Formula for due date

How to Calculate Your Due Date

Pregnancy lasts an average of 280 days (40 weeks) from the first day of your last menstrual period (LMP). The first day of your LMP is considered day one of pregnancy, even though you probably didn’t conceive until about two weeks later (fetal development lags two weeks behind your pregnancy dates).

Read our report on the 13 best pregnancy iPhone and Android apps of the year here.

Calculating your due date isn’t an exact science. Very few women actually deliver on their due date, so, while it’s important to have an idea of when your baby will be born, try not to get too attached to the exact date.

If you have regular 28-day menstrual cycles, there are two ways to calculate your due date.

Naegele’s rule

Naegele’s rule involves a simple calculation: Add seven days to the first day of your LMP and then subtract three months.

For example, if your LMP was November 1, 2017:

- Add seven days (November 8, 2017).

- Subtract three months (August 8, 2017).

- Change the year, if necessary (to the year 2018, in this case).

In this example, the due date would be August 8, 2018.

Pregnancy wheel

The other way to calculate your due date is to use a pregnancy wheel. This is the method that most doctors use. It’s very easy to estimate your due date if you have access to a pregnancy wheel.

The first step is locating the date of your LMP on the wheel. When you line up that date with the indicator, the wheel displays your due date.

Remember that the due date is only an estimate of when you will deliver your baby. The chances of actually having your baby on that exact date are very slim.

This is more common than you’d think. Luckily, there are ways to figure out your due date when you can’t remember the first day of your LMP:

- If you know you had your LMP during a particular week, your doctor can estimate your due date accordingly.

- If you have no idea when your last period was, your doctor may order an ultrasound to determine your due date.

Some women have cycles that are consistently longer than the average 28-day cycle. In these cases, a pregnancy wheel can still be used, but some simple calculations are necessary.

The second half of a woman’s menstrual cycle always lasts for 14 days. This is the time from ovulation to the next menstrual period. If your cycle is 35 days long, for example, then you probably ovulated on day 21.

Once you have a general idea of when you ovulated, you can use an adjusted LMP to find your due date with a pregnancy wheel.

For example, if your menstrual cycle is usually 35 days long and the first day of your LMP was November 1:

- Add 21 days (November 22).

- Subtract 14 days to find your adjusted LMP date (November 8).

After you calculate your adjusted LMP date, simply mark it on the pregnancy wheel and then look at the date where the line crosses. That is your estimated due date.

Some pregnancy wheels may allow you to enter the date of conception — which occurs within 72 hours of ovulation — instead of the date of your LMP.

Your doctor may change your due date if your fetus is significantly smaller or larger than the average fetus at your particular stage of pregnancy.

Generally, your doctor orders an ultrasound to determine the gestational age of your baby when there’s a history of irregular periods, when the date of your LMP is uncertain, or when conception occurred despite oral contraceptive use.

An ultrasound allows your doctor to measure the crown-rump length (CRL) — the length of the fetus from one end to the other.

During the first trimester, this measurement provides the most accurate estimation for the age of the baby. Your doctor may change your due date based on the ultrasound measurement.

This is most likely to occur in the first trimester, especially if the date estimated by the ultrasound differs by more than one week from the date estimated by your doctor based on your LMP.

In the second trimester, an ultrasound is less accurate and your doctor probably won’t adjust your date unless the estimates vary by more than two weeks.

The third trimester is the least accurate time to date a pregnancy. Estimates based on an ultrasound can be off by as much as three weeks, so doctors rarely adjust dates during the third trimester.

However, it’s not uncommon for a doctor to perform an ultrasound in the third trimester if they’re thinking about changing your date.

A repeat ultrasound provides valuable information about the growth of the fetus and may reassure you and your doctor that the change in due date is reasonable.

Did you know?Ultrasound measurements for estimating the age of a fetus are more accurate during the early stages of pregnancy. In the first few weeks, fetuses tend to develop at the same rate. However, as pregnancy progresses, the rates of fetal growth begin to vary from pregnancy to pregnancy.

This is why ultrasound measurements can’t be used to accurately predict the age of the baby in the later stages of pregnancy.

Ultrasounds are not a necessary part of prenatal care. Avoid numerous scansTrusted Source and have ultrasounds for medical reasons only.

Avoid numerous scansTrusted Source and have ultrasounds for medical reasons only.

When a doctor performs an ultrasound, they write a report on the findings and include two estimated due dates. The first date is calculated using the date of the LMP. The second date is based on the ultrasound measurements. These dates are rarely the same.

When your doctor evaluates the ultrasound results, they’ll determine whether or not these dates are in agreement. Your doctor probably won’t change your due date unless its significantly different from your ultrasound date.

If you have more ultrasounds, each ultrasound report will contain a new due date based on the most recent measurements. An expected due date shouldn’t be changed based on measurements from a second- or third-trimester ultrasound.

Due date estimations are more accurate earlier in pregnancy. Later ultrasounds are helpful in determining whether the fetus is growing well but not for determining the age of the fetus.

Learn more about how your body changes during your pregnancy.

- ACOG reinvents the pregnancy wheel: Launches new due date app. (2016). https://www.acog.org/About-ACOG/News-Room/News-Releases/2016/ACOG-Reinvents-the-Pregnancy-Wheel

- Avoid fetal “keepsake” images, heartbeat monitors. (2014). https://www.fda.gov/ForConsumers/ConsumerUpdates/ucm095508.htmTrusted Source

- Calculating a due date. (n.d.). http://www.hopkinsmedicine.org/healthlibrary/conditions/pregnancy_and_childbirth/calculating_a_due_date_85,P01209/

- Calculating your estimated due date. (2014). https://my.clevelandclinic.org/health/diseases_conditions/hic_Am_I_Pregnant/hic_Calculating_Your_Estimated_Due_Date

- Due date calculator. (n.d.). http://www.marchofdimes.org/pregnancy/calculating-your-due-date.aspx

- Pregnancy due date and gestational age calculator. (n.d.). http://www.perinatology.com/calculators/Due-Date.htm

How to Calculate Your Due Date

Pregnancy lasts an average of 280 days (40 weeks) from the first day of your last menstrual period (LMP). The first day of your LMP is considered day one of pregnancy, even though you probably didn’t conceive until about two weeks later (fetal development lags two weeks behind your pregnancy dates).

The first day of your LMP is considered day one of pregnancy, even though you probably didn’t conceive until about two weeks later (fetal development lags two weeks behind your pregnancy dates).

Read our report on the 13 best pregnancy iPhone and Android apps of the year here.

Calculating your due date isn’t an exact science. Very few women actually deliver on their due date, so, while it’s important to have an idea of when your baby will be born, try not to get too attached to the exact date.

If you have regular 28-day menstrual cycles, there are two ways to calculate your due date.

Naegele’s rule

Naegele’s rule involves a simple calculation: Add seven days to the first day of your LMP and then subtract three months.

For example, if your LMP was November 1, 2017:

- Add seven days (November 8, 2017).

- Subtract three months (August 8, 2017).

- Change the year, if necessary (to the year 2018, in this case).

In this example, the due date would be August 8, 2018.

Pregnancy wheel

The other way to calculate your due date is to use a pregnancy wheel. This is the method that most doctors use. It’s very easy to estimate your due date if you have access to a pregnancy wheel.

The first step is locating the date of your LMP on the wheel. When you line up that date with the indicator, the wheel displays your due date.

Remember that the due date is only an estimate of when you will deliver your baby. The chances of actually having your baby on that exact date are very slim.

This is more common than you’d think. Luckily, there are ways to figure out your due date when you can’t remember the first day of your LMP:

- If you know you had your LMP during a particular week, your doctor can estimate your due date accordingly.

- If you have no idea when your last period was, your doctor may order an ultrasound to determine your due date.

Some women have cycles that are consistently longer than the average 28-day cycle. In these cases, a pregnancy wheel can still be used, but some simple calculations are necessary.

In these cases, a pregnancy wheel can still be used, but some simple calculations are necessary.

The second half of a woman’s menstrual cycle always lasts for 14 days. This is the time from ovulation to the next menstrual period. If your cycle is 35 days long, for example, then you probably ovulated on day 21.

Once you have a general idea of when you ovulated, you can use an adjusted LMP to find your due date with a pregnancy wheel.

For example, if your menstrual cycle is usually 35 days long and the first day of your LMP was November 1:

- Add 21 days (November 22).

- Subtract 14 days to find your adjusted LMP date (November 8).

After you calculate your adjusted LMP date, simply mark it on the pregnancy wheel and then look at the date where the line crosses. That is your estimated due date.

Some pregnancy wheels may allow you to enter the date of conception — which occurs within 72 hours of ovulation — instead of the date of your LMP.

Your doctor may change your due date if your fetus is significantly smaller or larger than the average fetus at your particular stage of pregnancy.

Generally, your doctor orders an ultrasound to determine the gestational age of your baby when there’s a history of irregular periods, when the date of your LMP is uncertain, or when conception occurred despite oral contraceptive use.

An ultrasound allows your doctor to measure the crown-rump length (CRL) — the length of the fetus from one end to the other.

During the first trimester, this measurement provides the most accurate estimation for the age of the baby. Your doctor may change your due date based on the ultrasound measurement.

This is most likely to occur in the first trimester, especially if the date estimated by the ultrasound differs by more than one week from the date estimated by your doctor based on your LMP.

In the second trimester, an ultrasound is less accurate and your doctor probably won’t adjust your date unless the estimates vary by more than two weeks.

The third trimester is the least accurate time to date a pregnancy. Estimates based on an ultrasound can be off by as much as three weeks, so doctors rarely adjust dates during the third trimester.

However, it’s not uncommon for a doctor to perform an ultrasound in the third trimester if they’re thinking about changing your date.

A repeat ultrasound provides valuable information about the growth of the fetus and may reassure you and your doctor that the change in due date is reasonable.

Did you know?Ultrasound measurements for estimating the age of a fetus are more accurate during the early stages of pregnancy. In the first few weeks, fetuses tend to develop at the same rate. However, as pregnancy progresses, the rates of fetal growth begin to vary from pregnancy to pregnancy.

This is why ultrasound measurements can’t be used to accurately predict the age of the baby in the later stages of pregnancy.

Ultrasounds are not a necessary part of prenatal care. Avoid numerous scansTrusted Source and have ultrasounds for medical reasons only.

When a doctor performs an ultrasound, they write a report on the findings and include two estimated due dates. The first date is calculated using the date of the LMP. The second date is based on the ultrasound measurements. These dates are rarely the same.

The first date is calculated using the date of the LMP. The second date is based on the ultrasound measurements. These dates are rarely the same.

When your doctor evaluates the ultrasound results, they’ll determine whether or not these dates are in agreement. Your doctor probably won’t change your due date unless its significantly different from your ultrasound date.

If you have more ultrasounds, each ultrasound report will contain a new due date based on the most recent measurements. An expected due date shouldn’t be changed based on measurements from a second- or third-trimester ultrasound.

Due date estimations are more accurate earlier in pregnancy. Later ultrasounds are helpful in determining whether the fetus is growing well but not for determining the age of the fetus.

Learn more about how your body changes during your pregnancy.

- ACOG reinvents the pregnancy wheel: Launches new due date app. (2016). https://www.acog.org/About-ACOG/News-Room/News-Releases/2016/ACOG-Reinvents-the-Pregnancy-Wheel

- Avoid fetal “keepsake” images, heartbeat monitors.

(2014). https://www.fda.gov/ForConsumers/ConsumerUpdates/ucm095508.htmTrusted Source

(2014). https://www.fda.gov/ForConsumers/ConsumerUpdates/ucm095508.htmTrusted Source - Calculating a due date. (n.d.). http://www.hopkinsmedicine.org/healthlibrary/conditions/pregnancy_and_childbirth/calculating_a_due_date_85,P01209/

- Calculating your estimated due date. (2014). https://my.clevelandclinic.org/health/diseases_conditions/hic_Am_I_Pregnant/hic_Calculating_Your_Estimated_Due_Date

- Due date calculator. (n.d.). http://www.marchofdimes.org/pregnancy/calculating-your-due-date.aspx

- Pregnancy due date and gestational age calculator. (n.d.). http://www.perinatology.com/calculators/Due-Date.htm

Payback formula and examples

Online calculators

More than 100 free online calculators in mathematics, geometry and physics are collected on our site.

Handbook

Basic formulas, tables and theorems for students. Everything you need to do your homework!

Order solution

Can't solve the test?!

We will help! More than 20,000 authors will complete your work from 100 rubles!

Home Economics formulas Formula of the payback period of the project

The concept of the payback period

To start making investments, each investor must determine the period after which, investments can begin to make a profit. To do this, economists use the calculation of the payback period as the most important financial tool.

To do this, economists use the calculation of the payback period as the most important financial tool.

When calculating the payback period of the project, the time interval is calculated, after which the invested funds will be equated to the amount of profit received. That is, the formula for calculating the payback period allows you to determine the period during which all funds invested in the project are returned to investors, and the project begins to make a profit.

Usually, the formula for calculating the payback period of the project is used when choosing one of the alternative projects for investment. Investors will give preference to the project with the shortest payback period. At the same time, the payback period formula reflects the enterprise that will become profitable the fastest.

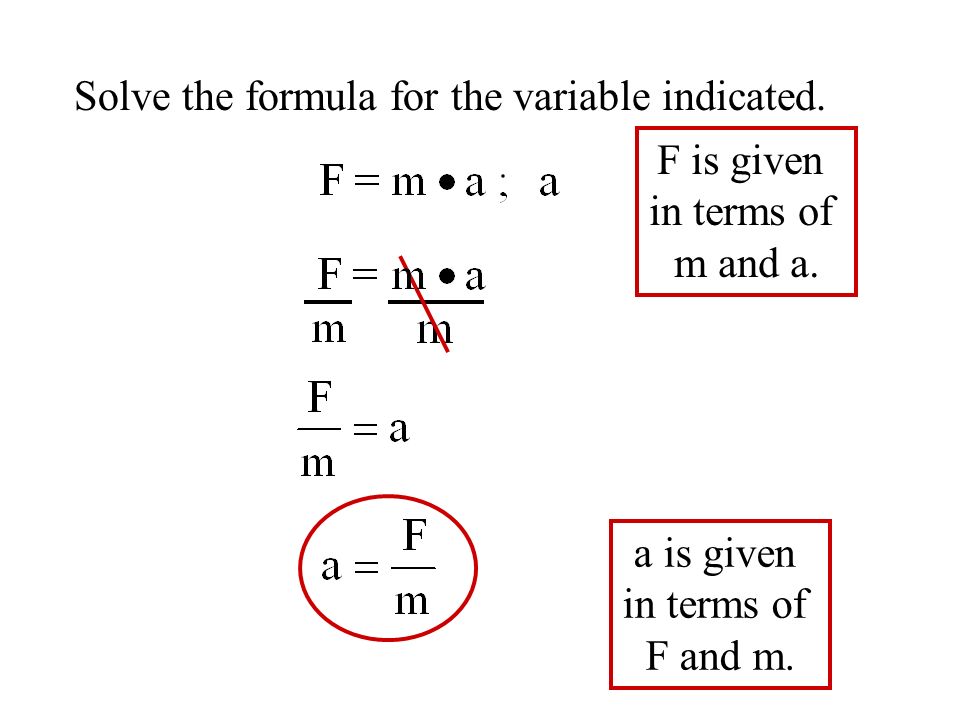

The formula for calculating the payback period of the project

To calculate the payback period of the project, a simple formula is used that makes it possible to calculate the period that occurs from the moment the funds are invested until the moment they are paid back.

The formula for calculating the payback period of the project in this case is as follows:

T \u003d K / P

Here T is the payback period of the project,

K is the amount of investments (investments),

P is the amount of profit.

The payback period of the project is calculated in years

This formula for calculating the payback period of the project is as accurate as possible if several conditions are met:

- Comparison of several alternative projects only if their lifetimes are equal;

- Investments are made at the start on a one-time basis;

- Income from invested funds is received evenly and in the same amount.

Disadvantages of a simple payback formula

A simple formula for calculating the payback period of a project is the simplest and clearest in calculations. It is quite informative when the investment risk indicator is determined. With a high value of the payback period, we can conclude that there is a high risk of investing and vice versa.

However, this formula has several drawbacks:

- The value of the money that was invested at the start of the project can change significantly over time;

- When the project pays off, it can continue to generate profit, which is important to determine.

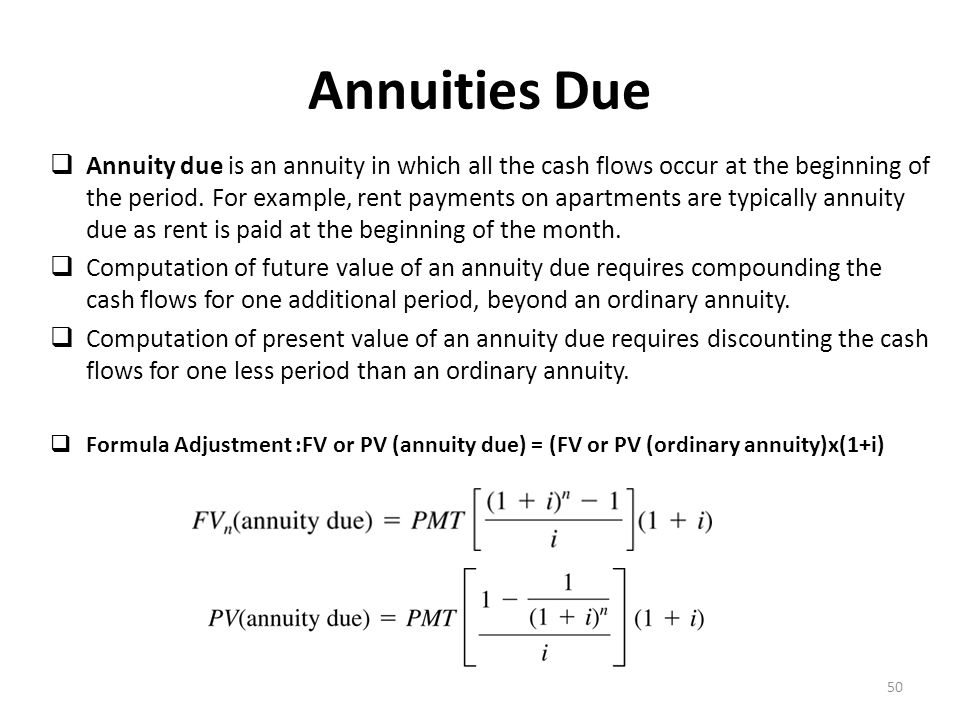

Dynamic formula for calculating the payback period of the project

The dynamic payback period of the project (discounted) is an indicator of the length of the period that passes from the start of investments to the moment of its payback. At the same time, in contrast to the simple formula for determining the payback period of the project, the fact of discounting is taken into account.

The payback period for this calculation occurs at the moment when the net present value is positive and will remain so in the future. The value of the dynamic payback period is always greater than the value of the static period, since when calculating the dynamic indicator, the change in the value of invested funds for a certain period of time is taken into account.

The value of the formula for calculating the payback period

The formula for calculating the payback period of a project is often used when calculating capital investments. The payback period indicator evaluates the effectiveness of a production reconstruction or modernization, reflects the period of the appearance of savings and additional profits that exceeded the amount of capital investments.

The formula for calculating the payback period of a project is also used in assessing the effectiveness and feasibility of investments. In this case, with a very large value of the coefficient, it is necessary to abandon these investments.

In the process of calculating the payback period of equipment, it is possible to obtain information on the period of time during which the invested funds in any production unit will return due to the profit received from its use.

Examples of problem solving

| Liked the site? Tell your friends! | |||

How to calculate the payback period of the project - Home

For any business project, one of the most important indicators is the payback period of invested funds. For those involved in various investment projects, the payback period of investment becomes a truly fundamental factor. To correctly determine the rationality of investing funds, you need to study the methods for obtaining and calculating the return on investment.

For those involved in various investment projects, the payback period of investment becomes a truly fundamental factor. To correctly determine the rationality of investing funds, you need to study the methods for obtaining and calculating the return on investment.

It should be understood that up to a certain point, each business is considered unprofitable, and only after reaching the point of return on investment and growth, it begins to be successful and profitable. You also need to remember that the project continues to be in the red, having crossed the time bar that was set for payback at the beginning of the investment.

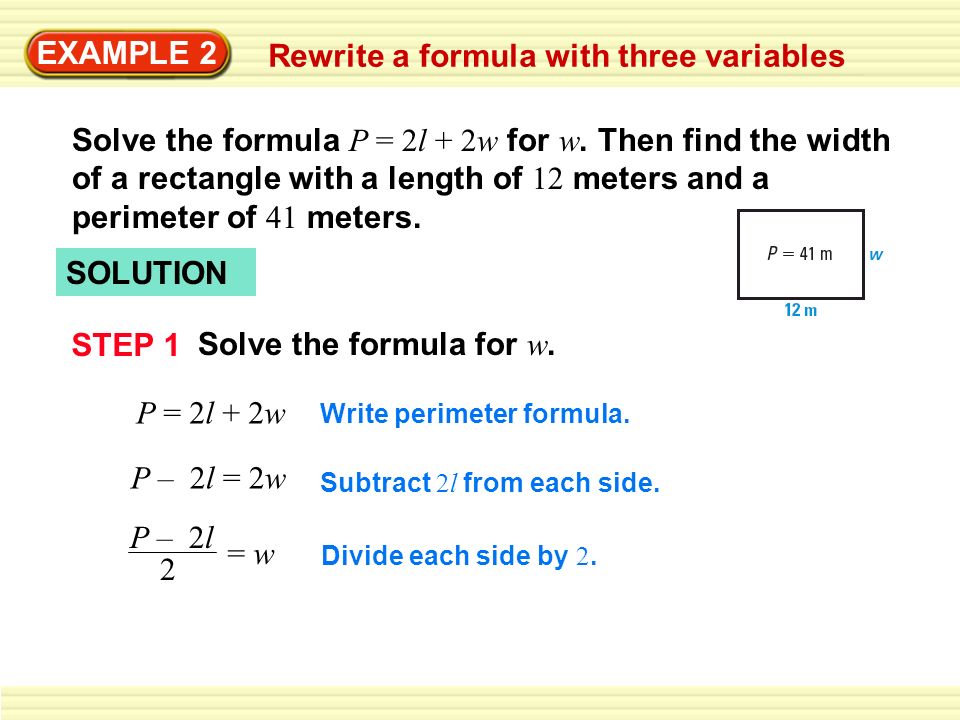

Simple calculation formula The simplest formula for calculating the payback period of a project is: PP = Ko / CFcr, where PP (Payback Period) is the payback period of investments (years), Ko is the initial investment, CFcr is the average annual cash receipts from the project. Most often, this method of calculation is used to assess the question: will the initial investment return during the life cycle of the invested project.

The main advantages of the method are its simplicity, clarity and the possibility of separating and classifying investment funds depending on this indicator. In fact, we can numerically evaluate the investment risk from investing in a particular project. There is an inverse relationship, that is, the shorter the payback period, the lower the investment risk and, conversely, the longer you have to wait for the return of invested funds, the riskier the corresponding investments will be. The disadvantage of this method is that it does not provide the accuracy of calculations, since the time factor is not taken into account. In fact, the income that we receive outside the payback period does not have any effect on the size of this period.

To correctly analyze the effectiveness of investments, first of all, it should be understood that investments are the costs of creating, expanding, technical re-equipment and reconstruction of fixed capital. Therefore, the return on such investments will not come immediately. An investor, investing in the development of a certain line of business, must take into account that he will receive a net positive capital inflow only after a few months. Therefore, it is imperative to use dynamic methods that offer a discounting procedure, that is, bringing the value of money to a single point in time. This must be done because the cost of money capital at the zero moment (the date on which the first investment falls) and the final period (the point in time at which the end of the project falls) are different.

An investor, investing in the development of a certain line of business, must take into account that he will receive a net positive capital inflow only after a few months. Therefore, it is imperative to use dynamic methods that offer a discounting procedure, that is, bringing the value of money to a single point in time. This must be done because the cost of money capital at the zero moment (the date on which the first investment falls) and the final period (the point in time at which the end of the project falls) are different.

Methods for calculating the payback period of an invested project The concept of "investment project" is an event, activity or business that requires a set of specific actions to achieve the intended goals (obtaining planned results) and requiring investment resources for this. Also, this concept means a system of settlement, financial and organizational and legal documents for the implementation of any actions related to investment, or describing such actions.

Investment projects can have very different content and form, but in any case, there must be a time lag - this is the delay between the moment the investment starts and the time when the project starts to make a profit. At the moment, many methods are used for the economic evaluation of investment projects and their payback periods. Each investor, investing a lot of money, must be completely sure that in the future the implementation of the project will not only give him the opportunity to return the invested resources, but also to receive the planned profit. To do this, you need to know how to calculate the payback of the project and what methods are available for this.

In his work “The Concept and Practical Application of the Net Present Value”, the author suggests using the NPV indicator to evaluate any capital investment. In this case, the calculation formula will be as follows: T = IC / FV, where T is the payback period, IC is the investment costs and FV is the future profit of the enterprise. Using this formula, you can calculate the return on investment. But there are other formulas and methods for calculating.

Using this formula, you can calculate the return on investment. But there are other formulas and methods for calculating.

If the cash receipts from investment are the same over the years, then in this case the payback period of the project is calculated according to the following formula: РР = Кo / CFcr. If the cash receipts by year are not the same, then the calculation is performed in several stages. First, you need to find an integer number of periods for which the accumulated amount of income will be closest to the amount of investment. Next, you will have to find the uncovered balance, that is, the difference between the amount of investment and the amount of accumulated cash receipts. After that, the uncovered balance is divided by the amount of cash receipts of the next period.

The main economic standard used in discounting is the discount rate, expressed as a percentage or fraction of a unit per year. Sometimes the value of the discount rate can be chosen differently for different calculation steps (variable discount rate).