How can i get social security for my child

Apply For A Child (Under Age 18) | Disability Benefits

SSI provides monthly cash payments to help meet the basic needs of children who have a physical or mental disability or who are blind. If you care for a child or teenager with a disability, and have limited income and savings or other resources, your child may be eligible for SSI.

SSI Eligibility for Children

Children under age 18 can get SSI if they meet Social Security's definition of disability for children and there are limited income and resources in the household. Social Security defines a disability as:

- The child must have a physical or mental condition(s) that very seriously limits his or her activities; and

- The condition(s) must have lasted, or be expected to last, at least 1 year or result in death.

How to Apply

Tell us you want to apply for SSI for a child

Get Started

Other Ways to Apply

Apply By Phone

Call us to make an appointment to file an application at 1-800-772-1213. If you are deaf or hard of hearing, you can call us at TTY 1-800-325-0778.

Begin the Application Online

Applying for SSI requires 2 steps. You will need to complete the online Child Disability Report AND, with the help of a Social Security representative, complete an Application for SSI.

Step 1

TIP: Before completing the Child Disability Report, use our Child Disability Starter Kit to get answers to commonly asked questions about applying for SSI. The kit also includes a worksheet that will help you gather the information you need.

Fill out the online Child Disability Report

The report usually takes about an hour to complete and collects information about the child's disabling condition and how it affects their ability to function.

We will ask you to sign a form that gives the child's doctor(s) permission to give us information about their disability. We need this information so that we can make a decision on the child's claim. In some cases, if the child is over age 12, he or she must sign his or her own medical release.

We need this information so that we can make a decision on the child's claim. In some cases, if the child is over age 12, he or she must sign his or her own medical release.

Start the Child Disability Report

If you previously started a Child Disability Report for this child but did not finish it, you can use your re-entry number to return to your online Child Disability Report.

Step 2

After you submit a report, we will call you within 3-5 business days. Together, we will:

- Review the completed Child Disability Report.

- Discuss whether the income and resources of the household are within the allowed limits.

- Start the SSI application process.

Related Questions

How can I get ready for the disability interview?

- Review the disability starter kit. It includes a checklist and a worksheet to help you gather the information you need.

Have this information with you at the time of the interview.

Have this information with you at the time of the interview. - You can fill out a Child Disability Report.

- For more information visit Benefits for People with Disabilities or call toll-free 1-800-772-1213 (for the deaf or hard of hearing, call TTY 1-800-325-0778).

How will I know what Social Security has decided?

We will send you a letter. It can take 3 to 5 months for us to make a decision on a child’s SSI disability claim. We may also contact you by phone to ask additional questions. Let us know if your address or telephone number changes so that we can get in touch with you.

What if I am more comfortable speaking in a language other than English?

We provide free interpreter services to help you conduct your Social Security business, including helping you complete the SSI application and answering your questions. NOTE: the Child Disability Report is only available in English.

NOTE: the Child Disability Report is only available in English.

Call our toll-free number, 1-800-772-1213. If you need service in Spanish, press 7 and wait for a Spanish-speaking representative to help you. For all other languages, stay on the line and remain silent during our English voice automation prompts until a representative answers. The representative will contact an interpreter to help with your call. You may access the information on this page in Spanish.

Parents and Guardians | SSA

With you through life’s journey...

The makeup of American families has changed in the last 20 to 30 years. Today, family units are diverse, rich in culture, and may include two parents, same-sex parents, only one parent, grandparents, and other relatives. Social Security knows that whether single parent, blended, diverse, small or large, every family is important.

For more than 80 years, Social Security has helped families secure today and tomorrow by providing financial benefits, tools, and programs that help support millions throughout life’s journey. Our programs and services have evolved to meet your unique family needs and especially the children in your care.

Our programs and services have evolved to meet your unique family needs and especially the children in your care.

We are there from day one

Getting your child a Social Security number should be near the top of the list of things you need to do as a new parent or guardian. Your child's Social Security number is the first step in ensuring valuable protection for any benefits they may be eligible for in the future.

You’ll need your child’s Social Security number to claim them as a dependent on your income tax return or open a bank account in the child’s name and buy savings bonds. Your child’s Social Security number is also necessary to obtain medical coverage or apply for any kind of government services for your child.

Most people apply for their child’s Social Security number at birth, usually at the hospital. When the time comes for your child’s first job, the number is already in place. For more information on getting your child a Social Security number and card, check out Social Security Numbers for Children.

A fun bonus of assigning Social Security numbers at birth is that we know the most popular baby names, which we announce each year. On our website, you can find the top baby names for the last 100 years.

We’re there with support if you’re raising a grandchild…

More and more grandparents are finding themselves raising their grandchildren. Social Security will pay benefits to grandchildren when the grandparent retires, becomes disabled, or dies, if certain conditions are met. Generally, the biological parents of the child must be deceased or disabled, or the grandparent must legally adopt the grandchild.

To receive this benefit, your grandchild must have begun living with you before age 18 and received at least one half of his or her support from you for the year before the month you became entitled to retirement or disability insurance benefits, or died. Also, the natural parent(s) of the child must not be making regular contributions to his or her support.

If your grandchild was born during the one-year period, you must have lived with and provided at least one-half of the child's support for substantially the entire period from the date of birth to the month you became entitled to benefits.

Your grandchild may qualify for benefits under these circumstances, even if he or she is a step-grandchild. However, if you and your spouse are already receiving benefits, you would need to adopt the child for them to qualify for benefits.

We’re there when they get their first job

Once your child starts working and throughout their career, employers will verify their Social Security number to help reduce fraud and improve the accuracy of their earnings records.

Employers collect FICA, or Federal Insurance Contributions Act withholdings, and report earnings electronically. This is how we verify earnings and is how your child earns Social Security retirement, disability, and survivors coverage.

Once they turn 18, they can open a my Social Security account and watch their personal earnings and future benefits grow over time.

We’re there to help if disability strikes…

As a working parent, your earnings can become a source of Social Security protection for your family. If you retire or become disabled and unable to work, your earnings would be partially replaced by your monthly Social Security benefit payments.

A child who is disabled may depend on your help for a lifetime. When you start receiving Social Security retirement or disability benefits, your family members also may be eligible for payments. If you are a parent, caregiver, or representative of a child younger than age 18 who has a disability, your child may be eligible for Supplemental Security Income (SSI) payments. More information is provided in the Benefits for Children with Disabilities booklet.

For children 18 years or older who have been disabled before the age of 22 and continue to be disabled, Social Security benefits may be paid to them if you retire, become disabled, or die. Social Security benefits for disabled children may continue as long as they are unable to work because of their disability.

Social Security benefits for disabled children may continue as long as they are unable to work because of their disability.

Additionally, you can find information on the specific benefits and qualifications in the Disability Benefits publication.

We’re there to provide comfort during difficult times…

The loss of a parent or guardian can be both emotionally and financially difficult. Social Security helps by providing benefits to help stabilize the family’s financial future. Widows, widowers, and their dependent children may be eligible for Social Security survivors benefits.

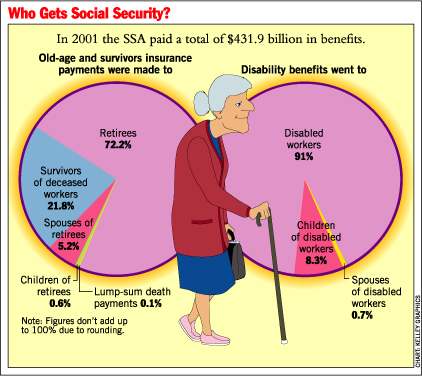

In fact, 98 of every 100 children could get benefits if a working parent dies. And Social Security pays more benefits to children than any other federal program.

Providing protection for parents too…

Even if you have never worked in a job covered by Social Security, as a parent, there are two ways that you may still qualify for benefits.

- If you are a parent and take care of your child who receives Social Security benefits and is under age 18, you can get benefits until your child reaches age 16. Your child's benefit will continue until he or she reaches age 18, or 19 if he or she is still in school full time. Your monthly payments stop with the child’s 16th birthday, unless your child is disabled and stays in your care.

- If you are a parent who receives most of your support from your adult child, and your child dies, Social Security also pays monthly benefits to you under the following conditions:

- You must be at least 62 years old and must not have remarried since the worker (your child)'s death

- You cannot be entitled to your own, higher Social Security benefit; and

- You must be able to show that you received one-half of your financial support from the worker at the time of their death. You must submit this proof of support to Social Security within two years of the worker's death.

We are there for those who need it most…

The Supplemental Security Income (SSI) program helps children with qualifying disabilities by providing critical financial assistance. Children and youth with specific medical conditions—whose families meet certain income and resource limits—can receive SSI from birth until age 18.

If you think your child or someone you know could be eligible for SSI, visit our webpage SSI Eligibility for Children to learn more and apply.

Assisting Youths with Disabilities Transition to Adulthood

The transition to adulthood is one of the most important periods in life’s journey. For foster children living with a disability, it can be even more challenging. Turning 18 triggers an important change in SSI benefits: Social Security must make a new determination on their SSI eligibility using the adult disability standards. About one-in-three such beneficiaries lose their SSI benefits.

For more information, please visit our spotlight page.

Information for parents on new payments for children from 8 to 17 years old in questions and answers

Presidential Decree[1] introduced a new monthly payment to low-income families for children aged 8 to 17 years from May 1. The PFR Department for St. Petersburg and the Leningrad Region receives many questions from parents. The Pension Fund has prepared answers to the most frequently asked questions about the new allowance.

I made a mistake when applying for benefits. How can I fix this?

If an error is made when filling out the application, the Pension Fund will return it to you for revision without issuing a refusal. Changes must be made within 5 business days.

What documents do I need to submit to receive the payment?

To receive a payment, you must submit an application through the Public Services Portal, through the MFC, or contact the PFR customer service at the place of residence.

You will need to provide additional information about income only if the family has military, rescuers, police officers or employees of another law enforcement agency, as well as if someone receives scholarships, grants and other payments from a scientific or educational institution.

How long does it take to receive payment after applying?

Consideration of the application takes 10 business days. In some cases, the maximum period will be 30 working days. If the payment is denied, a notice of this is sent within one business day. Funds are paid within 5 working days after the decision on the purpose of the payment is made. In the future, the transfer of funds is carried out from the 1st to the 25th day of the month following the month for which the allowance is paid.

Can I receive payment via mail?

Yes, you can. To receive money through the post office, you need to mark the appropriate item in the application for payment, as well as indicate the address of the recipient and the number of the post office.

If you receive money in the bank, then only on the Mir card?

Yes, the new payment will be credited only to Mir bank cards. It is important to remember that when filling out applications for payment, it is the details of the applicant's account that are indicated, and not the card number.

Who is entitled to the monthly payment?

The payment is assigned to low-income families that raise children from 8 to 17 years old, subject to the following conditions:

- monthly income per person in the family does not exceed the regional subsistence minimum per capita;

- family property does not exceed the requirements for movable and immovable property;

- the applicant and children are citizens of the Russian Federation permanently residing in the Russian Federation.

One of the parents, adoptive parent or guardian of the child can apply for payment.

When can I apply for the payment?

You can apply from May 1, 2022 and onwards at any time.

The payment is established for 12 months, but not more than until the child reaches the age of 17 years.

Can I receive a payment if I already receive child support for single parents aged 8 to 17?

Yes, you can apply for a new payment. If, after calculating the average per capita income of the family, the new payment turns out to be more profitable in terms of amount, you will be assigned a new payment in an increased amount, that is, 75% or 100% of the child's regional subsistence level, taking into account the paid amounts of the previous allowance. In this case, the payment of the previous benefit will automatically stop.

Do I need to apply for a new payment if I am already receiving child support from 8 to 17 years as a single parent, but my income is still less than the living wage?

Yes. If the income of families who are already receiving allowance for children from 8 to 17 years as single parents still does not reach the living wage, they need to reapply and start receiving a payment at an increased amount, i. e. 75% or 100% of the regional living wage. minimum, and not 50% as before. In this case, the payment of the previous benefit will automatically stop.

e. 75% or 100% of the regional living wage. minimum, and not 50% as before. In this case, the payment of the previous benefit will automatically stop.

My son turned 8 years old in February 2022, will I receive benefits for this period?

No, the allowance is granted from the child's 8th birthday, but not earlier than April 1, 2022.

The Decree of the President says that the allowance is established from April 1, if applications can only be submitted from May 1, then how to get money for April?

For applications submitted before October 1, 2022, the money will be paid for the period from April 1, 2022, but not earlier than the month the child reaches the age of 8 years.

This means that if a family applies for a new payment in the first days of May, then the first payment in May will be for two months at once - for April and May. If the family applies at the end of May, the allowance will be received in June immediately for 3 months - April, May and June.

Is it possible to receive benefits without Russian citizenship?

No.

Does the payment apply to children who are already 17 years old?

The payment is only for children under 17 years of age.

Monthly allowance for each child?

Yes, the allowance is paid for each child from 8 to 17 years old in the family.

The family has two children aged 8 to 17 years. Do I need to write an application for each child?

No, if there are two or more children aged 8 to 17 in the family, one joint application is completed for each of them to receive the monthly payment. Two or more applications are not required in this case.

My application was returned for revision, how long will it take to process it?

The term for consideration of the application is 10 business days. In your case, the deadline has been suspended. If the revised application is received by the FIU within 5 working days, its consideration will be restored from the date of submission.

If the revised application is received by the FIU within 5 working days, its consideration will be restored from the date of submission.

What happens if I don't submit the revised application or documents within 5 business days?

In this case, the payment will be denied and you will need to reapply.

How can I find out if a payment is due or not?

When submitting an application through the Public Services Portal, a notification about the status of its consideration will appear there.

If the application was submitted personally at the PFR client service or at the MFC, in case of a positive decision, the funds will be transferred within the period established by law without additional notice.

In the event of a denial, the applicant will be sent a notice within one business day stating the reason for the denial.

How long is the payment?

The benefit is granted for one year and extended upon application. In 2022, applicants who lost their jobs after March 1, 2022 and are registered with employment centers are subject to a special calculation of average per capita income. Such applicants receive benefits for 6 months. After this period, you can apply for benefits again.

In 2022, applicants who lost their jobs after March 1, 2022 and are registered with employment centers are subject to a special calculation of average per capita income. Such applicants receive benefits for 6 months. After this period, you can apply for benefits again.

How long can I receive the payment?

The allowance is paid from the age of eight until the child reaches the age of 17.

Does the payment depend on family income?

Yes, the payment is due to families whose monthly income per person does not exceed the subsistence level per capita in the region of residence. To calculate monthly income, you need to divide the annual family income by 12 months and the number of family members. Also, when assessing means, family property is taken into account and the “zero income rule” is used.

What is the “zero income rule”?

The “zero income rule” assumes that the allowance is granted if adult family members have earnings (stipends, income from work or business activities or pensions) or the lack of income is justified by objective life circumstances.

Will the money be withheld if I have a debt under an executive document?

No.

I receive unemployment benefits. Will it be taken into account when calculating the average per capita income?

Yes, they will.

Will a car bought on credit be considered in the property appraisal?

Yes.

Does the payment apply to children left without both parents?

Yes. The payment applies to orphans. In this case, their guardian (custodian) has the right to a monthly allowance, but only if the child is not fully supported by the state.

In order to be granted benefits, guardians must personally submit an application to the PFR customer service at the place of residence or at the MFC.

I am a guardian. Can I receive benefits if the parents of the child have been deprived of parental rights?

Yes, you can.

How can I verify my actual place of residence if I do not have a residence registration?

The place of actual residence is determined by the place where the application for the allowance was submitted.

At what subsistence level will my income be calculated if I have two registrations - at the place of residence and at the place of temporary residence?

In this situation, the subsistence minimum at the place of temporary residence will be taken into account.

When calculating income, will the received alimony be taken into account?

Yes.

My family owns an apartment and a residential building, in total their area exceeds the standard of 24 sq. m. m. per person, will I be denied benefits?

No. Restrictions on square meters apply if the family owns several apartments or several residential buildings. When owning one type of residential property, its area is not taken into account.

I registered with the Pension Fund the care of my husband's 86-year-old grandmother and receive benefits for caring for citizens over 80 years old. Will this allowance be taken into account when calculating my income?

Yes.

Do I have to report to the Pension Fund information about changes in family composition and income if they occurred after the application was submitted?

No. Beneficiaries are not required to report changes in income levels to the Pension Fund during the benefit period.

Can I get benefits only for children aged 8 to 17?

No, not only. It also provides for payments for low-income families for pregnant women who registered early, benefits for children from 0 to 3 years old, as well as benefits for children from 3 to 8 years old.

Will the payment be indexed?

Yes. The monthly payment will be indexed annually from January 1st.

Where can I contact if I have any questions about the purpose of the payment?

If you have any questions about this payment, you can call the Unified Contact Center at 8-800-600-0000. In addition, you can ask your question on the official social networks of the PFR or contact any client service of the fund.

[1] Decree of the President of the Russian Federation of March 31, 2022 No. 175 “On Monthly Cash Payments to Families with Children”

Share the news

Questions and Answers

What should I do if I make a mistake while filling out the application?

If you made a mistake when filling out the application, the fund, without making a refusal, will return it to you for revision, which takes 5 working days.

What is the procedure for providing this benefit? What documents and where should the parent send in order to receive the payment? Does the employer participate in this process?

To receive benefits, you only need to submit an electronic application through the State Services portal or contact the client service of the Pension Fund of Russia at the place of residence, you can also apply through the MFC.

You will need to provide additional information about income only if the family has military, rescuers, police officers or employees of another law enforcement agency, as well as if someone receives scholarships, grants and other payments from a scientific or educational institution.

Can I receive benefits only on the Mir card?

Yes, the new payment will be credited to families only on Mir bank cards. It is important to remember that when filling out applications for payment, it is the details of the applicant's account that are indicated, and not the card number.

How long does it take to receive payment after applying?

Consideration of the application takes 10 business days. In some cases, the maximum period will be 30 working days. If the payment is denied, a notification of this is sent within 1 business day.

Funds are paid out within 5 business days after the decision on the purpose of the payment is made. In the future, the transfer of funds is carried out from the 1st to the 25th day of the month following the month for which the allowance is paid.

How do I get benefits?

In most cases, when applying for a payment, you only need to submit an application through your personal account on the State Services portal, in the PFR customer service at the place of residence or at the MFC. The Fund independently collects information about the income of the applicant and his family members as part of the program of interagency cooperation.

You will need to submit documents only if one parent (guardian, trustee) is a military man, rescuer, police officer or employee of another law enforcement agency, as well as if someone in the family receives scholarships, grants and other payments from a scientific or educational institution .

When applying in person, you will need to present an identity document.

Reception at the PFR client services is carried out by appointment. Appointments can be made on the Foundation's website. The service is available to all citizens, including those not registered on the Unified Portal of Public Services. To do this, on the main page of the website of the Pension Fund of Russia, select the "Citizen's Personal Account" item. At the bottom of the page, in the blue field, click on "Make an appointment".

To do this, on the main page of the website of the Pension Fund of Russia, select the "Citizen's Personal Account" item. At the bottom of the page, in the blue field, click on "Make an appointment".

Who is entitled to the monthly payment?

The payment is assigned to low-income families that raise children from 8 to 17 years old, subject to the following conditions:

- monthly income per person in the family does not exceed the regional subsistence minimum per capita;

- family property does not exceed the requirements for movable and immovable property;

- the applicant and children are citizens of the Russian Federation permanently residing in the Russian Federation.

One of the parents, adoptive parent or guardian of the child can apply.

From what date can I apply for the payment?

You can apply from May 1, 2022 and anytime thereafter.

Payment is established for 12 months, but not more than until the child reaches the age of 17 years.

Can I receive payment via Russian Post?

Yes, you can. To receive money through the post office, you need to mark the appropriate item in the application for payment, as well as indicate the address of the recipient and the number of the post office.

Can I receive a payment if I already receive child support for single parents aged 8 to 17?

Yes, you can apply for a payment if, after calculating the average per capita income of the family, the new payment turns out to be more profitable in terms of amount, you will be assigned a new payment in an increased amount, that is, 75 or 100% of the regional subsistence minimum, taking into account the paid amounts of the previous allowance . In this case, the payment of the previous benefit will automatically stop.

You submitted an application before May 1, why is there still no payment?

According to the rules, applications for new benefits are processed within 10 working days. In some cases, this period may be longer, up to 30 working days. An extension of the period is usually necessary if the organizations did not submit information to the Pension Fund on time confirming the family's right to payment. If after this period there is no answer to the application, you should contact the Pension Fund. This can be done in person at the PFR customer service where the application was submitted, or by calling the PFR hotlines: www.pfr.gov.ru/contacts/counseling_center/reg_lines

An extension of the period is usually necessary if the organizations did not submit information to the Pension Fund on time confirming the family's right to payment. If after this period there is no answer to the application, you should contact the Pension Fund. This can be done in person at the PFR customer service where the application was submitted, or by calling the PFR hotlines: www.pfr.gov.ru/contacts/counseling_center/reg_lines

What should I do if I receive a denial of payment due to property that does not actually exist?

In this case, you need to contact the PFR client service or an organization that can document the absence of property in the family's property. For example, in Rosreestr or the Ministry of Internal Affairs. Since it is such organizations that inform the Pension Fund about the presence of a family of this or that property. The document issued by the organization must be submitted to the client service of the Pension Fund at the place of residence. Pre-registration is not required for this. After confirming that the property does not own the property for which the refusal was made, the decision will be reviewed.

Pre-registration is not required for this. After confirming that the property does not own the property for which the refusal was made, the decision will be reviewed.

What to do if the payment is refused due to the lack of documents that were submitted to the Pension Fund?

In this case, you need to contact the branch of the Pension Fund, where the application was submitted, so that the specialists check the information again. To do this, you can contact the Pension Fund in person or by calling the reference numbers of the fund's departments: www.pfr.gov.ru/contacts/counseling_center/reg_lines.

When can I submit a new application if I am denied?

A new application may be submitted at any time after the reason for the denial has been resolved. There is no point in submitting a new application earlier.

Do I need to apply for a new payment if I am already receiving child benefit from 8 to 17 years as a single parent, but my income is still less than the living wage?

Yes. If the income of families who are already receiving allowance for children from 8 to 17 years as single parents still does not reach the living wage, they need to reapply and start receiving payment at an increased amount, i.e. 75 or 100% of the regional living wage instead of 50% as before. In this case, the payment of the previous benefit will automatically stop.

If the income of families who are already receiving allowance for children from 8 to 17 years as single parents still does not reach the living wage, they need to reapply and start receiving payment at an increased amount, i.e. 75 or 100% of the regional living wage instead of 50% as before. In this case, the payment of the previous benefit will automatically stop.

My son turned 8 in February 2022 will I receive benefits for this period?

No, the allowance is granted from the child's 8th birthday, but not earlier than April 1, 2022.

The Presidential Decree says that the allowance is established from April 1, if applications can only be submitted from May 1, then how to get money for April?

For applications submitted before October 1, 2022, the money will be paid for the period from April 1, 2022, but not earlier than the month the child reaches the age of 8 years.

This means that if a family applies for a new payment in the first days of May, then the first payment in May will be for two months at once - for April and May. If the family applies at the end of May, the allowance will be received in June immediately for 3 months - April, May and June.

If the family applies at the end of May, the allowance will be received in June immediately for 3 months - April, May and June.

Is it possible to receive benefits without Russian citizenship?

No

What payment details do I need to provide when applying?

The application must indicate the details of the applicant's bank account: the name of the credit institution or the BIC of the credit institution, the correspondent account, the applicant's account number. The payment cannot be transferred to the account of another person. If the application was submitted with another person's bank details, you can submit a new application with your own bank details.

Payment will be credited only to Mir bank cards.

Does the payment apply to children who are already 17 years old?

The payment is only for children under 17 years of age.

Monthly allowance for each child?

Yes, the allowance is paid for each child from 8 to 17 years old in the family.

The family has two children aged 8 to 17 years. Do I need to write an application for each child?

No, if there are two or more children aged 8 to 17 in a family, one general application is completed for each of them to receive a monthly payment. Two or more applications are not required in this case.

My application was returned for revision, how long will it take to process it?

The term for consideration of the application is 10 business days. In your case, it has been suspended. If the revised application is received by the Fund within 5 working days, its consideration will be restored from the date of submission.

What happens if I don't submit the revised application or documents within 5 working days?

In this case, the payment will be denied and you will need to reapply.

How can I find out if a payment is due or not?

When submitting an application through the Public Services Portal, a notification about the status of its consideration will appear there.

If the application was submitted in person at the client service of the Pension Fund of Russia or at the MFC, in case of a positive decision, the funds will be transferred within the period established by law without additional notice to the applicant.

In the event of a denial, the applicant will be sent a notice within 1 business day stating the reason for the denial.

How long is the payment?

The allowance is granted for one year and extended upon application. Its review takes 10 business days. In some cases, the maximum period will be 30 working days.

In 2022, applicants who lost their jobs after March 1, 2022 and are registered with employment centers are subject to a special calculation of average per capita income. Such applicants receive benefits for 6 months. After this period, you can apply for benefits again.

How long can I receive the payment?

The benefit is paid from the age of eight until the child reaches the age of 17.

Does the payment depend on family income?

Yes, the payment is due to families whose monthly income per person does not exceed the subsistence level per capita in the region of residence. To calculate monthly income, you need to divide the annual family income by 12 months and the number of family members. Also, when assessing means, family property is taken into account and the “zero income rule” is used.

What is the zero income rule?

The "zero income rule" implies that the allowance is awarded if the adult family members have earnings (stipends, income from work or business activities or pensions) or the lack of income is justified by objective life circumstances.

Will the money be withheld if I have a debt under an executive document?

No

I receive unemployment benefits. Will it be taken into account when calculating the average per capita income?

Yes, they will.

Will a car bought on credit be considered in the property appraisal?

Yes.

Does the payment apply to children left without both parents?

Yes. The payment applies to orphans. In this case, their guardian (custodian) has the right to a monthly allowance, but only if the child is not fully supported by the state.

To assign benefits, guardians must personally submit an application to the client service of the Pension Fund of Russia at the place of residence or at the MFC.

I am a guardian. Can I receive benefits if the parents of the child have been deprived of parental rights?

Yes, you can.

In my place of residence there is a local subsistence minimum. Will it be taken into account when calculating benefits?

Yes.

How can I verify my actual place of residence if I do not have a residence registration?

The place of actual residence is determined by the place where the application for the allowance was submitted.

At what subsistence level will my income be calculated if I have two registrations - at the place of residence and at the place of temporary residence?

In this situation, the subsistence minimum at the place of temporary residence will be taken into account.

In our region, the area standard for one person is 18 square meters. meters, and the rules for assigning benefits say that no more than 24 square meters are taken into account. How many square meters per person should be in my case?

In your case, the standard of 24 square meters is taken into account. meters.

Our family lives in a house that was provided as social support to a large family. Do I have to provide documents that state this?

No, the FIU will request these documents independently within the framework of the system of interdepartmental interaction.

When calculating income, will the received alimony be taken into account?

My family owns an apartment and a residential building, in total their area exceeds the standard of 24 sq. m. m. per person, will I be denied benefits?

No. Restrictions on square meters apply if the family owns several apartments or several residential buildings. When owning one type of residential property, its area is not taken into account.

I registered with the Pension Fund the care of my husband's 86-year-old grandmother and I receive an allowance for caring for citizens over 80 years old. Will this allowance be taken into account when calculating my income?

Yes.

In what order are district coefficients applied in determining the amount of benefits?

The district coefficient is not applied when assigning the allowance, since the amount of the allowance is set depending on the subsistence minimum per capita, in which the district coefficient is already taken into account.

Do I have to report to the Pension Fund information about changes in family composition and income if they occurred after the application was submitted?

No. Beneficiaries are not required to report changes in income to the Pension Fund during the benefit period.

Can I get benefits only for children aged 8 to 17?

No, not only. There are also payments for low-income families for pregnant women who registered early, benefits for children from 0 to 3 years old, as well as benefits for children from 3 to 8 years old.