In wisconsin how much is child support

Easy-to-use Wisconsin Child Support Calculator 2022

Easy-to-use Wisconsin Child Support Calculator 2022 | Divergent Family Law WisconsinFREE INITIAL CONSULT

Child Support Rates

According to the United States Census Bureau, the national average child support payment was $430 per month in 2010. This means you could end up spending around $100,000 or more over the course of your child’s adolescence. Other factors unique to your situation could inflate that number even higher, such as number of children, the parents’ incomes, placement schedules, and more.

Minimize the cost spent on child support payments by contacting the professional Milwaukee Family law firm, Divergent Law. Our attorneys specialize in child support and child custody laws in Wisconsin. Use our free 2022 Wisconsin child support calculator for primary or shared placement schedules to estimate your monthly Wisconsin child support payments. Our child maintenance calculator uses statistics and rates found in DCF 150. Select different child custody arrangements to see how 50/50, 60/40 and 70/30 placement schedules would affect the child support amount.

Child support is just one of the many aspects to consider when determining the cost of divorce in Wisconsin. Our Milwaukee divorce attorneys offer flat-fee quotes & flexible payment plans. See also: How much does a divorce cost in Wisconsin?

Divorce Cost Calculator

How Wisconsin Calculates Child Support Rates

Child custody and child support laws in Wisconsin are complex and hard to follow at times. Many factors can play into determining child support rates such as joint vs sole placement, the yearly gross income of the parents, special needs of the child(ren), and more. A 50:50 placement schedule would result in a very different child support payment than a 70:30 child custody schedule.

Guidelines exist for given situations for the courts to follow. The courts are required to follow these child support guidelines but they can deviate from them and increase or decrease payments based on other factors.

The courts are required to follow these child support guidelines but they can deviate from them and increase or decrease payments based on other factors.

Divergent Law attorneys can help you navigate the complex landscape of Wisconsin child support and placement laws, codes, regulations, and violations to make sure your child support payments are fair.Contact Milwaukee child support attorneys at Divergent Law today for a free initial consultation.

FREEInitial Consult Get started now! Because it's worth it. KNOWThe Real Costs

Guidelines for the following placement situations are suggested for use by the courts:

Primary Placement

Shared Placement

Low-Income

High-Income

How Wisconsin Calculates Primary Placement Child Support Rates

When the non-residential parent has less than 92 (less than 25% of the time) overnight visits with the child(ren), Wisconsin considers the case to be of primary placement to the residential parent. The child(ren)’s primary residence and supervision are provided by the residential parent, while the non-residential parent is entitled to visitation, which may or may not include overnights.

The child(ren)’s primary residence and supervision are provided by the residential parent, while the non-residential parent is entitled to visitation, which may or may not include overnights.

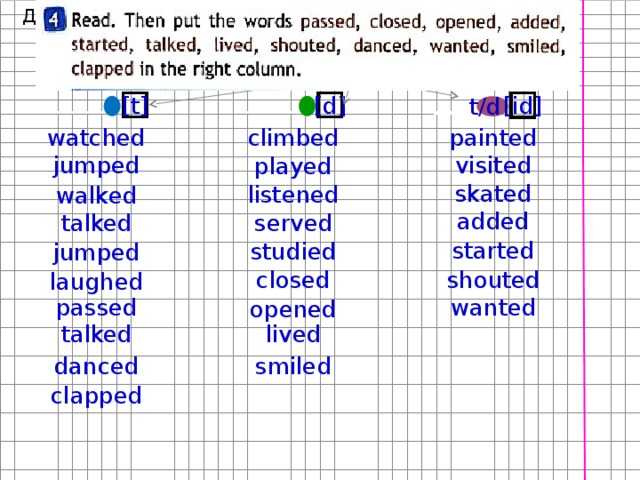

Wisconsin uses the standard percentage formula, set by DCF 150 of our State Legislature. The percentage is based on the number of kids to be in primary placement of a parent. The paying parent will make child support payments based on the following percentages:

- For 1 child, it's 17% of gross income

- For 2 children, it's 25% of gross income

- For 3 children, it's 29% of gross income

- For 4 children, it's 31% of gross income

- For 5+ children, it's 34% of gross income

In Wisconsin, the courts may use their discretion in evaluating other factors to increase or decrease monthly child support payments. Additionally, percentages vary based on low or high-income of either party.

Use Divergent Law’s Wisconsin child support calculator with overnights to estimate child support payments for shared custody, split custody or full custody situations. These calculations should only be used as estimates to determine your monthly child support based on time spent with the child(ren).

These calculations should only be used as estimates to determine your monthly child support based on time spent with the child(ren).

Wisconsin Child Support Percentage Conversion (Examples)

| Monthly Income | 1 child (0.17) | 2 children (0.17) | 3 children (0.17) | 4 children (0.17) | 5+ children (0.17) |

|---|---|---|---|---|---|

| $2,000.00 | $340.00 | $500.00 | $580.00 | $620.00 | $680.00 |

| $2,100.00 | $357.00 | $525.00 | $609.00 | $651.00 | $714.00 |

| $2,300.00 | $391.00 | $575.00 | $667.00 | $713.00 | $782.00 |

| $2,500.00 | $425.00 | $625.00 | $725.00 | $775.00 | $850.00 |

| $2,900.00 | $493.00 | $725.00 | $841.00 | $899.00 | $986.00 |

View the WI Child Support Percentage Conversion Table (Chapter DCF 150 APPENDIX A) for more examples.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

How Wisconsin Calculates Shared Placement Child Support Rates

To qualify for shared placement in Wisconsin, both parents are required to have at least 92 (25% of the time) overnight visits with the child(ren). Both parents have a significant amount of contact and time with their child(ren).

Wisconsin uses a Shared Placement formula based on the percentage standard as well as time spent with each parent. Child support in Wisconsin is determined by each parent’s gross monthly income, the standard percentage based on the number of children (see table below), and the percentage of time each parent spends with the child(ren).

In Wisconsin, the use of the shared placement formula for shared placement is at the discretion of the courts. The courts may also use other factors in increasing or decreasing monthly child support payments.

Use Divergent Law’s free online Wisconsin child support calculator for joint custody to determine an estimate of your monthly child support payments. These calculations should only be used as estimates to determine your monthly child support cost.

Wisconsin Child Support Standard Percentage

| 1 child | 2 children | 3 children | 4 children | 5+ children |

|---|---|---|---|---|

| 17% of gross income | 25% of gross income | 29% of gross income | 31% of gross income | 34% of gross income |

View the WI Shared Placement Worksheet.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

How Wisconsin Calculates Low-Income Child Support Rates

If you’re gross monthly income is less than $1,485/month (75% to 150% of the 2022 Federal Poverty Guidelines), your child support obligation may be based off the low-income formula for primary placement or shared placement.

In Wisconsin, the use of the low-income formula for primary placement or shared placement is at the discretion of the courts. The courts may also use other factors in increasing or decreasing monthly child support payments.

Use Divergent Law’s easy-to-use online Wisconsin child support calculator to determine an estimate of your monthly child support payments. Our child support formula should only be used as estimates to determine your monthly child support cost.

Child Support Obligation of Low−Income Payers (Examples)

| Gross Monthly Income Up To: | Child Support for 1 child | Child Support for 2 kids | Child Support for 3 kids | Child Support for 4 Kids | Child Support for 5+ children | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Percent | Child Support Amount | Percent | Child Support Amount | Percent | Child Support Amount | Percent | Child Support Amount | Percent | Child Support Amount | |

| $781. | 11.22% | $88 | 16.50% | $129 | 19.14% | $149 | 20.46% | $160 | 22.44% | $175 |

| $808.00 | 11.43% | $92 | 16.80% | $136 | 19.49% | $157 | 20.84% | $168 | 22.85% | $185 |

| $889.00 | 12.05% | $107 | 17.71% | $157 | 20.55% | $183 | 21.97% | $195 | 24.09% | $214 |

| $1,057.00 | 13.28% | $140 | 19.54% | $206 | 22.66% | $240 | 24.22% | $256 | 26. | $281 |

| $1,309.00 | 15.14% | $198 | 22.27% | $291 | 25.83% | $338 | 27.61% | $361 | 30.28% | $396 |

| $1,485.00 or higher | – No longer eligible for Low Income formula – | |||||||||

View the WI Low-Income Payer Guidelines (Chapter DCF 150 – APPENDIX C) for more examples.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

How Wisconsin Calculates High-Income Child Support Rates

If the paying parent’s gross income is $7000/month ($84,000/year) or more, your child support obligation may be based on the high-income payer worksheet for primary placement or shared placement.

In Wisconsin, the use of the high-income formula for primary placement or shared placement is at the discretion of the courts. The courts may also use other factors in increasing or decreasing monthly child support payments.

Use Divergent Law’s free online Wisconsin child support calculator to determine an estimate of your monthly child support amount per child.

Child Support Obligation of High-Income Payers

|

| 1 child | 2 children | 3 children | 4 children | 5+ children |

|---|---|---|---|---|---|

| The first $7,000/month of income | 17% of gross income | 25% of gross income | 29% of gross income | 31% of gross income | 34% of gross income |

| Portion of income between $7,000/month and $12,500/month | 14% of gross income | 20% of gross income | 23% of gross income | 25% of gross income | 27% of gross income |

| Portion of income that is more $12,500/month | 10% of gross income | 15% of gross income | 17% of gross income | 19% of gross income | 20% of gross income |

View the WI High-Income Payer Worksheet.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

Frequently Asked Child Support Questions in Wisconsin

I don’t think my child(ren)’s parent is using the child support the way it should be. What can I do?

Child support is intended to go toward your child(ren)’s welfare, which includes rent, food, clothes, etc. Some of these things such as rent and food overlap where the other parent may benefit from. If you are concerned your child(ren) is being neglected, you could try to contact the Department of Health and Human Services to see what can be done. However, the paying parent does not have the right to decide how the support is spent on the child(ren).

If the other parent is refusing to let me see our child(ren), can I stop paying child support?

Your obligation first and foremost is to care for your child(ren), so do not stop paying. The issue of placement of the child(ren) and child support are considered two entirely different issues with the court and if you stop paying your child support, you could be held in contempt of court. If your court-ordered child placement schedule is being violated, you can file a motion to enforce physical placement against the other parent. Contact our attorneys today to find out all your options going forward.

The issue of placement of the child(ren) and child support are considered two entirely different issues with the court and if you stop paying your child support, you could be held in contempt of court. If your court-ordered child placement schedule is being violated, you can file a motion to enforce physical placement against the other parent. Contact our attorneys today to find out all your options going forward.

Can I just use the Child Support Calculator to determine the monthly child support payment?

Using the Child Support Calculator can give a calculated estimate to determine the monthly child supported cost. Though the calculator is based on guidelines determined by the State of Wisconsin courts, specifically DCF 150. The courts can deviate from these guidelines and increase or decrease payments based on other factors. A child support lawyer in Wisconsin can help you determine more accurate child support payment estimations.

How is child support determined?

Child support determination is based on the needs of the child, income and needs of the custodial parent, the paying parent's ability to pay and the child's standard of living before divorce or separation.

How many overnights is every other weekend?

Custody of your child(ren) every other weekend results in 52 overnights per year.

How many overnights is joint custody?

To qualify for joint physical custody, Wisconsin requires that each parent host more than 92 overnights per year. Use our child support shared custody calculator to see how many overnights for various joint custody arrangments.

How much child support will I pay for one child?

For one child, you will pay 17% of your gross income in child support. Percentages vary for low-income payers.

How do I apply for child support in Wisconsin?

To apply for child support in Wisconsin, you should visit your local child support agency. Filing for child support in Wisconsin can take place by downloading an application form online at the Wisconsin DCF website and returning the completed application to the child support agency.

How do I determine the first weekend of the month?

To determine the first weekend of the month, look at the first Friday of the month. If the 1st of the month is on or before Friday, that is the first weekend. However, if the 1st of the month is on Saturday, the following weekend will be the first weekend of the month.

If the 1st of the month is on or before Friday, that is the first weekend. However, if the 1st of the month is on Saturday, the following weekend will be the first weekend of the month.

What percentage of income do you pay for child support?

Wisconsin uses the standard percentage formula, set by DCF 150 of our State Legislature. The percentage is based on the number of kids to be in primary placement of a parent: For 1 child, it's 17% of gross income; For 2 children, it's 25% of gross income; For 3 children, it's 29% of gross income; For 4 children, it's 31% of gross income; For 5+ children, it's 34% of gross income.

BROKENHEARTED?

USE YOUR BRAIN.

WE'LL HANDLE THE DETAILS

GET STARTED NOW!Wisconsin Child Support Calculators & Worksheets 2022

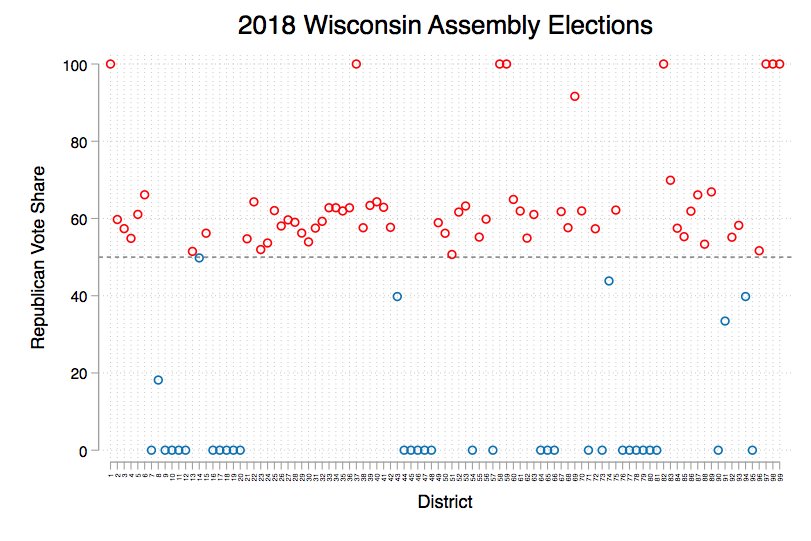

Wisconsin uses overnights, or where the children sleep, to determine how much child support should be paid by the non-residential parent. Joint custody payments vary depending on overnights, but for sole custody, the court uses the standard percentage model based on the number of children.

Joint custody payments vary depending on overnights, but for sole custody, the court uses the standard percentage model based on the number of children.

- For 1 child, it is 17%

- For 2 children, it is 25%

- For 3 children it is 29%

- For 4 children, it is 31%

- For 5 children, it is 34%

Book My Consult

Calculate Child Support

Use the calculators below to estimate child support payments.

Shared Custody Child Support Calculator

Sole Custody Child Support Calculator

Be aware when using the phrase, child custody, legally we are not talking about spending time with the child(ren) nor does child custody impact child support payments. The phrase child custody from the court's perspective is defined as decision-making responsibility. The correct legal term for time with the child(ren) is placement. Placement or time spent with the child(ren) does directly impact child support obligations, while child custody or decision-making does not impact child support obligations.

How To Calculate Child Support in Wisconsin

Every state has set child support guidelines as well as several different child support worksheets you can fill out. There are also options when determining child support. In Wisconsin, our support order guidelines help determine the amount due from one spouse to the other in the event of a divorce or legal separation. Below you will find the type of information you need to as well as the percentages required for payment based on Wisconsin DCF 150. First, we need to calculate the paying party's net income. To determine net income we need to add up monies considered income like the following:

- Wages

- Overtime work

- Commissions

- Tips

- Bonuses

- Rental income

- Interest income

Once the gross income is determined the court will determine the net income of the paying party. This is not done by using tax returns rather the court will deduct social security taxes, federal income taxes based on the tax rate for a single person claiming one personal exemption and the standard deduction, state income tax, union dues, and expenses for the cost of health insurance for the child. It is also worth mentioning that child support is not taxable by the spouse receiving it, so it will not be a tax-related issue for the recipient of it.

It is also worth mentioning that child support is not taxable by the spouse receiving it, so it will not be a tax-related issue for the recipient of it.

Wisconsin Child Support Guidelines for Shared Custody

Yes, one parent will be obligated to pay child support unless both parents spend the exact amount of time with the child and earn the exact same income, which is rare. Wisconsin child support laws say that a shared placement formula can be used if certain guidelines are met. Typically the court will approve the use of this formula when:

- if the parenting plan states that both parents will have the children at least 92 overnights per year

- if the parenting plan states each parent will pay for the child’s basic needs proportionately to the time each parent has placement of the child.

The Wisconsin 50/50 Child Support formula is based on the Percentage Standard guideline in conjunction with the time spent with each parent. The Percentage Standards guidelines are as follows:

For a detailed worksheet on how the Wisconsin Shared-Placement formula works download the worksheet here.

To refer directly to DCF 150 review the section labeled DCF 150.035(2)(b) Support Orders. Above is a worksheet we put together to help calculate the amount child support payers will pay in child support. If you need further assistance please contact us we would be happy to help.

For Immediate help with your family law case or answering any questions please call (262) 221-8123 now!

Wisconsin Shared Custody Child Support Calculator

These are estimates based on the statutory guidelines. Please also note child support payments may be different than displayed below based on the circumstances of your individual case.

Loading...

Enter Parent A's YEARLY gross income (before taxes)

Income Parent A *

Enter Parent B's YEARLY gross income (before taxes)

Income Parent B *

Parent A Zero Out Subtotal

Parent A Child Support Percentage

Parent A Obligation Subtotal

Parent B Zero Out Subtotal

Parent B Child Support Percentage

Parent B Obligation Subtotal

How many minor children? * 1 Child2 Children3 Children4 Children5+ Children

Percent of time the Children spend with Parent A * 25%30%35%40%45%50%55%60%65%70%75%

Percent of time the Children spend with Parent B * 75%70%65%60%55%50%45%40%35%30%25%

150 Multiplier

Parent A: 274 Overnights

Parent B: 91 Overnights

Example: Forty six weekends (Friday night & Saturady night) throughout the year.

Parent A: 255 Overnights

Parent B: 110 Overnights

Example: Every weekend (Friday night & Saturady night) throughout the year.

Parent A: 237 Overnights

Parent B: 128 Overnights

Example: Every weekend (Friday night & Saturady night) plus one weekday night every other week (i.e. Wednesday night) throughout the year.

Parent A: 219 Overnights

Parent B: 146 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights twenty two weeks (i.e. Wednesday night & Thursday night) throughout the year.

Parent A: 200 Overnights

Parent B: 165 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights every other week (i. e. Wednesday night & Thursday night) throughout the year.

e. Wednesday night & Thursday night) throughout the year.

Parent A: 183 Overnights

Parent B: 182 Overnights

Example: Alternating weeks where the first week parent A has three overnights (i.e. Wednesday, Thursday & Friday night) and during the second week four overnights (i.e. Wednesday, Thursday, Friday & Saturday night).

Parent A: 165 Overnights

Parent B: 200 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights every other week (i.e. Wednesday night & Thursday night) throughout the year.

Parent A: 146 Overnights

Parent B: 219 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights twenty two weeks (i. e. Wednesday night & Thursday night) throughout the year.

e. Wednesday night & Thursday night) throughout the year.

Parent A: 128 Overnights

Parent B: 237 Overnights

Example: Every weekend (Friday night & Saturady night) plus one weekday night every other week (i.e. Wednesday night) throughout the year.

Parent A: 110 Overnights

Parent B: 255 Overnights

Example: Every weekend (Friday night & Saturady night) throughout the year.

Parent A: 91 Overnights

Parent B: 274 Overnights

Example: Forty six weekends (Friday night & Saturady night) throughout the year.

Parent A's Estimated Payment to Parent B

Parent B's Estimated Payment to Parent A

Subtotal A-B Zero Out

Subtotal A-B

Estimated Monthly Support Payment

Subtotal B-A Zero Out

Subtotal B-A

Estimated Monthly Support Payment

* Required

Are you ready to move forward? Call

(262) 221-8123

to schedule a strategy session with one of our attorneys.

Wisconsin Child Support Guidelines for Sole Custody

The court will then use a standard percentage model based on the number of children when one parent has the children for less than than 92 overnights throughout the year. A typical example of this type of arrangement is every other weekend. When these placement arrangements are in place the court will use the percentage standard model shown below.

- For 1 child, it is 17%

- For 2 children, it is 25%

- For 3 children it is 29%

- For 4 children, it is 31%

- For 5 children, it is 34%

Sole Custody Child Support Examples

| Monthly Income | 1 child (17%) | 2 children (25%) | 3 children (29%) | 4 children (31%) | 5 children (34%) |

|---|---|---|---|---|---|

| $1,500 | $255 | $375 | $435 | $465 | $510 |

| $2,000 | $340 | $500 | $580 | $620 | $680 |

| $2,500 | $425 | $625 | $725 | $775 | $850 |

| $3,000 | $510 | $750 | $870 | $930 | $1,020 |

| $3,500 | $595 | $875 | $1,015 | $1,085 | $1,190 |

| $4,000 | $680 | $1,000 | $1,160 | $1,240 | $1,360 |

For more examples download the pdf here.

To refer directly to DCF 150 review the section labeled DCF 150.03 Support Orders. Above is a worksheet we put together to help calculate the amount child support payers will pay in child support. If you need further assistance please contact us we would be happy to help.

Wisconsin Sole Custody

Child Support Calculator

These are estimates based on the statutory guidelines. Please also note child support payments may be different than displayed below based on the circumstances of your individual case.

Loading...

Enter the non-custodial parent's YEARLY gross income (before taxes) *

How many minor children with the custodial parent? * 1 Child2 Children3 Children4 Children5+ Children

Subtotal1

Subtotal

Subtotal

Monthly Support Payments

$0

* Required

For Immediate help with your family law case or answering any questions please call (262) 221-8123 now!

Frequently Asked Questions

How do you calculate child support in Wisconsin?

To calculate child support in Wisconsin first the type of custody needs to be determined. If each parent has more than 92 overnights per year, then the State of Wisconsin has determined those parents are in a joint custody scenario and they must use a joint custody calculator to determine child support payments. If both parents do not have 92 overnights per year then the State of Wisconsin has determined the parent with the greater number of overnights has sole custody of the child. To determine child support in a sole custody scenario the parents must use a percentage standard to determine child support payments.

If each parent has more than 92 overnights per year, then the State of Wisconsin has determined those parents are in a joint custody scenario and they must use a joint custody calculator to determine child support payments. If both parents do not have 92 overnights per year then the State of Wisconsin has determined the parent with the greater number of overnights has sole custody of the child. To determine child support in a sole custody scenario the parents must use a percentage standard to determine child support payments.

What is child support percentage in Wisconsin?

The percentage of child support paid in Wisconsin is determined by the type of custody arrangement. If the custody arrangement is sole custody, then the following are the percentages used to calculate child support payments.

- 17 percent of gross income for 1 child

- 25 percent of gross income for 2 children

- 29 percent of gross income for 3 children

- 31 percent of gross income for 4 children

- 34 percent of gross income for 5 or more children

If the custody arrangement is joint custody, meaning both parents have the child more than 92 overnights a year, then child support payments are determined based on gross income and time spent with both parents. The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

Does a father pay child support with 50/50 custody?

In a shared custody scenario, where both parents have the children 182.5 overnights per year and both parents make the same gross income no child support payments would be required. However, if one parent makes substantially more than the other parent in the same scenario where both parents have 182.5 overnights then the higher-earning parent will pay child support to the other parent. The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

Is child support based on gross income or net income?

In the State of Wisconsin, child support is determined using estimated annual gross income.

Can child support take your whole paycheck?

In the State of Wisconsin, law limits the amount that can be garnished for a child support order as follows. 50% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has no arrears 55% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has arrears 60% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has no arrears 65% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has arrears The State of Wisconsin defines gross income as all of the employee’s income from all sources before mandatory deductions for federal, state, local, and Social Security taxes are deducted. Gross income also includes employee contributions to any employee benefit program or profit-sharing and voluntary contributions to any pension or retirement account whether or not the account provides for tax deferral or avoidance. The State of Wisconsin defines disposable income as the part of the earnings of the employee remaining after deducting federal, state, and local withholding taxes, and Social Security taxes.

50% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has no arrears 55% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has arrears 60% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has no arrears 65% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has arrears The State of Wisconsin defines gross income as all of the employee’s income from all sources before mandatory deductions for federal, state, local, and Social Security taxes are deducted. Gross income also includes employee contributions to any employee benefit program or profit-sharing and voluntary contributions to any pension or retirement account whether or not the account provides for tax deferral or avoidance. The State of Wisconsin defines disposable income as the part of the earnings of the employee remaining after deducting federal, state, and local withholding taxes, and Social Security taxes. Deductions for Individual Retirement Accounts, medical expense accounts, etc. do not reduce disposable income.

Deductions for Individual Retirement Accounts, medical expense accounts, etc. do not reduce disposable income.

References: Child Support Guidelines Wisconsin, DCF 150.03 Support Orders, DCF 150.035(2)(b) Support Orders

Lawyers in New York (USA) - Bukh Global

We solve legal problems of any complexity on an international scale

Bukh Global Law Firm is more than a close-knit team of experienced and qualified Russian-speaking professionals in New York. We position ourselves first of all as reliable and responsive assistants who will do everything possible to successfully solve the client's problems. We are not afraid of difficulties, we take on even the most difficult and hopeless cases. Focus on results and maximum perseverance, multiplied by deep knowledge of various areas of international and American law, make it possible to guarantee the effectiveness of the legal assistance provided!

Bukh Global is an international law firm. We have experience in successfully resolving disputes in courts and state bodies of various countries. We work not only in European, but also in more exotic Asian and African states. Regardless of the complexity of the dispute and the chosen jurisdiction, we always help to find the most effective and beneficial option for the client to solve the existing legal problem.

We have experience in successfully resolving disputes in courts and state bodies of various countries. We work not only in European, but also in more exotic Asian and African states. Regardless of the complexity of the dispute and the chosen jurisdiction, we always help to find the most effective and beneficial option for the client to solve the existing legal problem.

Please note that we are ready to provide high-quality legal assistance in the most diverse categories of cases with a foreign element. At the same time, we do not limit ourselves to consultations and representation of clients in court, but we provide the widest possible range of services from lobbying interests to supporting transactions of any scale and level of complexity.

An important advantage is the clear specialization of the lawyers of the law office "Bukh Global" in specific areas of law. Thanks to this, we thoroughly understand the features and nuances of each case under consideration. With us, your chances of success are maximized!

With us, your chances of success are maximized!

-

Law

- ” International “

- ” Criminal “

- ”Family “

- ” Civil “

- Immigration

Law firm "Bukh Global" provides qualified and timely legal assistance in a wide variety of areas of international law. Thanks to the presence of a whole team of experienced lawyers, we are ready to understand even the most complex nuances of international and national legislation. Thanks to this, we provide really high-quality and effective protection of your rights and interests.

We successfully cooperate with both private clients and large corporations, governmental and non-governmental organizations, various financial institutions. We are always open to fruitful work, enthusiastically take on the resolution of non-standard disputes and take into account the wishes of customers. Learn more about the branches of international law with which we work

Learn more about the branches of international law with which we work

More about international law

Arkady Bukh: Why should you contact us?

Penalties for criminal offenses are generally the most severe. Depending on the degree of danger of the committed act, offenders can get by with fines and community service, as well as life imprisonment or even the death penalty. Therefore, it is so important to receive high-quality legal protection in the event of criminal prosecution against you or close people.

Bukh Global lawyers have vast experience in defending clients in criminal cases of various categories. We will provide you with high-quality and comprehensive protection against charges of drug trafficking, tax evasion, money laundering, economic and many other crimes. We develop the most effective line of defense that helps to avoid or minimize punishment!

Learn more about US Criminal Law

Arkady Bukh: Why should you contact us?

Family litigation is an extremely delicate category of cases. Here, the lawyer becomes not just a lawyer, but even a psychologist, who often, thanks to competent argumentation, helps to save a family or dissolve a marriage on mutually beneficial terms while maintaining good human relations between former spouses. In their work, experienced lawyers of Bukh and Partners resolve disputes that have arisen amicably and exclusively within the framework of the current legal field.

Qualified lawyers work with a variety of family matters from helping draft marriage contracts and mediating family disputes to legally organizing moves abroad with children and helping to return children. Regardless of the complexity of the situation, we guarantee effective protection of your rights and interests!

More about US family law

Arkady Bukh: Why should you contact us?

Civil disputes can definitely be called the most common category of cases heard in the courts of any country. Of course, without the help of a qualified lawyer, in most cases it is extremely presumptuous to hope for a successful consideration of the case and the adoption of an acceptable decision by the court. Therefore, in the event of civil proceedings, we recommend that you seek help from experienced lawyers of the Bukh and Partners law office as soon as possible.

Our lawyers will thoroughly study all the details of the case, collect the most complete evidence base, if necessary, negotiate with the opposite side and do everything possible to achieve the task. We guarantee the most responsible approach, attention to even the smallest details and impeccable service!

More about US civil law

Arkady Bukh: Why should you contact us?

Immigration to the USA and leading European countries is a dream for many people living in the countries of the former Soviet Union. Bukh & Partners Law Office helps make this dream a reality. Thanks to the accumulated experience, we help to choose the most optimal immigration program, taking into account the needs and wishes of the client. In addition to legal assistance, we provide assistance in acquiring real estate in the United States of America and other organizational support.

Additionally, if necessary and in the presence of relevant circumstances, we help to obtain political asylum in the United States or a visa for domestic violence. We successfully resolve disputes with US immigration services and greatly simplify the process of obtaining a visa for clients and their families. Moving to America is easy with us!

More about immigration to the USA

Arkady Bukh: Why should you contact us?

Score for

Copyright © 2013

until what age do they pay, how much percentage of income can they withhold, and what documents are needed to file for alimony

1. Who can apply for child support?

Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under 18 years old and has not yet become fully capable by decision of the guardianship authority or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years old, but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he needs and is recognized Disabled adults entitled to alimony are considered to be disabled people of I, II, III groups and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.0020

- wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and cares for a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, health status and other circumstances. marriage or within five years thereafter, and the spouses have been married for a long time.0020

Alimony can also be received by:

- disabled and needy parents, including stepfather and stepmother, from their adult able-bodied children.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient means for this, if they cannot receive alimony from their parents. After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

- incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive maintenance from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members. Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at the place of your residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested persons;

- to the district court - in all other cases.

If one of the parents voluntarily pays support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

3. What documents are needed to apply for child support?

The child support claim must be accompanied by:

- copies of it, one each for the judge, the defendant, and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- single housing document and income statements of all family members;

- calculation of the amount you expect to receive as alimony. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If children remain with each of the parents, the court determines the amount of alimony in favor of the less well-to-do of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

Under exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which the recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and until the age of 18, unless the child gets married earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated.

00

00 57%

57%