct any questions regarding this PI to your Regional Office.

Thank you for your work on behalf of children and families.

/ Ann Linehan /

Ann Linehan

Acting Director

Office of Head Start

Page not found — State government institution “Regional Center for Social Protection of the Population” of Zabaykalsky Krai

404

Page not found

This page does not exist

Ask a question

×

Make an appointment

Full name

e-mail (required)

Phone (required)

Direction of application

issuance of a certificate of recognition of a family as needyissuance of a certificate of recognition of a family with many children EDV in large families EDV from 3 to 7 years one-time payment for the FIRST childmonthly monetary compensation for major repairs to citizens aged 70 and 80 months monthly monetary compensation for housing and communal services (benefits)monthly allowance for the FIRST child under 418 FZZHKU for families with many children other measures of social support (explain in the 'Message' field) provision of state social assistance registration of documents for the title of 'Veteran of Labour' allowance for a large family for children from 0 to 3 years old allowance for a child regional maternity capital subsidy for housing and communal services 9Ol000 )

- I give my consent to the processing of personal data

- I give my consent to receive a response to the specified e-mail.

mail

mail

The procedure for receiving and considering applications is carried out in accordance with the Federal Law of the Russian Federation “On the procedure for considering applications from citizens of the Russian Federation No. 59-FZ of May 2, 2006.

In your appeal, you must indicate your last name, first name, patronymic (the last one, if available), e-mail, to which the answer should be sent, notification of the redirection of the appeal.

If the written request does not indicate the name of the citizen who sent the request and the e-mail to which the response should be sent, the response to the request is not given.

A written appeal is subject to mandatory registration within three days from the date of receipt by a state body, local government body or official.

A written appeal received by a state body, a local government body or an official in accordance with their competence is considered within 30 days from the date of registration of the written appeal.

In exceptional cases, the head of a state body or local self-government body, an official or an authorized person has the right to extend the period for consideration of an application by no more than 30 days, notifying the citizen who sent the application of the extension of the period for its consideration.

×

State benefits

State benefits- New documents

- New documents for the week

- New documents for the month

New documents

- Codes

- Banking Code of the Republic of Belarus

- Budget Code of the Republic of Belarus

- Water Code of the Republic of Belarus

- Air Code of the Republic of Belarus

- Civil Code of the Republic of Belarus

- Civil Procedure Code of the Republic of Belarus

- Housing Code of the Republic of Belarus

- Electoral Code of the Republic of Belarus

- Code of the Republic of Belarus on marriage and family

- Land Code of the Republic of Belarus

- Subsoil Code of the Republic of Belarus

- Code of the Republic of Belarus on the judiciary and the status of judges

- Code of the Republic of Belarus on Administrative Offenses

- Code of the Republic of Belarus on Education

- Code of Inland Water Transport of the Republic of Belarus

- Merchant Shipping Code of the Republic of Belarus

- Codex of the Republic of Belarus Ab Culture

- Forest Code of the Republic of Belarus

- Tax Code of the Republic of Belarus (General Part)

- Tax Code of the Republic of Belarus (Special Part)

- Procedural-executive code of the Republic of Belarus on administrative offenses

- Labor Code of the Republic of Belarus

- Penal Code of the Republic of Belarus

- Code of Criminal Procedure of the Republic of Belarus

- Criminal Code of the Republic of Belarus

- Economic Procedure Code of the Republic of Belarus

- Customs Code of the Eurasian Economic Union

Codes

- Documents by topic

- Administrative Procedures

- To help the accountant and economist

- To help an ideological worker

- To help the personnel officer

- State bodies of the Republic of Belarus (officials) and other state organizations

- Eurasian economic integration

- Purchasing

- Healthcare

- Individual entrepreneur

- Informatization

- Codes of the Republic of Belarus

- Rulemaking

- Education

- Rights of minors

- Sports law

- Litigation

- Labor and trade union movement

- Centers for ensuring the activities of budgetary organizations

- Electronic library of scientific works in the field of law

- Technical regulations

Documents on topics

- Specialized Resources

- Calculators

- Law Dictionary

- Document Designer

- Checking counterparties

- ETALON-Standard

- ETALON.

Register

Register - REFERENCE. Chief Accountant

- REFERENCE. Lawyer

- GUARANTEE. RF legislation

Specialized resources

- Reference information

- Calculators

- Foreign exchange rates

- Refinancing rate of the National Bank of the Republic of Belarus

- Production calendar

- Estimated working hours per year

- Information about holidays and memorable dates

- Tariff rate of the first category

- Base rate

- Minimum wage

- Average wages of workers and employees

- Norms for payment of travel expenses

- Forms of travel certificates

- Subsistence minimum budget

- Minimum consumer budget

- Government benefits

- Base value

- Basic rental value

- Tax rates (republican)

- Tax reporting forms

- Price indices in the Republic of Belarus

- Prices for precious metals

- Coefficients of change in the cost of types (groups) of fixed assets

- Linear Fuel Rates

- News

- Legal overview

- Important things in a nutshell

- Competent opinion

- Shares

- About the system

- Description

- How to connect

- Operator policy

- Contacts

- User Manual

- Public contracts

About

- New documents

- New documents for the week

- New documents for the month

- Codes

- Banking Code of the Republic of Belarus

- Budget Code of the Republic of Belarus

- Water Code of the Republic of Belarus

- Air Code of the Republic of Belarus

- Civil Code of the Republic of Belarus

- Civil Procedure Code of the Republic of Belarus

- Housing Code of the Republic of Belarus

- Electoral Code of the Republic of Belarus

- Code of the Republic of Belarus on marriage and family

- Land Code of the Republic of Belarus

- Subsoil Code of the Republic of Belarus

- Code of the Republic of Belarus on the judiciary and the status of judges

- Code of the Republic of Belarus on Administrative Offenses

- Code of the Republic of Belarus on Education

- Code of Inland Water Transport of the Republic of Belarus

- Merchant Shipping Code of the Republic of Belarus

- Codex of the Republic of Belarus Ab Culture

- Forest Code of the Republic of Belarus

- Tax Code of the Republic of Belarus (General Part)

- Tax Code of the Republic of Belarus (Special Part)

- Procedural-executive code of the Republic of Belarus on administrative offenses

- Labor Code of the Republic of Belarus

- Penal Code of the Republic of Belarus

- Code of Criminal Procedure of the Republic of Belarus

- Criminal Code of the Republic of Belarus

- Economic Procedure Code of the Republic of Belarus

- Customs Code of the Eurasian Economic Union

- Documents by topic

- Administrative procedures

- To help the accountant and economist

- To help an ideological worker

- To help the personnel officer

- State bodies of the Republic of Belarus (officials) and other state organizations

- Eurasian economic integration

- Purchasing

- Healthcare

- Individual entrepreneur

- Informatization

- Codes of the Republic of Belarus

- Rulemaking

- Education

- Rights of minors

- Sports law

- Litigation

- Labor and trade union movement

- Centers for ensuring the activities of budgetary organizations

- Electronic library of scientific works in the field of law

- Technical regulations

- Specialized Resources

- Calculators

- Law Dictionary

- Document Designer

- Checking counterparties

- ETALON-Standard

- ETALON.

Register

Register - REFERENCE. Chief Accountant

- REFERENCE. Lawyer

- GUARANTEE. RF legislation

- Reference information

- Calculators

- Foreign exchange rates

- Refinancing rate of the National Bank of the Republic of Belarus

- Production calendar

- Estimated working hours per year

- Information about holidays and memorable dates

- Tariff rate of the first category

- Base rate

- Minimum wage

- Average wages of workers and employees

- Norms for payment of travel expenses

- Forms of travel certificates

- Subsistence minimum budget

- Minimum consumer budget

- Government benefits

- Base value

- Basic rental value

- Tax rates (republican)

- Tax reporting forms

- Price indices in the Republic of Belarus

- Prices for precious metals

- Coefficients of change in the cost of types (groups) of fixed assets

- Linear Fuel Rates

- News

- Legal overview

- Important things in a nutshell

- Competent opinion

- Shares

- About the system

- Description

- How to connect

- Operator policy

- Contacts

- User Manual

- Public contracts

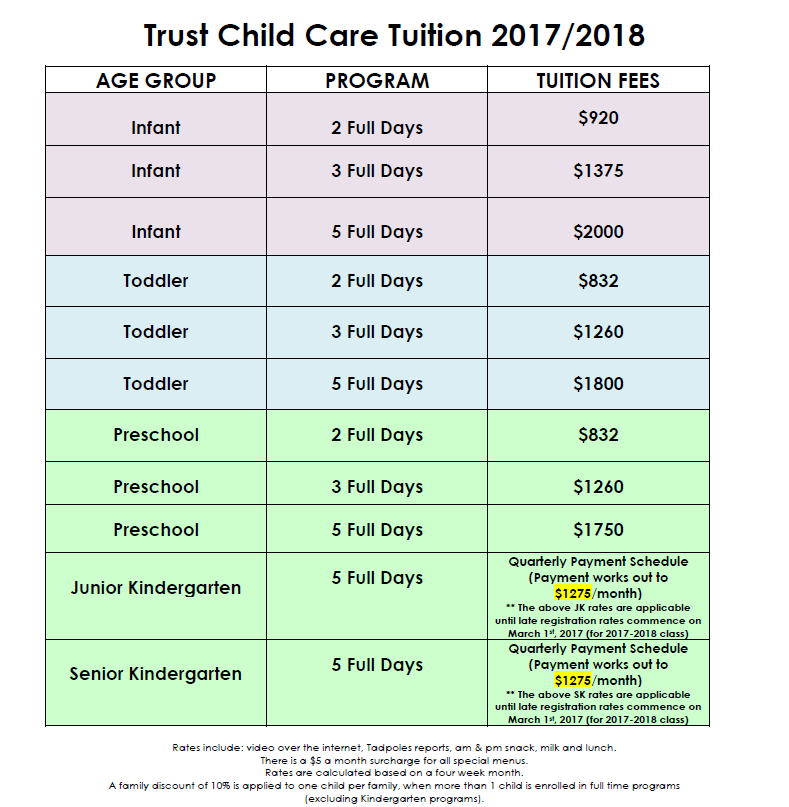

| Benefit calculated from the average monthly salary of workers in the republic | Benefit amount | Amount, in rubles | Amount, in rubles | Amount, in rubles |

|

|

| from 08/01/2021 to 01/31/2022 | from 02/01/2022 to 07/31/2022 | from 08/01/2022 to 01/31/2023 |

|

| ||

| Benefit for caring for a child aged up to 3 years (monthly): |

|

|

|

|

|

|

| on first child | 35 percent of the average monthly salary | 495. | 539.56 | 556.05 |

|

|

| on second and subsequent children | 40 percent of the average monthly salary | 566.56 | 616.64 | 635.48 |

|

|

| on disabled child under 3 years old | 45 percent of the average monthly salary | 637.38 | 693.72 | 714.92 |

|

|

|

|

|

|

|

|

|

|

| Benefit calculated from the subsistence minimum budget per capita on average | Benefit amount | Amount, in rubles | Amount, in rubles | Amount, in rubles | Amount, in rubles | Amount, in rubles |

| from 11/01/2021 to 01/31/2022 | from 02/01/2022 to 04/30/2022 | from 05/01/2022 to 07/31/2022 | from 08/01/2022 to 31. | from 11/01/2022 to 01/31/2023 | ||

| Childbirth allowance (one-time): |

|

|

|

|

|

|

| at birth of the first child | 10 times the highest living wage budget, valid on the date of birth of the child | 2880.10 | 2965.50 | 3111.50 | 3285.00 | 3398.30 |

| at birth of the second and subsequent children | 14 times the highest living wage budget, valid on the date of birth of the child | 4032. | 4151.70 | 4356.10 | 4599.00 | 4757.62 |

| Allowance for registered women health care organizations up to 12 weeks of gestation (one-time) | 100 percent of the largest subsistence budget minimum effective on the date of birth of the child | 288.01 | 296.55 | 311.15 | 328.50 | 339.83 |

| Family allowance for children aged 3 and over up to 18 years of age while raising a child under 3 years of age (monthly) | 50 percent of the largest subsistence budget minimum | 144.01 | 148. | 155.58 | 164.25 | 169.92 |

| Benefit for children over 3 years of age certain categories of families provided for by law (monthly): |

|

|

|

|

|

|

| on children over 3 years of age raised in such families (except disabled child) | 50 percent of the largest subsistence budget minimum | 144.01 | 148.28 | 155.58 | 164.25 | 169.92 |

| on disabled child older than 3 years | 70 percent of the largest subsistence budget minimum | 201. | 207.59 | 217.81 | 229.95 | 237.88 |

| Disabled Child Care Allowance under the age of 18 (monthly) |

|

|

|

|

|

|

| with I and II degree of loss of health before the child is 18 years old and from III and IV degree of loss of health before the child reaches the age of 3 9 years old0007 | 100 percent of the largest subsistence budget minimum | 288.01 | 296.55 | 311.15 | 328.50 | 339. |

| with III and IV degree of loss of health after the child reaches the age of 3 years | 120 percent of the largest subsistence budget minimum | 345.61 | 355.86 | 373.38 | 394.20 | 407.80 |

| Allowance for children under the age of 18, infected with human immunodeficiency virus (monthly) | 70 percent of the largest subsistence budget minimum | 201.61 | 207.59 | 217.81 | 229.95 | 237.88 |

Dimensions state benefits for families raising children for 2021 year.

Dimensions state benefits for families raising children for 2020 year.

74

74  10.2022

10.2022  14

14  28

28  61

61  83

83