How can i get stimulus check for my child

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

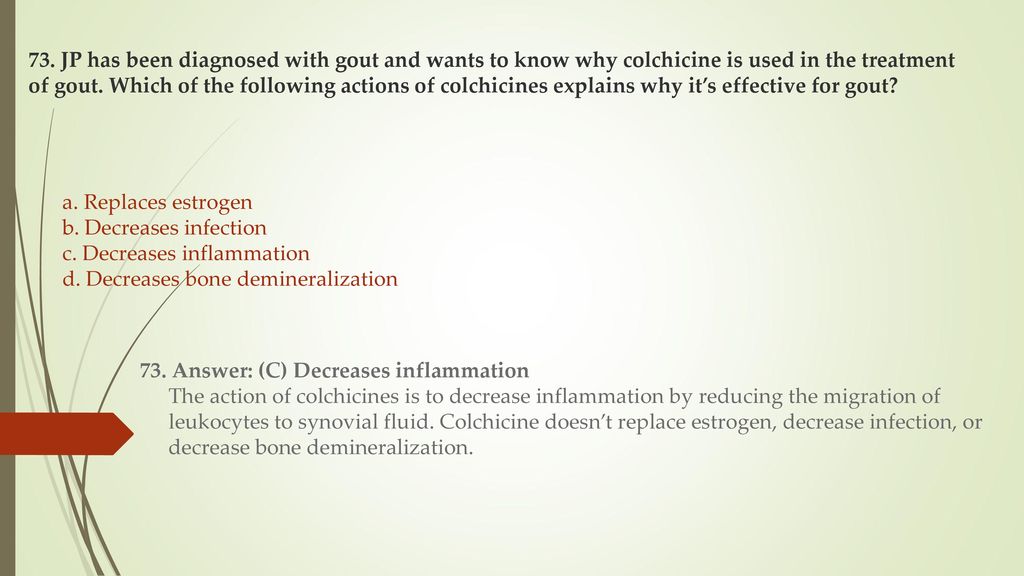

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

How can I Claim My Remaining Child Tax Credit (CTC) or Missing Dependent Stimulus Payment in 2022? IRS Refund Payment Delays |

This article provides updates, income qualification thresholds and FAQs on the various COVID relief child tax credit (CTC) and dependent stimulus (economic impact) payments paid over the last year. Each one has slightly different rules (and payment constraints) so please ensure you review each one separately and the associated FAQs/videos. Click the links below to jump to the relevant stimulus payment.

Covered in this Article:

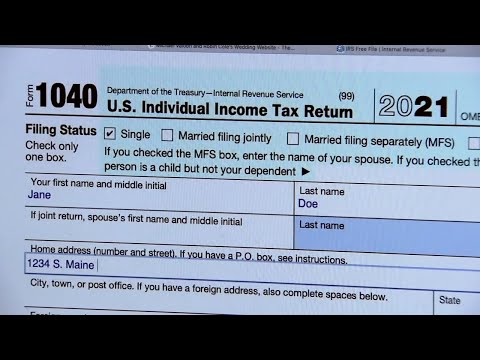

Claiming Remaining CTC Payment in your Tax Return (Reconcile Amounts)

Millions of households can now claim the remaining portion or any missing amounts of the expanded child tax credit in their 2021 tax return, which are now being processed by the IRS. This also includes any missing dependent stimulus payments.

This also includes any missing dependent stimulus payments.

TurboTax Free Edition: $0 Fed. $0 State. $0 to File. See if you qualify

Non-filers or those who didn’t register last year can use the IRS CTC portal to provide information or unenroll from receiving monthly CTC payments. See more FAQs on the CTC payment in this detailed article.

Note that as in previous years, the CTC refund payment is subject to the PATH act delay. Further the IRS has noted issues with some of the reconciliation 6419 letters they sent out earlier this year outlining payments made in 2021.

In particular married spouses are getting separate letters but need to ensure they combine amounts if filing jointly. Another error was with a small group of taxpayers who moved or changed bank accounts in December. The IRS 6419 notice didn’t always account for this payment and so could be under reporting what you got.

The best option is to ensure your 6419 letter and online IRS CTC account reconcile. In fact the IRS guidance is that if they amounts don’t reconcile, go with the total amount reflected on the online IRS account because it has the most up-to-date information regarding the CTC.

In fact the IRS guidance is that if they amounts don’t reconcile, go with the total amount reflected on the online IRS account because it has the most up-to-date information regarding the CTC.

You want to ensure the CTC portion claimed in your 2021-22 Tax return is consistent with that the IRS has. Otherwise your tax return and refund could be held up further for manual IRS verification.

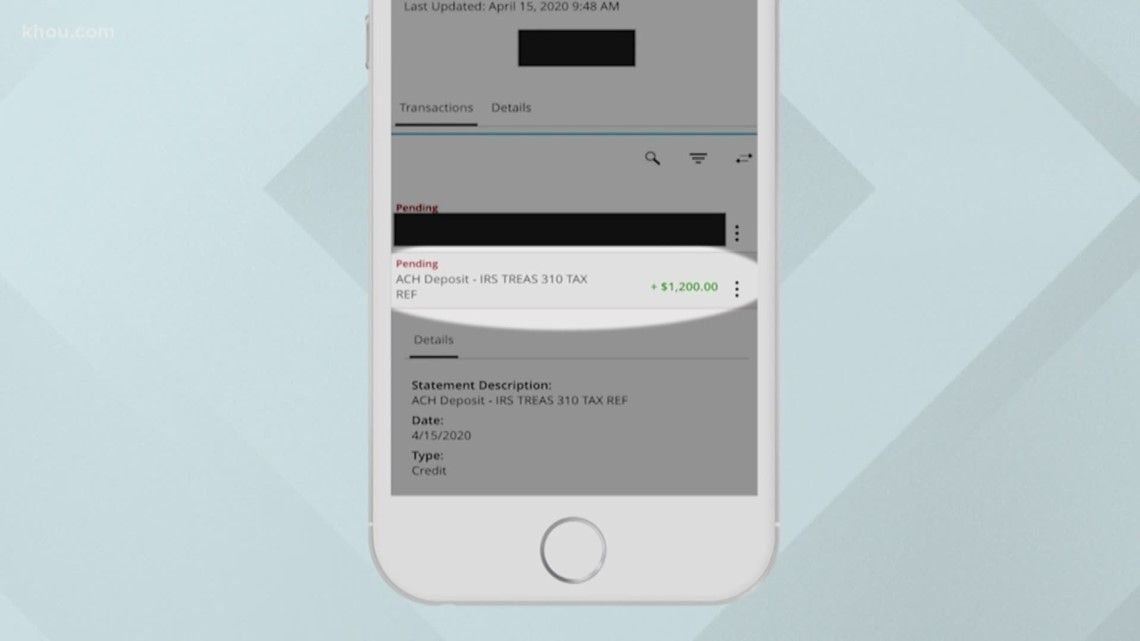

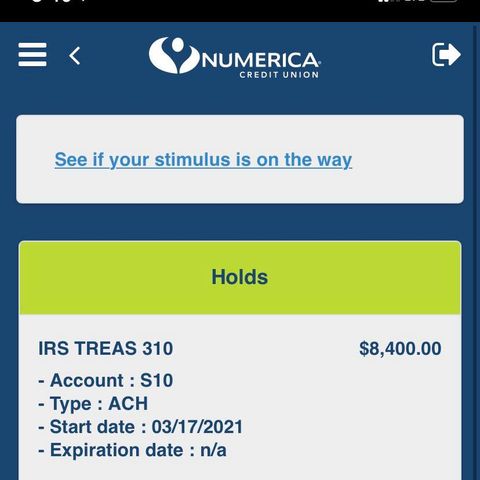

IRS Payment Confirmation for Monthly Advance CTC Direct DepositsGet the latest money, tax and stimulus news directly in your inbox

California $500 Golden Stimulus Dependent Check

CA Governor Newsom recently announced, thanks to large state budget surplus’ and federal funding via the Biden ARPA stimulus package, another $12 billion in direct cash payments to Californians. This expansion, called the “Comeback Plan” is in addition to the recent Golden State Stimulus, provides $1100 in additional direct payments to middle-class families that make up to $75,000. It will provide $600 direct payments to adults. Qualified families with dependents, including undocumented families, will also be eligible for an additional $500 dependent payment. This will include dependents in undocumented families.

It will provide $600 direct payments to adults. Qualified families with dependents, including undocumented families, will also be eligible for an additional $500 dependent payment. This will include dependents in undocumented families.

To get this payment you would have needed to file your 2020 tax return (state and federal). Income data (AGI) in your tax return will be the main source for determining eligibility for these payments. I will provide more updates as details and payment dates are released. You can follow along via the options below

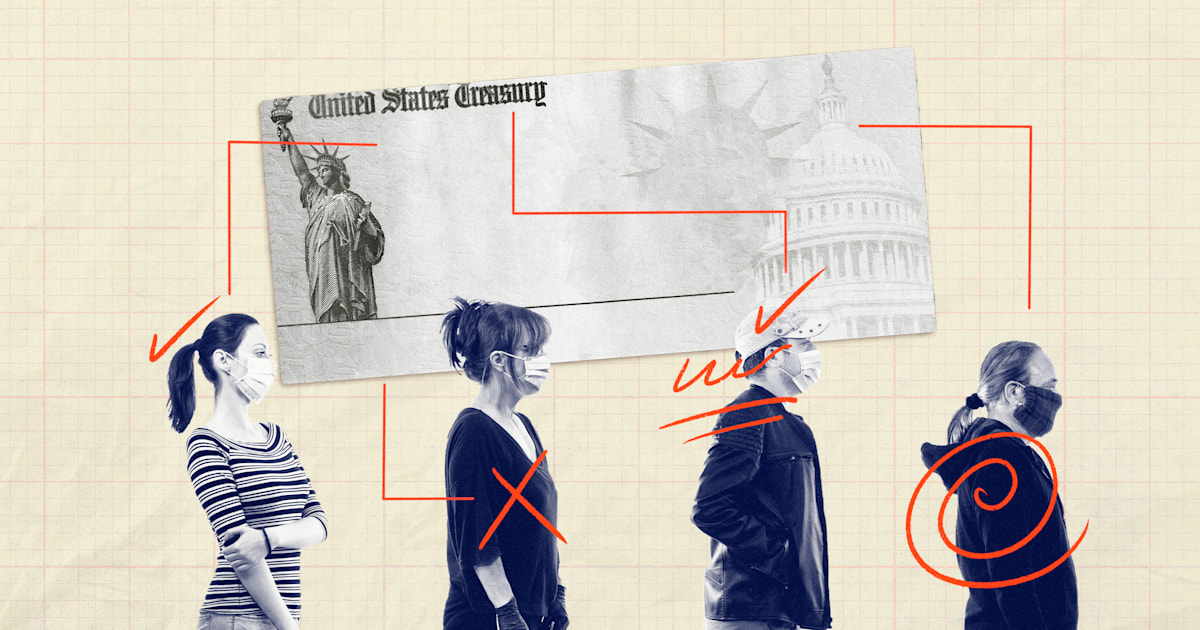

Update on Third $1400 Dependent Stimulus Check

Under the now approved $1.9 Trillion Biden Stimulus Package, or American Rescue Plan (ARP), there are provisions included for another round of stimulus checks. The amount being paid for this third round of stimulus “checks” is $1400 for each dependent – the same as the third adult stimulus check.

Unlike earlier dependent stimulus payments which were restricted to those under the age of 17, the third stimulus check would go to a broader set of dependents that were claimed in an adult tax return. This includes college age children and elderly dependent parents. It will also allow people to use the later of 2019 or 2020 tax data (file your tax return via TurboTax to update dependent information) to ensure the latest dependent and payment information is leveraged by the IRS.

This includes college age children and elderly dependent parents. It will also allow people to use the later of 2019 or 2020 tax data (file your tax return via TurboTax to update dependent information) to ensure the latest dependent and payment information is leveraged by the IRS.

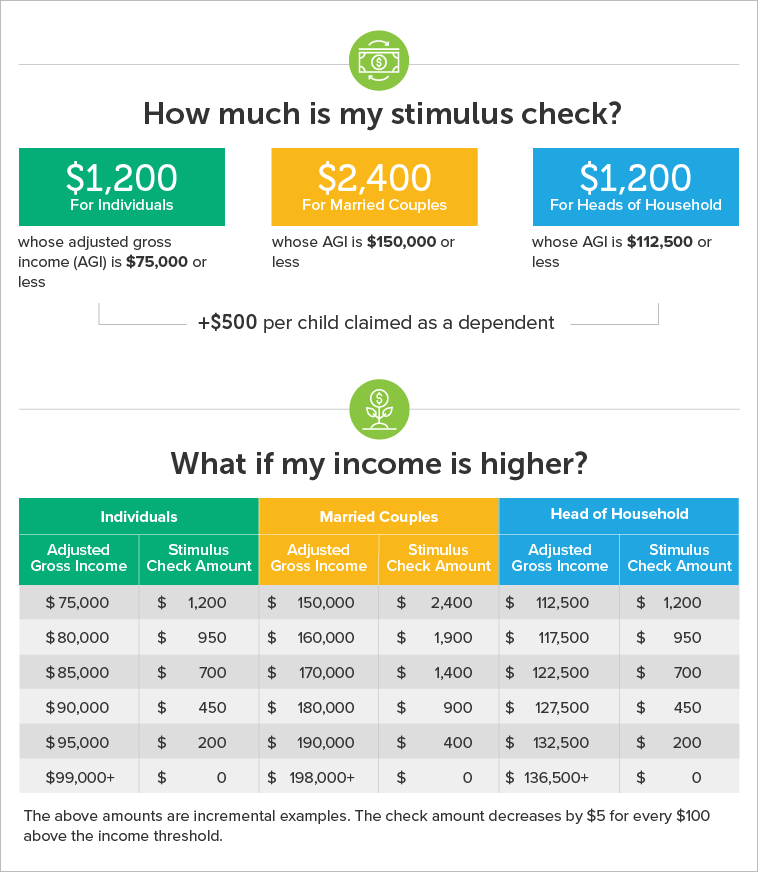

Note that even though adult dependents will qualify, the stimulus payment will still go to the parent or head of household who claims the dependent on their latest tax return. The adult claimant will also need to qualify for the stimulus payment which is based on the following income thresholds where the lower limit indicates the maximum amount of income (MAGI) to get the full stimulus payment, which is reduced until the maximum threshold (or phase-out) limit is reached. Almost 80% of households will qualify for a stimulus payment based on these thresholds.

| 2019 or 2020 Tax Filing Status | Income Below Which FULL Stimulus is Paid | Maximum Income To Qualify for Partial Stimulus |

|---|---|---|

| Single or Married filing separate | $75,000 | $80,000 |

| Head of household | $112,500 | $120,000 |

| Married filing jointly | $150,000 | $160,000 |

When Will I Get The $1400 Payment from the IRS?

Most eligible Americans and their dependents have received their stimulus payments (see the estimated IRS stimulus processing schedule). Payments will occur in several batches to most eligible recipients and are expected to be complete by mid-April for normally processed payments. Catch-up or “plus-up” payments are also being made to those who filed their return later and had a change on circumstance that allowed them to qualify for these payments.

Payments will occur in several batches to most eligible recipients and are expected to be complete by mid-April for normally processed payments. Catch-up or “plus-up” payments are also being made to those who filed their return later and had a change on circumstance that allowed them to qualify for these payments.

Exception processing will start after that. You can see the comments section below for Q&A on payment issues and updates, which I do expect to occur again with this round of payments given the changed income qualification criteria and expansion to a broader set of dependents.

Note: Like the first and second dependent stimulus checks, I expect there to be ongoing issues with paying this round of stimulus payments. You can see a discussion of issues (and solutions) in this video.

Stimulus Payments for Non-Filer Dependents

For non-filers who haven’t filed a recent tax return, the IRS worked with relevant agencies (e.g. SSA for Social Security recipients) to get the latest payment and dependent data. There is also talk of a new non-filer tool the IRS would roll out to allow payment and dependent detail updates for this payment. This would also allow updates to flow through for other expanded Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) stimulus payments in the ARP package. Or else the IRS will use payment and dependent details based on previous stimulus payments (which created issues for many).

There is also talk of a new non-filer tool the IRS would roll out to allow payment and dependent detail updates for this payment. This would also allow updates to flow through for other expanded Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) stimulus payments in the ARP package. Or else the IRS will use payment and dependent details based on previous stimulus payments (which created issues for many).

Do College Age kids or Adult dependents get the payment directly?

No. While college students and relatives who are claimed as dependents in 2019 or 2020 tax returns will be eligible to get this stimulus check payment (unlike the past two economic impact payments) they will NOT be getting a direct payment from the IRS. The dependent payment would instead go to the parent or qualified taxpayer – which may be a surprise to many college aged kids hoping for some bonus/free money!

Also note, you cannot claim the stimulus check as an adult and as a dependent. If you were claimed as a dependent in a 2019 or 2020 tax return, you cannot now file a claim for the larger stimulus check.

If you were claimed as a dependent in a 2019 or 2020 tax return, you cannot now file a claim for the larger stimulus check.

Get the latest money, tax and stimulus news directly in your inbox

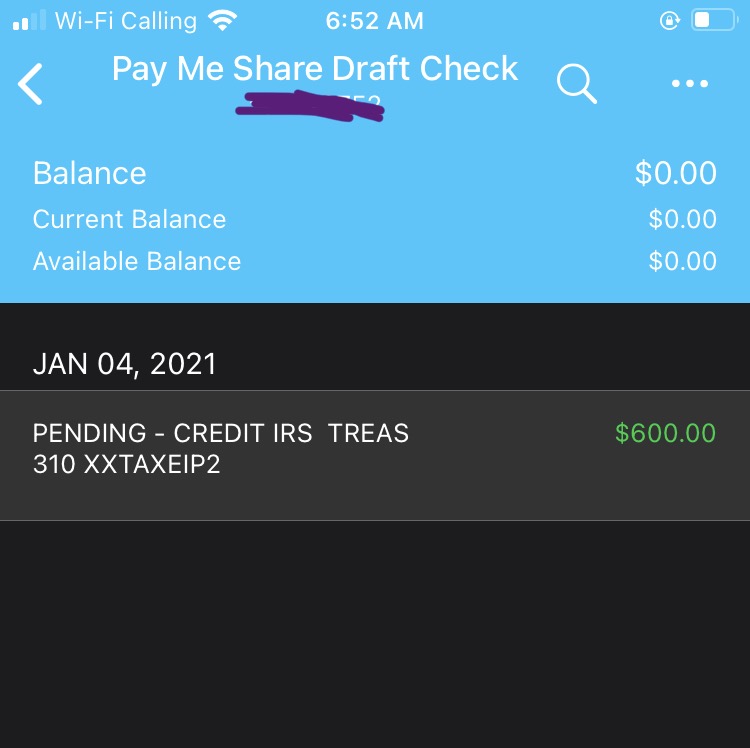

Second Child Dependent Stimulus Check ($600)

[Update following initial IRS payments] In addition to adult stimulus checks (a.k.a 2020 Recovery Rebates) the recently passed $900 billion COVID relief bill includes another round of stimulus payments for adults and ALL qualifying dependent children under the age of 17 at the end of 2020. While the adult stimulus check amount was only $600, half of the original $1200 stimulus payment, in order to keep the overall stimulus package price tag reasonable for Republican Senators to approve, the new dependent stimulus payment will be $100 more at $600 per qualified dependent.

Eligibility for the $600 child dependent recovery rebate stimulus is still subject to (AGI) income limits, which were adjusted from original levels, as shown in the table below. The benefit will phase out or reduce by $5 (or 5%) for every $100 of income above the lower level threshold to get the full stimulus. For every additional dependent the maximum income threshold rises by $12,000 ($600 / 5%).

The benefit will phase out or reduce by $5 (or 5%) for every $100 of income above the lower level threshold to get the full stimulus. For every additional dependent the maximum income threshold rises by $12,000 ($600 / 5%).

| Status | Income Below Which FULL Dependent Stimulus is Paid (Lower Threshold) | Max Income To Qualify for Stimulus (no kids) | Max Income to Qualify with 1 Child | Max Income to Qualify with 2 Children |

|---|---|---|---|---|

| Single or married filing separate | $75,000 | $87,000 | $99,000 | $111,000 |

| Head of household | $112,500 | $124,500 | $136,500 | $148,500 |

| Married filing jointly | $150,000 | $174,000 | $186,000 | $198,000 |

Are Adult High School or College Age Dependents Covered?

Unfortunately the approved stimulus bill has not addressed this same criticism around the original $500 dependent stimulus (see updates and comments below) which excluded adult dependents from getting this payment. This includes thousands of college students and high school kids who are older than 17, but are still being claimed as a dependent by their parents or relative on their federal tax return, who will continue to be ineligible for the additional $600 payment. The one exception to this is that if you are a college student AND filed a single 2019 tax return AND were not claimed as a dependent on another adult’s tax return (file for free at Turbo tax), you may qualify for the $1200 adult stimulus check per standard rules.

This includes thousands of college students and high school kids who are older than 17, but are still being claimed as a dependent by their parents or relative on their federal tax return, who will continue to be ineligible for the additional $600 payment. The one exception to this is that if you are a college student AND filed a single 2019 tax return AND were not claimed as a dependent on another adult’s tax return (file for free at Turbo tax), you may qualify for the $1200 adult stimulus check per standard rules.

When will I get the second $600 dependent stimulus payment?

Like the original dependent stimulus this payment will be made by the IRS to qualifying guardians who filed a 2019 recent tax return and claimed the child as dependent. Stimulus check 2 payments started on December 30th, 2020 per IRS guidance and dependent payments will be issued with the adult stimulus payment. Payments will occur in several batches to most eligible recipients within 1 to 2 weeks of the initial round and are expected to be complete by mid-January 2021 for normal processing. Exception processing will start after that. You can see the comments section below for Q&A on payment issues and updates.

Exception processing will start after that. You can see the comments section below for Q&A on payment issues and updates.

Also I have posted two recent videos on this topic – one is a detailed review of the $600 Dependent Stimulus and a subsequent one is a Q&A for Issues People are Seeing with this Payment.

Dependents not in 2019 returns or born in 2020

Households that added dependents in 2020, who might not qualify for the dependent stimulus based on 2019 tax returns, would be able to claim this payment in their 2020 tax returns. The stimulus checks work like a refundable tax credit so are no additional taxes are due on them when filing your tax return.

While there is no limit to the number of qualifying dependents a tax payer can claim, the same dependent cannot be claimed twice for this payment and the IRS will this payment based on dependent information from 2019 tax returns.

For parents who had babies this year, and who won’t be listed in 2019 tax returns, they will need to file a return (start for free at Turbo Tax) to claim their dependent payments. The good news is that all babies born this year will be eligible for both the original $500 dependent stimulus (details in earlier updates below) and the second $600 one being paid in 2021. This makes a total of $1,100 that parents could get for their newborns born in 2020. You will still need to meet income qualification thresholds for both dependent stimulus payment and will need to file a tax return; or for non-filers wait till the IRS opens it’s GMP tool to allow you to add dependents born this year.

The good news is that all babies born this year will be eligible for both the original $500 dependent stimulus (details in earlier updates below) and the second $600 one being paid in 2021. This makes a total of $1,100 that parents could get for their newborns born in 2020. You will still need to meet income qualification thresholds for both dependent stimulus payment and will need to file a tax return; or for non-filers wait till the IRS opens it’s GMP tool to allow you to add dependents born this year.

Start filing your taxes for Free today with the #1 best-selling tax software

The inclusion of the one-time stimulus payment however has also meant a cut in extra unemployment benefits that are also part of the overall package. You can also see more on this topic in the $600 Dependent Stimulus Check Video.

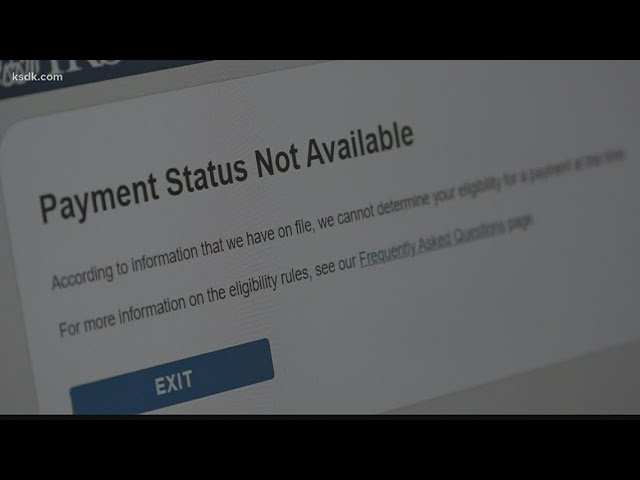

Issues with my Second Dependent Stimulus Check (Recovery Rebate) Payments

Like the first round of dependent payments (see updates below), many readers are reporting similar issues with the IRS payments for the second child dependent stimulus payment, despite having received their adult stimulus checks. At this point it is best to wait for the IRS to finish processing, especially if you had issues with the first round of payments. It is highly likely you will also get your dependent stimulus check later after the first round of “standard” payments is done in early to mid-January 2021. If you don’t have your payment you will need to check state on the IRS website, call their call center (later in January is better) or just file for this when you submit your 2020 tax return.

At this point it is best to wait for the IRS to finish processing, especially if you had issues with the first round of payments. It is highly likely you will also get your dependent stimulus check later after the first round of “standard” payments is done in early to mid-January 2021. If you don’t have your payment you will need to check state on the IRS website, call their call center (later in January is better) or just file for this when you submit your 2020 tax return.

First Dependent Economic Stimulus Payment ($500)

[August 2020 update] This IRS has fixed certain stimulus payment issues (which were due to a programming errors) for non-filer groups, many of whom are yet to receive their first $500 dependent stimulus credit. The resolved $500 dependent stimulus (economic impact) payments were being seen by several eligible recipients from early August for each qualifying child.

Further the IRS has announced it will reopen the registration period – starting Aug. 15 through Sept. 30 – for eligible non-filing federal beneficiaries (e.g. SSDI, Retirees and SSI recipients) who were eligible for the $500 per child payments but had not filed or needed to update payment details to get their payment. Those who file (via the IRS Non-filer tool) and are deemed eligible should start seeing their payments by Mid-October.

15 through Sept. 30 – for eligible non-filing federal beneficiaries (e.g. SSDI, Retirees and SSI recipients) who were eligible for the $500 per child payments but had not filed or needed to update payment details to get their payment. Those who file (via the IRS Non-filer tool) and are deemed eligible should start seeing their payments by Mid-October.

For those Social Security, SSI, Department of Veterans Affairs and Railroad Retirement Board beneficiaries who have already used the Non-Filers tool to provide information on children, no further action is needed. The IRS will automatically make a payment in October.

The above is great news for those who were in limbo about their payment and hopefully addresses many of the comments below.

$500 Dependent Stimulus Credit Qualification Thresholds and FAQs

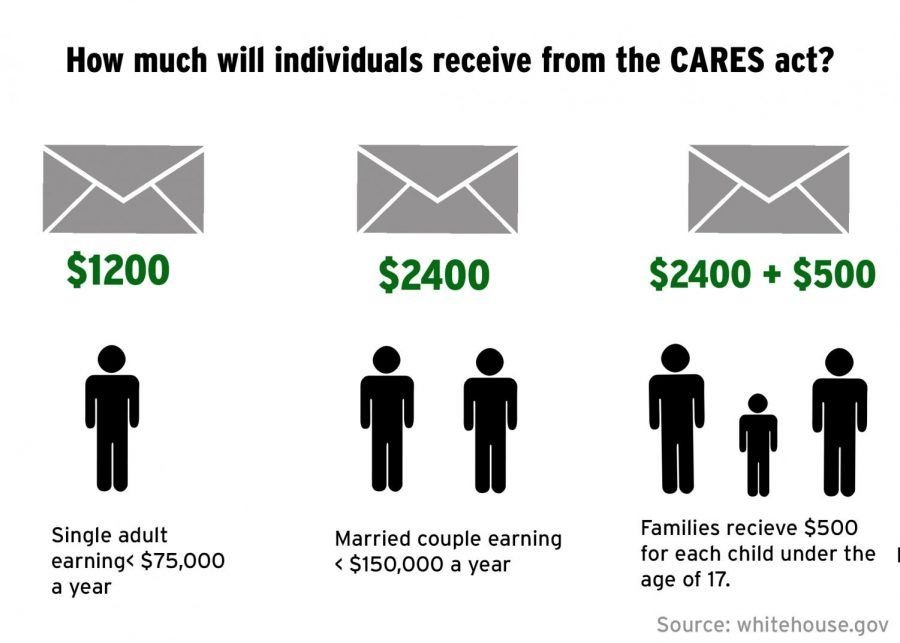

Updated in May 2020 with answers at the end of this article. Several readers have asked questions around the additional $500 child dependent stimulus payment approved under the CARES stimulus bill. This is in addition to the $1200 individual and $2400 couple stimulus checks being paid to qualifying Americans. To get the supplementary child stimulus check payment you must have filed a recent (2018 or 2019) tax return, claimed the child as dependent AND the child must be younger than 17-years-old. They must also be related to you by blood, marriage, or adoption. There is no limit to the number of dependents who can qualify for the additional $500 in one household.

This is in addition to the $1200 individual and $2400 couple stimulus checks being paid to qualifying Americans. To get the supplementary child stimulus check payment you must have filed a recent (2018 or 2019) tax return, claimed the child as dependent AND the child must be younger than 17-years-old. They must also be related to you by blood, marriage, or adoption. There is no limit to the number of dependents who can qualify for the additional $500 in one household.

[Updated answer to the 700+ comments] By far the most common comment I am seeing on this article is where parent(s) have received their $1200/$2400 stimulus check but did not get their $500 kid stimulus credit for one or more of their eligible dependent children. This reader comment is a good example of this, “My husband and I filed married filing jointly and claimed our two boys 10 , and 6. We have filed it this way for years! And we only received the stimulus for us and nothing for them! And we have no idea who to call or how to fix this.

It was obviously an error. Which is understandable considering all the people they have to do this for. But I just wish there was a way we could get the extra $1,000. Before filing next year.”

You can scroll down to see further examples (and some underlying reasons) like this but at this point there is little recourse for most people to resolve this in the near future as the IRS is not taking calls on this.

This age limit to get the dependent stimulus check is much younger than what is used by the IRS in the qualifying child test where a child must be younger than 19 years old or be a “student” younger than 24 years old as of the end of the calendar year. Hence the confusion being caused for many trying to claim this stimulus payment. So just remember if your child or eligible dependent is 17 or over at the end of 2020 you cannot claim the stimulus dependent payment for them. The full qualifying criteria for this payment is shown below.

Thousands of college students and high school kids who are older than 17, but are still being claimed as a dependent by their parents or relative on their federal tax return, are unfortunately ineligible for the additional $500 payment based on current rules.

However if you are a college student AND filed a 2018 or 2019 tax return (file for free at Turbo tax), you may qualify for the $1200 stimulus check per standard rules. Note that you can still file a tax return (and must, if you want to get a refund of federal or state tax withholding) AND be a dependent on your parents return. So many 17 to 26 year old’s who filed federal returns will still not get a stimulus payment because they are considered dependents on their parents return (and their parents likely received a $500 tax credit for their dependency on the original return). A parent could technically file a revised tax return in which they no longer claim their college student (giving up $500) that would allow their child to claim the $1200 normal stimulus. This however may take a while to get paid out.

This however may take a while to get paid out.

It’s not uncommon for a grandparent, close relative or a step parent to claim a child living with them as a dependent. In these cases, the payment goes to the person who claimed that child as a dependent on the most recent tax return. They will still also have to meet the standard rules to qualify for the overall stimulus check payment. Just ensure multiple people don’t claim the same person as a dependent or like your tax refund, the stimulus payment could be delayed a long time as the IRS figures out the right person to pay.

$500 Payment

Most people who qualify for this payment will get it along with their stimulus check payment (direct deposit or check). The IRS has already started making these payments. In special circumstances or where the IRS needs to investigate further, the payment will come separately at a later date. This payment is not taxable and does not have to be paid back. You also won’t be required to repay any of the stimulus check even if your qualifying dependent turns 17 in 2020.

You also won’t be required to repay any of the stimulus check even if your qualifying dependent turns 17 in 2020.

The one exception to this are for veterans or those who receive Social Security retirement or disability benefits (SSDI), Railroad Retirement benefits or SSI and have a qualifying child. The IRS does not have their qualifying dependent information so they will have to explicitly register via the IRS’ Non Filers payment update tool by April 22nd to receive the $500 per dependent child payment in addition to their $1,200 individual payment. If beneficiaries in these groups do not provide their information they will have to wait until later in the year to receive their $500 per qualifying child payment.

Frequently Asked Questions (FAQ)I am getting several hundred questions on this topic! Based on the IRS website and what I am seeing across several other reputable sites, I have tried to group and answer some of more common questions. Please consider this informational as everyone has a unique tax and life situation.

It depends and the IRS guidelines are not very clear on for this. The ruling is that eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples AND up to $500 for each qualifying child. So it appears that both parents have to be eligible under standard rules to get the dependent stimulus. Note that the entire stimulus payment is subject to the income phase out – $5 for every $100 between the lower and higher Adjusted Gross Income (AGI) range – shown in the table below.

But where it gets a little complicated is that if you have kids, the maximum AGI threshold limits to get some of the $500 stimulus rise since your phase out limit is tied to your credit ($5 of credit for every $100 AGI). This allows you add $10,000 to your AGI limit for every child you claim as a dependent. For example if your income was exactly $99,000 as a single (or $198,000 joint) and you had no kids it would completely disqualify you for the standard $1,200 (or $2,400). But if you had two kids and were married filing jointly in 2019 you would still get some type of the $500 dependent stimulus until your AGI reaches $218,000.

For example if your income was exactly $99,000 as a single (or $198,000 joint) and you had no kids it would completely disqualify you for the standard $1,200 (or $2,400). But if you had two kids and were married filing jointly in 2019 you would still get some type of the $500 dependent stimulus until your AGI reaches $218,000.

| Status | Income Below Which FULL Dependent Stimulus is Paid | Max Income To Qualify for Stimulus (no kids) | Max Income to Qualify with 1 Child | Max Income to Qualify with 2 Children |

|---|---|---|---|---|

| Single or married filing separate | $75,000 | $99,000 | $109,000 | $119,000 |

| Head of household | $112,500 | $136,500 | $146,500 | $156,000 |

| Married filing jointly | $150,000 | $198,000 | $208,000 | $218,000 |

This is by far the most common theme I see questions around. While everyone has a unique situation when it comes to a qualifying dependent here are some answers I found from my research on why you didn’t get a payment or where it was much lower than expected. I have also addressed questions in the many comments below so please review those before adding a new one.

While everyone has a unique situation when it comes to a qualifying dependent here are some answers I found from my research on why you didn’t get a payment or where it was much lower than expected. I have also addressed questions in the many comments below so please review those before adding a new one.

Your child was claimed by someone else according to IRS records. In this case you won’t get the $500 payment and will need to lodge a claim with the IRS (process still to be confirmed).

While you may have qualified for the stimulus payment based on income thresholds (shown above) your dependent child wasn’t qualified per IRS records and CARES stimulus rules summarized below. This is even more strict than the Child Tax Credit (CTC) criteria.

- They must be related to you (blood, marriage, or adoption)

- They must either be under the age of 17 by the end of 2020

- You must claim them as a dependent on your tax return

- They cannot provide more than half of their financial support during the tax year and must have lived with you for at least half of the year

- They must be a U.

S. citizen, a U.S. national or a U.S. resident alien

S. citizen, a U.S. national or a U.S. resident alien

Note if you didn’t qualify for the CTC in your 2018 or 2019 tax return, you will not qualify for this stimulus payment either!

You get Social Security retirement, disability benefits (SSDI), Railroad Retirement benefits or SSI. Per the section above you need to take an extra step and explicitly register via the IRS’ Non Filers payment update tool to receive the $500 per dependent child payment

Children born or adopted in 2020 or Change in Dependent statusIf you had or adopted a child in 2020 or there was a change in dependent status since your 2019 tax filing the parent or qualifying relative could still be eligible for the $500 payment. But it will not be paid in via the current batch of stimulus check payments and will instead need to be claimed in your 2020 tax return as an additional credit. This is because the IRS is basing stimulus check payments on information from your 2019 or 2018 tax return, which won’t reflect children born or adopted this year, or any change in dependent status.

The $500 child stimulus, like the regular adult stimulus payment, can be offset only by past-due child support or can be garnished by creditors once it hits your bank account. Both these reasons could mean a lowered stimulus payment that may look like you didn’t get the $500 additional kid stimulus. You will need to wait for a letter from the Bureau of the Fiscal Service to confirm the offset. For garnishments you will need to check with your bank to see which creditors have taken this payment.

IRS payment errors and missing dependent paymentsThe most common error I am seeing across the comments on this article is around the following examples:

“I claimed my [son or daughter] for [2018 or 2019] taxes and didn’t receive $500! What’s going on?????

My husband and I received 1200 each but nothing for our 13 year old son. We are under the income guidelines, no child support involved, and he has always been claimed on our taxes. I sure hope there is a solution to this soon. It’s so strange that this has happened to so many people.

I sure hope there is a solution to this soon. It’s so strange that this has happened to so many people.

“We received our $2400.00 stimulus check on April 15, but didn’t get the additional $500 for our son/daughter. Is there something additional I need to fill out?”

So today I finally received my 1200 stimulus payment, which was suppose to be 1700 with the 500 for my son who is 8. I filed my taxes with him as a dependent and don’t understand why I did not receive the 500!! This is pretty heartbreaking that our country is falling apart and the only money I had coming in to support us during this time I didn’t even receive the full amount.

I used the IRS non filers tool to get my stimulus check. I received the $1200 stimulus payment, but did not receive the dependent portion for my 8 year old son. Upon review of the 1040 form I downloaded after submitting my personal information for my son and I, using the IRS Non-Filers Tool. I noticed that the box for the child tax credit was not [✔]checked off. Even though my son does qualify for the dependent stimulus payment. This is definitely an error on the IRS side. Checking the box was not an option when filling out the form online. It was something that had to be done when the form was generated using the tool. Anyway, my theory is that the “box” not being checked is the reason myself and many others did not receive their dependent portions of the stimulus payments.

Even though my son does qualify for the dependent stimulus payment. This is definitely an error on the IRS side. Checking the box was not an option when filling out the form online. It was something that had to be done when the form was generated using the tool. Anyway, my theory is that the “box” not being checked is the reason myself and many others did not receive their dependent portions of the stimulus payments.

Readers have left several comments along these lines and at a high level it looks the IRS is either not paying the $500 correctly for qualifying dependents or missing payments for families with multiple dependents, despite the adults getting the standard $1200 or $2400 stimulus.

But even if you do see a clear error or miss in your payments it might be difficult to get a hold of someone in the IRS to correct the issue in the near future. This is because the IRS teams are focused on getting the remaining stimulus payments out and have staffing constraints due to Coronavirus/COVID-19 related absences.

Also note if the IRS is still processing your 2019 tax return or refund it will likely use your 2018 tax return data to process this stimulus payment, so if your dependent information changed between your 2018 and 2019 return (e.g you had a kid) you may have a missed payment that would have been accounted if your 2019 tax return had actually been processed.

Get the latest money, tax and stimulus news directly in your inbox

Can I contact the IRS for Stimulus Check Payment Issues or Errors?The IRS has been mailing Economic Impact Payment (EIP) letters to each eligible recipient’s last known address 15 days after the stimulus check payment is made. It was supposed to provide details on how the payment was made and how to report any failure or underpayments (e.g a way to report the missing $500 payment). Unfortunately the letter has been of little help as discussed in this article. It provides a number to call which gets you an automated line that directs you to the IRS website for details. But if you stay on the line you can get connected to an IRS representative (after a long wait) to discuss general questions about the payment and your situation. See details and numbers to call in this article.

But if you stay on the line you can get connected to an IRS representative (after a long wait) to discuss general questions about the payment and your situation. See details and numbers to call in this article.

Update – The IRS has confirmed that those who did not receive the full amount of stimulus payment they believe they were entitled to – including the $500 child dependent payment – will need to claim the additional amount when they file their 2020 tax return. This is tough news for many families who needed/expected the $500 payment as soon as possible and were hoping to get a supplementary or corrective payment in the mail sometime in the near future. You’ll now need to wait till 2021 when you file your tax return to fix this.

For VA and SSI recipients who don’t have a filing requirement and have a child, they need to use the Non-Filers tool (see above) to have the $500 added automatically to their standard stimulus check payment.

It has also been nearly impossible to contact the IRS via numbers provided in the EIP for your issues with the $500 child stimulus per this article. But also note that the IRS will not contact you about your stimulus check payment details either. Watch out for scams and people trying to steal this information from you in the name of expediting your Economic Impact Payments.

Finally you will also likely be able to claim any missing payments in your 2020 tax return. All this unfortunately will mean delays in getting your stimulus payment until issues are worked through.

Now everyone has different tax and dependent situations so I first suggest you review the above FAQs in this article to ensure you meet income and qualifying dependent criteria per your most recently filed tax return. You can also search for many articles on this website for commonly reported stimulus check errors. Before leaving a comment see what others have written and lessons learned. And most of all, be nice to each other.

Does the parent of the guardian receive an incentive check for non-personal parents?

what happens is that the state that represented the case usually receives money from the offset within two to three weeks . The money is then paid to the proper recipient (eg custodial parent).

Will the child's policy be given the 4th stimulus test?

In fact, this Cares Act states that the only reason a stimulus check can be compensated is for overdue child support. Your stimulus check will be , so will be decorated for the appropriate amount of unpaid support if the recipient has reported this to the authorities.

can the aliat pass the third stimulus test?

This third stimulus payment cannot be withdrawn or embellished for alimony, but can be taken on to meet private debts .

Which parent gets a stimulus check for a child?

Ultimately, the current rules regarding stimulus testing state that whichever parent can claim the child on their tax returns as . The addict is eligible for a stimulus loan for that child.

The addict is eligible for a stimulus loan for that child.

Who is not eligible for an incentive check?

These checks disappear faster this time. Singles with an adjusted gross income of $80,000 or more and household heads with $120,000 and married couples with $160,000 are not eligible for payment. Other requirements also apply. You must be a US citizen or an alien.

How do I get a $500 incentive for my child?

Parents who pay or receive child support may each claim $500 dependency with the first check, but they must share custody of the child and may need to file a claim this year to receive payment.

Who qualifies for the $500 per child incentive test?

This may consist of dependents seventeen years of age or older, dependent parents, or other seniors. Dependents between the ages of nineteen and twenty-four and college state students are also eligible for the $500 raise.

Who qualifies for a $500 stimulus dependency test?

US families with adult children aged 18 to 24 may qualify for a one-time $500 stimulus check. Parents with cared for 18 year dependents can claim a maximum of $500 each against the tax credit they receive.

Parents with cared for 18 year dependents can claim a maximum of $500 each against the tax credit they receive.

What if I didn't get a stimulus check on my addict?

IRS payment update $500 – Unfortunately, the IRS has confirmed that those who did not receive the full amount of their pending stimulus payment, including the additional $500 contingent payment, must claim the additional amount when they file their 2020 tax return.

Can I get a no income stimulus check?

Even if you have no income, you are eligible for a stimulus check. … you don't need to be a US citizen to receive a stimulus payment, but you do need a valid social security number.

Can I get a stimulus check if I haven't filed taxes?

If you do not receive full economic impact payment, you may be eligible to claim a Recovery Discount Credit. If you have not received any payments or received less than the full amounts, you may qualify for credit even if you do not normally file taxes.

How do I apply for an incentive?

You can file taxes online for free at https://www.myfreetaxes.com/ or you can go to https://www.getyourrefund.org/ to get free virtual help with filing. Due to the Covid-19 pandemicCongress passed the Care Act. Under this act, most Americans will receive economic influence from the IRS.

Who gets the incentive for the child if divorced?

How does your divorce affect this payment? The new law states that the child stimulus payment will be paid to the parent who stated that the child was dependent on his/her tax return last year.

Do SSI recipients receive an incentive check as a dependent?

Stimulus payments for persons who are considered dependents will be paid to the taxpayer who claims them. Those who receive Social Security or Supplemental Security Income benefits do not have to take any action to get the extra money, even if they do not file a tax return.

Who qualifies for the incentive test?

To qualify, you must have been a California resident for most of the past year and still live in the state, filed a 2020 tax return, earned less than $75,000 (adjusted gross income and wages) during tax year 2020 have a Social Security Number (SSN) or a separate taxpayer identification number (ITIN), and may . ..

..

Do you need to file taxes to get a 2021 stimulus check?

The deadline for filing your taxes this year was May 17, 2021 . The tax filing extension deadline is October 15, 2021. If you miss the application deadline, you can still file your tax return to receive your first and second stimulus checks. If you don't owe taxes, there is no penalty for late filing.

Too late to get a stimulus check?

Fortunately, if your direct deposit never arrived and you never cashed your original stimulus check, the IRS will send you a replacement. Once this is done, the IRS will display the status of your check and whether it has been posted or not. …

Why didn't I get a stimulus check?

stimulus checks can be withdrawn to cover past debt

The same goes for the second payment if you claim no money in the recovery discount. You may be notified by the Fiscal Bureau or your bank if any of these scenarios occur.

Am I getting an incentive check for my dependents?

For the third round of stimulus payments, taxpayers can receive payments for dependents of all ages, including children over 17, college students, and adults with disabilities. … The payments are an advance against a new loan for the 2021 tax year. These payments will not affect eligibility for other tax credits.

… The payments are an advance against a new loan for the 2021 tax year. These payments will not affect eligibility for other tax credits.

How to get a reissued incentive?

There are two ways to request a payment trace for the third stimulus check:

- Call the IRS at 800-919-9835; or.

- Mail or fax completed Form 3911 to the IRS.

What would you do if you didn't get an incentive?

If you did not receive the full amount of the first or second Economic Impact Payment, you may be eligible to claim the 2020 Restoration Discount and must file a 2020 tax return even if you do not normally file. The third economic impact payment will not be used to calculate the 2020 Recovery Credit Discount.

Do you receive stimulus money for a 17 year old dependent?

New American Rescue Scheduled $1,400 Dependent of any age to be included on their parent's or guardian's checks. For the first time, 17-year-olds and adult dependents (anyone aged 18 and over) are also eligible for payment.

How much money will I get for the incentive money?

Single tax registrars earning less than $75,000 will receive $1400. Payments will decrease for AGIS over $75,000 until they are fully saved at $80,000. Joint tax factories earning less than $150,000 will receive $2,800.

9 life hacks on how to motivate a child to do "homework" - magazine

One side presses, accuses, promises all sorts of benefits and threatens with punishments, keeps at the desk. The second - in every possible way tries to evade, run away for a walk, ask for time off to eat for the hundredth time. So few adults are satisfied with the state of things and do not sigh: when it is already a child it will be easy to do homework. There is no magic key, says child psychotherapist, art therapist Maryana Serazhim, but you can pick up a key for each child.

There is no magic key, says child psychotherapist, art therapist Maryana Serazhim, but you can pick up a key for each child. It is important to understand step by step why the child does not want to sit down for lessons. Start with physiological nuances. Maybe he is hungry or tired? Does he have an uncomfortable workplace? Convenience is important to control for parents: a child may consider an easy chair and a desktop littered with dinosaurs to be ideal, but impaired blood circulation and unfocused attention prevent him from doing the task.

When to start doing homework? Some parents think: the child needs to relax after a school day. Others: eat - study, but you can walk and have fun when everything is done, otherwise the student will get carried away and forget about the lessons. The mistake is that adults decide it on their own. In fact, the most fruitful time for children is different, and we need to look for it together. And if the child has already graduated from elementary school, he should be allowed to find his own “peak” performance. According to the biological clock, the "lark" will do the lessons early in the morning, the "owl" - after dinner.

And if the child has already graduated from elementary school, he should be allowed to find his own “peak” performance. According to the biological clock, the "lark" will do the lessons early in the morning, the "owl" - after dinner.

Temperament is also important. After school, a choleric person should be sent for a walk or go in for sports so that he throws out excess energy. It is better for a phlegmatic person to leave more time to complete tasks so that he can study in his usual leisurely manner. Melancholic people quickly overwork, they have low stress resistance. Before classes, they benefit from quiet pleasant activities, relaxation and even daytime sleep. And it’s better to break the “homework” into small subtasks, after which you should take breaks.

via GIPHY

Turn off your phone, computer, TV. Do not talk on the mobile next to the student yourself, do not work in front of his eyes with a laptop that makes the child think about computer games.

Do not talk on the mobile next to the student yourself, do not work in front of his eyes with a laptop that makes the child think about computer games.

It is advisable not to start interesting things at this time in which the student would like to take part (for example, baking a pie if the daughter likes to help).

If everything is fine on the bodily level, problems should be looked for in the psychological mood. And above all… mom/dad. It's hard to get a child to be productive if you're annoyed while working with them. Mom is often overworked, and helping a schoolboy takes her time to recuperate. Then it is better to check homework less often, but do it in a calm mood.

Sometimes parents are so interested in completing tasks faster that they start doing them themselves for the child. But if the mother worries about the lessons more than the child, the motivation decreases. It is important not to take responsibility for homework, otherwise the student will think that this is the concern of mom and dad. Realize that you are just helping, and the result depends on the teacher and the student. If the child does not cope at all, the tutor will help. And if the teacher teaches badly, the student has the legal right to receive answers to questions and explanations after the lessons.

Realize that you are just helping, and the result depends on the teacher and the student. If the child does not cope at all, the tutor will help. And if the teacher teaches badly, the student has the legal right to receive answers to questions and explanations after the lessons.

Why do parents turn "homework" into an overvalued idea? Why do they behave as if the lessons learned are more important than health, acquired knowledge, experience? Perhaps, I recall my own childhood fear of the teacher, guilt for not completing homework, the feeling that everything was “not right”, but my child should go perfectly. Decide for yourself why you need grades from your son or daughter. Perhaps we should accept that everyone has their own abilities and inclinations: in some subjects your student will be successful, in others not, and there is no point in “squeezing out” high scores. At the same time, the child will no longer be afraid of homework.

Is the child upset, afraid? In some schools, those who have problems with their studies are humiliated, they do not give a natural right to make a mistake. By letting go of your own fear, you can bring in positivity. Make any remark on “homework” according to the “sandwich rule”: before and after criticism, talk about the noticed “pluses”. They are not here? Even an avid loser can find neatly written lines, a step in the right direction, or at least the effort spent.

By letting go of your own fear, you can bring in positivity. Make any remark on “homework” according to the “sandwich rule”: before and after criticism, talk about the noticed “pluses”. They are not here? Even an avid loser can find neatly written lines, a step in the right direction, or at least the effort spent.

Is it necessary to reward? You decide. It is better if the reward is not something material, but the time spent together, favorite entertainment. Such incentives are best used not daily, but after the successful completion of the most difficult tasks or on weekends - as a result of the week's work.

In primary school, it is important for parents to create the most friendly field around the lessons. The child has the right to test his abilities, make mistakes, not do his homework - and see what comes of it.

A trusting relationship with parents will help, who will support and help, no matter what grade the student brings.

If your boss sat next to you and commented on every action, every word that was written, how long would you hold out? It is better to leave the child alone while he does his homework.

First, it is worth planning together what needs to be done, breaking tasks into specific operations. Often you also have to explain the conditions of tasks and exercises. Many breakdowns occur due to the fact that the student simply does not understand what is required of him. Then leave, but be within reach in case there are new questions about the material.

At the end, check the lessons, find the mistakes (it is more useful to point out them, rather than answer them; the student himself should redo them). But the student will be sure that he is not alone with incomprehensible tasks, together you will cope.

via GIPHY

Motivate not with what bothers you, but with what is close to the child. One has this conformist mood: not to be the only one who did not do the lessons, to be in the subject, like the rest of the students. Another has developed a spirit of competition: to do better or more original than others. Fantasize together about a “glory moment” worth striving for.

One has this conformist mood: not to be the only one who did not do the lessons, to be in the subject, like the rest of the students. Another has developed a spirit of competition: to do better or more original than others. Fantasize together about a “glory moment” worth striving for.

If the child is afraid of stress, convince him that homework is like a test rehearsal, only his mother is nearby. Practice and it will be easy. If the student has strong cognitive interests, it is important to add something interesting to the lessons. Yes, you will have to "sweat", looking for additional information. But this is no more difficult than fighting, driving a child behind notebooks. If there is an exploratory mood, the student wants to get personal experience. He will be concerned about how to apply this knowledge in life, why they are. Show or find a video on the desired topic. Even better, invite the student to look for it themselves and discuss it with you. Emphasize that "homework" is more mature than classwork, because you are learning to work on your own.

Choose individually what will help organize your studies. For example, it is useful for assiduous children with uniform working capacity to single out the most unpleasant tasks - “frogs” and engage in “eating a frog”, that is, move from complex to easy.

"Tomato technique" is suitable for those who are not very diligent. The student Francesco Cirillo, who was about to be expelled, having invented this method, graduated from the university in such a way that he was awarded the handshake of the Prime Minister of Italy for outstanding academic knowledge. It is enough to break the work into 25-minute segments - tomatoes (this is what Cirillo's kitchen timer looked like) and set the timer. It is done? Five minutes break. Did you eat four tomatoes? Half an hour of pleasure: watching a “quarter” of a movie, a walk, your favorite computer game, friends. If the 25-minute cycle was interrupted, it’s far from a “bonus”: set a timer and work on the task again.