How can i check my child support status

Child Support - Mississippi Department of Human Services

Skip to contentChild SupportMorgan Stewart2022-09-29T16:44:20+00:00

Child Support serves children and families that need help with financial, medical and emotional support.

Upload Documents Here

Payment Options

for Custodial Parents

for Non-Custodial Parents

- Payroll deduction

- this option must be discussed with your employer

- eCheck/bank account debit

- Cash

- PayNearMe

- (FAQ)

- MoneyGram

- all locations accept cash, and some locations accept a pin-based debit card.

- Visit www.MoneyGram.com/BillPayLocations to find a location.

- Quick Reference Guide

- PayNearMe

- Check, Money Order and/or cashier’s check

- Include Social Security Number AND Case Number

- Mail to: MDHS/SDU, P.

O. Box 23094, Jackson, MS 39225

for Employers

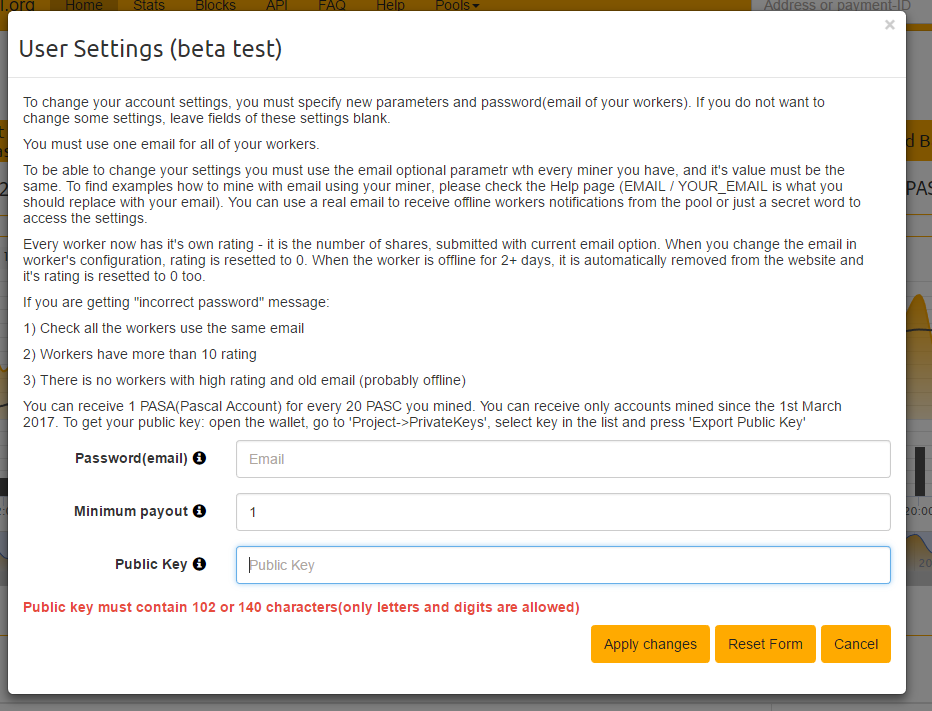

eCheck/bank account debit

PayNearMe

Pay your child support in cash without leaving your neighborhood.

Find Nearest Location

It's convenient

Pay in less than 60 seconds at nearly 27,000 locations. Payment history and receipts are stored in the app and you can set reminders for next time.

It's guaranteed

You’ll get a receipt as proof of payment, just like buying something at the store. We’ve already processed over a million payments for customers just like you!

It's mobile

You can store everything you need to pay on your phone or in your wallet, so it’s always with you.

Visit Site

Parents HandbookApply for ServicesChild Support Brochure: English | Spanish | VietnameseClick here for the application: English | Spanish | VietnamesePlease mail your completed application and check to MDHS-Division of Child Support 950 E. County Line Road, Suite #G, Ridgeland, MS 39157

County Line Road, Suite #G, Ridgeland, MS 39157

If you are an employer who is receiving a monthly Child Support Income Withholding Bill for an employee, you may view and print these documents online.

These documents are available in Portable Document Format (PDF) only.

Click on here for the Child Support Web-based Bills/Notices.

NOW AVAILABLE ONLINE

- Download to print monthly

- Bills/Notices will ONLY be mailed out annually

- All other inquiries, please contact the Child Support Call Center at 877-882-4916.

There are several methods used to collect and enforce child support:

-

- Income Withholding-The employer of a noncustodial parent who owes child support may have support withheld from their wages.

- Unemployment Intercept-A noncustodial parent who owes child support may have support withheld from their unemployment benefits.

- Tax Offset Intercept-A noncustodial parent who owes back child support may be subject to interception of any refund due from federal or state taxes

- Contempt Action-A noncustodial parent who owes back child support may be taken to court for contempt, which could result in the court ordering incarceration.

- Credit Bureau Reporting-A noncustodial parent who owes back child support will be reported to the Credit Bureau.

- Liens-A non custodial parent who owes back child support may have liens placed against their workers compensation or personal injury claims

- Accounts Frozen and Seized-A noncustodial parent who owes back child support may have their account(s) frozen and seized from financial institutions such as banks and credit unions.

- License Suspension-A noncustodial who owes back child support may have their license suspended.

- Passport revocation-A noncustodial parent who owes back child support of $2500 or more will have their passport revoked or application denied.

- Income Withholding-The employer of a noncustodial parent who owes child support may have support withheld from their wages.

Paternity Establishment

A Simple Acknowledgment of Paternity (ASAP)

ASAP is Mississippi’s voluntary paternity establishment program. ASAP makes it possible for parents to establish paternity in hospitals and other birthing facilities, at the State Department of Health, County Health Departments, and the Division of Field Operations.

This procedure carries the same legal effect as if the father and the mother were married at the time between conception and birth. The program allows the father’s name to be added to the birth certificate.

PATERNITY

Paternity means fatherhood. Paternity is in question when a child is born of unmarried parents. If a child’s parents are not married, paternity can be established through voluntary acknowledgment or through court proceedings.

It is important to establish paternity for a myriad of reasons, such as identity, medical history, death, disability and insurance benefits, and support.

It is important for a child to know who he/she is and to feel the sense of belonging that knowing both parents brings.

A child also needs to know if he/she may have inherited any diseases or birth defects. Also, by knowing both parents, this could ensure against marriage between close relatives.

A child should have the right to possible benefits from both parents such as social security, medical and life insurance, as well as veteran’s benefits.

Also, a child has the right to food clothing and a home, which can be better provided when both parents are involved. Support that is provided by one parent only to a child is often not adequate to meet his/her needs.

Support that is provided by one parent only to a child is often not adequate to meet his/her needs.

Legal paternity can be established while the mother is still in the hospital when both parents sign an acknowledgment of paternity and return it to the hospital staff. There is no fee involved, when the acknowledgment of paternity is filed along with the birth certificate. (To establish paternity upon leaving the hospital, please contact the Division of Field Operations at the Mississippi Department of Human Services.)

If establishment of paternity is involuntary, a petition to establish paternity must be filed with the appropriate court with jurisdiction over the matter.

Establishing paternity is the first step needed in order to ask for visitation privileges. The father will need to seek legal counsel for advice on visitation and, or custody.

Adding a father’s name to the birth certificate

A father’s name will be added to the birth certificate, when he is legally established as the child’s father after completing the acknowledgment form.

If the alleged father refuses to sign the Acknowledgment of Paternity form, the mother can request assistance from the Division of Field Operations at Mississippi Department of Human Services in establishing paternity, and obtaining child support through the court system. There is a $25 fee for this service UNLESS the mother is receiving any state supported benefit such as Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families, (TANF) and, or Medicaid, in which case there is no charge for this service.

Employer InformationReference Guide for Employers and Income Withholders

Child Support Web-based Bills/Notices

https://ccis.mdhs.ms.gov/

Questions please contact the Child Support Call Center 877-882-4916

Electronic Reporting

Electronic Funds Transfer/Electronic Data Interchange (EFT/EDI) make child support income withholding easier for employers. At your option, child support funds can be electronically remitted via EFT from your bank to the State Disbursement Unit (SDU). All the necessary information (case identifiers, date of withholding, etc.) is sent along with the electronic payments via EDI.

At your option, child support funds can be electronically remitted via EFT from your bank to the State Disbursement Unit (SDU). All the necessary information (case identifiers, date of withholding, etc.) is sent along with the electronic payments via EDI.

For additional information concerning EFT/EDI, please click here for the PDF version of A Guide for Employers Electronic Funds Transfer/Electronic Data Interchange (EFT/EDI) or Email: [email protected] or phone: 769-777-6111

State Agencies in Mississippi

State agencies who deduct child support payments from employee checks to pay to the Mississippi Department of Human Services can make remittances electronically via electronic funds transfer (EFT). Remittances will need to be directed to Regions Bank CHILD SUPPORT METSS, vendor # V0001361941. For more information, contact 601-359-4500.

Mississippi New Hire Reporting

All employers (or independent contractors) are required to report basic information about newly-hired personnel to a designated state agency within 15 days. A penalty of $25 per case (incident), or up to $500 for collusion between employer and worker, shall be assessed for not reporting as directed by law. To obtain more information, go to the website: www.ms-newhire.com or contact us at the following address:

A penalty of $25 per case (incident), or up to $500 for collusion between employer and worker, shall be assessed for not reporting as directed by law. To obtain more information, go to the website: www.ms-newhire.com or contact us at the following address:

P. O. Box 437

Norwell, MA 02061

Telephone: 800-241-1330

Fax: 800-937-8668

State Disbursement Unit

All child support income withholdings are required to be paid through Mississippi’s state disbursement unit, the State Disbursement Unit (SDU) at the following address:

MDHS/SDU

P. O. Box 23094

Jackson, Mississippi 39225

Fax: 769-777-6132

Each payment remitted must include the noncustodial parent’s name, social security number, the amount withheld and employer name.

Withholding Orders/Notices from Other States

A direct income withholding order issued by any state may be sent across state lines directly to the noncustodial parent’s employer in another state.

-

-

- Upon receipt, if the Order/Notice appears “regular on its face,” you must honor it.

- You must provide a copy of the Order/Notice to the employee immediately.

- You must begin income withholding and send the payments to the address cited in the Withholding Order/Notice.

- You must continue to honor the Withholding Order/Notice until official notification is received from the child support enforcement agency/court to stop or modify the withholding.

- If you comply with these basic requirements, you will not be subject to civil liability to an individual or agency with regard to your withholding of child support from the employee’s income.

-

What is the maximum amount that can be withheld?

For child support income withholdings, the upper limit on what may be withheld is based on the Federal Consumer Credit Protection Act (CCPA). The Federal withholding limits for child support and alimony are based on the following disposable earnings of the obligor (i. e., the employee):

e., the employee):

-

-

-

-

- The Federal CCPA limit is 50 percent of the disposable earnings if the employee lives with and supports a second family, and 60 percent if the employee does not support a second family.

- This limit increases to 55 percent and 65 percent respectively if the employee owes arrears that are 12 weeks or more past due.

-

-

-

Lump Sum Payment Requirements for Employers

Pursuant to Mississippi Code Section 93-11-103(13), employers are required to report lump-sums paid to employees of over $500 to the Department of Human Services if the employer has been served with a withholding order that includes a provision for the payment of arrears. Lump-sums are defined in Mississippi Code Section 93-11-101(l). The employer shall notify the Department of Human Services of its intention to make a lump-sum payment at least 45 days before the planned date of the payment or as soon as the decision is made to make the payment, should that be less than 45 days. The employer shall not release the lump-sum to the obligor until 30 days after the intended date of the payment or until authorization is received from the Department of Human Services, whichever is earlier. The Department of Human Services shall provide the employer with a Notice of Lien specifying the amount of the lump-sum to be withheld for payment of child support arrears.

The employer shall not release the lump-sum to the obligor until 30 days after the intended date of the payment or until authorization is received from the Department of Human Services, whichever is earlier. The Department of Human Services shall provide the employer with a Notice of Lien specifying the amount of the lump-sum to be withheld for payment of child support arrears.

To report a lump-sum or for further lump-sum inquiries, please email or fax us at [email protected] or 800-937-8668.

Multiple Child Support Orders for the Same Employee

You must add together the court-ordered current support owed for each order and withhold that amount first. If this amount does NOT exceed the CCPA or appropriate State law, you may withhold additional earnings for any arrears obligation, provided the total amount withheld does not exceed the amount available under the CCPA or appropriate State law.

May we combine child support payments from several employees?

You may send one check for each pay period to cover all child support withholdings for that pay period if they are all to be sent to the Mississippi Department of Human Services, provided you itemize the amount withheld from each employee, the date each amount was withheld, and the noncustodial parent’s social security number.

Is medical insurance required to be provided when the child does not live in the service area?

Yes. By law, medical insurance coverage available to the parent-employee cannot be denied to a child even though:

-

-

-

-

- The child was born out of wedlock and paternity has been established

- The child is not claimed as a dependent on the parent’s income tax return

- The child does not live with the parent

- The child does not live in your insurer’s service area

-

-

-

Under which insurance plan should the child be enrolled?

Enroll the child under the same health benefit plan in which your employee is enrolled. If the employee is offered more than one health plan, the plan chosen by the employee must provide coverage for dependents.

License Suspension ProgramWhat licenses can be suspended?

-

-

-

-

- If the delinquent parent does nothing or can not reach an agreed payment schedule within the 90 day period, then a notice is sent to the license agency to suspend the license.

- If the delinquent parent does nothing or can not reach an agreed payment schedule within the 90 day period, then a notice is sent to the license agency to suspend the license.

-

-

-

-

- NOTE: A suspended license may be reinstated if the payments are made or a payment plan is agreed upon. Failure to pay under the agreement will result in immediate license suspension. Additionally, a judge may order license suspension in any contempt proceeding for failure to pay child support. Also note that any licensed attorney may apply through MDHS for license information in a non-MDHS case.

Due Process

A licensee may request a review by MDHS on issues of correct personal identification and the state of delinquency. License suspensions may be appealed to the Chancery Court.

Mississippi Access & Visitation Program (MAV-P)Mississippi’s Access and Visitation Program (MAV-P) is designed for noncustodial parents to have access to visit their children as specified in a court order or divorce decree. Assistance with voluntary agreements for visitation schedules is provided to parents who have a child support case.

For more information click here

Frequently Asked Questions Child Support ManualClick here to view

Tax Offset GuideChild Support Call Center

877-882-4916

Dollars of Child Support Collected

0%

Number of children born out of wedlock who had paternity established

Page load linkGo to Top

1.0.0-Support

Child Support Enforcement is a family-first program intended to ensure families self-sufficiency by making child support a more reliable source of income.

The program goals are to ensure children have the financial and medical support of both their parents; to foster responsible behavior towards children; to emphasize the child's needs to have both parents involved in their lives; and reduce welfare costs.

Apply for Child Support Services

To apply for Child Support Services, please download, print, and complete the Application for Child Support Services and mail, fax or walk into your local Child Support office.

- Application for Child Support Services

- Solicitud de Manutención De Niños

- Child Support Offices

For additional information regarding child support or welfare programs please send us anemail at [email protected] or call:

Contact Welfare or Child Support Programs by Phone

| Location | Phone |

|---|---|

| Toll Free | (800) 992-0900 |

| Northern Nevada | (775) 684-7200 |

| Southern Nevada | (702) 486-1646 |

PLEASE NOTE: Customer Service experiences exceptionally high call volumes, especially the first week of each month. Alternate phone numbers for each office are provided on the Child Support Office web page.

Alternate phone numbers for each office are provided on the Child Support Office web page.

General Information

- Establishing Paternity

- Reservists, National Guard - Being Mobilized?

- OCSE Child Support Handbook

- More Information About Child Support

- Change Child Support Payee

- Employer Services Center

Receiving Payments

- Links/Info

How to Pay

- Child Support - How to pay

Make Payment Online

- Child Support - How to pay Online

Payment FAQs

- FAQs for Receiving Payments

Info for Employers

- Notice to Employees

- Download "Information for Employers" (PDF)

- New Hire Reporting

- Income Withholding

- Submitting Payments

- Submitting $2 Withholding Fee

- National Medical Support Notice

- Termination Notices

- FAQ's

Caseload Statistics

- Caseload Reports

Child Support Manual

- Contents

Documents & Links

- General Documents

- Applications & Forms

- Related Links

The Nevada Child Support Debit Card

* The ReliaCard is issued by U. S. Bank National Association pursuant to a license from Visa U.S.A. Inc. © 2021 U.S. Bank. Member FDIC.

S. Bank National Association pursuant to a license from Visa U.S.A. Inc. © 2021 U.S. Bank. Member FDIC.

** La Tarjeta ReliaCard es emitida por U.S. Bank National Association, de conformidad con una licencia de Visa U.S.A Inc. ©2021 U.S. Bank. Miembro FDIC.

Sign up for the Nevada Child Support Debit Card

- Child Support Payment Authorization

Quick Links

- Debit Card Frequently Asked Questions

- Debit Card Fees/Terms & Conditions | Cargos y Condiciones de la Tarieta de Debito

- Additional Debit Card Information

- More Information on Receiving Payments

- Change Child Support Payee

How to find out child support debt by last name - check child support debt online

There are several ways to see the amount of child support debt. To do this, you can contact the MFC or come to an appointment with a bailiff. In addition, you can find out the debt by last name via the Internet. To do this, you need to use the main website of the FSSP, the State Services portal or the State Payment service.

To do this, you need to use the main website of the FSSP, the State Services portal or the State Payment service.

State payment

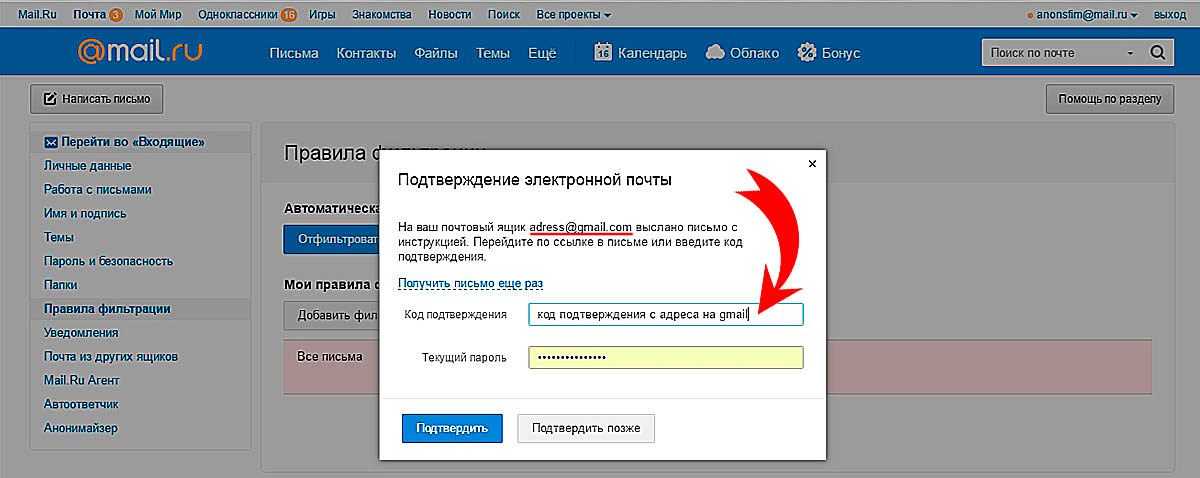

State payment online service offers the easiest and fastest way to find out the amount of alimony debt from yourself or another individual. The service does not require registration. To start checking:

- Go to the State Payments website;

- Enter the last name, first name and patronymic of the debtor, his date of birth and region of residence. Click "Check";

- Next, enter the code from the picture and wait for the verification results.

The service will check the FSSP database and provide information about the amount of debt from a particular person.

With the help of "Gosoplata" you can not only find out, but also immediately pay the debt using any bank card.

The service has the following benefits:

- Instant payment of legal, tax and other debts;

- Simple and intuitive interface;

- Convenient mobile application;

- Payment information is automatically transferred to databases;

- All transmitted data is securely encrypted;

- Payment receipt is sent to the payer's e-mail immediately after the payment is made.

FSSP website

To find out the debt for alimony through the official website of the FSSP, you need:

- Go to the site at the link: fssp.gov.ru;

- In the site menu, select the "Service" section, the "Database of Enforcement Proceedings" category;

- Next, you need to fill in all the fields marked with an asterisk (*):

- Territorial bodies;

- Last name, first name;

- Click the "Find" button to start checking. Next, the system will ask you to enter the code from the picture to confirm that the request is made by a person and not a robot.

If several debtors have the same first and last name, you need to enter the middle name and date of birth for a more accurate search.

As a result of the search, you will see a table where all the necessary information will be presented:

- amount of debt and enforcement fee;

- production number;

- court order number;

- territorial subdivision of the FSSP;

- surname and phone numbers of the bailiff.

On the main website of the bailiff service, you can not only find out the debt for alimony, but also pay it. If necessary, you can pay the debt online through the State Services portal or generate a receipt and pay it through any bank.

Public services

To find out the amount of alimony arrears through the Gosuslug portal, you must first register.

Attention! The search for accruals is carried out according to the data from your personal account.

To see if you have a legal debt, log into your personal account and follow these steps:

- Select the "Services" section, then the "Authorities" subsection and the "FSSP of Russia" category;

- Next, open the "Territorial authorities" tab and select the name of the desired department from the list;

- Select the electronic service “Providing information…”;

- Next, select the service "Law Debt";

- Click "Get Service";

You can pay your debt in several ways:

- With any bank card;

- Through Google Pay or Samsung Pay;

- Using an electronic wallet WebMoney, Qiwi, Yandex.

Money;

Money; - From a mobile phone account.

You can also generate a receipt and pay it at the bank or at the post office.

How quickly will an entry in the FSSP database be deleted?

If you have fully or partially paid the maintenance debt, the record in the Database will be deleted or changed no earlier than 3-7 working days from the date of payment. This is due to the fact that first the funds are credited to the account of the bailiff unit, and then to the account of the claimant. It takes at least 3 days to process and transfer funds. If the workload is high, it may take up to 7 days to delete or change an entry.

If you have any additional questions, you can personally contact the territorial division of the FSSP. You can make an appointment for a personal appointment through the official website of the bailiff service - fssp.gov.ru.

Kontselidze Ednary Emzarievich Legal Expert

Bad dad - how to check alimony debtor - Opendatabot

History

In Ukraine, 171,337 people do not pay child support.

What happened

New feature in Opendatabot. Now you can check if a person is a child support debtor and control your own status.

Why is it important

If you are going to make joint plans with a person, for example, start a family, it is important to know his background. Finding out if a person has problems with alimony is an important check point.

What does the status of "alimony debtor" mean?

The list of people who do not pay child support is published on the website of the Ministry of Justice. There are parents who have not paid child support for more than 6 months. Men usually become debtors for alimony, but there are also more than 13 thousand women in the register, which is almost 8%.

Status must be legally recognized. True, according to our data, in Ukraine, cases of evasion of alimony almost do not reach the courts.

“The database itself and the presence of information in it about the debtor does not pose a serious threat to the debtor.

It is rather a means of moral, social pressure. If you have children from a previous marriage, and you do not properly pay child support, then any person will be able to see this in the specified database and evaluate your real attitude to your duties. It may interfere with your new relationship. It is precisely this kind of influence that the authorities are counting on,"

- Natalya Chatskis, head of the Nakaz law firm, comments.

According to the law, which was signed by the President of Ukraine this year, debtors who have arrears in the payment of alimony are limited in their right to travel outside Ukraine, drive vehicles, use firearms, and hunt.

“Of the four restrictions that were widely announced by the Ministry of Justice, the most effective was the restriction on travel outside Ukraine. It applies without any exceptions, that is, even if the debtor's work is related to business trips abroad, this is not a benefit and such a restriction will be applied.

The reason for this success is that the corresponding mechanism for restricting a person's right to travel outside Ukraine was developed even before the adoption of this law (this was done for law enforcement agencies). Therefore, after the introduction of this restriction for alimony non-payers, it organically fit into existing mechanisms and law enforcement practice.

The least effective was the restriction on the right to drive a car. This is due to the absence of such a concept as “restriction of the right to drive a vehicle”: before that, there was only the concept of “deprivation of the right to drive”. Therefore, the police simply do not know what to do with the decision of the state executive service on the restriction on the right to drive a car. Obviously, even more time is needed for the mechanism of interaction between the GIS and the police to be developed. The situation with the restriction on the right to weapons is similar - the situation is still quite declarative",

— lawyer Oleg Prostibozhenko comments.

“Minister of Justice P. Petrenko said that this register is important for women who meet with a man, because in this way they can check whether he is a debtor for alimony. However, it seems to me that within the limits of personal relationships, the register does not have any special meaning. But this should be important for the contractors of the person and, to a certain extent, for the employer",

- Oleg comments.

“If the debtor is an individual entrepreneur, then it is necessary to be careful that there is no situation when such a debtor receives property or funds, but cannot fulfill his obligation due to the seizure of property. In this case, the counterparty may find itself in a really difficult situation from a legal and financial point of view.

As for the employer, now it is not so critical for him. But if he employs a person who is a debtor, then such an employer must be prepared for the fact that the state executive service will send him a document (we are talking about the decision of the contractor) on the forced deduction of part of his salary.

And this is an additional burden on the accounting department of the enterprise or the director himself. In addition, the employer must be prepared for the fact that such an employee cannot be sent abroad if his alimony arrears amount to the amount of payments for 6 months”,

he adds.

What to do if you find out that a person is on the list of debtors?

Your actions will depend on what type of relationship you plan to have with this person.

If this is a personal relationship , then we can understand that a person has children that were not reported to us, and in relation to which the person does not fulfill his duties. Then everyone will decide this situation in their own way.

If this is a business relationship , then it is worth registering contracts with such a counterparty in such a way that first it is he who fulfills the obligations, and only after that your side, that is, the risk must be transferred to such a counterparty.