How do you become a sponsor for an immigrant child

What are the required documents to sponsor an immigrant?

Posted by Frank Gogol in Immigrants | Updated on November 15, 2022

At a Glance: The latest Memorandum on Enforcing the Legal Responsibilities of Sponsors of Aliens will disallow certain agencies from providing certain public benefits to immigrants. Immigrants have been receiving some means-tested public benefits, even though these aren’t meant for them.

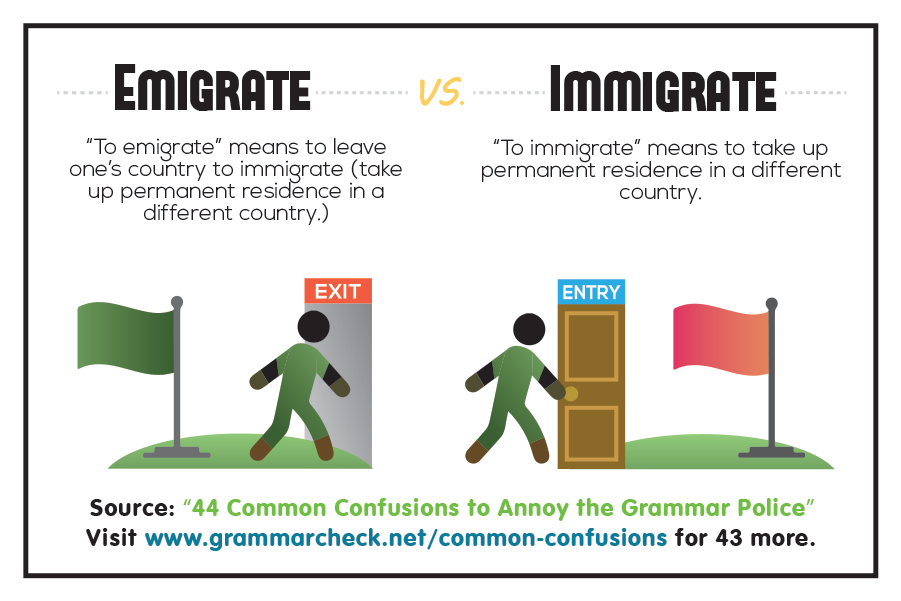

When it comes to United States immigration laws, they are quite stringent and demanding. Under the laws, every immigrant should have a financial sponsor to be eligible to immigrate to the US. If you’re looking to bring a foreign national into America and want to learn more about sponsorship, this article will answer all of your questions.

This article touches on how a person can sponsor an immigrant based on a family-based green card program. For corporate sponsors, there’s a whole different procedure.

Table of Contents

What is a Financial Sponsor?

A financial sponsor is either a person, a group of people, or a business entity that willingly provides financial backup to an immigrant. In other words, they sponsor the immigrant’s journey into the United States. When you’re a financial sponsor, you take up the responsibility. Responsibility of being in charge of the immigrant for the entire duration of his stay in the US.

Taking up legal responsibilities means making your income and assets available to sponsor an immigrant. Immigrants have been receiving some means-tested public benefits, even though these aren’t meant for them. These include Medicaid and Temporary Assistance for Needy Families and the State Child Health Insurance Program.

But the latest Memorandum on Enforcing the Legal Responsibilities of Sponsors of Aliens will disallow certain agencies from providing such benefits. This means the sponsor should be financially secure to be able to bring in someone using a family-based green card.

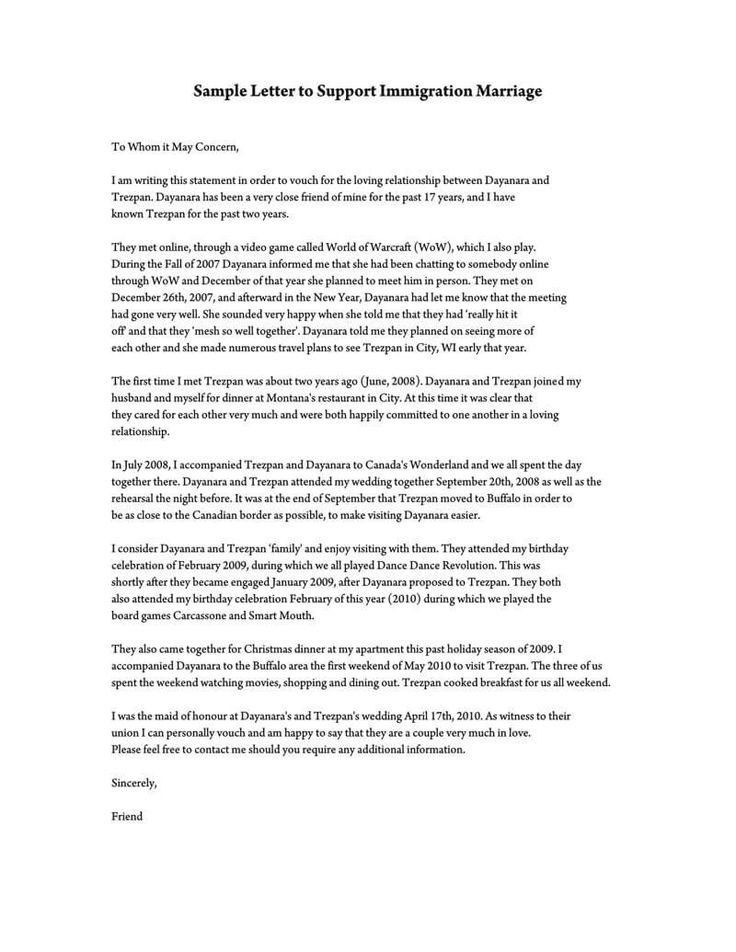

Affidavit of Support

This financial health is held accountable by you having to file an affidavit of support. If you’ve done some research on this topic, then you’ll be knowing that you need to file at least two forms, namely:

- Form I-130, Petition for Alien Relative

- Form I-864, Affidavit of Support

Form I-130 is straightforward and deals with basic personal and relationship-based information. But the Form I-864 is where you need to focus on if your main concern is financial sponsorship.

This form can be downloaded from the USCIS website here. This form will ask you to provide various information ranging from your salary and income sources to properties owned in the US and overseas. Consider the Form I-864 as a contract with the US government agreeing to secure the immigrant financially. If the immigrant uses any form of public benefits in the future, the US government can reimburse that amount from your income or assets.

There are various types of I-864 forms like Form I-864, Form I-864 EZ, and Form I-864A. You’ll be using different forms for different scenarios. By filling any of these forms, you can become a financial sponsor.

You’ll be using different forms for different scenarios. By filling any of these forms, you can become a financial sponsor.

Who Qualifies to Sponsor an Immigrant?

People who are willing to bring a non-citizen into America by sponsoring them should meet the eligibility criteria as laid out by the USCIS. In this section, we explore those in brief.

Eligibility Criteria to Become a Sponsor

To become eligible to sponsor a non-citizen into the United States, you must meet the following criteria:

- You must be a United States citizen or a permanent resident. Immigrants with any other visa status cannot sponsor a person in the US.

- You must be at least 18 years old at the time of filing the Form I-130.

- You should have your domicile in the US or any of its territories.

- You must have met the required financial requirements (more on this in the subsequent section)

- You must have filed Form I-864, Affidavit of Support.

Income Requirement to Become Financial Sponsors

By law, you must prove that you have an income level of at least 125% above the Federal poverty level. The poverty level is as per the ASPE’s determined metrics. At the time of writing, the poverty level was set at $12,760 per annum for a single person. For a two-person household, it was $17,240. These are the same for 48 US States and the District of Columbia. For Alaska and Hawaii, the numbers are different. So as per the income level requirement, your income should be at least $15,950 annually which would make you eligible for sponsoring.

The poverty level is as per the ASPE’s determined metrics. At the time of writing, the poverty level was set at $12,760 per annum for a single person. For a two-person household, it was $17,240. These are the same for 48 US States and the District of Columbia. For Alaska and Hawaii, the numbers are different. So as per the income level requirement, your income should be at least $15,950 annually which would make you eligible for sponsoring.

For military personnel, it is set at 100% of the poverty level, which is equal to the poverty level earnings.

Failure To Meet The Income Requirement

If you fail to meet the income requirement, the road to bring someone into the United States doesn’t end there. To meet the requirement, you can open up your financial assets. This includes, but is not limited to, checking accounts, saving accounts, bonds, stocks, real estate properties, business stakes, etc.

You will be mentioning these in your Form I-864 and the asset value will then be decided by the USCIS. If even after offering your assets doesn’t meet the income requirement, there’s another possible option: Joint Sponsorship.

If even after offering your assets doesn’t meet the income requirement, there’s another possible option: Joint Sponsorship.

Joint Sponsorship

Joint sponsorship is a way wherein you can jointly sponsor an immigrant with another person. The person who is willing to take legal responsibility for the immigrant along with you is called a joint sponsor. In most cases, joint sponsorship is undertaken to meet the income requirement. But the main requirement of a joint sponsor states that he should meet the 125% income requirement all by himself.

In most cases, the need for a joint sponsor to pay for the immigrant never arises. They, more or less, act as a financial backup or an insurance policy for the US government.

The same eligibility criteria applicable to you are applied to your co-sponsor as well. But they don’t need to have a direct relationship with the immigrant.

Immigrant Sponsorship FAQ

We’ve compiled a list of frequently asked questions about the immigrant sponsorship. Here are the top five questions:

Here are the top five questions:

When Should I File The Affidavit Of Support?

You, as a sponsor, should complete the form by the time the visa interview has been scheduled by the overseas consular officer. The immigrant will be attending this interview and will need to provide the I-864 form. The interview process will be initiated once you file I-130.

How Long Am I Responsible For The Immigrant?

You are responsible to take the financial responsibility until the immigrant either becomes a US citizen, credited with 40 quarters or 10 years of work, permanently moves out of the United States or dies – whichever event occurs first.

What If I Fail To Provide Financial Support?

In certain cases, if you fail to provide the required financial support, then your co-sponsor is obliged to take up the responsibility as agreed during the filing. If you filed without a co-sponsor, then the immigrant is eligible to apply for and receive certain means-tested public benefits. But these will be billed and you’d eventually have to pay for them.

But these will be billed and you’d eventually have to pay for them.

Do I Have To Notify USCIS If I Change The Address?

Yes. You are legally required to keep the USCIS officials up to date with your current location till your financial obligations are over. Whether you move domestically or internationally, you must file the Form I-865, Sponsor’s Notice of Change of Address, within a month (30 days) of shifting.

Can I Supplement The Lack Of Affidavit Of Support Requirements With A Credible Employment Offer?

No. The USCIS does not recognize such offers made.

Read More

- What is Visa Sponsorship?

- How to Write a Visa Invitation Letter

- Can I Sponsor an Immigrant that is a Non-Family Member?

- Affidavit of Support Samples

- What Are My Options for Change of Status Visa Stamping If I Am Already in America?

- OFC Appointment: What You Should Know About It?

Conclusion

Sponsoring an immigrant isn’t complex, but you definitely need to take care of due diligence. In case of confusion, it is advised to get in touch with an immigration attorney in your state.

In case of confusion, it is advised to get in touch with an immigration attorney in your state.

Need a Loan? Get One in 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon you’ll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days (some lenders will be as quick as 2-3 business days). Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. (F-1, OPT, H-1B, O-1, L-1, TN visa holders) at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on Google, Yelp, and Facebook or visit us at https://www.stilt.com. If you have any questions, send us an email at [email protected]

Frank Gogol

I’m a firm believer that information is the key to financial freedom. On the Stilt Blog, I write about the complex topics — like finance, immigration, and technology — to help immigrants make the most of their lives in the U. S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more.

S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more.

See author's posts

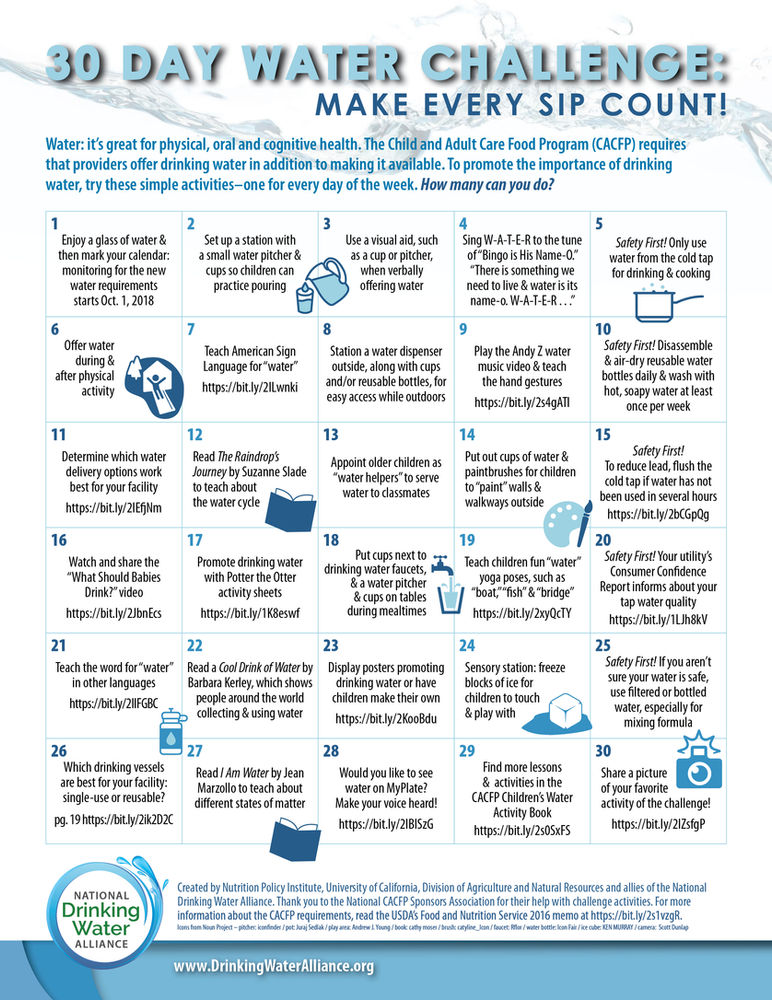

Unaccompanied Children Released to Sponsors by State

When a child who is not accompanied by a parent or legal guardian is apprehended by immigration authorities, the child is transferred to the care and custody of the Office of Refugee Resettlement (ORR). Federal law requires that ORR feed, shelter, and provide medical care for unaccompanied children until it is able to release them to safe settings with sponsors (usually family members), while they await immigration proceedings. These sponsors live in many states.

Sponsors are adults who are suitable to provide for the child’s physical and mental well-being and have not engaged in any activity that would indicate a potential risk to the child. All sponsors must pass a background check. The sponsor must agree to ensure the child’s presence at all future immigration proceedings. They also must agree to ensure the minor reports to ICE for removal from the United States if an immigration judge issues a removal order or voluntary departure order.

They also must agree to ensure the minor reports to ICE for removal from the United States if an immigration judge issues a removal order or voluntary departure order.

HHS is engaging with state officials to address concerns they may have about the care or impact of unaccompanied children in their states, while making sure the children are treated humanely and consistent with the law as they go through immigration court proceedings that will determine whether they will be removed and repatriated, or qualify for some form of relief.

HHS has strong policies in place to ensure the privacy and safety of unaccompanied children by maintaining the confidentiality of their personal information. These children may have histories of abuse or may be seeking safety from threats of violence. They may have been trafficked or smuggled. HHS cannot release information about individual children that could compromise the child’s location or identity.

The data in the table below shows state-by-state data of unaccompanied children released to sponsors as of October 31, 2022. ACF will update this data each month. Additional data on unaccompanied children released to sponsors by state is available on the HHS website Visit disclaimer page.

ACF will update this data each month. Additional data on unaccompanied children released to sponsors by state is available on the HHS website Visit disclaimer page.

View unaccompanied children released to sponsors by county.

Please note: ORR makes considerable effort to provide precise and timely data to the public, but adjustments occasionally occur following review and reconciliation. The FY2014 release data posted in the chart below were updated on March 13, 2015. The FY2015 release data were updated May 9, 2016. The FY2017 release data were updated May 22, 2018. The FY2018 release data were updated December 3, 2019. Questions may be addressed to ORR directly, at (202) 401-9246.

| State | Total Number of UC Released to Sponsors in FY15 (Oct. 2014 — Sept. 2015) | Total Number of UC Released to Sponsors in FY16 (Oct. 2015 — Sept. 2016) | Total Number of UC Released to Sponsors in FY17 (Oct.  2016 — Sept. 2017)* 2016 — Sept. 2017)* | Total Number of UC Released to Sponsors in FY18 (Oct. 2017 — Sept. 2018)* | Total Number of UC Released to Sponsors in FY19 (Oct. 2018 — Sept. 2019) | Total Number of UC Released to Sponsors in FY20 (Oct. 2019 — Sept. 2020) | Total Number of UC Released to Sponsors in FY21 (Oct. 2020 — Sept. 2021)* | Total Number of UC Released to Sponsors in FY22 (Oct. 2022 — Oct. 2022) |

|---|---|---|---|---|---|---|---|---|

| Alabama | 808 | 870 | 598 | 736 | 1,111 | 247 | 1,946 | 167 |

| Alaska | 2 | 5 | 3 | 0 | 4 | 0 | 4 | 2 |

| Arizona | 167 | 330 | 322 | 258 | 493 | 162 | 631 | 67 |

| Arkansas | 186 | 309 | 272 | 193 | 359 | 87 | 790 | 85 |

| California | 3,629 | 7,381 | 6,268 | 4,675 | 8,447 | 2,225 | 10,773 | 987 |

| Colorado | 248 | 427 | 379 | 313 | 714 | 172 | 1,088 | 147 |

| Connecticut | 206 | 454 | 412 | 332 | 959 | 260 | 1,447 | 99 |

| Delaware | 152 | 275 | 178 | 222 | 383 | 107 | 519 | 49 |

| DC | 201 | 432 | 294 | 138 | 322 | 48 | 307 | 26 |

| Florida | 2,908 | 5,281 | 4,059 | 4,131 | 7,408 | 1,523 | 11,145 | 1,074 |

| Georgia | 1,041 | 1,735 | 1,350 | 1,261 | 2,558 | 559 | 4,358 | 406 |

| Hawaii | 2 | 4 | 4 | 1 | 16 | 6 | 23 | 17 |

| Idaho | 11 | 39 | 11 | 28 | 62 | 19 | 84 | 14 |

| Illinois | 312 | 519 | 462 | 475 | 863 | 211 | 1,712 | 278 |

| Indiana | 240 | 354 | 366 | 394 | 794 | 209 | 1,593 | 125 |

| Iowa | 201 | 352 | 277 | 238 | 489 | 119 | 677 | 66 |

| Kansas | 245 | 326 | 289 | 305 | 453 | 95 | 718 | 76 |

| Kentucky | 274 | 503 | 364 | 370 | 710 | 158 | 1,042 | 80 |

| Louisiana | 480 | 973 | 1,043 | 931 | 1,966 | 355 | 2,851 | 223 |

| Maine | 4 | 9 | 11 | 22 | 26 | 11 | 64 | 11 |

| Maryland | 1,794 | 3,871 | 2,957 | 1,723 | 4,671 | 825 | 5,471 | 478 |

| Massachusetts | 738 | 1,541 | 1,077 | 814 | 1,756 | 448 | 2,549 | 186 |

| Michigan | 132 | 227 | 160 | 136 | 248 | 74 | 451 | 54 |

| Minnesota | 243 | 318 | 320 | 294 | 624 | 151 | 1,002 | 95 |

| Mississippi | 207 | 300 | 237 | 299 | 482 | 108 | 707 | 56 |

| Missouri | 170 | 261 | 234 | 203 | 431 | 93 | 794 | 103 |

| Montana | 2 | 0 | 2 | 3 | 0 | 2 | 28 | 4 |

| Nebraska | 293 | 486 | 355 | 374 | 563 | 130 | 889 | 53 |

| Nevada | 137 | 283 | 229 | 132 | 324 | 79 | 465 | 59 |

| New Hampshire | 14 | 25 | 27 | 20 | 25 | 8 | 67 | 1 |

| New Jersey | 1,462 | 2,637 | 2,268 | 1,877 | 4,236 | 921 | 5,911 | 524 |

| New Mexico | 19 | 65 | 46 | 43 | 89 | 34 | 116 | 7 |

| New York | 2,630 | 4,985 | 3,938 | 2,845 | 6,367 | 1,663 | 8,534 | 674 |

| North Carolina | 844 | 1,493 | 1,290 | 1,110 | 2,522 | 610 | 4,249 | 380 |

| North Dakota | 2 | 10 | 3 | 2 | 10 | 1 | 14 | 1 |

| Ohio | 483 | 693 | 584 | 547 | 1,091 | 260 | 1,675 | 154 |

| Oklahoma | 225 | 301 | 267 | 286 | 581 | 120 | 906 | 70 |

| Oregon | 122 | 188 | 170 | 200 | 318 | 71 | 438 | 61 |

| Pennsylvania | 333 | 604 | 501 | 563 | 1,229 | 271 | 2,103 | 182 |

| PR | 0 | 0 | 0 | 1 | 3 | 3 | 0 | 0 |

| Rhode Island | 185 | 269 | 234 | 235 | 453 | 92 | 520 | 40 |

| South Carolina | 294 | 562 | 483 | 508 | 1,012 | 255 | 1,743 | 193 |

| South Dakota | 61 | 81 | 81 | 96 | 149 | 44 | 233 | 13 |

| Tennessee | 765 | 1,354 | 1,066 | 1,173 | 2,191 | 510 | 4,267 | 311 |

| Texas | 3,272 | 6,550 | 5,391 | 4,136 | 9,900 | 2,336 | 15,341 | 1,433 |

| Utah | 62 | 126 | 99 | 97 | 179 | 75 | 307 | 51 |

| Vermont | 1 | 1 | 0 | 2 | 6 | 1 | 8 | 1 |

| Virginia | 1,694 | 3,728 | 2,888 | 1,650 | 4,215 | 770 | 5,400 | 450 |

| Washington | 283 | 476 | 494 | 435 | 723 | 237 | 1,113 | 90 |

| West Virginia | 12 | 26 | 23 | 23 | 41 | 4 | 60 | 6 |

| Wisconsin | 38 | 85 | 94 | 98 | 246 | 62 | 531 | 51 |

| Wyoming | 6 | 23 | 14 | 15 | 15 | 6 | 22 | 3 |

| Virgin Islands | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 0 |

| TOTAL | 27,840 | 52,147 | 42,497 | 34,953 | 72,837 | 16,837 | 107,686 | 9,783 |

*The FY2015 numbers have been reconciled.

*The FY2017 numbers have been reconciled.

*The FY2018 numbers have been reconciled.

*The FY2021 numbers have been reconciled.

For more information, please read ORR’s reunification policy.

Who can become an immigration sponsor?

Today we analyze the nuances of immigration sponsorship. This topic is especially useful for close relatives of US citizens (spouses, parents and children), as well as relatives of green card holders (spouses and minor children).

Who is an immigration sponsor?

An immigration sponsor in the United States is a person who agrees to certain contractual obligations.

Usually a contract is based on 3 criteria:

- Offer.

- Mutually beneficial terms.

- Acceptance of these conditions.

In this case, the immigration sponsor enters into contractual obligations with the state. It must be understood that such a contract implies 100% protection of the rights of the state. The sponsor vouches for the immigrant and guarantees that the latter will not turn to the state for help.

An immigrant is prevented from applying by Affidavit of Financial Support submitted by the sponsor.

How much income should an immigration sponsor have?

The income of a US citizen or green card holder must meet the cost of living. This is a prerequisite for immigration sponsorship in the United States.

If the sponsor's family consists of 2 people (including a sponsored relative), then the sponsor must earn at least $21,775 per year. If the family includes 3 people, the annual salary rises to $27,450.

A complete table with the required amounts can be found on the official USCIS website. Usually these figures change with the advent of the new financial year (from October 1).

Usually these figures change with the advent of the new financial year (from October 1).

It is important to understand that only the amount of official earnings (taxable income) is subject to accounting.

Example: The income of a US citizen was $100,000 per year. At the same time, only $15,000 was taxed. In this case, a US citizen will not be able to act as an immigration sponsor.

Sponsor's income is below the minimum. What are the solutions?

What if a person does not qualify as a sponsor? Let's talk about ways to solve this problem, which we have met in 26 years of work.

- Attract an additional sponsor

Anyone can act as an additional sponsor (regardless of whether he is related to you or not).

Additional sponsor requirements:

- US citizenship or permanent resident status.

- Sufficient income to provide for his family and immigrants.

Important: If the person is already an immigration sponsor, ie. has signed an Affidavit of Support within the past 10 years, all sponsored immigrants must be included in the sponsor's household.

has signed an Affidavit of Support within the past 10 years, all sponsored immigrants must be included in the sponsor's household.

Sponsorship is canceled if immigrants acquire US citizenship.

- Convert real estate into cash

This method is not as popular and effective as the previous one. For all the time of work, we met only a few such cases.

The success of the case depends on the immigration officer's perception. Many of them do not accept the translation of real estate into numbers, which leads to delays in consideration or refusals.

- Prove the availability of own funds

In this case, your income must cover the minimum requirement five times.

- Increase the sponsor's income

For example, the sponsor receives $7,000 less than the minimum. He can try to negotiate with management: take on an additional job or negotiate an increase in official income on mutually beneficial terms.

We hope that this material has helped you to learn more about sponsorship in the US and the required income.

Still have questions? The Rush In Documentation team will be happy to advise you and help you with the paperwork. Just contact us in any convenient way.

See also:

- Freedom of Information Act. What is it needed for?

- Issuance of US visas. Real picture

- Which travel passport should I choose?

Sponsorship to Canada of other relatives

A Canadian citizen or permanent resident can sponsor relatives through the Canadian immigration program.

Canada today is fast a developing country with a stable economy and hardworking citizens. At that At the same time, Canada is a country of immigrants. Only from 2001 to 2009 the population countries increased by 3.5 million people, most of whom are immigrants from other countries. Half of the immigrants are skilled professionals who are in high demand to improve the country's economy. The remaining half of the immigrants are people who came family reunification program.

The remaining half of the immigrants are people who came family reunification program.

The Canadian government takes care of its citizens and therefore enables permanent residents and citizens countries to act as a sponsor for their relatives located in other countries. Thus, the program was created - Family sponsprship (family sponsorship), which in turn is divided into several areas:

Spouse, civil or marriage partner, minor children.

Parents, grandparents.

Other relatives (brothers/sisters, uncles/aunts, nephews/nieces).

This article will cover basic requirements for sponsoring other relatives.

Sponsorship of other relatives

Ministry of Citizenship and Immigration takes the issuance of permanent resident status to foreigners very seriously. candidates and therefore puts high demands on the sponsor. In its turn the sponsor, who is also a permanent resident or citizen of Canada, must understand that takes on more responsibility when he decides to sponsor for your relative. Basic requirements for a sponsor:

Basic requirements for a sponsor:

Age - from 18 years.

Be a permanent resident or citizen Canada.

Have enough income to live providing for yourself and your relative (accommodation, food, clothing).

Be able to financially support relative upon arrival in Canada.

Ensure that the relative does not need or need will require financial assistance from the government in the future.

In case of non-compliance or violation one of the above, you will be denied sponsorship of any relative in the future.

In turn, there is a series requirements for sponsored relatives who wish to immigrate to Canada:

It is necessary to undergo a medical examination.

Submit a certificate of no criminal record.

Pass a background check.

Sponsored relatives will be denied permanent resident status in Canada if the candidate has a criminal record and in any way may threaten the safety of citizens countries.

You cannot be a sponsor if:

Have broken sponsorship terms in the past.

There is no child support payment.

Receive government financial assistance reasons other than disability.

Has a criminal record against a relative or any other crime of sexual violence character.

Have an unpaid immigration loan (missed or late payments).

Be in jail.

Declared bankruptcy and were not released from him.

Other causes not listed in this list may also prevent you from sponsoring your relative.

To become a sponsor you must:

Submit proof of your income complies with recommendations for the minimum required income for providing for the living needs of a sponsored relative.

agree in writing that take responsibility for providing financial support to a relative within 10 years* (number of years depending on the age of the sponsored relative, and degree of relationship). *This time period starts from the moment granting permanent resident status.

*This time period starts from the moment granting permanent resident status.

A big plus for the inspector, who will consider the application for permanent status resident for a relative, there will be the signing of a specific agreement. In this document, the sponsored relative must promise to make an effort to to support themselves financially. For sponsored relatives who have not reached the age of 19 do not sign such an agreement need.

Who can be sponsored

Depending on circumstances There are two categories of relatives that you can sponsor.

Category 1. Close relatives of an orphan.

This category includes relatives close by blood or adoption. For example, brothers/sisters nephews, grandchildren. You can sponsor the above relatives if they meet the following requirements:

They are orphans.

Have not reached the age of 18.

Are not civil, married or marital relationship.