How long can child collect social security from deceased parent

Survivors Benefits | SSA

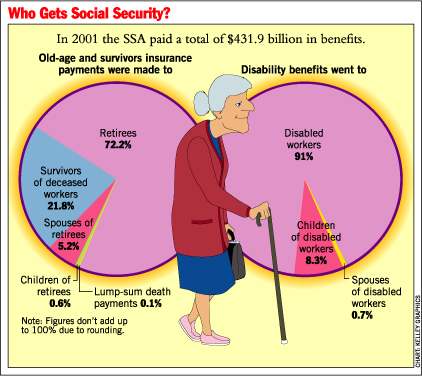

Social Security survivors benefits are paid to widows, widowers, and dependents of eligible workers. This benefit is particularly important for young families with children.

This page provides detailed information about survivors benefits and can help you understand what to expect from Social Security when you or a loved one dies.

The Basics About Survivors Benefits

Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died. The deceased person must have worked long enough to qualify for benefits.

For more information, please read How Social Security Can Help You When a Family Member Dies.

Apply for Survivors Benefits

You should notify us immediately when a person dies. However, you cannot report a death or apply for survivors benefits online.

In most cases, the funeral home will report the person’s death to us. You should give the funeral home the deceased person’s Social Security number if you want them to make the report.

If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778). You can speak to a Social Security representative between 8:00 a.m. – 7:00 p.m. Monday through Friday. You can find the phone number for your local office by using our Social Security Office Locator and looking under Social Security Office Information. The toll-free “Office” number is your local office.

If you are not getting benefits

If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

If you are getting benefits

If you are getting benefits on your spouse's or parent's record:

- You generally will not need to file an application for survivors benefits.

- We'll automatically change any monthly benefits you receive to survivors benefits after we receive the report of death.

- We may be able to pay the Special Lump-Sum Death Payment automatically.

If you are getting retirement or disability benefits on your own record:

- You will need to apply for the survivors benefits.

- We will check to see whether you can get a higher benefit as a widow or widower.

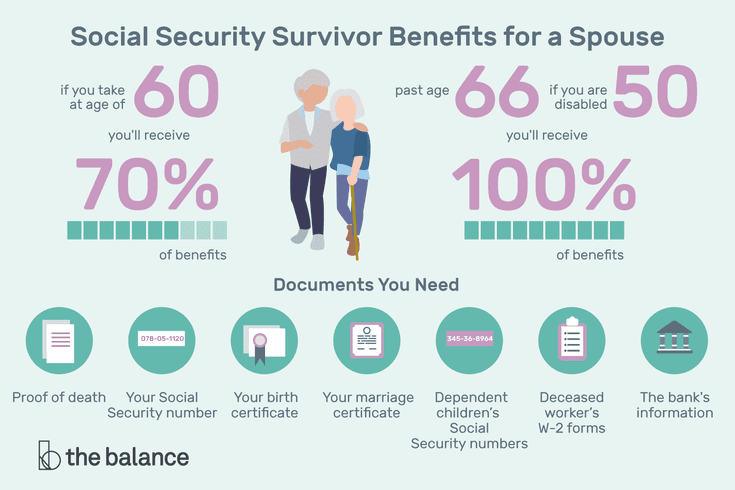

Documents You Need to Apply

Please select the benefit you will be applying for from the list below to see what information and documents you may need when you apply:

- Widows/Widowers or Surviving Divorced Spouse's Benefits.

- Child's Benefits.

- Mother's or Father's Benefits (You must have a child under age 16 or disabled in your care.)

- Lump-Sum Death Payment.

- Parent's Benefits (You must have been dependent on your child at the time of his or her death.)

If you don't have all the documents you need, don't delay applying for Social Security benefits.

In many cases, your local Social Security office can contact your state Bureau of Vital Statistics and verify your information online at no cost to you. If we can't verify your information online, we can still help you get the information you need.

Mailing Your Documents

If you mail any documents to us, you must include the Social Security number so that we can match them with the correct application. Do not write anything on the original documents. Please write the Social Security number on a separate sheet of paper and include it in the mailing envelope along with the documents.

Please write the Social Security number on a separate sheet of paper and include it in the mailing envelope along with the documents.

Related Information

- Survivors Publications

- What You Need to Know When You Get Retirement or Survivors Benefits

- Benefits for same-sex couples

- Amount of survivors benefit

- Schedule of Social Security Payments

- Your Payments While You Are Outside the United States

- Taxes and your benefits

- Estimate other potential benefits

- my Social Security

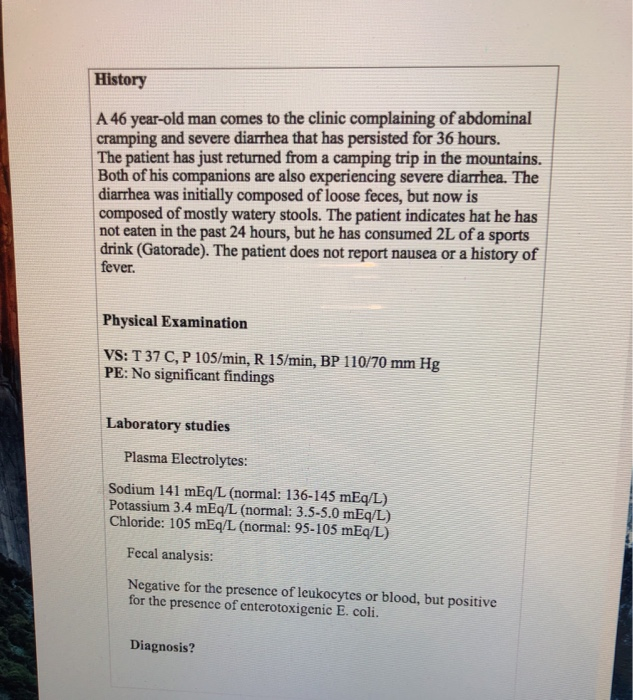

If You Are The Survivor

If You Are The Survivor

Just as you plan for your family's protection if you die, you should consider the Social Security benefits that may be available if you are the survivor — that is, the spouse, child, or parent of a worker who dies. That person must have worked long enough under Social Security to qualify for benefits.

That person must have worked long enough under Social Security to qualify for benefits.

How Your Spouse Earns Social Security Survivors Benefits

A worker can earn up to four credits each year. In 2022, for example, your spouse can earn one credit for each $1,510 of wages or self-employment income. When your spouse has earned $6,040 they have earned their four credits for the year.

The number of credits needed to provide benefits for survivors depends on the worker's age when they die. No one needs more than 40 credits (10 years of work) to be eligible for any Social Security benefit. But, the younger a person is, the fewer credits they must have for family members to receive survivors benefits.

Some survivors can get benefits if the worker has credit for one and one-half years of work (six credits) in the three years just before their death. Each person’s situation is different and you need to talk to one of our claims representatives about your choices.

When A Family Member Dies

We should be notified as soon as possible when a person dies. However, you cannot report a death or apply for survivors benefits online.

In most cases, the funeral home will report the person’s death to us. You should give the funeral home the deceased person’s Social Security number if you want them to make the report.

If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778). You can speak to one of our representatives between 8:00 am – 7:00 pm. Monday through Friday. You can also contact your local Social Security office.

Do we pay death benefits?

A one-time lump-sum death payment of $255 can be paid to the surviving spouse if they were living with the deceased. If living apart, they were receiving certain Social Security benefits on the deceased’s record.

If there is no surviving spouse, the payment is made to a child who is eligible for benefits on the deceased’s record in the month of death.

What happens if the deceased received monthly benefits?

If the deceased was receiving Social Security benefits, you must return the benefit received for the month of death and any later months.

For example, if the person died in July, you must return the benefits paid in August. How you return the benefits depends on how the deceased received benefits:

- For funds received by direct deposit, contact the bank or other financial institution. Request that any funds received for the month of death or later be returned to us.

- Benefits received by check must be returned to us as soon as possible. Do not cash any checks received for the month in which the person dies or later.

Who receives benefits?

Certain family members may be eligible to receive monthly benefits, including:

- A widow or widower age 60 or older (age 50 or older if they have a disability).

- A surviving divorced spouse, under certain circumstances.

- A widow or widower at any age who is caring for the deceased’s child who is under age 16 or has a disability and receiving child’s benefits.

- An unmarried child of the deceased who is one of the following:

- Younger than age 18 (or up to age 19 if they are a full-time student in an elementary or secondary school).

- Age 18 or older with a disability that began before age 22.

Are other family members eligible?

Under certain circumstances, the following family members may be eligible:

- A stepchild, grandchild, step grandchild, or adopted child.

- Parents, age 62 or older, who were dependent on the deceased for at least half of their support.

Eligible family members may be able to receive survivors benefits for the month that the beneficiary died.

Widow Or Widower

If you are the widow or widower of a person who worked long enough under Social Security, you can:

- Receive reduced benefits as early as age 60.

- Begin receiving benefits as early as age 50 if you have a disability and the disability started before or within 7 years of the worker's death.

- Receive survivors benefits at any age, if you have not remarried and you take care of the deceased worker's child who is under age 16 or has a disability and receives child’s benefits.

If you qualify for retirement benefits on your own record, you can switch to your own retirement benefit as early as age 62.

If a widow or widower who is caring for the worker's children receives Social Security benefits, they're still eligible if their disability starts before those payments end or within seven years after they end.

If you remarry after you reach age 60 (age 50 if you have a disability), your remarriage will not affect your eligibility for survivors benefits.

- A widow, widower, or surviving divorced spouse cannot apply online for survivors benefits. You should contact us at 1-800-772-1213 to request an appointment. If you are deaf or hard of hearing, call our TTY number at 1-800-325-0778.

- If you wish to apply for disability benefits as a survivor, you can speed up the disability application process if you complete an Adult Disability Report and have it available at the time of your appointment.

- We use the same definition of disability for widows and widowers as we do for workers.

A few other situations:

- If you already receive benefits as a spouse, your benefit will automatically convert to survivors benefits after we receive the report of death.

- If you are also eligible for retirement benefits, but haven't applied yet, you have an additional option. You can apply for retirement or survivors benefits now and switch to the other (higher) benefit later.

- For those already receiving retirement benefits, you can only apply for benefits as a widow or widower if the retirement benefit you receive is less than the benefits you would receive as a survivor.

If you became entitled to retirement benefits less than 12 months ago, you may be able to withdraw your retirement application and apply for survivors benefits only. If you do that, you can reapply for the retirement benefits later when they will be higher.

Surviving Divorced Spouse

If you are the divorced spouse of a worker who dies, you could get benefits the same as a widow or widower, provided that your marriage lasted 10 years or more.

Benefits paid to you as a surviving divorced spouse won't affect the benefit amount for other survivors getting benefits on the worker's record.

If you remarry after you reach age 60 (age 50 if you have a disability), the remarriage will not affect your eligibility for survivors benefits.

If you are caring for a child under age 16 or who has a disability and the child get benefits on the record of your former spouse, you would not have to meet the length-of-marriage rule. The child must be your former spouse's natural or legally adopted child.

If you qualify because you have the worker's child in your care, your benefit will affect the amount of the benefits of others on the worker's record.

Minor Or Child with a disability

If you are the unmarried child under age 18 of a worker who dies, you can be eligible to receive Social Security survivors benefits. You can also be eligible, if you are up to age 19 and attending elementary or secondary school full time.

And you can get benefits at any age if you have a qualifying disability that began before age 22 and remains the same.

Besides the worker's natural children, their stepchildren, grandchildren, step grandchildren, or adopted children may receive benefits under certain circumstances.

For Your Parents

If you are the dependent parent, who is at least age 62, of a worker who dies, you may be eligible to receive Social Security survivors benefits.

You must have been receiving at least half of your support from your working child. Also, you must not be eligible to receive a retirement benefit that is higher than the benefit we could pay on your child’s record. Generally, you must not have married after your deceased adult child’s death. However, there are some exceptions.

Besides being the natural parent, you could also be the stepparent, or the adoptive parent if you became the deceased worker’s parent before he or she was age 16.

Survivors Benefit Amount

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

These are examples of the benefits that survivors may receive:

- Widow or widower, full retirement age or older — 100% of the deceased worker's benefit amount.

- Widow or widower, age 60 — full retirement age — 71½ to 99% of the deceased worker's basic amount.

- Widow or widower with a disability aged 50 through 59 — 71½%.

- Widow or widower, any age, caring for a child under age 16 — 75%.

- A child under age 18 (age 19 if still in elementary or secondary school) or who has a disability — 75%.

- Dependent parent(s) of the deceased worker, age 62 or older receive:

- One surviving parent — 82½%.

- Two surviving parents — 75% to each parent.

Percentages for a surviving divorced spouse would be the same as above.

There may also be a special lump-sum death benefit.

Maximum Family Amount

There's a limit to the amount that family members can receive each month. The limit varies, but it is generally equal to between 150% and 180% of the basic benefit rate.

If the sum of the benefits payable to family members is greater than this limit, the benefits will be reduced proportionately. Any benefits paid to a surviving divorced spouse based on disability or age won't count toward this maximum amount.

Other Things You Need To Know

There are limits on how much survivors may earn while they receive benefits.

Benefits for a widow, widower, or surviving divorced spouse may be affected by several additional factors:

- If you remarry before age 60 (age 50 if you have a disability), you cannot receive benefits as a surviving spouse while you are married.

- If you remarry after age 60 (age 50 if you have a disability), you will continue to qualify for benefits on your deceased spouse's Social Security record.

- If you receive benefits as a widow, widower, or surviving divorced spouse, you can switch to your own retirement benefit as early as age 62. This assumes you are eligible for retirement benefits and your retirement rate is higher than your rate as a widow, widower, or surviving divorced spouse.

- In many cases, a widow or widower can begin receiving one benefit at a reduced rate and allow the other benefit amount to increase.

- If you will also receive a pension based on work not covered by Social Security, such as government or foreign work, your Social Security benefits as a survivor may be affected.

However, if your current spouse is a Social Security beneficiary, you may want to apply for spouse's benefits on their record. If that amount is more than your widow's or widower's benefit, you will receive a combination of benefits that equals the higher amount.

If that amount is more than your widow's or widower's benefit, you will receive a combination of benefits that equals the higher amount.

A Special Lump-Sum Death Payment

A surviving spouse or child may receive a special lump-sum death payment of $255 if they meet certain requirements.

Generally, the lump-sum is paid to the surviving spouse who was living in the same household as the worker when they died. If they were living apart, the surviving spouse can still receive the lump-sum if, during the month the worker died, they met one of the following:

- Were already receiving benefits on the worker's record.

- Became eligible for benefits upon the worker's death.

If there's no eligible surviving spouse, the lump-sum can be paid to the worker's child (or children) if, during the month the worker died, the child met one of the following:

- Was already receiving benefits on the worker's record.

- Became eligible for benefits upon the worker's death.

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death.

For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 (TTY 1-800-325-0778).

Benefits for orphans in Russia

Orphans are children under 18 whose both parents or only parent have died. Benefits are also provided to children left without parental care, as well as to people aged 18 to 23 years old if they lost their parents before they came of age - these are persons from among orphans and children left without parental care.

Education

Benefits in this area apply to orphans, children left without parental care, orphans and children left without parental care.

They are entitled to:

-

attendance at the public kindergarten free of charge;

-

study at the preparatory department of the university at the expense of the budget, but only if they study at the department for the first time;

-

admission to the university in the priority order and to the budget - according to the quota;

-

second secondary vocational education at the expense of the budget in full-time education;

-

payments during studies: a monthly state social stipend and an annual allowance for the purchase of educational literature and stationery.

The amount of payments is set by the regional authorities;

The amount of payments is set by the regional authorities; -

free travel on urban and suburban transport;

-

compensation for travel to the place of residence and back to the place of study if the educational institution is located in another locality;

-

maintaining full state support and social stipend during academic leave for medical reasons, pregnancy and childbirth or caring for a child under three years old;

-

receiving one-time financial assistance upon graduation from an educational institution.

Health

Also, such children can get vouchers to children's health camps and travel there and back. In addition, they are entitled to free trips to sanatoriums if there are medical indications.

Housing and housing and communal services

Children from the privileged category have the right to housing in which they can settle after they graduate from, for example, a boarding school. Housing is provided under a contract for the rental of specialized residential premises for five years. After that, the contract can be extended for another five years or re-registered for a social employment contract. Housing under a social lease agreement can eventually be privatized, rented out, exchanged or sold.

Housing is provided under a contract for the rental of specialized residential premises for five years. After that, the contract can be extended for another five years or re-registered for a social employment contract. Housing under a social lease agreement can eventually be privatized, rented out, exchanged or sold.

Benefits for paying for housing and utilities are provided at the regional level.

Employment benefits

First-time job seekers in this benefit category are entitled to benefits for six months. Important: to receive these payments, you need to register with the employment service. Payments will be in the amount of the average monthly salary in the region on the date of registration as unemployed.

If an organization where an orphan or a person left without parental care works is liquidated, the employer is obliged to pay for the necessary vocational training and employ him. The employer must do the same if a person from the privileged category is subject to reduction.

More payments

The following types of state assistance are provided for orphans:

monthly compensation payment for the maintenance of children to persons from among orphans and children left without parental care, studying full-time in state educational institutions of primary, secondary and higher vocational education, married to the same persons;

social pension for children under the age of 18 and over 18 years of age studying full-time in educational institutions, but not longer than until they reach the age of 23, both of whose parents are unknown or deceased, as well as to children of a deceased single mother and other categories of children. Orphaned children whose parents are known are also entitled to a fixed payment to the insurance pension in case of loss of a breadwinner;

monthly compensation payment to certain categories of children left without parental care - minor children who are not entitled to any type of pension provision and alimony.

Public services in the Republic of Tatarstan. / Services / Preschool education

| | Submission of an application for registration of a child in a kindergarten | |

| | Checking the current position in the queue - by application number; - by the number of the birth certificate or other document proving the identity of the child.  |