How do i calculate child support payments

Monthly Child Support Calculator | Office of the Attorney General

- About

- News

- Opinions

- Jobs

- Contact Us

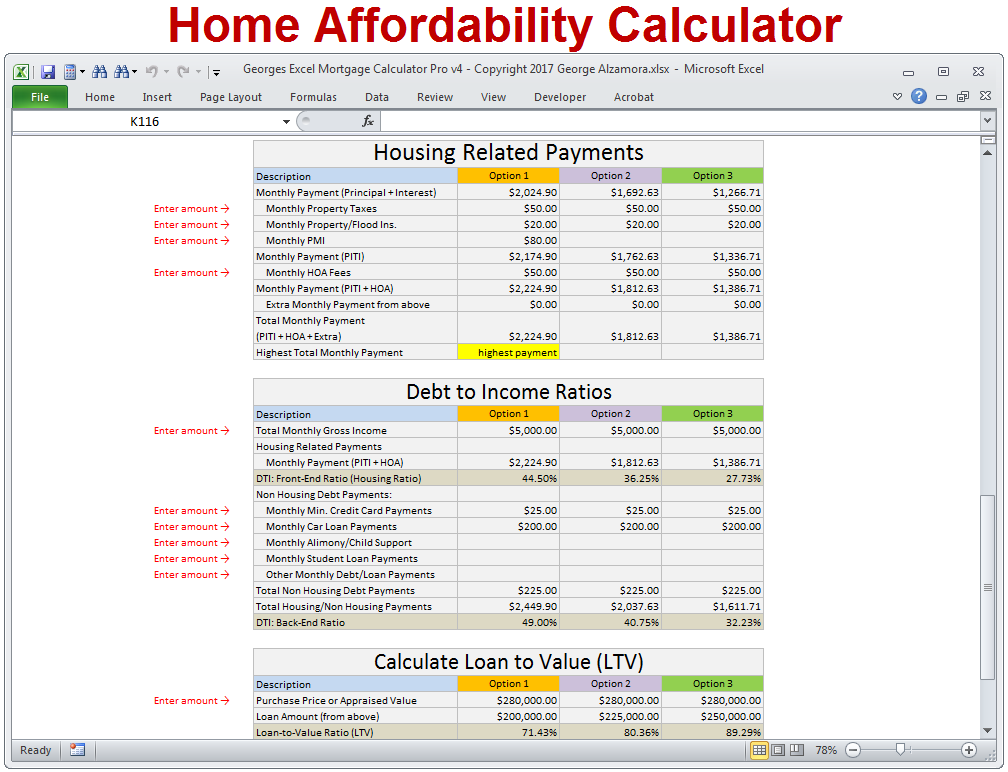

This calculator provides an estimate for a single source of income. The actual amount set or approved by the court may differ.

Income

The person paying support is:

an employeeself-employed

Income Frequency:

YearlyMonthlySemi-MonthlyBi-WeeklyWeeklyHourly

Amount:

Deductions

Medical Support

If you are providing (or can provide) health insurance for your children, enter the monthly premium amount.

Dental Support

If you are providing (or can provide) dental insurance for your children, enter the monthly premium amount.

Union Dues

If you are a member of a union and make regular payments to be a member of the union, enter the monthly dues amount.

State Income Tax

If you work or reside in a state where a state income tax is assessed against your income, enter the monthly amount.

Support Order Determination

Children in this Action

Enter the number of children under age 18 in the child support order.

Children outside this Action

Enter the number of other children for whom you have a legal duty to support.

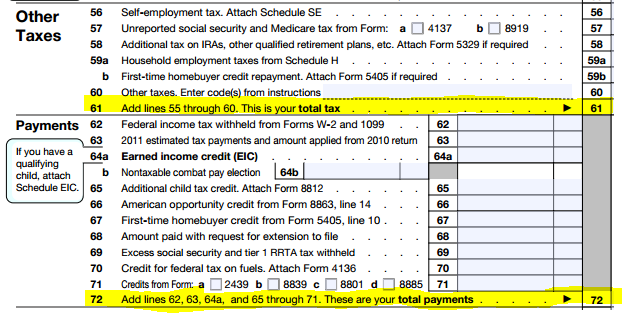

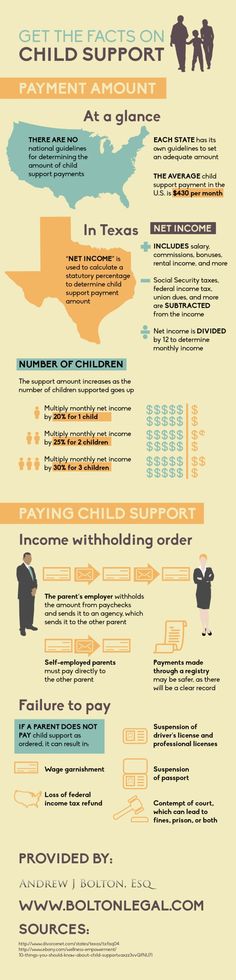

Support Order Calculations

Monthly Gross Income

Monthly OASDI, Medicare, and Federal Taxes

Monthly OASDI Taxes

Monthly Medicare Taxes

Monthly Federal Income Taxes

Monthly Income

Other Deductions

Medical Support Deduction

Dental Support Deduction

Union Dues Deduction

State Income Tax Deduction

Net Resources

Low-Income Child Support Guidelines Percentage:

Texas Family Code Sec. 154.125 Low-Income Child Support Guidelines are used in actions filed on or after 9/1/2021

154.125 Low-Income Child Support Guidelines are used in actions filed on or after 9/1/2021

Projected Monthly Child Support Obligation for net resources up to $9,200

**The Guidelines for the support of a child are specifically designed to apply to monthly net resources not greater than $9,200. This calculator does not calculate support in excess of the $9,200 net resource amount per Texas Family Code Sec. 154.125(a).

Indiana Judicial Branch: Child Support Calculator

Indiana Judicial Branch: Child Support CalculatorClose Menu

- Indiana Judicial Branch

- Services

- Current: Child Support Calculator

For Parents

Calculate Child Support Online

Use this calculator to estimate weekly child support payments and produce forms for use in court. Answer questions about children, income, parenting time, health care and other costs and generate only the forms you need to file. Save calculations securely and retrieve them later or share them with other parties to the case or your attorney.

Answer questions about children, income, parenting time, health care and other costs and generate only the forms you need to file. Save calculations securely and retrieve them later or share them with other parties to the case or your attorney.

Child Support Form Packets

Access forms with instructions for unrepresented litigants from the Coalition for Court Access website.

Get Legal Help

Even if you don't hire a lawyer to handle your case, you may want to talk with a lawyer before filing legal documents (or papers) with the court. Here you can find information about how to get legal help, including how to find low cost or no cost legal aid (pro bono).

For Practitioners

Calculate Child Support Online

Use this calculator to estimate weekly child support payments and produce forms for use in court. Enter information about children, income, parenting time, health care and other costs and generate only the forms you need to file. Save calculations securely and retrieve them later or share them with parties to the case, mediators, or judicial officers.

NO LONGER AVAILABLE - Downloadable Calculator for Windows

The Windows version of the child support calculator is obsolete and should no longer be used. Please try one of the online calculators instead.

Print Blank Forms or Complete Forms by Hand

Get the updated child support forms in Microsoft Word and Adobe PDF format. The PDF forms can be filled in on the computer and then printed for easier readability.

For Both Parents and Practitioners

Read the Child Support Guidelines

The new Indiana Child Support Guidelines include an updated schedule for calculation of support, changes related to health care costs, and other changes.

Read the Parenting Time Guidelines

The Indiana Parenting Time Guidelines are based on the premise that it is usually in a child's best interest to have frequent, meaningful and continuing contact with each parent, and so are designed to help parents make decisions on parenting time.

How is the amount of alimony determined? | Juristaitab

From now on, the subsistence minimum is separated from the so-called minimum wage, which has raised the subsistence minimum every year until now. HUGO lawyer Vahur Kõlvart explains the nature of the new system below.

In the future, minimum child support will have five different components.

A base amount of at least 200 euros per child, indexed annually to the previous year's consumer price index (which will be officially published by Statistics Estonia on 1 April). After indexation, the base amount resulting from indexation in the previous year is considered the base amount for the next year. nine0003

3% of the country's average monthly gross salary for the previous year is added (which is also officially published by Statistics Estonia on 1 April).

Number of children supported in one family - in this case, the amount of maintenance for subsequent children is reduced by 15 percent compared to the amount of maintenance for the first child. The amount of maintenance is not reduced in the case of twins/twins and in the case of children with a difference in age of more than three years. nine0003

The amount of maintenance is not reduced in the case of twins/twins and in the case of children with a difference in age of more than three years. nine0003

Family allowances - in comparison with the past, the law clearly states that the parent is not obliged to support the child to the extent that the needs of the child can be met by the child allowance and the multi-family allowance. If the benefit claimant receives these benefits, half of the benefit is deducted from the allowance for each child. However, if the recipient of the benefit is a payer, this amount is added to the alimony.

Child living together - if the child lives with the parent who pays support for an average of at least 7 days per month per year, the amount of support is reduced in proportion to the time spent with the obliging parent. Therefore, if the child lives equally with both parents, maintenance can only be collected if this is due to the greater needs of the child, a significant difference in the income of the parents, or an uneven distribution of expenses related to the child between the parents. nine0003

nine0003

Example:

The child lives with the mother, stays with the father for an average of 10 days per month, and a child allowance of 60 euros is paid to the account of the child's mother. The minimum allowance per child is 70.43 euros.

Base amount: 200 euros 3% of the average salary for the previous year: the average gross salary in 2020 was 1448 euros per month, of which 3% is 43.44 euros.

Family allowances: half of the child allowance is deducted from the parent's maintenance obligations (60/2=30), then the amount of maintenance is 213.44 euros (243.44-30). nine0009 Cohabitation: If the child lives with the parent in charge of maintenance between 7 and 15 days per month, the amount of maintenance may be further reduced according to the number of those days. The basis is how many percent of the time the child spends with the parent responsible for child support. 15 days count as half a month. In this example, the child spends 10 days or 66. 7% of the required time (10/15) with the parent responsible for child support. Subtracting the necessary time from the maintenance of one parent, we get 70.43 euros (216.59-(216.59*0.667)).

7% of the required time (10/15) with the parent responsible for child support. Subtracting the necessary time from the maintenance of one parent, we get 70.43 euros (216.59-(216.59*0.667)).

Using the Department of Justice's child support calculator, each parent can calculate the minimum amount of child support the court is likely to award in their case.

Frequently asked questions. Calculator for calculating alimony and a new procedure for paying the minimum amount of alimony

Basic rules for the amount of alimony collected by the court before January 1, 2022:

-

- all children who, based on a court decision in 2021, are entitled to receive maintenance in the amount of 292 euros per month, will continue to receive maintenance in the amount of 292 euros per month;

- for all children who, on the basis of a court decision in 2021, are entitled to receive maintenance as an annual change in the amount of more or less than 292 euros per month (for example, in the amount of 25% of the minimum monthly wage or twice the amount from the statutory minimum amount of alimony), the amount will continue to change depending on changes in the minimum monthly wage rate; nine0052

- all children who have been awarded child support by a court in the form of a certain amount (for example, 200 or 500 euros per month) will continue to receive child support in the same amount.

If the alimony has already been collected by the court, this amount will not change from January 1, 2022. Starting from the new year, the only difference from the previous alimony cases is that if the court determined the amount of alimony in the amount of half the minimum monthly wage or in the form of a statutory minimum amount of alimony (depending on the wording of the court decision), this amount will no longer be increase from next year, but will remain at the level of 2021 (292 euros per month for one child). If a parent or child does not agree with this amount, you can apply to the court to change the amount of child support. At the same time, it is important to keep in mind that when reviewing the amount of alimony, the court proceeds primarily from the fact that the amount of alimony covers the actual needs of the child.

If the alimony is fixed in a notarial agreement, then this amount will not change from the new year. If the amount of alimony is fixed in the notary agreement as a variable amount (tied to the minimum monthly wage rate or the minimum amount of alimony established by law), then, unlike court decisions, these amounts will change in accordance with the change in the minimum monthly wage rate from January 1, 2022 . In 2022, half of the minimum monthly wage is 327 euros. nine0003

In 2022, half of the minimum monthly wage is 327 euros. nine0003

If the parents have notarized the amount of support to be paid to the child and the circumstances affecting the amount of support have changed significantly, this may give rise to an emergency termination of the maintenance agreement. To do this, the parent who is obligated to provide maintenance does not need to go to court, but can do so by filing an application to the other parent to terminate the agreement. The Supreme Court found that the termination of the maintenance agreement may be based, among other things, on the fact that the circle of persons entitled to receive maintenance from the parent obliged to provide maintenance has changed (for example, more children are born in the family of the parent obliged to provide maintenance) or the income of the obliged parent the income of the eligible parent has significantly decreased or increased. nine0003

If enforcement proceedings have been initiated based on such an agreement, the obligated parent (debtor) may file a non-enforcement action based on a partial or total termination of the maintenance agreement.

The automatic adoption of new decisions in previous cases of alimony or the automatic change in the amounts of alimony collected in accordance with previous decisions would be contrary to the principle of the legal force of court decisions. There is no reason to believe that the change in the statutory minimum support amount has changed the child's needs or the parent's ability to pay court-ordered support. nine0003

If the court has previously awarded child support, all the circumstances of the case must be re-examined to determine how much support in a particular case would be justified in light of the new regulation and would meet the needs of that child. Such decisions cannot be made automatically.

The application provision of the alimony bill was a compromise between many parties with opposing interests and without it the bill most likely would not have passed. nine0003

-

- Oblige parent A to pay child X monthly maintenance in the amount of 200 euros per month from August 18, 2021, until child X reaches the age of majority.

- The amount of alimony will remain the same, since the alimony was collected in the form of a certain amount.

- The amount of alimony will remain the same, since the alimony was collected in the form of a certain amount. - Collect from parent B in favor of child X monthly maintenance in the amount of 132 euros per month from 12/01/2020, but not less than 45% of the minimum maintenance rate prescribed by law per month until child X reaches the age of majority. - nine0078 The amount of alimony remains tied to the minimum monthly wage rate set by the Government of the Republic, and will continue to change as this rate changes. For example, in 2022, the new amount of alimony in this case will be 147.15 euros per month (45% of half of the minimum monthly wage rate, which in 2022 will be 654 euros per month).

- To recover from March 1, 2021 from parent C until child X reaches the age of majority in favor of child X alimony, the amount of which corresponds to ½ of the minimum monthly wage rate approved by the Government of the Republic. - nine0078 From January 1, 2022 and in future years, the amount of maintenance will remain at the level of 292 euros and will no longer depend on changes in the minimum monthly wage.

- To collect from parent D for the maintenance of child X monthly alimony in the amount of 270 euros, but not less than the minimum monthly wage rate established by the Government of the Republic until child X reaches the age of majority. — From January 1, 2022 and in subsequent years, the amount of alimony will remain at the level of 292 euros and more will not be subject to changes in the minimum monthly wage rate.

- Collect from parent E in favor of child X monthly alimony from June 01, 2020 until child X reaches the age of majority in the amount provided for in part 1 of article 101 of the Family Law - From on January 1, , 2022 and in subsequent years, the amount of alimony will remain at the level 292 euros and more will not be subject to changes in the minimum monthly wage rate. Although the amount of alimony here is tied to a specific article of the Family Law, which establishes a minimum rate of alimony and which changes from January 1, 2022, the law in force at the time of the judgment must be observed, since at the time of the judgment the court did not know if this situation would change in the future and how.

However, together with the amendment to the law, an applicable provision is applied, which provides that if, according to a court decision made before January 1, 2022, a parent is obliged to pay maintenance to a minor child on a monthly basis in the amount of the minimum rate of statutory maintenance or half of the minimum monthly wage rate, it is considered that from January 1, 2022, according to the court order, the parent is obliged to pay child support in the amount of 292 euros per month.

However, together with the amendment to the law, an applicable provision is applied, which provides that if, according to a court decision made before January 1, 2022, a parent is obliged to pay maintenance to a minor child on a monthly basis in the amount of the minimum rate of statutory maintenance or half of the minimum monthly wage rate, it is considered that from January 1, 2022, according to the court order, the parent is obliged to pay child support in the amount of 292 euros per month. - To collect from parent F for the maintenance of child X from 08/01/2020 until child X reaches the age of majority, monthly alimony in the amount of the minimum rate provided for in Section 101, paragraph 1, of the Family Law (that is, half of the minimum monthly wage rate established by the Government of the Republic, which from 01.01. 2020 amounts to 292 euros), of which the defendant has the right to preliminarily deduct from the monthly maintenance payable to the plaintiff 50% of the monthly child allowance paid to the plaintiff in accordance with section 17 of the Family Benefits Act (in 2019year, the full rate of the child allowance was 60 euros per month).

– From 1 January 2022 and in future years, the amount of child support will remain at 292 euros, from which half of the child allowance will be deducted, and this amount will no longer depend on the change in the minimum monthly wage rate. However, this amount depends on the change in the child allowance rate.

– From 1 January 2022 and in future years, the amount of child support will remain at 292 euros, from which half of the child allowance will be deducted, and this amount will no longer depend on the change in the minimum monthly wage rate. However, this amount depends on the change in the child allowance rate.

- Oblige parent A to pay child X monthly maintenance in the amount of 200 euros per month from August 18, 2021, until child X reaches the age of majority.

According to the court order, I was charged a higher amount of child support than the calculator shows, according to which I would have to pay according to the new formula. Where should I apply? nine0079

Calculated using a calculator based on the average gross monthly wage, child support is the minimum amount a parent must pay to their child each month. The actual amount of child support depends primarily on the needs of the child, as well as on the financial situation of each parent and the distribution of expenses for the child between the parents. Thus, the actual amount may be greater than the amount calculated by the calculator. However, if the child or one of the parents does not agree with the amount of support collected before January 1, 2022, you can apply to the court to change the amount of support based on a change in the legal situation. However, in court proceedings, the court proceeds not only from the results calculated using the calculator, but also takes into account all the circumstances in general, including, in particular, the actual needs of the child. nine0003

However, if the child or one of the parents does not agree with the amount of support collected before January 1, 2022, you can apply to the court to change the amount of support based on a change in the legal situation. However, in court proceedings, the court proceeds not only from the results calculated using the calculator, but also takes into account all the circumstances in general, including, in particular, the actual needs of the child. nine0003

In the calculator, it is not possible to enter an amount of wages lower than the average monthly gross wage in Estonia, since the average monthly gross wage is the basis for calculating the minimum maintenance, and the court can only order maintenance in an amount less than the minimum amount of maintenance for a good reason, for example, if the parent is disabled or if their other children would be at a financial disadvantage. Under the Family Law Law, low income is not grounds for reducing the minimum amount of child support. nine0003

How and on what basis is the time spent with the parent liable to pay child support deducted from the child support amount?

Both parents are required to support their minor children, and child support must normally cover half of the monthly child support expenses (the other half is covered directly by the other parent). Thus, in fact, one parent is obliged to ensure the maintenance of the child within 15 days every month.

Thus, in fact, one parent is obliged to ensure the maintenance of the child within 15 days every month.

If a parent who is obliged to pay alimony spends at least 7 days a month with a child, then when calculating the minimum alimony, the amount of alimony is reduced for this time.

Thus, if a parent living separately spends with the child, for example, 8 days a month, then it is assumed that he will also meet the needs of the child directly at this time, and, therefore, when calculating the minimum amount of alimony, the amount will be proportionally reduced. nine0003

Calculation progress:

Time spent with responsible parent: 8 days or x%

Minimum support time: 15 days or 100%

(8 days × 100%) ÷ 15 days = 53, 33%

The child lives with the obligated parent every month for 53.33% of the obligated time. Therefore, the amount of alimony is reduced by this percentage.

(Please note that an error was made in the explanatory note to the law during the calculation)

When is the allowance for large families taken into account?

According to the law, the parent is not obliged to provide for the maintenance of the child to the extent that the needs of the child can be met through the child allowance and allowance for a large family. The explanatory note to the law contains a clarification that “taking into account the allowance for a large family when reducing the amount of alimony is justified, first of all, in situation , when the children on whom this allowance is paid (three or more children) are joint children of the person obliged to pay maintenance of the parent and the parent, mainly raising children. nine0003

The explanatory note to the law contains a clarification that “taking into account the allowance for a large family when reducing the amount of alimony is justified, first of all, in situation , when the children on whom this allowance is paid (three or more children) are joint children of the person obliged to pay maintenance of the parent and the parent, mainly raising children. nine0003

Thus, since there are many different life situations and family models, it is not advisable to prescribe them in the law, and thus the law does not directly determine whether the allowance for a large family should be taken into account in the case of the so-called. patchwork families. Parents must either come to an agreement on this issue themselves, or, depending on the situation, it will be decided by the court if such a claim reaches the court.

The child support calculator takes into account the family allowance for a large family only if this allowance is received for the joint children of the parent who requires support and the parent who is obliged to pay support. That is, if a family receives an allowance for a large family, because the family still has children with a new life partner, etc., then the calculator does not deduct the allowance for a large family from the amount of alimony. nine0003

That is, if a family receives an allowance for a large family, because the family still has children with a new life partner, etc., then the calculator does not deduct the allowance for a large family from the amount of alimony. nine0003

What about lawsuits that started under the old law?

With regard to claims for the recovery of alimony filed last year, the court proceeds from the claimant's claim and from the current law. Pursuant to article 6 of the Code of Civil Procedure, procedural actions in civil cases are carried out in accordance with the law in force at the time of these actions. Thus, in relation to pending cases on the recovery of alimony, the court makes a decision in accordance with the current law. nine0079

Since 2022, only the procedure for determining the minimum amount of alimony has changed, and in connection with this, the amount of the minimum alimony. The general principle of determining the amount of alimony remained the same. Section 99 of the Family Law provides that the amount of support is determined on the basis of the needs of the person entitled to receive support and his usual way of life. When determining the maintenance, all the vital needs of the entitled person shall be taken into account, including the costs associated with his education and professional training, corresponding to his abilities and inclinations, in the case of a minor dependent, also the costs associated with his upbringing. nine0003

Section 99 of the Family Law provides that the amount of support is determined on the basis of the needs of the person entitled to receive support and his usual way of life. When determining the maintenance, all the vital needs of the entitled person shall be taken into account, including the costs associated with his education and professional training, corresponding to his abilities and inclinations, in the case of a minor dependent, also the costs associated with his upbringing. nine0003

Thus, the court determines the needs of the child and the possibilities of his parents, including on the basis of the amended Family Law, and on this basis determines the amount of maintenance required. If maintenance was collected at the old minimum maintenance rate (292 euros), then, according to the new rules, the court may require the plaintiff to provide additional evidence or explanations about the actual expenses for the child in that part that exceeds the minimum calculated under the new law. If necessary, during the course of the trial, the plaintiff may also modify or clarify his claim. nine0003

If necessary, during the course of the trial, the plaintiff may also modify or clarify his claim. nine0003

The procedure for the minimum amount of alimony is provided only for minor children. From the moment the child reaches the age of 18, the general basis for determining maintenance (the standard of living of the person in need of maintenance and the ability of the person liable to provide maintenance) applies, so there is no fixed minimum amount. Therefore, this is not reflected in the calculator.

If children grow up in different families, then a person just needs to add these amounts together - you can simultaneously calculate alimony for children of one family. In such a situation, the amount of alimony from the second child does not decrease, since there is no savings when raising several children at the same time. nine0003

The bill establishes a formula for calculating the minimum amount of alimony. According to the new regulation, parents may agree or the court may order maintenance in excess of the minimum amount of maintenance if the needs of the child and/or the income of the obligated parent are higher. The court may order maintenance less than the minimum amount of maintenance only in exceptional cases , for example, if the obligated parent is unable to work or if the other children of the obligated parent would be in a worse situation than the children receiving support. nine0003

The court may order maintenance less than the minimum amount of maintenance only in exceptional cases , for example, if the obligated parent is unable to work or if the other children of the obligated parent would be in a worse situation than the children receiving support. nine0003

The Family Law provides that parents can clarify the fulfillment of the obligation to support the child by agreement between themselves and determine in what way and for what period the maintenance should be provided. The agreement does not exclude or limit the filing of a claim arising from the law, subject to the provisions of the agreement. Thus, the parent primarily raising the child has the right to go to court regardless of the agreement. The court proceeding will determine the child's expenses and needs, as well as the parent's ability to pay support. nine0003

The Family Law provides that parents have equal rights and obligations with respect to their children, unless otherwise provided by law. The parent has the duty and the right to take care of his minor child. If the parents with the joint right of custody permanently live separately or for some other reason do not wish to further jointly exercise the right of custody, then each of the parents has the right to petition the court in non-contentious proceedings for partial or complete transfer of the right of custody over the child to him (Part 1 of Article 137 of the Family Law). nine0003

The parent has the duty and the right to take care of his minor child. If the parents with the joint right of custody permanently live separately or for some other reason do not wish to further jointly exercise the right of custody, then each of the parents has the right to petition the court in non-contentious proceedings for partial or complete transfer of the right of custody over the child to him (Part 1 of Article 137 of the Family Law). nine0003

Regardless of the right of custody, a parent has the right to communicate with their child. Part 1 of Article 143 of the Family Law provides that a child has the right to communicate personally with both parents. Both parents are obliged and have the right to communicate with the child personally. According to paragraph 2 of the same article, the parent must refrain from actions that harm the relationship with the other parent or complicate the upbringing of the child. If you are not allowed to communicate with your child, you should apply to the court to determine the order of communication with the child, but this is not a reason for not paying child support.