How much are child tax credits 2023

Will There Be a Child Tax Credit in 2023?

The easy answer is yes, but there's more to the story.

Key points

- The Child Tax Credit got a massive boost in 2021 that helped many families shore up their finances.

- While the credit may not get a boost this year, eligible filers can still claim it.

- The Child Tax Credit is worth $2,000 per child, but only $1,540 is refundable.

Raising children is hardly an inexpensive feat. Parents routinely incur massive costs related to raising kids, from childcare fees to healthcare to apparel and food.

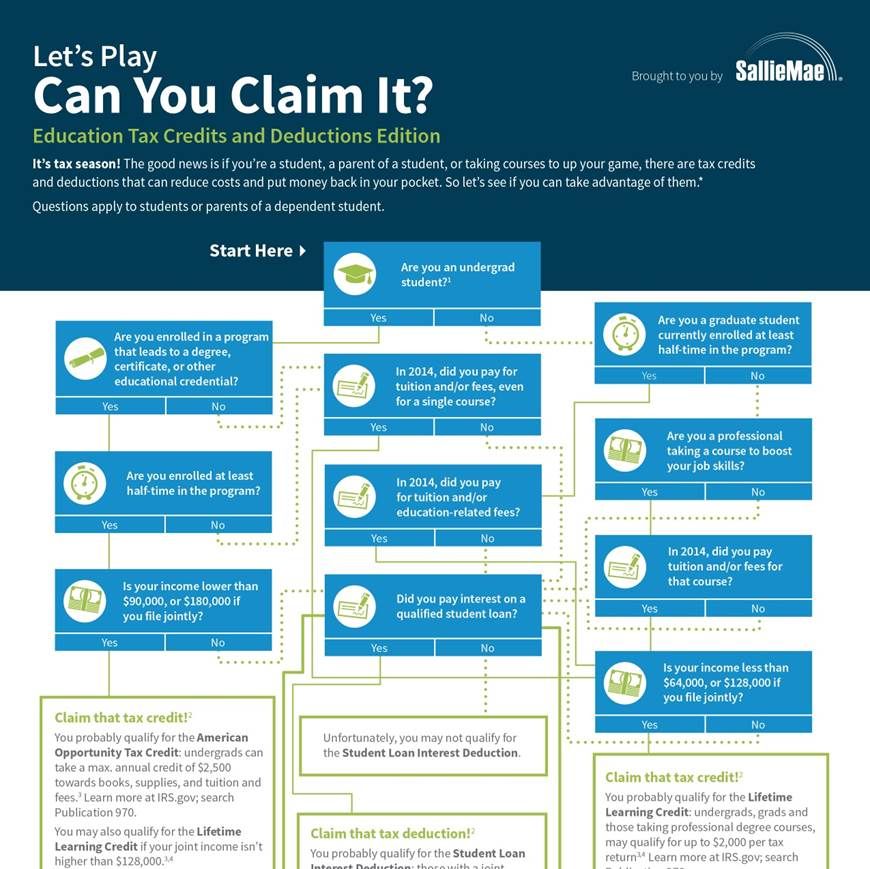

Lawmakers are aware that having kids can constitute a financial strain, so they put a tax credit in place designed to help ease that burden. It's called the Child Tax Credit, and it got a lot of publicity in 2021 when it underwent a major enhancement under the American Rescue Plan.

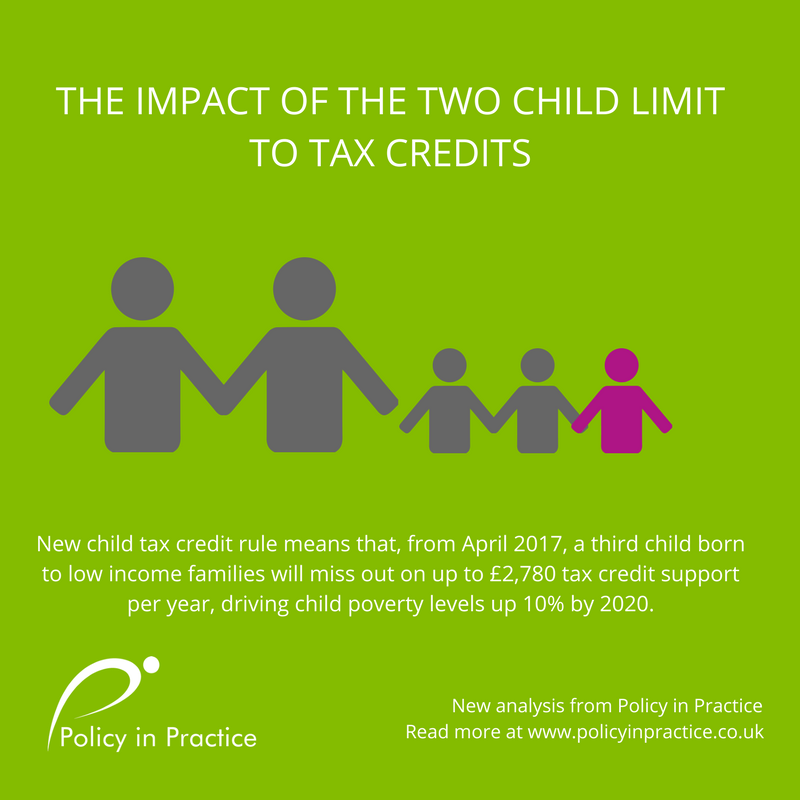

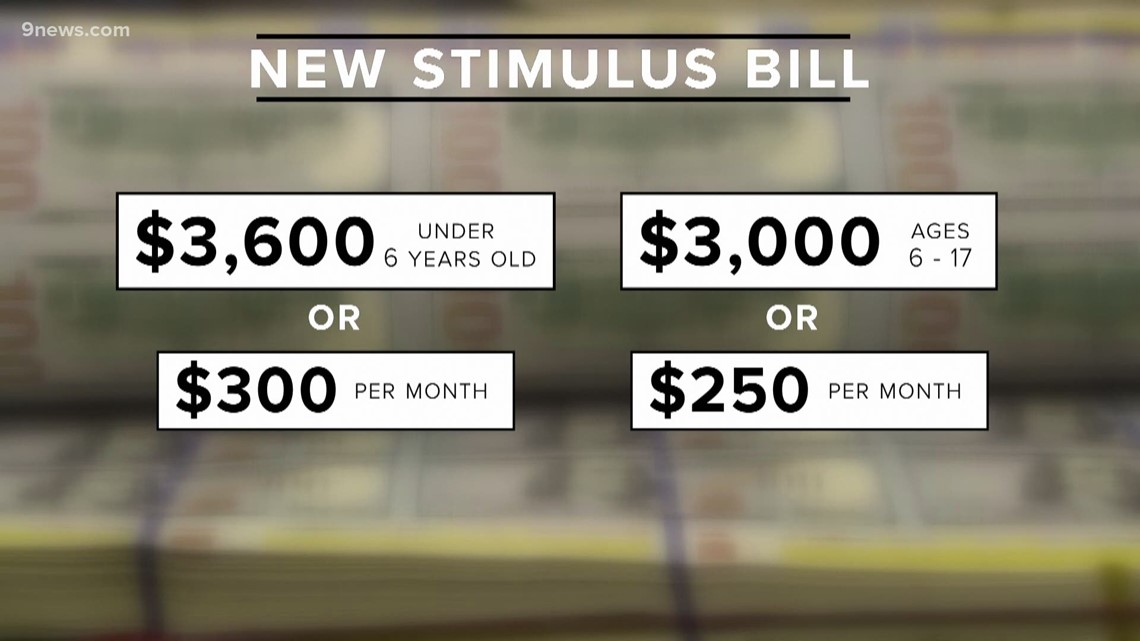

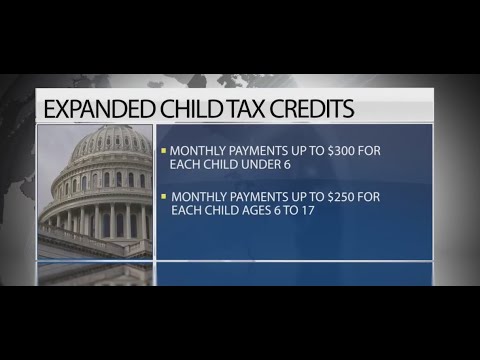

That year, the maximum value of the Child Tax Credit rose from $2,000 per child to $3,000 per child aged 6 to 17, and $3,600 for children under the age of 6. The credit also became fully refundable, which meant that someone who owed the IRS no money could still claim its full value.

Plus, half of the Child Tax Credit was made available via monthly installment payments that hit bank accounts between July and December of 2021. It was those consistent monthly payments that helped many families avoid going into debt and boost their savings account balances at a time when inflation levels were already starting to tick upward in a notable way.

But that helpful boost to the Child Tax Credit never got extended past 2021. And as a result, many parents struggled to cover their living costs in 2022.

But what does 2023 have in store for parents? Will there be a Child Tax Credit? And how much will it be worth?

The credit never went away

One big misconception is that the Child Tax Credit went away after the 2021 tax year. That's not true at all. It simply reverted to its former rules and value in the absence of an extended enhancement.

That's not true at all. It simply reverted to its former rules and value in the absence of an extended enhancement.

As such, there absolutely is a Child Tax Credit in 2023, and it's worth up to $2,000 per eligible child. And while there are no plans to make the credit available in the form of monthly installments, those eligible for it can still get their money when they file their 2023 tax returns in 2024.

Now one thing worth noting is that the Child Tax Credit is no longer fully refundable. This year, only $1,540 per child is refundable. This means that if someone doesn't owe the IRS more than $1,540, that's the maximum benefit they'll get.

A boost isn't off the table

As of the start of 2023, there's been no approved boost to the Child Tax Credit. But that doesn't mean lawmakers aren't still fighting for one.

Many agree that the credit needs an enhancement to give families more relief. So it's possible that legislation will pass this year that changes the credit for the better, whether by increasing its maximum value or allowing the credit to be fully refundable once again.

So it's possible that legislation will pass this year that changes the credit for the better, whether by increasing its maximum value or allowing the credit to be fully refundable once again.

As far as monthly installment payments go, those are still a possibility as well. Given that inflation is still quite high, getting paid on a monthly basis could make it much easier for families -- especially lower-income households -- to cover their bills without having to resort to debt.

In fact, 2021's Child Tax Credit boost helped many families emerge from poverty and avoid issues with food insecurity. Lawmakers are keenly aware of that, which is why it's too soon to write off the idea of an enhanced credit in 2023.

Alert: highest cash back card we've seen now has 0% intro APR until 2024

If you're using the wrong credit or debit card, it could be costing you serious money. Our experts love this top pick, which features a 0% intro APR until 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our experts even use it personally. Click here to read our full review for free and apply in just 2 minutes.

Read our free review

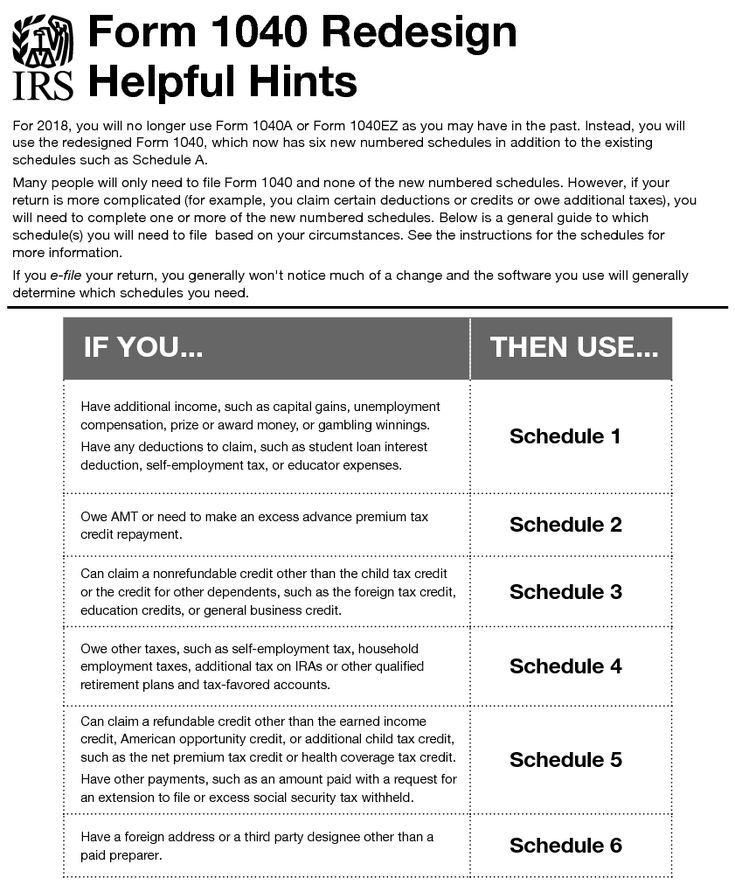

Guide to filing your taxes in 2023

Note

For tax year 2022 some tax credits that were expanded in 2021 will return to 2019 levels. This means that affected taxpayers will likely receive a smaller refund compared with the previous tax year. Changes include amounts for the Child Tax Credit (CTC), Earned Income Tax Credit (EITC) and Child and Dependent Care Credit.

- Those who got $3,600 per dependent in 2021 for the CTC will, if eligible, get $2,000 for the 2022 tax year.

- For the EITC, eligible taxpayers with no children who received roughly $1,500 in 2021 will now get a maximum of $530 in 2022.

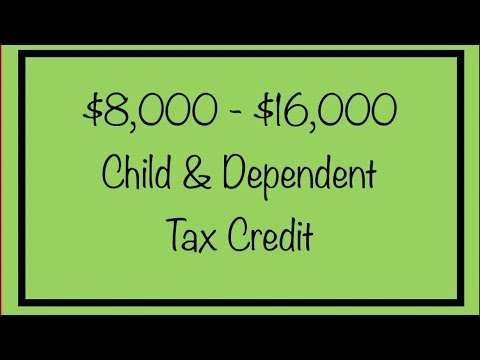

- The Child and Dependent Care Credit returns to a maximum of $2,100 in 2022 instead of $8,000 in 2021.

If you are one of the estimated 100 million people that are eligible to file your tax return for free you can keep all of your refund money by choosing one of three options.

In person full-service tax preparation

The IRS Volunteer Income Tax Assistance (VITA) , AARP Foundation Tax-Aide, and The Tax Counseling for the Elderly (TCE) programs have operated for over 50 years. All these services use IRS certified tax preparers and meet high IRS quality standards. VITA/TCE and Tax-Aide sites offer free tax help to people who need assistance in preparing their tax returns, including:

- People who generally make $60,000 or less

- Persons with disabilities; and

- Limited English-speaking taxpayers

- 60 years or older

To find a VITA or an AARP Tax Aide site go here .

Remote full-service tax preparation

You can prepare your own return with help from IRS certified volunteers when you need it through MyFreeTaxes if:

- Your income is $73,000 or less.

You can get connected to VITA providers around the country virtually to have your return prepared by signing up through GetYourRefund if:

- Your income is $66,000 or less.

Self-preparation

You can prepare and file your own return through IRS Free File :

- If your income is $73,000 or less, you can access guided return preparation assistance.

- If your income is greater than $73,000 you can access fillable forms to prepare your own return without assistance.

For servicemembers

You can prepare and file your tax return through MilTax if you are:

- Active-duty service members, spouses and dependent children of the eligible service members.

- Members of the National Guard and reserve — regardless of activation status.

- Retired and honorably discharged service members, including Coast Guard veterans, within 365 days of their discharge.

- A family member who is managing the affairs of an eligible service member while the service member is deployed.

- A designated family member of a severely-injured service member who is incapable of handling their own affairs.

- Eligible survivors of active-duty, National Guard and reserve deceased service members regardless of conflict or activation status.

- Some members of the Defense Department civilian expeditionary workforce.

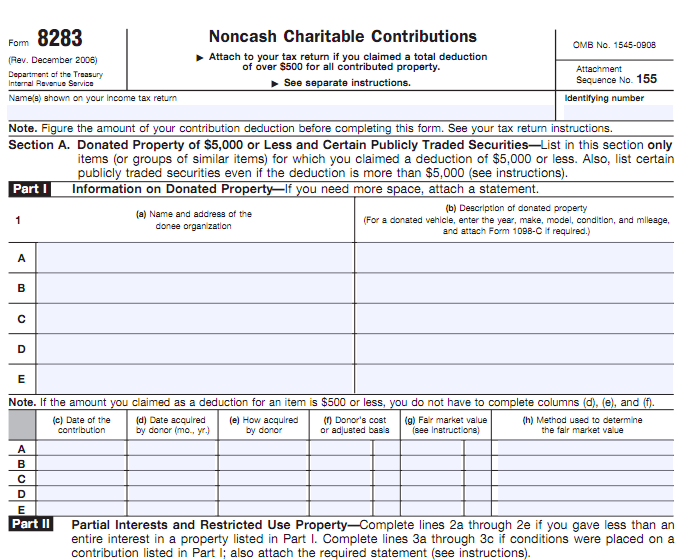

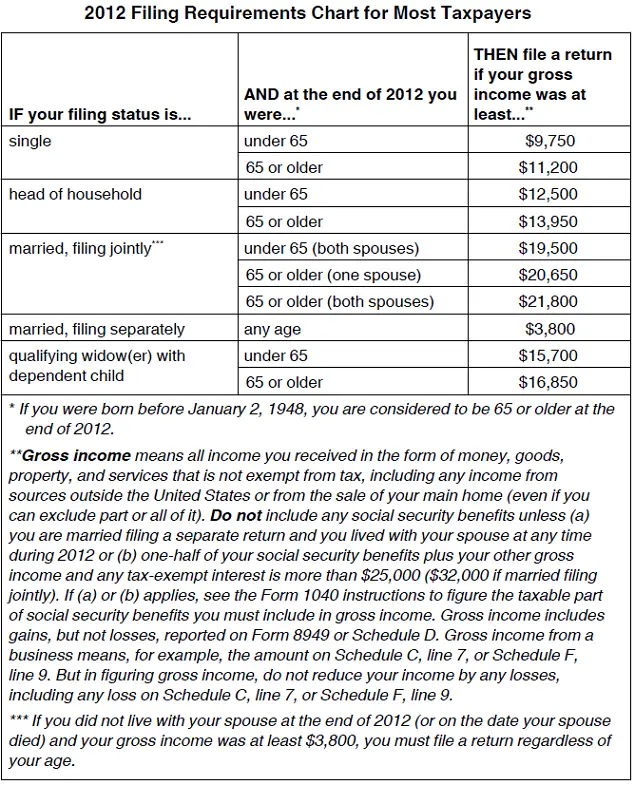

About filing your tax return

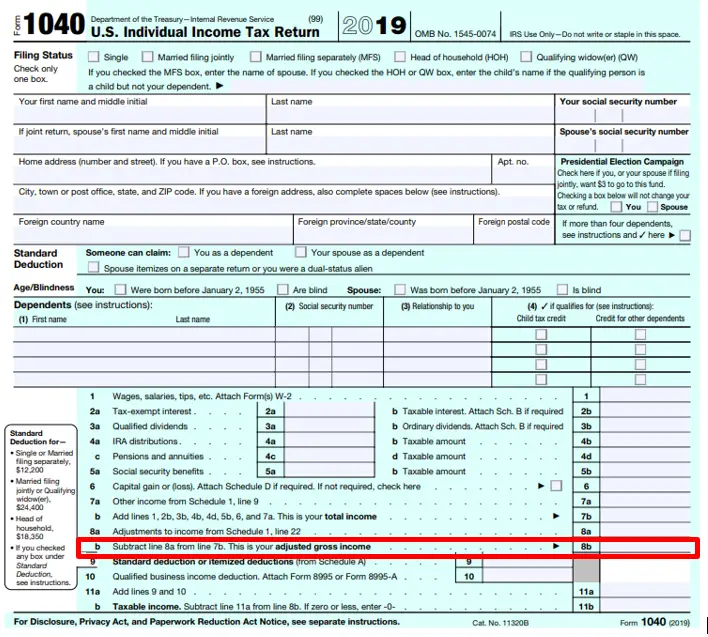

If you have income below the standard deduction threshold for 2022, which is $12,950 for single filers and $25,900 for married couples filing jointly , you may not be required to file a return. However, you may want to file anyway because you may be able to take advantage of several features and benefits in the tax system which could reduce the amount you owe, or in many cases, especially for people with low incomes, increase the amount you could receive in a refund. Some key factors to make sure you look out for include:

However, you may want to file anyway because you may be able to take advantage of several features and benefits in the tax system which could reduce the amount you owe, or in many cases, especially for people with low incomes, increase the amount you could receive in a refund. Some key factors to make sure you look out for include:

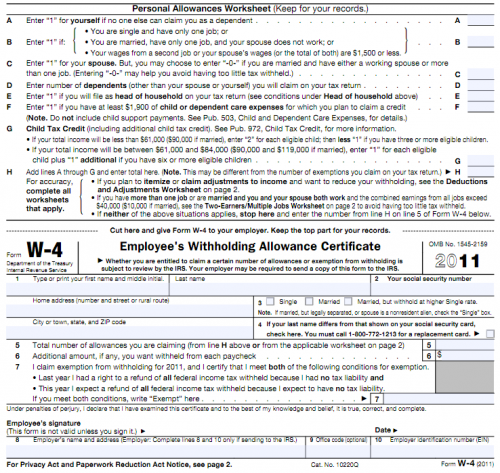

Over-withholding

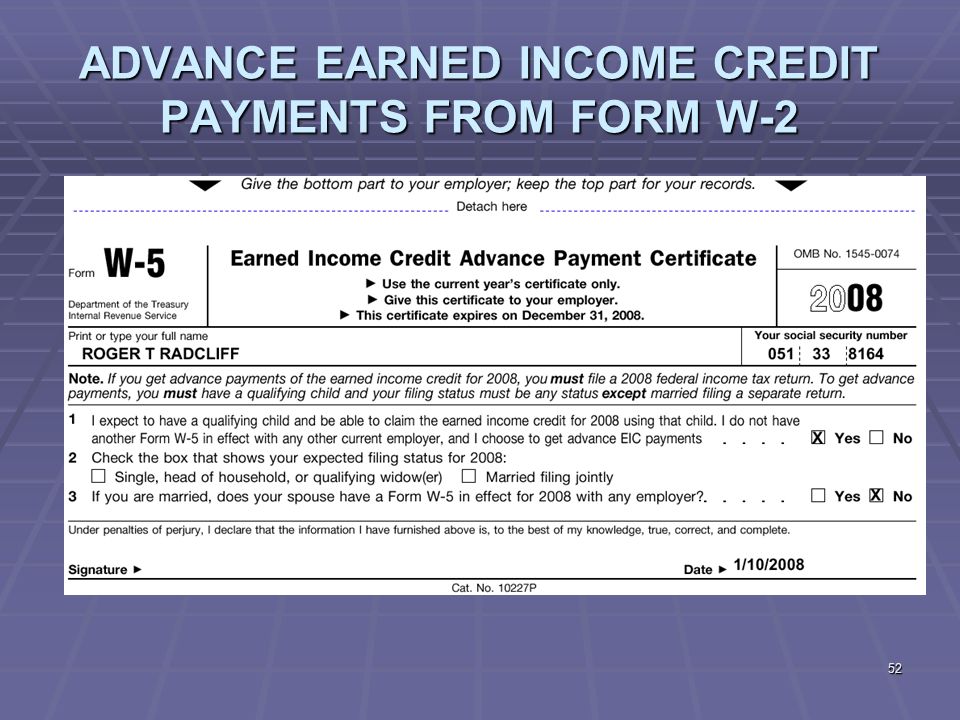

If you worked during 2022 and had taxes withheld from your paycheck, you may be able to get some or all of that “over-withholding” back in your refund. Make sure you get W2 forms from all your employers and enter that information into the tax form when you fill it out.

The earned income tax credit

To claim the Earned Income Tax Credit (EITC) , you must

- Have worked and had earned income under $59,187

- Have investment income below $10,000 in the tax year 2022

- Have a valid Social Security number by the due date of your 2022 return (including extensions)

- Be a U.

S. citizen or a resident alien all year

S. citizen or a resident alien all year - Not file Form 2555 (related to foreign earned income )

If you are eligible for this credit, the maximum amount you could receive is:

- $560 if you have no dependent children

- $3,733 if you have one qualifying child

- $6,164 if you have two qualifying children

- $6,935 if you have three or more qualifying children

The child tax credit (CTC)

The CTC is worth a maximum of $2,000 per qualifying child. Up to $1,400 is refundable. To be eligible for the CTC, you must have earned more than $2,500.

Access your tax refund quickly and safely

If you think you may receive a refund, here are some things to think about before you file your return:

- Electronically filing and choosing direct deposit is the fastest way to get your refund.

When using direct deposit, the IRS normally issues refunds within 21 days. Issuance of paper check refunds may take much longer.

When using direct deposit, the IRS normally issues refunds within 21 days. Issuance of paper check refunds may take much longer.- If you already have an account with a bank or credit union, make sure you have your information ready — including the account and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

- You can learn more about choosing the right prepaid card here.

- If you don’t have a bank account or prepaid card, consider opening an account or getting a prepaid card. Many banks and credit unions offer accounts with low (or no) monthly maintenance fees when you have direct deposit or maintain a minimum balance.

These accounts may limit the types of fees you can incur and may also offer free access to in-network automated teller machines (ATMs). You can often open these accounts easily online.

These accounts may limit the types of fees you can incur and may also offer free access to in-network automated teller machines (ATMs). You can often open these accounts easily online.- Learn more about the FDIC’s #GetBanked campaign.

Thousands of people have lost millions of dollars and their personal information to tax scams. Scammers use the regular mail, telephone, or email to set up individuals, businesses, payroll and tax professionals.

The IRS does not initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. Recognize the telltale signs of a scam. See also: How to know it’s really the IRS calling or knocking on your door.

Tax holidays for sole proprietors in 2023 | How to apply for tax holidays for IP

⚡ All articles / ⚡ All about taxes

Anastasia Sich

Tax holidays are a legal way to avoid paying taxes. This opportunity is available only to individual entrepreneurs who fall under the requirements of the law.

This opportunity is available only to individual entrepreneurs who fall under the requirements of the law.

Content

- How to understand that you have holidays?

- How to switch to tax holidays?

- How to report on tax holidays?

- When will the holidays end?

How do you know that you are on vacation?

- The authorities in your region have introduced tax holidays.

- You registered as an individual entrepreneur for the first time.

- Registered an individual entrepreneur after the introduction of holidays in your region.

- You apply a simplified taxation system or a patent.

- You are included in the list of preferential activities in the industrial, social, scientific fields or in the field of personal services to the population.

The list is approved in the regional law - find yours in the table.

The list is approved in the regional law - find yours in the table. - Comply with the conditions set by the local law. Some regions impose restrictions on the number of employees and the amount of revenue.

- Income from privileged activities is at least 70% of your total income.

If you are in doubt as to whether you qualify for the holiday, call your tax office.

How to switch to tax holidays?

If you are on the STS and fall under tax holidays, simply do not pay tax, and at the end of the year, submit a declaration at a rate of 0%. There is no need to submit special applications.

If you want to switch to a patent, , in the application for its receipt, indicate the 0% rate and the article of the regional law that introduced holidays for your business. Article "How to fill out an application for a patent."

New IP - the year of the Elbe as a gift

Year of online accounting at the Premium rate for sole proprietors under 3 months

Try for free

How to report on tax holidays?

Submit a declaration to the simplified tax system once a year: indicate the 0% tax rate and all income and expenses that you received.

Everything is quite simple on a patent: you don’t need to pay or report.

Important: do not forget to pay insurance premiums for individual entrepreneurs, tax holidays do not exempt them.

When will the holidays end?

You apply holidays for two tax periods, as long as you fall under the requirements of the law. But the tax holidays have an end date - December 31, 2024 (Article 346.50 of the Tax Code), after which the federal program may be curtailed.

For example, if you registered an individual entrepreneur in March 2022 and fell under a tax holiday, then do not pay tax until the end of 2024.

The article is relevant to

Continue reading

All articles

Responsibility of individual entrepreneurs for tax violations

Reporting deadlines in 2023 for individual entrepreneurs and LLCs on the simplified tax system and patent

Patent payment for IP

Even more useful

Newsletter for business

Digest about laws, taxes, reports twice a month

Social network

News and videos - in simple terms, with business in mind

How taxes will change in 2023 in Uzbekistan - News of Uzbekistan - Gazeta.

uz

uz Deputy Minister of Finance of Uzbekistan Dilshod Sultanov announced changes in the taxation of legal entities and individuals, as well as the application of customs benefits.

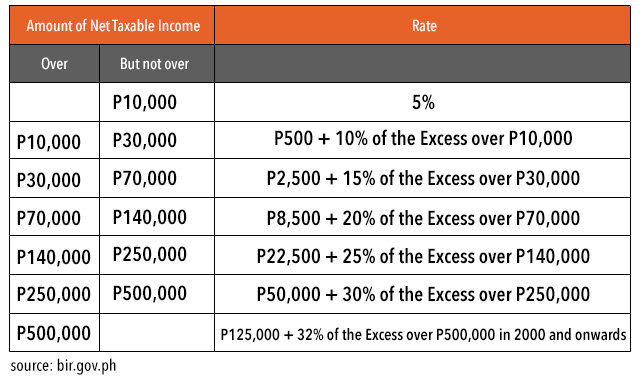

For 2023, the current rates for income tax (15%, for certain categories - 20%), personal income tax (12%), property tax for legal entities (1.5%), land tax for land agricultural purposes (0.95%), social tax (budgetary organizations - 25%, the rest - 12%).

VAT

The category of taxpayers, the procedure for calculating and paying tax, as well as the deadlines for submitting tax reports are retained.

From January 1, 2023, the tax rate is reduced from 15 to 12%. The terms for conducting a desk tax audit of the validity of the VAT amount to be reimbursed are reduced from 60 to 30 days.

From April 1, 2023 VAT exemptions will be canceled, granted under:

- geological services provided within the framework of annual state programs for the development and reproduction of the mineral resource base at the expense of the budget;

- sales of postage stamps, postcards, envelopes;

- turnover for the implementation of research and innovation work carried out at the expense of the budget.

From July 1, 2023, benefits provided for the services of the National Guard security units are excluded.

Advertisement on Gazeta.uz

In addition, public authorities and administrations may be recognized as VAT payers based on the decision of the President or the Cabinet of Ministers.

From January 1, 2023, a procedure is introduced providing that the amount of tax paid (payable) on goods (services) actually received, which is not accepted for offset due to the suspension of the certificate, in case of renewal of the certificate is subject to adjustment ( crediting) both for the taxpayer and his buyers for the period when the certificate was suspended.

Taxpayers who are registered with the Interregional State Tax Inspectorate for Large Taxpayers are granted the right to offset VAT amounts subject to reimbursement from the budget against VAT when importing goods.

VAT offset will be carried out by tax and customs authorities in automatic mode. To do this, the taxpayer - a participant in foreign economic activity, when registering a customs declaration, must make a note on the payment of VAT on imports at the expense of the amount subject to reimbursement.

To do this, the taxpayer - a participant in foreign economic activity, when registering a customs declaration, must make a note on the payment of VAT on imports at the expense of the amount subject to reimbursement.

Excise tax

The category of taxpayers, as well as the deadlines for submitting tax reports and paying taxes, are saved.

Starting February 1, 2023, excise tax rates for petroleum products, as well as for alcohol and tobacco products produced, are indexed (increase) by 10%.

From January 1, 2023, excise tax on the production of alcoholic products (excluding low-alcohol drinks) is calculated based on the share of ethyl alcohol contained in excisable products. At the same time, the unit of measurement for produced alcoholic products is “liter” (previously “dall”).

In 2022, the excise tax rate on vodka, cognac and other alcoholic products was set at 138,000 soums per 1 dal (or 13,800 soums per 1 liter).

In 2023, the excise tax rate for these products is set at 34,500 soums per 1 liter of anhydrous ethyl alcohol contained in excisable goods. For example, the share of ethyl alcohol in vodka is 40%, the amount of excise tax per 1 liter will be 13,800 soums (34,500 soums x 40%), and from February 1, 2023, taking into account indexation - 15,200 soums (38,000 soums x 40%).

From January 1, 2023, the excise tax rate on rectified ethyl alcohol from food raw materials, rectified ethyl alcohol from the etheraldehyde fraction and head fraction of ethyl alcohol will increase 5 times and will amount to 7450 soums per 1 liter.

Starting January 1, 2023, excise tax rates on the import of alcohol and tobacco products will be reduced by 5%.

Amended tables

Income tax

From November 1, 2022, profit from the sale of goods (services) for export is subject to taxation at a zero rate, regardless of the share of income from export in total income. At the same time, this rate will not be applied to profits received from the provision of services to non-residents of Uzbekistan from January 1, 2023.

The right to reduce the income tax rate by 50% is granted for the following category of taxpayers:

in which the taxpayer switched to paying tax, provided that in the tax period in which the reduced tax rate is applied, the total income of the taxpayer did not exceed 10 billion soums;

At the same time, these taxpayers have the right to determine the tax base in a simplified manner in the amount of 25% of total income.

Example. The taxpayer switched to paying income tax on October 1, 2022 (i.e. after September 1, 2022). In this case, the taxpayer during 2023 (1 year) is entitled to pay income tax at a rate of 7.5%, provided that in 2023 his total income did not exceed 10 billion soums.

b) taxpayers whose total income during the current tax period for the first time exceeded 10 billion soums after September 1, 2022 - during the current and subsequent tax periods, provided that the total income did not exceed 100 billion soums.

Example. According to the results of 9 months of 2023, the total income of the taxpayer exceeded 10 billion soums for the first time. The taxpayer pays income tax at a rate of 7.5% for the whole of 2023 and applies a reduced rate (7.5%) in 2024 (2 years) if its total income in 2023 or 2024 does not exceed 100 billion soums .

The reduced tax rate does not apply to taxpayers of subsoil use tax and excise tax, as well as in the event of liquidation of the taxpayer, and (or) detection of facts of division (splitting) of income from the sale of goods (services) of the taxpayer between two or more entities businesses to apply the reduced tax rate.

Taking into account the fact that stripping works, carried out at mineral deposits, are carried out for the future, they are transferred to a separate group of depreciation assets. It is provided that these expenses are deducted from the total income of the taxpayer in the form of depreciation deductions by applying the depreciation rate for this depreciable asset, but not more than 33% of the amount of accumulated expenses per year.

From 2022, net income remaining at the disposal of a non-resident working through a permanent establishment, after payment of tax, was treated as dividends and was subject to taxation at a tax rate of 10%. Clarifications have been made providing that a non-resident is now entitled to apply the reduced tax rate provided for by the international treaty on income in the form of dividends. If an international treaty on taxation of income in the form of dividends provides for several reduced tax rates, the smallest of them is applied.

From January 1, 2023, under a foreign trade contract for the purchase (sale) of equipment, which provides for installation and (or) commissioning services and other similar services by a non-resident, if the cost of the services provided is not specified separately, then the taxable income of a non-resident is determined based on the market value such services (previously - 20% of the cost of equipment).

Changes have been made to the deadline for submitting to the tax authorities a certificate on the amount of advance payments for income tax.

In particular, from January 1, 2023, the taxpayer has the right to submit this certificate before the 15th day (previously 10th day) of the first month of the next quarter, based on the expected amount of profit in the current quarter.

Turnover tax

Turnover tax unifies turnover tax rates, with the establishment of a single rate for all categories of taxpayers in the amount of 4%.

At the same time, reduced tax rates for enterprises located in remote and mountainous areas in the amount of 1%, in other settlements - 2% (including e-commerce) and in cities with a population of 100 thousand people and more - 3 %.

From 2023, VAT payers have the right to voluntarily choose to pay tax in a fixed amount. At the same time, if the total income does not exceed 500 million soums, the right to choose to pay a tax in a fixed amount of 20 million soums per year is granted, and if the total income exceeds 500 million soums - 30 million soums per year.

Tax in a fixed amount is paid in equal monthly installments no later than the 15th day of the month following the calendar month.

To switch to paying this tax, the taxpayer must send a notification to the tax authority at the place of tax registration no later than 10 days before the beginning of the next month. Taking into account that this rule comes into force on January 1, 2023, taxpayers switching to paying tax for the first time in a fixed amount have the right to submit a notification to the tax authorities no later than January 25, 2023.

Newly created taxpayers have the right to choose to pay tax in a fixed amount upon state registration.

Refusal to pay tax in a fixed amount is carried out from the beginning of the next tax period.

When switching to paying tax in a fixed amount during the tax period, the amount of tax is determined by dividing the fixed amount by 12 and multiplying the result by the number of months remaining until the end of the current tax period.

If during the tax period the total income of the taxpayer in a fixed amount exceeds 500 million soums, then the amount of tax in a fixed amount is recalculated starting from the month of its excess until the end of the current tax period, based on the tax rate established for taxpayers with a total income of over 500 million soums.

When switching from paying tax in a fixed amount to paying VAT and income tax during the tax period, the amount of tax in a fixed amount is payable taking into account the last calendar month in which the transition to payment of these taxes was made.

Dividends paid to taxpayers of turnover tax in a fixed amount are not subject to income tax and personal income tax.

At the same time, when switching to VAT payment on a voluntary or mandatory basis, such taxpayers are not granted the right to offset VAT on the balance of goods purchased with VAT.

Taxpayers, including newly created legal entities and newly registered individual entrepreneurs, whose total income during the tax period exceeded 1 billion soums, are transferred to the payment of VAT and income tax from the day the specified amount of total income is reached.

Personal income tax and social tax

For personal income tax and social tax, the category of taxpayers, tax rates, the procedure for calculating and paying taxes (including crediting 0.1% to individual accumulative pension accounts) are retained.

For personal income tax, the amount of non-taxable income increases from 15 million soums to 80 times the minimum wage (or 73.6 million soums) when individuals direct their income to repay mortgage loans, while canceling the requirement for the cost of housing (for today day 300 million soums).

Starting April 1, 2023, personal income tax benefits will be abolished in terms of income used to pay for long-term life insurance.

Personal income tax rates for individual entrepreneurs paying taxes in fixed amounts are indexed (increased) by 10%.

Changes have been made to the deadlines for submitting annual tax returns on personal income tax and social tax, , which are set no later than February 15 of the next year. Based on the results of 2022, annual tax returns must be submitted no later than February 15, 2023.

Based on the results of 2022, annual tax returns must be submitted no later than February 15, 2023.

The minimum rental rates set for individuals, for the purpose of calculating personal income tax, have been increased by 10% (table).

Corporate property tax

For the property tax of legal entities, the procedure for determining the tax base, the minimum cost established in absolute value per 1 sq. m, as well as a tax rate of 1.5% of the tax base.

The right of the Jokargy Kenes of Karakalpakstan and the kengashes of people's deputies of the regions to establish in the districts a reduction factor of up to 0.5 to the established minimum value of real estate objects, depending on their economic development, is also retained.

The gradual bringing of the reduced tax rate established for the objects provided for in the fourth part of Article 415 of the Tax Code to the base tax rate continues, by increasing it in 2023 from 0. 5 to 0.6%. A reduced tax rate for legal entities has been introduced since 2020 for objects that were previously granted tax benefits.

5 to 0.6%. A reduced tax rate for legal entities has been introduced since 2020 for objects that were previously granted tax benefits.

From July 1, 2022, the procedure for taxing objects for which legislation can apply enforcement measures by establishing increased tax rates on the property of legal entities has been canceled.

Changes have been made to the deadlines for submitting tax reports and paying taxes (advance payments). In particular, the following deadlines are set:

- for the submission of tax reports - no later than March 1 of the year following the reporting tax period. Within the same period, the final payment of tax for the tax period is made, taking into account advance payments;

- submission of a certificate on the amount of tax for the current tax period (advance payments) - no later than January 20 of the current tax period;

- payment of advance payments by payers of turnover tax - no later than the 20th day of the third month of each quarter.

For the rest of the taxpayers, the deadlines for making advance payments remain until the 10th day of each month, while for the month of January they pay no later than January 20th.

For the rest of the taxpayers, the deadlines for making advance payments remain until the 10th day of each month, while for the month of January they pay no later than January 20th.

Personal property tax

For personal property tax, the tax rates in effect in 2022 increase by an average of 10% for the items provided for in paragraphs 1-3 of part one of Article 422 of the Tax Code. This is due to the fact that for individuals, the size of the cadastral value of objects of taxation (tax base) determined by the authorities that carry out state registration of rights to real estate in 2018 is retained.

Retained in 2023 for individuals with housing stock (including parking spaces inextricably linked with an apartment building) the practice of applying a limit on the increase in the amount of tax in relation to the previous year. In particular, in 2023 the amount of tax calculated on the basis of the cadastral value determined in 2018 cannot exceed the amount of tax assessed for 2022 by more than 1. 3 times.

3 times.

For reference: This restriction applies to all real estate objects owned by individuals, starting from 2018, to prevent a sharp increase in the tax burden after the transfer of property tax from inventory value (until 2018) to property taxation based on cadastral value.

At the same time, from 2023, the practice of applying a limitation on the amount of tax on the property of individuals in relation to the previous year in terms of non-residential immovable property is canceled. This rule was introduced in order to create equal conditions for the taxation of real estate objects for their functional purpose (non-residential premises), regardless of whether they belong to an individual or legal entity.

For land tax, the restriction does not apply to land plots used by individuals in business activities from 2022.

From July 1, 2022, the procedure for taxing real estate objects, on which legislation can apply measures of influence by establishing increased tax rates provided for legal entities, has been canceled.

Land tax

For land tax, the procedure for calculating land tax from legal entities and individuals, as well as the tax rate established for agricultural land in the amount of 0.95% of the standard value of farmland, is retained.

The base land tax rates for non-agricultural land in force in 2022 are increased by an average of 10%. At the same time, the procedure for determining the specific amount of tax rates by local government bodies on the basis of base rates, with the use of increasing and decreasing coefficients, depending on their economic development, is preserved.

Preserved in 2023 for individuals who own non-agricultural land plots occupied by residential real estate objects, the practice of applying a limitation on the increase in the amount of tax in relation to the previous year. In particular, in 2023 the amount of tax should not exceed the amount of tax accrued in 2022 by more than 1.3 times in order to prevent a sharp increase in the tax burden.

The gradual bringing of the reduced tax rate for legal entities to the base tax rate continues by increasing in 2023 the reduction coefficient applied to tax rates for legal entities in relation to land occupied by individual objects provided for in Article 429 of the Tax Code from 0.25 up to 0.3. A reduced tax rate for legal entities has been introduced since 2020 for objects that were previously granted tax benefits.

In order to ensure equal conditions for the taxation of agricultural land, individuals who own agricultural land are subject to the procedure for calculating and paying land tax provided for dekhkan farms. The amount of land tax for them is calculated by the tax authorities based on the standard value of land plots determined in accordance with the law. At the same time, the standard cost of land plots is determined on average for the irrigated or non-irrigated land of the district (city), respectively.

In the event of deterioration or improvement in the quality of agricultural land (decrease or increase in the quality score), dekhkan farms and individuals with agricultural land are subject to the procedure provided for by parts nine and ten of Article 429 of the Tax Code.

From July 1, 2022, the procedure for taxing objects for which legislation can apply enforcement measures by establishing increased land tax rates for legal entities has been canceled.

Changes have been made to the deadlines for submitting tax reports and paying tax on non-agricultural land. In particular, the following deadlines are set:

- submission of tax reports and certificates of land plots held by a legal entity that are not subject to taxation - no later than January 20 of the current tax period;

- payment of tax by payers of turnover tax - no later than the 20th day of the third month of each quarter. For the rest of the taxpayers, the tax payment deadlines remain until the 10th day of each month, while for the month of January they pay no later than January 20th.

For agricultural land, the deadlines for submitting tax reports and paying taxes remain.

Tax for the use of water resources

For the tax for the use of water resources, the procedure for calculating and paying tax for the use of water resources is retained.

The payment of tax for the use of water resources is introduced for individuals having:

- non-residential real estate objects intended for entrepreneurial activity and (or) generating income at tax rates established for individual entrepreneurs.

- agricultural land at the tax rates established for dekhkan farms.

This norm was introduced in order to create equal conditions for the taxation of water resources used in entrepreneurial activities by individual entrepreneurs and individuals in non-residential premises, as well as dekhkan farms and individuals for irrigation of agricultural land.

For this category of taxpayers, the tax will be calculated by the tax authorities.

Tax rates effective in 2022 are indexed by 10% on average.

Changes have been made to the deadlines:

- for submission of tax reports for legal entities of Uzbekistan (excluding agricultural enterprises), which is set no later than March 1 of the year following the reporting tax period.

Within the same period, the final payment of tax for the tax period is made, taking into account advance payments;

Within the same period, the final payment of tax for the tax period is made, taking into account advance payments; - delivery by the tax authorities of a payment notice of tax payment, which is established no later than March 1 of the year following the tax period.

For agricultural enterprises, 2 tax payment deadlines are established:

- until October 1 - 70% of the annual tax amount determined by the tax authorities based on the volume of water used by the agricultural enterprise in the previous tax period for irrigating agricultural land and breeding ( growing) fish. In the absence of information on the volume of water used by an agricultural enterprise in the previous tax period, the amount of tax is determined according to the water consumption standards approved by the authorized body in the field of water use and water consumption;

- until December 15 - the remaining tax amount.

Subsoil use tax

As part of the subsoil use tax on ferrous, precious, non-ferrous and radioactive metals, as well as rare and rare earth elements (hereinafter referred to as metals), a procedure is introduced in accordance with which:

- is the object of taxation actual sale of mined (recovered) metals;

- The tax base is the value of the volume of actual sales of mined (extracted) metals.

The tax base for gas condensate is determined in the same way as for natural gas and oil.

For metals and hydrocarbons, for which the Netback mechanism is applied, the fiscal perimeter is specified. At the same time, when determining the tax base for these types of minerals, the amount of expenses associated with the transportation and (or) processing of extracted minerals, including their processing on a tolling basis, is determined by the taxpayer together with the tax authorities. The amount of these expenses can be adjusted based on the results of the calendar year, in a similar manner.

The iron tax rate is reduced from 5% to 2%.

Other changes

From April 1, 2023, customs duty exemptions for property imported into the customs territory by enterprises with foreign investment with a share of foreign investment in the authorized capital (authorized capital) of at least 33% for their own production needs are canceled, unless otherwise not provided for by investment agreements concluded between a foreign investor and an authorized state body in the field of state regulation of investments and investment activities before January 1, 2023.

In order to preserve fixed assets and other property necessary for carrying out financial and economic activities, the period for collecting tax debts on the property of taxpayers with tax debts is extended from 30 to 60 days.

Taxpayers of VAT and income tax with a total income of up to 10 billion soums are entitled to a notification procedure for installment payments for payment of tax debts for a period of for 6 months (excluding legal entities with a state share in the authorized capital (authorized capital) of 50 percent or more, subsoil users and manufacturers of excisable goods).

At the same time, interest-free installments are provided once during a calendar year.

Extended until January 1, 2024, the period of application of the zero rate of customs duty for certain goods imported into the territory of Uzbekistan.

Amounts of taxes (penalties, fines) overpaid by a liquidated legal entity or overcharged from it are subject to offset by the tax authority against the payment of tax debts on other taxes.