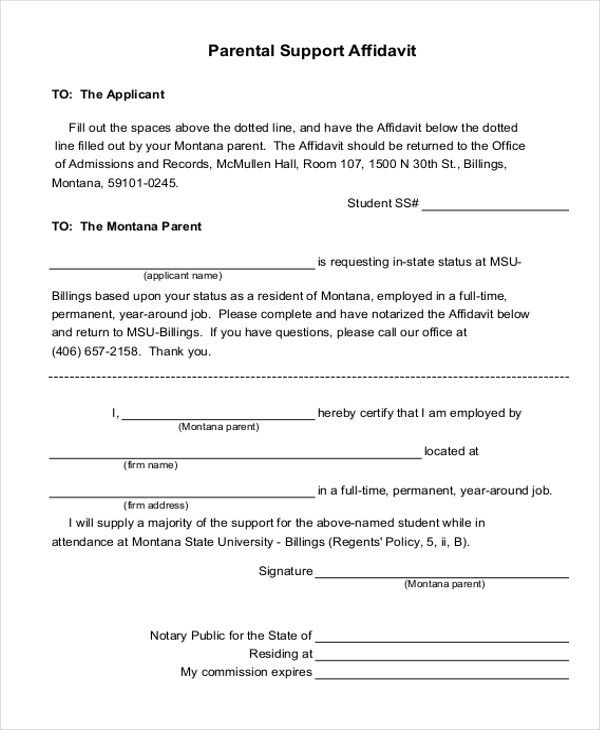

Parent financial support

Financial Assistance for Families | Childcare.gov

There are many programs available in your state or territory that provide financial assistance to eligible low-income families to help them pay for necessities such as food, nutrition, and heat—just to name a few. If you need help, take a look at these programs.

Temporary Assistance for Needy Families (TANF)

TANF helps eligible low-income families by providing time-limited cash assistance. States receive federal funding to run their own TANF programs. You can apply for help at your local TANF office.

To learn about and find TANF services where you live, select your state or territory from the list on the “See Your State’s Resources” page, and then select the “Financial Assistance for Families” tab.

Low Income Home Energy Assistance Program (LIHEAP)

LIHEAP is a federally funded program that helps low-income families with their home energy costs. LIHEAP provides eligible families with financial assistance and information to help them manage their home energy bills, energy emergencies, weatherproofing, and energy-related minor home repairs. You can apply for help at your local LIHEAP office.

To learn about and find LIHEAP services where you live, select your state or territory from the list on the “See Your State’s Resources” page, and then select the “Financial Assistance for Families” tab.

Special Supplemental Nutrition Program for Women, Infants, and Children (WIC)

WIC is a federal nutrition program that helps low-income pregnant women, new mothers, and young children from birth through age 5 eat well, learn about nutrition, and stay healthy. Most WIC programs provide vouchers that moms can use at approved grocery stores. WIC also provides information on healthy eating, breastfeeding support, and health care referrals. You can apply for help at your local WIC office.

To learn about and find WIC services where you live, select your state or territory from the list on the “See Your State’s Resources” page, and then select the “Financial Assistance for Families” tab.

Supplemental Nutrition Assistance Program (SNAP)

SNAP offers food assistance to low-income individuals and families. The federal Food and Nutrition Service works with state agencies, nutrition educators, and neighborhood and faith-based organizations to assist people who are eligible for SNAP benefits. You can apply for help at your local SNAP office.

The federal Food and Nutrition Service works with state agencies, nutrition educators, and neighborhood and faith-based organizations to assist people who are eligible for SNAP benefits. You can apply for help at your local SNAP office.

To learn about and find SNAP services where you live, select your state or territory from the list on the “See Your State’s Resources” page, and then select the “Financial Assistance for Families” tab.

Child Nutrition Support Programs

School and child care meal programs fight hunger and obesity by helping schools, child care centers, family child care programs, and afterschool programs provide healthy meals for children.

- School meal programs provide low-cost or free nutritionally balanced meals to children each school day. School meal programs are available in public and nonprofit private schools. Speak with your child’s school to see if your child may be eligible for free and reduced-cost meals during the school day.

- The Child and Adult Care Food Program provides financial aid to help child care providers pay for nutritious foods that contribute to the wellness, growth, and healthy development of young children. Ask your child care program if it participates in this program and can provide free snacks and meals to your child.

Parents | Federal Student Aid

Home » Conduct Outreach » Targeting Your Outreach » Parents

Find out how to help parents understand financial aid.

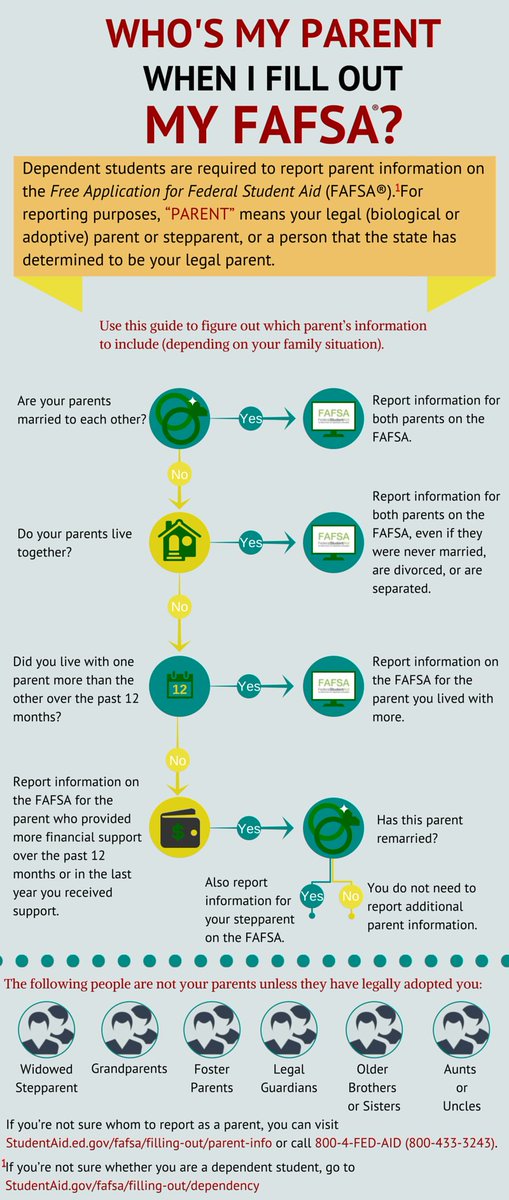

As students work their way through the financial aid application process, their parents worry about such issues as the affordability of schools, whether they'll qualify for loans, and the privacy of FAFSA data.

Most families find the financial aid process mystifying and overwhelming and, unfortunately, many rely on inaccurate information from well-meaning friends or acquaintances. Parents need to know that this whole process is made more manageable because it all begins with the Free Application for Federal Student Aid (FAFSA®) form.

Parents need to know that this whole process is made more manageable because it all begins with the Free Application for Federal Student Aid (FAFSA®) form.

Here you'll find information and tips you can pass on to parents to help them understand their role in their child's financial aid application.

How can parents make college more affordable?

How can parents find out whether they will qualify for loans?

Why do parents have to be involved when it's the student who's applying for federal student aid?

What parent information is reported on the FAFSA® form, and is it kept private?

Many parents believe a college education is out of reach for their child. Reassure them that a great number of financial resources can help make the dream of a college degree a reality. The key is planning ahead and learning about the financial aid process. Here are some things parents can do to bring college costs within reach:

- Save.

State-sponsored college savings plans and prepaid tuition plans are available and are more effective the earlier parents start saving.

State-sponsored college savings plans and prepaid tuition plans are available and are more effective the earlier parents start saving. - Get free money to help pay. Enlist parents' help in encouraging students to look for scholarships early—ideally, in spring of 11th grade or the summer between 11th and 12th grades. The more scholarships a student gets (even if each one is small), the more affordable college is.

- Compare colleges for the best deal. The College Scorecard offers a way to assess not only a school's affordability but also its value for money. You can find scorecards for colleges based on factors such as programs or majors offered, location, and enrollment size.

Talking points:

- Students should apply for aid even if they and their parents don't think they'll be eligible. Even if the assistance they receive is nothing more than an unsubsidized loan, the interest rate on the loan may be less than what they would pay on a private loan.

- Tuition is not the whole picture; a student shouldn't rule out a school until he or she knows what the net price will be after financial aid is taken into account.

- When considering loans to help pay for postsecondary education, parents need to be as upfront with their children as possible. Everyone should be aware of what they can afford and how much they are willing to get in debt for.

Saving Early = Saving Smart! Watch Your Money Grow With Your Child(Result Type: PDF)

Description:

Fact sheet for parents with tips on saving money for college or career school. [40 KB]

Resource Type:

Handout

Also

Available in: Spanish(Result Type: General)

top

Whether a student is starting at a community college to later transfer to a four-year school, or he or she is trying to decide between a public or private college, the cost of school can be daunting, but most families do qualify for some form of aid.

- To supplement the aid the student receives, parents can apply for a Direct PLUS Loan, which is made to the parent to help cover costs for the parent's dependent child. A parent can estimate how much in Direct PLUS Loan funds he or she will receive by using this formula: Cost of Attendance − Other Financial Assistance Received = Eligibility for PLUS Loan.

- Although a student does not need a credit history in order to get a federal student loan, a parent's credit record will be checked when he or she applies for a Direct PLUS Loan. If you find that a parent is concerned that he or she may not qualify, you can reassure him or her that a borrower with an adverse credit history can obtain an endorser or document extenuating circumstances.

- If a parent is unable to obtain a Direct PLUS Loan, the student may be able to get additional Direct Unsubsidized Loan funds. Tell the student to contact the college financial aid office to ask about this option.

top

The FAFSA form was designed to provide a picture of the family's financial strength. If a dependent student is applying for federal student aid to help pay for college, the parent's financial information is required on the FAFSA form. Providing information does not commit the parent to contributing anything toward the student's education; it is simply required for the assessment of the family's situation.

If a dependent student is applying for federal student aid to help pay for college, the parent's financial information is required on the FAFSA form. Providing information does not commit the parent to contributing anything toward the student's education; it is simply required for the assessment of the family's situation.

We recommend you send students and parents to StudentAid.gov/dependency for answers to their questions about dependency status and what to do if the student has no access to the parent's information.

top

Parents must include tax, income, and some asset information on the FAFSA form. They must also obtain an FSA ID to serve as their electronic signature for the financial aid application process.

Assets not included in the financial aid calculation include personal property, annuities, cash value of life insurance, retirement accounts, and 529 plans owned by people other than the student or parents.

The information reported by students and parents on fafsa.gov is encrypted (scrambled using a mathematical formula) so it is unreadable by anyone who might intercept it. Additionally, the U.S. Department of Education does not sell student or parent information and does not share that information with any entities beyond those specified on the FAFSA form: the schools the student lists on the FAFSA form, the state agencies of the states in which those schools are located, and the state agency in the student's state of residence.

Talking points:

- The income and assets of the student are weighed more heavily than those of the parents in the assessment of the student's eligibility for federal student aid.

- The parents' home equity is not considered in the FAFSA form. Parents shouldn't allow lenders to persuade them to draw equity out of their home (usually to purchase expensive investments or insurance) in order to “qualify” for more aid.

top

Financial assistance of parents to adult children: evil or good?

Financial support for an already grown child is a fairly common phenomenon. Moreover, it is far from always possible to immediately determine who needs such help more than - the one who gives, or the one who receives. Analytical psychotherapist, clinical psychologist Anna Borodkina tells how to find out what underlies this and whether something needs to be changed in the current situation.

Moreover, it is far from always possible to immediately determine who needs such help more than - the one who gives, or the one who receives. Analytical psychotherapist, clinical psychologist Anna Borodkina tells how to find out what underlies this and whether something needs to be changed in the current situation.

Boy or husband?

“According to the revision of the WHO age classification, today a person under 25 years old is considered a child (for comparison: at the beginning of the Great Patriotic War, childhood lasted up to 14 years, in the 1960s - up to 16 years), says Anna Borodkina. “The period of youth as part of global changes now begins at 25 and lasts up to 44.” Can such changes strengthen the desire of parents to continue to provide financial support to adult children who have reached physical, biological and psychological maturity? nine0009

Call of the ancestors or a dangerous signal?

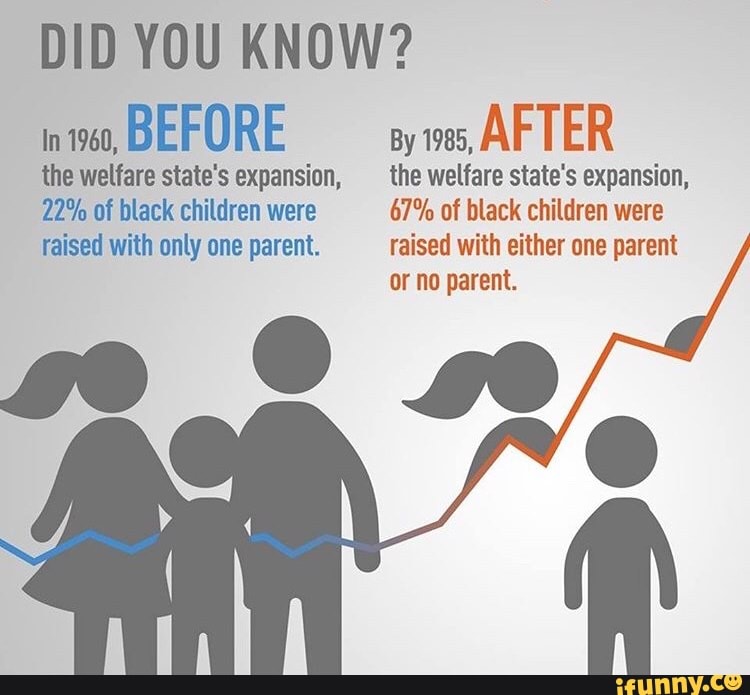

On the one hand, the desire for material assistance from parents to children can be seen as an echo of the collective way of life, which in the era of total individualization continues to unconsciously connect us with the generations that lived in the village community, where mutual assistance and support were seen as a natural interaction within the family structure.

On the other hand, the desire of a parent to provide regular financial assistance to an adult son or daughter may signal a violation of a healthy relationship between an adult and a child. Unfortunately, in modern realities, in most cases today, financial assistance from parents continues to exist. nine0009

Look into yourself

The desire of a mother or father to constantly provide financial assistance to their child can have both visible, obvious, and hidden, deep reasons. In order to get rid of such material dependence, it is necessary to analyze your condition and try to understand what underlies the need to financially support adult children.

Apparent reasons

- Fear of loneliness. Fear of losing the love of a child. nine0027 Feeling of own uselessness.

- Natural age-related changes.

- Loss of value and meaning of one's own life.

- Feeling of guilt before the child.

- Formation of financial dependence as a continuation of previously built dependent relationships between a child and a parent.

- Unconscious desire of the parent to depend on the child as an obstacle to the psychological maturation of the child and, as a consequence, the natural process of separation from the parent. nine0028

Deep causes

- The unconscious desire of a parent to control the life of a child: to continue to be present in the life of an adult child, to influence decisions and choices, feeding their own right to vote with material participation.

The desire for control is nothing more than a signal of a serious sense of fear and strong anxiety of the parent, and indicates that the parent is not ready to let the child go into adulthood so that he learns to rely on his own strength. nine0009

- Strengthening a sense of self-worth: the desire of the parent to continue to be needed, that "big" adult who always knows what's best.

Reinforcing a sense of self-worth through financial injections, a parent unconsciously "buys" for himself the opportunity to live not his own life, seeking and finding new meanings in it, overcoming age crises, and simply taking care of himself, but to live someone else's life - the life of adult children who no longer need the constant presence of a parent, because they are ready to solve the difficulties of adult life on their own.

nine0009

- The desire to remain a “good” parent (or finally become one), earn love, “buy” the right to the last glass of water.

- The latent desire of a parent to prove to himself and others that he can be a good mother or a good father, sharing financial obligations with an adult child.

- The desire to compensate for unformed emotional closeness with a child in early childhood, where care and love were expressed in a material manifestation. nine0028

- Imposed financial assistance from a parent as an opportunity to earn a child's right to care and care at a later age.

Solutions

1. Realize that the child has grown up and no longer needs the presence of a parent on a permanent basis, including material. The ability to bear financial responsibility, earn according to needs, overcome financial difficulties on their own - indicators of a mature personality. Becoming an adult means gaining independence, including financial independence, but the parent gives the right to independence and growing up. nine0009

nine0009

2. Give the child the right to make mistakes, wrong financial decisions. You can't learn to ride a bike without falling and breaking your knees. No matter how old a child is, he has the right to do with his own money as he sees fit. Even if the parents don't think so. The child grows up in the process of acquiring life experience, including negative ones.

3. Provide financial assistance upon request and subject to conditions. In life there are various unforeseen situations, unfortunately, no one can insure oneself for the future. The child can apply for financial support to the parent, and the parent, in turn, must determine for himself whether he is ready to help and whether there is such an opportunity now. nine0009

4. Investing in the future of the clan. Use material means for a prosperous existence and procreation. For example, parents and children may agree to purchase real estate, not to decide for the children the issue of separate residence, but, for example, to make a valuable investment and leave a memory of themselves (for example, take a financial contribution to the construction of a house that will pass future generations). Financial assistance to adult children can be timed to coincide with holidays and personal dates, or aimed at increasing and preserving intangible values, for example, to gain new knowledge. nine0009

Financial assistance to adult children can be timed to coincide with holidays and personal dates, or aimed at increasing and preserving intangible values, for example, to gain new knowledge. nine0009

If you can't figure out the cause and figure out what is happening on your own, you can always seek help from a psychologist who will help correct the situation and solve the problem.

Financial dependence on parents | ELLE

Psychology

While a child is small, no one doubts that parents should feed, clothe and provide for him. But until what age is this considered the norm, and when does the destructive process called “financial dependence” begin? We deal with the family psychologist Alena Tretyakova. nine0009

Practicing psychologist, expert in family psychology

It is impossible to say unequivocally that there is a specific age, for example, the standard 18 years, after which it is bad to take money from parents. There are many factors on which the situation depends. First of all, the financial possibilities of the family. It is easy to see that the children of low-income parents are more likely to switch to self-sufficiency. If a family with a high level of income, children are more likely to stay on maintenance. Although traditions will also play an important role here. There are families where, despite the wealth of parents, it is not customary to support adult children. Or vice versa, even with a difficult financial situation, there is a family tradition that parents are obliged to help. nine0009

There are many factors on which the situation depends. First of all, the financial possibilities of the family. It is easy to see that the children of low-income parents are more likely to switch to self-sufficiency. If a family with a high level of income, children are more likely to stay on maintenance. Although traditions will also play an important role here. There are families where, despite the wealth of parents, it is not customary to support adult children. Or vice versa, even with a difficult financial situation, there is a family tradition that parents are obliged to help. nine0009

The task of parents is to give support and support to the child, both emotionally and financially. But it is important not to miss the moment when this support begins to interfere with further development and maturation.

Helping a child get an education is okay. But it is important to see the difference here as well. For example, if he goes to a medical university, then for objective reasons it is rather problematic to combine study with work without harming the educational process or his own health - and the help of parents in this case may be justified. But when a person, having received one education, decides that this is not his, goes for a second, then for a third, and all this time his parents pay for his “search for himself” - this is a story about the inability to grow up. nine0009

But when a person, having received one education, decides that this is not his, goes for a second, then for a third, and all this time his parents pay for his “search for himself” - this is a story about the inability to grow up. nine0009

It also happens that a child has grown up and earns by himself, lives independently and does not depend on anyone. And suddenly something happens in his life - he was unexpectedly fired, the company was closed, he fell ill. It is also absolutely normal for parents to provide support in such a situation, if they have such an opportunity. Simply put, everything that parents give to help the development of the child is the norm.

If a situation comes when a person does not need to do something himself — he knows that he can always get it from his parents — this leads to a halt in development and problems with his self-realization. nine0009

It is important to understand that financial assistance remains assistance only if it is free of charge, that is, parents do not expect anything in return and do not dictate living conditions.

There are problems when, having given money or bought an expensive thing, they consider themselves entitled to decide how their adult child should live. In this case, "help" becomes a tool of control and a way to tie it to oneself and turns into that same "financial dependence". Examples of such a situation can be very different: from the obvious - they gave money, and then they ask what they spent on; to hidden ones - for example, when parents get a child a job at their own company and pay a salary, even if he does nothing, so long as he does not go to work in an area that they do not like. nine0009

The greatest and most detrimental impact of such assistance is on young families. The older generation under the pretext of “support” regularly gives money, helps with the purchase of an apartment / car, etc., and then considers itself entitled to decide how young people should build relationships or raise children. This often leads to disagreements and can cause the breakup of a not very experienced family. In such situations, the only option to grow up and become independent is to refuse such gifts.

In such situations, the only option to grow up and become independent is to refuse such gifts.

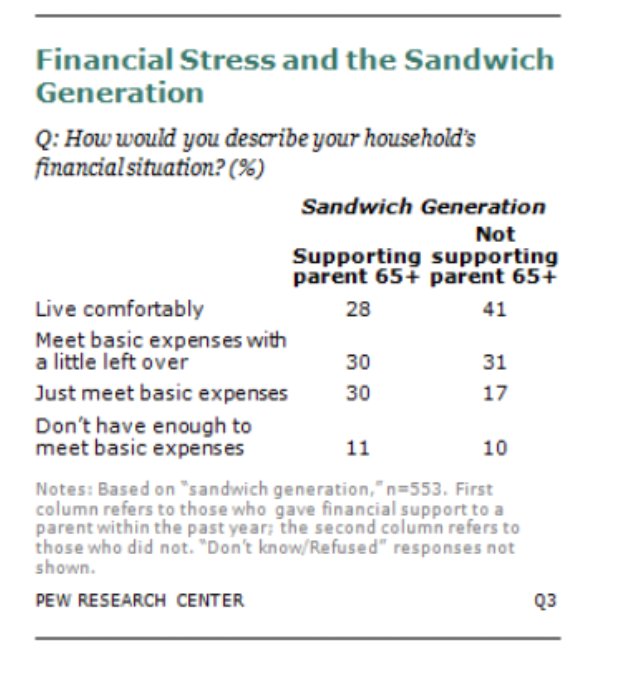

Another important aspect in this topic is the ability of parents.

A healthy and absolutely normal situation looks like this - adult children are able to provide for themselves and develop in life. At the same time, parents have a high income and they sincerely want to share it with their children or grandchildren. It can be just gifts, or, for example, money for business development or even for buying an apartment. The main thing is to remember that they do not expect anything in return. And I emphasize once again: they do it because they have enough funds. In such cases, you can safely accept family support. nine0009

A completely different situation is when adult children have taken out loans, mortgages, or simply do not develop professionally, and parents are forced to help with all their might, barely making ends meet themselves.