Medicare card australia

Medicare: what it covers, eligibility | Health and wellbeing

What is Medicare?

Medicare provides payments and services that can help when you, or someone you provide care for, use health care services or buy medicines.

Who is eligible for Medicare?

Your eligibility for Medicare depends on your residency and other factors. If you live in Australia you are eligible for Medicare benefits if you:

- are an Australian or New Zealand citizen, or

- are a permanent resident, or

- have applied for a permanent visa (excludes an application for a parent visa) and meet certain other criteria, or

- are covered by a Reciprocal Health Care Agreement with another country

Read more about Medicare eligibility

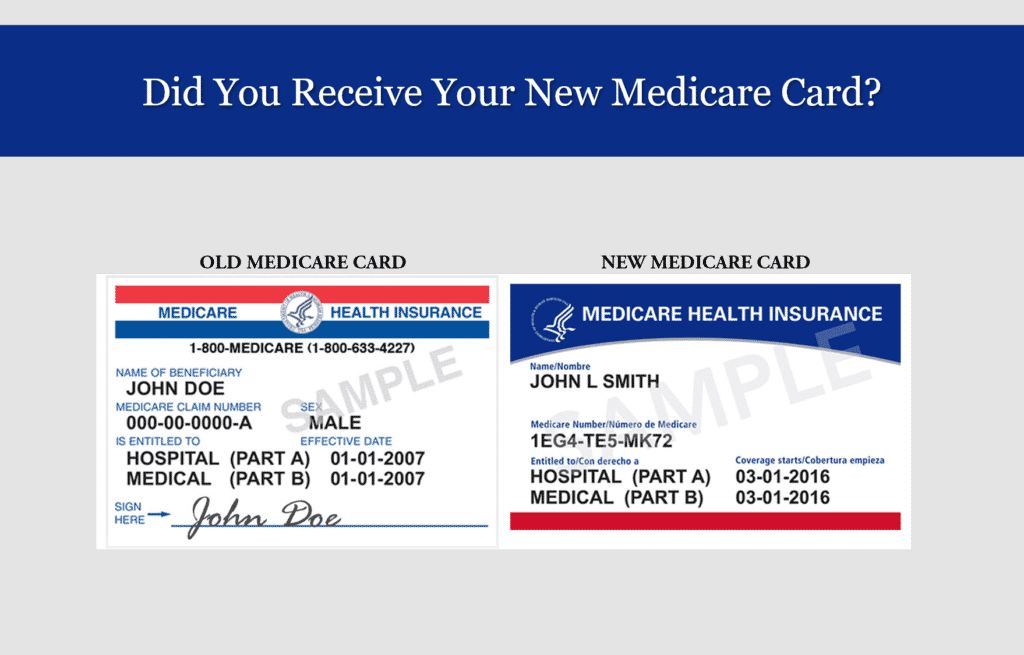

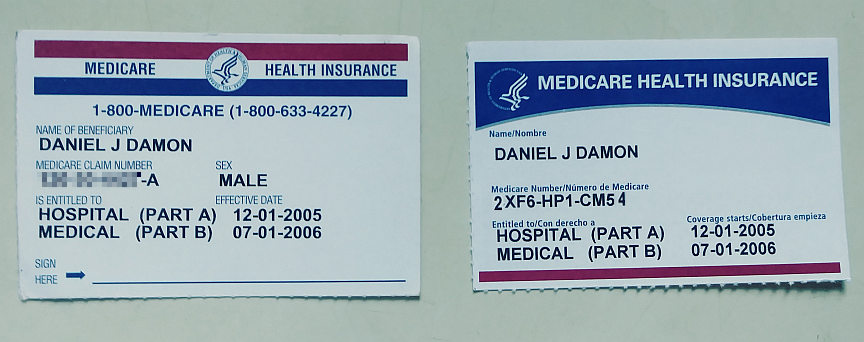

Medicare card

To access public health services, you need a Medicare card. Cards are issued to people enrolled in Medicare. If you are aged 15 or older, you can get your own card. Children under 15 can be listed on their parents’ card.

You use your Medicare card when:

- making a Medicare claim for a paid or unpaid doctor's bill

- visiting a doctor who bulk-bills

- getting treatment as a public patient in a public hospital

- filling a Pharmaceutical Benefits Scheme prescription at a pharmacy

Read more about Medicare cards.

What does Medicare cover?

Medicare helps with some of your health care costs for hospital, medical and pharmaceutical. The benefits you receive from Medicare are based on a schedule of fees set by the Australian Government. Health care providers may choose to charge more than the fees in the schedule, and you will have to pay the extra amount, often called a ‘gap’ payment.

Medicare usually pays:

- the full schedule fee for general practitioner services

- 85% of the schedule fee for other out-of-hospital services

- 75% of the schedule fee for in-hospital services as a public patient.

You may receive a higher benefit under the Medicare safety net if you have a lot of medical expenses.

Find out what Medicare covers.

What is not covered by Medicare?

Medicare does not cover a range of costs like:

- private patient costs in hospital

- extras services like dental and physiotherapy

- medical aids like glasses or hearing aids

You may choose to take out private health insurance to help with these costs. Private health insurance may cover some of your costs for things like glasses, or hearing or mobility aids. You may also be eligible for free or low-cost medical aids under the Medical Aids Subsidy Scheme.

- Last updated:

- 23 February 2023

Can I use Australian Medicare as an Australian Expat living overseas in 2023?

Have you moved to America and thought to yourself at some point: “If I ever get sick or need hospital care, I’ll just go back to Australia!” well then this is for you because it’s not always so easy to use Australian Medicare as an expat.

On this page

The straightforward answer as to whether you can use Medicare as an Australian living abroad, straight from Medicare is this:

If you’ve moved overseas, you continue to be eligible for Medicare for 5 years. The 5 years starts from the date you first left Australia.

There you have it. It’s very clear. They do go on, though:

You can’t access Medicare services from outside of Australia. If we have a Reciprocal Health Care Agreement with the country you’re in [not Canada], you may get access to medically necessary care. You’ll need a Medicare card to do this.

If you move back to Australia after more than 5 years overseas, you can re-enrol in Medicare. You don’t need to visit a service centre.

What to do to ensure you have as long as possible on your Medicare card

That all being said, if you do want to retain the benefits of Medicare you do need to have a valid (read: not expired) Medicare card, so if you leave Australia with a Medicare card that has less than 5 years validity on it, you’re going to have some issues gaining the benefits of Medicare once it’s expired. If you want to renew the card you must know that:

If you want to renew the card you must know that:

If you’re overseas, we can’t replace your card until you return to Australia to live.

This includes if you’re:

- an Australian citizen who’s overseas for more than 5 years

- an Australian permanent resident or New Zealand citizen who’s overseas for more than 12 months

Re-enrolling is not too difficult, you just need to prove that you are an Australian citizen and have become a resident again:

You need to give them 2 of the following documents proving you live in Australia or 1 document from Australia and 1 from where you last lived:

Please note that this is a very separate discussion from whether you have to pay the Medicare Levy, whether you are taxed as an Australian resident, and what the ATO might think about all of this, so please take care!

P.S. If you haven’t moved overseas yet, great, because there are a few things you can do:

Updating Medicare before you leave Australia

From “Australians Overseas” page on the old Medicare website:

Please make sure you update your details before you travel.

You can do this by signing in to your Centrelink online account through myGov. Or you can contact us.

Register your travel plans on smartraveller on the Department of Foreign Affairs and Trade website.

As someone who has tried this, be sure to switch your myGov access to the myGov app, not your mobile number, because it’s a PAIN to try and change (you have to start fresh).

Also, from above, renew your Medicare card so it has a full 5 years validity on it!

Medicine in Australia - Abroadz

Medicine in Australia

The first hospital on the Green Continent was founded by British colonists in 1788. The hospital was a wooden hut with a thatched roof and was intended for convicts. The treatment left much to be desired. Poor sanitation, poor food and little space - in such conditions, patients died more often than they recovered.

Now, according to the analytical agency Bloomberg, Australia ranks sixth in the world in terms of health care. We will understand the features of the Australian medical system in this article.

We will understand the features of the Australian medical system in this article.

Public health insurance

Public health insurance - Medicare - available to nationals, refugees and immigrants with a permanent visa. Medicare is funded by a mandatory health care tax, the Medicare Levy, which is 2% of your monthly taxable income. Even if there is only one worker in the family, the insurance covers all other family members. Low-income families (whose annual income is less than $21,000), retirees, students, and the unemployed are exempt from the medical care tax.

Online tax calculator.

The country's government annually approves official rates (Schedule of Fees) for various types of medical care. The services on this list are fully covered by Medicare. Public hospitals provide care according to official rates. The exceptions are physiotherapy, manual therapy and dentistry.

Private doctors are allowed to set premiums for their services, so their cost is higher than the official set by the state. Medicare reimburses 85% of the official cost of treatment. The remaining 15% and the premium set by the clinic will have to be paid from your own wallet. You must bring your payment receipt to the Medicare office to receive reimbursement.

Medicare reimburses 85% of the official cost of treatment. The remaining 15% and the premium set by the clinic will have to be paid from your own wallet. You must bring your payment receipt to the Medicare office to receive reimbursement.

Some private doctors work on a Bulk Billing system - they provide care in accordance with official rates. In this case, you will not have to pay extra. The reception registers the patient's Medicare card number, after the medical care is rendered, the doctor sends the bill to the Medicare office and receives payment.

Good news for expectant mothers: childbirth is one of the free services. However, pregnant women are considered ordinary patients here, special care and management of pregnancy is not provided. Childbirth is attended by midwives, and a doctor is called only in case of complications. A more attentive approach and respect for women in labor are offered by private clinics. But it is not cheap - about 7-8 thousand dollars.

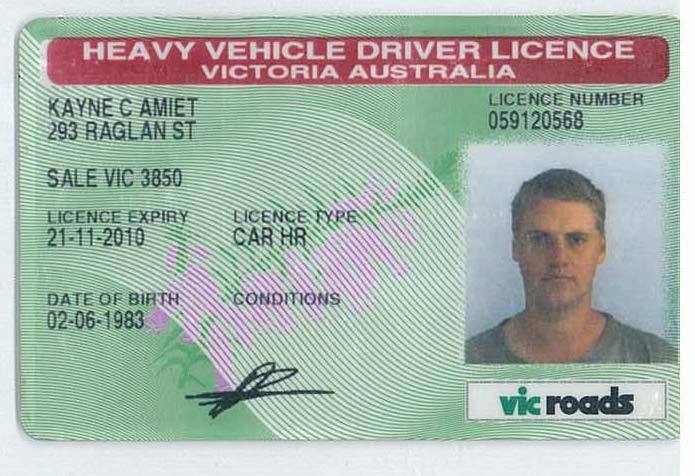

To get public health insurance, you need to visit a Medicare office and fill out an enrollment form. You must have a passport with a valid visa with you. The registration form can be completed in advance on the Australian Department of Human Services website. The card will be ready in one to two weeks.

You must have a passport with a valid visa with you. The registration form can be completed in advance on the Australian Department of Human Services website. The card will be ready in one to two weeks.

Medicare office locations.

Medicine in Australia: private health insurance

Private companies offer insurance for everything from breast augmentation to a bad shave. But usually they are contacted when specialist help, surgery or other medical research is required. These services can also be obtained in public hospitals, but for this you will have to wait several months for your turn.

A private insurance policy covers expenses for services not covered by Medicare, such as physical therapy, emergency calls, chiropractor or dentist visits. Without private insurance, dental treatment in Australia can cost a fortune – one filling can cost around $150.

The cost of an insurance policy depends on the insurer. You can compare prices here.

The government of the country encourages residents to take out health insurance in private companies in order to reduce the burden on the state budget. For this purpose, certain programs are being implemented.

For this purpose, certain programs are being implemented.

Medicare Levy Surcharge. Medicare holders who do not have private health insurance and whose annual income is above the threshold ($88,000 for an individual and $176,000 for a family) pay an additional tax surcharge of 1%.

Private Health Insurance. Under the state compensation program, a part of the cost of a private medical policy is returned. The amount of compensation depends on the annual income of the insured person or family. More about it here.

Lifetime Health Cover. The Lifetime Health Insurance Program aims to increase the number of young people with private health insurance. Private health insurance after the age of 30 will cost 2% more than those under this age. With each year of life, the interest rate will increase by 2%. If the policy at the age of 30 cost $150, then at the age of 40 it will be 20% more expensive - $180. True, the cost of insurance will not grow indefinitely - the maximum price can grow by 70%.

For immigrants, there is relief - you must get private insurance within a year from the date of receipt of Medicare. If this is not done, every year insurance premiums will also increase by 2%.

Medibank Private

Medibank Private is a 40 year old private insurer in Australia with four million customers. Not only Australian citizens can become Medibank clients, insurance is provided to tourists, contract workers and foreign students without a permanent visa who are not eligible for Medicare.

With this insurance, you can receive treatment in public and private hospitals, reimburse the costs of dental services and an ambulance.

But it is not possible to treat diseases and injuries received before coming to Australia, undergo a psychiatric examination or undergo cosmetic surgery. In addition, in order to prevent health tourism in local hospitals, there is a "waiting period" for treatment of certain diseases, which can last from six months to three years. For example, the treatment of eye diseases will become available after six months of residence in the country, and the treatment of diabetes after two.

For example, the treatment of eye diseases will become available after six months of residence in the country, and the treatment of diabetes after two.

Official website of Medibank Private.

Health Care Card

Beneficiaries of Centrelink, a department of the Australian Department of Human Services, have the Health Care Card, which provides additional benefits for buying medicines and receiving medical care, including emergency and dental services. Read more about benefits here.

List of benefits from Centrelink.

Medicine in Australia: pharmaceutical benefits

Australian citizens and permanent residents with Medicare in hand receive a Pharmaceutical Benefits Scheme. The discount is valid only for medicines that are issued by prescription.

Medicines are expensive in Australia - prices can go up to $300, but with a discount the price is only $38. And for pensioners and holders of the Health Care Card - $ 6.

More information about PBS.

List of medicines covered by the discount.

For those who spend a lot of money on prescription drugs, there is an additional discount - PBS Safety Net. If during the calendar year medical expenses amounted to $1,475, then for the rest of the year the price for them will be only $6.

Retirees and Health Care Card holders will get free drugs if they spend $372 a year.

Prescription drug purchases must be kept in order to receive the Safety Net discount. A special registration form can be obtained at the pharmacy.

If you need help

In Australia, you will not be able to see a specialist doctor right away. First you need to visit a general practitioner or "GP" (General Practitioner), who, after examination, will refer you to a specialized doctor for further examination, diagnosis and treatment.

Usually every family has a permanent "G.P." - a family doctor who knows the medical history of all family members, writes out medicines and prescribes treatment. GPs usually work on a direct payment system. You can find a general practitioner using this service.

GPs usually work on a direct payment system. You can find a general practitioner using this service.

In the event of an accident and a critical condition, you should immediately go to the traumatology (Casualty) or emergency department (Emergency) in a public hospital. A preliminary examination by a general practitioner is not required! You need to take your Medicare card and Health Care Card with you if you have it.

If it is difficult to get to the hospital on your own, you need to call an ambulance (Ambulance). Ambulance in Australia is a paid service. The cost depends on the state and the condition of the patient. The number for calling an ambulance is 000. You can call from the numbers of any telephone operators and even without a SIM card.

Community Health Centers

Health consultations, dentists, physical therapists and other specialists are available at Community Health Centers.

Community health centers provide health services to women, immigrants, disabled people and families with small children (free of charge for families with children of preschool age, including vaccination of the child).

Children's vaccinations are taken very seriously in Australia. Kindergartens may refuse to accept a child if they are not vaccinated. Some Child Care Rebate also require the child to be vaccinated.

Read more about vaccinations for children here.

Medicine in Australia: Health care for the elderly

In Australia, you don't have to worry about getting old. Elderly people who for some reason need care or supervision can contact Aged Care Assessments Teams. The organization will assign home care or referral to a nursing home depending on the health condition and wishes of the elderly patient.

Home care includes not only medical care, but also help with cleaning, cooking and personal hygiene. The cost of such services depends on marital status and the size of the pension. Online calculator for calculations.

Nursing Home or Aged Care Home care for the elderly around the clock. They undergo medical procedures, attend recreational activities and receive the necessary medical care.

The cost of the stay depends on the family and financial situation of the guest.

Online calculator for calculations.

Website of the Ministry of Health and Senior Affairs.

Australia Health Insurance - Travel insurance for travel

What does travel insurance cover for Australia

Visiting Australia is a travel destination for anyone who wants to see the world. The Australian government welcomes visitors with a 90-day visa, offering plenty of time to see the country. However, the wonders and adventures of Australia come with a certain amount of risk when traveling there.

You are not required to have travel insurance to visit Australia, but it is highly recommended. Medical care can be expensive for tourists. A visit to a doctor or dentist can cost hundreds of dollars. And hospital stays for emergencies or sickness are expensive. An insurance policy is a kind of financial cushion and a guarantee of your safety abroad.

Read the terms and conditions of travel insurance before paying for it. Try to match insurance coverage with your plans and needs for your trip to Australia. For example, if you are involved in extreme sports, make sure that the appropriate insurance is included in the policy. If you have pre-existing medical conditions, make sure they are covered by insurance.

Try to match insurance coverage with your plans and needs for your trip to Australia. For example, if you are involved in extreme sports, make sure that the appropriate insurance is included in the policy. If you have pre-existing medical conditions, make sure they are covered by insurance.

Health insurance features

Although a medical insurance policy is not included in the list of mandatory documents for obtaining a visa to Australia, its presence will affect the decision regarding crossing the border.

From November 2021, travelers to Australia must be vaccinated against COVID-19. You will also need to confirm your COVID-19 vaccination after your flight at the security checkpoint. Depending on the conditions of the pandemic, you may need a PCR test that shows you are negative for COVID-19.

Before planning your trip, please read the conditions for visiting Australia. The Covid-19 situation can change every week.

How to get insurance in Australia

To purchase a health policy, you will need the following information:

- travel dates and destination;

- number and age of tourists;

- duration of the trip;

- list of coverages you want to add to your insurance.

Enter the data in the insurance section on Finance.ua and select the appropriate offer from the insurance company. You can pay for the policy online using any bank card.

What the policy covers

An insurance policy for travel to Australia may include coverage for:

- Medical expenses. If you become ill, injured, or need medical treatment covered by travel health insurance, the plan will reimburse you up to the limits.

- Cancellation, delay and interruption of the trip. Life is unpredictable and the unexpected can happen while planning your dream vacation. For example, if something happens to you or your family member five days before your trip to Australia, you may want to cancel your trip. Travel insurance can reimburse you for 100% of prepaid and non-refundable travel expenses that you lose by not being able to travel.

- Loss of baggage. If your baggage is lost, stolen or damaged, insurance may reimburse you for the cost of replacing items within the limits of your policy.