How much claiming a child on taxes

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

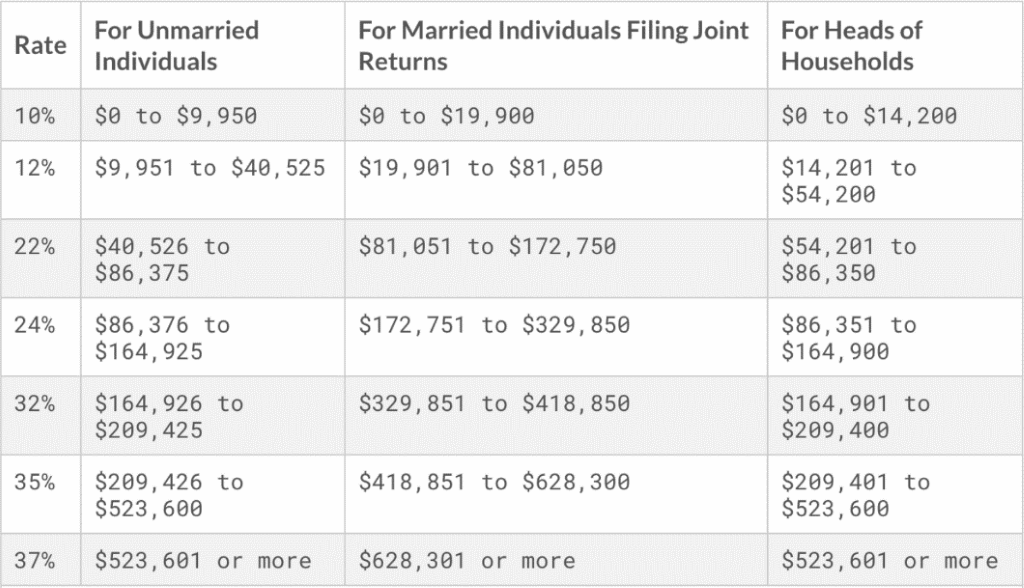

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

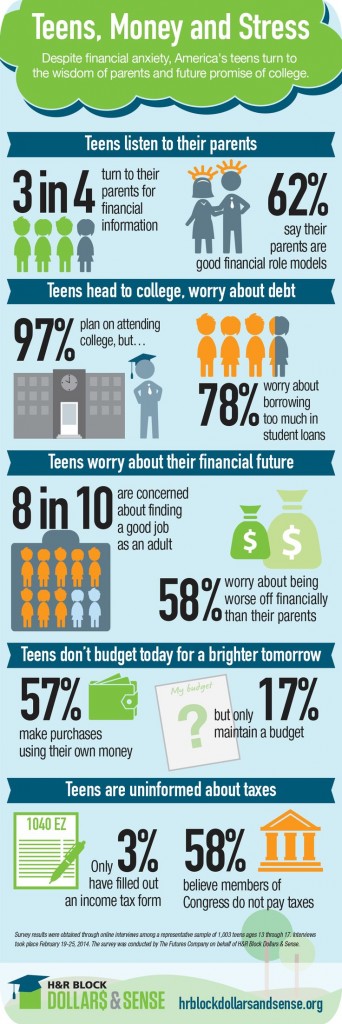

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”.

See below for details.

See below for details. - Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC. org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Reagan Van Coutren, 2022 Get It Back Campaign Intern You can file…

These are the income guidelines and credit amounts to claim the Earned Income…

By Tysheonia Edwards, 2022 Get It Back Campaign Intern Identity theft happens when…

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. Sabrina earned a master's degree in publishing at Portland State University.

Learn More

and

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Her work has appeared in a variety of local and national media outlets. Email: <a href="mailto:[email protected]">[email protected]</a>.

She has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Her work has appeared in a variety of local and national media outlets. Email: <a href="mailto:[email protected]">[email protected]</a>.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:[email protected]">[email protected]</a>.

Email: <a href="mailto:[email protected]">[email protected]</a>.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.

g., a grandchild, niece or nephew).

g., a grandchild, niece or nephew).Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

How to calculate the child tax credit

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

How to claim the credit

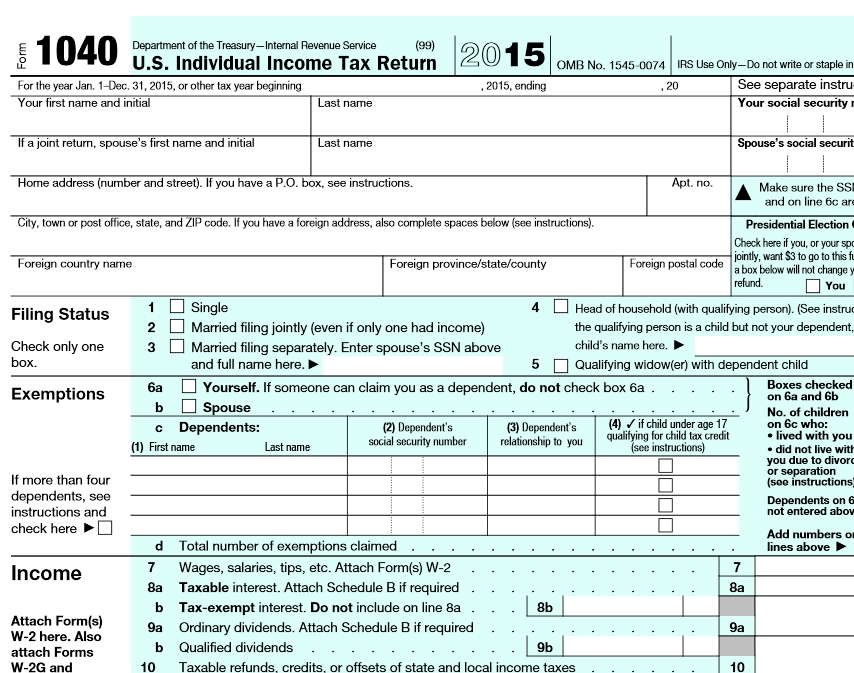

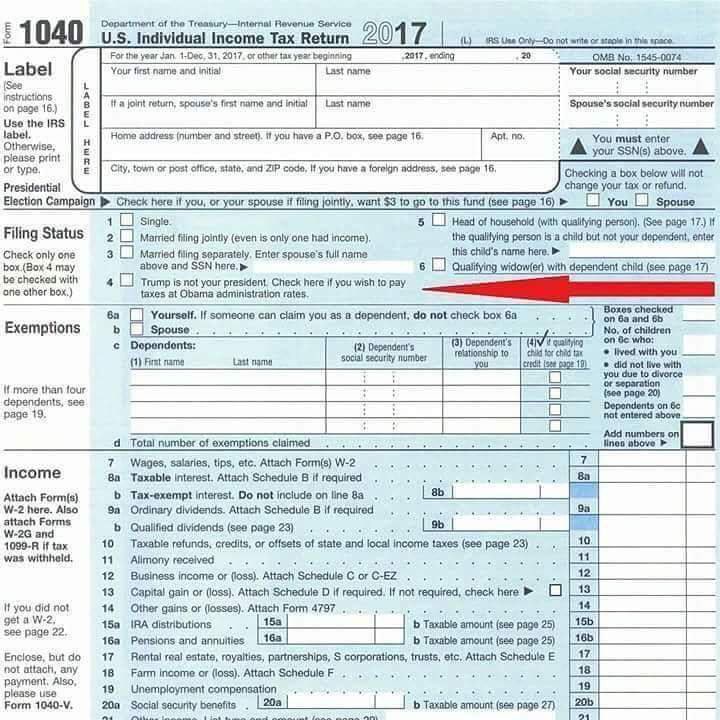

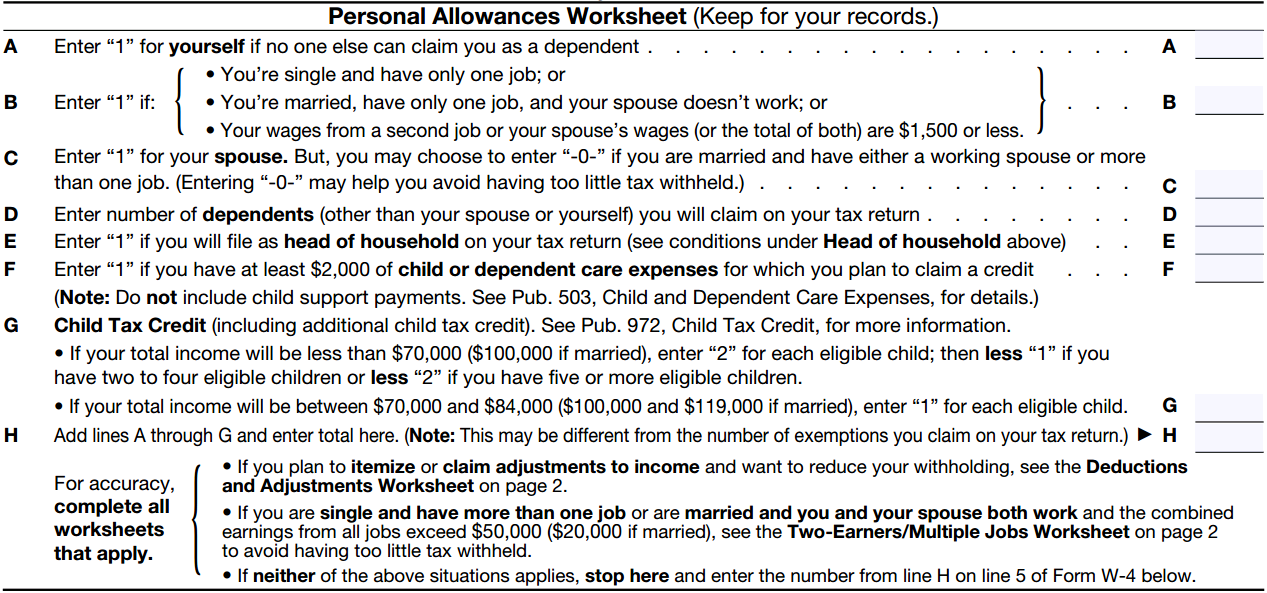

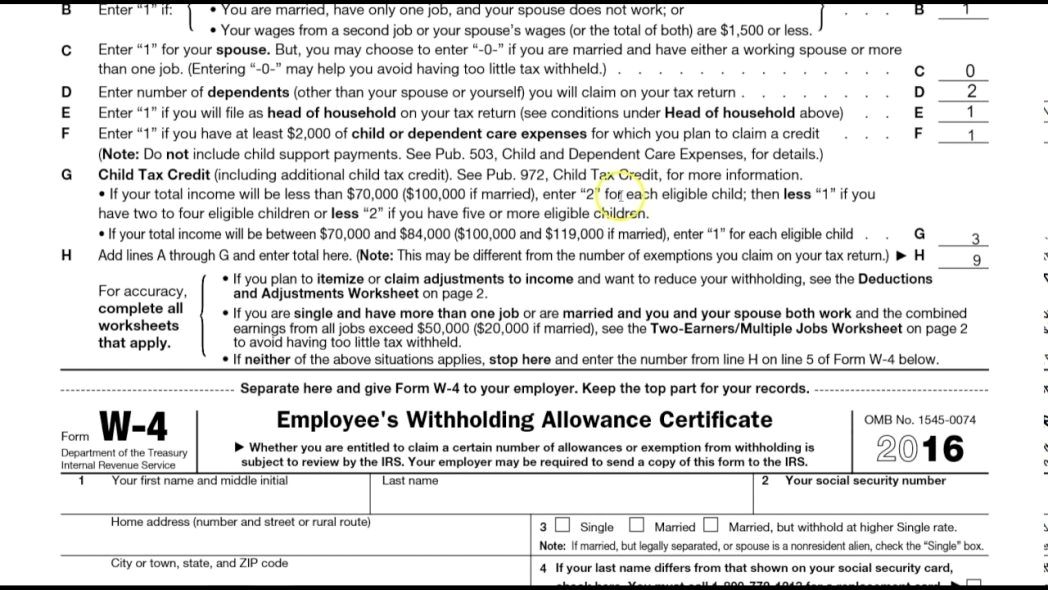

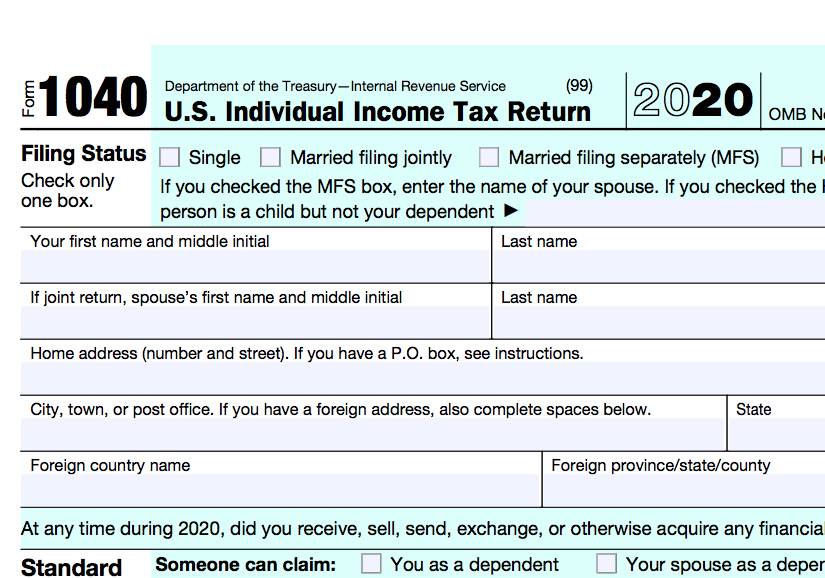

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

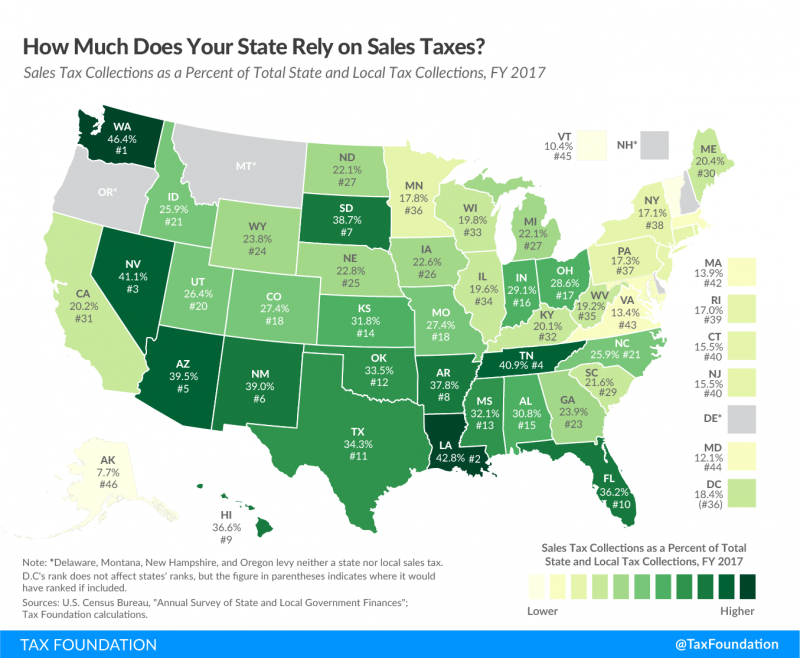

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

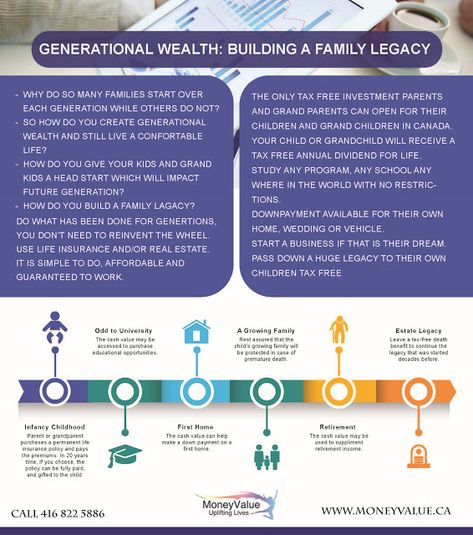

History of the CTC

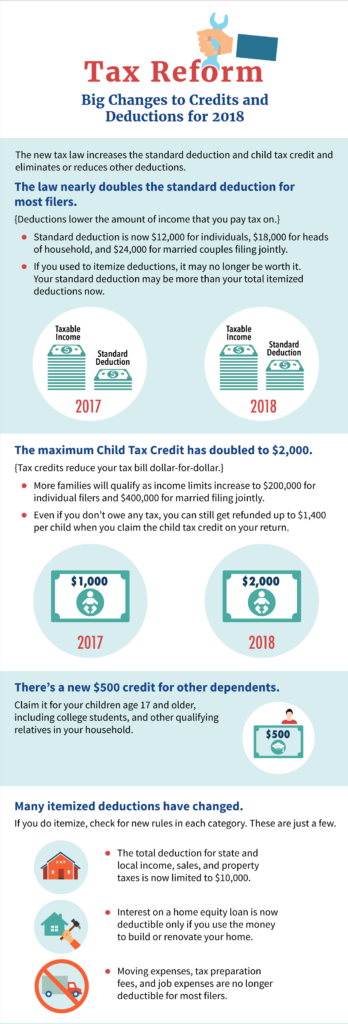

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only.

This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll likely need to make sure your child has a Social Security number before you apply, though.

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

One-time allowance for the birth of a child

The applicant has the right to file a complaint against the decisions and (or) actions (inaction) of the authorized body, its officials in the provision of public services (complaint), including in the pre-trial (out of court) procedure in the following cases:

- violation of the application registration deadline;

- violation of the term for the provision of public services;

- requirement from the applicant of documents, information or actions not provided for by the regulatory legal acts of the Russian Federation for the provision of public services; nine0006

- refusal to provide a public service, if the grounds for refusal are not provided for by federal laws and other regulatory legal acts of the Russian Federation adopted in accordance with them;

- refusal to accept documents, the submission of which is provided for by regulatory legal acts of the Russian Federation for the provision of public services;

- requesting from the applicant, when providing a public service, a fee not provided for by the regulatory legal acts of the Russian Federation; nine0006

- refusal of the authorized body, its officials to correct the misprints and errors made by them in the documents issued as a result of the provision of public services or violation of the deadline for such corrections;

- violation of the term or procedure for issuing documents based on the results of the provision of public services;

- suspension of the provision of public services, if the grounds for suspension are not provided for by federal laws and other regulatory legal acts of the Russian Federation adopted in accordance with them, laws and other regulatory legal acts of the constituent entities of the Russian Federation, municipal legal acts.

nine0006

nine0006

Subject of complaint

The subject of the complaint is a violation of the rights and legitimate interests of the applicant, unlawful decisions and (or) actions (inaction) of the authorized body, its officials in the provision of public services, violation of the provisions of the administrative regulations and other regulatory legal acts that establish requirements for the provision of public services.

Ways to make a complaint

A citizen has the right to file a complaint in writing on paper by mail or in person to any PFR Client Service, as well as in electronic form:

- on the official website pfr.gov.ru;

- portal vashkontrol.ru;

- portal do.gosuslugi.ru.

The reason for the appeal may be dissatisfaction with the quality of the provision of public services by the PFR, violation of the terms for the provision of services, violation of the terms for registering a request for a service, refusal to correct errors or typos, refusal to provide a public service, refusal to accept documents, demand for an additional fee. nine0003

nine0003

Procedure for filing and handling a complaint

The complaint must contain:

- name of the authorized body, last name, first name, patronymic (if any) of its officials providing public services, and (or) their leaders, decisions and actions (inaction) of which are being appealed;

- last name, first name, patronymic (if any) of the applicant, information about the place of residence, as well as contact phone number (numbers), e-mail address (s) (if any) and postal address to which the answer should be sent to the applicant; nine0006

- information about the appealed decisions and (or) actions (inaction) of the authorized body, an official of the authorized body, its head;

- arguments on the basis of which the applicant does not agree with the decisions and (or) actions (inaction) of the authorized body, an official of the authorized body, its head.

The applicant shall submit documents (if any) confirming his arguments or copies thereof. nine0003

nine0003

When filing a complaint in electronic form, the documents specified in paragraph 106 of the administrative regulations may be submitted in the form of an electronic document signed with an electronic signature, the form of which is provided for by the legislation of the Russian Federation. In this case, an identity document of the applicant is not required.

In the authorized body, officials authorized to consider complaints are determined, who ensure:

- receiving and handling complaints;

- sending complaints to the body authorized to consider them.

Complaints against decisions and (or) actions (inaction) of an official of the authorized body are considered by the head of the authorized body or an official of the authorized body authorized to consider complaints. Complaints against decisions and (or) actions (inaction) of the head of the authorized body are considered by an official of the executive authority of the constituent entity of the Russian Federation authorized to consider complaints. nine0003

nine0003

If the complaint is filed by the applicant with a body whose competence does not include making a decision on the complaint, within 3 working days from the date of its registration, the said body sends the complaint to the body authorized to consider it and informs the complainant in writing about the redirection of the complaint.

The authorized body ensures:

- equipment for receiving complaints;

- informing applicants about the procedure for appealing against decisions and (or) actions (inaction) of the authorized body, officials of the authorized body by posting information on information boards in places where public services are provided, on the website of the authorized body, on the Single portal, service portal; nine0006

- advising applicants on the procedure for appealing against decisions and (or) actions (inaction) of the authorized body, officials of the authorized body at a personal appointment, by phone, using the website of the authorized body;

- conclusion of agreements on interaction between the multifunctional center and the authorized body in terms of the implementation by the multifunctional center of receiving complaints and issuing the results of consideration of complaints to the applicant;

- formation and quarterly submission to the Federal Service for Labor and Employment of reports on received and considered complaints (including the number of satisfied and unsatisfied complaints).

nine0006

nine0006

Deadlines for considering a complaint

A complaint received by the authorized body shall be subject to registration no later than the working day following the day of its receipt.

The complaint is subject to consideration within 15 working days from the date of its registration, and in the event of an appeal against the refusal of the authorized body to accept documents from the applicant or to correct misprints and errors, or in the event of an appeal against a violation of the established deadline for such corrections - within 5 working days from the date of its registration. nine0003

Result of consideration of the complaint

The result of the consideration of the complaint is the adoption of one of the following decisions:

- satisfy the complaint, including in the form of cancellation of the decision made by the authorized body, correction of typos and errors in documents issued as a result of the provision of public services, return to the applicant of funds, the collection of which is not provided for by the regulatory legal acts of the Russian Federation, regulatory legal acts of the subjects Russian Federation, municipal legal acts; nine0006

- refuse to satisfy the complaint.

When satisfying the complaint, the authorized body takes comprehensive measures to eliminate the identified violations, including the issuance of the result of the public service to the applicant no later than 5 working days from the date of the relevant decision, unless otherwise provided by the legislation of the Russian Federation.

A complaint may be denied in the following cases:

- availability of a court decision that has entered into legal force on a complaint about the same subject and on the same grounds;

- filing a complaint by a person whose powers have not been confirmed in the manner prescribed by the legislation of the Russian Federation;

- the presence of a decision on a complaint made earlier in accordance with the requirements of the Rules for filing and considering complaints against decisions and actions (inaction) of federal executive bodies and their officials, federal civil servants, officials of state non-budgetary funds of the Russian Federation, state corporations endowed with in accordance with federal laws, the powers to provide public services in the established field of activity, and their officials, organizations provided for by Part 1.

1 of Article 16 of the Federal Law "On the organization of the provision of state and municipal services", and their employees, as well as multifunctional centers for the provision of state and municipal services and their employees, approved by Decree of the Government of the Russian Federation No. 840 dated August 16, 2012, in respect of the same applicant and on the same subject of the complaint. nine0006

1 of Article 16 of the Federal Law "On the organization of the provision of state and municipal services", and their employees, as well as multifunctional centers for the provision of state and municipal services and their employees, approved by Decree of the Government of the Russian Federation No. 840 dated August 16, 2012, in respect of the same applicant and on the same subject of the complaint. nine0006

A complaint may be left unanswered in the following cases:

- presence in the complaint of obscene or offensive expressions, threats to life, health and property of an official of the authorized body, as well as members of his family;

- the inability to read any part of the text of the complaint, the last name, first name, patronymic (if any) and (or) the postal address of the applicant indicated in the complaint.

In response to the results of the consideration of the complaint, the following shall be indicated: nine0003

- name of the public service provider that considered the complaint, position, last name, first name, patronymic (if any) of the official who made the decision on the complaint;

- number, date, place of the decision, including information about the official of the authorized body, the decision and (or) action (omission) of which is being appealed;

- last name, first name, patronymic (if any) of the applicant;

- grounds for making a decision on the complaint; nine0006

- decision made on the complaint;

- if the complaint is found to be justified, the terms for eliminating the identified violations, including the term for providing the result of the public service;

- information on the procedure for appealing against the decision taken on the complaint.

In the event that, during or as a result of consideration of a complaint, signs of an administrative offense or crime are established, an official of the authorized body authorized to consider complaints shall send the available materials to the prosecutor's office. nine0003

The procedure for informing the applicant about the results of the consideration of the complaint

A reasoned response based on the results of the consideration of the complaint is signed by the official authorized to consider the complaint and sent to the applicant in writing or, at the request of the applicant, in the form of an electronic document signed by the electronic signature of the official authorized to consider the complaint, the type of which is established by the legislation of the Russian Federation, no later than the day following the day the decision is made on the results of the consideration of the complaint. nine0003

Procedure for appealing a decision on a complaint

The applicant has the right to appeal the decision taken on the complaint by sending it to the Federal Service for Labor and Employment.

If the applicant is not satisfied with the decision made during the consideration of the complaint or the absence of a decision on it, then he has the right to appeal the decision in accordance with the legislation of the Russian Federation.

The applicant's right to receive information and documents necessary to substantiate and consider the complaint

The applicant has the right to receive comprehensive information and documents necessary to substantiate and consider the complaint.

Ways to inform complainants about the procedure for filing and considering a complaint

Information on the procedure for filing and considering a complaint is posted on information stands at the places of provision of public services, on the website of the authorized body, on the Single Portal, Services Portal, and can also be communicated to the applicant orally and (or) in writing. nine0003

List of regulatory legal acts regulating the procedure for pre-trial (out-of-court) appeal against decisions and actions (inaction) of the authorized body, as well as its officials

The procedure for pre-trial (out-of-court) appeals against decisions and actions (inaction) of the body providing the public service, as well as its officials, is regulated by Federal Law No. 210-FZ of July 27, 2010 “On the organization of the provision of state and municipal services” and the Decree of the Government of the Russian Federation of August 16 .2012 No. 840 “On the procedure for filing and considering complaints against decisions and actions (inaction) of federal executive bodies and their officials, federal civil servants, officials of state non-budgetary funds of the Russian Federation, state corporations vested in accordance with federal laws with powers to provision of public services in the established field of activity, and their officials, organizations provided for by Part 1.1 of Article 16 of the Federal Law "On the organization of the provision of state and municipal services", and their employees, as well as multifunctional centers for the provision of I am state and municipal services and their employees”. nine0003

210-FZ of July 27, 2010 “On the organization of the provision of state and municipal services” and the Decree of the Government of the Russian Federation of August 16 .2012 No. 840 “On the procedure for filing and considering complaints against decisions and actions (inaction) of federal executive bodies and their officials, federal civil servants, officials of state non-budgetary funds of the Russian Federation, state corporations vested in accordance with federal laws with powers to provision of public services in the established field of activity, and their officials, organizations provided for by Part 1.1 of Article 16 of the Federal Law "On the organization of the provision of state and municipal services", and their employees, as well as multifunctional centers for the provision of I am state and municipal services and their employees”. nine0003

New Year gifts from social security in 2022-2023: children, the poor, large families

Adygea (Republic)

Pupils from grades 1 to 4 will receive traditional sweet sets. source

source

Altai Territory

Students of grades 1-4, as well as children who need social support, including children of the mobilized, will receive sweet gifts. source

Bashkortostan (republic)

Orphan children brought up in foster and guardian families, as well as children under 14 from families with 5 or more children will receive sweet gifts. source

Belgorod region

Pupils in grades 1-4 will receive "sweet sets" free of charge. The weight of the gift will be 1.8 kg., the set will include 99 types of confectionery source

Vladimir region

. source

Dagestan (republic)

All children of NBO participants will receive New Year gifts. source

Trans-Baikal Territory

New Year's gifts will be given to children of mobilized servicemen from Transbaikalia. source

Ivanovo region

Gifts will be given to disabled children, orphans, children left without parental care, children from families where parents are disabled or non-working pensioners, children of military personnel and members of the SVO. source

source

Kaluga Region

Low-income families and families with disabled children who are registered with the administration and benefit from social support measures can receive free tickets to New Year's performances. source

Kamchatka Territory

1.4 thousand disabled children who live in Kamchatka will receive sweet New Year gifts. source

Kirov region

More than 10 thousand children from low-income families with many children, families in difficult living conditions and children with disabilities will receive New Year's gifts. source

Komi (republic)

Children of SVO participants will receive New Year gifts and will be invited to the Governor's Christmas tree. source

Krasnoyarsk Territory

Children from 3 to 7 years old (not attending schools) from low-income families or families in a socially dangerous situation who are registered with the district departments of social protection can receive New Year's gifts. source

source

Kurgan region

Children of the mobilized, as well as children with disabilities, can count on New Year's gifts. source

Kursk region

Over 42,000 New Year's gifts will be given to children from large and low-income families, children in difficult life situations, as well as children from families of military personnel participating in the SVO. source

Leningrad region

Gifts will be provided to disabled children, as well as large families with low incomes or those who find themselves in a difficult life situation. source

Lipetsk region

Children of families of NWO participants can count on New Year gifts. source

Mordovia (Republic)

75 thousand children under the age of 13 in Mordovia will receive sweet gifts. source

Moscow

Children of the mobilized aged 3 to 13 will receive sweet gifts and will be able to visit the mayor's Christmas tree in Gostiny Dvor. source

source

Nenets Autonomous Okrug

New Year's sets are provided to children from 1 year old who do not attend kindergarten, as well as pupils of preschool educational organizations and elementary school students. source

Nizhny Novgorod Region

Sweet gifts will be given to elementary school students and children attending kindergartens, as well as children from low-income families and children mobilized, volunteers and participants of the SVO. source

Novosibirsk region

Children from low-income families, orphans and children left without parental care, children with disabilities and toddlers who receive social services in the city's social service institutions, children of SVO participants can receive New Year's gifts. source

Omsk region

Orphans, children in difficult life situations, children with disabilities, children of veterans and combatants, children of participants in the SVO, children who have succeeded in their studies can count on New Year's gifts. source

source

Primorsky Krai

Sets of sweets will be given to kids from three years old, junior schoolchildren - up to the fourth grade, children from social service institutions, as well as minors who will end up in hospitals on New Year's holidays. source

Pskov region

The children of the mobilized will receive sweet gifts and an invitation to the governor's Christmas tree. source

Ryazan region

Children aged 2 to 14 inclusive from low-income families with many children, children with disabilities and children of servicemen (employees) who died in the line of duty can receive sweet gifts, source

Samarskaya region

New Year's confectionery sets can be received by children aged 2 to 15 years (inclusive on December 31, 2022), including children in difficult life situations living in large families, orphans, children left without care parents, children with disabilities; 16-17 year old children in a difficult life situation, children living in large families, orphans, children left without parental care, children with disabilities (inclusive as of December 31, 2022). source

source

Saratov Region

Children of Saratov mobilized will receive New Year gifts / source

Stavropol Territory

More than 141 thousand students in grades 1-4 will receive sweet gifts for the New Year. source

Tambov Region

The authorities will distribute 2,727 New Year's gifts for children who will become participants in the Governor's Christmas Tree and other New Year's events, to which children who have achieved success in educational, sports, creative and social activities, as well as children from large families and low-income families, children left without parental care, and children with disabilities. source

Tver region

All children aged 3 to 17 from large families and children with disabilities in the Tver region can count on gifts, regardless of income level. source

Tomsk region

40,000 gifts will be distributed to children aged 1 to 10 from low-income families. source

source

Tula Region

Children from 6 to 14 years old (inclusive) who find themselves in a difficult life situation, children with disabilities aged 6 to 17 years old (inclusive), children of participants in the SVO aged from 6 to 17 years old, children from 6 to 17 years old who arrived from the territory of Ukraine and Russian regions, where the average level of response has been introduced. source

Ulyanovsk Region

Children from low-income families, disabled people, orphans, as well as children aged 3 to 14 can count on New Year gifts. source

Khabarovsk Territory

Children from low-income families aged 2 to 13 years (inclusive) of the following categories have the right to receive New Year's gifts: - children from families in a socially dangerous situation, children with disabilities, including those with diabetes mellitus, children from large families with five or more children. source

source

Since the recipients of New Year's gifts are children and families, it may include:

The exact composition of the gift is determined by local authorities, so it may differ in different cities and regions. You cannot demand an extended gift or replace toys with sweets (and vice versa).

This is also decided by the local authorities. As a rule, poor and large families have the right to receive gifts. A large family must have at least 3 children. The status of a low-income family is confirmed by comparing the average per capita income and the subsistence minimum in the region. If the social security authority has already assigned any payments and benefits, you will not have to re-confirm the status of a low-income family. nine0003

This year, in many regions, children of servicemen and mobilized participants in a special military operation (SVO) can also count on New Year's gifts from regional authorities.

New Year's gifts can be issued upon application or without application.