How to lower child support arrears

How to Get Child Support Arrears Dismissed

Upon becoming a parent, it is your responsibility to provide for your child. Some parents may struggle with that obligation, however, leading to them accumulating child support arrears.

There is no question that parents should do everything in their power to fulfill their obligations to their children. Still, we cannot ignore the reality that some parents have valid reasons for why they struggle to keep up with payments.

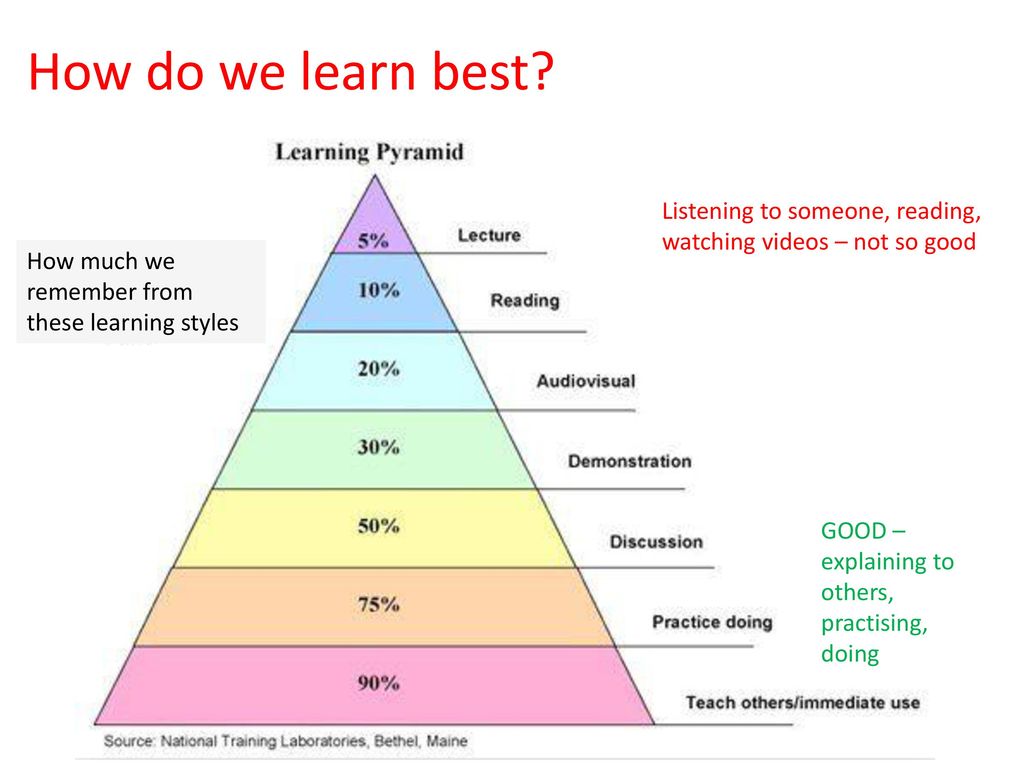

In this article, we’ll dive deeper into the subject of child support and its importance. We’ll also highlight the different reasons why parents cannot always pay on time and the penalties stemming from that. You’ll also learn more about the process of getting unpaid child support dismissed.

What Is Child Support?

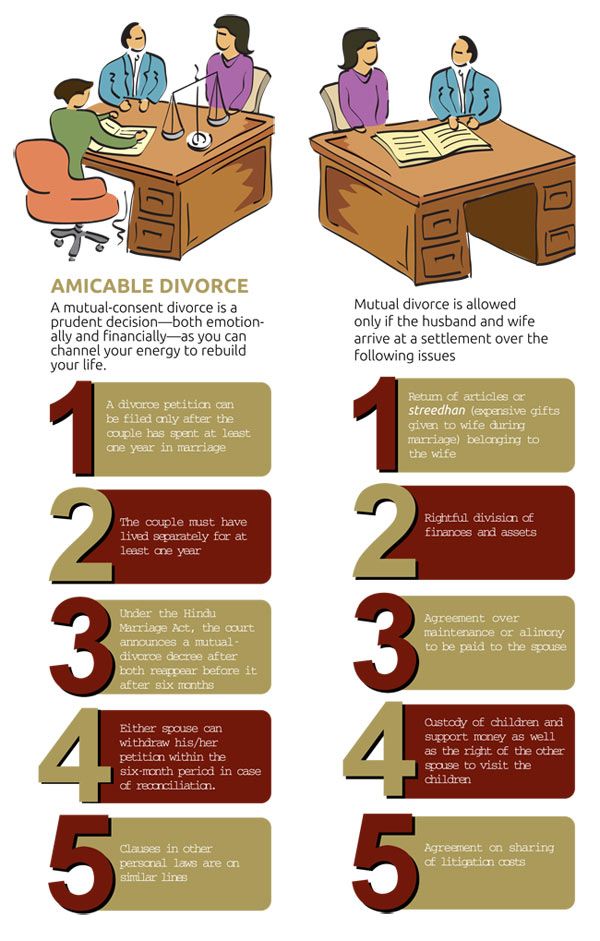

To get things started, let us first define child support. In cases where the parents of an underage child or children are divorced or separated, they usually award one parent primary custody, while designating the other as the non-custodial parent. Crucially, non-custodial parents may still have legal custody over their child even if they don’t have physical custody, according to VeryWell Family.

Regardless of which party they award primary custody, both parents still need to bear the financial responsibility of raising their child or children. The state of Arizona requires both parents to offer “reasonable support” to their kids, who the courts regard as minors.

This is where child support comes into play.

Child support divides financial responsibility among the parents. While the parent with primary custody may be in charge of paying for their kids’ daily expenses, the other parent must still provide timely payments.

The timeliness of child support payments can vary depending upon what the parents agreed upon. Often, they pay monthly. That’s probably due in no small part to many child support payments being taken directly from paychecks.

How Are Child Support Payments Used?

The parents will have to determine how to use the child support payments. You probably know what to expect here, though.

You probably know what to expect here, though.

You can use child support payments for food, school-related expenses, medical bills, clothing, toys, and housing. If there are activities that a child wishes to try, the support payments can also go toward them.

Basically, if you use the payments for something the child benefits from, no issues will arise.

Custodial parents must refrain from using the child support payments on themselves. If the custodial parent uses the support payments on their own expenses, they may run into trouble with their co-parent and possibly the law.

How Are Child Support Payment Amounts Calculated?

There is no one set of guidelines followed by all the states in the country when it comes to determining how much child support a non-custodial parent owes.

In the state of Arizona, some of the factors considered include the child’s medical bills, childcare costs, and education expenses. The state also refers to a Schedule of Basic Support Obligations, which accounts for the number of children and the adjusted gross income of both parents. The child support payments will also be proportionate to the salaries the parents are taking home.

The child support payments will also be proportionate to the salaries the parents are taking home.

Figuring out the right amount of child support payments you are obligated to make and negotiating with the other party can be complicated undertakings. That’s why many parents enlist the help of experienced lawyers in these scenarios.

What Are Child Support Arrears?

Child support arrears refer to unpaid child support payments. There are also two types of child support arrears.

Assigned Child Support Arrears

First off, you have what is known as assigned child support arrears. Assigned child support arrears pile up when the non-custodial parent fails to fulfill his/her obligation while the custodial parent is on public assistance. I In a case such as that, the non-custodial parent owes money to the state as opposed to the custodial parent since the government is supporting their child.

When accounting for assigned child support arrears, there is no guarantee that the custodial parent will receive any money from the payments made by the non-custodial parent. The non-custodial parent’s priority is to pay the state in full. If there is money left over once they pay the arrears, the custodial parent will receive that amount.

The non-custodial parent’s priority is to pay the state in full. If there is money left over once they pay the arrears, the custodial parent will receive that amount.

Non-custodial parents who have accumulated assigned child support arrears could find themselves in a difficult position. The good news for them is that states are willing to negotiate their debts.

Unassigned Child Support Arrears

Unassigned child support arrears refer to the payments a non-custodial parent owes directly to their co-parent. This time around, the government will not receive any money from the provided back payments.

Unassigned child support arrears don’t necessarily have to be paid by the non-custodial parent provided that the parent with primary custody agrees to waive those debts. We’ll get into the process of having those child support arrears waived later in this article.

Why Do Parents Fall Behind on Child Support Payments?

We first want to reiterate in this section that it is a parent’s job to financially support their child. Becoming a parent is an enormous responsibility, and you must be ready for everything that entails before taking the plunge.

Becoming a parent is an enormous responsibility, and you must be ready for everything that entails before taking the plunge.

Unfortunately, circumstances do change. Some parents may want nothing more than to support their children, but the reality of their situation may prevent them from doing so.

Included below are some of the reasons why non-custodial parents may fall behind on their child support payments.

The Non-Custodial Parent No Longer Has a Job

Losing a job is a nightmarish scenario for many. Suddenly, the source of income for food, rent money, and other essential expenses are gone. Parents will also have a tough time keeping up with their child support payments if they’ve lost their job.

The Non-Custodial Parent’s New Job Pays Less

Non-custodial parents may have jobs but cannot meet the terms of the agreement with the custodial parent. This often happens when the non-custodial parent gets demoted at work or if they’re starting a new job that doesn’t pay as well.

The issue here is that the agreement both parties signed up for previously is no longer an accurate representation of the parents’ current financial situations. Now that one party is making significantly less money, they cannot abide by the guidelines set in the agreement.

The Non-Custodial Parent Has a Serious Medical Condition

The non-custodial parent’s medical condition could also explain why they can no longer make payments on time. The parent in question may have recently suffered a heart attack and is currently unable to work. It’s also possible that they had to undergo emergency surgery that has impacted their finances.

A chronic illness affecting the non-custodial parent may also worsen over time. Because of that, their medical expenses may increase, thus making it harder for them to fulfill their obligation to their child.

The Non-Custodial Parent Is Unable to Pay the Arrears Due to Interest Accrued

Yes, interest can indeed accumulate on overdue child support payments. The interest rates can vary depending on the state.

The interest rates can vary depending on the state.

Some states like Connecticut, Delaware, and Hawaii don’t add interest to child support arrears, according to the National Conference of State Legislatures. Meanwhile, states such as Colorado, Kentucky, and Washington impose an annual interest rate of 12 percent. In Arizona, an interest rate of 10 percent per annum is on arrears.

As a non-custodial parent working to make up for unpaid child support, you may be caught off guard by the accumulated interest. You may have assumed that you had enough money to cover your missed payments only to find out later that the added interest means you have more work to do.

What Are the Penalties Imposed on Parents Who Cannot Make Child Support Payments?

Once they determine that you’re missing child support payments and there’s no valid reason, you can find yourself facing serious consequences. Debt.org has highlighted some of the penalties.

A Bad Credit Score

Remember that loan you were planning to take out to start your dream business? Well, you may need to bid farewell to that dream if you’ve been late on your child support payments.

The government allows credit agencies to know if you’re missing those payments. The agencies may adjust your credit score to reflect that. You’ll probably have a hard time securing a loan, and even if you do, the terms may be difficult for you.

The Loss of a Driver’s License

Getting around town could become an ordeal unto itself if you start missing child support payments. The state may suspend your driver’s license, and you may need to pay up before you get it back.

Your Finances Are Targeted

The government has a way of making unwilling debtors pay up. In the case of parents not paying child support, the government can order wages to be garnished or seize tax returns.

A Jail or Prison Sentence

Among the penalties people may be hit with if they fail to comply with the law is incarceration. Don’t assume that you can avoid that kind of punishment even if we’re only talking about unpaid child support.

Since the courts mandate child support payments, you could find yourself in legal hot water if you fail to pay. On top of that, accumulating a hefty bill for child support owed could land you in prison.

On top of that, accumulating a hefty bill for child support owed could land you in prison.

How Do You Get Your Child Support Arrears Waived?

We’ve already highlighted some of the reasons why parents can’t pay child support as well as the penalties they may face for their failure to comply with a government order. You probably want nothing to do with prison, so the best thing you can do if you cannot make payments any longer is to get the arrears waived.

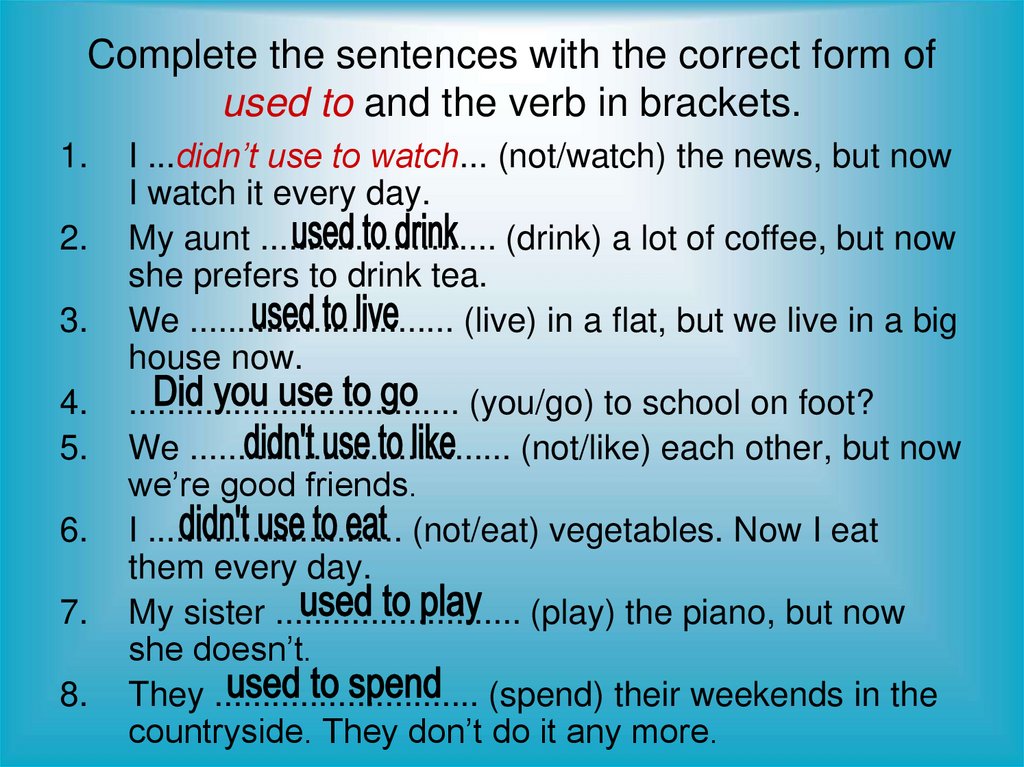

Here is how you get unassigned child support arrears waived or reduced:

- Get in Touch with Your Co-Parent – Start the process by contacting your co-parent and explain why you no longer can make the payments in your agreement. You will need them to agree to the revised terms, or else nothing will happen.

- Create a New Written Agreement – Together with your respective lawyers, you and your co-parent must now work on crafting a revised agreement. The lawyers will help you avoid mistakes and ensure that the document is ready for the next step.

- File the New Agreement with the Court – Now that the new agreement is ready, you can file it with the court. Remember to include the explanations for why you’re revising the agreement in the document.

- See What the Court Decides – There is no guarantee that the court will sign off on the revised agreement. As far as the court is concerned, their job is to see that you meet the best interests of the child or children.

- Tweak the Agreement and Re-file – In cases where the court didn’t approve the revised agreement, both sides can continue negotiating until they create something better. Now, here is how you get assigned child support arrears waived:

- Enter Waiver Negotiations with the State – Instead of making your case to your co-parent, your main task is to convince the government that the agreement must be changed. Continue negotiating together with your lawyer until you can get the assigned arrears waived or at least reduced.

- Inform Your Co-Parent – Don’t forget to inform your co-parent about the steps you’re taking to have your arrears waived or reduced.

While evaluating your request, the court may get in touch with your co-parent, and the information they provide may influence the court’s decision.

While evaluating your request, the court may get in touch with your co-parent, and the information they provide may influence the court’s decision. - Follow the Court’s Conditions – According to LegalZoom, the court may require you to meet certain conditions if you want your debt waived or reduced. Understand those conditions well and make sure you follow them as best you can.

You’ll have a tough time negotiating agreements regarding child support and child support arrears on your own. It’s best to partner up with a lawyer who has experience regarding these cases. Work with us at the Schill Law Group and we will do everything in our power to secure the best agreement for you, your co-parent, and your children.

Debt Reduction - HRA

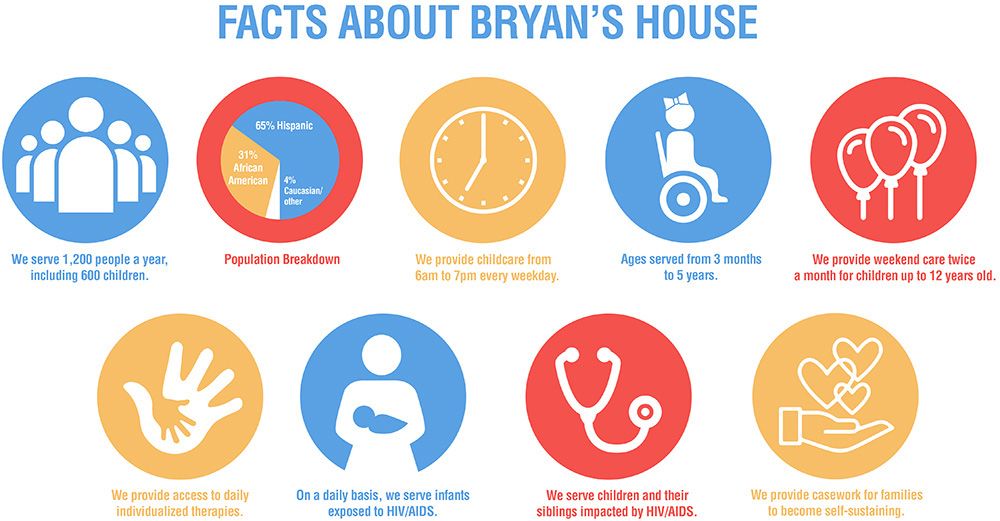

There is one aspect of the Child Support Program that is barely discussed: child support debt. This issue is large in scale and complexity and mostly owed by people with little to no recorded income. Child Support debt is owed to the government or to the child's other parent, and in some cases to both.

People owe child support to the government because money is retained by the government to pay back public cash assistance (most commonly, TANF benefits) received by that parent’s child. Overwhelmingly, it is low-income fathers, a very large percentage of them Black or Latino, who feel the greatest effects of this policy and the indebtedness that it creates.

The New York City Office of Child Support Services (OCSS) understands that debt from any source can have a negative effect on an individual’s mental and physical health, but research suggests that it can also affect whole families. When that debt comes from unpaid child support, it can even undermine the primary goal of the program—getting children the financial support they need—by potentially discouraging employment among noncustodial parents and causing them to disengage from their children’s lives.

Noncustodial parents who owe DSS child support arrears can improve their future, and their children's, by taking the necessary steps to lower their debt or to bring their child support order into line with their income. Many parents qualify for the programs described below but few take advantage of them. To date, OCSS has reduced over $225 million of debt owed to the government and what we have seen is that reducing debt leads to increased child support payments.

Many parents qualify for the programs described below but few take advantage of them. To date, OCSS has reduced over $225 million of debt owed to the government and what we have seen is that reducing debt leads to increased child support payments.

For noncustodial parents with debt owed to the child’s other parent, free or low-cost mediation services can help both parents work out an agreement on whether they want to reduce the arrears and under what conditions.

If you have questions about any of these programs, email us at [email protected] with the program’s name, for instance, “MOTS” or “Arrears Cap,” in the email subject line.

In addition, the Earned Income Tax Credit (EITC) helps low- to moderate-income parents get a tax break on their federal tax return. The City offers free financial counseling through the Department of Consumer and Worker Protection. One-on-one professional counselors can help with managing money and minimizing debt.

Arrears Cap can put a limit on the amount of child support debt that a noncustodial parent owes to the government. The amount of arrears can be reduced to as low as $500. To qualify, noncustodial parents must owe child support debt to the NYC Department of Social Services (DSS). The parent's income must have been below the federal poverty level when their DSS arrears accumulated. Noncustodial parents can apply by mail.

The Arrears Credit Program is open to noncustodial parents who owe DSS child support arrears and do not have more than $3,000 in the bank or more than $5,000 in property. Parents can qualify for a yearly credit of up to $5,000 on their DSS debt. They can also take advantage of this program up to three years – for a credit of up to $15,000 on DSS debt for each eligible case. There are two ways to participate: 1) by paying the full amount of child support owed each month for one year, or 2) for those without a current order, by paying the full amount of the last child support order each month for one year toward the debt owed on the account. Noncustodial parents can apply by mail.

Noncustodial parents can apply by mail.

The new Parent Success Program is designed to help noncustodial parents by supporting their well-being and strengthening their ability to provide for their children. In the first phase of the program, parents can eliminate up to $10,000 in DSS child support debt by completing a qualifying substance use treatment program. The treatment program must be certified by the New York State Office of Alcoholism and Substance Abuse Services (OASAS). Once parents have completed the course, they must submit a completion certificate or letter from their service provider to OCSS to qualify for the Parent Success Program's DSS debt reduction.

Pay It Off is a time-limited program that enables noncustodial parents to pay off New York City DSS child support debt twice as fast – by matching their payments that total a minimum required amount (up to the amount of DSS child support arrears they owe). This year, the program is offered October 17 - 31, 2022.

Modifying Orders Through Stipulation (MOTS) gives parents the opportunity to discuss modifying their order with an OCSS worker and to enter into an agreement voluntarily before an appearance in court. For a stipulated agreement:

- An OCSS worker drafts the agreement using the same guidelines as the court and helps the parents gather the required documents.

- The approved stipulated agreement package is filed in court for a hearing to be scheduled.

- Usually only one court appearance is required for the Support Magistrate to make sure the parents understand their rights and responsibilities and to issue a modified order on consent.

Reducing the amount of debt on alimony \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Reducing the amount of alimony arrears

A selection of the most important documents upon request Reducing the amount of child support arrears (regulations, forms, articles, expert advice and much more).

- Alimony:

- Alimony obligations of children for the maintenance of parents

- Alimony obligations of spouses

- Alimony in 6-NDFL

- Alimony in a solid amount of

- Alimony of individual entrepreneur

- more ...

- Ponsistrict

- 18810807141011000110

- Form of receipt for payment of state duty

- Accounting for state duty for attestation

- more ...

Documents : reduction in the amount of debt on alimony

Judicial practice : reducing the amount of debt for alimony

Register and get testpli -plus for 2 days 2 days 2 days 2 days

Open document in your system0065 (R.B. Kasenov) The court refused to satisfy the plaintiff's claims against the OSP UFSSP of Russia for the constituent entity of the Russian Federation on the recognition of illegal decisions on the calculation of alimony arrears in the framework of enforcement proceedings. At the same time, the court rejected the plaintiff's reference to the period during which the children lived with him together and he provided them with maintenance. As the court pointed out, in accordance with Part 2 of Art. 102 of the Federal Law "On Enforcement Proceedings" the amount of debt for alimony is determined in the decision of the bailiff based on the amount of alimony established by a judicial act or agreement on the payment of alimony. Thus, the bailiff is obliged to determine the amount of alimony arrears within the period established by law and is not authorized to resolve issues of reducing the amount of debt or exempting it from payment. In addition, the law defines the circumstances under which only the court has the right to release a person obliged to pay alimony from paying alimony arrears, and which are to be established in the course of a trial when resolving a claim for exemption from paying debts (Article 114 of the Family Code of the Russian Federation) . Meanwhile, the administrative plaintiff did not file a corresponding claim for exemption from the payment of alimony; no evidence to the contrary was presented.

At the same time, the court rejected the plaintiff's reference to the period during which the children lived with him together and he provided them with maintenance. As the court pointed out, in accordance with Part 2 of Art. 102 of the Federal Law "On Enforcement Proceedings" the amount of debt for alimony is determined in the decision of the bailiff based on the amount of alimony established by a judicial act or agreement on the payment of alimony. Thus, the bailiff is obliged to determine the amount of alimony arrears within the period established by law and is not authorized to resolve issues of reducing the amount of debt or exempting it from payment. In addition, the law defines the circumstances under which only the court has the right to release a person obliged to pay alimony from paying alimony arrears, and which are to be established in the course of a trial when resolving a claim for exemption from paying debts (Article 114 of the Family Code of the Russian Federation) . Meanwhile, the administrative plaintiff did not file a corresponding claim for exemption from the payment of alimony; no evidence to the contrary was presented.

Articles, Comments, answers to questions : Reducing the amount of debt on alimony

Register and receive trial access to the ConsultantPlus system free 2 days

Open the ConsultantPlus:

Article: Superior Article: Superior employment as a measure of influence on the debtor in order to fulfill his maintenance obligation

(Konovalov A.M.)

("Russian Legal Journal", 2021, N 1) One can, of course, refer to a number of such "stimulating measures" as a temporary restriction on departure from the Russian Federation, temporary restriction of the right (for example, the right to drive a car) taken in relation to debtors by a bailiff in accordance with Federal Law of October 2, 2007 N 229-FZ (as amended on December 22, 2020) "On Enforcement Proceedings", as well as the threat of bringing the debtor to administrative or criminal liability. However, such methods of influence are insufficient for at least two reasons. First, as already noted, the amount of child support debt in Russia is only growing from year to year, which in itself speaks of the need to find a new way to solve the problem. Secondly, the measures taken at the moment seem to be effective only in relation to wealthy debtors who own property, who want to go abroad, who are afraid to end up in places of deprivation of liberty or suffer other negative consequences. In relation to other categories of persons (for example, the unemployed), such measures of influence are absolutely useless, and it seems that bringing them to administrative or criminal liability will not reduce the amount of maintenance debt, but only increase it.

Secondly, the measures taken at the moment seem to be effective only in relation to wealthy debtors who own property, who want to go abroad, who are afraid to end up in places of deprivation of liberty or suffer other negative consequences. In relation to other categories of persons (for example, the unemployed), such measures of influence are absolutely useless, and it seems that bringing them to administrative or criminal liability will not reduce the amount of maintenance debt, but only increase it.

Normative acts : Reducing the amount of alimony arrears

Resolution of the Plenum of the Supreme Court of the Russian Federation of 04/27/2021 N 6

"On some issues that arise in judicial practice when considering cases of administrative offenses related to non-payment of funds for the maintenance of children or disabled parents." If, when considering a case on an administrative offense, it is established that the court reduced the amount of alimony or debt on them, or the person was released from paying alimony (debt) for the period reflected in the protocol on an administrative offense, and taking into account these circumstances, as well as the amounts previously paid, the judge comes to the conclusion that there is no non-payment for the specified period, the proceedings are subject to termination due to the absence of an event of an administrative offense on the basis of paragraph 1 of part 1 of Article 24. 5 of the Code of Administrative Offenses of the Russian Federation.

5 of the Code of Administrative Offenses of the Russian Federation.

Reduction of alimony arrears \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Reduction of alimony arrears

A selection of the most important documents upon request Reduction of alimony arrears (regulations, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children to support their parents

- Alimony obligations of spouses

- Alimony in 6-NDFL

- Alimony in a solid amount of

- Alimony of an individual entrepreneur

- more ...

forms of documents : reduction of arrears on alimony

Judicial practice : reduction for alimony

Register and get trial access to the ConsultantPlus system for free for 2 days

Open the document in your system ConsultantPlus:

Selection of court decisions for 2020: Article 115 "Responsibility for late payment of alimony" of the IC of the Russian Federation the amount claimed for collection does not deserve attention, and the conclusions of the court correspond to the legal position of the Constitutional Court of the Russian Federation, reflected in the decision of DD. MM.YYYY N "On the case of checking the constitutionality of the provisions of paragraph 2 of Article 115 of the Family Code of the Russian Federation and paragraph 1 of Article 333 of the Civil Code of the Russian Federation in connection with the complaint of citizen K. ", according to which the provisions of paragraph 2 of article 115 of the IC of the Russian Federation and paragraph 1 of article 333 of the Civil Code of the Russian Federation, in their constitutional and legal meaning in the system of current legal regulation, do not prevent the court in the presence of deserving attention to circumstances, reduce the penalty in the event of debt formation through the fault of the person obliged to pay alimony s by a court decision, if the penalty payable is clearly disproportionate to the consequences of a violation of the obligation to pay alimony.

MM.YYYY N "On the case of checking the constitutionality of the provisions of paragraph 2 of Article 115 of the Family Code of the Russian Federation and paragraph 1 of Article 333 of the Civil Code of the Russian Federation in connection with the complaint of citizen K. ", according to which the provisions of paragraph 2 of article 115 of the IC of the Russian Federation and paragraph 1 of article 333 of the Civil Code of the Russian Federation, in their constitutional and legal meaning in the system of current legal regulation, do not prevent the court in the presence of deserving attention to circumstances, reduce the penalty in the event of debt formation through the fault of the person obliged to pay alimony s by a court decision, if the penalty payable is clearly disproportionate to the consequences of a violation of the obligation to pay alimony.

Register and get the trial access to the consultantPlus system free 2 days 2 days

Open the document in your consultantPlus system:

Selection of court decisions for 2019: Article 113 "Determination of arrears of alimony" of the IC of the Russian Federation

(p . B. Kasenov) The court refused to satisfy the plaintiff's claims against the bailiff to challenge the actions / inaction of the bailiff to recalculate the existing debt for alimony from the debtor downward. As the court pointed out, by virtue of paragraphs 3, 4 of Art. 113 of the Family Code of the Russian Federation, the amount of debt is determined by the bailiff based on the amount of alimony determined by a court decision or an agreement on the payment of alimony. The amount of debt on alimony paid for minor children is determined based on the earnings and other income of the person obliged to pay alimony for the period during which no alimony was collected. Having established in this case the debtor's income from renting a vehicle, the bailiff lawfully recalculated the debt, the court did not see in this case violations of the plaintiff's rights by the actions of the bailiff.

B. Kasenov) The court refused to satisfy the plaintiff's claims against the bailiff to challenge the actions / inaction of the bailiff to recalculate the existing debt for alimony from the debtor downward. As the court pointed out, by virtue of paragraphs 3, 4 of Art. 113 of the Family Code of the Russian Federation, the amount of debt is determined by the bailiff based on the amount of alimony determined by a court decision or an agreement on the payment of alimony. The amount of debt on alimony paid for minor children is determined based on the earnings and other income of the person obliged to pay alimony for the period during which no alimony was collected. Having established in this case the debtor's income from renting a vehicle, the bailiff lawfully recalculated the debt, the court did not see in this case violations of the plaintiff's rights by the actions of the bailiff.

Articles, Comments, answers to questions : Reducing debt on alimony

Register and receive trial access to the ConsultantPlus system Free 2 days

Open the Consultant Pluss:

Situations: When the situation is terminated alimony payments?

("Electronic journal "Azbuka Prava", 2022) However, it happens that even after adoption, the alimony payer retains obligations in relation to the child, including the payment of alimony.