How much child support can i get in california

California Child Support Laws - Support Calculation, Enforcement, and More

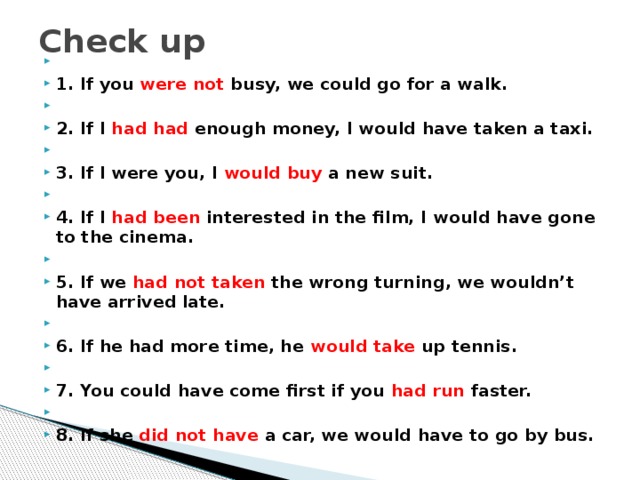

Child support is an ongoing payment by a non-custodial parent to assist with the financial support of their children. Child support payments are often determined during the process of dissolution of a marriage through divorce, though the only requirements for requesting child support payments are establishment of paternity and maternity.

Child support is handled on a state level, and California has a set of specific child support guidelines. On this page you can learn about how child support is calculated in California, how custody split and extraordinary costs affect child support payments, and more.

California uses the "income share" method for calculating child support payments, which is designed to ensure that both the custodial and non-custodial parents contribute to their child's upkeep.

California's child support formula directly accounts for parents who share custody of a child, and support payment amounts are connected to the custody split. Other special situations accounted for under California's child support law include childcare costs and extraordinary medical costs. These costs may be additions to the basic California child support order.

If the court orders a phasein of child support payments, and the court finds evidence that the obligor violated the phasein payment schedule or intentionally lowered their income for paying child support, the court can order the immediate payment of the full formula amount of child support and the difference in the amount of support that would have been due without the phasein schedule and the amount of support due with the phasein, in addition to any other penalties provided for by law.

Whenever the court grants a request for a phasein payment schedule, they will declare the following in writing:

- The specific reasons why

- how the immediate imposition of the full monthly amount would create hardship for the obligor

- how this extraordinary hardship on the obligor would outweigh the hardship caused to the supported children through the temporary phasein of the full amount of support

In any proceeding where there is an issue for the support of a child or a child for whom support is authorized, the court can order either or both parents to pay an amount that is necessary for the support of the child.

Child support can be arranged out of court by a mutual support agreement between the parents, or can be decided in California family court through a child support order. In California, a number of factors are taken into account when determining the amount of child support to be paid in court. Here is an explanation of the two most common methods used to calculate basic child support amounts.

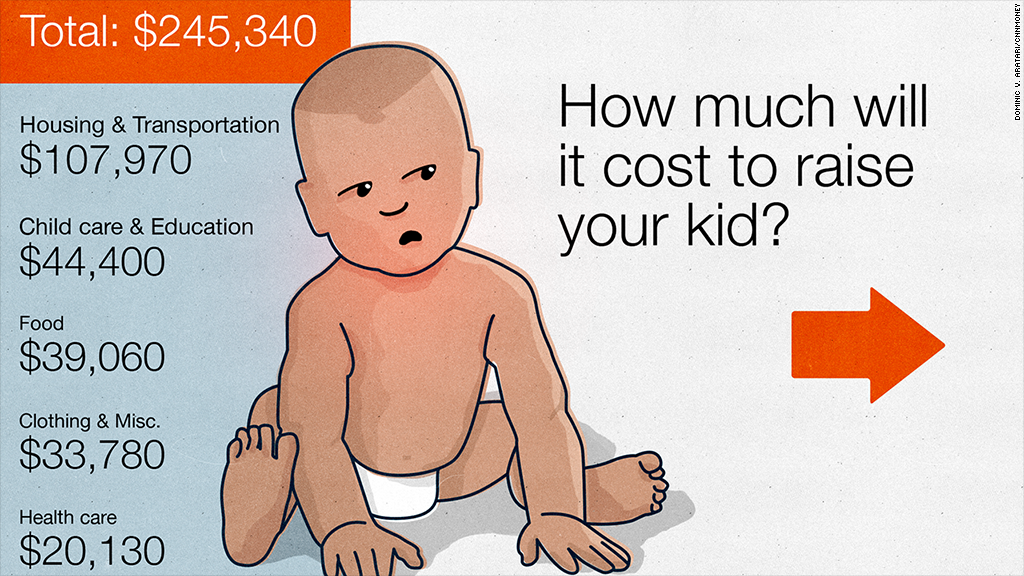

Income Share MethodUnder the income share model, the court uses economic tables to estimate the total monthly cost of raising the children. The non-custodial parent pays a percentage of the calculated cost that is based on their proportional share of both parents' combined income.

Example: The non-custodial parent of one child has an income of $2,000 per month, and the custodial parent has an income of $1,000 per month. The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66. 6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

California does use the income share method to calculate child support

Percentage Of Income MethodThis method of calculating child support is simple - a set percentage of the non-custodial parent's income is paid monthly to the custodial parent to cover basic child support expenses. The percentage paid may stay the same, or vary if the non-custodial parent's income changes.

Example: The non-custodial parent of one child has an income of $2,000 per month. The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent. Therefore, the non-custodial parent pays $500 per month in child support. If the non-custodial parent's monthly income changes, the dollar amount they pay in child support will change as well.

California does not use the percentage of income method to calculate child support

California Child Support FAQ

- How does having shared custody of the child affect child support in California?

- How are extraordinary medical costs treated by child support in California?

- How are child care costs treated by child support in California?

- Does child support cover college education expenses in California?

- How is child support enforced in California?

- What are child support arrears?

- How are child support payments taxed in California?

How does having shared custody of the child affect child support in California?

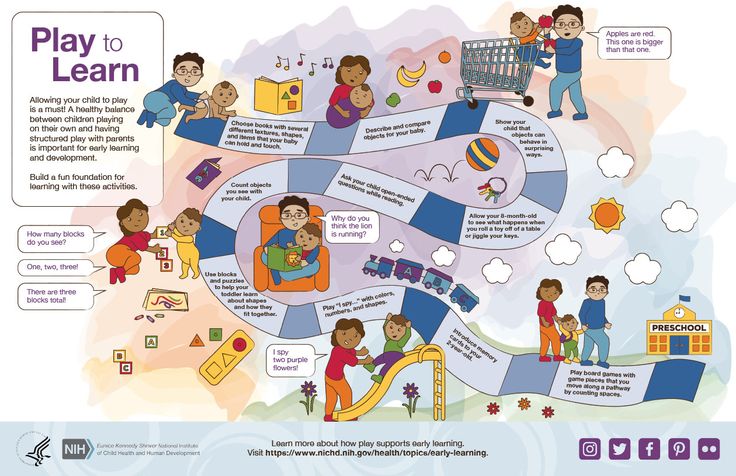

All states have a method of modifying the amount of child support owed in cases where the custody agreement provides for joint or shared custody of a child between both parents.

California law accounts for shared custody of a child directly in the child support formula used to calculate payment amounts. This means that, in cases where custody is shared, the amount of child support paid by the paying parent will be reduced according to the amount of time they have custody of the child.

This means that, in cases where custody is shared, the amount of child support paid by the paying parent will be reduced according to the amount of time they have custody of the child.

How are extraordinary medical costs treated by child support in California?

California has specialized guidelines for the sharing of a child's extraordinary medical care costs that are separate from, and in addition to, basic child support payments. Extraordinary medical costs are generally costs generated by things such as illness, hospital visits, or costly procedures such as getting braces.

California treats extraordinary medical care costs as a "mandatory deduction" for basic child support. This means that if the non-custodial parent pays child care costs, the portion of the total monthly child care costs attributed to the custodial partner are deducted from the noncustodial partner's monthly child support payment. If the custodial parent pays for child care, the non-custodial parent must pay their share in addition to basic child support.

How are child care costs treated by child support in California?

Due to the high costs of child care for a single payment, California has specialized guidelines that consider child care costs separately from the general costs of raising a child for the purposes of calculating child support payments.

California treats child care costs as a "mandatory deduction" for basic child support. This means that if the non-custodial parent pays child care costs, the portion of the total monthly child care costs attributed to the custodial partner are deducted from the noncustodial partner's monthly child support payment. If the custodial parent pays for child care, the non-custodial parent must pay their share in addition to basic child support.

Does child support cover college education expenses in California?

While the state of California has no explicit requirement for college expenses to be covered under child support, support for college expense by the non-custodial parent may be voluntarily agreed to by both parties, after which it is contractually enforceable.

How is child support enforced in California?

In the state of California, child support is enforced by the state child support agency. The state agency handles the location of non-custodial parents, enforcement of support orders, and the handling of unpaid child support arrears.

What are child support arrears?

Child support arrears are the amount of child support that is delinquent, or unpaid, by the noncustodial parent to the custodial parent. Child support arrears may be collected by the state through wage garnishment, bank levy. withholding of California welfare benefits, or other collection methods.

How are child support payments taxed in California?

Under IRS guidelines, the recepient of child support does not need to pay federal tax on child support payments, and the payer of child support cannot deduct their child support payments. This differs from the federal taxation of alimony payments, which are treated as taxable income by the receiver and are deductible by the payor. California tax law may vary on tax treatment of child support.

California tax law may vary on tax treatment of child support.

Is There a Limit on Child Support in California?

If you live in California, child support payments can be limited in terms of the percentage of the paying parent’s income, but not an actual dollar amount. This means that child support payments are based on both parents’ income and how much more the higher-earning parent makes, but there is no law that caps child support at any specific dollar amount.

Calculating child support in California is no small task, and there’s no way to pinpoint what the court will order until the judge issues a decision. That said, you can get a general idea of what you may pay or receive in child support by considering the Income Shares Model.

What Is the Income Shares Model?

The Income Shares Model is a method used by California to estimate child support. It works by multiplying a presumptive child support obligation by the noncustodial parent’s share of both parents’ combined income.

Here is an example of how the Income Shares Model can work:

- The noncustodial parent makes $4,000 per month

- The custodial parent makes $2,000 per month

- Together, they make $6,000 per month

- The noncustodial parent contributes about 66% of the parents’ combined income

- The court determines that basic child support is $800 plus $100 in monthly childcare expenses ($900 total)

- The noncustodial parent’s child support obligation is 66% of $900, or about $600 per month

The model also works if the incomes of each parent were switched. If the custodial parent was the higher earner, then in this example the noncustodial parent’s child support obligation would be about $300 (33% of $900).

Other Factors Can Affect the Final Amount of Child Support

Although the Income Shares Model can give you a general idea of what child support may look like in your situation, other factors can affect the actual outcome.

One of these factors is how much time each parent spends with their child, while others include property tax, mortgage interest, union dues, and other financial obligations that reduce a parent’s disposable income.

If you want to see a more realistic picture of what your child support could look like, you might want to use California’s child support calculator. Again, however, take whatever amount online tools like this give you with a grain of salt. There’s a lot that goes into determining child support, and a judge’s discretion for what they think is in your child’s best interest is a major wildcard to consider.

Can I Change the Amount of Child Support?

You may be able to alter the amount of child support you pay or receive by petitioning the court for a modification. Generally speaking, the court will only consider such a petition if either parent’s financial situation or a child’s needs have significantly changed.

Regardless of whether you’re seeking to pay less child support or receive more, keep in mind that a petition to modify it can result in a modification contrary to your goal. This is why filing a petition in good faith is always the best approach.

This is why filing a petition in good faith is always the best approach.

When Can I Stop Paying Child Support?

In California, an obligation to pay child support usually ends when a child turns 18 years old. If they turn 18 while they’re in high school, then an obligation to pay child support ends when they graduate or turn 19 – whichever comes first. If a child dies, then the support obligation for that child also ends.

Under no other circumstances should you stop paying child support. Failure to pay results in accruing child support debt that you can’t eject in bankruptcy. You will also accrue interest (10% annually) and penalties on that debt, which can skyrocket the amount on your arrears.

Consistent failure to pay child support can also result in misdemeanor criminal charges. Although a conviction can result in fines, a judge is more likely to order jail time because any money used for a fine could go toward your unpaid child support instead.

Do You Need Help with Child Support?

Child support is one of the most contentious family law issues, perhaps second only to child custody. Like child custody, disputes over child support come up over the years – sometimes when you need them the least.

Like child custody, disputes over child support come up over the years – sometimes when you need them the least.

If you’re dealing with a child support matter at an inconvenient time, you can reach out to our legal team at Claery & Hammond, LLP for experienced legal support. Our attorneys can assess your situation and offer legal advice and services to help you resolve your child support challenge.

For more information about our assistance, contact us online today and request a free initial consultation.

Family Law - Sharifov & Associates - Attorneys at Law

division of joint property in New York

Family law is the branch of law that deals with matters relating to the family and family relations. Our family law practice includes representing clients both at the negotiation stage and in court in cases involving domestic violence (usually followed by an order of protection), divorces, separation, residence of children after divorce, and visitation of children. , child and spousal support, property division, domestic violence, prenuptial agreements, and juvenile delinquency lawsuits. We take part in out-of-court negotiations and also conduct court hearings when necessary.

, child and spousal support, property division, domestic violence, prenuptial agreements, and juvenile delinquency lawsuits. We take part in out-of-court negotiations and also conduct court hearings when necessary.

divorce by consent in New York

Frequently Asked Questions:

1. What is the difference between a contested divorce and a non-contested divorce?

When both husband and wife voluntarily agree on all aspects of divorce, including division of joint property, residence and visitation of children, child support and for former spouses, or are able to sign a separation agreement, their divorce is considered a divorce by consent. Arrest for Domestic Violence in New York On the other hand, when spouses cannot agree among themselves on all aspects of divorce and separation, and require the court to make appropriate decisions on the above aspects of divorce, they are forced to deal with a judicial divorce. On the practical side, a legal divorce requires a lot more work, usually takes longer, and tends to cost more.

order of protection in new york

2. How can I get an order of protection in case family violence?

If something threatens your physical or emotional safety or the safety of your children, you should immediately seek the advice of a lawyer or seek the assistance of the Court. You need to take immediate steps to keep you and your children safe. Family courts in all counties in the State of New York are able to make a quick decision on an application for an order of protection; usually, if needed, it can be done within one day. The Summons, Petition and Order of Protection must be delivered to the defendant. This can be arranged through the local police station, privately, or through a professional document delivery agent. The Family Court may order the Sheriff's Department to serve the documents. The case will be rescheduled and the defendant will be subpoenaed to respond to the domestic violence petition. Either by agreement of the parties or after a hearing, the judge may issue a permanent order of protection, limited or complete, for up to 2 years.

Sometimes the police refuse to make an arrest during an investigation into domestic violence; however, the police may advise the victim to go to Family Court and ask the Judge to issue an Order of Protection. Both the New York State Criminal and Family Courts have concurrent jurisdiction over certain domestic violence offenses. The difference between the procedure in these two courts is that in Family Court, you, as the plaintiff, are a party to the process, and you have control of the lawsuit against the defendant (the person you accuse committed acts of domestic violence against you). violence). at any time you can reach an agreement with the defendant as closed; case, or you can just pick up your petition. If the police refuse to arrest the person you complained about, you can file a petition with Family Court. The Family Court Judge has jurisdiction to issue an Order of Protection (full or limited), which will have the same effect as an Order issued by a Criminal Court Judge. For the past few months, due to the Coronavirus pandemic, Family Court has operated largely virtual, with court hearings via Skype or Microsoft Teams Meetings, and filing petitions via email or Electronic Document Delivery (" EDDS").

For the past few months, due to the Coronavirus pandemic, Family Court has operated largely virtual, with court hearings via Skype or Microsoft Teams Meetings, and filing petitions via email or Electronic Document Delivery (" EDDS").

The Domestic Violence Petition, in the absence of agreement by both parties, will be decided by the Family Court Judge at the conclusion of the hearing on the merits. The New York State Family Court has jurisdiction over other types of petitions, such as Child Visit and Residence, Child Support, Neglect of a Child, Establishment of Paternity, etc.

Sometimes, after an arrest and first appearance in criminal court, a Domestic Violence Petition is also filed in Family Court, requiring the client to attend both courts for both of the relevant cases. If there are minor children in the family, the Criminal Court will often include such children in the Protective Order, however, making an exception for Family Court modifications of the order. In such a case, the defendant who wishes to maintain a relationship with his children must go to Family Court and register a child visitation petition, asking the Judge to schedule visits to the children. Depending on the circumstances of the original case that led to the Order of Protection, the judge may allow limited visits, supervised visits, or even supervised visits by a welfare agency.

Depending on the circumstances of the original case that led to the Order of Protection, the judge may allow limited visits, supervised visits, or even supervised visits by a welfare agency.

legal guardianship

3. I can't find my spouse, can I file for divorce?

Personal delivery of original divorce papers (Summon Notice or Summons of Complaint) is required by law. However, in the event that the plaintiff (the person initiating the divorce case) cannot find his/her spouse, the plaintiff must obtain court permission for alternative delivery of documents by filing a written petition with the court.

4. When am I officially divorced?

The parties to a divorce proceeding are considered divorced from the moment the judge signs the divorce decree. In the case of a divorce by consent, if a postcard has been filed in advance, the court will notify the final divorce by mail. In the event of a judicial divorce, although the judge may verbally announce during the trial that the parties are divorced, the divorce is officially finalized after the parties' lawyers have submitted the documents to the court and the judge has signed the divorce decree.

5. What is custody and how is the issue of child custody after divorce resolved?

There are two types of custody – legal custody and physical custody. Legal custody essentially means the right to make decisions. During marriage, both parents have rights to raise the child. This includes the right to make decisions about all aspects of a child's upbringing, including religion and education, as long as the parent's decisions do not pose a threat to the child. After a divorce, one of the spouses who has received legal custody of the child makes all decisions independently. You can consult with the other parent, and this is even recommended, however, if you are unable to agree with the other parent or do not wish to consult, you can make your own parenting decisions. Note that the court can always review a parent's decision to raise a child to ensure that the decision is in the best interests of the child. Joint legal custody essentially means that both parents have equal rights to make significant decisions that affect their children's lives. If the parents agreed to joint legal custody, then they essentially agreed to set aside their personal differences in order to effectively raise their children. If the parents are unable to agree on legal custody, then such a decision will be made by the court.

If the parents agreed to joint legal custody, then they essentially agreed to set aside their personal differences in order to effectively raise their children. If the parents are unable to agree on legal custody, then such a decision will be made by the court.

Post-divorce custody means the right of a parent to have a child permanently reside with that parent in the same family and be responsible for their child as long as they live with that parent. If one of the parents received the right to live with the child after the divorce, then the other parent is likely to receive the right to visit the child (visitation). If the parents cannot agree on a visitation schedule for the child, the court will provide such a schedule. Sometimes it is possible to have a joint right of residence of a child with parents in turn in equal shares (joint physical custody). In this case, the child will live half the time in the family of one parent, and half the time in the family of the other.

6.

Will I have less time to visit my child if the other parent has exclusive legal custody?

Will I have less time to visit my child if the other parent has exclusive legal custody? Optional. Legal custody means the right to make decisions, not the right to spend time with the child. The parent with exclusive legal custody has the right to make most parenting decisions if both parents cannot agree on that decision. If the parents agreed to joint legal custody, then they essentially agreed to set aside their personal differences in order to effectively raise their children. Each parent in this case has equal rights to make decisions regarding the child. Regardless of whether your spouse has exclusive legal custody or both of you, you still have the opportunity to see your child as much as his schedule allows. Visitation of a child is usually independent of legal custody.

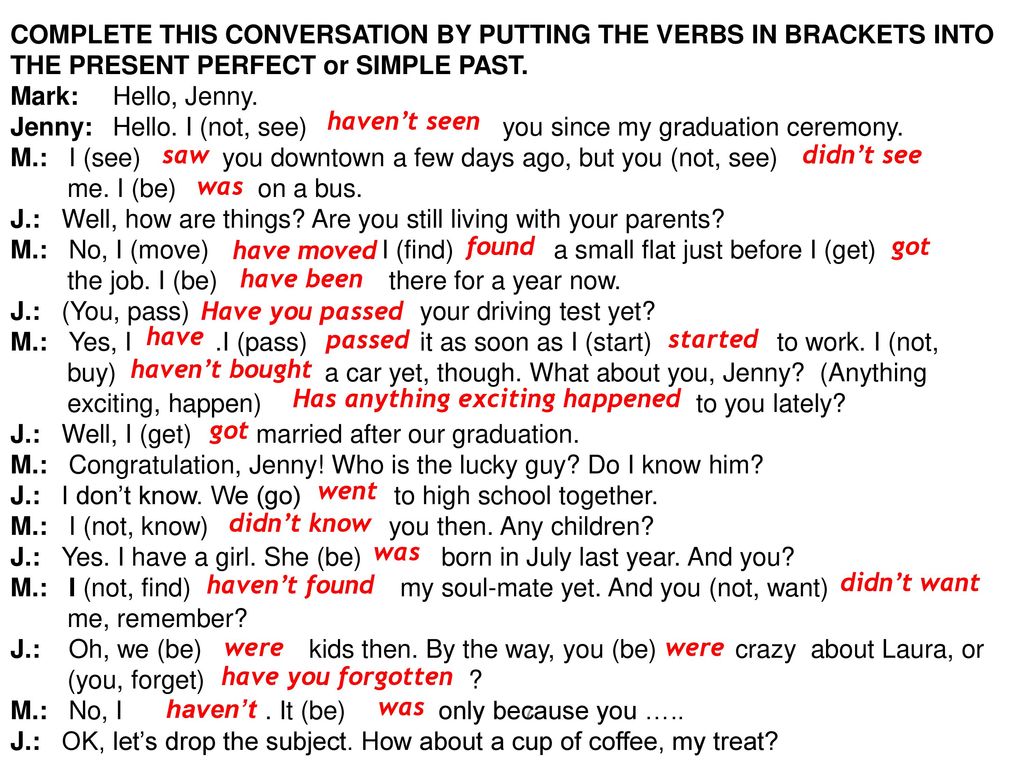

7. How is child support calculated?

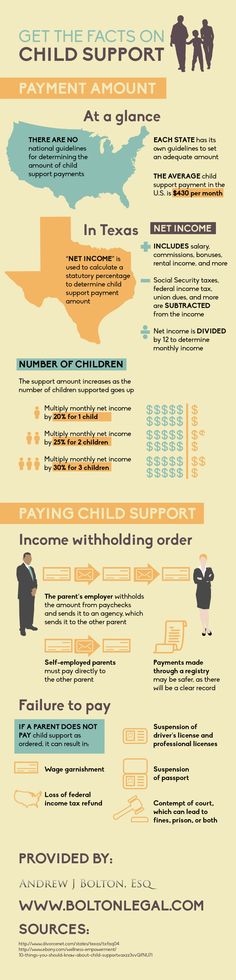

New York State offers a formula for calculating the amount of child support payable by a parent as specified in Family Code section 240(1-b). This is a rather complicated article of law that must be read and interpreted carefully in order to accurately calculate the amount of child support. Usually, after the allowed deductions from the parent's total earnings, a certain percentage is applied to the balance of earnings to calculate basic child support. The percentage depends on the number of dependent children under 21:

17% per child, 25% for two children, 29% for three children, 31% for four children, and 35% for five or more children;

It is necessary to carefully and carefully interpret the article of the law in order to accurately calculate child support, as there are many factors and conditions prescribed in the law that affect these calculations.

8. Who pays child support?

Generally, the parent with whom the child does not live most of the time will pay child support to the other parent.

child support in New York

9. Will I be able to pay less child support than is legally allowed?

The best chance to achieve this is to negotiate a reduction in child support as part of a common agreement between the parties. Do not forget, however, that the other party is not obliged to agree to this. Only in rare cases does the court find reasons not to apply the formula provided by law.

10. What if the children spend a significant part of their time with me, or even 50% of the time?

Once again, if you are unable to negotiate a reduction in child support with the other party, it will be extremely difficult for you to persuade the court not to apply the statutory formula. To illustrate this, note that even if the parents spend the same amount of time with the children, there is case law stating that the parent with the higher income counts as the parent not living with the child for purposes of calculating child support, and such parent would have to pay formula support! ! This shows how much more beneficial it is for clients to take good faith negotiations seriously as the best way to resolve a dispute.

11. Until what age should a parent support a child?

In New York State, a child is entitled to parental support until the age of 21, unless he/she begins independent living earlier. If a child chooses not to attend college and instead joins the military or starts working full-time, then parental support ends when the child reaches 18 years of age.

If a child chooses not to attend college and instead joins the military or starts working full-time, then parental support ends when the child reaches 18 years of age.

12. Will a child be eligible for support if she stays in college after her 21st birthday to complete her studies and earn a bachelor's or graduate degree?

No. If child support continues after his 21st birthday, it will only be as a result of the agreement of both parents. The law does not require parents to continue supporting children after they turn 21, regardless of whether higher education is completed.

OK with this parent?

The Court takes the issue of changing the residence of children very seriously. The main criterion for the court is the issue of the welfare of the children. In attempting to make such a decision, the court will ask the question: "If such a change in the place of residence of the child is allowed, will it significantly change the nature of the relationship between the child and the parent who does not move to a new place with him?" The court will try to find out as much as possible about the nature of the relationship with the parent. (For example, how often do you see your children? Do you go to their school events? Do you meet with your children during the school week? Do you make use of all the visits that you have assigned to your children? How good are your visits to children?) will evaluate all reasons for the expected relocation of children to determine whether the parent with whom the child lives has explored all possibilities to avoid such a relocation. The distance over which the proposed move is made is also an important factor. Is this the distance that will prevent you from regularly visiting your children? The latest trend in jurisprudence is to generally allow moves up to 2 hours by car from the children's previous residence (assuming the parent with whom the children live generally has a good reason for the move). These decisions were determined by the circumstances, so don't try to reassure yourself ahead of time based on what the court has decided in other cases.

(For example, how often do you see your children? Do you go to their school events? Do you meet with your children during the school week? Do you make use of all the visits that you have assigned to your children? How good are your visits to children?) will evaluate all reasons for the expected relocation of children to determine whether the parent with whom the child lives has explored all possibilities to avoid such a relocation. The distance over which the proposed move is made is also an important factor. Is this the distance that will prevent you from regularly visiting your children? The latest trend in jurisprudence is to generally allow moves up to 2 hours by car from the children's previous residence (assuming the parent with whom the children live generally has a good reason for the move). These decisions were determined by the circumstances, so don't try to reassure yourself ahead of time based on what the court has decided in other cases.

14. Will my spouse be required to pay me alimony or maintenance after the divorce, and if so, for how long?

A recent change to the law that went into effect in 2016 provides for a formula on how to calculate temporary alimony, as well as a recommended formula for calculating permanent alimony after divorce and how long it lasts. There are also additional factors that the court must consider when determining the amount and duration of child support.

Here are a few factors that are considered the most significant:

- length of marriage; the age and state of health of each spouse;

- present and future earning potential for each spouse;

- your opportunity to become financially independent;

- reduced or lost earning opportunity due to denial or delay in education, training, employment, or career development during marriage;

- having children in your home;

This is a complex decision and will be influenced by many factors.

15. Can my spouse evict me from our home?

Unless you have physically, verbally, or mentally abused your spouse, or have already found another place to live, it will be extremely difficult for your spouse to evict you from their home. Unless you agree to move out voluntarily, your spouse will have to file a petition with the court for you to be evicted, and the court will give you an opportunity to respond to it.

16. Can I and my children continue to live in our house after the divorce?

Assuming that the children will be living with you, and if you have a child under 18, the court will generally try to keep the child in the home, neighborhood, and school to which the child is already accustomed, assuming that the child is fine in that environment, and also implying that financial circumstances allow it.

17. Am I entitled to a share in the value of the house, even if the title is not in my name?

If the house was purchased during the marriage with funds earned during the marriage (regardless of which spouse earned the money), then it is likely that you will be entitled to a share in the price of the house, even if the house is not registered on you. There are many factors to calculate the size, value and percentage of this share.

18. I bought our house before our marriage with funds I bought before our marriage. Will I have to share the cost of my home with my ex/ex-spouse?

Usually not. However, if the house increased in value during the marriage as a result of your spouse's efforts, or as a result of a joint investment in the house, then your spouse may claim a share of the excess price during the marriage. Please note that if you put your spouse's name on the home title deeds, this may cause your spouse to be able to claim a share of the total value of the home.

However, if the house increased in value during the marriage as a result of your spouse's efforts, or as a result of a joint investment in the house, then your spouse may claim a share of the excess price during the marriage. Please note that if you put your spouse's name on the home title deeds, this may cause your spouse to be able to claim a share of the total value of the home.

19. Will the court force me to sell my house?

If there are no children, and assuming the house is jointly owned, the court will allow each spouse to buy out the other spouse's share. If neither spouse has the ability to buy out the other's share, or is not interested in doing so, the court may order the sale of the house and divide the proceeds from the sale at the discretion of the court.

20. Credit cards: Should they be cancelled?

If you think your spouse will use credit cards beyond justified living expenses, consider closing the account. Most accounts can be closed by either paying off the debt or transferring to another credit card. If your name is first on the account, you can achieve the same goal simply by removing your spouse's name from the account. The final liability for debts will be determined by the court or by agreement. In most cases, it is recommended that you inform your spouse of your actions (after the accounts have already been changed) so that he/she is not unpleasantly surprised or embarrassed when the payment is unexpectedly declined.

If your name is first on the account, you can achieve the same goal simply by removing your spouse's name from the account. The final liability for debts will be determined by the court or by agreement. In most cases, it is recommended that you inform your spouse of your actions (after the accounts have already been changed) so that he/she is not unpleasantly surprised or embarrassed when the payment is unexpectedly declined.

21. Do I have to withdraw money from all joint accounts to protect myself from my spouse taking or hiding the money?

The courts do not approve of either spouse withdrawing all the money from a joint account or withdrawing money without good reason. The husband should think seriously before withdrawing money. Do not forget that the court has the right to demand liability from the spouse if it is proved that he squandered or hid the joint funds.

22. If I own a business or share in a business, will my spouse get a share of the business?

If your business was created during your marriage, or you acquired an interest in a business during your marriage, then your spouse will likely be able to claim a portion of that business or a portion of your interest in the business. If you acquired the business before marriage, or you acquired an interest in the business using funds from an inheritance or a gift, then your spouse may claim an excess (if any) of the value of the business that occurred during the marriage if you or your spouse is actively contributed to the value of the business. Usually an accountant is hired to do this calculation and there are many factors that go into this calculation. Once the overall valuation of the business has been made, it is calculated what percentage of that value should be used to calculate the spouse's share. There are many factors the court will take into account to determine this percentage, including but not limited to the length of the marriage, your spouse's contribution to the business, family earnings or assets invested in the business, etc.

If you acquired the business before marriage, or you acquired an interest in the business using funds from an inheritance or a gift, then your spouse may claim an excess (if any) of the value of the business that occurred during the marriage if you or your spouse is actively contributed to the value of the business. Usually an accountant is hired to do this calculation and there are many factors that go into this calculation. Once the overall valuation of the business has been made, it is calculated what percentage of that value should be used to calculate the spouse's share. There are many factors the court will take into account to determine this percentage, including but not limited to the length of the marriage, your spouse's contribution to the business, family earnings or assets invested in the business, etc.

23. Can my spouse claim the estimated value of my professional license or higher education diploma?

For divorces initiated before 2016, by law, if all or part of a professional license or higher education occurred during marriage and was paid for by joint family funds, then it is likely that the spouse will be able to claim a portion of the assessed value of such a license or diploma. Following recent changes to the New York State Family Code that went into effect in 2016, the court must no longer consider increased earning potential due to a professional license, college degree, celebrity status, or career advancement as part of a family partnership. assets. However, when deciding on an equitable division of joint marital property, the court must take into account each spouse's direct and indirect contribution to enhancing the earning potential of the other spouse. NY Dom. Rel. L. § 236B(5)(d)(7).

Following recent changes to the New York State Family Code that went into effect in 2016, the court must no longer consider increased earning potential due to a professional license, college degree, celebrity status, or career advancement as part of a family partnership. assets. However, when deciding on an equitable division of joint marital property, the court must take into account each spouse's direct and indirect contribution to enhancing the earning potential of the other spouse. NY Dom. Rel. L. § 236B(5)(d)(7).

24. Which courts can hear divorce, custody and alimony cases?

The Supreme Court has exclusive jurisdiction over divorce cases; however, Family Court has concurrent jurisdiction over custody, visitation, and child support matters. If a person wants to get a divorce, he needs to fill out the original documents in the Supreme Court. If the child's parents are not seeking a divorce, or are not married at all, and want to sue for domestic violence, custody, visitation, or child support, they should file an application in Family Court.

25. What is a juvenile delinquency trial?

This is a New York State Family Court lawsuit involving a juvenile delinquency case between the ages of 7 and 16. When such a minor is arrested in New York State, he/she may obtain a subpoena from the police in Family Court in the county where the alleged offense was committed. On the other hand, when the allegations are serious enough and/or the minor child has had previous police referrals, the child may be detained overnight in a special detention center for children and brought to Family Court the next day when the court is open.

When a child comes to court with a parent or guardian, he/she and the parent will be interviewed by a probation officer and, depending on the charges, previous criminal convictions, the wishes of the victim and their parents, if the victim is a minor, the case may be referred to probation department. In this case, the petition against the juvenile delinquent is not filed and the child agrees to follow the rules of the probation department for an initial period of up to 60 days. The child must attend school, report to the probation department when required, write an essay and/or do community service under the direction of a probation officer, and also have no new drives. If the child complies with all this, the case will be dismissed.

The child must attend school, report to the probation department when required, write an essay and/or do community service under the direction of a probation officer, and also have no new drives. If the child complies with all this, the case will be dismissed.

If a juvenile is charged with a felony, or if the victim wants the case to continue, the New York City Law Department, which in such cases acts as a prosecutor, will file a petition against the juvenile delinquent, and the child will be required to appear before judge. A case on juvenile delinquency is similar to a criminal case of an adult in a criminal court, however, there are significant differences: there is no bail for the release of the defendant to freedom for a minor - either he is left in custody or released without bail on bail to the parent / guardian; no right to a jury trial, instead a court hearing before a judge; no criminal conviction - instead, recognition as a juvenile delinquent; punishment options also vary, including case closure, conditional closure, suspended sentences of up to 2 years, or detention with varying degrees of security for an initial period of up to 18 months. For the most serious crimes allegedly committed by minors 13 years of age or older, the prosecutor has the option to refer the case to an adult criminal court.

For the most serious crimes allegedly committed by minors 13 years of age or older, the prosecutor has the option to refer the case to an adult criminal court.

26. What is marriage annulment and how is it different from divorce?

A man and a woman must be legally capable of entering into a legal marriage. If the parties are not authorized to enter into a marriage, such a marriage can be annulled, that is, declared invalid. Grounds for marriage annulment are untraceable disability, minority, lack of consent, or consent obtained through fraud or intimidation, and incurable mental illness for five years.

- If one of the spouses is terminally incapable of sexual activity, the marriage can be annulled.

- Both parties must be over 18 years of age to marry without parental consent. A marriage between persons under the age of 18 may be annulled, at the discretion of the court, if the spouse under 18 wishes to annul the marriage.

- If, after marriage, either partner becomes terminally ill for 5 years or more, the marriage may be annulled.

However, a healthy spouse may be required to maintain a mentally ill spouse for life.

However, a healthy spouse may be required to maintain a mentally ill spouse for life. - The parties must knowingly consent to the marriage. A marriage can be declared invalid if either party consented to the marriage as a result of violence or threats from the other party, or if either party did not understand the meaning and consequences of marriage.

- A marriage may be annulled if the consent was obtained by fraud, provided that the fraud was such as to deceive an ordinary reasonable person and was essential to obtain the consent of the other party. Fraud must be at the heart of the marriage contract. Only the injured party can annul the marriage on the grounds of lack of consent.

27. What is a declaration of invalidity of a marriage and how does it differ from annulment?

Unlike an annulment, where a marriage can be declared invalid, some marriages are invalid from the moment they are contracted. Such marriages include incest and bigamy. In the case of incest, this is a marriage between ancestors and descendants, brothers and sisters (including half blood). In the case of bigamy, one of the parties is already married to another person.

In the case of incest, this is a marriage between ancestors and descendants, brothers and sisters (including half blood). In the case of bigamy, one of the parties is already married to another person.

For more information, please contact our company.

tel 516-505-2300

TE L 718-368-2800

Email [email protected]

Alimony from the child

Family Law: Distribution of birth rights, Rights of parental rights, Right alimony. (Russia)

?

Question

My problem is to collect child support from the father of the child, who is a US citizen and lives in the US, respectively. He came to Russia quite often earlier, before the birth of the child, and by mutual agreement, I went to the USA to give birth, but the pregnancy took place practically in Russia (St. Petersburg). The child was born in New York in 2010, recorded on the father, a US citizen, respectively. The child was issued an American passport, and Russian citizenship was issued at the Russian consulate.

In March 2011, the child and I returned to St. Petersburg, where I registered her in my apartment. In the near future, I would not like to return to America (to her father) because of the unfavorable family situation, and therefore I would like to resolve the issue of providing for the child on Russian territory.

Currently, the child's father sends $1200 per month (subject to stipulated conditions). After 6 months, he will stop funding the child (or will do so in a minimum amount).

Since there are no written agreements between us, and we are not married, it is difficult for me to rely on his promises, desires, etc. I consulted with an American lawyer in 2010 - the process of collecting alimony in America is extremely long, tedious, and due to certain facts, the outcome can be in the range of $ 350-400.

At the same time, the issue of the child's residence will also be determined within 2-3 years, and if I do not want to live with the father of the child, I will also have to rent an apartment until the court decides. In addition, the mode of meetings with the father will be determined - because of which, in principle, in the future I will not be able to leave the United States (or only with the consent of the father of the child - because, as per American laws, even if we are not married, but we have minor child - he can prevent me from leaving the United States). I am not satisfied with this kind of litigation in any way.

In addition, the mode of meetings with the father will be determined - because of which, in principle, in the future I will not be able to leave the United States (or only with the consent of the father of the child - because, as per American laws, even if we are not married, but we have minor child - he can prevent me from leaving the United States). I am not satisfied with this kind of litigation in any way.

Therefore, I would like to clarify the following questions:

- Is it possible to collect alimony in Russia and in what amount?

- What factors influence (if they do) the formation of a fixed amount of alimony (for example: the father of the child does not have a salary, he has a mini-pizzeria as a source of income, etc.) and how can this be proved in a Russian court?

- According to European laws (at least there is a precedent in Strasbourg), as well as according to the RF IC, the second line of relatives can be involved in providing for the child (for example, grandparents), to what extent it is accepted in practice in Russian courts and is it possible to appeal to this position in my case? (an American grandmother has 4 real estate leased officially under contracts, in addition, she sold an apartment in May 2011 for $ 2. 3 million).

3 million).

- If the child's father sends $1,200 per month, which is documented, can this fact be used as evidence of his ability to pay and determine the amount of child support in the claim of the approximate level?

- How is a court decision ratified in the United States (through which state structures)? Can they not accept it for execution? Should I apply to the American consulate at this stage to expedite the execution of the decision?

- How long does it take on average for a similar trial in a Russian court? And are there any difficulties in execution on the American side?

- If the father of the child does not pay child support according to the decision of the growing. court more than 6 months, can I apply for deprivation of his parental rights?

- How much does it cost to file a claim with you?

- If the child's father files a lawsuit in the US (for example, about his right to see the child, etc.), will I be able to file a lawsuit in ros. court after it? Or, in this case, should he be ahead of him? (In principle, he is a lawyer by education, not a practitioner, but in the future I do not exclude any claims from him on the return of the child to the United States, etc.)

court after it? Or, in this case, should he be ahead of him? (In principle, he is a lawyer by education, not a practitioner, but in the future I do not exclude any claims from him on the return of the child to the United States, etc.)

- Given the above, what points should be emphasized in my child support claim? I know from experience that very often a well and logically drafted claim forms the basis of a decision, even if complex cases - as is the case for the recovery of alimony from foreign citizens - does the Russian court go beyond $ 250-300 in decisions?

These are questions that are not clear to me, I hope for your many years of experience in this field, and I will wait for your answers.

I would like to clarify one more point, should I determine the place of residence of the child in some separate claim in order to avoid that the father will file such a claim in the United States? If he files it while my Russian child support claim is being filed, will my claim be suspended or will the Russian court still decide child support first? Or do I, as a mother, have the priority of the child's right to live with me?

!

Reply

I believe that you need to apply to a Russian court, and urgently. You need to determine the place of residence of the child, and in order for foreign countries to reckon with this decision, it is highly desirable that your claim be filed first, and not in response to the child's father's claim to return the child to the United States.

You need to determine the place of residence of the child, and in order for foreign countries to reckon with this decision, it is highly desirable that your claim be filed first, and not in response to the child's father's claim to return the child to the United States.

You are not deprived of the opportunity to make both claims at the same time: to determine the place of residence of the child with you and to collect alimony. If he does not comply with the court decision, you will be able to raise the issue of deprivation of parental rights in the future. Now he has equal rights with you, and moreover, he has reason to believe that it was you who violated his parental rights, and the American court will most likely support him.

So you need to sue and notify your spouse of the hearing. If the father of the child goes to an American court, you must immediately inform the American court about the existence of a case in Russia and demand that the case initiated later be dismissed. A Russian court clearly has jurisdiction over your child who resides in Russia and has Russian citizenship.

A Russian court clearly has jurisdiction over your child who resides in Russia and has Russian citizenship.

According to Art. 81, 83 of the RF IC, in the absence of an agreement on the payment of alimony, alimony for one minor child is collected by the court on a monthly basis in the amount of one quarter of earnings. The amount of alimony may be reduced or increased by the court, taking into account the financial or marital status of the parties and other noteworthy circumstances. In the absence of an agreement between the parents on the payment of alimony for minor children and in cases where the parent obliged to pay alimony has irregular, fluctuating earnings and / or receives earnings wholly or partially in foreign currency, the court has the right to determine the amount of alimony collected on a monthly basis in hard cash. amount. The amount of a fixed amount of money is determined by the court based on the maximum possible preservation of the child's previous level of support, taking into account the financial and marital status of the parties and other noteworthy circumstances.

Thus, since the father of the child has income in foreign currency and voluntarily paid alimony in a certain amount every month, you can refer to these circumstances in court and ask for child support to be established in this amount until the child reaches the age of majority.

In case of non-compliance with the court decision on the territory of the Russian Federation, the father of the child will have problems leaving the territory of the Russian Federation: if he likes to travel to Russia, this will be a serious argument for him.

As for the execution of the decision abroad, as you probably know, there is no agreement between Russia and the United States on legal assistance in civil and family matters.

Enforcement of a Russian court decision abroad is possible only in court by filing a petition for recognition and enforcement of the court decision. Neither the Ministry of Foreign Affairs nor the Consulate will help you with this: only the court. An American court can decide both in your favor and in favor of the father of the child - you need to consult with an American lawyer about the prospects for considering such a petition.