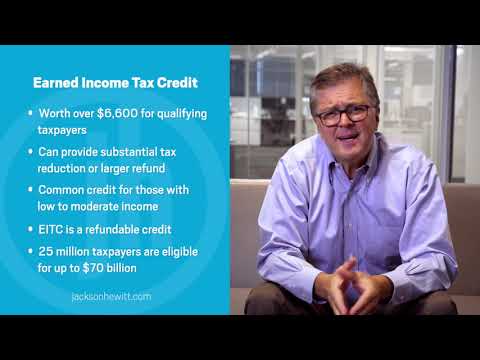

How do i qualify for child earned income credit

What is the Earned Income Tax Credit (EITC)? – Get It Back

What is the Earned Income Tax Credit (EITC)?

The Earned Income Tax Credit (EITC) may lower the taxes you owe and refund you up to $6,728 at tax time.

The Earned Income Tax Credit (EITC) is a tax credit that may give you money back at tax time or lower the federal taxes you owe. You can claim the credit whether you’re single or married, or have children or not. The main requirement is that you must earn money from a job.

The credit can eliminate any federal tax you owe at tax time. If the EITC amount is more than what you owe in taxes, you get the money back in your tax refund. If you qualify for the credit, you can still receive a refund even if you do not owe income tax.

Beyond the federal EITC, 29 states and D.C. have adopted state EITCs. Check out the state EITC map to see if your state offers a tax credit.

Click on any of the following links to jump to a section:

-

- How much can I get with the EITC?

- Am I eligible for the EITC?

- Does my child qualify for the EITC?

- How do I claim the EITC?

- Does my state have an EITC?

- What’s new about the EITC?

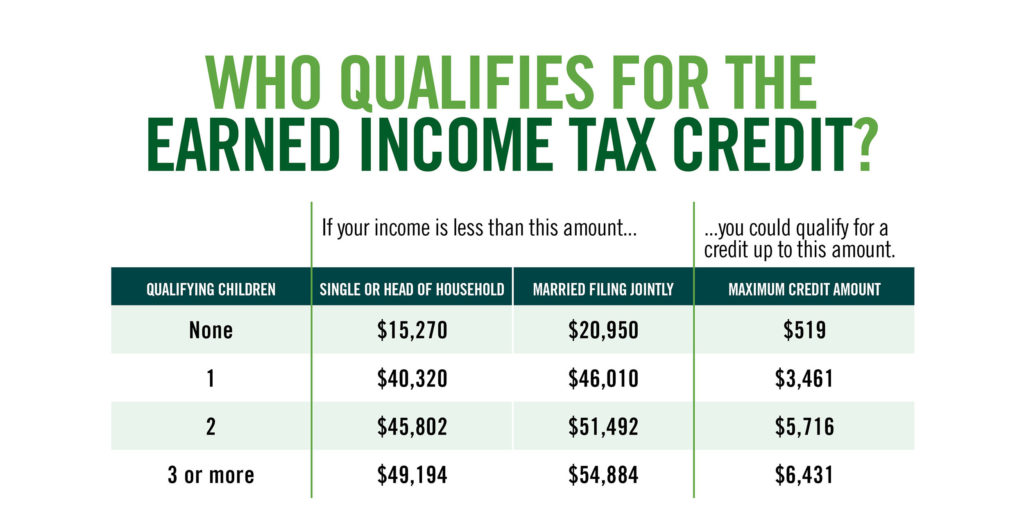

The credit amount depends on your income, marital status, and family size. In 2021, the credit is worth up to $6,728. The credit amount rises with earned income until it reaches a maximum amount, then gradually phases out. Families with more children are eligible for higher credit amounts.

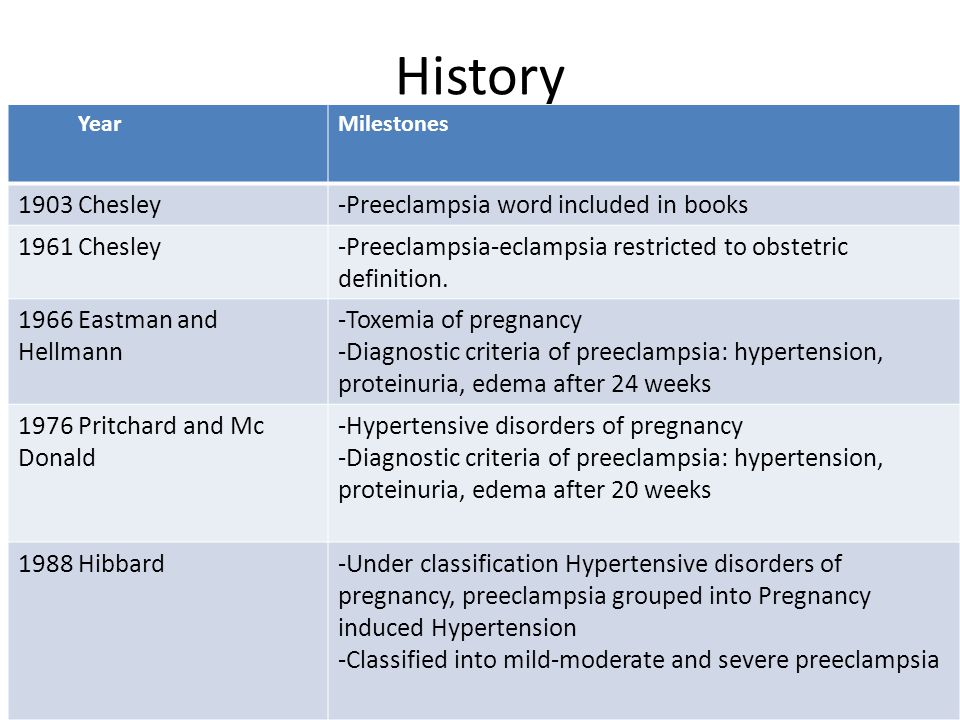

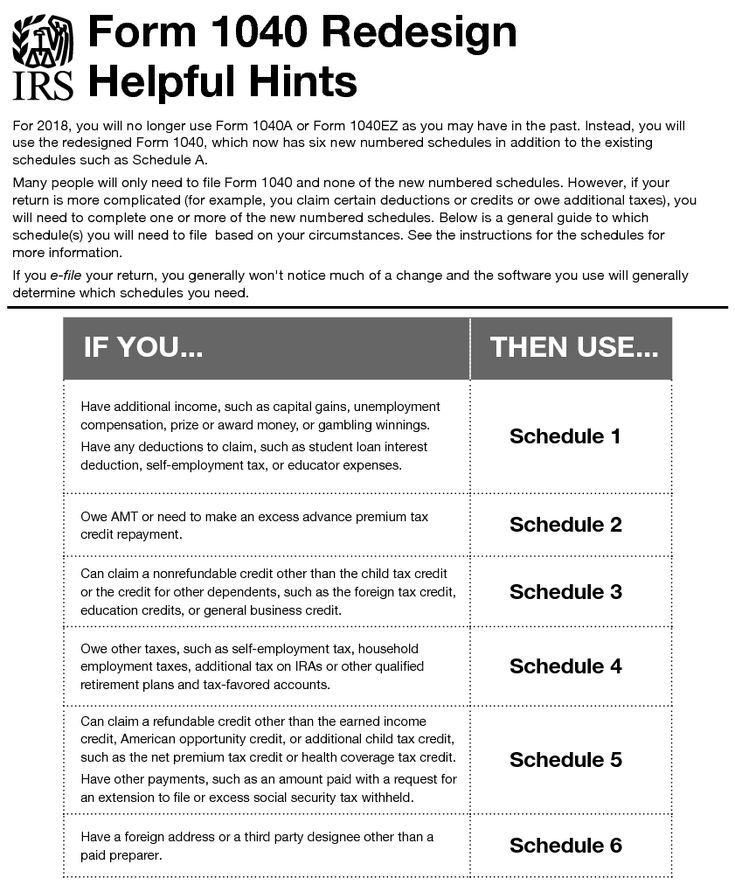

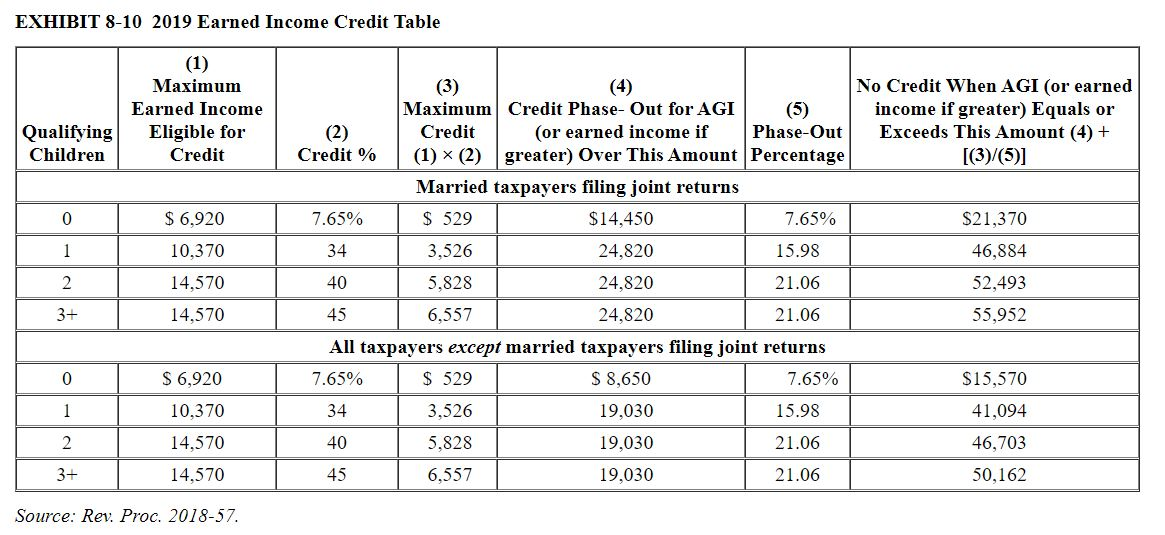

The Earned Income Tax Credit in Tax Year 2021

| Number of children: | Single workers with income less than: | Married workers with income less than: | EITC up to: |

| 3 or more children | $51,464 | $57,414 | $6,728 |

| 2 children | $47,915 | $53,865 | $5,980 |

| 1 child | $42,158 | $48,108 | $3,618 |

| No children | $21,430 | $27,380 | $1,502 |

You cannot get the EITC if you have investment income of more than $10,000 in 2021. Investment income includes taxable interest, tax-exempt interest, and capital gain distributions.

Investment income includes taxable interest, tax-exempt interest, and capital gain distributions.

There are three main criteria to claim the EITC:

- Income: You need to work and earn income. Your work doesn’t have to be year-round. Your earnings cannot be more than the amounts in the chart above, including investment income. Earned income can be from wages, salary, tips, employer-based disability, self-employment income, military pay, or union strike benefits.

- Taxpayer Identification Number: You need to have Social Security numbers that permit work for you, your spouse, and any children claimed for the EITC. You do not need to be a citizen to claim the EITC if you have a Social Security Number. You cannot claim the federal EITC if you file your taxes with an ITIN. For more information, please see Tax Filing with Immigrant or DACA Status. New: if you live in California, Colorado, Maine, Maryland, or New Mexico, you may be eligible to get the state EITC with an ITIN.

- Qualifying Child: If you claim children for the EITC, they must be a “qualifying child”. See below for details.

Additional criteria for some people to claim the EITC:

- You must be 19 years of age and above if you are not claiming children

- You cannot file as married filing separately

Exceptions apply for both. See What’s New about the EITC? for details.

If you claim children as part of your EITC, they must pass three tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be under 19, under 24 if a full-time student, or any age if totally and permanently disabled.

- Residency: The child must live with you in the U.

S. for more than half the year. Time living together doesn’t have to be consecutive.

S. for more than half the year. Time living together doesn’t have to be consecutive.

To claim the EITC, you must file a tax return. If you are claiming a child for the EITC, you also need to submit “Schedule EIC”.

Going to a paid tax preparer is expensive and reduces the amount of your tax refund. Luckily, there are free options available. You can visit a Volunteer Income Tax Assistance (VITA) site or GetYourRefund.org to have IRS-certified volunteers accurately file your taxes for free. You can also visit MyFreeTaxes.com to file your own taxes for free online if you do not have self-employment income.

Many states have their own version of the federal EITC that can add more money to your tax refund. Most states match a percentage of your federal credit amount. Find out if your state has a state-level tax credit.

For those ages 18-24:You may be navigating filing taxes for the first time. Here are some resources that may help:

- Tax Filing and Tax Credits for Young Adults: John Burton Advocates for Youth have created several resources for young adults, including a guide to tax credits and a tax checklist.

Many of these resources are also available in Spanish.

Many of these resources are also available in Spanish. - Earned Income Tax Credit Guide that focuses on former foster and youth experiencing homelessness from SchoolHouse Connection.

- Taxes FAQ for young adults with experience in foster care or homelessness

Under the 2021 American Rescue Plan, there are multiple temporary and permanent changes to the EITC.

Temporary Expansions to the EITC for Tax Year 2021 Only

There are 2 key temporary EITC expansions.

- If You Have No Qualifying Children

You may qualify for the EITC if you are 19 years old or older and not a student. There are two exceptions:

-

-

- Workers who are 19-23 and were a full- or part-time student for more than 5 months in 2021 do not qualify.

- Qualified homeless youth or former foster youth who are at least 18 years old and work are eligible even if they are a student.

-

- If Your 2021 Income is Lower Than Your 2019 Income

If your income in 2021 is less than your 2019 income, you can use your 2019 earned income to calculate your EITC. Choose the year that gives you the bigger refund. If you are married filing jointly, the total earned 2019 income refers to the sum of each spouse’s earned income in 2019.

Choose the year that gives you the bigger refund. If you are married filing jointly, the total earned 2019 income refers to the sum of each spouse’s earned income in 2019.

Permanent Changes to the EITC

There are 4 major permanent changes to the EITC.

- If Your Qualifying Child Doesn’t Have a Social Security Number

You can claim the EITC for workers without children if you have a qualifying child for the EITC who doesn’t have a Social Security number.

- If You’re Married Filing Separately

If you are married filing separately, you may still qualify for the EITC if your qualifying child lives with you for more than six months of the year and you fulfill at least one of the following requirements:

-

-

- You and the qualifying child do not live with your spouse during the last six months of the taxable year

- You and your spouse have a decree, instrument, or agreement (besides a divorce decree) and do not live together

-

Note: Filing taxes as married filing separately may affect your eligibility for other tax benefits. Please consult a tax professional if you need help determining your filing status.

Please consult a tax professional if you need help determining your filing status.

- If You Have Investment Income

The maximum investment income allowed to claim the EITC is permanently increased to $10,000 from $3,650.

- If You Live in a U.S. Commonwealth or Territory

Starting in 2021, individuals living in the following U.S. Commonwealths and territories are allowed to claim the EITC:

-

-

- Puerto Rico

- U.S. Virgin Islands

- Guam

- The Commonwealth of the Northern Mariana Islands

- American Samoa

-

Recommended for you

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

Earned Income Credit (EITC): Definition, Who Qualifies

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Here is a list of our partners.

In general, the less you earn, the larger the credit. Families with children often qualify for the largest credits.

Written by Sabrina Parys, Tina Orem

Reviewed by

Lei Han

At NerdWallet, we have such confidence in our accurate and useful content that we let outside experts inspect our work.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

What is the earned income tax credit (EITC)?

The earned income tax credit, also known as the EITC or EIC, is a refundable tax credit for low- and moderate-income workers.

For the 2022 tax year, the earned income credit ranges from $560 to $6,935 depending on tax-filing status, income and number of children. In 2023, the credit will be worth $600 to $7,430. People without children can qualify.

If you fall within the guidelines for the credit, be sure to claim it on your return when you do your taxes. And if you didn’t claim the earned income credit when you filed your taxes in the last three years but think you qualified for it, the IRS encourages you to file an amended tax return so you can get that money back.

Internal Revenue Service

. How to Claim the Earned Income Tax Credit (EITC).

Accessed Oct 20, 2022.

View all sources

How does the earned income tax credit work?

Here are some quick facts about the earned income tax credit:

For the 2022 tax year (the tax return you'll file in 2023), the earned income credit ranges from $560 to $6,935 depending on your filing status and how many children you have.

You don't have to have a child in order to claim the earned income credit.

The earned income tax credit doesn't just cut the amount of tax you owe — the EITC could also score you a refund, and in some cases, a refund that's more than what you actually paid in taxes.

If you claim the EITC, the IRS cannot issue your refund until mid-February by law.

Internal Revenue Service

. Earned Income Tax Credit (EITC).

Accessed Oct 20, 2022.

View all sources

Income limit for the earned income credit (EIC)

Below are the maximum earned income tax credit amounts, plus the max you can earn before losing the benefit altogether.

2022 Earned Income Tax Credit

(for taxes due in April 2023)

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$16,480 | $22,610 | ||

$3,733 | $43,492 | $49,622 | |

$6,164 | $49,399 | $55,529 | |

3 or more | $6,935 | $53,057 | $59,187 |

Both your earned income and your adjusted gross income each have to be below the levels in the table.

In general, the less you earn, the larger the earned income credit.

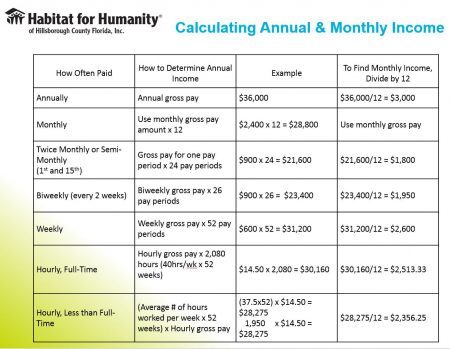

Your earned income usually includes job wages, salary, tips and other taxable pay you get from your employer. Your adjusted gross income is your earned income minus certain deductions.

2023 Earned Income Tax Credit

(for taxes due in April 2024)

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$17,640 | $24,210 | ||

$3,995 | $46,560 | $53,120 | |

$6,604 | $52,918 | $59,478 | |

3 or more | $7,430 | $56,838 | $63,398 |

Who qualifies for the earned income tax credit?

Besides staying below the income thresholds noted above, there are other qualification rules and requirements. Here are the big eligibility rules, but you can also check out our quiz below for a quick read on whether you might qualify for the earned income credit.

Here are the big eligibility rules, but you can also check out our quiz below for a quick read on whether you might qualify for the earned income credit.

You must have at least $1 of earned income (pensions and unemployment don't count).

Your investment income must be $10,300 or less in 2022. In 2023, it can't exceed $11,000.

You can qualify for the EITC if you’re separated but still married. To do so, you can’t file a joint tax return and your child must live with you for more than half the year. You also must have not lived with your spouse during the last six months or you must have a separation agreement or decree.

There are special EIC rules for members of the military and the clergy, as well as for people who have disability income or who have children with disabilities.

Kids and the earned income credit

If you claim one or more children as part of your earned income credit, each must pass certain tests to qualify:

The child can be your son, daughter, adopted child, stepchild, foster child or grandchild.

The child also can be your brother, sister, half-brother or half-sister, stepbrother or stepsister or any of their children (your niece or nephew).

The child also can be your brother, sister, half-brother or half-sister, stepbrother or stepsister or any of their children (your niece or nephew).The child must be under 19 at the end of the year and younger than you or your spouse if you're filing jointly, OR the child must be under 24 if he or she was a full-time student. There's no age limit for kids who are permanently and totally disabled.

The child must have lived with you or your spouse in the United States for more than half the year.

For each child you're claiming with the EITC, you’ll also need:

If you don't have kids

You may be able to get the EITC if you don’t have a qualifying child but meet the income requirements for your filing status. To qualify, you typically must meet three more conditions:

You must have resided in the United States for more than half the year.

No one can claim you as a dependent or qualifying child on their tax return.

You must be at least 24 if you were a student for at least five months of the year, 18 if you were in foster care any time after turning 14 or were homeless in any taxable year, and at least 19 otherwise.

Consequences of an EIC-related error

Not only does an error on your tax form delay the EIC part of your refund — sometimes for several months — but it also means the IRS could deny the entire earned income credit.

If the IRS denies your whole EIC claim:

You must pay back any EIC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information to Claim Earned Income Credit After Disallowance," before you can claim the EIC again.

You could be banned from claiming EITC for the next two years if the IRS finds you filed your return with “reckless or intentional disregard of the rules.”

You could be banned from claiming EITC for the next 10 years if the IRS finds you filed your return fraudulently.

Most tax software walks you through the EITC with a series of interview questions, greatly simplifying the process. (Plus, if you qualify for the EITC, you might be able to get free tax software.) But remember: Even if someone else prepares your return for you, the IRS holds you responsible for all information on any return you submit.

Past years' earned income tax credit

If you need the income thresholds and credit amounts from past years, take a look back.

2020 tax year

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$15,820 | $21,710 | ||

$3,584 | $41,756 | $47,646 | |

$5,920 | $47,440 | $53,330 | |

3 or more | $6,660 | $50,954 | $56,844 |

You can use either your 2019 income or 2020 income to calculate your EITC — you might opt to use whichever number gets you the bigger EITC.

2021 tax year

Number of children | Maximum earned income tax credit | Max AGI, single or head of household filers | Max AGI, married joint filers |

|---|---|---|---|

$1,502 | $21,430 | $27,380 | |

$3,618 | $42,158 | $48,108 | |

$5,980 | $47,915 | $53,865 | |

3 or more | $6,728 | $51,464 | $57,414 |

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

|

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

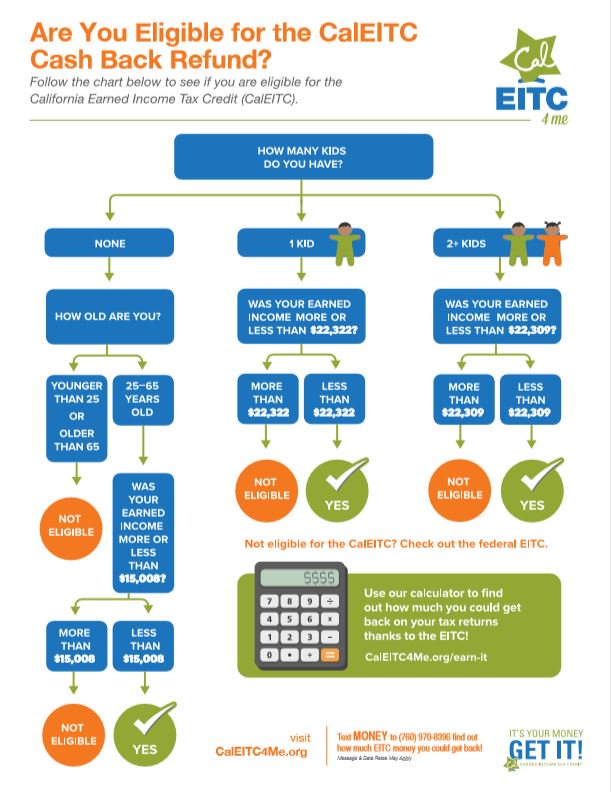

- CalEITC4Me

Earned Income Tax Credit (EITC) is a tax credit for working people with low to moderate income. You may be entitled to a cash refund or a reduction in the amount of tax you owe. There are two EITCs: the California Earned Income Tax Credit (CalEITC) and the Federal Earned Income Tax Credit (EITC).

CalEITC

- You may qualify for CalEITC if: You are at least 18 years old or have a qualifying child 9 child0008

- You received income of $30,000 or less

The number of children entitled

Maximum California income

CALEITC (up to)

Federal EITC (up to)*

Tax loan for younger children 9000 9000 없음

$30,000 90,003 90,002 $255 90,003 90,002 $1,502 90,003 90,002 $0 90,003 90,002 1 90,003 90,002 $30,000

Federal EITC

The Earned Income Tax Credit (EITC) is a federal tax credit for working people with low to moderate incomes. Unlike CalEITC, only people with Social Security numbers are eligible for the program. If you qualify, you may see a reduced tax bill or a larger refund. This is more money in your pocket to pay for what you need.

If you qualify, you may see a reduced tax bill or a larger refund. This is more money in your pocket to pay for what you need.

You can apply for a loan whether you are single or married, have children or not. The main requirement is that you must earn money at work.

You are eligible for a federal EITC if:

- You (or your spouse if filing jointly) are at least 19 years old.

- You (or your spouse if you file jointly) and all qualifying children have a Social Security number; and

- You (and your spouse, if filing jointly) have lived in the United States for more than half of the tax year; and

- You (and your spouse if filing jointly) cannot be claimed as a dependent or eligible child on someone else's declaration; and

- You are single, applying separately; and

- Your investment income for the tax year is $10,000 or less; and

- Earned at least $1 in income and no more:

The number of children

Lonely employee with an income less than:

Working workers with income less than:

EITC up to

3 or more0003

$51,464

$57,414

$6,728

2

$47,915

$53,865

$5,980

1

$42,158

$48,108

$3,618

$21,430

$27,380

$1,502

Was I eligible last year?

Did you know that you can amend your three-year-old tax returns if you find out you qualify for tax credits that you didn't originally claim?

Good news; you can still get that refundable credit.:max_bytes(150000):strip_icc()/ScreenShot2021-05-05at3.12.40PM-ad486e92d61441a9b09a3e39b758696c.png) Review the table below to see if you were eligible and how much you could qualify for in 2020.

Review the table below to see if you were eligible and how much you could qualify for in 2020.

Dependent children or relatives

AGI Maximum Adjusted Gross Income (declaring as single, head of household or widower)

AGI Maximum Adjusted Gross Income (jointly reporting as married)

$ 15.820

$ 21,710

1

$ 41,756

$ 47,646

2

$ 47,440

$ 53,330

3

9000 $ 9000,000,000,844 9000,844EITC Temporary Extensions for Tax Year 2021 only

There are 2 key EITC Temporary Extensions.

- If you do not have eligible children. You may qualify for the EITC program if you are 19 years of age or older and not a student. There are two exceptions:

- If you are a student, you must be at least 24 years old to qualify for the EITC.

- If you are a qualified homeless teen or a qualified former foster teen, you are eligible for the EITC program if you are at least 18 years old.

- If your 2021 income is lower than your 2019 income, you can use your 2019 earned income to calculate your EITC. Choose the year that gives you the most return. If you are married and filing jointly, total earned income for 2019year refers to the amount of earned income of each spouse in 2019.

Note:

- The federal EITC has special rules for members of the military, clergy, and certain people with disabilities.

- Tax credits such as CalEITC and EITC are not considered public benefits under USCIS.

- Taxpayers with an ITIN (Individual Taxpayer Identification Number) are eligible for CalEITC and YCTC with 2021 taxes

Page not found - portal Vashfinansy.rf

Moscow

Your city:

Moscow

PartnersFor media

Rus Eng

Financial Literacy Week

2021 Check your financial literacy level

Learn to drive

personal finance Find out

how to protect your

rights Financial

calculators How to

talk to children

about money

From October 1, 2021, you can read up-to-date materials on financial literacy on the website

MOIFINANCE.