How many women pay child support

Are Moms Less Likely Than Dads To Pay Child Support?

Dear Mona,

I heard a piece of news that sounded strange: The proportion of deadbeat moms (women who do not fulfill their child support obligations) is higher than for deadbeat dads.

Is this true?

Jack, 32, San Francisco

Dear Jack,

When people write to me with a question, more often than not, they’ve had a personal experience that makes them feel invested in getting an answer. It turned out that was true for you, Jack; you let me know that growing up, you lived with one custodial parent while your other parent lived elsewhere — an experience you share with 28 percent of all American children younger than 21.1

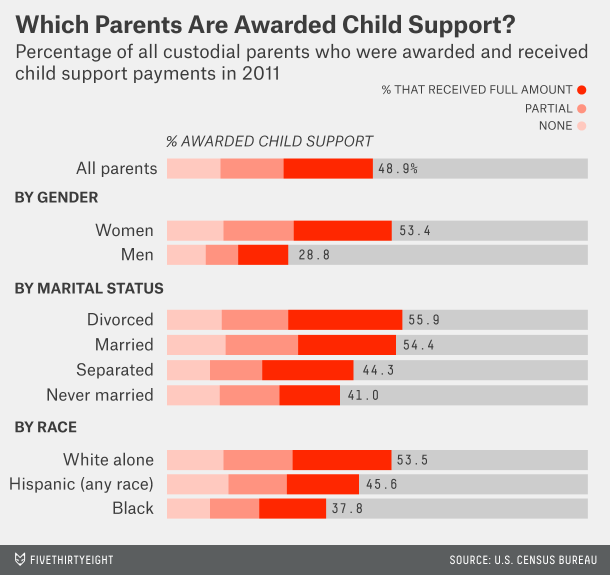

You also told me that your dad was awarded custody of your care. That’s not as rare as some people might think — 18.3 percent of custodial parents in 2011 were fathers, according to the latest numbers from the U.S. Census Bureau, which is the source I’m using for all these figures. (Unfortunately, it doesn’t have data on same-sex parents.) While half of custodial mothers had legal child support agreements in place, only a quarter of fathers did (more on the reasons a bit later on).

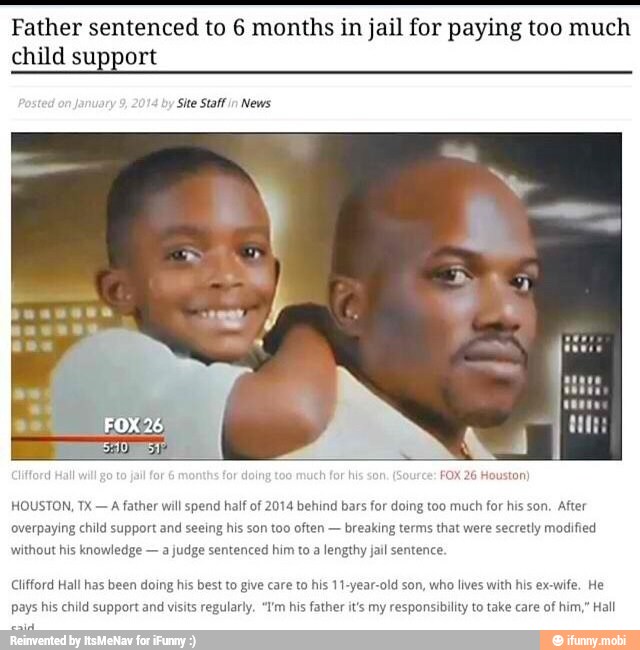

But the real heart of your question seems to be whether custodial fathers struggle more than custodial mothers to receive child support. I’m not sure where you heard your claim, but it appears to be a correct one. In 2011, 32 percent of custodial fathers didn’t receive any of the child support that had been awarded to them, compared with 25.1 percent of custodial mothers. That’s a relatively small difference. And when you look at the other extreme (i.e., the percentage of parents who receive the full amount), the difference isn’t statistically significant at all: 43.6 percent of custodial mothers compared with 41.4 percent of fathers.

Then there’s the gray area in between paying nothing and paying everything. The most common amount of child support due to custodial mothers is $4,800 annually, of which $2,500 is typically received (52 percent). For custodial fathers, median annual child support is less — it’s $4,160 — and fathers receive 40 percent of the amount they’re due.

For custodial fathers, median annual child support is less — it’s $4,160 — and fathers receive 40 percent of the amount they’re due.

Nationally, this all adds up to a lot of outstanding child support. In 2011, America’s custodial fathers were owed a total of $1.7 billion and custodial mothers were owed $12.1 billion (keep in mind, moms who are owed child support outnumber dads almost 9 to 1).

So far, the data isn’t looking great for mothers who don’t live with their kids, is it, Jack? But there’s more to it — custodial fathers are in a better situation financially, even without child support payments. Custodial dads who don’t receive the child support they’re due have an average household income that is $9,749 higher than dads who do get child support. For custodial moms, it’s a completely different story: Those who don’t receive the child support they’ve been awarded have a household income that’s $4,132 lower than moms who do.

That’s not all. The average household income of a dad who doesn’t get the child support money he’s due is $51,791. For moms, that figure is $26,231.

For moms, that figure is $26,231.

Poverty rates also differ between custodial mothers and fathers, even if you set aside whether or not they’re receiving child support payments. In 2011, 31.8 percent of custodial mothers were living in poverty — the figure for custodial fathers is half that. That gap has persisted since 1993, although it narrowed in 2001 and again in 2009. Looking at the chart below, I’d hazard a guess that was because more custodial fathers lost their jobs in a bad economy.

In fact, the overall employment status of custodial mothers and custodial fathers looks very different. Mothers were far more likely than fathers to be in part-time work or working for only part of the year, as opposed to in full-time work, and they were also more likely to be out of work altogether.

After you told me that you had no siblings, Jack, I wondered whether child care might be affecting those parents’ employment patterns. Custodial mothers were more likely than custodial fathers to have two or more children living with them (45. 3 percent and 33.7 percent, respectively).2

3 percent and 33.7 percent, respectively).2

Custodial dads are also more likely than custodial moms to receive non-cash support from the other parent. That means that moms who don’t have custody are more likely to pitch in for things like groceries, medical expenses, clothes and gifts.

It’s starting to look like the term “deadbeat” is sort of misleading — not least because it’s a pejorative, colloquial term used to refer to parents who evade their responsibilities.

Let’s consider for a moment a separate group of custodial parents: those who weren’t awarded child support in the first place. There are lots of them to look at — nearly half of all custodial mothers and three-quarters of custodial fathers don’t have a legal agreement for child support payments in place. When asked why, custodial fathers are twice as likely to say “child stays with other parent part of the time.” They’re also slightly more likely to cite financial reasons like “child’s other parent provides what she can” or “child’s other parent could not afford to pay. ”

”

It’s important, then, to take a step back and understand who is awarded child support and why — especially if you want to go beyond comparing just moms and dads. Whether a custodial parent is black, white or Hispanic doesn’t really change the likelihood that he or she will get the full amount of child support owed, but it does change the chances of being awarded child support in the first place. Only 38 percent of black custodial parents are awarded child support, compared with 54 percent of white custodial parents. (Half of all African-American children younger than 21 live with one custodial parent.)

Like race, marital status3 affects the chances of being awarded child support. Only 41 percent of never-married custodial parents are awarded child support, compared with 64 percent of those who are divorced and remarried. Unlike race, however, marital status makes a big difference in the likelihood that a parent will receive the child support payments that he or she has been awarded: Custodial moms and dads who have never been married or are in their first marriages are much less likely to get any of the payments they’re due.

In reality, though, race and marital status are probably related — we know that white Americans are more likely than African-Americans to be married. So we need to understand why marriage appears to be such an important factor in receiving child support payments.

Cynthia Osborne, director of the Child and Family Research Partnership at the University of Texas at Austin, told me that there are two ways that child support can be put in place. The first is when spouses file for divorce; they might settle on custody and child support arrangements as well as the usual property matters. Those, Osborne told me, “tend to be moderately affluent families.” Then there’s another system called the IV-D program, which was established in 1975 to help custodial parents get the money they’re owed by giving the state the right to collect child support payments. Families in the IV-D program are more likely to be “moms on welfare,” according to Osborne.

If going through the state system as opposed to divorce courts means a parent is more likely to be poor and more likely to be concerned with chasing down child support payments, that could explain why a higher percentage of custodial moms are getting the child support they’ve been awarded. When I looked at the divorce rates of custodial parents, I spotted a pretty big difference: Only 40 percent of custodial moms are either divorced or divorced and remarried, compared with 52 percent of custodial dads.

When I looked at the divorce rates of custodial parents, I spotted a pretty big difference: Only 40 percent of custodial moms are either divorced or divorced and remarried, compared with 52 percent of custodial dads.

I’ll admit it, Jack — I was surprised to learn that a slightly higher percentage of noncustodial mothers don’t pay any of the child support they’re supposed to. But looking at the statistics on poverty, working status and the reasons given for not establishing an agreement, it’s clear that on the whole, custodial fathers struggle a lot less financially than moms do.

Hope the numbers help,

Mona

Have a question you would like answered here? Send it to @MonaChalabi or [email protected].

The Socio-Economic Division Among Women in Child Support Proceedings

June 18, 2021

Practice PointsAcross all income levels, single mothers bear the burden of the prevalent lack of consistent financial contribution from noncustodial parents.

By Leslie Silva

Share:Simplistically speaking, there are two major areas of contention in family law: money and children. These areas combine to produce a process we know as child support.

Each state has their own set of child support laws, though often they can be similar and reflect federal child support statutes, such as Title 18 for enforcement and Title 28 for full faith and credit of support orders. The basic theory is the same: the noncustodial parent pays the custodial parent.

In 2020, U.S. Census Bureau data reported that 82 percent of single parent households were headed by mothers only. Women are more frequently the custodial parent, making them the majority of candidates to receive child support. In contrast, the number of men that are custodial parents has only increased 4 percent in 24 years, according to the U.S. Census Bureau. Therefore, the collection and enforcement of child support can morph into an unexpected burden for single mothers. Further research has shown that the burden for these mothers grows relative to the disparity in income between these women.

Further research has shown that the burden for these mothers grows relative to the disparity in income between these women.

Women who have primary custody of their children and who also maintain a financially stable career are often dissuaded from collecting or enforcing child support orders and payments. This misguided theory suggests that if a woman has attained a certain level of professional and financial status, she does not need financial contribution from the other parent. Too often women who are financially independent from the noncustodial parent, yet statutorily entitled to financial support for their children, are discouraged and ultimately do not pursue or receive support. This archaic mind set puts additional pressure on working mothers. One parent’s success does not alleviate the responsibility of the noncustodial parent. It also should not diminish the benefit of additional income for their children. The point remains, it is the children who are entitled to benefit from the income of both parents.

On the other end of the spectrum, there are working mothers who have primary custody of their children but are of more modest financial means. Their struggle is not so much in deciding to obtain a support order, but more likely in the collection or enforcement of a child support order. These women, who comprise nearly half of working mothers, rely on child support to pay the week’s grocery bill, utility bill, or to make up a shortfall on housing costs.

If the parties do not participate in having their order enforced by a state-backed collection unit, the collection of support can become even more challenging. Only 44 percent of child support orders are collected in full. For the staggering amount of other cases, parents are faced with continuing conflict, both in and out of court. Often, parents who do not use the collection unit take on the responsibility of tracking, calculating, and pursuing their own support collection and enforcement. This requires the parent receiving support to engage in additional record keeping and potentially contentious communications with the other parent. When they cannot collect, arrearages add up, but so do the bills, leaving them alone to bear the burden of financially supporting their children while still being the primary caretaker. It must be said that you can witness substantial drive and commitment from these mothers to take on these challenges, for no other reason than to provide to the best of their ability for their children. They are driven by their faith in, and love of, their children.

When they cannot collect, arrearages add up, but so do the bills, leaving them alone to bear the burden of financially supporting their children while still being the primary caretaker. It must be said that you can witness substantial drive and commitment from these mothers to take on these challenges, for no other reason than to provide to the best of their ability for their children. They are driven by their faith in, and love of, their children.

However, faith and love can only drive some so far when there is no foundation of steady and livable income. At some point, payments stop, arrearages reach unattainable amounts, and women lose hope of ever collecting much needed funds to support their children. The National Women’s Law Center reported that in 2019, one in three families headed by unmarried mothers lived in poverty in 2019. It is not surprising that there are a striking number of single-mother homes that live in poverty considering that the vast amount of mothers are not collecting full child support, or any support at all. This presents a cyclical socio-economic crisis.

This presents a cyclical socio-economic crisis.

Being the custodial parent often prevents these women from ever becoming financially independent. Indeed, a 2019 Pew Research survey found that 50 percent of employed mothers said they struggled to advance their career while balancing parental duties.

It is not just basic child support that is at issue. Most states provide for an add-on of childcare expenses contributed to by both parties. Not only are a significant amount of women not receiving full child support, they also are not receiving reimbursement for childcare which is necessary for them to be employed themselves.

All of these challenges were amplified during the pandemic. According to the U.S. Census Bureau, childcare demands forced over 32 percent of mothers out of the workforce. We now see an increase in family court filings for violations and modifications of child support. Childcare options have dwindled as well, and those that remain saw an increase in cost. In a 2020 study, the Center for American Progress found that the cost of childcare since COVID has increased on average about 47 percent. During the pandemic, the share of unpartnered mothers who are working in the U.S. dropped to 67.4 percent in September 2020 compared to 76.1 percent in September 2019. A likely contributing factor was the increase in childcare costs, together with the inability of mothers to collect full child support.

In a 2020 study, the Center for American Progress found that the cost of childcare since COVID has increased on average about 47 percent. During the pandemic, the share of unpartnered mothers who are working in the U.S. dropped to 67.4 percent in September 2020 compared to 76.1 percent in September 2019. A likely contributing factor was the increase in childcare costs, together with the inability of mothers to collect full child support.

Across all income levels, single mothers are bearing the burden of the prevalent lack of consistent financial contribution from noncustodial parents. Supporting, and encouraging, efficient government backed collection bureaus, is one step in the right direction. However, it may be some time until we see a stronger economic recovery across the country that can provide the income infusion that these families need. Only time will tell.

Leslie Silva is a partner at Tully Rinckey PLLC in Albany, New York.

Entity:

- Litigation

Topic:

- General Practice

- Diversity and Inclusion

The material in all ABA publications is copyrighted and may be reprinted by permission only.

Request reprint permission here.

Request reprint permission here. Copyright © 2021, American Bar Association. All rights reserved. This information or any portion thereof may not be copied or disseminated in any form or by any means or downloaded or stored in an electronic database or retrieval system without the express written consent of the American Bar Association. The views expressed in this article are those of the author(s) and do not necessarily reflect the positions or policies of the American Bar Association, the Litigation Section, this committee, or the employer(s) of the author(s).

up to what age they pay, how much percentage of income they can withhold, and what documents are needed to apply for alimony

1. Who can apply for child support?

Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under the age of 18 and has not yet become fully capable by decision of the guardianship or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years of age but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he needs and is recognized Disabled adults who are entitled to alimony are considered disabled people of groups I, II, III and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.0010

- wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and cares for a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, health status and other circumstances.

marriage or within five years thereafter, and the spouses have been married for a long time.0010

marriage or within five years thereafter, and the spouses have been married for a long time.0010

Also, child support can be received by:

- disabled and needy parents, including stepfather and stepmother, from their adult able-bodied children. This rule does not apply to guardians, trustees and adoptive parents;

- disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient funds for this, if they cannot receive alimony from their parents. After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

- incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive alimony from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members. Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

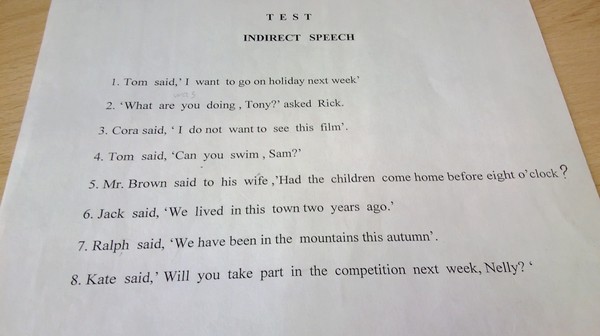

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at the place of your residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

3. What documents are needed to apply for child support?

The child support claim must be accompanied by:

- copies of it, one for the judge, the defendant, and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- a single housing document and income statements for all family members;

- calculation of the amount you expect to receive towards child support. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-to-do of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

In exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which their recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and up to 18 years of age, if the child does not marry earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated. Parents must support the child, even if he does not need material assistance. The incapacity of the parents, the recognition of their incapacity in court or the deprivation of parental rights also does not release from this obligation.

Parents must support the child, even if he does not need material assistance. The incapacity of the parents, the recognition of their incapacity in court or the deprivation of parental rights also does not release from this obligation.

Alimony may be denied: or spouse, including an ex, if he or she has become disabled and needs help due to alcohol, drug abuse, or intentional crime, or has behaved unworthily in marriage, such as gambling;

| ||||

| ||||

The wife categorically refused, arguing that he is a man and is obliged to support his family. The court, where the father filed a lawsuit, satisfied his requirements in full, forcing the mother to pay alimony.

The wife categorically refused, arguing that he is a man and is obliged to support his family. The court, where the father filed a lawsuit, satisfied his requirements in full, forcing the mother to pay alimony.  In this case, the agreement will be legally binding.

In this case, the agreement will be legally binding.  In the event of her malicious evasion, the following sanctions may be applied to her:

In the event of her malicious evasion, the following sanctions may be applied to her: