How long can you claim your child on income tax

How Long Do Kids Stay Dependents?

Once you are a parent, you never stop being a parent. You stayed up with your kids when they had the flu, helped them study for the ACT, cheered them on at their graduation. You have been there for their highs, lows, and everything in between. You will continue to care, love, and support your children for the rest of your life.

But will there ever be a time they can fly away from the nest?

According to the federal government, the answer is yes!

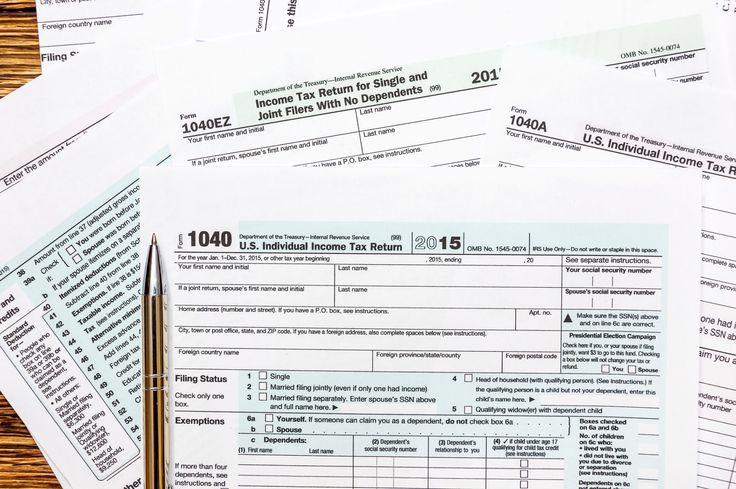

From the time your children were born, you claimed them as dependents on your federal and state taxes, which has saved you money on your taxes over the years. The decision to claim children as dependents rests on a myriad of factors, let’s see how those could affect you this year.

In the Nest – How Long You Can Claim

The federal government allows you to claim dependent children until they are 19. This age limit is extended to 24 if they attend college. If your child is over 24 but not earning much income, they can be claimed as a qualifying relative if they meet the income limits and/or if they are permanently disabled. It is important to know that there is no age limit if your child is permanently disabled.

Other factors that contribute to your ability to claim your children as dependents are:

- Amount of time your children live with you

- Your child must live with you for at least 6 months before you can claim them as a dependent.

- Financial support

- If your child makes more than half of their own support during the tax year, they cannot be claimed as a dependent. This support consists of housing, food, education, medical care, insurance, and recreational spending.

- Marital Status

- If you are not married and the child lived with you and the other parent half of the time, the person with the highest adjusted gross income will often take the deduction. This, however, can be negotiated.

- If you pay child support but the child lives with you for less than half of the year, you cannot claim the child as a dependent unless you have a signed Form 8332.

Still unclear if you can claim your child as a dependent? The IRS has a questionnaire here you can use to find out. Simply answer a few questions and the IRS will tell you whether or not you are eligible to claim a person as your dependent on your taxes.

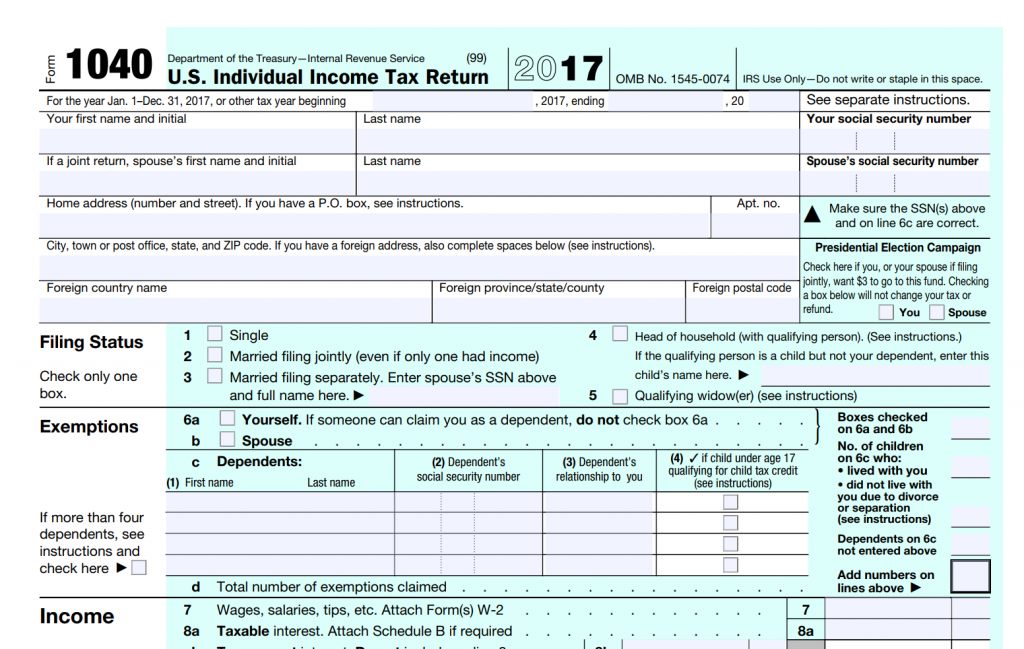

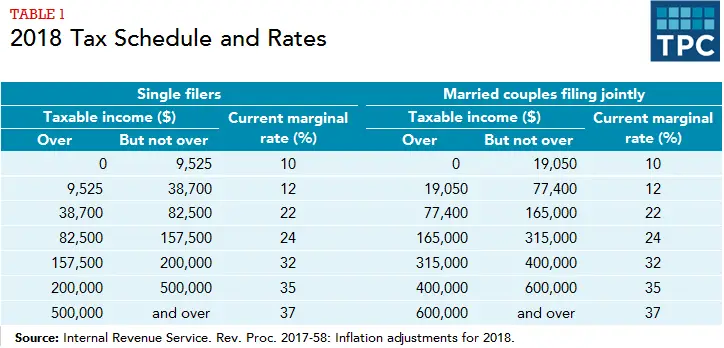

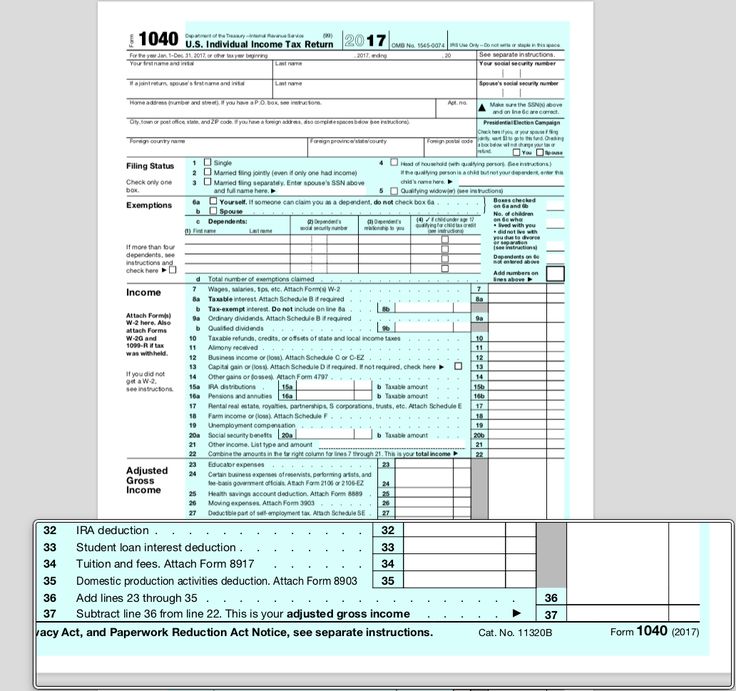

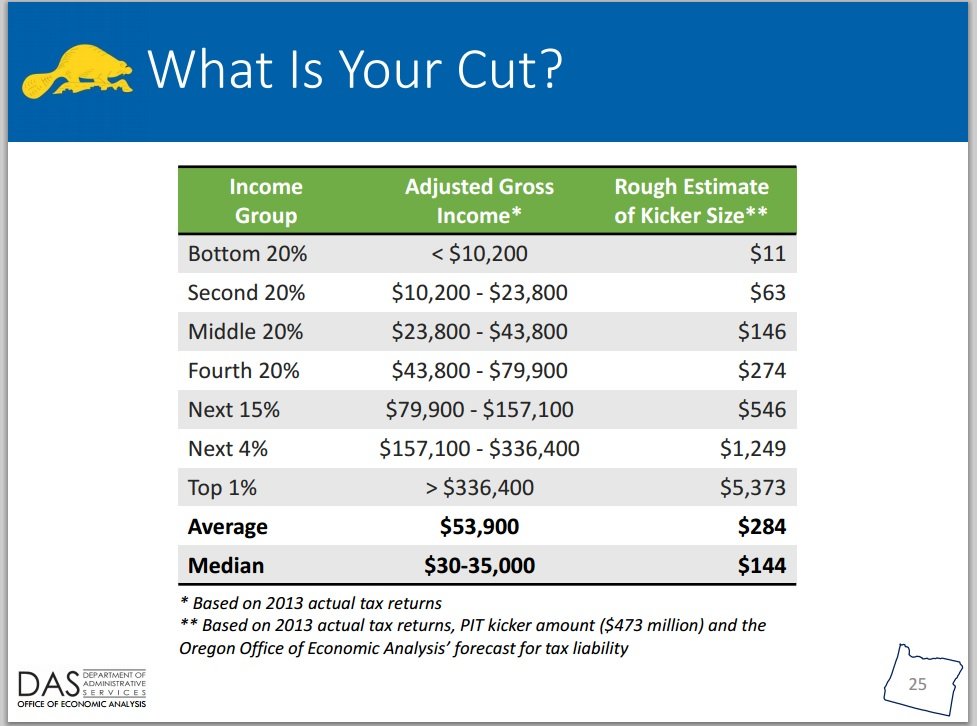

For many families, the longer they are able to claim their children as dependents the better it will be. But the new Tax Cuts and Job Act has changed the way parents claim dependents. Prior to 2018, parents were able to receive a personal exemption that reduced taxable income. For example, in 2017, a married couple filing jointly could take a $4,050 exemption for themselves and each dependent. The new tax law has suspended that exemption benefit from 2018-2025. This means that parents will need to use other tax exemptions to help make up for the loss of the child exemptions.

Out of the Nest

Since the exemption for dependents is suspended until 2025, parents have to look for other tax credits and deductions that can help them on their tax bill. Here are a couple of credits to keep an eye on.

Here are a couple of credits to keep an eye on.

This is just one of the many examples of how our comprehensive tax planning creates value for our clients. See other important tax planning topics on our website, here.

- Earned Income Credit

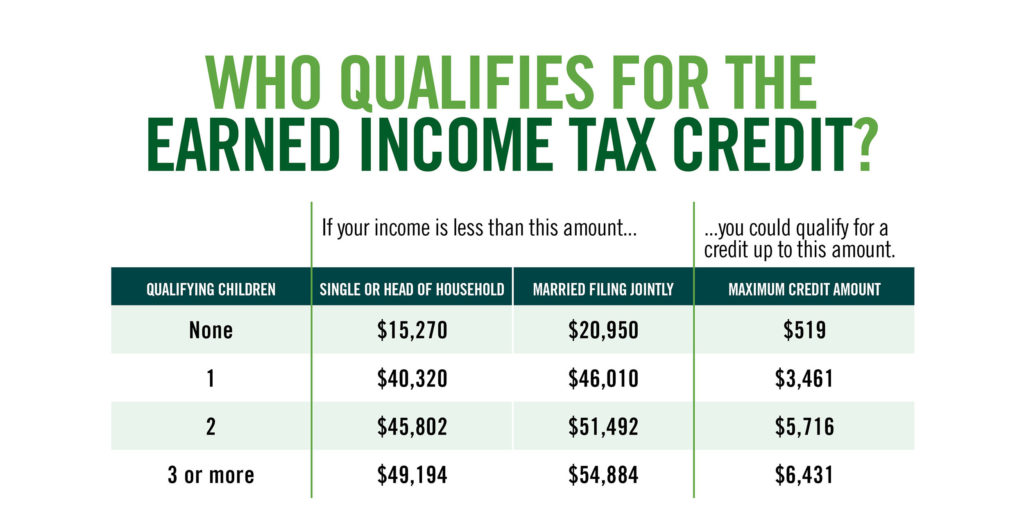

- This credit is based on the amount of money you earn in a tax year. Designed to benefit low to medium income families with children, this credit will allow you access to a certain amount of money based on your income and the number of children you have. $6,431 is the maximum earned income credit available for 2018 for three children and parents earning no more than $54,884. For two children the maximum credit is $5,716 with an income threshold of $51,492. $3,461 is the maximum credit for one child with the parents’ income being less than $46,010. Remember, for any credit, your child must pass the qualifying child test.

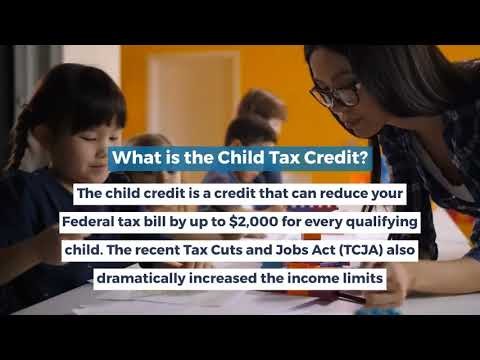

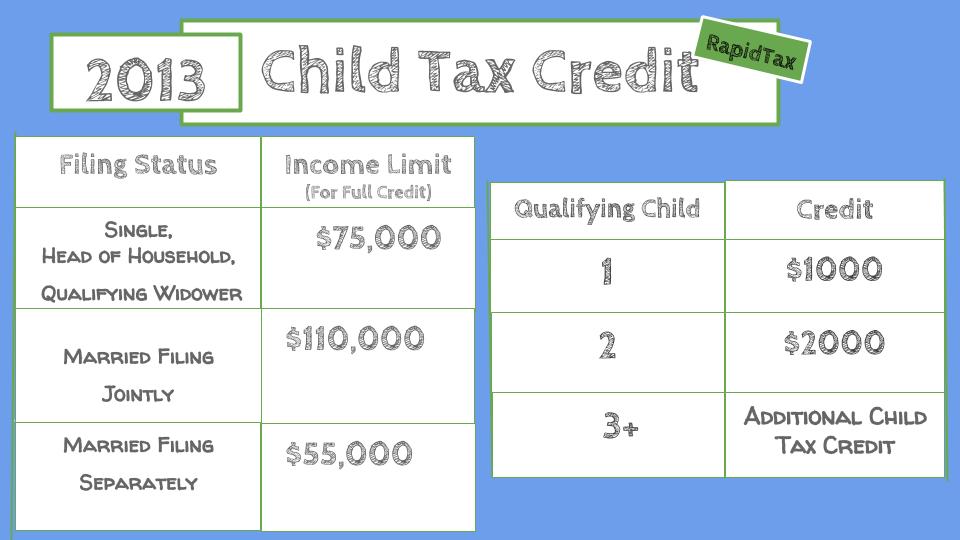

- Child Tax Credit

- The Tax Cuts and Jobs Act stipulates that parents with qualifying children are eligible to receive a $2,000 refundable credit per child.

A refundable credit will allow some or all of the credit to be refunded to the taxpayer after the tax liabilities are met. The reform allows for up to $1,400 of the credit to be refunded. The $2,000 credit is an increase from the $1,000 limit in 2017 and is set to stay until 2025. Additionally, under the new tax law, many more families will qualify for this particular tax credit as the income limit has increased.

A refundable credit will allow some or all of the credit to be refunded to the taxpayer after the tax liabilities are met. The reform allows for up to $1,400 of the credit to be refunded. The $2,000 credit is an increase from the $1,000 limit in 2017 and is set to stay until 2025. Additionally, under the new tax law, many more families will qualify for this particular tax credit as the income limit has increased. - If your child does not qualify for the tax credit, the new tax code does offer a $500 benefit per child. This is a non-refundable tax credit which means that the credit is limited to the tax liability and nothing is refunded.

- The Tax Cuts and Jobs Act stipulates that parents with qualifying children are eligible to receive a $2,000 refundable credit per child.

The new Tax Cuts and Jobs Act has changed the way parents will claim dependents in 2018. Therefore it is important to understand the nuances of the IRS qualifying system, exemptions that may or may not be applicable, and the other forms of tax credits available to you.

Related Video – Claiming College Students as Dependents

If you want personal advice on how to claim your dependents, contact us!

Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Let's learn more about each other.

Ready to Get Started?

Claim IRS Qualifying Child As a Dependent On a Tax Return

A Qualifying Child is a child who meets the IRS requirements to be your dependent for tax purposes. Though it does not have to be your child, the Qualifying Child must be related to you. If someone is your Qualifying Child, then you can claim them as a dependent on your tax return.

Not sure if a child is your dependent? Use our Free DEPENDucator tax tool to find out!

Find out if your child is a Dependent now!

A child must meet all 6 of these requirements in order to be considered your IRS Qualifying Child:

- Relationship: The person must be your daughter, son, stepdaughter, stepson, foster child, sister, brother, half-sister, half-brother, stepsister, stepbrother, or a descendant of any of these such as a niece or nephew.

- Age: They must be one of the following:

- Under the age of 19 on the last day of the tax year (Dec. 31) and younger than you (and your spouse if filing jointly).

- A full-time student under the age of 24 on the last day of the tax year (Dec. 31) and younger than you (and your spouse if filing jointly).

- Permanently disabled at any time during the year, regardless of their age.

- Support: They must have not provided more than half of their own support for the year (regardless of who did provide the support). Support includes food, actual or fair rental value of housing, clothing, transportation, medical expenses, and recreation.

- Residency: They must have lived with you for more than half of the year, except for temporary absences.

- Joint Return: They must not file a joint tax return for the year (if he or she is married).

- Qualifying Child of more than one person: If they could be a qualifying child for more than one person, you must be the person who is entitled to claim the child.

If it turns out that someone is not your Qualifying Child, you may want to see if they are your Qualifying Relative. You may not be able to claim certain tax credits if they are not, such as the Child Tax Credit, but you may be eligible for other tax credits or breaks. When you prepare a tax return on eFile.com, we will help you determine the status of your dependent as well as claim any tax credits you are entitled to based on your information.

Qualifying Child Special Cases

Temporary Absence

A child is still considered to still be living with you during any period of time when you or the child is temporarily absent from the home due to school, business, military service, medical care, or vacation.

Birth or Death of Child

If a child was born or passed away during the tax year, they are considered to have lived with you all year if they lived in your home the entire time they were alive during the year. Any time in the hospital is considered a temporary absence.

Kidnapped Child

If a child was kidnapped during the year, they are still considered to have lived with you all year if law enforcement presumes the child has been been kidnapped by someone who is not a member of your family or the child's family. Additionally, if, in the year of the kidnapping, the child lived with you for more than half of the part of the year before the kidnapping occurred, as long as the child is missing, they are considered to be living with you until the year of the child's 18th birthday or until the child is determined to be deceased.

Foster Child

Generally, if you meet the conditions above for caring for a child dependent, then your foster child may qualify as your dependent. Learn more about how the taxation implications of a foster child.

Learn more about how the taxation implications of a foster child.

Qualifying Child Examples

Child in College

Your daughter was 20 years old at the end of the year and was not married. She was a full-time college student during the year and lived in a dorm for most of the year. She worked part-time and earned $6,000, but she did not provide more than half of her own total support. She is your Qualifying Child and you can claim her as a dependent on your tax return. Since she has her own earned income, she would have to file her own tax return and indicate that she can be claimed on another person's tax return. You do not report your dependent's income on your tax return.

Married Child

Your daughter was 18 years old at the end of the tax year and was married. However, she and her estranged husband are filing separate tax returns and she lived with you for more than 6 months of the year. She provided some of her own support for the year, but between your support and her husband's, she did not provide more than half of it. Your daughter qualifies as your Qualifying Child and can be claimed as a dependent on your tax return. After she turns 19, she will no longer meet the requirements to be your Qualifying Child unless she has become a full-time student. After that, she might be your Qualifying Relative.

She provided some of her own support for the year, but between your support and her husband's, she did not provide more than half of it. Your daughter qualifies as your Qualifying Child and can be claimed as a dependent on your tax return. After she turns 19, she will no longer meet the requirements to be your Qualifying Child unless she has become a full-time student. After that, she might be your Qualifying Relative.

Adult Child

Your son was 24 and unmarried at the end of the year. He was unemployed for most of the year and had an income of only $3,000. He lived with you in your home all year. In this case, your son is too old to be your Qualifying Child even if he lived with you and did not provide most of his own support. BUT, because his income was under $4,300 and you provided more than half of his support for the year, he is your Qualifying Relative and can be claimed as your dependent on your tax return.

Niece or Nephew

Your brother's 12-year old daughter lived with you for 7 months out of the year. You, your brother, and your father each provided some of her financial support during the year - but she provided none of her own support. Your niece meets the requirements to be your Qualifying Child and you can claim her as a dependent.

You, your brother, and your father each provided some of her financial support during the year - but she provided none of her own support. Your niece meets the requirements to be your Qualifying Child and you can claim her as a dependent.

Child of Girlfriend or Boyfriend

Your girlfriend's 4-year old son, who is not your own child, lived with you and your girlfriend all year. Your girlfriend had some income, but you provided more than half of her son's support. He is not your Qualifying Child because he is not related to you, but he is your Qualifying Relative and you can claim him as a dependent.

This is a special case. In the past, you would not be able to claim your girlfriend's child as a Qualifying Relative because the child was the Qualifying Child of the mother, even if she did not claim the child as a dependent. But the IRS has revised its views and now allows the boyfriend or girlfriend with whom the parent and child lived to claim the child as a dependent - as long as the parent’s income is so low that he or she doesn’t need to file a tax return.

Additional Resources

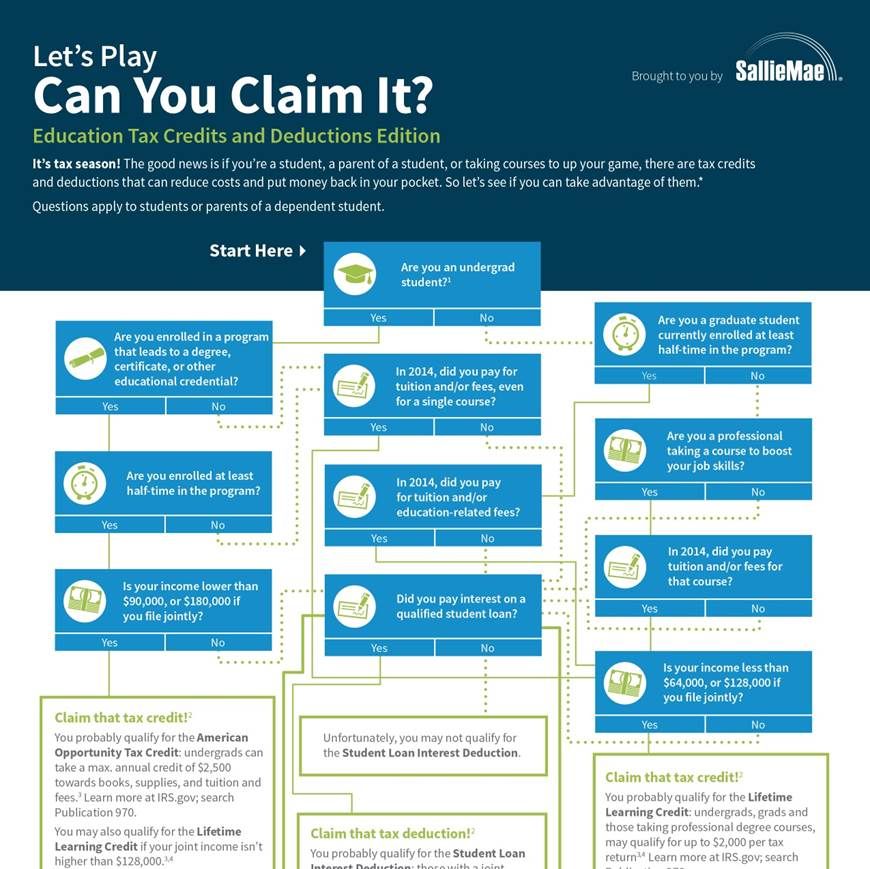

- If you pay for childcare so you can work, you may be entitled to a hefty tax credit, the Child and Dependent Care Tax Credit.

- Tax deductions and credits for dependents - find a comprehensive list of all tax credits and tax deductions you may be able to claim when you have at least one dependent on your tax return.

- Was your dependent wrongly claimed by someone else?

- If your child is in higher education, learn about student tax credits you may be able to claim.

Sign up for a free eFile.com account and receive valuable Taxercise Tips! Bring all your tax forms and dependent information to the eFile tax app and let it handle all the complicated calculations and forms for you when it comes time to prepare and efile an income tax return. Prepare to tax prepare during the year with eFile.com!

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

Accounting for tax-free income

Since your tax-free income decreases as your income increases, it is important to know how wages, pensions, benefits, and other types of income affect your tax-free income.

Knowing the amount of your income, you have the opportunity to account for tax-free income in the correct amount already during the year and thus avoid the obligation to pay additional income tax by October 1 of the next year.

How does it affect the amount of tax-free income...

If you receive monthly wages from several employers in excess of 1200 euros, then you should add up all the amounts received for work.

Since the employer does not know about your other income (for example, wages from other employers) and cannot take them into account when determining tax-free income, you yourself must notify one of the employers of the refusal to apply tax-free income or on the application of tax-free income in the amount of less than 500 euros.

Example

If you earn 1,000 euros per month with two employers, then you have the right to apply the full tax-free income (500 euros) in one workplace, and income tax will be withheld at this workplace only from the remaining 500 euros. At another workplace, tax-free income will not be taken into account and income tax will be deducted from 1000 euros.

Based on your annual income statement, your annual income will be 24,000 euros, the tax-free income calculated by the formula will be 666.62 euros per year and you will have to pay additional income tax by October 1 of the following year.

To avoid this situation, you must tell your employer that you are waiving tax-free income or that you allow tax-free income to be counted, for example, only in the amount of 55 euros per month.

NB!

- There is a right to apply tax-free income only at one workplace.

If your monthly salary with several employers exceeds 2,100 euros, then the tax-free income for the year will not be applied to your income.

Ask the employer who has previously accounted for your tax-free income to apply the €0 tax-free income, or do not submit an application for tax-free income in the future. - If you work for several employers at the same time, then the employer who has chosen you to apply tax-free income when withholding income tax must pay social tax at the annual monthly rate. Therefore, when you have more than one employer, it is important to submit an application for the application of tax-free income, even if you ask the employer to take into account the tax-free income of 0 euros.

If you expect your salary to fluctuate throughout the year, or if you are eligible for bonuses, performance bonuses, etc., then it pays to be conservative when determining tax-free income.

Even when the calculated tax-free income per month can be applied in the amount of 200 euros, it makes sense to submit an application to the employer for applying as tax-free income only, for example, 100 euros per month. In this way, you will avoid having to pay additional income tax on the basis of the annual income tax return by October 1st.

In this way, you will avoid having to pay additional income tax on the basis of the annual income tax return by October 1st.

But if you paid more income tax during the year, then after filing your annual return by April 30, the overpaid income tax will be returned to you. Income tax will also be refunded if you ask your employer to deduct tax-free income.

If you are a working pensioner and in addition to your salary you also receive a pension from the Social Insurance Department (including old-age pension, survivor's pension, disability pension, reduced pension and pension supplements) and your monthly income exceeds 1200 euros, then you have to add up the gross amounts of wages and pensions.

A working pensioner who receives both a pension and a salary of less than 500 euros has the right to apply tax-free income in two places, and to submit an application indicating the specific tax-free amount, both to the Social Insurance Board and employer.

It is important to note that a working pensioner can distribute tax-free income between the employer and the Social Insurance Board in the amount of 500 euros.

Example

A person's pension is 416 euros and salary is 300 euros.

A person has the right to submit an application for the application of tax-free income in the amount of 416 euros to the Social Insurance Board, and an employer to submit an application for the application of tax-free income in the amount of 84 euros.

If, however, you have unexpected income during the year, such as from the sale of real estate or securities, then you can submit a lower amount on your application for tax-free income. In this way, you can avoid the obligation to pay additional income tax by October 1 of the following year.

NB!

Disability pension paid by the Social Insurance Board is included in the annual income and affects the amount of tax-free income.

Disability allowance paid by the Unemployment Insurance Fund is not taken into account in determining annual income and does not affect the amount of tax-free income.

Additional information

Website of the Social Insurance Board "Income tax on benefits and pensions"

If you are a pensioner and there is no other income apart from your pension (including old-age pension, survivor's pension, disability pension, reduced pension and pension supplements), then your total tax-free income is applied to your pension ( 500 Euro).

The amount of non-taxable income depends on the income of working pensioners and persons receiving special preferential pensions, whose monthly income exceeds 1200 euros per month.

NB!

It is important that you submit an application to the Social Security Department for exemption. The application can be submitted via the portal eesti.ee or on site at the Social Insurance Board.

More information

Social Insurance Board website "Income tax on benefits and pensions"

If you are on parental leave and receive parental benefit, parental benefit is your taxable income. If the parental benefit is less than 1,200 euros per month, then you are entitled to tax-free income of 500 euros per month. If the parental benefit is more than 1200 euros per month, then tax-free income is applied in accordance with the Income Tax Law.

If the parental benefit is less than 1,200 euros per month, then you are entitled to tax-free income of 500 euros per month. If the parental benefit is more than 1200 euros per month, then tax-free income is applied in accordance with the Income Tax Law.

NB!

If you have filed an exemption application with the Social Insurance Department and you have no other income, then the Social Insurance Department will apply the correct formula-based tax-free tax and you will have no additional tax liability.

Additional information

Website of the Social Insurance Board "Income tax on benefits and pensions"

State benefits paid by the Social Insurance Board (including child allowance, childbirth allowance, child care allowance, etc.) are not subject to income tax and are not declared in the income tax return.

NB!

Tax-free benefits do not count towards annual income and do not affect tax-free income.

Additional information

Website of the Social Insurance Board "Income tax on benefits and pensions"

Disability and unemployment benefits are tax-free benefits that are not declared on your income tax return. Disability benefits and unemployment benefits are not taken into account in determining the amount of tax-free income.

Disability benefits and unemployment benefits are not taken into account in determining the amount of tax-free income.

NB!

There is a difference with the disability pension, which is taxable income, is taken into account in determining annual income and affects the amount of tax-free income.

If you receive unemployment benefits from the Unemployment Insurance Fund, this is your taxable income.

If the insurance benefit does not exceed 1,200 euros per month, then you are entitled to tax-free income of 500 euros per month. If the insurance indemnity exceeds EUR 1200, then tax-free income is applied in accordance with the provisions of the Income Tax Law.

NB!

If you have submitted an application to the Unemployment Insurance Fund for the application of tax-free income and you have no other income, then the Unemployment Insurance Fund will apply the correct tax-free tax calculated according to the formula and you will not have additional tax liabilities.

If you receive dividends during the year taxed at the company level at the ordinary tax rate of 20/80, then this is your income, which is taken into account in determining the annual income.

In the income statement, the amount of dividends transferred to you, or the money you receive (table 7.1) is taken into account as annual income, and this affects the amount of tax-free income.

At the same time, if you receive dividends from abroad, from which income tax is withheld or paid in a foreign country, then the so-called gross amount of dividends is taken into account as annual income, i.e. received dividends together with income tax withheld or paid in a foreign country.

If you receive dividends during the year that are taxed at company level at a lower tax rate of 14/86 and from which income tax of 7% has been withheld, then this is your taxable income, which also affects the amount of non-taxable income.

The amounts transferred to the business account, from which a part of the social tax has been deducted, are taken into account in the annual income and affect the amount of your tax-exempt income.

Additional information

Entrepreneur account

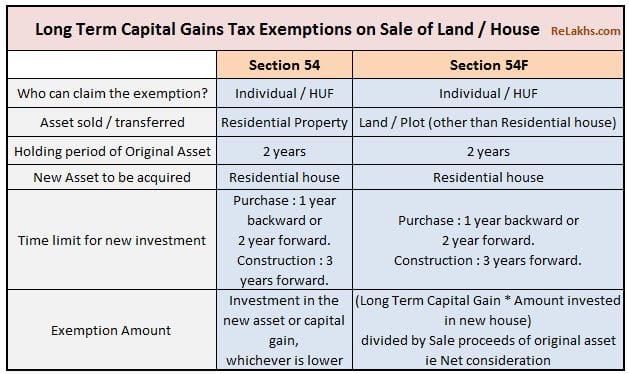

If during the year you receive income, for example from the sale of property (from the sale of real estate, from the sale of securities, from the sale of timber or from the alienation of the right to cut down a growing forest), then this income is taxable and affects the amount tax-free income.

If you know in advance that in addition to wages and/or pensions you will also have income from the disposal of property, you can notify the employer or the Social Insurance Board, i.e. the one to whom the application for the application of tax-free income was submitted , that you waive the application of tax-free income in whole or in part.

NB!

Tax-free income from the sale of one's place of residence or income from the sale of movable things that are in personal use are not declared in the annual income statement and are not taken into account in determining annual income for determining tax-free income.

The taxation of the funded pension payment depends on the conditions of payment and can be either tax-free or subject to income tax at a rate of 20% or 10%.

Read more on the web page "Taxation of pensions from January 1, 2021".

Tax-free mandatory funded pension payments are not declared in the income statement of an individual, are not taken into account in his annual income and do not affect the amount of tax-free income.

State pension (I pillar) paid by the Department of Social Affairs and mandatory funded pension (II pillar) paid by the Pension Center or an insurance company, taxed at 20% or 10%, are taxable income, which is also declared in the declaration on the income of an individual, but with the difference that the state pension is included in the annual income and affects the amount of tax-free income, while payments under the mandatory funded pension (II pillar) are not included in the annual income and do not affect the amount of non-taxable income. taxable income.

taxable income.

Links

Examples of calculating total tax-free income

It is still possible to deduct contributions to the supplementary funded pension, or III pillar, up to 15% of a person's taxable income in Estonia, or up to 6,000 euros per year.

The taxation of the payment of additional funded pension depends on the conditions of payment and can be either tax-free or subject to income tax at a rate of 20% or 10%.

Read more on the webpage " Taxation of pensions from January 1, 2021 ".

Tax-free supplementary funded pension payments are not declared in the income tax return of an individual, are not taken into account as annual income and do not affect the amount of tax-free income.

Supplementary funded pension payment (III pillar) from the Pension Center or an insurance company, taxed at 20% or 10%, is taxable income, which is declared in the income tax return, except that the payment, taxed at 20% is included in annual income and affects the amount of tax-free income, and the taxable payment of 10% is not included in annual income and does not affect the amount of tax-free income.

Links

Examples of calculating total tax-free income

Tax return | Handbook Germany

Work

Update 03.08.2022

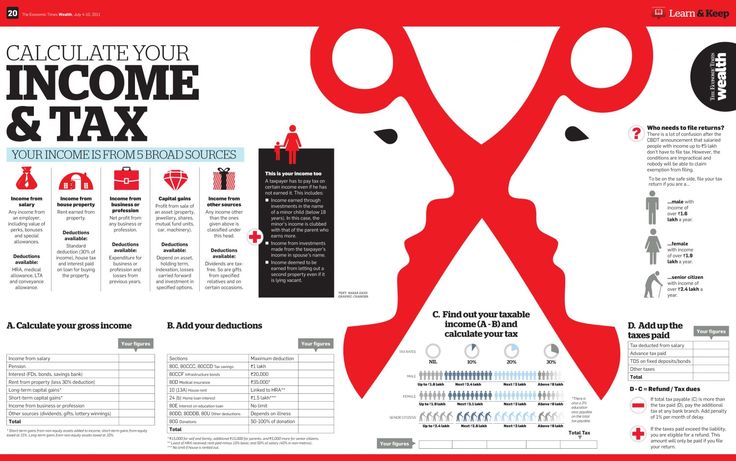

A tax return is needed in order to file information about the most important tax for you - income. You pay it from the income that you earned during the year. This could be your salary (if you are an employee), your income (if you are self-employed), and also, for example, interest accrued on your savings or rental income. For detailed information on the different types of taxes, see the chapter on the German tax system.

The tax return is submitted to the tax office (Finanzamt) once a year. Whether you have to file a declaration depends on various factors. The basic rule says: self-employed and entrepreneurs are obliged to submit it and must personally take care of the information provided by the tax office about their income and transfer all necessary taxes. If you are an employee, then your employer will do all this for you - the tax will be deducted from your salary. In this case, as a rule, you do not have to file a tax return. But even if you are not obliged to do so, filing a declaration in many cases still pays off. Perhaps you overpaid taxes last year and you can get some of the money back.

The basic rule says: self-employed and entrepreneurs are obliged to submit it and must personally take care of the information provided by the tax office about their income and transfer all necessary taxes. If you are an employee, then your employer will do all this for you - the tax will be deducted from your salary. In this case, as a rule, you do not have to file a tax return. But even if you are not obliged to do so, filing a declaration in many cases still pays off. Perhaps you overpaid taxes last year and you can get some of the money back.

Listen

What should I know?

Income tax (Einkommenssteuer) is the most important tax in Germany. It is he who brings the greatest revenue to the state budget and is paid by both employees and self-employed. There are seven types of income on which you must pay income tax. These are income from freelancing

- employment activities

- from activities of private enterprises

- agriculture and forestry

- capital

- rent and hire

- as well as other income specified in the Income Tax Law, such as pensions.

You do not have to pay income tax on some income. This includes, among other things, childcare benefits (Elterngeld), unemployment benefits, BAföG benefits or scholarships. The same rule applies to those who work for a Mini-Job or whose income does not exceed the basic non-taxable minimum (Grundfreibetrag). The basic non-taxable minimum is adjusted every year and currently stands at 10.347 euros (2022). If your income does not exceed this amount, you do not have to pay income tax. In all other cases, the following rule applies: everyone who lives in Germany and earns money, must pay income tax. This provision also applies to refugees and asylum seekers.

Please note : If you are registered in Germany, you must pay taxes on all your income. This may include the income that you earned abroad. So that you do not have to pay taxes twice, there is a so-called Double Tax Treaty (Doppelbesteuerungsabkommen). Detailed information about it can be found on the website of the Federal Ministry of Finance in German and English.

It depends on how much you earn. In general, the following rule applies: the more you earn, the greater the amount of income tax. With the help of the tax calculator, you can independently calculate how much income tax you will have to pay. On the website www.brutto-netto-rechner.info you will find a tax calculator, which can also be used in English.

If you are retired, it all depends on what your total income is in total: the pension itself and additional income (for example, from rent or income from interest). If your income exceeds the basic non-taxable minimum (Grundfreibetrag), you must pay pension tax. The same applies to students. Anyone who earns more than the basic non-taxable minimum must pay taxes. By working on a Mini-Job, you can regularly earn up to 450 euros per month. If your total income does not exceed this amount, you generally do not have to pay taxes. Unemployment benefits are not taxed. However, it must be shown on the tax return.

If you have freelancing income, you must file a tax return. The situation is different for hired workers. Since their income tax is automatically deducted from their salary to the tax office (Finanzamt) every month, in most cases they are not required to file a tax return. However, there are exceptions:

The situation is different for hired workers. Since their income tax is automatically deducted from their salary to the tax office (Finanzamt) every month, in most cases they are not required to file a tax return. However, there are exceptions:

- You and your spouse are both employed and have chosen a combination of tax classes III and V. For more information about tax classes, see What are tax classes?

- You or your spouse have registered a non-taxable minimum (Freibetrag) with the tax office, for example for tuition, disability or travel expenses.

- You have additional income without payroll tax (Lohnsteuerabzug), for example from renting an apartment, and this income exceeds 410 euros per year.

- You received wages from multiple employers and were not taxed.

- In addition to regular wages, you also received wage compensation, such as child care allowance (Elterngeld), disability allowance (Krankengeld) or unemployment allowance (Arbeitslosengeld).

- You got divorced and remarried/remarried in the same year.

- You have received compensation (Abfindung).

- You have retained losses from previous years.

- You have a spouse with limited tax liability living outside of Germany in one of the EU countries and have entered his/her details in your electronic tax card.

In all of these cases, you must file a tax return.

Some retirees may also be required to file a tax return. For example, if this is required by the tax office or if your total gross income exceeds the basic non-taxable minimum (Grundfreibetrag).

Most employees are not required to file a tax return. However, in some cases it makes sense to do so voluntarily. After all, you can deduct certain expenses from the tax. This means that you will tell the tax office (Finanzamt) on your tax return (Steuererklärung) what expenses you have incurred. The tax office adds up these expenses and deducts them from your annual income. After that, you will only need to pay tax on the remaining amount. This is your so-called "taxable income" (zu versteuerndes Einkommen). For more information, visit the Lohnsteuerhilfeverein website - www.vlh.de.

After that, you will only need to pay tax on the remaining amount. This is your so-called "taxable income" (zu versteuerndes Einkommen). For more information, visit the Lohnsteuerhilfeverein website - www.vlh.de.

Tax incentives provided by the state can be divided into three categories:

- Advertising expenses (Werbungskosten): These are expenses related to professional activities, such as travel and training, education.

- Special expenses (Sonderausgaben): These are private expenses, such as donations, contributions to health and disability insurance, or childcare costs. For more information, see What Tax Benefits Are Available for Families?.

- Unforeseen expenses (Außergewöhnliche Belastungen): These are unforeseen expenses that you have to pay due to illness, for example.

All of these expenses must be reported on your tax return. Supporting documents, such as invoices and checks, do not need to be submitted with the tax return. However, you should keep them in case the tax office asks you to show them. If you are unable to do the calculations yourself, please contact a tax advisor (Steuerberater*in) or ask the Lohnsteuerhilfeverein for assistance by providing them with all the necessary documents to complete your tax return.

Supporting documents, such as invoices and checks, do not need to be submitted with the tax return. However, you should keep them in case the tax office asks you to show them. If you are unable to do the calculations yourself, please contact a tax advisor (Steuerberater*in) or ask the Lohnsteuerhilfeverein for assistance by providing them with all the necessary documents to complete your tax return.

To make it easier for the tax office and for you to file your tax return, there are so-called "Pauschalbeträge". You can use them without having to provide supporting documents. You can find information on which "Pauschalbeträge" are available at www.vlh.de.

Various tax incentives are available to support families.

- Child care allowance (Elterngeld): If you have to work less after having a child, the state will help you financially by paying child care allowance. Its size depends on your income. You can increase your benefit by changing your tax class.

As soon as you know that you will have a child, as a couple you can consult on this issue. The spouse who goes on maternity leave must generally choose tax class III. To change the tax class, you need to act quickly. An application for a tax class change must be submitted at least seven months before the so-called "maternity protection" (Mutterschutz) comes into effect. More information about this can be found on the Stiftung Warentest website. Please note that Parental Allowance is not taxable, but it is used to calculate your tax rate.

As soon as you know that you will have a child, as a couple you can consult on this issue. The spouse who goes on maternity leave must generally choose tax class III. To change the tax class, you need to act quickly. An application for a tax class change must be submitted at least seven months before the so-called "maternity protection" (Mutterschutz) comes into effect. More information about this can be found on the Stiftung Warentest website. Please note that Parental Allowance is not taxable, but it is used to calculate your tax rate. - Child allowance (Kindergeld) / tax-free minimum for children ( Freibeträge für Kinder): For each child, parents receive a benefit of at least 219 euros. To receive it, you need to submit an application for a child benefit to the family fund (Familienkasse). You can find more information in the fact sheet "Child Benefit". For information on recognized refugees, see the fact sheet Child Benefit for Asylum Eligible and Recognized Refugees.

In addition, low-paid workers can additionally apply for a child allowance. You will find information on what conditions must be met for this on the website of the employment agency. In addition, there is also a tax-free minimum for children (Kinderfreibetrag). You have the option of either receiving child support or the tax-free minimum for children. You must file your tax return with an Anlage Kind for each child you have. After that, the tax office (Finanzamt) will check which option is the most beneficial for you. You can receive the application form for a child directly from the tax office or you can download it online, for example, at steuertipps.de.

In addition, low-paid workers can additionally apply for a child allowance. You will find information on what conditions must be met for this on the website of the employment agency. In addition, there is also a tax-free minimum for children (Kinderfreibetrag). You have the option of either receiving child support or the tax-free minimum for children. You must file your tax return with an Anlage Kind for each child you have. After that, the tax office (Finanzamt) will check which option is the most beneficial for you. You can receive the application form for a child directly from the tax office or you can download it online, for example, at steuertipps.de. - Care expenses (Betreuungskosten) / education ( Ausbildungskosten): The state will also help you with the reimbursement of childcare costs. Thus, you can deduct two-thirds of your childcare costs as special expenses from tax. In addition, in some cases, you may also include the cost of your child's maintenance and vocational training as a contingency expense.

If your adult child is in vocational training and does not live with you, you may be able to get advice about covering the cost of their education.

If your adult child is in vocational training and does not live with you, you may be able to get advice about covering the cost of their education. - Single parent benefits (Entlastungsbetrag für Alleinerziehende) If you are a single mother or father and qualify for child support or the tax-free minimum for children, you can also receive single parent benefits.

- Joint return for spouses and partners : Spouses and those in a registered partnership (Lebenspartnerschaft) can file a joint tax return. This is beneficial if one of the partners earns significantly more than the other. To do this, you can simply file a joint tax return, and on page 1 of the main form, mark “Zusammenveranlagung” with a cross.

- Expenses for caring for a family member (Pflege-Pauschalbetrag): If you are caring for a family member, you can claim your expenses as a tax deduction. This will lower your taxable income.

Further information on family tax benefits can be found on the Family Portal of the Ministry of Family.

In general, tax incentives provided by the state can be divided into three categories:

- Advertising expenses (Werbungskosten) : These are expenses related to professional activities, such as commuting, education and training.

- Special expenses (Sonderausgaben) : These are private expenses, such as donations, health and disability insurance contributions, or child care expenses.

- Unforeseen expenses (Außergewöhnliche Belastungen) : These are unforeseen expenses that you have to pay due to illness, for example.

All of these expenses must be reported on your tax return. Supporting documents, such as invoices and checks, do not need to be submitted with the tax return. However, you should keep them in case the tax office asks you to show them.

To make it easier for the tax office and for you to file your tax return, there are so-called "Pauschalbeträge". You can use them without having to provide supporting documents. You can find information on which "Pauschalbeträge" are available at www.vlh.de.

You can find information on which "Pauschalbeträge" are available at www.vlh.de.

As a self-employed person, you can additionally deduct work-related expenses from tax. This could be the cost of buying a new laptop, travel or entertainment expenses, travel expenses, mobile phone expenses, office supplies you need for work, or office expenses. Small purchases can be credited immediately, more expensive items usually need to be written off over several years. Planning ahead for these purchases will save you some tax money. If you are self-employed, it makes sense for you to seek the help of a tax advisor (Steuerberater*in). They know exactly what expenses you can and cannot deduct from tax. Their services are paid. But you can deduct those expenses from tax again next year.

If you are self-employed, have income from agriculture and forestry, or are self-employed, you must file your tax return electronically. This is done through the Internet portal of the German tax authority Elster. There you must register with your tax identification number (Steueridentifikationsnummer) and email address and be authenticated. Don't do this at the last minute, as the authentication process takes several days. You can also file your tax return electronically and through paid programs. They tend to be easier to work with than Elster.

There you must register with your tax identification number (Steueridentifikationsnummer) and email address and be authenticated. Don't do this at the last minute, as the authentication process takes several days. You can also file your tax return electronically and through paid programs. They tend to be easier to work with than Elster.

Employees can file a tax return electronically voluntarily. If, along with their wages, they had other income or, for example, child care allowance (Elterngeld) or unemployment benefit in excess of 410 euros per year, they are required to file a tax return electronically.

If you would like to complete your tax return by hand and mail it in or take it in person to the tax office (Finanzamt), you can obtain the forms from the tax office or download them online at formulare-bfinv.de. You can find the tax office that is responsible specifically for you using the index of government agencies.

Please note that supporting documents relating to a tax return do not normally need to be sent to the tax office. However, you must keep these documents. In case of questions, the tax office may require you to present these documents within ten years from the date of filing the tax return.

However, you must keep these documents. In case of questions, the tax office may require you to present these documents within ten years from the date of filing the tax return.

If you are required to file a tax return, you must do so by July 31st of the following year. If your tax return is being prepared by a tax advisor (Steuerberater*in) or specialists from the Lohnsteuerhilfeverein, you have more time to spare. The last day of delivery in this case will be the last day of February after the next year. Please note: tax returns for 2021 can be filed later as an exception. The deadline has been extended until October 31, 2022. If you are filing your tax return with the help of Lohnsteuerhilfeverein or a tax advisor, you have until 31 August 2023. For the 2022 tax return, the deadline will also be extended in due course.

In exceptional cases, you can submit a written application to the tax office asking for an extension of the deadline for filing a tax return. To do this, you must provide a convincing justification for your request for an extension and provide a new tax filing date. However, the tax inspectorate is not required to give its consent to this.

To do this, you must provide a convincing justification for your request for an extension and provide a new tax filing date. However, the tax inspectorate is not required to give its consent to this.

If you file your tax return voluntarily, you have four years to do so.

If you miss your tax return deadline, the tax office (Finanzamt) may charge a late fee. Whether this will be done depends on the tax officer. However, remember that if you file your tax return less than 14 months after the end of the year for which you are filing, you will still have to pay late fees. This can cost you dearly. According to §152 of the Regulation on the Collection of Taxes, Fees and Duties (Abgabenordnung), the penalty fee is 0.25% of the amount of tax, minus advance payments and the amount of applicable tax deductions for each started month of delay, but not less than 25 euros per month.

In addition, the tax office may impose an administrative fine. The amount of the fine is usually between 100 and 500 euros, and the demand for payment is sent by post.

You are responsible for paying taxes and properly reporting your income to the tax office (Finanzamt). The only exception is income tax (Lohnsteuer), which is automatically deducted from your salary. If you do not pay taxes or pay less than necessary, or you try to deceive the tax office, this is tax evasion (Steuerhinterziehung). Tax evaders face fines and, in particularly serious cases, up to 10 years in prison. If you are not sure that you can properly complete your tax return yourself, you can seek help. For more information, see the Who can help me with my tax return? section.

If you do not want to complete your tax return yourself and free of charge using Elster's tax administration program, you have a number of options.

- The most cost-effective solution is tax software. There are various vendors selling such programs. On the website finanztip.de you will find an overview of the programs offered. SteuerGo offers its software in different languages.

- If you do not want to complete your tax return yourself, you can contact the Lohnsteuerhilfeverein or a tax advisor (Steuerberater*in.) A list of tax advisors can be found, for example, at steuerberater.de. The amount of his remuneration is regulated by the Tax Advice Fee Regulations. It also depends on the amount of work. The services of the Lohnsteuerhilfeverein are more cost effective than the services of tax advisors, but they are not authorized to advise the self-employed and business owners. If you are an employee and want to be assisted by the Lohnsteuerhilfeverein, you must become a member of the association and pay a membership fee. The membership fee depends on your income. You can find such an association near you, for example, on the website of the organization Bundesverband Lohnsteuerhilfe e.V.. And although you will have to pay for professional help in preparing a tax return, this will still allow you to save on taxes, and the self-employed will also avoid mistakes.