How long does a child receive survivor benefits

If You Are The Survivor

If You Are The Survivor

Just as you plan for your family's protection if you die, you should consider the Social Security benefits that may be available if you are the survivor — that is, the spouse, child, or parent of a worker who dies. That person must have worked long enough under Social Security to qualify for benefits.

How Your Spouse Earns Social Security Survivors Benefits

A worker can earn up to four credits each year. In 2022, for example, your spouse can earn one credit for each $1,510 of wages or self-employment income. When your spouse has earned $6,040 they have earned their four credits for the year.

The number of credits needed to provide benefits for survivors depends on the worker's age when they die. No one needs more than 40 credits (10 years of work) to be eligible for any Social Security benefit. But, the younger a person is, the fewer credits they must have for family members to receive survivors benefits.

Some survivors can get benefits if the worker has credit for one and one-half years of work (six credits) in the three years just before their death. Each person’s situation is different and you need to talk to one of our claims representatives about your choices.

When A Family Member Dies

We should be notified as soon as possible when a person dies. However, you cannot report a death or apply for survivors benefits online.

In most cases, the funeral home will report the person’s death to us. You should give the funeral home the deceased person’s Social Security number if you want them to make the report.

If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778). You can speak to one of our representatives between 8:00 am – 7:00 pm. Monday through Friday. You can also contact your local Social Security office.

Do we pay death benefits?

A one-time lump-sum death payment of $255 can be paid to the surviving spouse if they were living with the deceased. If living apart, they were receiving certain Social Security benefits on the deceased’s record.

If living apart, they were receiving certain Social Security benefits on the deceased’s record.

If there is no surviving spouse, the payment is made to a child who is eligible for benefits on the deceased’s record in the month of death.

What happens if the deceased received monthly benefits?

If the deceased was receiving Social Security benefits, you must return the benefit received for the month of death and any later months.

For example, if the person died in July, you must return the benefits paid in August. How you return the benefits depends on how the deceased received benefits:

- For funds received by direct deposit, contact the bank or other financial institution. Request that any funds received for the month of death or later be returned to us.

- Benefits received by check must be returned to us as soon as possible. Do not cash any checks received for the month in which the person dies or later.

Who receives benefits?

Certain family members may be eligible to receive monthly benefits, including:

- A widow or widower age 60 or older (age 50 or older if they have a disability).

- A surviving divorced spouse, under certain circumstances.

- A widow or widower at any age who is caring for the deceased’s child who is under age 16 or has a disability and receiving child’s benefits.

- An unmarried child of the deceased who is one of the following:

- Younger than age 18 (or up to age 19 if they are a full-time student in an elementary or secondary school).

- Age 18 or older with a disability that began before age 22.

Are other family members eligible?

Under certain circumstances, the following family members may be eligible:

- A stepchild, grandchild, step grandchild, or adopted child.

- Parents, age 62 or older, who were dependent on the deceased for at least half of their support.

Eligible family members may be able to receive survivors benefits for the month that the beneficiary died.

Widow Or Widower

If you are the widow or widower of a person who worked long enough under Social Security, you can:

- Receive reduced benefits as early as age 60.

- Begin receiving benefits as early as age 50 if you have a disability and the disability started before or within 7 years of the worker's death.

- Receive survivors benefits at any age, if you have not remarried and you take care of the deceased worker's child who is under age 16 or has a disability and receives child’s benefits.

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62.

If a widow or widower who is caring for the worker's children receives Social Security benefits, they're still eligible if their disability starts before those payments end or within seven years after they end.

If you remarry after you reach age 60 (age 50 if you have a disability), your remarriage will not affect your eligibility for survivors benefits.

- A widow, widower, or surviving divorced spouse cannot apply online for survivors benefits. You should contact us at 1-800-772-1213 to request an appointment. If you are deaf or hard of hearing, call our TTY number at 1-800-325-0778.

- If you wish to apply for disability benefits as a survivor, you can speed up the disability application process if you complete an Adult Disability Report and have it available at the time of your appointment.

- We use the same definition of disability for widows and widowers as we do for workers.

A few other situations:

- If you already receive benefits as a spouse, your benefit will automatically convert to survivors benefits after we receive the report of death.

- If you are also eligible for retirement benefits, but haven't applied yet, you have an additional option. You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later.

- For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

If you became entitled to retirement benefits less than 12 months ago, you may be able to withdraw your retirement application and apply for survivors benefits only. If you do that, you can reapply for the retirement benefits later when they will be higher.

Surviving Divorced Spouse

If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more.

Benefits paid to you as a surviving divorced spouse won't affect the benefit amount for other survivors getting benefits on the worker's record.

If you remarry after you reach age 60 (age 50 if you have a disability), the remarriage will not affect your eligibility for survivors benefits.

If you are caring for a child under age 16 or who has a disability and the child get benefits on the record of your former spouse, you would not have to meet the length-of-marriage rule. The child must be your former spouse's natural or legally adopted child.

If you qualify because you have the worker's child in your care, your benefit will affect the amount of the benefits of others on the worker's record.

Minor Or Child with a disability

If you are the unmarried child under age 18 of a worker who dies, you can be eligible to receive Social Security survivors benefits. You can also be eligible, if you are up to age 19 and attending elementary or secondary school full time.

And you can get benefits at any age if you have a qualifying disability that began before age 22 and remains the same.

Besides the worker's natural children, their stepchildren, grandchildren, step grandchildren, or adopted children may receive benefits under certain circumstances.

For Your Parents

If you are the dependent parent, who is at least age 62, of a worker who dies, you may be eligible to receive Social Security survivors benefits.

You must have been receiving at least half of your support from your working child. Also, you must not be eligible to receive a retirement benefit that is higher than the benefit we could pay on your child’s record. Generally, you must not have married after your deceased adult child’s death. However, there are some exceptions.

Besides being the natural parent, you could also be the stepparent, or the adoptive parent if you became the deceased worker’s parent before he or she was age 16.

Survivors Benefit Amount

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

The more they paid into Social Security, the higher your benefits would be.

These are examples of the benefits that survivors may receive:

- Widow or widower, full retirement age or older — 100% of the deceased worker's benefit amount.

- Widow or widower, age 60 — full retirement age — 71½ to 99% of the deceased worker's basic amount.

- Widow or widower with a disability aged 50 through 59 — 71½%.

- Widow or widower, any age, caring for a child under age 16 — 75%.

- A child under age 18 (age 19 if still in elementary or secondary school) or who has a disability — 75%.

- Dependent parent(s) of the deceased worker, age 62 or older receive:

- One surviving parent — 82½%.

- Two surviving parents — 75% to each parent.

Percentages for a surviving divorced spouse would be the same as above.

There may also be a special lump-sum death benefit.

Maximum Family Amount

There's a limit to the amount that family members can receive each month. The limit varies, but it is generally equal to between 150% and 180% of the basic benefit rate.

If the sum of the benefits payable to family members is greater than this limit, the benefits will be reduced proportionately. Any benefits paid to a surviving divorced spouse based on disability or age won't count toward this maximum amount.

Other Things You Need To Know

There are limits on how much survivors may earn while they receive benefits.

Benefits for a widow, widower, or surviving divorced spouse may be affected by several additional factors:

- If you remarry before age 60 (age 50 if you have a disability), you cannot receive benefits as a surviving spouse while you are married.

- If you remarry after age 60 (age 50 if you have a disability), you will continue to qualify for benefits on your deceased spouse's Social Security record.

- If you receive benefits as a widow, widower, or surviving divorced spouse, you can switch to your own retirement benefit as early as age 62. This assumes you are eligible for retirement benefits and your retirement rate is higher than your rate as a widow, widower, or surviving divorced spouse.

- In many cases, a widow or widower can begin receiving one benefit at a reduced rate and allow the other benefit amount to increase.

- If you will also receive a pension based on work not covered by Social Security, such as government or foreign work, your Social Security benefits as a survivor may be affected.

However, if your current spouse is a Social Security beneficiary, you may want to apply for spouse's benefits on their record. If that amount is more than your widow's or widower's benefit, you will receive a combination of benefits that equals the higher amount.

A Special Lump-Sum Death Payment

A surviving spouse or child may receive a special lump-sum death payment of $255 if they meet certain requirements.

Generally, the lump-sum is paid to the surviving spouse who was living in the same household as the worker when they died. If they were living apart, the surviving spouse can still receive the lump-sum if, during the month the worker died, they met one of the following:

- Were already receiving benefits on the worker's record.

- Became eligible for benefits upon the worker's death.

If there's no eligible surviving spouse, the lump-sum can be paid to the worker's child (or children) if, during the month the worker died, the child met one of the following:

- Was already receiving benefits on the worker's record.

- Became eligible for benefits upon the worker's death.

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death.

For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 (TTY 1-800-325-0778).

Social Security Children's Benefits: How They Work

Social Security is usually associated with monthly payments to retirees. However, there is another important facet of Social Security benefits—providing financial assistance to children. Children may qualify for benefits if a parent is retired, disabled, or deceased.

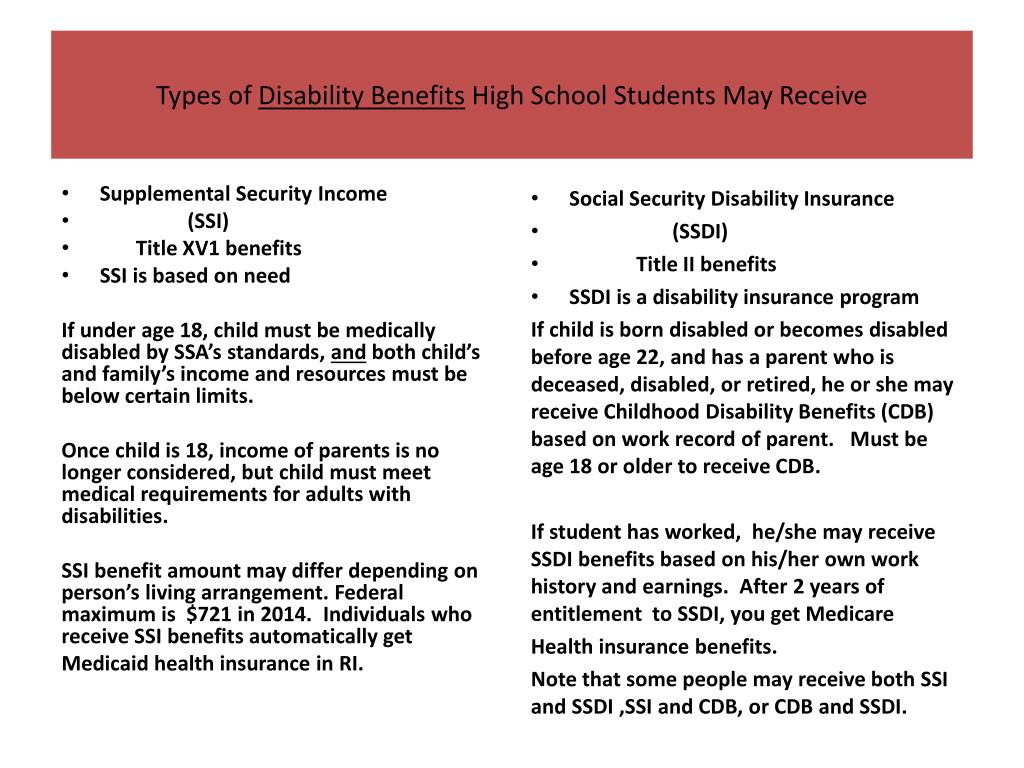

Children who are disabled may be eligible for Supplemental Security Income (SSI), a separate program that's also run by the Social Security Administration (SSA). Here's the lowdown on who qualifies for what.

Key Takeaways

- Children may be eligible for Social Security payments based on a parent's work record.

- For a child to qualify, the parent must be retired, disabled, or deceased.

- Children who are disabled may be eligible for Supplemental Security Income, a separate program that's also run by the Social Security Administration.

- Children can receive survivor benefits until the age of 18 or 19 if still in primary or secondary school.

- The maximum family Social Security benefit ranges from 150% to 180% of the original payee's benefit.

How Children Qualify for Social Security Benefits

Eligible children can collect Social Security benefits based on a parent's work record. The parent must have earned enough Social Security credits. Biological or adopted children or stepchildren can be eligible for Social Security benefits if they meet the following criteria:

- Have a parent who is disabled or retired and eligible for Social Security benefits

- Are unmarried

- Are younger than 18 or are between ages 18 and 19 and are full-time high school students

- Are 18 or older and disabled (as long as the disability began before they turned age 22)

The requirements for Social Security survivor benefits are similar, except that the parent must be deceased for the child to qualify.

Grandchildren or step-grandchildren can sometimes collect survivor benefits under certain circumstances.

SSI Benefits for Children

Supplemental Security Income is a separate program for Americans with limited incomes and few other resources. Recipients must generally be 65 or older, blind, or disabled. But SSI is also available to children under age 18 in certain cases. To qualify for SSI benefits:

- The child must have a physical or mental impairment (or impairments) that results in marked and severe functional limitations.

- The impairment or impairments must have lasted or be expected to last for a continuous period of at least 12 months or be expected to result in death. In the case of blindness, that duration requirement doesn't apply.

- A child who isn't blind must not earn more than $1,350 per month. A child who is blind must not earn more than $2,260 per month.

Decisions for granting SSI can take time. However, if a child has qualifying conditions, the Social Security Administration may begin making payments while an application is under review.

However, if a child has qualifying conditions, the Social Security Administration may begin making payments while an application is under review.

How Much Do Children Receive in Social Security Benefits?

A child may receive a Social Security benefit equal to 50% of the parent’s full retirement benefit or disability benefit. If the parent is deceased, the child is eligible to receive up to 75% of the parent’s full retirement benefit.

There is a limit to the total amount that a family can receive from Social Security based on one worker's earnings record, though. The maximum family benefit typically ranges from 150% to 180% of the parent's full benefit amount. The formula for maximum family benefits is based on a retired parent's work record. If the parent is disabled, a different formula applies.

$2.92 billion

The total average amount of monthly Social Security benefits paid to children as of 2022. Approximately 4.97 million children received benefits each month.

If the amount due to the entire family surpasses the maximum, some individual payments will be proportionately reduced. As an example, consider a retiree named June, who has a dependent child, Ruth, who is also eligible for benefits. June's full retirement amount is $1,500 per month, and her family maximum is $2,300 per month. June would receive her full $1,500, while her spouse, John, and daughter Ruth would split the remaining $800 payment, each receiving $400.

SSI benefits are determined by a different calculation, and the maximum benefit changes each year. Some states also supplement SSI. In addition, a disabled child who collects SSI may also be eligible for Medicaid to help pay for medical bills.

How to Receive Benefits

You can apply for benefits by calling 800-772-1213 or by visiting your local Social Security office. Applications for children's benefits are not accepted online. However, you may apply online for SSI for children.

The family must present the child's birth certificate, the parents' Social Security numbers (SSNs), and the child's Social Security number. Additional documents may also be required. In relevant cases, the applicant must provide a parent's death certificate and/or evidence of disability from a doctor.

Additional documents may also be required. In relevant cases, the applicant must provide a parent's death certificate and/or evidence of disability from a doctor.

If you are taking care of a child and are receiving Social Security benefits for that reason, the child's benefits may stop at a different time from your own. For example, if your child is not disabled, your benefits will end when the child turns 16 years old. If the child is disabled and you are responsible for them, your benefits may continue. For these types of specific circumstances, it’s best to contact the Social Security Administration for guidance.

If your child is disabled, the Social Security Administration offers a Disability Starter Kit that can help you navigate the process of applying for benefits.

How Soon Can Survivor Benefits for Children Be Started?

To initiate survivor benefits for children, an application and supporting documentation must be supplied to the Social Security Administration. How quickly benefits begin depends on how long it takes the agency to determine eligibility and for the applicant to submit the required documentation. However, benefits cannot be paid for the month in which the recipient died.

How quickly benefits begin depends on how long it takes the agency to determine eligibility and for the applicant to submit the required documentation. However, benefits cannot be paid for the month in which the recipient died.

How Do You Use Social Security Benefits for Children of Disabled Parents?

Social security benefits for children can be used to care for their basic needs and to cover their share of living expenses. For example, it can be used for food, school supplies, rent or mortgage, and utilities.

When Do Survivor Benefits End for the Parent With Children?

Survivor benefits for the surviving child's parent end when the child turns 16. However, if the child is disabled and remains in their care, the benefits may continue indefinitely.

Article 9. Conditions for the appointment of a labor pension in case of loss of a breadwinner \ ConsultantPlus

In accordance with the Federal Law of December 28, 2013 N 400-FZ, this document does not apply from January 1, 2015, with the exception of the rules governing the calculation of the amount of labor pensions and subject to application for the purpose of determining the amount of insurance pensions in the part that does not contradict the specified Federal Law.

Article 9. Conditions for granting a labor pension in case of loss of a breadwinner

1. Disabled members of the family of the deceased breadwinner who were his dependents (with the exception of persons who committed an intentional criminally punishable act that resulted in the death of the breadwinner and established in court) have the right to a labor pension in the event of the loss of a breadwinner. One of the parents, spouse or other family members specified in subparagraph 2 of paragraph 2 of this article shall be granted the said pension regardless of whether or not they were dependent on the deceased breadwinner. The family of the missing breadwinner is equated to the family of the deceased breadwinner, if the missing breadwinner is certified in the prescribed manner. nine0003

(as amended by Federal Law No. 213-FZ of July 24, 2009)

(see the text in the previous version)

the breadwinner under the age of 18, as well as children, brothers, sisters and grandchildren of the deceased breadwinner who are studying full-time in basic educational programs in organizations engaged in educational activities, including in foreign organizations located outside the territory of the Russian Federation, if the direction for training was made in accordance with the international treaties of the Russian Federation, until they complete such training, but not longer than until they reach the age of 23 or the children, brothers, sisters and grandchildren of the deceased breadwinner are older than this age, if they become disabled people. At the same time, brothers, sisters and grandchildren of the deceased breadwinner are recognized as disabled members of the family, provided that they do not have able-bodied parents; nine0003

At the same time, brothers, sisters and grandchildren of the deceased breadwinner are recognized as disabled members of the family, provided that they do not have able-bodied parents; nine0003

(as amended by Federal Laws N 213-FZ of 24.07.2009, N 185-FZ of 02.07.2013)

(see the text in the previous edition)

2) one of the parents or spouse or grandfather, grandmother of the deceased the breadwinner, regardless of age and ability to work, as well as the brother, sister or child of the deceased breadwinner who has reached the age of 18 if they are caring for the children, brothers, sisters or grandchildren of the deceased breadwinner who have not reached the age of 14 and are entitled to a labor pension in case of loss the breadwinner in accordance with subparagraph 1 of this paragraph, and do not work; nine0003

3) the parents and spouse of the deceased breadwinner, if they have reached the age of 60 and 55 years (men and women, respectively) or are disabled;

(as amended by Federal Law No. 213-FZ of July 24, 2009)

213-FZ of July 24, 2009)

(see the text in the previous edition)

) or are disabled, in the absence of persons who, in accordance with the legislation of the Russian Federation, are obliged to support them. nine0003

(as amended by Federal Law No. 213-FZ of July 24, 2009)

(see the text in the previous edition)

from him help, which was for them a constant and main source of livelihood.

4. Dependence of children of deceased parents is assumed and does not require proof, with the exception of these children, who are declared in accordance with the legislation of the Russian Federation as fully capable or who have reached the age of 18 years. nine0003

5. Disabled parents and the spouse of a deceased breadwinner, who were not dependent on him, are entitled to a survivor's pension if they, regardless of the time that has passed since his death, have lost their source of livelihood.

6. Family members of the deceased breadwinner, for whom his assistance was a permanent and main source of livelihood, but who received a pension themselves, have the right to transfer to the labor pension in case of loss of the breadwinner. nine0003

nine0003

7. The labor pension in case of loss of the breadwinner-spouse is maintained upon entering into a new marriage.

8. Adoptive parents have the right to a labor pension in case of loss of a breadwinner on an equal basis with their parents, and adopted children - on an equal basis with their own children. Minor children who are entitled to a survivor's pension shall retain this right upon adoption.

9. A stepfather and stepmother are entitled to a survivor's pension on an equal footing with a father and mother, provided that they raised and supported the deceased stepson or stepdaughter for at least five years. A stepson and stepdaughter are entitled to a survivor's pension on an equal footing with their own children if they were raised and supported by a deceased stepfather or stepmother, which is confirmed in the manner determined by the Government of the Russian Federation. nine0003

10. A survivor's pension is established regardless of the duration of the insurance period of the breadwinner, as well as the cause and time of his death, except for the cases provided for in paragraph 11 of this article.

11. If the deceased insured person has no insurance record, and also if the person commits an intentionally punishable act that resulted in the death of the breadwinner and is established in court, a social pension for the loss of the breadwinner is established in accordance with the Federal Law "On state pension provision in the Russian Federation". In this case, paragraph 12 of this article shall apply. nine0003

(clause 11 as amended by Federal Law No. 213-FZ of 24.07.2009)

(see the text in the previous edition)

old age or until the size of this part of the specified pension is adjusted taking into account additional pension savings, the funds recorded in the special part of his individual personal account (with the exception of the funds (part of the funds) of the maternity (family) capital, aimed at forming the funded part of the labor pension, and income from their investments) are paid in accordance with the established procedure to the persons specified in paragraph 12 of Article 16 of this Federal Law. At the same time, the insured person shall have the right at any time, by submitting an appropriate application to the Pension Fund of the Russian Federation, to determine specific persons from among those indicated in paragraph 12 of Article 16 of this Federal Law or from among other persons to whom such payment may be made, and also to establish in which shares, the funds indicated above should be distributed among them. The specified application may be submitted in the form of an electronic document, the procedure for issuing which is determined by the Government of the Russian Federation and which is transmitted using public information and telecommunication networks, including the Internet, including a single portal of state and municipal services. In the absence of this application, the funds recorded in the special part of the individual personal account, payable to the relatives of the insured person, are distributed among them in equal shares. nine0003

At the same time, the insured person shall have the right at any time, by submitting an appropriate application to the Pension Fund of the Russian Federation, to determine specific persons from among those indicated in paragraph 12 of Article 16 of this Federal Law or from among other persons to whom such payment may be made, and also to establish in which shares, the funds indicated above should be distributed among them. The specified application may be submitted in the form of an electronic document, the procedure for issuing which is determined by the Government of the Russian Federation and which is transmitted using public information and telecommunication networks, including the Internet, including a single portal of state and municipal services. In the absence of this application, the funds recorded in the special part of the individual personal account, payable to the relatives of the insured person, are distributed among them in equal shares. nine0003

(as amended by Federal Laws N 213-FZ of 24. 07.2009, N 378-FZ of 27.12.2009, N 227-FZ of 27.07.2010, N 243-FZ of 03.12.2012)

07.2009, N 378-FZ of 27.12.2009, N 227-FZ of 27.07.2010, N 243-FZ of 03.12.2012)

(see text) in the previous version)

Up to what age the survivor's pension is paid \ Acts, samples, forms, contracts \ ConsultantPlus

- Legal resources

- Collections

- Until what age is the survivor's pension paid

A selection of the most important documents on request Up to what age the survivor's pension is paid (legal acts, forms, articles, expert advice and much more).

- Pensions:

- 42 years old

- 60 years Pension

- Alimony with pension

- Alimony with pensions

- Pension

- more ...

Register and get trial access to the ConsultantPlus 9 system0075 free for 2 days

Open the document in your system an insurance pension in case of loss of a breadwinner, including after reaching the age of majority, is consistent with the provisions of the Constitution of the Russian Federation (part 2, article 7; part 1, article 39), as well as international legal acts in the field of social security, the norms of which provide that the term "child" can cover not only persons who have not reached the age of completion of compulsory school education, but also those who have crossed this age limit, provided that they pass apprenticeship or continue their studies, in connection with which, the survivor's insurance pension paid to the children of the deceased breadwinner who are studying full-time in basic educational programs in organizations engaged in educational activities, until they complete such training, but no longer than when they reach the age of 23, by its legal nature is a special measure of state support, the purpose of which is to create favorable conditions for the exercise by this category of persons of the constitutional right to education. "

"

Register and get trial access to the ConsultantPlus system for free for 2 days

Open a document in your ConsultantPlus system:

for those studying in organizations engaged in educational activities, the opportunity to receive an insurance pension in the event of the loss of a breadwinner, including after reaching the age of majority, is consistent with the provisions of the Constitution of the Russian Federation (part 2 of article 7; part 1 of article 39), as well as international legal acts in the field of social security, the norms of which provide that the term "child" can cover not only persons who have not reached the age of completion of compulsory school education, but also those who have crossed this age limit, provided that they pass apprenticeship or continue their studies, in connection with which, the survivor's insurance pension paid to the children of the deceased breadwinner who are studying full-time in basic educational programs in organizations engaged in educational activities, until they complete such training, but no longer than when they reach the age of 23, by its legal nature is a special measure of state support, the purpose of which is to create favorable conditions for the exercise by this category of persons of the constitutional right to education. "

"

Articles, Comments, answers to questions : to what age is the breadwinner pension

Register and receive trial access to the ConsultantPlus system 2 days

Open the document in your system consultantPluss:

"Commentary to the Federal Law of December 28, 2013 N 400-FZ "On insurance pensions"

(item-by-item)

(Mironova T.K., Arzumanova L.L., Peshkova (Belogortseva) H.V., Rozhdestvenskaya T. E., Bondareva E.S., Gusev A.Yu., Luminarskaya S.V., Menkenov A.V., Rotko S.V., Sapozhnikova N.I., Chernus N.Yu., Elaev A.A. , Zagorskikh S.A., Kotukhov S.A., Sokolov R.A.)

(Prepared for the ConsultantPlus system, 2021)1.7. Paragraph 7 of part 1 of the commented article corresponds to part 19.1 of Art. 21 of this Federal Law, in accordance with which the payment of a survivor's pension to persons who have reached the age of 18 and are studying full-time in basic educational programs in foreign organizations engaged in educational activities located outside the territory of the Russian Federation is subject to annual confirmation a pensioner of the fact of full-time education in the specified educational programs in these organizations. If the specified information is not confirmed, the payment is suspended for a period of 6 months. nine0003

If the specified information is not confirmed, the payment is suspended for a period of 6 months. nine0003

Register and get trial access to the ConsultantPlus system for free for 2 days

Open the document in your ConsultantPlus system:

Article: The Constitutional Court of the Russian Federation: 30 years of protecting the rights of citizens. Using examples of practice

("Official website of the Constitutional Court of the Russian Federation", 2022), the Constitution of the Russian Federation, in accordance with the goals of the welfare state enshrined in its Article 7 (Part 1), guarantees everyone social security by age, in case of illness, disability, loss of a breadwinner, for the upbringing of children and in other cases established by law (Article 39, part 1). However, on the basis of the interpretation of the contested legal provisions, law enforcement authorities refused to pay pensions for the loss of life to the citizens studying in a foreign educational institution who entered there on their own (without being sent to study in accordance with an international treaty of the Russian Federation).