How old can i claim a dependent child

How Long Do Kids Stay Dependents?

Once you are a parent, you never stop being a parent. You stayed up with your kids when they had the flu, helped them study for the ACT, cheered them on at their graduation. You have been there for their highs, lows, and everything in between. You will continue to care, love, and support your children for the rest of your life.

But will there ever be a time they can fly away from the nest?

According to the federal government, the answer is yes!

From the time your children were born, you claimed them as dependents on your federal and state taxes, which has saved you money on your taxes over the years. The decision to claim children as dependents rests on a myriad of factors, let’s see how those could affect you this year.

In the Nest – How Long You Can Claim

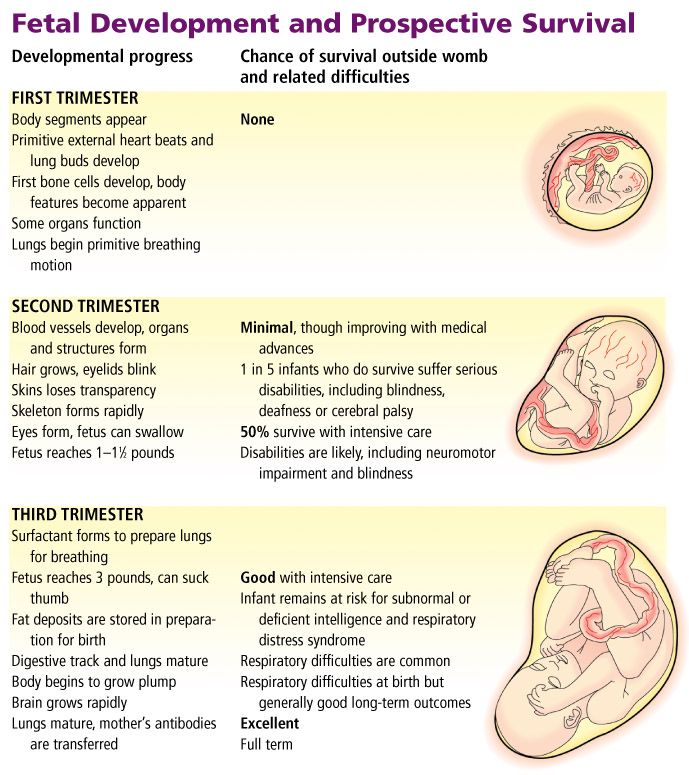

The federal government allows you to claim dependent children until they are 19. This age limit is extended to 24 if they attend college. If your child is over 24 but not earning much income, they can be claimed as a qualifying relative if they meet the income limits and/or if they are permanently disabled. It is important to know that there is no age limit if your child is permanently disabled.

Other factors that contribute to your ability to claim your children as dependents are:

- Amount of time your children live with you

- Your child must live with you for at least 6 months before you can claim them as a dependent.

- Financial support

- If your child makes more than half of their own support during the tax year, they cannot be claimed as a dependent. This support consists of housing, food, education, medical care, insurance, and recreational spending.

- Marital Status

- If you are not married and the child lived with you and the other parent half of the time, the person with the highest adjusted gross income will often take the deduction. This, however, can be negotiated.

- If you pay child support but the child lives with you for less than half of the year, you cannot claim the child as a dependent unless you have a signed Form 8332.

Still unclear if you can claim your child as a dependent? The IRS has a questionnaire here you can use to find out. Simply answer a few questions and the IRS will tell you whether or not you are eligible to claim a person as your dependent on your taxes.

For many families, the longer they are able to claim their children as dependents the better it will be. But the new Tax Cuts and Job Act has changed the way parents claim dependents. Prior to 2018, parents were able to receive a personal exemption that reduced taxable income. For example, in 2017, a married couple filing jointly could take a $4,050 exemption for themselves and each dependent. The new tax law has suspended that exemption benefit from 2018-2025. This means that parents will need to use other tax exemptions to help make up for the loss of the child exemptions.

Out of the Nest

Since the exemption for dependents is suspended until 2025, parents have to look for other tax credits and deductions that can help them on their tax bill. Here are a couple of credits to keep an eye on.

Here are a couple of credits to keep an eye on.

This is just one of the many examples of how our comprehensive tax planning creates value for our clients. See other important tax planning topics on our website, here.

- Earned Income Credit

- This credit is based on the amount of money you earn in a tax year. Designed to benefit low to medium income families with children, this credit will allow you access to a certain amount of money based on your income and the number of children you have. $6,431 is the maximum earned income credit available for 2018 for three children and parents earning no more than $54,884. For two children the maximum credit is $5,716 with an income threshold of $51,492. $3,461 is the maximum credit for one child with the parents’ income being less than $46,010. Remember, for any credit, your child must pass the qualifying child test.

- Child Tax Credit

- The Tax Cuts and Jobs Act stipulates that parents with qualifying children are eligible to receive a $2,000 refundable credit per child.

A refundable credit will allow some or all of the credit to be refunded to the taxpayer after the tax liabilities are met. The reform allows for up to $1,400 of the credit to be refunded. The $2,000 credit is an increase from the $1,000 limit in 2017 and is set to stay until 2025. Additionally, under the new tax law, many more families will qualify for this particular tax credit as the income limit has increased.

A refundable credit will allow some or all of the credit to be refunded to the taxpayer after the tax liabilities are met. The reform allows for up to $1,400 of the credit to be refunded. The $2,000 credit is an increase from the $1,000 limit in 2017 and is set to stay until 2025. Additionally, under the new tax law, many more families will qualify for this particular tax credit as the income limit has increased. - If your child does not qualify for the tax credit, the new tax code does offer a $500 benefit per child. This is a non-refundable tax credit which means that the credit is limited to the tax liability and nothing is refunded.

- The Tax Cuts and Jobs Act stipulates that parents with qualifying children are eligible to receive a $2,000 refundable credit per child.

The new Tax Cuts and Jobs Act has changed the way parents will claim dependents in 2018. Therefore it is important to understand the nuances of the IRS qualifying system, exemptions that may or may not be applicable, and the other forms of tax credits available to you.

Related Video – Claiming College Students as Dependents

If you want personal advice on how to claim your dependents, contact us!

Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Let's learn more about each other.

Ready to Get Started?

Rules for Claiming Dependents on Taxes

Editor’s Note: Relationship changes and job loss can all affect who is living in your house and, therefore, claiming dependents on your tax return. Here are the most important rules that you need to know about claiming dependents before preparing your taxes this year.

Few things are more important than family. These are the people we share special memories with…the people we rely on when we hit tough spots.

However, sometimes you are the family member who helps others out. Maybe your grandmother couldn’t live safely on her own anymore, so she moved in with you this year. Maybe your uncle lost his job so he’s been staying with you.

This is what family is about – helping each other, regardless of the burden. But the extra expense of additional family members can put a financial strain on you. The rising costs of food, electricity, gas, and water can all add up quickly.

The rising costs of food, electricity, gas, and water can all add up quickly.

Special Rules for Claiming Dependents on Tax Returns

There are a few rules to help you navigate claiming dependents on tax returns – and decide who you should and shouldn’t claim as tax dependents:

The DOs: Who Can I Claim as a Dependent?

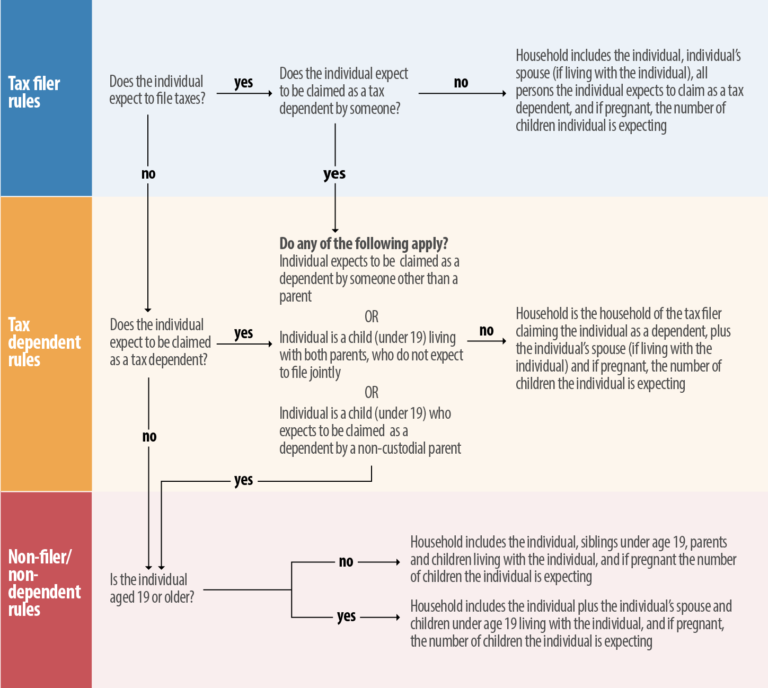

You can only claim dependents who are either a qualifying child or a qualifying relative.

DO claim all qualifying children that were born or adopted within the tax year. Even if your child was born on December 31, your child may be able to be claimed as a dependent on your taxes. To qualify as a dependent, the child must:

- Be under age 19, a full-time student under age 24 or permanently and totally disabled;

- Not provide more than one-half of the child’s own total support; and

- Live with you for more than half of the year.

DO claim certain family members (such as parents, grandparents, aunts or uncles, nieces or nephews) as qualifying relatives. You should claim certain family members only if:

You should claim certain family members only if:

- You provided more than half of the person’s total support for the year;

- They aren’t yours or another taxpayer’s qualifying child; and

- The relative’s gross income is less than the personal exemption amount (which is $4,200 for 2019).

All dependents must be a United States citizen, resident alien of the United States, or resident of Mexico or Canada (with certain adopted children as an exception) and can’t file a joint return (unless it’s to receive a claim of refund of taxes withheld or estimated taxes paid). You can’t claim a dependent if you or your spouse (if filing jointly) could be claimed as a dependent by another taxpayer.

The DON’Ts: Rules for Claiming a Dependent

DON’T claim a child that has lived with you for less than six months of the year. Unless the child was born within the tax year, the child must have lived with you at least six months of the tax year to fall under the qualifying child rules. If you have a child that lives with each of the child’s parents separately for different portions of the year, the parent that cares for the child longer should claim the child as a dependent unless the custodial parent in the divorce has a signed Form 8332. There is an exception to the six-month rule for claiming a qualifying relative, but only if the child can’t be claimed as a qualifying child of any other taxpayer.

If you have a child that lives with each of the child’s parents separately for different portions of the year, the parent that cares for the child longer should claim the child as a dependent unless the custodial parent in the divorce has a signed Form 8332. There is an exception to the six-month rule for claiming a qualifying relative, but only if the child can’t be claimed as a qualifying child of any other taxpayer.

DON’T attempt to claim a child for whom you have paid child support, but lives with you for less than half the year unless you have a Form 8332 signed by the custodial parent.

Help is at Your Fingertips

For additional assistance with the tax rules for claiming a dependent, H&R Block has your back.

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H&R Block to help you navigate the rules for claiming a dependent family member on your taxes.

Dependent children

Developments

Branch of the Pension Fund of Russia in the Chechen Republic informs that in accordance with Federal Law No. 400-FZ of 28.12.2013 “On Insurance Pensions” an increase in the fixed payment to the insurance old-age (disability) pension is established.

In accordance with Article 10 of the above-mentioned Law, disabled family members are, in particular, children under the age of 18, as well as children studying full-time in basic educational programs in organizations engaged in educational activities, including in foreign organizations located outside the territory of the Russian Federation, until they complete such training, but not longer than until they reach the age of 23 or children older than this age, if they become disabled before the age of 18. nine0003

Based on the provisions of Article 10 of Federal Law No. 400-FZ dated December 28, 2013, family members can be recognized as dependents of the insured person if they are fully supported by him or receive assistance from him, which is a permanent and main source of funds for them to existence.

400-FZ dated December 28, 2013, family members can be recognized as dependents of the insured person if they are fully supported by him or receive assistance from him, which is a permanent and main source of funds for them to existence.

At the same time, the dependence of children under the age of 18 is assumed and does not require proof, with the exception of these children who are declared in accordance with the legislation of the Russian Federation as fully capable or who have reached the age of 18. nine0003

Thus, the establishment of an increase in the fixed payment to the insurance old-age (disability) pension, taking into account disabled family members who have reached the age of 18, is possible if there is documentary evidence of the fact that these family members are dependent on the insured person.

The requirement for persons over 18 years of age to prove the fact that they are dependent on their parents is based on the assumption that the person who has reached the age of majority is able to work. Adult citizens can work on full legal grounds, thereby earning their own income to ensure their livelihoods. Accordingly, the presumption of being dependent on parents can no longer be applied to such persons, even if they are studying full-time in basic educational programs in organizations that carry out educational activities. nine0003

Adult citizens can work on full legal grounds, thereby earning their own income to ensure their livelihoods. Accordingly, the presumption of being dependent on parents can no longer be applied to such persons, even if they are studying full-time in basic educational programs in organizations that carry out educational activities. nine0003

At the same time, the fact that a disabled family member has income in connection with the implementation of work, the amount of which does not exceed the subsistence level in the Voronezh Region, cannot serve as an obstacle to recognizing him as a dependent, if the main and permanent source of livelihood is the assistance of a pensioner, and not the specified source of income (must be documented).

The issue of the fact that a disabled family member is dependent is decided by the territorial body of the PFR, including taking into account the current legal regulation, according to which the presence of disabled family members dependent is confirmed by documents issued by housing maintenance organizations or local authorities, documents on income of all family members and other documents stipulated by the legislation of the Russian Federation (other documents may include a court decision). nine0003

nine0003

In addition, according to the Federal Law of December 28, 2013 400-FZ on the occurrence of circumstances (including those affecting the fact of dependence) that entail a change in the amount of the pension, the pensioner is obliged to notify the body providing pensions no later than the next working day after occurrence of the relevant circumstances.

Share news

How to apply for a survivor's pension, who is entitled to such a pension? - Lawyer in Samara and Moscow - representation in court and legal services

HomeQuestions and answers How to apply for a survivor's pension, who is entitled to such a pension?

How to apply for a survivor's pension, who is entitled to such a pension?

A prerequisite for the provision of this assistance is the material maintenance of the deceased members of their family, unable to work for various reasons. Minors are eligible for this assistance. The concept of "children" includes not only the relatives of the deceased, but also his younger sisters, brothers, grandchildren, who at the time of calculating the pension are minors, do not work and cannot independently support themselves. Children under the age of 23, if they are studying and cannot work independently. The natural children of the deceased are over 23 years old, if they are not able to earn money due to their health, which is confirmed by the presence of a disability. As for this category of citizens, it is necessary to take into account the fact that a person’s disability must be established before he reaches adulthood. As for the siblings and grandchildren of the breadwinner who are disabled and unable to support themselves, the latter are only entitled to survivor benefits if they are not supported by someone else and are orphans. Husband (wife) of the deceased, father (mother), adult brother (sister) who care for the young children of the deceased.

Minors are eligible for this assistance. The concept of "children" includes not only the relatives of the deceased, but also his younger sisters, brothers, grandchildren, who at the time of calculating the pension are minors, do not work and cannot independently support themselves. Children under the age of 23, if they are studying and cannot work independently. The natural children of the deceased are over 23 years old, if they are not able to earn money due to their health, which is confirmed by the presence of a disability. As for this category of citizens, it is necessary to take into account the fact that a person’s disability must be established before he reaches adulthood. As for the siblings and grandchildren of the breadwinner who are disabled and unable to support themselves, the latter are only entitled to survivor benefits if they are not supported by someone else and are orphans. Husband (wife) of the deceased, father (mother), adult brother (sister) who care for the young children of the deceased. In this case, only one of the family members who cares for children under the age of 14 receives a survivor's pension. If there are several children, then these payments are paid to the youngest until the age of 14. In this case, only those citizens who care for young children and do not have a personal source of income can apply for a pension. The right to assistance after the death of the breadwinner is for relatives who have retired or received a disability and do not have other relatives who are required to support them by law . Adoptive parents and adopted children have the same status as natural children and parents. If an orphaned child who is already receiving state assistance after the death of his relatives is adopted, then his right to receive payments does not disappear. A survivor's pension is also provided for a non-native father or mother (stepfather or stepmother) who has been dependent on the deceased for the past five years or more. nine0003

In this case, only one of the family members who cares for children under the age of 14 receives a survivor's pension. If there are several children, then these payments are paid to the youngest until the age of 14. In this case, only those citizens who care for young children and do not have a personal source of income can apply for a pension. The right to assistance after the death of the breadwinner is for relatives who have retired or received a disability and do not have other relatives who are required to support them by law . Adoptive parents and adopted children have the same status as natural children and parents. If an orphaned child who is already receiving state assistance after the death of his relatives is adopted, then his right to receive payments does not disappear. A survivor's pension is also provided for a non-native father or mother (stepfather or stepmother) who has been dependent on the deceased for the past five years or more. nine0003

Yours faithfully, attorney Anatoly Antonov.