How much do you get for claiming 1 child on your taxes

What is the Child Tax Credit (CTC)? – Get It Back

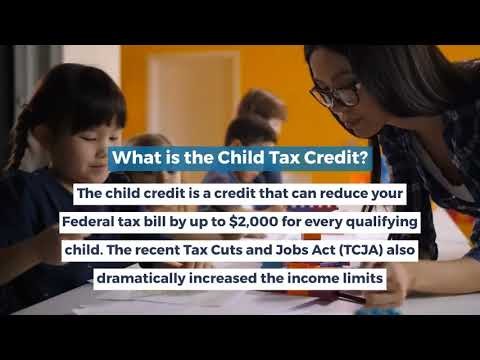

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”.

See below for details.

See below for details. - Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC. org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Tysheonia Edwards, 2022 Get It Back Campaign Intern Identity theft happens when…

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

2022 Child Tax Credit: Definition, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

For the 2022 tax year, taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. For the 2022 tax year, people with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent, and $1,500 of that credit may be refundable.

For the 2022 tax year, people with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent, and $1,500 of that credit may be refundable.

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

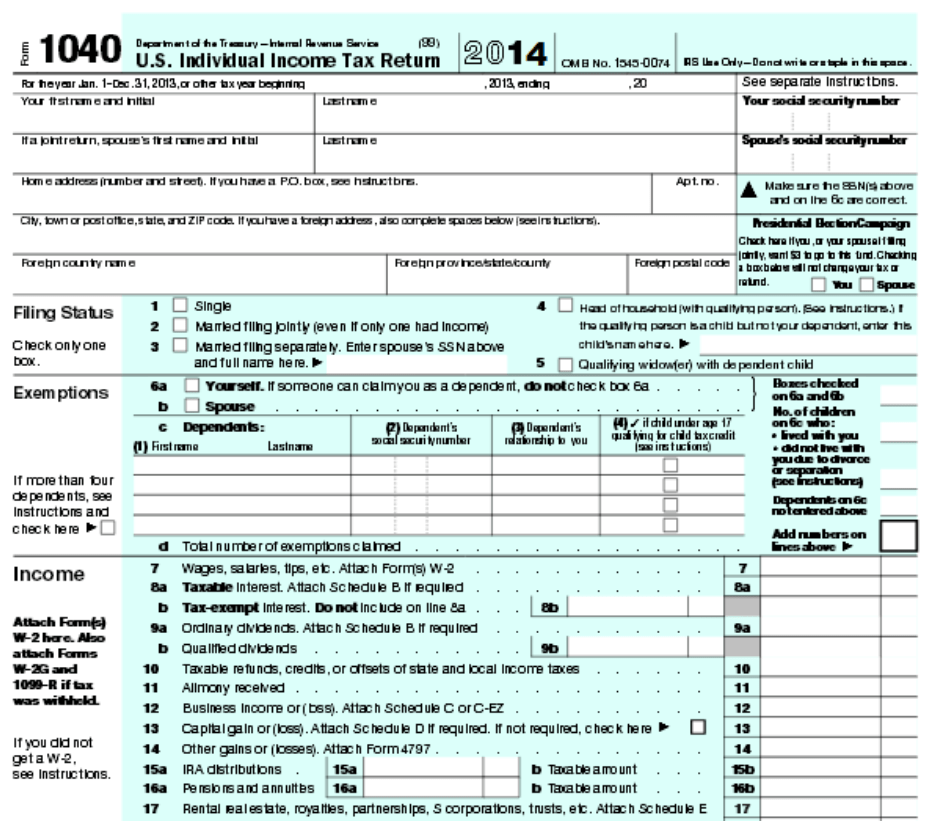

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Determining your eligibility for the credit begins with understanding which children qualify and what other criteria you need to be mindful of.

Determining your eligibility for the credit begins with understanding which children qualify and what other criteria you need to be mindful of.

Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.g., a grandchild, niece or nephew).

Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year.

In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

How to calculate the child tax credit

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

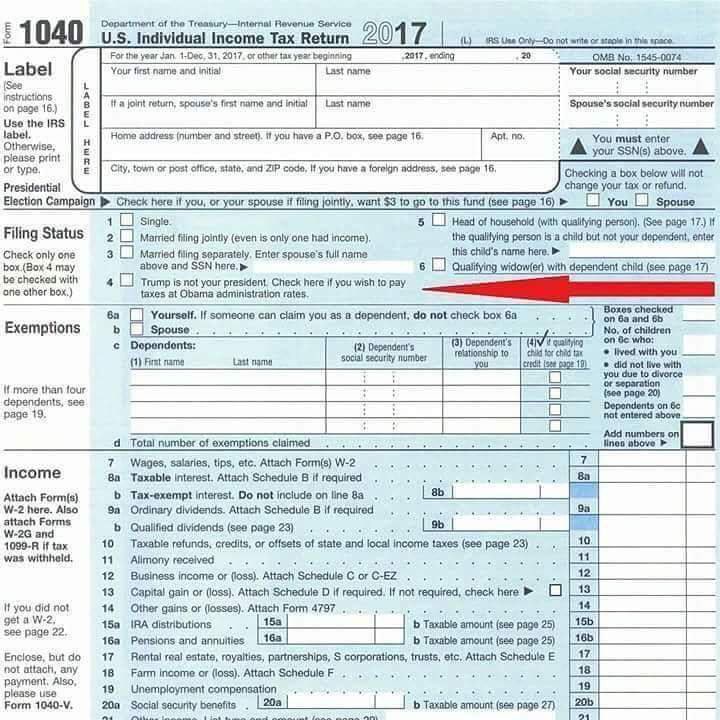

How to claim the credit

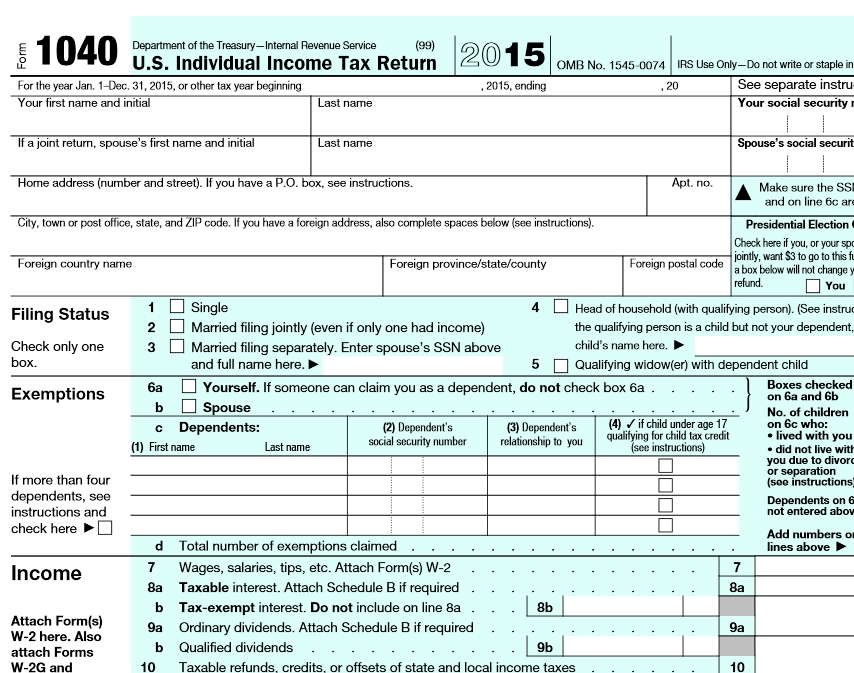

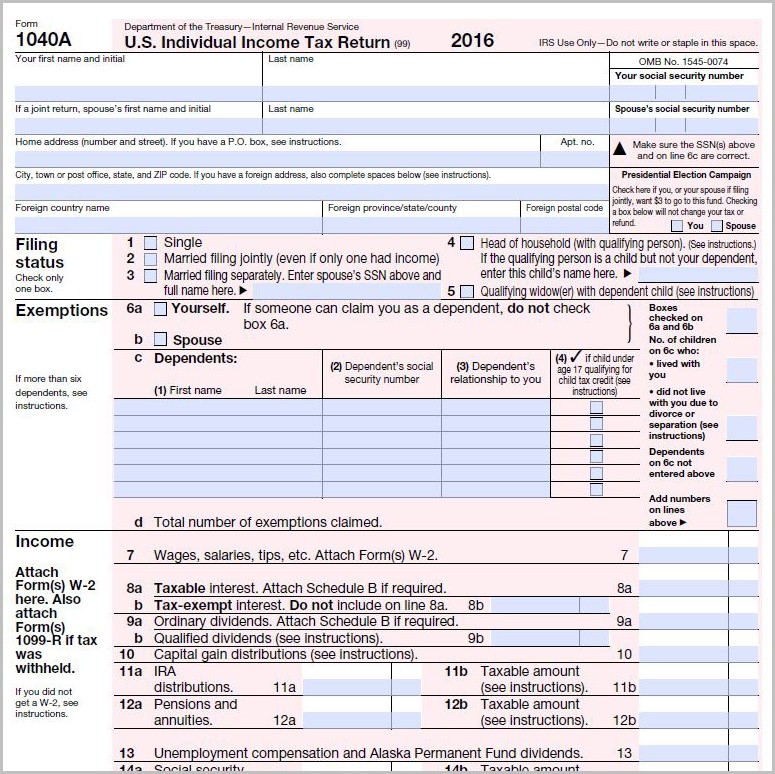

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

A word of warning: In the eyes of the IRS, you’re ultimately responsible for all information you submit, even if someone else prepares your return.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the CTC part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

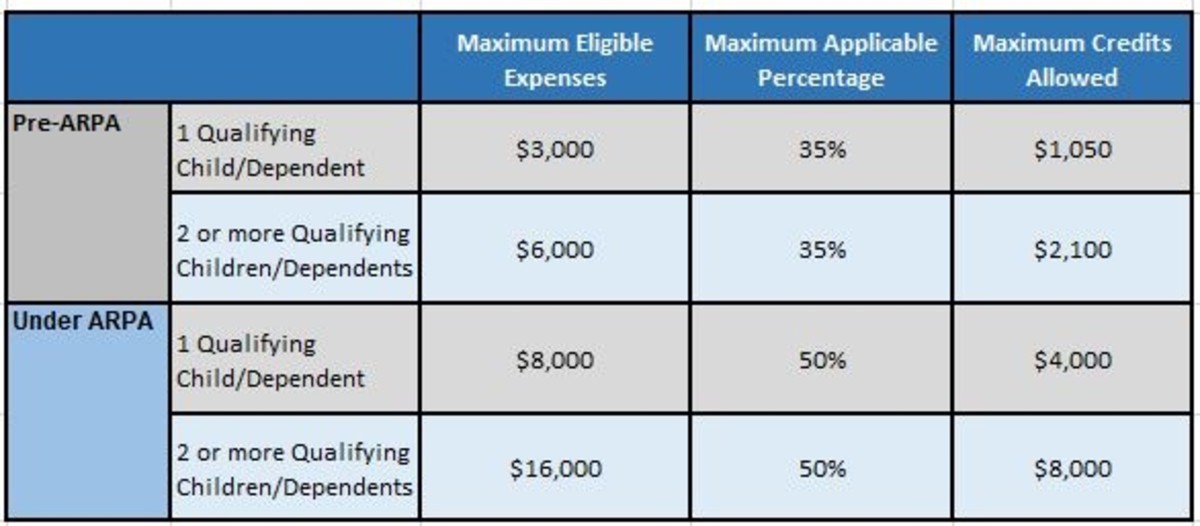

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

1. Does the CTC include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

2. I had a baby in 2022. Am I eligible for the CTC?

Yes. You'll likely need to make sure your child has a Social Security number before you apply, though.

3. Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

4. Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Accounting for tax-free income

Since your tax-free income decreases as your income increases, it is important to know how wages, pensions, benefits, and other types of income affect your tax-free income.

Knowing the amount of your income, you have the opportunity to account for tax-free income in the correct amount already during the year and thus avoid the obligation to pay additional income tax by October 1 of the next year.

How does it affect the amount of tax-free income...

If you receive monthly wages from several employers in excess of 1200 euros, then you should add up all the amounts received for work.

Since the employer does not know about your other income (for example, wages from other employers) and cannot take them into account when determining tax-free income, you yourself must notify one of the employers of the refusal to apply tax-free income or on the application of tax-free income in the amount of less than 500 euros. nine0003

Example

If you earn 1,000 euros per month with two employers, then you have the right to apply the full tax-free income (500 euros) in one workplace, and income tax will be withheld at this workplace only from the remaining 500 euros. At another workplace, tax-free income will not be taken into account and income tax will be deducted from 1000 euros.

Based on your annual income statement, your annual income will be 24,000 euros, the calculated tax-free income will be 666. 62 euros per year and you will have to pay additional income tax by October 1 of the following year. nine0003

62 euros per year and you will have to pay additional income tax by October 1 of the following year. nine0003

To avoid this situation, you must tell your employer that you are waiving tax-free income or that you allow tax-free income to be counted, for example, only in the amount of 55 euros per month.

NB!

- There is a right to apply tax-free income only at one workplace.

If your monthly salary with several employers exceeds 2,100 euros, then the tax-free income for the year will not be applied to your income. nine0014 Ask the employer who has previously accounted for your tax-free income to apply the €0 tax-free income, or do not submit an application for tax-free income in the future. - If you work for several employers at the same time, then the employer who has chosen you to apply tax-free income when withholding income tax must pay social tax at the annual monthly rate. Therefore, when you have more than one employer, it is important to submit an application for the application of tax-free income, even if you ask the employer to take into account the tax-free income of 0 euros.

nine0027

nine0027

If you expect your wages to fluctuate throughout the year, or you are eligible for bonuses, performance bonuses, etc., then it pays to be conservative when determining tax-free income.

Even when the formula-based tax-free income per month can be applied in the amount of 200 euros, it makes sense to submit to the employer an application for applying as tax-free income only, for example, 100 euros per month. In this way, you will avoid having to pay additional income tax on the basis of the annual income tax return by October 1st. nine0003

But if you paid more income tax during the year, then after filing your annual return by April 30, the overpaid income tax will be returned to you. Income tax will also be refunded if you ask your employer not to count tax-free income.

If you are a working pensioner and in addition to your salary you also receive a pension from the Social Insurance Department (including old-age pension, survivor's pension, disability pension, reduced pension and pension supplements) and your monthly income exceeds 1200 euros, then you have to add up the gross amounts of wages and pensions. nine0003

nine0003

A working pensioner who receives both a pension and a salary of less than 500 euros has the right to apply tax-free income in two places, and to submit an application indicating the specific tax-free amount, both to the Social Insurance Board and employer.

It is important to keep in mind that a working pensioner can distribute tax-free income between the employer and the Social Insurance Board in the amount of 500 euros.

Example

A person's pension is 416 euros and salary is 300 euros.

A person has the right to submit an application for the application of tax-free income in the amount of 416 euros to the Social Insurance Board, and an employer to submit an application for the application of tax-free income in the amount of 84 euros.

If, however, you have unexpected income during the year, such as from the sale of real estate or securities, then you can submit a lower amount on your application for tax-free income. In this way, you can avoid the obligation to pay additional income tax by October 1 of the following year. nine0003

nine0003

NB!

Disability pension paid by the Social Insurance Board is included in the annual income and affects the amount of tax-free income.

Disability allowance paid by the Unemployment Insurance Fund is not taken into account in determining annual income and does not affect the amount of tax-free income.

Additional information

Website of the Social Insurance Board "Income tax on benefits and pensions"

If you are a pensioner and there is no other income apart from your pension (including old-age pension, survivor's pension, disability pension, reduced pension and pension supplements), then your total tax-free income is applied to your pension ( 500 Euro).

The amount of non-taxable income depends on the income of working pensioners and persons receiving special preferential pensions, whose monthly income exceeds 1200 euros per month.

NB!

It is important that you submit an application to the Social Security Department for exemption. The application can be submitted via the eesti.ee portal or on site at the Social Insurance Board. nine0003

The application can be submitted via the eesti.ee portal or on site at the Social Insurance Board. nine0003

More information

Social Insurance Board website "Income tax on benefits and pensions"

If you are on parental leave and receive parental benefit, parental benefit is your taxable income. If the parental benefit is less than 1,200 euros per month, then you are entitled to tax-free income of 500 euros per month. If the parental benefit is more than 1200 euros per month, then tax-free income is applied in accordance with the Income Tax Law. nine0003

NB!

If you have filed an exemption application with the Social Insurance Department and you have no other income, then the Social Insurance Department will apply the correct formula-based tax-free tax and you will have no additional tax liability.

Additional information

Website of the Social Insurance Board "Income tax on benefits and pensions"

State benefits paid by the Social Insurance Board (including child allowance, childbirth allowance, child care allowance, etc. ) are not subject to income tax and are not declared in the income tax return.

) are not subject to income tax and are not declared in the income tax return.

NB!

Tax-free benefits do not count towards annual income and do not affect tax-free income.

Additional information

Website of the Social Insurance Board "Income tax on benefits and pensions"

Disability and unemployment benefits are tax-free benefits that are not declared on your income tax return. Disability benefits and unemployment benefits are not taken into account in determining the amount of tax-free income.

NB!

There is a difference with the disability pension, which is taxable income, is taken into account in determining annual income and affects the amount of tax-free income. nine0003

If you receive unemployment benefits from the Unemployment Insurance Fund, this is your taxable income.

If the insurance benefit does not exceed 1,200 euros per month, then you are entitled to tax-free income of 500 euros per month. If the insurance indemnity exceeds EUR 1200, then tax-free income is applied in accordance with the provisions of the Income Tax Law.

NB!

If you have submitted an application to the Unemployment Insurance Fund for the application of tax-free income and you have no other income, then the Unemployment Insurance Fund will apply the correct tax-free tax calculated according to the formula and you will not have additional tax liabilities. nine0003

If you receive dividends during the year taxed at the company level at the ordinary tax rate of 20/80, then this is your income, which is taken into account in determining the annual income.

In the income statement, the amount of dividends transferred to you, or the money you receive (table 7.1) is taken into account as annual income, and this affects the amount of tax-free income.

At the same time, if you receive dividends from abroad, from which income tax is withheld or paid in a foreign country, then the so-called gross amount of dividends is taken into account as annual income, i.e. received dividends together with income tax withheld or paid in a foreign country. nine0003

nine0003

If you receive dividends during the year that are taxed at company level at a lower tax rate of 14/86 and from which income tax of 7% has been withheld, then this is your taxable income, which also affects the amount of non-taxable income.

The amounts transferred to the business account, from which a part of the social tax has been deducted, are taken into account in the annual income and affect the amount of your tax-exempt income.

Additional information

Entrepreneur account

If during the year you receive income, for example from the sale of property (from the sale of real estate, from the sale of securities, from the sale of timber or from the alienation of the right to cut down a growing forest), then this income is taxable and affects the amount tax-free income.

If you know in advance that in addition to wages and/or pensions you will also have income from the disposal of property, you can notify the employer or the Social Insurance Board, i. e. the one to whom the application for the application of tax-free income was submitted , that you waive the application of tax-free income in whole or in part. nine0003

e. the one to whom the application for the application of tax-free income was submitted , that you waive the application of tax-free income in whole or in part. nine0003

NB!

Tax-free income from the sale of one's place of residence or income from the sale of movable things that are in personal use are not declared in the annual income statement and are not taken into account in determining annual income for determining tax-free income.

The taxation of the funded pension payment depends on the conditions of payment and can be either tax-free or subject to income tax at a rate of 20% or 10%.

Read more on the web page "Taxation of pensions from January 1, 2021".

Tax-free mandatory funded pension payments are not declared in the income statement of an individual, are not taken into account in his annual income and do not affect the amount of tax-free income.

State pension (I pillar) paid by the Department of Social Affairs and mandatory funded pension (II pillar) paid by the Pension Center or an insurance company, taxed at 20% or 10%, are taxable income, which is also declared in the declaration on the income of an individual, but with the difference that the state pension is included in the annual income and affects the amount of tax-free income, while payments under the mandatory funded pension (II pillar) are not included in the annual income and do not affect the amount of non-taxable income. taxable income. nine0003

taxable income. nine0003

Links

Examples of calculating total tax-free income

It is still possible to deduct contributions to the supplementary funded pension, or III pillar, up to 15% of a person's taxable income in Estonia, or up to 6,000 euros per year.

The taxation of the payment of the additional funded pension depends on the conditions of payment and can be either tax-free or subject to income tax at a rate of 20% or 10%.

Read more on the webpage " Taxation of pensions from January 1, 2021 ".

Tax-free supplementary funded pension payments are not declared in the income tax return of an individual, are not taken into account as annual income and do not affect the amount of tax-free income.

Supplementary funded pension payment (III pillar) from the Pension Center or an insurance company, taxed at 20% or 10%, is taxable income, which is declared in the income tax return, except that the payment, taxed at 20% is included in annual income and affects the amount of tax-free income, and the taxable payment of 10% is not included in annual income and does not affect the amount of tax-free income. nine0003

nine0003

Links

Examples of calculating the total tax-free income

How to get a certificate of non-receipt of a tax deduction

05.05.2021

Such a certificate is needed if for some reason you terminated the insurance contract ahead of schedule and did not receive a tax deduction from the state. If you have a debt, a certificate will help you clear it.

Why debt arises

nine0002 If you did not receive a tax deduction, you do not need to pay the debt.The appearance of debt is a standard security measure on the part of the state, so that those who receive the deduction immediately return it.

A certificate of non-receipt of a tax deduction can be obtained from the tax office in person or online.

Step 1

Get a certificate from the tax office

Step 2

Send help to us

How to get a tax certificate online

You can get help online in a few minutes. You must have an account on nalog.ru or on State Services.

You must have an account on nalog.ru or on State Services.

- Log in to your personal tax office

- Go to the section "Life situations"

- Select the relevant certificate

- Fill in all fields of the application

Go to nalog.ru and log in to your personal account: using your login and password, using an electronic signature, or through your account on the State Services.

Next, find "All life situations" and click on "Request help and other documents."

Click on "Get a certificate confirming the fact of receipt (non-receipt) of a social deduction.

It is important to fill out the application correctly - a sample of the correct certificate and how its fields should be filled in can be viewed here. nine0003

The tax office will send you a certificate in several files. Please send us all the files you receive from the tax office.

How to get a certificate from the tax office

You can get a certificate at the tax office of your place of residence ( it will take about 30 times longer than obtaining a certificate online ).

There are often errors in certificates - check it after receiving it without leaving the tax office. nine0003

Sample certificate can be viewed here.

- Select the nearest tax office

- Prepare a package of documents

- Apply in person or by Russian Post

- Wait until the help is ready

It is not necessary to apply to the inspection at the permanent registration address. Choose the nearest inspection to you.

Will need to submit:

- A copy of the life insurance contract - can be downloaded in your personal account

- A copy of payment documents confirming the payment of contributions - can be downloaded in your personal account

- A written application for a certificate - the form will be provided at the tax office

A package of documents can be sent by mail. Send them by registered mail with acknowledgment of receipt and a description of the attachment.

This takes some time.