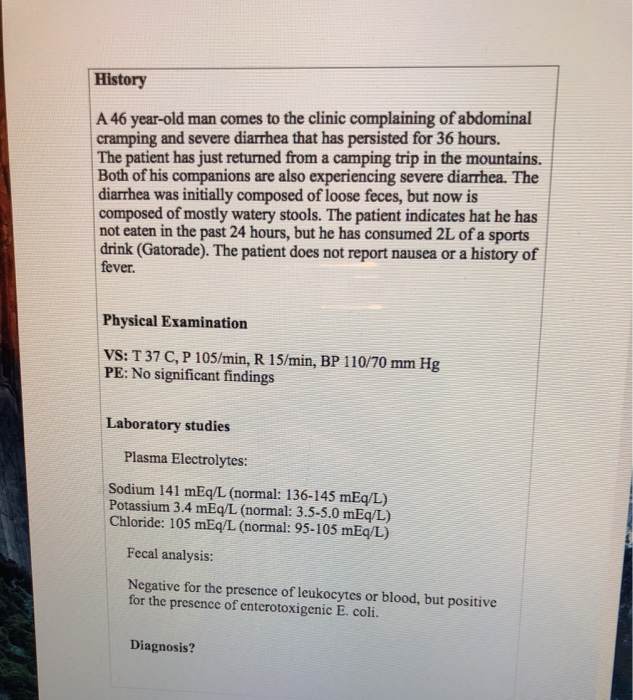

How much do you get on tax return per child

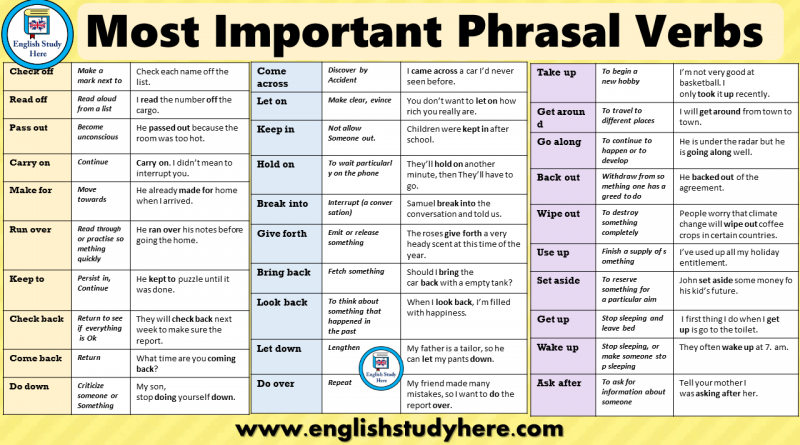

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

2022 Child Tax Credit: Definition, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Here is a list of our partners.

For the 2022 tax year, taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. For the 2022 tax year, people with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent, and $1,500 of that credit may be refundable.

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Determining your eligibility for the credit begins with understanding which children qualify and what other criteria you need to be mindful of.

Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.

g., a grandchild, niece or nephew).

g., a grandchild, niece or nephew).Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

How to calculate the child tax credit

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

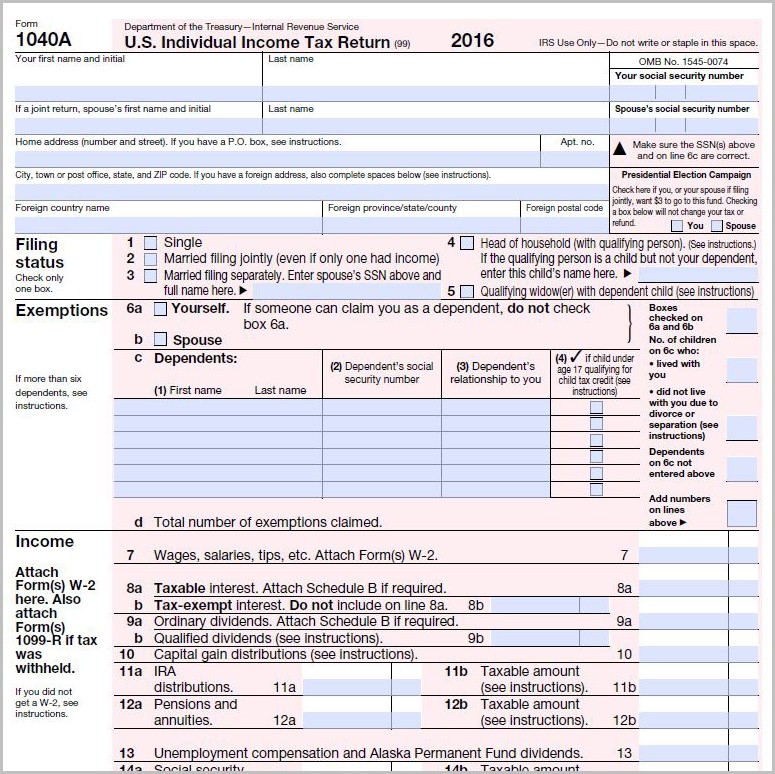

How to claim the credit

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

A word of warning: In the eyes of the IRS, you’re ultimately responsible for all information you submit, even if someone else prepares your return.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the CTC part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

1. Does the CTC include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

2. I had a baby in 2022. Am I eligible for the CTC?

Yes. You'll likely need to make sure your child has a Social Security number before you apply, though.

3. Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

4. Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

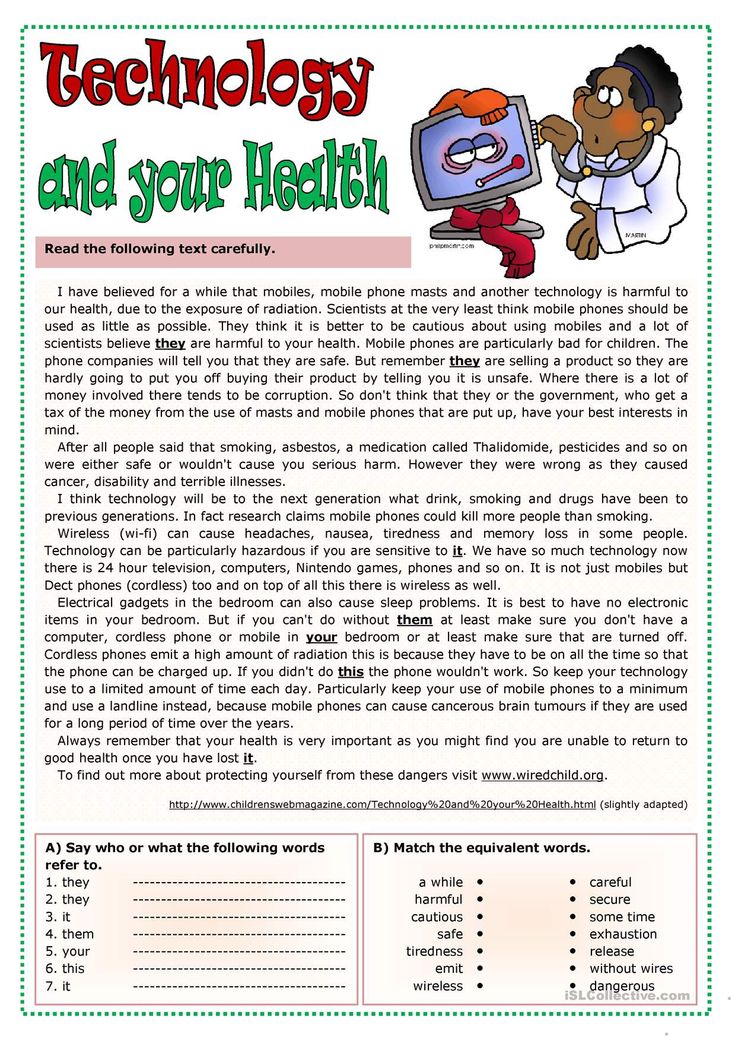

Tax return and notice of tax due

In Finland, taxpayers receive a pre-filled tax return (veroilmoitus) from the Tax Administration in March-April. The tax return contains information about income and tax deductions for the previous year. Most people also receive a notice of the amount of tax due (verotuspäätös) and a tax certificate (verotustodistus) along with the declaration. The tax administration sends the tax return through the OmaVero online service and by mail to the taxpayer's home address. nine0003

- Tax return

- Notice of tax due

- Tax refund and residual tax

Tax return

The tax return (veroilmoitus) states information about income, taxes and tax deductions for the previous year. Check your tax return and correct erroneous or incomplete data via the OmaVero online service. If the information is correct, you don't need to do anything.

Check your tax return and correct erroneous or incomplete data via the OmaVero online service. If the information is correct, you don't need to do anything.

You can use the internet service if you have a Finnish internet bank account or mobile ID. You can correct any data in OmaVero. If you are filing on paper, make corrections on the separate forms that appear on your tax return for each item. Please note that the forms must be submitted to the Tax Administration no later than the date shown on the tax return. nine0003

External link Verohallinto

Tax return and notice of tax due External link The tax administration issues part of the tax deductions automatically, but some must be processed independently. You can list deductions on your tax card or tax return. nine0003

Tax deductions include, for example:

- income-related expenses

- membership fees of the labor fund and the unemployment fund

- discount for travel between home and work

If you receive wages, the automatic tax deduction for income-related expenses is 750 euros. If your income expenses exceed EUR 750, list them on your tax return. Remote work can also be associated with expenses for which you can receive a tax deduction. Such costs include, for example, the cost of the office space, work tools and communications. nine0003

If your income expenses exceed EUR 750, list them on your tax return. Remote work can also be associated with expenses for which you can receive a tax deduction. Such costs include, for example, the cost of the office space, work tools and communications. nine0003

You can get a tax deduction for travel expenses that go to work and do work. The tax deduction for travel between home and work is calculated based on the cost of traveling by the cheapest available mode of transport. The membership fees of the labor fund and the unemployment fund are fully deducted from the income of an individual.

External resource link Verohallinto

Tax credits External resource link

FinnishSwedishEnglish

Notice of tax due

The total amount of tax for the previous year is shown on your notice of tax due (verotuspäätös). If you make changes to your pre-filled tax return, or if the IRS receives information that affects your tax amount from some other source (such as an employer), you will receive a new notice of tax due. The tax due notice contains calculations of the total tax amount. You may need to be notified of the amount of tax due, for example, when you apply for a rental and when you are charged for your child's daycare. nine0003

The tax due notice contains calculations of the total tax amount. You may need to be notified of the amount of tax due, for example, when you apply for a rental and when you are charged for your child's daycare. nine0003

Keep your pre-filled tax return, notice of tax due, and tax certificate. If necessary, you can also print them via the OmaVero online service.

Tax Refunds and Residual Tax

The notice of tax due states whether you have paid enough taxes. If you have paid more taxes than were actually due, you will receive a tax refund (veronpalautus). If you do not pay enough taxes, you will need to pay the residual tax (jäännösvero). nine0003

Tax refunds are made to the bank account you specified. Provide your bank account number through the OmaVero online service or by completing a separate paper form. If the Tax Administration does not know your bank account number, the tax refund will be made in the form of a postal order or money order through Nordea Bank.

If you didn't pay the tax for the year, you will have to pay the residual tax. The notice of tax due and the OmaVero online service account contain all the information required to pay the residual tax. nine0012 What is the Earned Income Tax Credit?

The Earned Income Tax Credit (EITC) is a credit for low income earners that allows you to receive money from the federal government. Even if you don't earn enough to be taxable, you can still get a one-time earned income tax credit! To receive credit, you must file a federal income tax return and send it to the IRS. nine0003 Massachusetts also has an Earned Income Tax Credit (EIC) that helps low earners get a refund from state government. To receive credit, you must file a state income tax return and mail it to the Massachusetts Department of Revenue. You may be able to get a refund from both the federal and state governments if you file your tax returns and state that you are entitled to these credits. If you did not have children living with you in 2014, you can receive up to $496. If one child lived with you in 2014, you can receive up to $3,305. If you had two children living with you in 2014, you can receive up to $5,460. If you had three or more children living with you in 2014, you can receive up to $6,143. If you receive a federal credit, the State of Massachusetts will also pay you a credit. It will be 15% of what the federal government pays you. For example, if you receive $496 from the federal government, the state will pay you another $74.40. You must have earned income from working for an employer, full-time or part-time in 2014; You must have a valid Social Security Number and: or or or This amount is for unmarried adults. If you are married and filing jointly, add $5,340 to each of the above amounts. As a general rule, the child must be 19 years of age or younger in 2014. but if the child is under 24 in 2014 and is a full-time student. nine0003 also , children of any age are counted if they are completely incapacitated, even if they are adults. Even if you are not a US citizen, you may be entitled to credits if you are a legal permanent resident. You will be able to receive the money from 7-10 days after filing your tax return. No. Getting tax credits will not affect your receipt of welfare (welfare) or food stamps (SNAP/Food Stamps), SSI, Medicaid, or community housing programs. But some programs may have rules about how long you can keep that money in the bank without spending it. See Tax refunds and credits. nine0003 Yes. If there is a program called the Volunteer Tax Assistance Program (VITA), which will point you for free to help you fill out all the paperwork you need. You can search (VITA) by the name of your place of residence or the zip code of a free tax precinct near you, or call 1-800-829-1040. nine0003

nine0003 How much money can you get?

Federal credit

Staff credit

How do I get these credits?

To get a higher tax credit because a child lived with you, how old must the child be?

What if you are not a US citizen? Is it possible to receive these credits?

You also have the option to get them if you are married to a US citizen or legal permanent resident of the US.

You also have the option to get them if you are married to a US citizen or legal permanent resident of the US. How soon can I get the money? nine0013

Will receiving money reduce other public benefits you already receive, such as welfare or food stamps (SNAP/Food Stamps)?

Can I get tax filing help to get money for these credits?