How are child support arrears paid

What are Child Support Arrears? | Overdue Child Support

Learn what happens when parents don't pay child support, how to get help collecting unpaid support from your child's other parent, and what you can do if you owe child support arrears but can't pay.

All parents are legally responsible for supporting their children, with or without a court order. But once a court has ordered one parent to pay a certain amount of child support, failing to keep up with those payments could lead to serious and financial legal consequences. The other parent can get help from the state to collect the money. And if those steps don't work, authorities have ways to punish deadbeat parents until they pay what they owe.

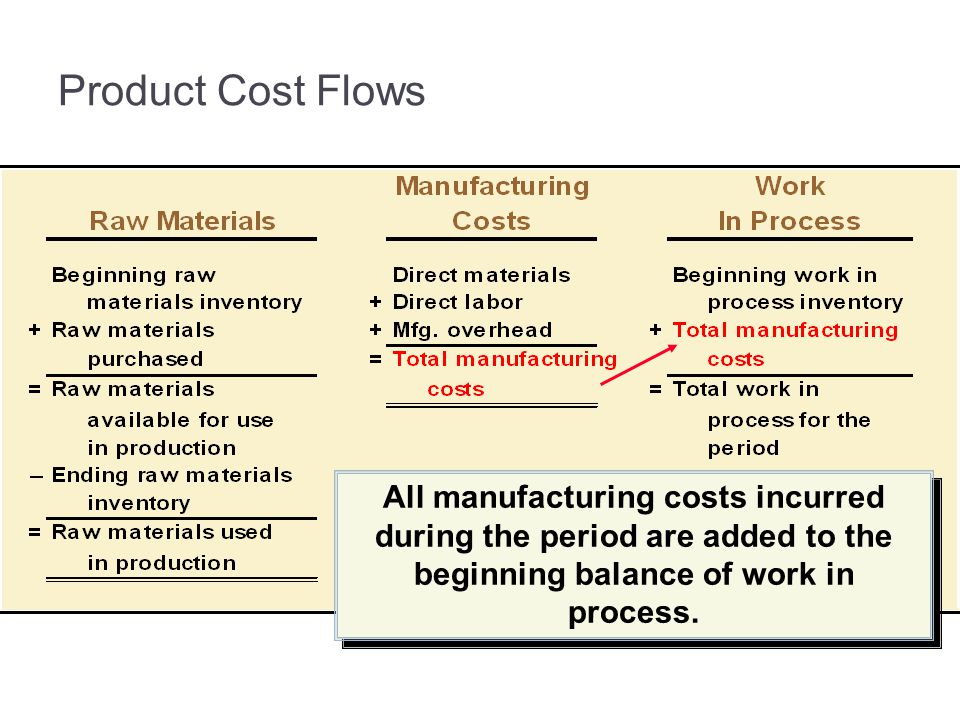

What Are Child Support Arrears?

"Child support arrears" is just a fancy name for unpaid or past-due child support. When a parent gets behind with court-ordered child support—or stops paying completely—the unpaid amounts add up (or "accrue") and become child support arrears (sometimes called "arrearages"). Because support arrears don't accrue until there's an actual child support order in place, any parent who wants to collect past-due support needs to have an official order that establishes who must pay and how much. When parents get divorced, the divorce judgment should include an order like this. When married parents are separated, one of them may ask the court for a temporary child support order until the divorce is final. If the parents were never married, the one with the child (almost always the mother) will also need to legally establish parentage (traditionally paternity) along with a child support order.

Parents may have an agreement about child support, but most state laws require that a judge approve and include the agreement in a court order before it can be enforced. If you don't yet have a child-support order, you might be able to get help with that from your state's child support agency (more on that below).

What's the Difference Between Child Support Arrears and Retroactive Child Support?

Sometimes, judges will order retroactive child support—requiring a parent to pay support for a period of time before the court order was in place. (But most states have limits on how far back a retroactive support order may go.)

(But most states have limits on how far back a retroactive support order may go.)

The typical situations when judges order retroactive child support include:

- An unmarried mother wasn't able to establish the legal paternity of her child at first.

- It took a long time for a parent's request for child support to work its way through the court system.

- A judge increases the amount of child support that was in a previous order and makes the higher amount take effect on an earlier date.

If you've been ordered to pay retroactive child support (often under a payment schedule), it won't be considered child support arrears until you get behind on the payments.

How to Collect Child Support Arrears

If your child's other parent owes you past-due child support, you should be able to get help from the child support agency in your state. (You can find links and phone numbers for state and tribal agencies here, along with information on applying for assistance. )

)

The specific procedures and rules vary from state to state, but your state or local child support agency can provide a range of services, such as:

- finding the other parent, if you don't know where they are

- establishing parentage when that's necessary

- helping you get a child-support order if you don't already have one, and

- taking steps to enforce the order and collect past-due support.

Depending on the rules in your state and the circumstances in your case, the child support agencies have many ways to collect past due child support, including:

- having an amount withheld (or "garnished") from the other parent's wages or from other kinds of income, like workers' compensation benefits, some disability benefits, and settlements from lawsuits or insurance companies

- reporting the arrears to federal and state tax authorities, who will then take (or "intercept") all or part of the other parent's tax refunds; and

- freezing bank accounts or seizing other property.

Child support agencies also have other legal tools meant to make life difficult for deadbeat parents who owe a certain amount of past-due support, such as revoking or suspending their driver's license or other business or professional licenses.

Enforcing Child Support Arrears in Court

If none of the child-support agency's collection efforts work, you may need to ask a judge to enforce your child support order by issuing a judgment for child support arrears. The child support agency will often help with this step. If you have a lawyer, the attorney may represent you in the court proceedings (in coordination with the agency, if that agency has been involved in collection efforts).

In most cases, if you win the enforcement action in court, you'll be entitled to collect payment of your attorney's fees and costs from the deadbeat parent, along with the child support arrearages and any interest due under state law. In extreme situations, such as where a parent refuses to pay the judgment without justification, that parent might be charged with contempt of court, which can result in fine or even jail time.

What If the Deadbeat Parent Is in Another State or Country?

Child support agencies (and courts) may enforce child-support orders across state lines, in coordination with the parallel agencies and/or courts in the other state. Most of the collection efforts will be the same across the United States.

In fact, federal law provides another possible tool for going after deadbeat parents who live in a different state than their child—or who've crossed state lines in order to avoid paying support. It's a federal crime for a parent to deliberately refuse to pay court-ordered support for a child in another state for more than a year (or when the arrears total more than $5,000). In addition to paying a fine and/or spending time in federal prison, a guilty parent will have to pay the full amount of arrearages as restitution.

There are fewer enforcement options available when deadbeat parents are in another country. However, the U.S. State Department could revoke their passports or, in some cases, even arrest them when they try to reenter the United States.

What Should You Do If You Can't Pay Child Support or Are Behind on Payments?

If you're behind on the child support payments you owe, it might be a good idea to reach out to your child's other parent, as long as you have a decent working relationship. The two of you might be able come to an agreement on a payment schedule to catch up with the arrearages. If you aren't sure how much you owe in past-due support, the local child support agency can figure that out for you.

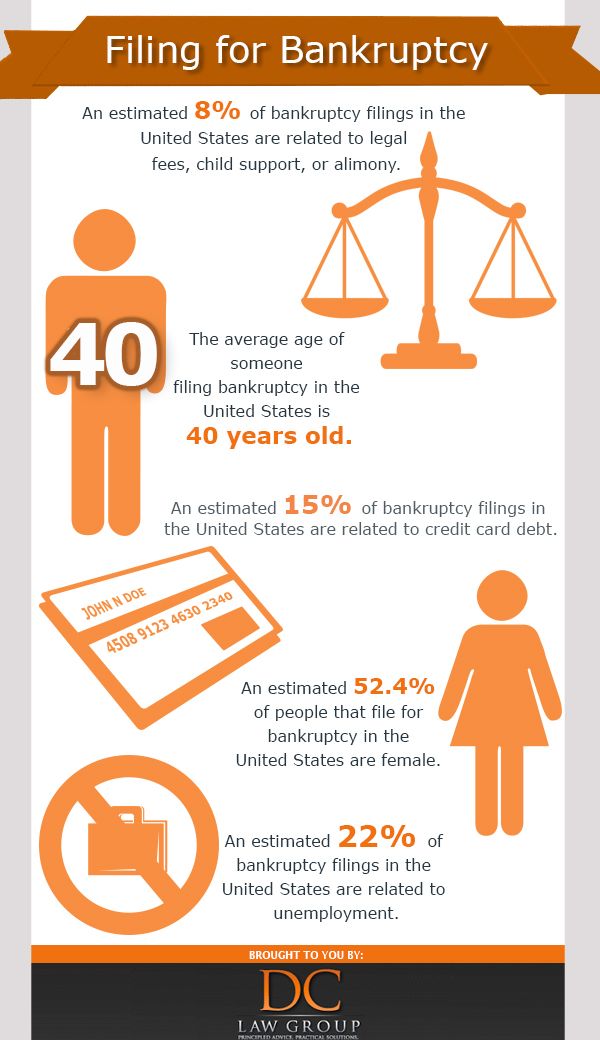

However, you should know that you can't automatically get out your obligation to pay child support just because you've lost a job or other earnings, have been hit with unexpected medical bills, or even have filed for bankruptcy. If you're not able to pay the amount of court-ordered child support because your circumstances have changed, you'll need to request a modification of the support order.

How Can You Request a Change in the Amount of Child Support?

Parents who owe child support can generally turn to the local child support agency for help with seeking a support modification. Generally, this requires filing a petition or motion in court, but your state might have slightly different procedures. For instance, Ohio's child support enforcement agency may conduct an administrative review of modification requests in some cases.

Generally, this requires filing a petition or motion in court, but your state might have slightly different procedures. For instance, Ohio's child support enforcement agency may conduct an administrative review of modification requests in some cases.

In all states, parents who want to change the amount of court-ordered child support must demonstrate that they have experienced a substantial change in their circumstances since the order was issued. (This requirement also applies when the parents who receive child support want to have the payments increased.) Judges will also consider whether the change was part of a deliberate attempt to avoid paying support. For instance, judges may reduce support when the paying parents were laid off, but not when parents voluntarily quit work to avoid paying child support.

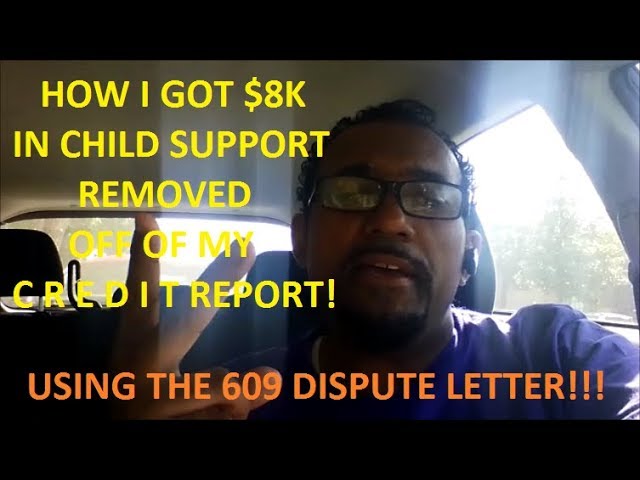

Can Child Support Arrearages Be Wiped Out?

Even if a judge lowered the amount of your current child support obligation, in most cases the change will apply only from when you filed the modification request. You will still be legally responsible for paying any child support arrears. And because arrearages are the unpaid amounts of past support, you still have to pay them off even after you child has turned 18. If you want to contest the amount of arrearages that the agency or court says you owe, you will need to provide evidence (such as bank statements and pay stubs showing withheld support) to back up your claims.

You will still be legally responsible for paying any child support arrears. And because arrearages are the unpaid amounts of past support, you still have to pay them off even after you child has turned 18. If you want to contest the amount of arrearages that the agency or court says you owe, you will need to provide evidence (such as bank statements and pay stubs showing withheld support) to back up your claims.

Although you can wipe out many types of debts in bankruptcy, that's not the case with child support debts, including arrearages. However, filing for bankruptcy could help you pay off your past-due child support by getting rid of other debts. It could also make it easier for the other parent to collect the child-support arrears. (Learn more about how Chapter 7 or Chapter 13 bankruptcy affects enforcement of child support.)

In some extreme circumstances, such as a terminal illness or catastrophic accident, a judge may waive or reduce the amount you owe for child support arrearages. In most cases, however a judge won't eliminate child support arrearages but instead might come up with a payment plan to let you pay off the balance over time.

In most cases, however a judge won't eliminate child support arrearages but instead might come up with a payment plan to let you pay off the balance over time.

Once you've finishing paying off your child support arrears, you should ask the court or the child support agency to dismiss or close your case.

What Happens When Child Support Isn't Being Paid?

Once you have a child support order, you can get help enforcing it from government agencies or from the courts.

Everywhere in the United States—including the 50 states, Washington, D.C., territories, and tribal nations—parents have a legal duty to support their children financially. The duty exists whether the parents are married, never married, separated, or divorced.

If your co-parent isn't meeting that support obligation, your first step will be get a court order establishing child support. Then, when you have an order in hand, you'll have federal and state tools available to enforce the order and collect the amounts owed.

- How to Get a Child Support Order

- Types of Child Support

- How to Enforce a Child Support Order

- Tools for Collecting Child Support

- Federal Prosecution of Deadbeat Parents

- Next Steps

How to Get a Child Support Order

The procedure for getting a child support order depends on your situation. Usually, the parent who isn't living with the child most of the time (the noncustodial parent, or "obligor") will owe child support to the custodial parent (the "recipient").

Divorcing Parents

When a couple with children divorces, the court will issue a child support order as part of the final divorce decree. All states have detailed guidelines that judges use to determine how much the obligor will owe each month. Although parents can ask the judge to order a different amount than what the guidelines show, the judge will do so only if it's in the child's best interests.

Unmarried Parents

If you and your co-parent never married, you'll still need to get a court order establishing child support. But in most states, you won't have to go to court. Instead, you'll apply through your local, state, or tribal child support agency (more about these agencies below). A child support order obtained through an agency has the same legal weight as one that you get as part of a divorce.

But in most states, you won't have to go to court. Instead, you'll apply through your local, state, or tribal child support agency (more about these agencies below). A child support order obtained through an agency has the same legal weight as one that you get as part of a divorce.

Government child support service offices don't represent either parent. Instead, they act on behalf of the state to make sure children receive the financial support they need. The agency will help you with all the legwork, such as establishing paternity (if necessary) and gathering financial information. The agency will then secure the child support order on your behalf.

In some states, the agencies may issue support orders through their own administrative process. In other states, the agencies will take care of getting the order from the court. Either way, if your co-parent doesn't pay support on time, the agency will help enforce the order.

Types of Child Support

Because parents usually are responsible for supporting their child financially from birth until the child reaches the age of majority, it's possible that an obligor could owe money for a period of time before a child support order was issued, as well as the amounts owed after that.

Retroactive Child Support

Retroactive child support is the amount a parent owes before the court (or agency) issued the support order. State laws vary on how far back in time a parent may owe retroactive child support.

Some states allow courts to reach back and calculate the support a parent should've paid for a certain number of years before the custodial parent applied for support. For example, in North Carolina, a custodial parent can seek retroactive child support as far back as three years. (N.C. Gen. Stat. §§ 1-52; 50-13.4 (2022).)

Other states limit awards of retroactive support to the date that the custodial parent applied for child support. For example, in Michigan, a custodial parent may seek retroactive support from the date of the application or petition. However, retroactive support could start further back if the obligor tried to prevent the custodial parent from seeking an order or otherwise tried to delay the process. (Mich. Comp. Laws § 552.452 (2022). )

)

Child Support Arrears

Once a child support order is in place, the obligor parent must pay the full amount of ordered support each month or risk being in "arrears." Child support arrears—also known as arrearages or "back" child support—is the difference between what a parent is ordered to pay and what the parent has actually paid. Unlike retroactive child support, child support arrears begin to add up only after a court has issued a child support order.

More than half of the states charge interest on child support arrears. In some states, the amount of interest varies depending on market conditions, while in others interest accrues at a fixed rate. The National Conference of State Legislatures' website breaks down how and when interest accrues in all the states. Judges in many states may waive interest if it will help obligors fulfill their basic support obligations.

Courts don't differentiate between a large amount of arrears and a small amount. Once any amount of back support accumulates, the custodial parent may seek to have the order enforced.

How to Enforce a Child Support Order

It's important to note that you won't be able to enforce a child support order on your own. You'll need to seek enforcement through the courts or governmental agencies. (Learn more about the child support enforcement process in your state.)

You can hire a local family law attorney to help you navigate the enforcement process. But if the cost of using an attorney is a concern, the good news is that you can get help enforcing child support orders from your state or tribal child support agency at a very low cost—without the need for an attorney.

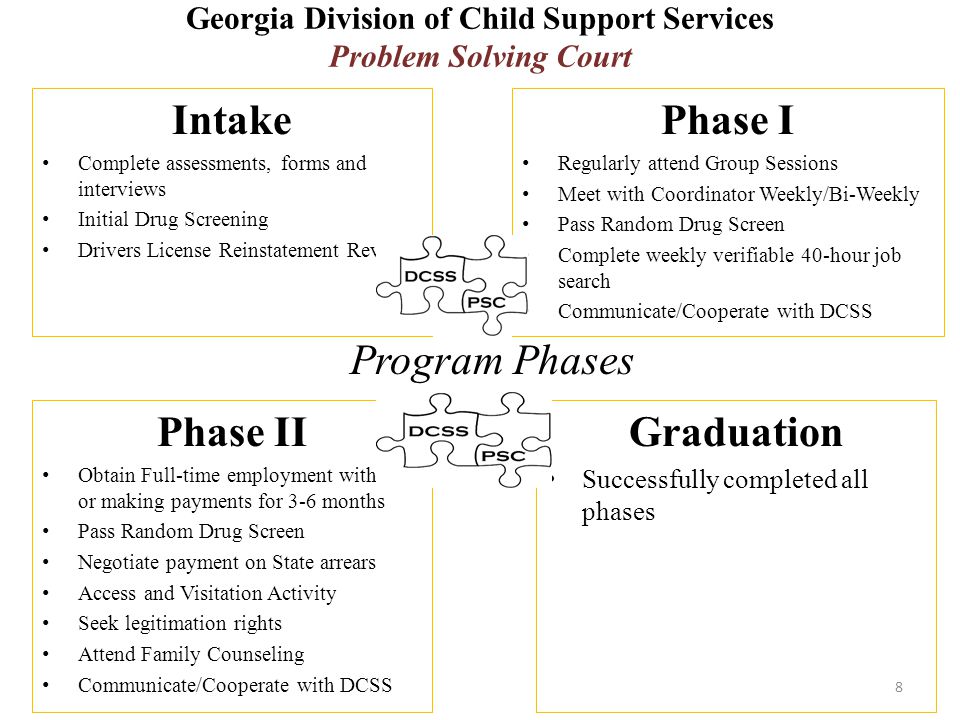

Child Support Enforcement Agencies

The Child Support Enforcement program (CSE) provides a framework under which states and the federal government work together to enforce child support orders and secure child support as a reliable source of income for custodial parents. The CSE is sometimes called the "IV-D" program—a reference to the section of the Social Security Act that created the program. The program is available in all states, as well as Washington, D.C., certain territories, and 60 tribal nations.

The program is available in all states, as well as Washington, D.C., certain territories, and 60 tribal nations.

Under CSE, all of the states (and some territories and tribal nations) have an agency that's tasked with enforcing child support orders. The agencies go by different names (such as "Department of Child Support Services" or "Office of Child Support Services"), but they're generally referred to as "Child Support Services" (CSS).

You can look up your local office on the federal Office of Child Support Enforcement's website. (The Office of Child Support Enforcement is the federal agency that oversees the CSE.) Most local agencies process applications for enforcement online—look for a button or menu item labeled "apply now" or "apply for services."

CSS will help you with any steps you need to take in order to move forward with enforcement, such as locating an obligor. If you have even a little bit of identifying information, such as a full name, date of birth, last known address, or social security number, CSS can help you track down a delinquent obligor.

The Cost of Using a Child Support Enforcement Agency

For most people applying for child support enforcement services, there will be a one-time application fee of $25. If CSS collects at least $550 per year on the applicant's behalf, there's an additional annual fee of $35.

Some families are required to enroll in the CSE but are not charged for enforcement services. These families include those who receive:

- cash assistance under the Temporary Assistance for Needy Families (TANF) program

- Medicaid coverage, or

- Supplemental Nutrition Assistance Program (SNAP) food assistance.

Tools for Collecting Child Support

Child support agencies have many tools for enforcing child support orders. Here's a breakdown of some of the most common methods CSS uses when attempting to collect past-due child support.

Wage Withholding

All child support orders include the enforcement tool of immediate wage withholding (also called "wage deduction," "wage garnishment," and "income (or earnings) assignment"). The state can order the obligor's employer to deduct the child support amount from the obligor's paycheck. Employers must deduct the payment from the obligor's paycheck just like any other payroll deduction (such as income tax or social security). Depending on the order, the employer will send the payment to either the local child support office or the custodial parent.

Wage withholding is very effective when the obligor has a regular job with a steady, predictable paycheck. However, it often isn't the best enforcement method when the obligor changes jobs often, is self-employed, or is unemployed. When that's the case, other tools come into play.

Withholding Other Income

Wages aren't the only income that state agencies can withhold to cover unpaid child support. CSS may also order that money be withheld from payments such as commission income, employment bonuses, and pension benefits.

State child support agencies can also participate in the Administrative Offset Program. This program allows interception of certain federal payments, such as pay to vendors who perform work for a government agency and federal retirement payments.

This program allows interception of certain federal payments, such as pay to vendors who perform work for a government agency and federal retirement payments.

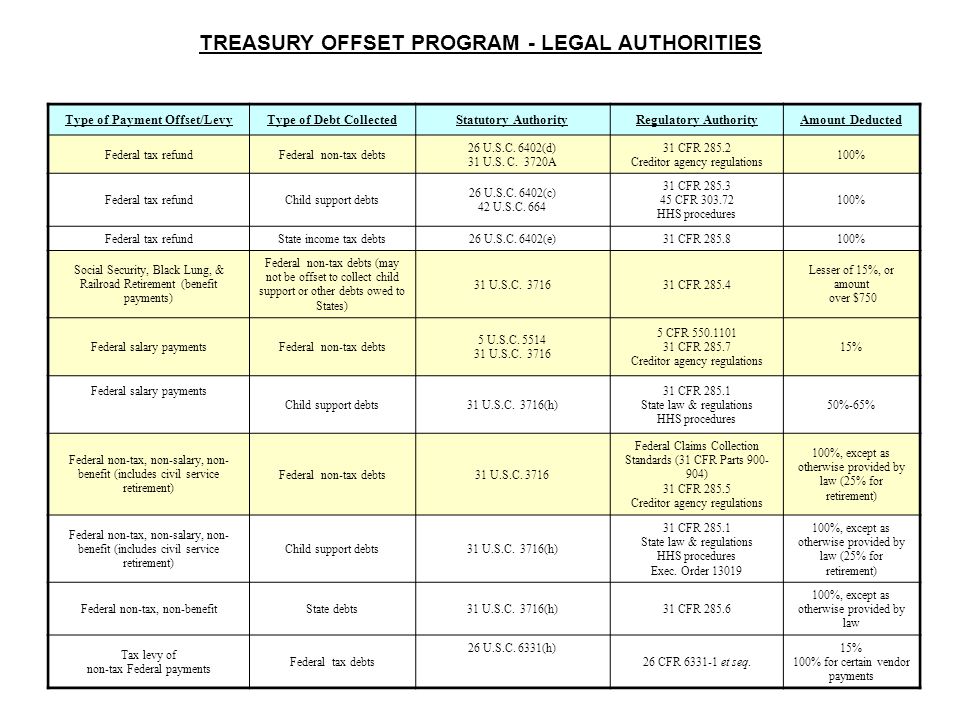

Tax Offsets

State child support agencies can report parents who haven't paid child support to federal and state tax agencies.

Federal Income Tax Returns

Under the federal Treasury Offset Program, state child support enforcement agencies may report parents who fail to pay child support to the federal Treasury Department. The Treasury Department may then withhold refund payments for federal tax returns and other government payments, and apply the money toward overdue child support.

Sometimes, parents who owe child support receive a refund based on a joint tax return—perhaps because they've remarried and filed a joint tax return with the new spouse. In most states, the parent who's owed support may collect only from the portion of the joint return that's based on the obligor's income. Note, however, that community property laws might affect whether a new spouse's share of the tax return can be applied toward the obligor's unpaid child support. (For more information about how tax offsets can be taken against tax returns where you live, and how you can make sure the IRS takes only the obligor's share of the tax return, see the IRS's instructions for Form 8379 (Injured Spouse Allocation).)

(For more information about how tax offsets can be taken against tax returns where you live, and how you can make sure the IRS takes only the obligor's share of the tax return, see the IRS's instructions for Form 8379 (Injured Spouse Allocation).)

State Income Tax Returns

Every state that collects income tax is required to offset state income tax refunds when a parent owes child support. Similar to the situation with federal tax refunds, most states may withhold money only from the portion of the return that's based on the obligor's income if the obligor has remarried and is filing a joint return. (Check out IRS Publication 555 (03/2020), Community Property, for more information.)

License Suspensions and Revocations

One of the most effective ways of obtaining past-due child support payments is to have the state revoke or suspend an obligor's driver's license. CSS also has the power to order withholding, suspension, or even revocation of a delinquent parent's professional license (such as a medical, legal, cosmetic, or real estate broker license) or recreational license (such as a hunting or fishing license).

For obligors who are sincerely trying to earn money to pay back child support, losing a license to drive or practice a profession might actually make it harder to do that. After all, these types of licenses are usually critical to the person's ability to make money. CSS often won't use this penalty if it's not in the child's best interest to do so.

For other obligors, though, losing a driver's license or a professional or recreational license is a powerful incentive to pay the amount due.

Liens

If the obligor parent owns real estate or certain other types of property (like a car), child support payments can be enforced by placing a lien on the property. Every state has its own laws on who can file a child support lien. In some states, the parent who's owed money may file the lien; in others, only a child support agency may file one. The holder of a lien has a claim on the property, and the obligor usually can't sell the property without paying off the lien. In rare cases, the holder of a lien has the right to force a sale of the property to pay off the lien.

One of the downsides of a lien is that it doesn't lead to an immediate payment. The parent who's owed support usually has to wait until the obligor sells the property or is able to pay off the lien without a sale.

Bank Account Freezing and Attachments

CSS has the power to freeze an obligor's accounts held by certain financial institutions (such as banks, credit unions, and insurance companies). When a child support agency freezes an obligor's bank or other financial account, the obligor can't use the account until the debt is paid off. In some states, after the account has been frozen for a period of time (such as 30 days), and the obligor still hasn't paid the debt, the financial institution may seize (withdraw) the amount owed from the obligor's account and send it directly to the child support agency.

Another option available to CSS is to "attach" or seize other property the obligor owns to cover the unpaid child support. In that situation, the obligor will have to either sell the item and apply the proceeds to unpaid child support, or transfer ownership of the item to the custodial parent.

Passport Restrictions

When a parent owes at least $2,500 in child support, CSS can submit the parent's information to the federal Office of Child Support Enforcement (OCSE). OCSE can then submit the parent's information to the Department of State, which can reject the parent's passport application. Sometimes, the child support agency can attempt to get a federal warrant that gives the Department of State the power to revoke an obligor's passport and arrest the parent when they try to re-enter the United States.

Contempt of Court

When none of these enforcement methods work, the custodial parent (on their own or with the help of an attorney) may take the obligor to court. After hearing the evidence, a judge may then find the obligor "in contempt of court"—in other words, guilty of ignoring the court order requiring payment of child support. A contempt can result in fines or even jail time.

If you're the custodial parent, you should consult with CSS before taking this drastic step. Many states won't allow you to pursue a contempt case until you've worked with CSS and attempted all other reasonable collection methods.

Other Consequences of Failing to Pay Child Support

On top of all of these enforcement tools, CSS is required by federal law to report late child support to the major credit bureaus (Equifax, Experian, and TransUnion) every month. That means that anyone who's delinquent in paying child support will take a major hit to their credit score. Having a low credit score can make it difficult to obtain a loan (for a car or house, for example) or obtain credit.

Federal Prosecution of Deadbeat Parents

For the vast majority of delinquent child support cases, state and local enforcement through CSS is effective. For particularly egregious cases, though, the federal government might get involved.

The U.S. Office of the Inspector General (OIG) can intervene in child-support cases where the noncustodial (paying) parent has refused to pay child support for over one year (or owes more than $5,000) and lives in a different state than the child or has traveled to another state or country to avoid paying support.

The punishment varies, depending on whether it's a first offense, whether the parent left the state to avoid paying, and the amount of time or dollar amount of unpaid support. (18 U.S.C. § 228 (2022).)

The OIG doesn't automatically investigate cases that meet the criteria for this federal crime. Instead, after a state or local agency refers the case to OIG, the Department of Justice will decide whether to prosecute the case at the federal level.

Some of the most notorious deadbeat parents are also added to OIG's Most Wanted Deadbeats list.

Next Steps

Given all the resources available to custodial parents when child support isn't being paid, it's often worth it to start by applying for help from your local CSS office. You can always decide to work with an attorney if something comes up that CSS can't handle, or if you feel overwhelmed by the process and need further help.

Article 102. The procedure for collecting alimony and debt on maintenance obligations \ ConsultantPlus

This document is applied taking into account the features established by Federal Laws of 04/03/2020 N 106-FZ, of 10/07/2022 N 377-FZ, of 12/29/2022 N 573 -FZ, dated 08. 06.2015 N 138-FZ.

06.2015 N 138-FZ.

Consultant Plus: note.

See also Chapter 17 of the Family Code of the Russian Federation on the issue of the procedure for collecting alimony.

Article 102. The procedure for collecting alimony and debt on maintenance obligations

Prospects and risks of disputes in a court of general jurisdiction. Situations related to Art. 102

- The recipient of the alimony disputes the decision of the bailiff on determining the amount of debt for alimony

- The payer of alimony disputes the decision of the bailiff on the determination of the amount of debt for alimony

or another person to whom it was sent in the cases specified in paragraph 1 of Article 9and paragraph 8 of Part 1 of Article 47 of this Federal Law, the executive document (copy of the executive document), indexes the alimony collected in a fixed amount of money in proportion to the growth of the subsistence minimum for the corresponding socio-demographic group of the population established in the corresponding subject of the Russian Federation at the place residence of the person receiving alimony, and in the absence of the indicated value in the corresponding subject of the Russian Federation, in proportion to the increase in the subsistence minimum for the corresponding socio-demographic group of the population, established as a whole for the Russian Federation. On such indexation, these persons are required to issue an order (instruction), and the bailiff is obliged to issue a decision. nine0003

On such indexation, these persons are required to issue an order (instruction), and the bailiff is obliged to issue a decision. nine0003

(as amended by the Federal Laws of November 30, 2011 N 363-FZ, of November 14, 2017 N 321-FZ)

(see the text in the previous edition)

the executor on the calculation and collection of alimony arrears based on the amount of alimony established by a judicial act or an agreement on the payment of alimony.

(Part 2 as amended by Federal Law No. 321-FZ of November 14, 2017)

(see the text in the previous edition)

3. The amount of debt on alimony paid for minor children as a share of the debtor's earnings is determined on the basis of the debtor's earnings and other income for the period during which no alimony was collected. If the debtor did not work during this period or documents on his income for this period were not submitted, then the alimony debt is determined based on the average wage in the Russian Federation at the time of debt collection.

4. In the event that the amount of alimony arrears determined by the bailiff violates the interests of one of the parties to the enforcement proceedings, the party whose interests are violated has the right to apply to the court to determine the amount of the debt.

5. The performance fee for non-payment of alimony is calculated and collected from the amount of each debt separately.

6. In case of malicious evasion from paying alimony, the debtor may be held criminally liable in accordance with the legislation of the Russian Federation. nine0003

If alimony debts have accumulated...

Veronika Salnikova

Lawyer, partner of Yakovlev & Partners

June 16, 2021

Tips

Pay attention to the date of publication of the material: the information may be outdated due to changes in legislation or law enforcement practice.

How to collect them, what threatens the parent-debtor and in what case will he be released from liability?

Through which court to collect alimony from a father with many children? nine0053

“In 2018, the Magistrate's Court ruled to collect alimony from her husband for the maintenance of two minor children. In 2020, we had twins. Currently, the marriage is not dissolved. Tell me where to apply (to the world or district court) and how to file an application to collect alimony for twins?

Alimony (funds for the maintenance of minor children) can be collected through the court in the order of writ or action proceedings. Writ proceedings are a simplified procedure for collecting alimony in the Magistrate's Court. When filing an application, the court issues a court order without summoning the plaintiff and the defendant. Claim proceedings are carried out in the district court with the summons of the parties. nine0003

As a general rule, if the parent-debtor already pays child support, then they should be collected on other children through the district court. The mother of twins needs to apply to the district court at her place of residence or the defendant.

You can file a claim with an attorney. In addition, sample applications are often placed in courts. You can use this sample, detailing your situation and attaching supporting documents.

nine0055 (Answers to other questions of alimony recipients and their payers can be found in the articles “On child support - in detail”, “On the payment of alimony - on real examples”, “Cross-border alimony”).

What threatens a parent for non-payment of alimony?

For late payment or non-payment of alimony in full, the debtor parent may be held liable - administrative (Article 5.35.1 of the Code of Administrative Offenses of the Russian Federation) or criminal (Article 157 of the Criminal Code of the Russian Federation). nine0003

Bailiffs bring to administrative responsibility negligent parents. This is possible in the event of non-payment without good reason of funds for the maintenance of children according to a judicial act, a court order or an agreement on the payment of alimony. The court already attracts criminal liability for malicious evasion from the fulfillment of maintenance obligations of parents.

On April 27, 2021, the Plenum of the Supreme Court of the Russian Federation approved a resolution stating that “violation of a judicial act or agreement on the payment of alimony should be understood as non-payment of alimony in the amount, on time and in the manner established by this decision or agreement. ” Partial payment of alimony cannot exclude the application of liability measures (read about this also in the news “The Plenum of the Supreme Court clarified the nuances of administrative responsibility for non-payment of alimony”) .

” Partial payment of alimony cannot exclude the application of liability measures (read about this also in the news “The Plenum of the Supreme Court clarified the nuances of administrative responsibility for non-payment of alimony”) .

In which case will the parent-debtor be released from liability despite the maintenance debt?

If the parent-debtor has good reasons for which he cannot pay child support in the prescribed amount, he has the right to go to court and ask to change the procedure for collection. In the presence of such reasons, the debtor may be released from liability. nine0003

Valid reasons may be recognized such circumstances in which non-payment of alimony occurred regardless of the will of their payer: his illness (incapacity for work), his military service on conscription, force majeure circumstances, the fault of other persons, for example, non-payment of wages by the employer, delay or incorrect transfer bank of funds to the recipient of alimony.

The list of reasons that may be recognized as valid for exemption from liability is not exhaustive. In all cases, the judge must assess whether specific circumstances can be attributed to the number of good reasons for non-payment of alimony. nine0003

How do bailiffs force persistent non-payers to fulfill maintenance obligations?

If the parent does not just evade the payment of alimony, but hides and prevents their collection, i.e. becomes a malicious defaulter, the bailiffs start the procedure for searching for the debtor. But they can do this only if there is a statement from the alimony claimant. During the search, bailiffs try to locate the debtor and his property in order to bring him to justice and force him to fulfill maintenance obligations. How do they do it? nine0003

Bailiffs are endowed with special powers. They have the right:

- to receive personal data from the internal affairs authorities, tax authorities, the Pension Fund, registry offices, traffic police;

- check information through the customs authorities;

- check in banks information about accounts, deposits, securities;

- to interview relatives, friends, colleagues - everyone who has information about the non-payer; nine0094

- to carry out a visit to the location of the debtor's property for its examination and evaluation;

- use information obtained through the involvement of a private detective bureau or from open sources, including those posted on personal pages on social networks.