How does a child qualify for ssi

Apply For A Child (Under Age 18) | Disability Benefits

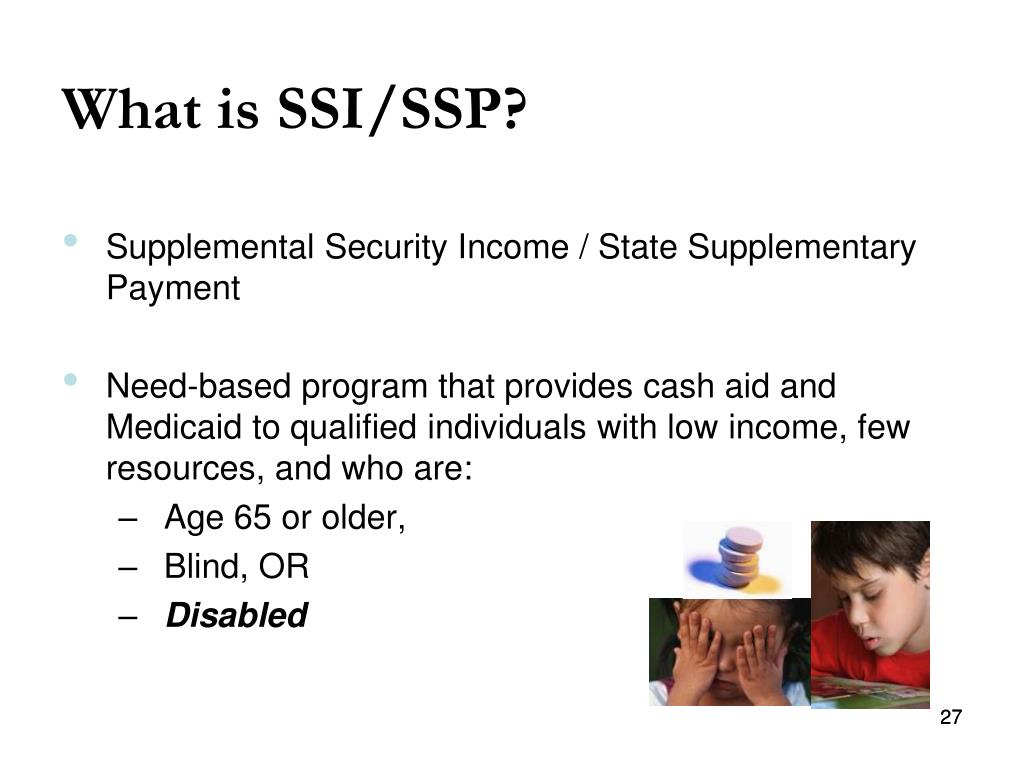

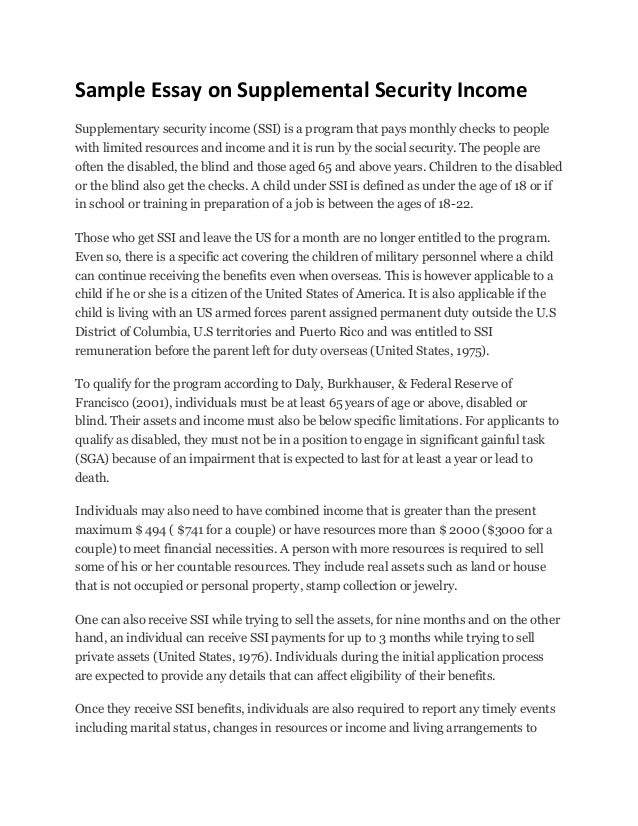

SSI provides monthly cash payments to help meet the basic needs of children who have a physical or mental disability or who are blind. If you care for a child or teenager with a disability, and have limited income and savings or other resources, your child may be eligible for SSI.

SSI Eligibility for Children

Children under age 18 can get SSI if they meet Social Security's definition of disability for children and there are limited income and resources in the household. Social Security defines a disability as:

- The child must have a physical or mental condition(s) that very seriously limits his or her activities; and

- The condition(s) must have lasted, or be expected to last, at least 1 year or result in death.

How to Apply

Tell us you want to apply for SSI for a child

Get Started

Other Ways to Apply

Apply By Phone1

Call us to make an appointment to file an application at 1-800-772-1213. If you are deaf or hard of hearing, you can call us at TTY 1-800-325-0778.

1 If you are in the Commonwealth of Pennsylvania and received a letter from the Pennsylvania Department of Human Services with a specific phone number, please use that number for the best service.

Begin the Application Online

Applying for SSI requires 2 steps. You will need to complete the online Child Disability Report AND, with the help of a Social Security representative, complete an Application for SSI.

Step 1

TIP: Before completing the Child Disability Report, use our Child Disability Starter Kit to get answers to commonly asked questions about applying for SSI. The kit also includes a worksheet that will help you gather the information you need.

Fill out the online Child Disability Report

The report usually takes about an hour to complete and collects information about the child's disabling condition and how it affects their ability to function.

We will ask you to sign a form that gives the child's doctor(s) permission to give us information about their disability. We need this information so that we can make a decision on the child's claim. In some cases, if the child is over age 12, he or she must sign his or her own medical release.

Start the Child Disability Report

If you previously started a Child Disability Report for this child but did not finish it, you can use your re-entry number to return to your online Child Disability Report.

Step 2

After you submit a report, we will call you within 3-5 business days. Together, we will:

- Review the completed Child Disability Report.

- Discuss whether the income and resources of the household are within the allowed limits.

- Start the SSI application process.

Related Questions

How can I get ready for the disability interview?

- Review the disability starter kit.

It includes a checklist and a worksheet to help you gather the information you need. Have this information with you at the time of the interview.

It includes a checklist and a worksheet to help you gather the information you need. Have this information with you at the time of the interview. - You can fill out a Child Disability Report.

- For more information visit Benefits for People with Disabilities or call toll-free 1-800-772-1213 (for the deaf or hard of hearing, call TTY 1-800-325-0778).

How will I know what Social Security has decided?

We will send you a letter. It can take 3 to 5 months for us to make a decision on a child’s SSI disability claim. We may also contact you by phone to ask additional questions. Let us know if your address or telephone number changes so that we can get in touch with you.

What if I am more comfortable speaking in a language other than English?

We provide free interpreter services to help you conduct your Social Security business, including helping you complete the SSI application and answering your questions. NOTE: the Child Disability Report is only available in English.

NOTE: the Child Disability Report is only available in English.

Call our toll-free number, 1-800-772-1213. If you need service in Spanish, press 7 and wait for a Spanish-speaking representative to help you. For all other languages, stay on the line and remain silent during our English voice automation prompts until a representative answers. The representative will contact an interpreter to help with your call. You may access the information on this page in Spanish.

Child Disability Starter Kit Fact Sheet

Child Disability Starter Kit - Fact Sheet

What You Should Know Before You Apply for SSI Disability Benefits for a Child

Children from birth up to age 18 may get Supplemental Security

Income (SSI) benefits. They must be disabled and they must have

little or no income and resources. Here are answers to some questions

people ask about applying for SSI for children.

How does Social Security decide if a child is disabled?

Social Security has a strict definition of disability for children.

- The child must have a physical or mental condition(s) that very seriously limits his or her activities; and

- The condition(s) must have lasted, or be expected to last, at least 1 year or result in death.

A state agency makes the disability decision. They review the information you give us. They will also ask for information from medical and school sources and other people who know about the child.

If the state agency needs more information, they will arrange an examination or test for the child, which we will pay for.

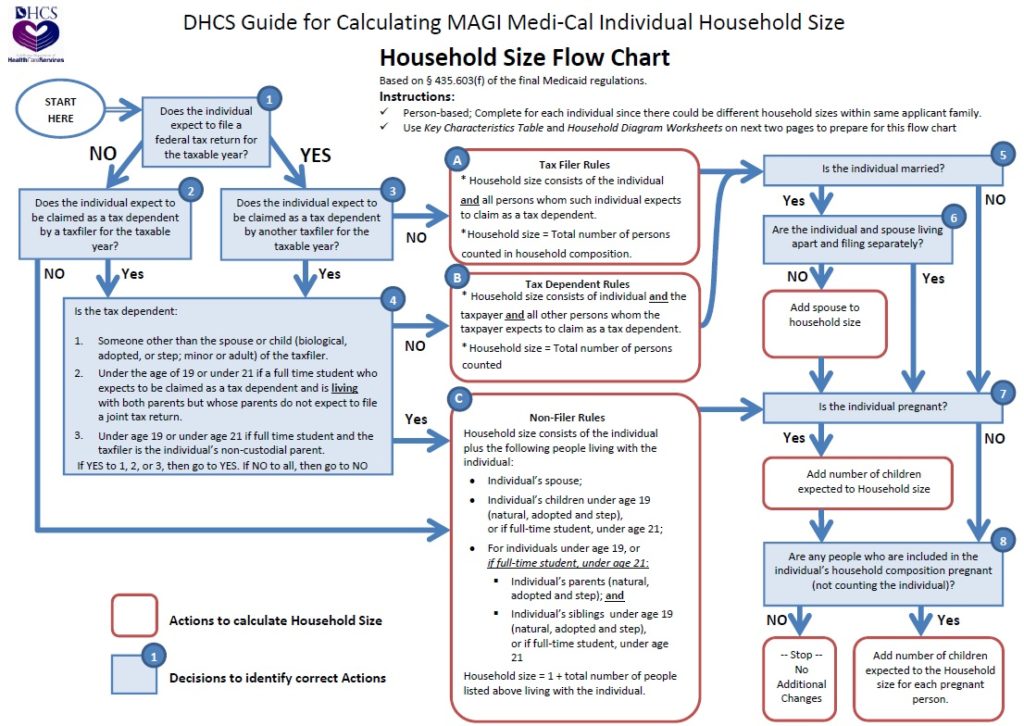

How does Social Security decide if a child can get SSI?

Children can get SSI if they meet Social Security’s definition

of disability for children and if they have little or no income

and resources. We also consider the family’s household

income, resources and other personal information.

We also consider the family’s household

income, resources and other personal information.

How will I know what Social Security has decided?

We will send you a letter. It can take 3 to 5 months to decide a child’s SSI disability claim. Let us know if your address or telephone number changes so that we can get in touch with you.

Will my personal information be kept safe?

Yes. Social Security protects the privacy of those we serve. As a federal agency, we are required by the Privacy Act of 1974 (5 U.S.C. 522a) to protect the information we get from you.

What if I am more comfortable speaking in a language other than English?

We provide free interpreter services to help you conduct your

Social Security business.

Other Important Information

SSI is not a medical assistance program. Your state Medicaid agency, local health department, social services office or hospital can help you find your nearest health care agencies. Your Social Security office can also help you find health care agencies.

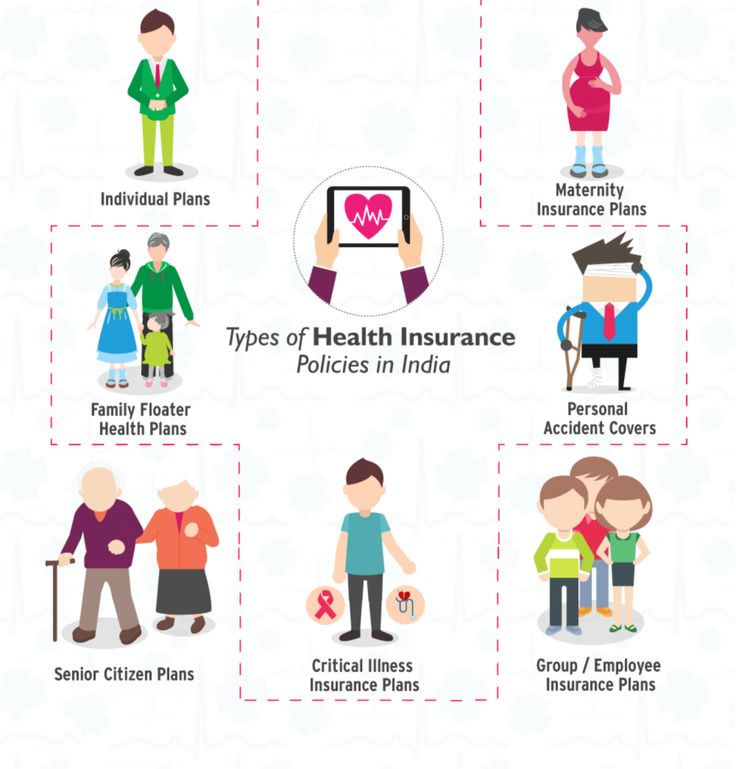

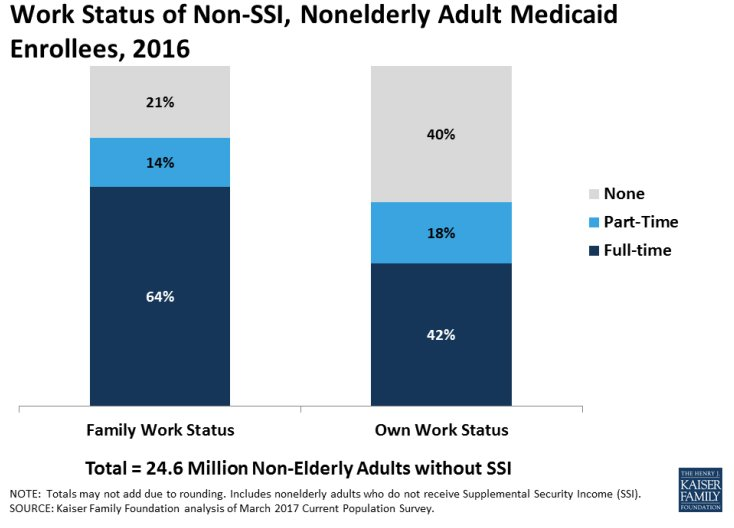

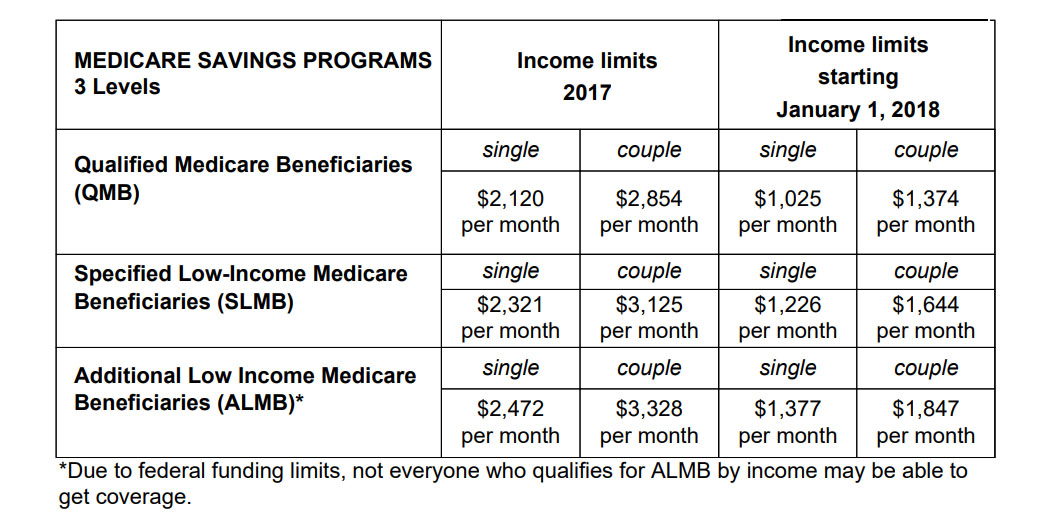

Medicaid

Medicaid is a health care program for people with low incomes and limited resources. In most states, children who get SSI benefits can also get Medicaid. Even if your child cannot get SSI, he or she may be able to get Medicaid. Your state Medicaid agency, Social Security office or your state or county social services office can give you more information.

State Children's Health Insurance Program (SCHIP)

Children may be able to get health insurance from SCHIP even if

they do not get SSI. SCHIP provides

health insurance to children from working families with incomes

too high to get Medicaid, but who cannot afford private health

insurance. SCHIP provides insurance for prescription drugs and

for vision, hearing and mental health services in all 50 states

and the District of Columbia. Your state Medicaid agency can provide

more information about SCHIP. You can also go to www.insurekidsnow.gov/ or call toll free 1-877-KIDS-NOW (1-877-543-7669) for more information

on your state’s program.

SCHIP provides

health insurance to children from working families with incomes

too high to get Medicaid, but who cannot afford private health

insurance. SCHIP provides insurance for prescription drugs and

for vision, hearing and mental health services in all 50 states

and the District of Columbia. Your state Medicaid agency can provide

more information about SCHIP. You can also go to www.insurekidsnow.gov/ or call toll free 1-877-KIDS-NOW (1-877-543-7669) for more information

on your state’s program.

Other Health Care Services

If the child is under age 16 and we decide he or she is disabled

and can get SSI, we will refer him or her to your state children’s

agencies for social, developmental, educational and medical services.

Even if the child cannot get SSI, these state agencies may be able

to help him or her.

Work Opportunities for Young People Who are Getting SSI

Many young people who get SSI disability benefits want to work. The following information may be helpful.

- We do not count most of a child’s earnings when we figure the SSI payment. We count even less of a child’s earnings if the child is a student.

- We subtract the cost of certain items and services that a child needs to work from his or her earnings in figuring the SSI payment.

- If a child is age 15 or older, he or she can establish a Plan to Achieve Self-Support (PASS). With a PASS, a child can set aside income for a work goal. We will not count this income when we figure the SSI payment.

- A child’s Medicaid coverage can continue even

if his or her earnings are high enough to stop SSI payment,

as long as the earnings are under a certain amount.

Social Security has two programs that can assist young people who get SSI disability benefits and want to go to work:

- Work Incentives Planning and Assistance (WIPA)

- Protection and Advocacy for Beneficiaries of Social Security (PABSS) program

Your local Social Security office can provide more information

about these programs. You can also find more information on our

Work website, www.socialsecurity.gov/work/.

Benefit Development Tool: SSA

Benefit Development Resource Kit

Review

The following section provides links to various web pages for help. Please note that web page addresses change frequently, and although the addresses were accurate at the time of this manual's release, if you are unable to access any of the web pages via the links, please refer to the main Social Security website www . socialsecurity.gov and navigate to the information you need.

socialsecurity.gov and navigate to the information you need.

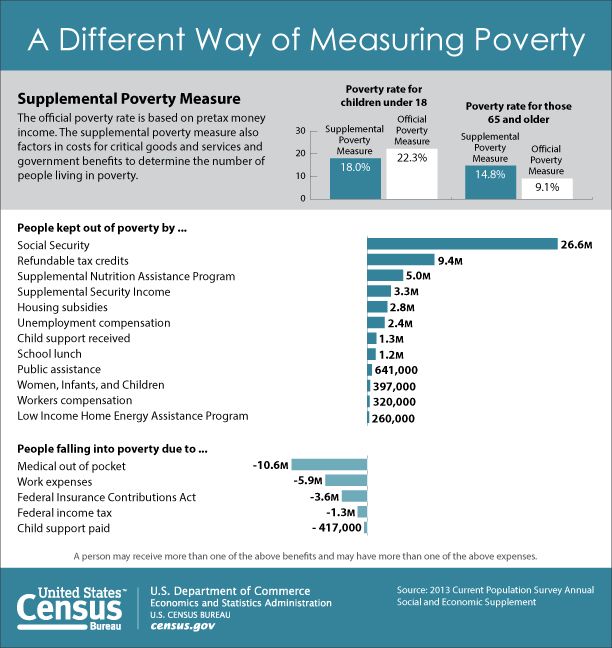

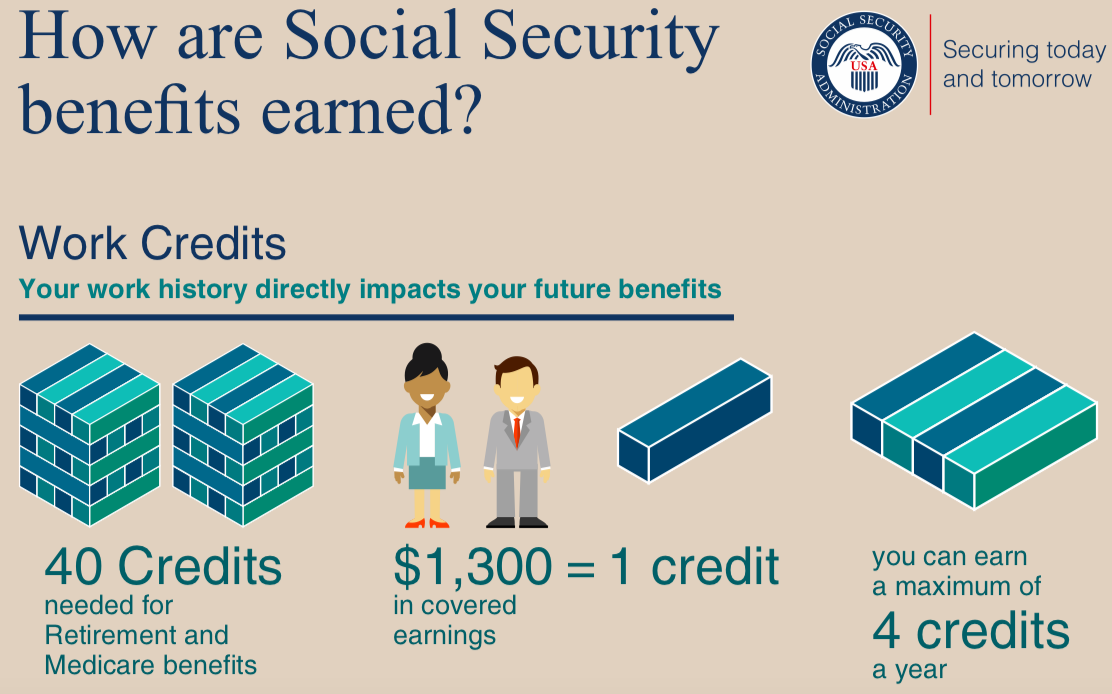

Definition

Social security benefits are payments made to covered individuals based on contributions made by an employee to a social security trust fund. The Federal Insurance Contributions Act (FICA) requires that Social Security contributions be deducted from an employee's wages. The Social Security Administration (SSA) is responsible for administering Social Security benefits.

Difference between SSI and Social Security

Supplemental Security Income (SSI) is different from Social Security benefits discussed below. Unlike SSI, Social Security benefits are not based on need. Social Security benefits are payments based on employee contributions; therefore, there are no factors that determine eligibility for income or resources for Social Security benefits. The amount paid to the recipient depends on the earnings of the individual worker. Information about SSI can be found elsewhere in the manual.

Types of social security benefits

Types of social security benefits that an employee or some members of his family may receive are as follows:

- Social Security Disability Insurance (SSDI)

- Social Security Retirement

- Social security for breadwinners

Applying for Social Security benefits

A person must apply for Social Security benefits as soon as they are determined to be eligible (for information on eligibility for Social Security benefits, see . in the SSA Benefit Eligibility Chart). There is no waiting period to apply for benefits; however, there is a five-month waiting period for a disabled worker to begin receiving Social Security Disability Insurance (SSDI) benefits. SSDI benefits are sometimes referred to as SSDs or SSAs.

Eligibility for Social Security benefits

A person may be eligible for Social Security benefits based on their own work record or on the basis of a spouse or parent's work record. The amount of benefits depends on the employee's contributions, and there is a maximum amount of benefits paid on the employee's work record.

The amount of benefits depends on the employee's contributions, and there is a maximum amount of benefits paid on the employee's work record.

Note: Adult children with disabilities may be eligible for Social Security benefits based on the parent's employment history; therefore, it is important to determine whether a person's parents are working, retired, disabled, or deceased, and to apply for benefits as soon as possible after the parents stop working.

social security benefits

Social Security retirement benefits

After retirement, a person may qualify for Social Security retirement benefits. They can choose to reach full retirement age and receive full Social Security retirement benefits or retire at age 62 and receive reduced benefits. The full retirement age is gradually increasing to 67 years. Deferring the application until full retirement age, based on the applicant's year of birth, allows him or her to receive full benefits. Information about Social Security benefit levels and retirement ages can be found on the SSA website https://www.ssa.gov/benefits/retirement/ .

Information about Social Security benefit levels and retirement ages can be found on the SSA website https://www.ssa.gov/benefits/retirement/ .

An insured worker's pension payment depends on his lifetime earnings. An employee's actual earnings are indexed to reflect changes in the average wage over the insured's years of employment.

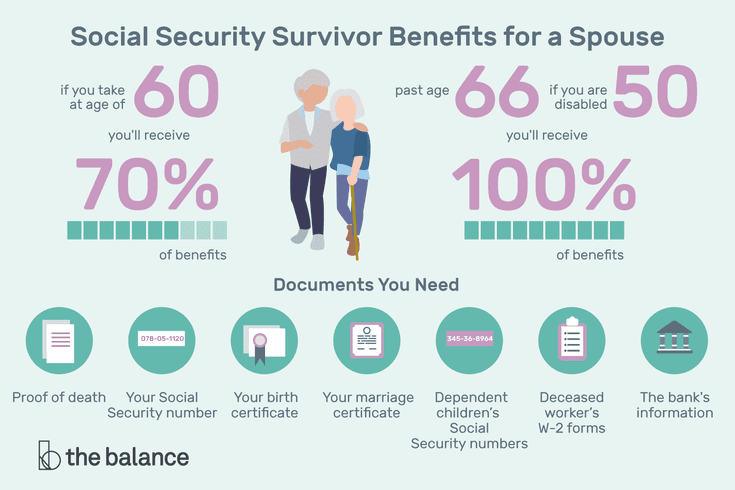

Survivors Social Security

Social Security Survivors are available to certain family members of a deceased worker who earned enough credits while working to be insured.

Social security survivor benefits can be paid:

- Widow or widower - full pension coverage at full retirement age, or benefits already at age 60

- Widow or disabled widower - from 50 years old

- Widow or widower of any age if caring for a child of the deceased who is under 16 years of age or disabled and receiving Social Security benefits

- Unmarried children under 18 or under 19years if they are a full-time secondary school student (under certain circumstances, benefits may be paid to stepchildren, grandchildren or adopted children)

- Children of any age who became disabled before the age of 22 and remain disabled

- Dependent parents aged 62 or over

For more information about survivor benefits, please visit: https://www. ssa.gov/benefits/survivors/

ssa.gov/benefits/survivors/

Disability Social Security

OPWDD people are most likely to receive Social Security Disability Insurance (SSDI) payments. This program provides income benefits to disabled or blind people who meet all of the following criteria: 90,003 90,026 90,027 people who have worked and paid Social Security taxes long enough to be insured with Social Security (number of credits needed to receive disability benefits, depends on the person's age at the time of disability)

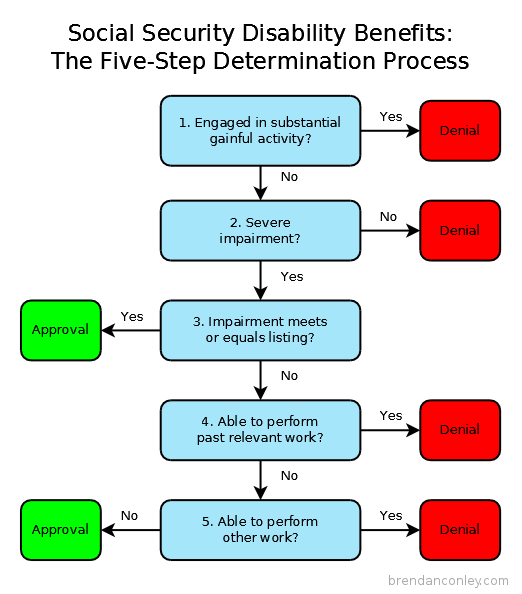

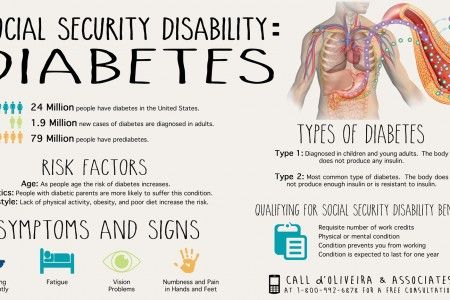

Definition of Disability

A person is considered disabled if they are unable to perform the job they were doing prior to becoming disabled or blind, and cannot adjust to other work due to their health condition. The SSA defines disability as the inability to engage in any significant paid activity due to a medically defined physical or mental disorder that either:

The SSA defines disability as the inability to engage in any significant paid activity due to a medically defined physical or mental disorder that either:

- lasts or is expected to last at least one year; or

- Expected to cause death

Significant Beneficial Activity

The SSA evaluates the employment history of a person claiming disability benefits under SSDI. SSA uses earnings guidelines to determine whether an individual's work activity is considered a Substantial Gainful Activity (SGA) and whether the individual has a disability.

SGA is the performance of significant and productive physical or mental work for pay or profit. The dollar amount is referred to as the SGA level. Individuals whose monthly earnings, on average, exceed the SGA level are considered to be in a substantial gainful occupation unless there is evidence to the contrary. A person whose average monthly earnings are below the SGA level is considered to be unemployed in the SGA. The SGA level is higher for blind people. Current SGA levels can be found at: https://www.ssa.gov/OACT/COLA/sga.html.

The SGA level is higher for blind people. Current SGA levels can be found at: https://www.ssa.gov/OACT/COLA/sga.html.

Child welfare benefits

Minor children may qualify for parent's workbook benefits when the parent retires, becomes disabled, or dies. An eligible child may be a biological, adopted, or stepchild. A dependent grandchild may also be eligible for benefits.

To receive the allowance, the child must:

- Not married

- Be under 18 years of age

- Be aged 18-19 and a full-time student (not higher than grade 12)

- Age 18 or older and with a disability before age 22 (see below for information on Social Security benefits for an adult child with a disability)

If a child works while receiving benefits, they are subject to the same earnings restrictions as an employee. The child's earnings only affect his own benefits. They do not affect benefits for the worker or other beneficiaries assigned to the worker. If a worker works while receiving benefits, their earnings may affect the benefits of all beneficiaries receiving benefits on the worker's track record.

If a worker works while receiving benefits, their earnings may affect the benefits of all beneficiaries receiving benefits on the worker's track record.

Minor child benefits are "derivative" benefits based on the parent's years of service. Although the child may be disabled, benefits paid to children who have not reached the age limits listed above are not disability benefits. Generally, benefits will end when the child turns 18, however, if the child is still in full-time secondary (or elementary) school at age 18, payments will continue until graduation or two months after the child turns 19.years, whichever comes first. If the child is disabled and is 18 years of age or older (or 19 if still in primary or secondary school), a disability determination is required to receive the adult disabled child benefit.

Social Security benefits for an adult child with a disability

An unmarried child 18 years of age or older with a disability that began before age 22 may be eligible for Social Security benefits based on the parent's seniority when the parent begins receiving SSDI or retirement benefits or dies. These are Disabled Adult Child (DAC) benefits. If a person is already receiving Social Security benefits when they turn 18, an SSA statement of disability is required to receive benefits as a DAC.

These are Disabled Adult Child (DAC) benefits. If a person is already receiving Social Security benefits when they turn 18, an SSA statement of disability is required to receive benefits as a DAC.

Marriage of a DAC recipient to a non-recipient of Social Security disability benefits results in termination of DAC payments. If a DAC beneficiary marries a person who is receiving Social Security disability benefits at the time of the marriage, that person's DAC payments do not stop because of the marriage.

A person who loses DAC upon marriage may be eligible for DAC again if the marriage is annulled or void. An annulled or void marriage is legally non-existent under state law, with or without a court order. The parties to an invalid or annulled marriage are considered to have never been husband and wife. A person who loses DAC upon marriage will not be eligible for DAC again if the marriage ends due to death or divorce.

An individual's DAC is independent of any SSDI or DAC benefits received by their spouse. Therefore, Social Security benefits paid to a DAC recipient do not end if/when their spouse's SSDI or DAC payments end.

Therefore, Social Security benefits paid to a DAC recipient do not end if/when their spouse's SSDI or DAC payments end.

DAC payments end when Social Security determines that the person is no longer disabled.

Questions about whether a person is eligible for continued DAC payments or re-eligibility should be directed to the local welfare office.

For more information about Social Security Disability, visit: https://www.ssa.gov/benefits/disability/

How to apply for Social Security benefits

There are four ways to apply for Social Security benefits:

1. Online at www.ssa.gov or www.socialsecurity.gov

2. Call 1-800-772-1213

3. Mail (Specific local office can be found by zip code at www.ssa.gov or www.socialsecurity.gov.

4. In person (Specific local office can be found by zip code at www.ssa.gov or www.socialsecurity.gov

About the Interview Process

If you are not applying online, you must schedule a disability interview by calling the SSA toll-free number (1-800) to begin the application process. - 772-1213) to make an appointment DAC cannot be applied for online.0003

- 772-1213) to make an appointment DAC cannot be applied for online.0003

The disability interview lasts about one hour. When an interview is scheduled, SSA will mail a disability starter kit to the applicant. The Disability Starter Kit will help the applicant prepare for the interview. The Disability Starter Kit is also available online at www.ssa.gov or www.socialsecurity.gov.

To prepare for your interview, complete the Disability Report, Medical and Work Worksheet, and the Disability Checklist included in the kit in advance. Copies of these forms can be found on the Social Security website.

Required information about the applicant

Regardless of the type of Social Security benefit, the applicant must be prepared to provide the following information about themselves:

- Name, gender, social security number

- Date and place of birth

- Relationship with the employee whose work book is claimed by the applicant

- Birth or Baptism Certificate

- Marital status

- Citizenship status

- Does the applicant have a legal guardian

- whether they earned social security loans under the social security system of another country

- Have they had an income in all years since 1978

- Brief description of the places where they worked and the type of work performed

- Name(s) of employer(s) or information on self-employment and earnings for the current and previous year

- Copy of latest Form W-2 (Payroll and Tax Record) or, if self-employed, their most recent federal tax return

- Have they received or expect to receive any money from their employer since they became disabled

- Have they ever worked in the railway industry

- Active military service dates prior to 1968 and any benefits they were ever entitled to from a military or civilian agency

- Are they eligible or expected to receive a pension or annuity based on their employment with the US federal government or one of its states or local subdivisions

- Has the applicant ever been convicted of a serious crime

- Does the applicant, age 13 or older, have pending criminal arrest warrants or pending federal or state arrest warrants for parole or probation violations

In addition, in order to receive disability benefits, the applicant must provide the following:

- Names, addresses and telephone numbers of doctors, employment workers, hospitals and clinics who provided treatment and dates of visits

- Name(s) and strength(s) of all medicines they take

- Date they became disabled due to illness, injury or health condition

- Are they still unable to work

- Medical records already in their possession from doctors, physicians, hospitals, clinics and welfare workers

- Laboratory and test results

- Have they filed or are going to apply for labor compensation or any government disability benefits

- For disability benefits for adult children who became disabled before the age of 22, forms SSA-3368 and SSA-827 describing health conditions and authorizing disclosure.

- SSA information (See Disability Report - Adult (SSA-3368) and Social Security Administration (SSA) Disclosure Authorization (SSA-827).

In addition to demographic and medical information, where applicable, an applicant for Social Security benefits must be prepared to provide information about their parents and/or spouse (current and any former), as well as their work history or work history, for which the applicant is applying. The following are examples of information the SSA may request:

Parent information

- Parent names, dates of birth and social security numbers

- Does the applicant have parents who were half dependent on the worker at the time of the disability (if applicable).

- If the applicant is the stepson of the worker, the date on which the worker and the applicant's parents got married.

- Whether the worker is the natural or adoptive parent of the applicant

- Date of adoption if adopted by an employee

- Whether the applicant was adopted by someone other than an employee

Spouse information

- Spouse's name, date of birth (or age), and social security number (if known) of current and all former spouses

- Dates and places of all marriages, and for marriages that ended, how and when they ended

- Has the applicant's spouse ever worked in the railway industry

Information about the applicant's children

- Names of any unmarried children under the age of 18, aged 18-19 and in high school, or disabled under 22

- Did the applicant have or lived with a child under the age of three during the calendar year when he was unemployed

Information about the deceased employee:

- Date and place of death of the employee

- State or foreign country of permanent residence of employee at death

- Was the employee unable to work due to illness, injury or condition at any time during the 14 months prior to his or her death (if Yes,

- SSA will also ask for the date they became disabled)

- Whether the employee was on active duty prior to 1968 or ever worked in the railroad industry (if yes, SSA will ask for dates of service and if the employee has ever received a military, federal, or civilian pension).

- Whether the worker received social security loans under the social security system of another country

- Whether the employee was employed or self-employed in all years from 1978 to the latest year

- How much the employee earned in the year of death and the year before death

- Has the employee ever applied for Social Security, Medicare, or Supplemental Security Income (if yes, SSA will also ask whose Social Security record they applied for)

- Whether the applicant lived with the employee at the time of death

SSA accepts photocopies of W-2 forms, self-employment tax returns, or medical records, but for most other documents, such as a birth certificate, the original must be shown (SSA will return the original documents to the applicant).

When SSA makes a decision on an application, it sends a letter to the beneficiary stating whether the application was approved or denied. If the application is approved, SSA will provide an application number, which is the employee's social security number with one of the following suffixes:

A = Self

B = Spouse

C = Child (includes DAC)

D = Widow/Widower

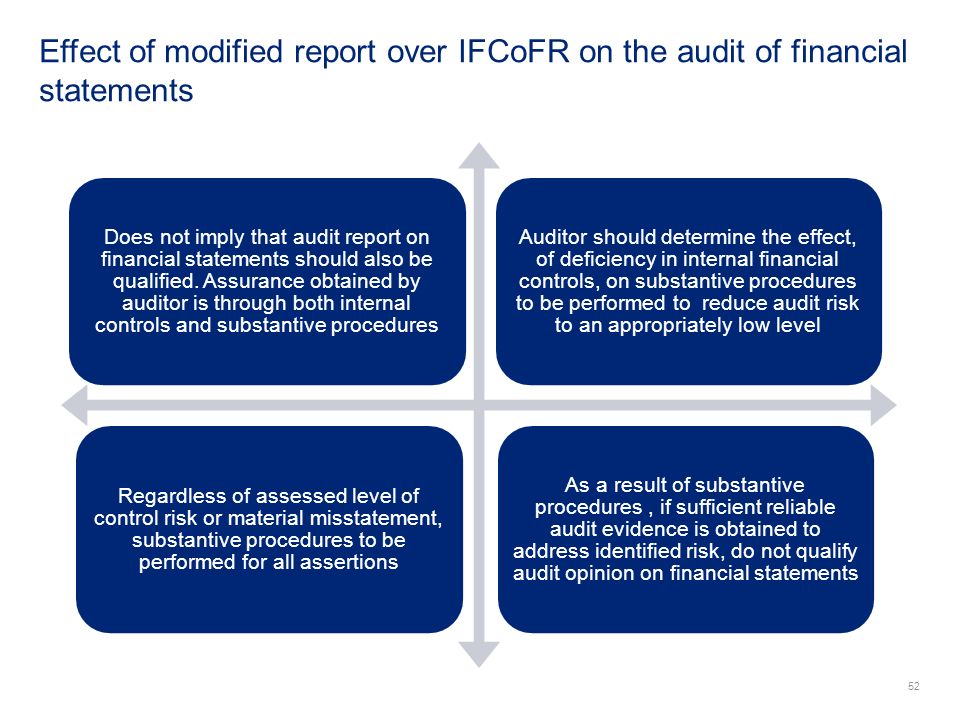

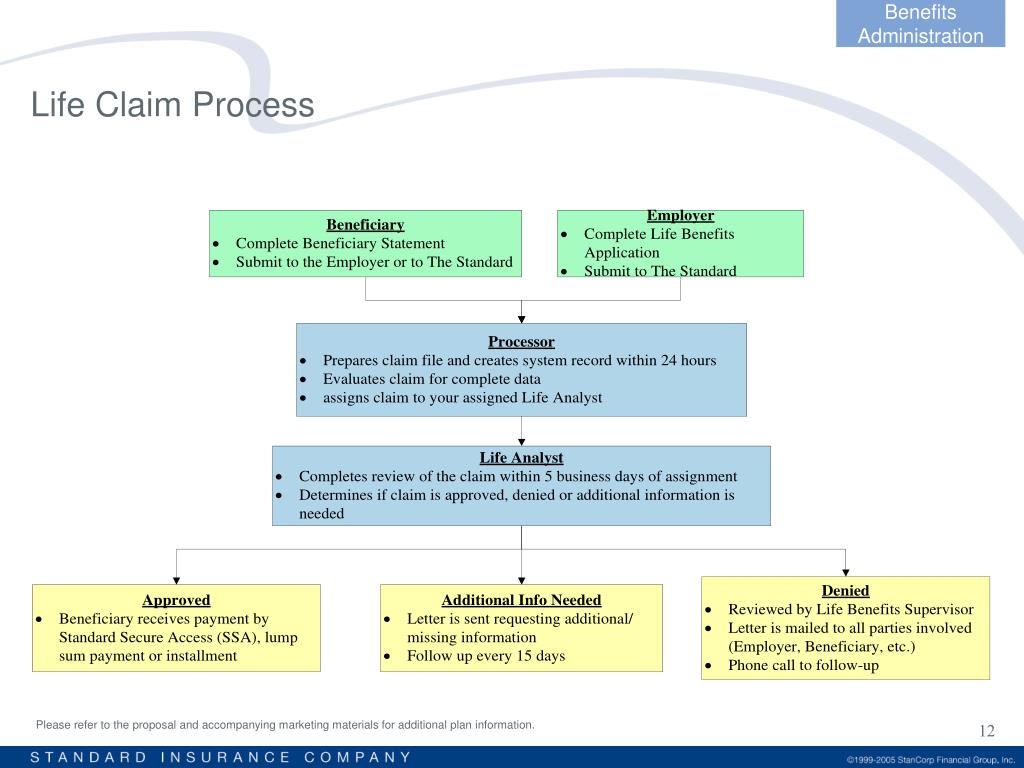

Benefit Determination Process

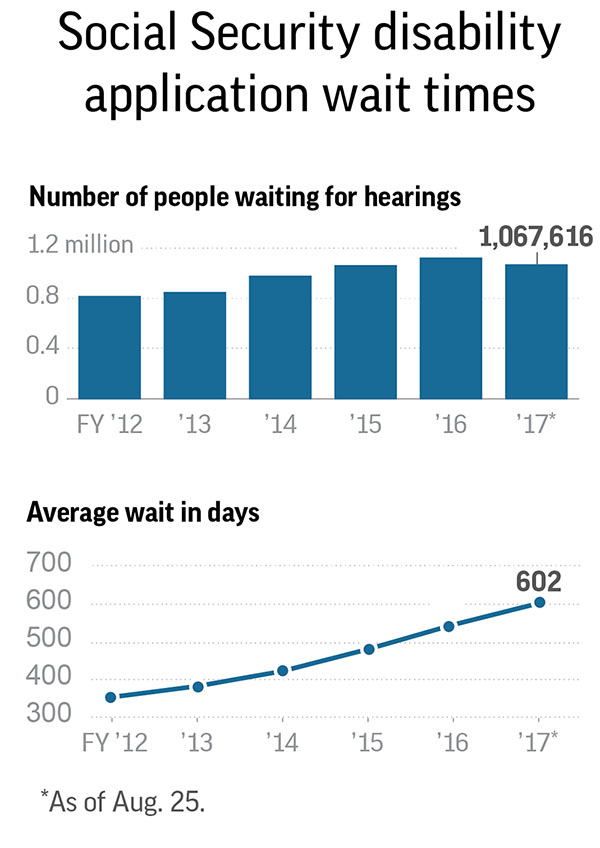

It can take three to five months for a disability claim to be processed. Once a decision has been made on the case, the SSA will send a letter to the applicant. If the application is approved, the letter will tell you the amount of the benefit and when the payment will start. If the application is not approved, the letter explains the reason for the denial and how the decision can be appealed if the applicant does not agree with it.

Once a decision has been made on the case, the SSA will send a letter to the applicant. If the application is approved, the letter will tell you the amount of the benefit and when the payment will start. If the application is not approved, the letter explains the reason for the denial and how the decision can be appealed if the applicant does not agree with it.

When benefits are paid

Social Security benefits are paid either to the person or their representative by check or direct deposit. SSA strongly recommends using Direct Deposit.

The day of the month when a person receives a benefit check depends on the date of birth of the person (employee) on whose employment record the benefit is paid. The following table details which day of each month a check or direct deposit will be received:

| Employee's date of birth: | Monthly payment date |

|---|---|

| 1st to 10th | Wednesday 2nd |

| 11th to 20th day | 3rd Wednesday |

| 21st to 31st | Wednesday 4th |

Social Security benefits through May 1997; or if you receive both Social Security and SSI, Social Security is paid on the third of the month.

Restrictions on Replacing Social Security Cards

A person can replace their Social Security card if it is lost or stolen. There is a limit to the issuance of three replacement cards in one year and a total of ten cards in a lifetime. Lawful name changes and immigration status changes that require a card update may not be counted against these restrictions. Limits may also not apply if the person can prove that the card is necessary to prevent significant hardship. See https://faq.ssa.gov/en-US/Topic/article/KA-02017 for more information.

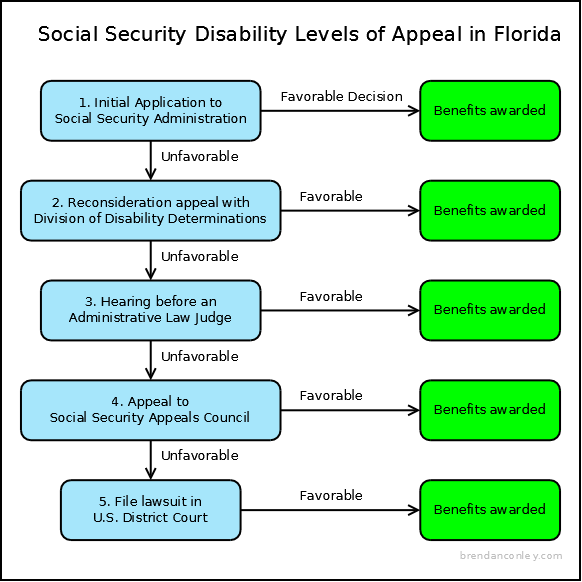

Appealing an Adverse Decision

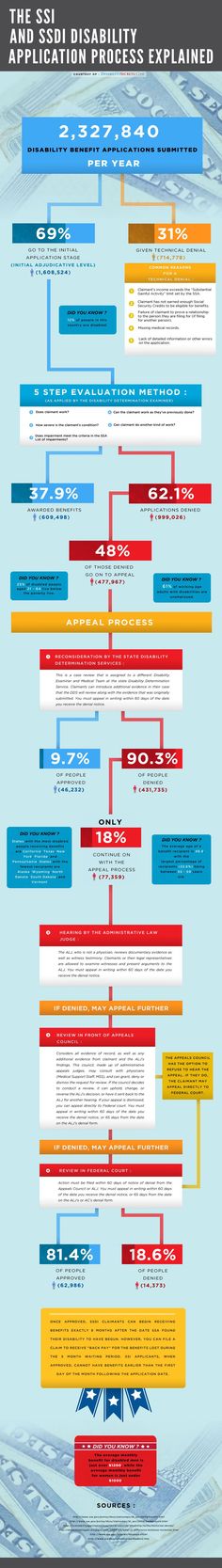

If a person disagrees with Social Security's or SSI's initial determination or decision, they can file an appeal. An appeal consists of several levels of administrative review, as listed below.

Levels of Administrative Review

Reconsideration

Complete review of the application by SSA staff who were not involved in the first decision. You can request a retrial or an informal or formal conference. In a case review, the SSA reviews the case without meeting the person. In informal and formal conferences, a person and his representative may participate and represent witnesses. The formal conference also gives the person the opportunity to ask questions of the witnesses and gives the SSA the opportunity to request the appearance of the witnesses.

Note: SSA does not currently use the reconsideration step for a New York State disability determination, but a reconsideration may be requested in other adverse eligibility issues. Disability appeals can be filed online at: https://secure.ssa.gov/iApplsRe/start .

Administrative Judge Hearing

If the applicant does not agree with the original decision or the decision to reconsider (if applicable), a hearing may be requested. The hearing will be conducted by an administrative law judge who was not involved in the original decision or retrial.

Board of Appeals Hearing

If the applicant does not agree with the decision of the hearing, the applicant may request a review by the Social Security Board of Appeals. The Appeals Board reviews all requests for review, but it may deny the request if it believes the decision of the hearing was correct. If the Board of Appeal decides to reconsider the case, it will either decide the case itself or return it to the ALJ for further review.

Federal Court Review

If a person disagrees with the Board of Appeals' decision, or if the Board of Appeals decides not to review the case, they can file a lawsuit in federal district court. The letter SSA sends to the person about the Board of Appeal's decision will also tell you how to ask the court to hear the case.

Time limits for filing an appeal

The person has 60 days from the date of the Social Security or SSI decision letter to file an appeal. If the last day of the 60-day deadline falls on a Saturday, Sunday, or national holiday, the last day of the deadline is the next business day. SSA will assume that the person received the decision letter within five days.

If the last day of the 60-day deadline falls on a Saturday, Sunday, or national holiday, the last day of the deadline is the next business day. SSA will assume that the person received the decision letter within five days.

days after the date in the letter, unless the person proves that they received it later.

Appeal Format

The request for an appeal must be in writing, either using the SSA form (available from SSA upon request) or by sending a signed letter to SSA stating that the person wishes to appeal the decision, and with his social security number. If a person does not file an appeal within 60 days, they may lose their right to do so. In this case, the final decision of the SSA is final. If a person has a good reason for not filing an appeal by the deadline, they may request additional time. The person must ask SSA for more time in writing and state the reason for the delay.

Request to continue payments on appeal

A person may ask SSA to continue receiving benefits while SSA decides on the appeal if the person is appealing a decision that they can no longer receive Social Security disability benefits, because his medical condition is not a disability. In order for payments to continue, the request must be made within ten days of receiving a letter from SSA informing the person of the decision. If a person's appeal is denied, they may have to return money they were not entitled to receive.

In order for payments to continue, the request must be made within ten days of receiving a letter from SSA informing the person of the decision. If a person's appeal is denied, they may have to return money they were not entitled to receive.

Reimbursement Process for a Denied Appeal to an Administrative Judge

If the appeal is denied, the person and their payment representative (if applicable) will receive a notice of the Administrative Judge's decision. If SSA benefits are required, a person can pay them in a lump sum or arrange with SSA to pay benefits in installments (at least $10 per week) over 12 months. If repayment within 12 months is not possible, repayment can be spread over 36 months. Alternatively, if a person receives other benefits from SSA, they may choose to have their benefits reduced by the repayment obligation until the funds are repaid.

Representative Payment Program

Information about the duties of a beneficiary representative can be found on the Social Security website: www. ssa.gov or www.socialsecurity.gov.

ssa.gov or www.socialsecurity.gov.

Individuals moving to or living in OPWDD certified facilities may need a trustee. The agency at the place of residence must determine whether a person needs a proxy. This assessment must be completed within 10 days of admission, when moving, if there is a change in circumstances or ability to manage funds, or if the individual or someone else requests a review on their behalf. If the agency determines that a person needs a benefits representative and did not have one before, the healthcare professional must conduct an assessment and submit their findings to SSA. For more information about the responsibility of OPWDD residential care providers to help an individual manage benefits, see the OPWDD Personal Benefits Guide at: https://opwdd.ny.gov/opwdd_resources/benefits_information/personal_allowance/msc_personal_allowance_manual%20#residentialproviders .

Learn more about Social Security benefits

For more information about Social Security benefits, visit the SSA website:

www. ssa.gov or www.socialsecurity.gov.

ssa.gov or www.socialsecurity.gov.

Social Security Administration Rules Regarding Parental Income Credit for a Child with a Disability to Determine a Child's Eligibility for SSI and to Determine the SSI Benefit

This pub will tell you about the rules of "counting". This means that a portion of a parent's income and resources are considered in relation to their child when deciding SSI eligibility and benefit amounts. This pub will help you figure out how SSI counts your income. He gives examples. It tells you how to report income.

Print this publication

Generally, a parent's income and money is "credited" or credited to a child receiving Supplemental Security Income (SSI). This means that a portion of the parent's income and money counts against the child in determining eligibility for SSI. This publication explains the rules for crediting income, namely the rules for determining the amount of a parent's income that is credited to a child with a disability and determining the child's eligibility for any additional social income.

Before looking at the method of calculating the amount of parental income credited to a child and the amount of SSI a child is entitled to, you need to understand how the Social Security Administration's Retrospective Monthly Accounting system works and how are your reporting obligations. The Social Security Administration only considers the income and money of the parent with whom the child on SSI lives. The Social Security Administration does not count the income or money of a parent with whom a child receiving SSI does not live. The income of a foster parent with whom a child receiving SSI lives is counted.1

Retrospective monthly calculation

The Social Security Administration uses the retrospective monthly calculation system for the period of eligibility for SSI benefits. Section 20 of the Code of Federal Regulations (C.F.R., Code of Federal Regulations), part 416.420. This means that any month's income determines your SSI benefit two months later. For example, income received in January affects the amount of the March SSI check. If, however, any month's income exceeds the maximum amount for any Supplemental Social Income, SSI for that month will be suspended. Therefore, if January's income is so high that your child is no longer eligible for SSI, January's SSI will be suspended. Your child is eligible for automatic reinstatement of benefits without filing a new petition if your income is low enough to make your child eligible for SSI in any of the next 11 months.2 Title 20 CFR Part 416.1323(b). If within 12 months your income does not drop enough for your child to be eligible for any additional social income, the suspension becomes a cessation of benefits. Title 20 CFR Part 416.1335. If your child's eligibility has been terminated, you will need to file a new petition in order for your child to be eligible for SSI again.

If, however, any month's income exceeds the maximum amount for any Supplemental Social Income, SSI for that month will be suspended. Therefore, if January's income is so high that your child is no longer eligible for SSI, January's SSI will be suspended. Your child is eligible for automatic reinstatement of benefits without filing a new petition if your income is low enough to make your child eligible for SSI in any of the next 11 months.2 Title 20 CFR Part 416.1323(b). If within 12 months your income does not drop enough for your child to be eligible for any additional social income, the suspension becomes a cessation of benefits. Title 20 CFR Part 416.1335. If your child's eligibility has been terminated, you will need to file a new petition in order for your child to be eligible for SSI again.

Obligation to report changes in parental income

In order for the Retrospective Monthly Calculation system to work, the Social Security Administration has a rule that you must notify the Social Security Administration of changes in your income by the 10th of the month following the month in which the change occurred. Section 20 CFR 416.708(c), 416.714.3 If your January income was higher or lower than your December income, you must report the change so that the Social Security Administration is aware of it by the 10th February - or better if before the 5th. You do not need to report if your income for January is the same as your income for December. When the Social Security Administration receives your January income statement, the Social Security Administration must enter the changes into the computer so that your March SSI check will be increased or decreased to reflect the change in your January income.

Section 20 CFR 416.708(c), 416.714.3 If your January income was higher or lower than your December income, you must report the change so that the Social Security Administration is aware of it by the 10th February - or better if before the 5th. You do not need to report if your income for January is the same as your income for December. When the Social Security Administration receives your January income statement, the Social Security Administration must enter the changes into the computer so that your March SSI check will be increased or decreased to reflect the change in your January income.

Below is a sample income statement form to help you meet your reporting obligations. We recommend that you partially complete the report form with the address of your department of the Social Security Administration and all the information in the heading "regarding". And then make more photocopies of the partially completed form.

For each month you have a change in income, write the date you signed the document, the month you are reporting for, and your income information at the bottom of the form. Then sign the form. Only one parent must sign the report form. Make a photocopy of the completed form or complete the second form and keep it as a copy. Attach photocopies of pay stubs or check stubs to the report form you send to the Social Security Administration. Attach the originals to the copy you keep. Do not send the originals of your pay stubs to the Social Security Administration, only photocopies.4 The Social Security Administration often loses items sent in the mail. Keep the original pay stubs and check stubs with a copy of your report form so that the Social Security Administration can review the originals during your annual review. Write the date the letter was sent on the copy of the income statement you keep.5 Keep a copy of any paperwork you send to the Social Security Administration.

Then sign the form. Only one parent must sign the report form. Make a photocopy of the completed form or complete the second form and keep it as a copy. Attach photocopies of pay stubs or check stubs to the report form you send to the Social Security Administration. Attach the originals to the copy you keep. Do not send the originals of your pay stubs to the Social Security Administration, only photocopies.4 The Social Security Administration often loses items sent in the mail. Keep the original pay stubs and check stubs with a copy of your report form so that the Social Security Administration can review the originals during your annual review. Write the date the letter was sent on the copy of the income statement you keep.5 Keep a copy of any paperwork you send to the Social Security Administration.

In addition, keep a record of all your conversations with the Social Security Administration. Write down the date of the conversation, the name of the person you spoke to, and the content of your conversation. We recommend that you bind the documents you receive from the Social Security Administration with a 3-hole punch and make copies of all documents you send to the Social Security Administration. Keep all documents in a notebook or folder.

We recommend that you bind the documents you receive from the Social Security Administration with a 3-hole punch and make copies of all documents you send to the Social Security Administration. Keep all documents in a notebook or folder.

Cash and income not credited to children

The Social Security Administration does not consider the following funds in the context of determining a child's eligibility for SSI benefits: these funds can be converted into cash. Title 20 CFR Part 416.1202(b).

The Social Security Administration does not count the following income in determining a child's eligibility for SSI:

- Income received by a parent for providing In-Home Supportive Services (IHSS) to a child with a disability.

Income earned from IHSS Services does not count towards determining SSI eligibility. Title 20 CFR Part 416.1161(a)(16).

Income earned from IHSS Services does not count towards determining SSI eligibility. Title 20 CFR Part 416.1161(a)(16). - Income received through the IHSS Community First Choice Option (CFCO) program provided by a parent to a child is covered by Medi-Cal and income received by the parent is not considered in determining eligibility for Medi-Cal. In addition, income and funds that are considered in determining a child's financial eligibility for SSI benefits and the amount of the child's SSI check cannot be secondary to determining eligibility of other family members for Medi-Cal.6

For more information about the IHSS (IHSS Fair Hearing and Self-Assessment) program, see our IHSS Fair Hearing and Self-Assessment Information Pack: http://www.disabilityrightsca.org/pubs/501301.htm

Child Benefit Calculation

For instructions on calculating parental child benefit income, see 20 CFR 416.1160, 416.1161, and 416.1165. “Employed income” includes wages and salaries or income from self-employment. 7 Everything else is considered “unearned income”: gifts, unemployment benefits, state disability benefits, and social security benefits are examples of unearned income. You pool your parents' unearned income. You also combine the parents' earned income. Earned income is considered gross income, not what you bring home. Gross income is the amount you earn before any deductions.8

7 Everything else is considered “unearned income”: gifts, unemployment benefits, state disability benefits, and social security benefits are examples of unearned income. You pool your parents' unearned income. You also combine the parents' earned income. Earned income is considered gross income, not what you bring home. Gross income is the amount you earn before any deductions.8

The Social Security Administration begins by deducting contributions for every child in the family who does not have a disability, except for a child on SSI or children with disabilities. Contributions are deducted first from any unearned income and then from earned income to the extent of the unused share of the contributions (see examples). The term "child" for deductions includes children under 21 living in the same household and 21-year-olds who are full-time students under the standards of Title 20 CFR Part 416.1861. The contribution for each non-disabled child is the difference between the individual Federal Benefit Rate (FBR) and the spousal FBR. (The federal benefit rate is the portion of the SSI check amount received from the federal government; the remainder of the SSI check amount is money received from the state.)9The own income of a child who does not qualify for benefits will reduce the amount of the contribution. However, if the ineligible child is a full-time student, the money earned will not be counted to the same extent as for a child or young adult under 22 receiving SSI benefits. Title 20 CFR 416.1112(c)(3), 416.1160(d), 416.1161(c), 416.1163(b), 416.1165, 416.1861.

(The federal benefit rate is the portion of the SSI check amount received from the federal government; the remainder of the SSI check amount is money received from the state.)9The own income of a child who does not qualify for benefits will reduce the amount of the contribution. However, if the ineligible child is a full-time student, the money earned will not be counted to the same extent as for a child or young adult under 22 receiving SSI benefits. Title 20 CFR 416.1112(c)(3), 416.1160(d), 416.1161(c), 416.1163(b), 416.1165, 416.1861.

After deductions for children without disabilities living in the home, there will be a deduction of $20.00 from any income not included in the income assessment. It is deducted first from unearned income (if any or remaining), and then from earned income to the extent of the deduction unused by unearned income. This is followed by special deductions from earned income - first $65.00 and then 50% of the balance. Then you add the remaining amounts of unearned and earned income. From the amount received, you deduct either individual FBR (for a single parent) or spousal FBR (if both parents or a parent and a foster parent are at home). The remaining amount is credited to the child with a disability as his or her unearned income. If there is more than one child with a disability in the family, the amount credited is divided between them.

From the amount received, you deduct either individual FBR (for a single parent) or spousal FBR (if both parents or a parent and a foster parent are at home). The remaining amount is credited to the child with a disability as his or her unearned income. If there is more than one child with a disability in the family, the amount credited is divided between them.

A child's SSI benefit is determined in the same way as any other SSI recipient, with two exceptions. First, only two-thirds of the amount of child support is counted. Title 20 CFR Part 416.1124(c)(11). Second, if the child is a student and does not reach age 22 in 2016, the Social Security Administration does not credit the first $1,780.00 of earned income for each month up to an annual maximum of $7,180.00. 20 CFR 416.1112(c)(3).10 This is in addition to the deductions normally applicable to earned income.

Examples of applying the rules for calculating child credit

This note includes a worksheet template (see below). You are encouraged to make several copies of this worksheet and use them to calculate your child's SSI benefit amount. In addition to this, we have attached two worksheets completed according to examples "A" and "B". These calculations are based on 2016 benefit amounts. The numbers and letters below correspond to the numbers and letters on the Child Benefit Income Worksheet.

You are encouraged to make several copies of this worksheet and use them to calculate your child's SSI benefit amount. In addition to this, we have attached two worksheets completed according to examples "A" and "B". These calculations are based on 2016 benefit amounts. The numbers and letters below correspond to the numbers and letters on the Child Benefit Income Worksheet.

| The January 2016 Individual Federal Benefit Rate is $733.00. | The January 2014 Individual Federal Benefit Rate was $721.00. | The January 2015 Individual Federal Benefit Rate is $733.00. |

| The January 2016 Spousal Federal Benefit Rate is $1,100.00. | The Spousal Federal Benefit Rate for January 2014 was $1,082.00. | The January 2015 Spousal Federal Benefit Rate is $1,100.00. |

| January 2016 income deduction for a non-disabled child is $367. | The income deduction for a child without a disability for January 2014 was $361.00. | January 2015 income deduction for a non-disabled child is $367.00. |

| The January 2016 SSI benefit rate for a child with a disability is $796.40. | The SSI benefit rate for a child with a disability for January 2014 was $784.40. | The January 2015 SSI benefit rate for a child with a disability is $796.40. |

| The January 2016 SSI benefit rate for a child with blindness is $944.40. | January 2014 SSI benefit rate for a child with blindness was $932.40. | The January 2015 SSI benefit rate for a child with blindness is $944.40. |

Example A: Mr. and Mrs. Apple have three children, including Adam, who is ill. Mr. Apple's gross earned income is $2,000.00 per month. Ms. Apple works part-time and earns $1,000.00 per month. They also receive an income of $30 per month from oil field leases.

Disclaimer: This publication is for legal information only and does not constitute legal advice regarding your individual situation. It is current as of the date of publication. We try to update our content regularly. However, laws change regularly. If you want to make sure the law hasn't changed, contact the DRC or another legal office.

- 1. Although the Social Security Administration considers a foster parent's income and money when determining SSI eligibility, the state agency's Medi-Cal (Medicaid) agency does not. Section 42 of the United States Code, Part 1396a(a)(17)(D). For a child, Medi-Cal only considers the income and money of the parent and child. If your child is ineligible for SSI because of the income and money of the foster parent, apply for Medi-Cal under the Federal Aging Program and for Children and Adults with Disabilities Living Below the Poverty Line (A&D FPL) , Federal Poverty Level for aged and for children and adults with disabilities).

If your child is not eligible for Medi-Cal under the A&D FPL program, apply for Medi-Cal under the Aged, Blind, and Medically Needed Disability (ABD, aged-blind-disabled). You can apply for Medi-Cal at your county department of social assistance. To ensure that the appropriate rules are applied, explain that your child is subject to the Sneede case (title of lawsuit).

If your child is not eligible for Medi-Cal under the A&D FPL program, apply for Medi-Cal under the Aged, Blind, and Medically Needed Disability (ABD, aged-blind-disabled). You can apply for Medi-Cal at your county department of social assistance. To ensure that the appropriate rules are applied, explain that your child is subject to the Sneede case (title of lawsuit). - 2. To renew your child's SSI benefits, write or go to your local Social Security Administration office and let them know that your income has decreased or that your money is now within the Social Security Administration limits to qualify for benefits. . Attach proof that your income has decreased or that your money is now within the limits set by the Social Security Administration to qualify for benefits. You must specifically request a reinstatement of SSI benefits. If you are requesting recovery by mail, we advise you to do so by certified mail.

- 3. You must report more than just changes in income.

See Title 20 CFR § 416.708. You must also tell the Social Security Administration if you move, if your child with a disability or children without a disability moves house, if a parent gets married or a parent moves out of home, or if your child with a disability moves to a residential facility. institution.

See Title 20 CFR § 416.708. You must also tell the Social Security Administration if you move, if your child with a disability or children without a disability moves house, if a parent gets married or a parent moves out of home, or if your child with a disability moves to a residential facility. institution. - 4. Some parents told us that they were told at the local offices that the Social Security Administration does not accept photocopies. This is not true. In the income change letter, you swear under penalty of perjury that the photocopies are exact copies of the original documents

- 5. Some families tell us that they were told at their local office of the Social Security Administration that they were not required to submit monthly income statements, that the Social Security Administration would make adjustments after the fact during the annual review. This is sometimes true, in cases where the Social Security Administration arranges for your benefits to be adjusted according to anticipated changes in your income.

If you receive benefits once a week, you will receive five checks in some months instead of four; if you get biweekly benefits, twice a year you will get three checks a month instead of two. During the annual review, the Social Security Administration may make anticipated changes in your income for the following year in its program. However, if you do not receive written approval from the Social Security Administration that you do not need to report changes in your income, you must report changes in your income. If you don't and end up with extra pay, the Social Security Administration will blame you because you didn't notify them of the change in your income.

If you receive benefits once a week, you will receive five checks in some months instead of four; if you get biweekly benefits, twice a year you will get three checks a month instead of two. During the annual review, the Social Security Administration may make anticipated changes in your income for the following year in its program. However, if you do not receive written approval from the Social Security Administration that you do not need to report changes in your income, you must report changes in your income. If you don't and end up with extra pay, the Social Security Administration will blame you because you didn't notify them of the change in your income. - 6. Title 42 of the United States Code, Part 1309, C.C.R., California Code of Regulations, Title 22, Part 50555.1. In the case of the Apple family members in Example A on page 8, the other two children would be eligible for Medi-Cal benefits from zero income. Parents may not be eligible if both of them are working. If there is only one parent in the family, or if one of the parents is unemployed or underemployed, or has a disability, including a temporary one, the parents may also be eligible for Medi-Cal coverage.

If a parent receives an IHSS program to care for a child with a disability, that income is not considered in determining the child's financial eligibility for SSI, and under the IHSS First Choice of the Public program, this income is also not considered in determining Mediation eligibility. -Cal of any other members of this household.

If a parent receives an IHSS program to care for a child with a disability, that income is not considered in determining the child's financial eligibility for SSI, and under the IHSS First Choice of the Public program, this income is also not considered in determining Mediation eligibility. -Cal of any other members of this household. - 7. If you are self-employed, the Social Security Administration will want to know your adjusted gross income. Title 20 CFR Part 416.1110(b). Bring last year's income tax return to the Social Security Administration along with your gross income for this year. The Social Security Administration will count your income tax return for last year along with your gross income for this year. The Social Security Administration will use your last year's income tax return as the basis for estimating your adjusted gross income for this year. If your gross income for the past year was $40,000 and your adjusted gross income (the amount you paid in taxes after IRS-allowed business deductions) was $18,000, or 45% of your gross income, the Social Security Administration calculates that your adjusted gross income this year will be 45% of your gross income for that year.

Because self-employment income is determined on an annual basis and then spread out evenly over 12 months under section 20 CFR 416.1111(b), you will be using adjusted estimates when filing your tax return. The Social Security Administration does not consider real estate necessary to cover costs from proceeds, including for employees, as a monetary resource. Section 42 of the United States Code, Part 1382b(a)(3). This may include inventory, computers, farm equipment and livestock, agricultural land, separate business trading accounts, buildings, a fishing boat, and a car you use to work or need to commute to work. and back.

Because self-employment income is determined on an annual basis and then spread out evenly over 12 months under section 20 CFR 416.1111(b), you will be using adjusted estimates when filing your tax return. The Social Security Administration does not consider real estate necessary to cover costs from proceeds, including for employees, as a monetary resource. Section 42 of the United States Code, Part 1382b(a)(3). This may include inventory, computers, farm equipment and livestock, agricultural land, separate business trading accounts, buildings, a fishing boat, and a car you use to work or need to commute to work. and back. - 8. Some employers have benefit plans that allow you to put money into a special account to pay for child care or medical care under Section 125 of the Internal Revenue Code. Such plans are often referred to as "cafeteria plans". Money set aside in these accounts and used to pay for eligible benefits is not considered "income" because you don't pay Social Security taxes on it.

Title 20 CFR Part 404.1054. To determine your eligibility for SSI benefits, your gross earned income is your gross income minus money set aside in the Benefits Cafeteria. However, cash receipts deposited in a tax-exempt retirement account are considered income. The money in the parent's retirement account is a deductible resource that is not credited to the child. Title 20 CFR Part 416.1202(b).

Title 20 CFR Part 404.1054. To determine your eligibility for SSI benefits, your gross earned income is your gross income minus money set aside in the Benefits Cafeteria. However, cash receipts deposited in a tax-exempt retirement account are considered income. The money in the parent's retirement account is a deductible resource that is not credited to the child. Title 20 CFR Part 416.1202(b). - 9. Due to the retrospective monthly calculation (see pages 1-2), the November and December income calculations must use the next year's Federal Benefit Rate. This is because the SSI check received in January and February must reflect income received and credited to the child in November and December of the previous year.

- 10. Annual and monthly maximums are increased each year by the amount of the annual cost of living allowance. Title 20 CFR Part 416.112(c)(3)(B). Regulations provide flexibility and accommodation for health conditions in defining a child or young adult as a student in the context of a deduction from earned income.

00.

00.