How to set up an annuity for a child

Should You Buy an Annuity for Your Grandchild?

(Image credit: Getty Images)

By Ken Nuss

published

A trust is one way to leave a legacy, but you’ll need to hire a lawyer to draw it up. And there may be ongoing management fees that will reduce the amount your loved ones will receive.

There are simpler, cheaper ways to leave a legacy. For instance, you can buy a cash-value life insurance policy or fund a 529 college savings plan.

But one of the best options, an income annuity, is usually overlooked. It’s an ideal vehicle for leaving a legacy. An annuity offers unique benefits. It’s the only gift guaranteed to keep on giving for a lifetime.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of Kiplinger’s expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of Kiplinger’s expert advice - straight to your e-mail.

One Way to Execute This Plan

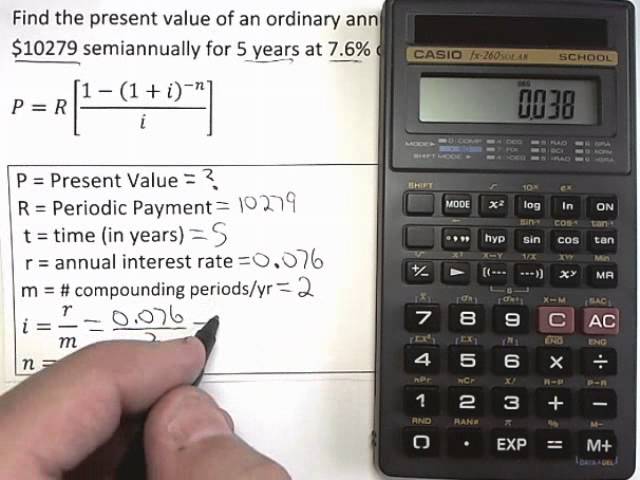

Here’s how it would work for a grandchild. You buy a longevity annuity — also called a deferred income annuity — for your grandchild. This type of annuity defers payments until a future date that you choose.

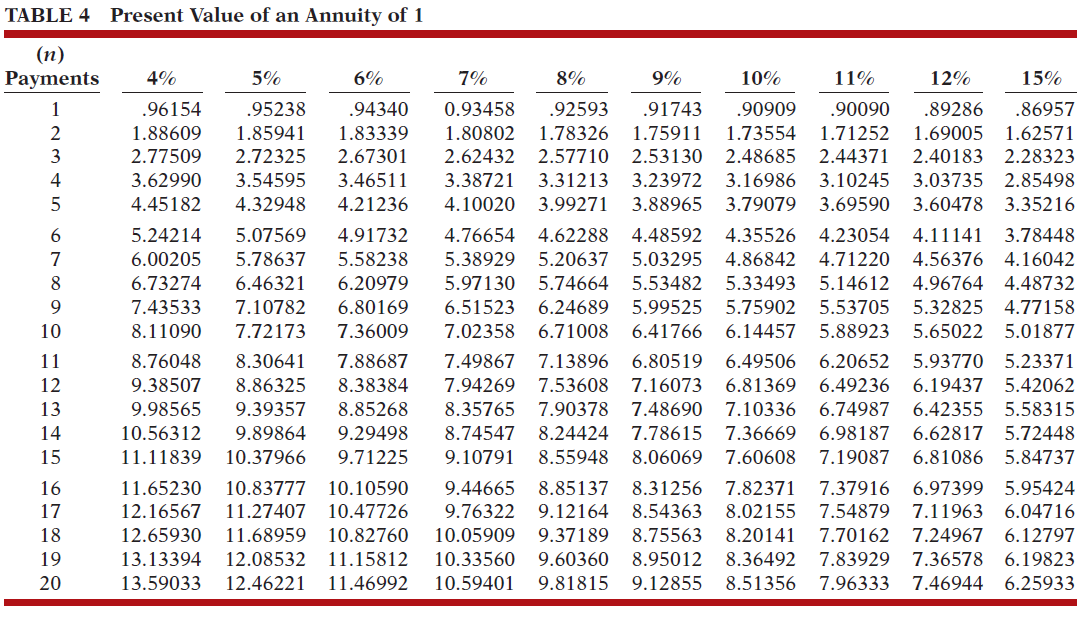

For example, your grandchild is 10 years old. You make a $100,000 deposit. You decide to have income payments begin when your grandchild reaches age 25 and continue for the remainder of his or her life.

One top insurer will guarantee a payment of $481.68 per month, with $335.73 of it taxable. If your grandchild lives to age 85, he or she will collect $346,809.60: $246,809.60 in interest plus the $100,000 of principal.

Pros and Cons

The Issue of Cash Value

An income annuity has no cash value, and that’s something that can be both a pro AND a con. As a pro, after you’re gone, your grandchild won’t be able to blow the money on a fancy pickup truck or whatever. Upon request, some insurance companies will even add a non-assignable/transferable clause to the policy in order to prevent your loved one from selling their annuity on the secondary market.

Upon request, some insurance companies will even add a non-assignable/transferable clause to the policy in order to prevent your loved one from selling their annuity on the secondary market.

While lack of cash value has advantages, it does have some downsides. Of course, you must be sure you’ll never need the money before you give it away for good. I use the example of a $100,000 deposit, but you don’t need to spend that much. You can buy an income annuity with as little as $10,000. In addition, you’re trading your cash for the insurer’s promise to pay a stream of income. So, you need to take care to choose a financially strong company.

Depending on your state’s laws, once you buy an annuity you have 10 to 30 days to change your mind and get your money back. But once the “free look” period is over, you can’t get out of the contract, though you or your heirs may be able to sell an income annuity on the secondary market, if you didn’t have a non-assignable/transferable clause added to the policy as described above.

A Fond Remembrance

Another pro is that since your grandchild will receive a check from you every month or year, you’ll be remembered fondly. If you choose annual payments, you might have the annuity check arrive each year on your grandchild's birthday or on Christmas, Hanukkah or another holiday.

You can also extend your legacy. With the right type of annuity and strategy, you can choose to have annuity payments continue to go to his or her child or children for the remainder of their lives, too. While you may never even meet your great-grandchildren, they too can receive a regular gift from you. This option, however, does reduce the amount of income your grandchild will receive.

Possibility of Inflation Protection

In addition, the checks can increase. For an added cost, you can add an inflation-protection rider so that the amount will go up over time. This will help the recipients retain future purchasing power. Over time, an initial deposit of $100,000 could grow to $300,000, $400,000 or more in total gifts received. It depends on how long the income pays out, the internal rate of return offered by the insurance company, and how many recipients are set up to receive the income payouts. What other financial product will let you do this?

It depends on how long the income pays out, the internal rate of return offered by the insurance company, and how many recipients are set up to receive the income payouts. What other financial product will let you do this?

Tax Management

Another advantage is tax efficiency. When income is received, only a portion of it will typically be taxable. This is because part of the income from an annuity is considered to be a return of principal and part is considered to be earnings. While earnings are taxed, return of principal is not.

Who Might Be Interested in This Strategy, and Who Might Want to Consider Another Route

Buying an annuity for a child or grandchild is probably not the best approach for someone with a relatively large estate and sufficient resources to hire estate planning attorneys and accountants, as well as having the necessary time and patience to implement a more complex estate plan involving various forms of trusts, etc. But for someone who wants a quick, easy and inexpensive way to be remembered as giving the gift of guaranteed lifetime income to younger loved ones, it can be a good fit.

Keep in mind that this strategy is not intended to replace your entire estate plan, it’s just an option for part of it.

While others may give gifts that are soon forgotten, providing those loved ones with an ongoing gift of income that will last for the remainder of their lives or longer will ensure that you have created a legacy for yourself as well as a nice financial cushion for the younger generation of your heirs.

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.

Retirement-income expert Ken Nuss is the founder and CEO of AnnuityAdvantage, a leading online provider of fixed-rate, fixed-indexed and immediate-income annuities. Interest rates from dozens of insurers are constantly updated on its website. He launched the AnnuityAdvantage website in 1999 to help people looking for their best options in principal-protected annuities. More information is available from the Medford, Oregon, based company at https://www.annuityadvantage.com or (800) 239-0356.

More information is available from the Medford, Oregon, based company at https://www.annuityadvantage.com or (800) 239-0356.

Create a pension for kids and grandkids

Advertisement

comments

No need to worry about your child’s future employer or the government providing a lifetime pension payment. You can set one up for them right now.

Just like any parent, my hope is that my two teenage daughters will both have great lives ahead of them and never have to worry about money and the stresses that come with not having enough.

After college, I hope that they find careers that are rewarding and eventually retire with a good pension. I know that I can't control a lot of these wishes, but now I can control them having a pension, and a guaranteed income stream that they can never outlive.

There are 2 ways to solve for what I call Income Later or target date income planning. The first is by attaching an income rider to a policy that grows at a contractually guaranteed rate, and can only be used for income. Most income riders cannot be issued to someone younger than 40 years old, and the contractually guaranteed growth is usually limited to a specific time period like 10 years and up to a maximum of 20 with some annuities.

The first is by attaching an income rider to a policy that grows at a contractually guaranteed rate, and can only be used for income. Most income riders cannot be issued to someone younger than 40 years old, and the contractually guaranteed growth is usually limited to a specific time period like 10 years and up to a maximum of 20 with some annuities.

The second way to solve for Income Later is the only pension solution that you can use for your kids and grand kids. It's called a Longevity Annuity. This relatively new strategy allows you to defer payments for as long as 45 years, and provide a lifetime income stream just like a pension. In essence, a longevity annuity is a deferred immediate annuity structure with an enhanced payout at the time the income stream is turned on.

Below are the contractually guaranteed numbers for my two daughters. I set up their longevity annuities to defer for 45 years. At that time, their lifetime income stream would start.

Daughter age 15

$100,000 premium

Defer for 45 years

Lifetime income starting at age 60:

$24,104. 77 annually for life

77 annually for life

Daughter age 17

$100,000 premium

Defer for 45 years

Lifetime income starting at age 62

$25,176.89 annually for life

Recently, I had a client set up a longevity annuity for his grandson who was going through some personal issues. This caring grandfather wanted to make sure that income would not be a problem down the road for his grandson, and also make sure that his great-grandson would receive the payments just in case his grandson passed away early in the contract. Below are those contractually guaranteed pension payment numbers:

Grandson Age 35

$200,000 premium

Defer for 20 years

Lifetime annual income starting at age 55

$2,204.16 per month for life

In this case, the guaranteed lifetime monthly payments were a little lower because we structured the longevity annuity to make sure that the great-grandson received the payments if his father passed away early.

Here are some key points to consider with a longevity annuity:

- You choose the when the income starts on the application and that start date is locked in and can’t be changed.

- There is no growth component, and the death benefit pre-income stream is the initial premium.

- You can structure the payout life only or with backstops like installment refund or specific period certain guarantees.

- Part of the income stream will be nontaxable because of the exclusion ratio rule that is a part of the longevity annuity structure.

As I always advise my clients, you need to consult with your qualified tax adviser, CPA, or tax lawyer in order to structure the annuity premium correctly. A couple of strategies that I have used is funding the longevity annuity through a trust and also through current annual gifting rules. You can also set up the owner of the annuity and the annuitant (person the payments are based on) within the policy for maximum control and tax benefits.

For all of you stock historians that are going to make the "market return" comparison argument, don't waste your time because I totally agree with you. Of course the equity markets have better growth potential which could lead to a larger future income.

What I am suggesting for consideration is a contractually guaranteed future income stream that is turnkey and hands off. What I am talking about is a transfer of risk pension payment that you know will always be in place for you children or grandchildren. This translates into peace of mind as a parent and grandparent for your kid or grandkid's future income needs.

In a recent MarketWatch article by Anne Tergeson "More boomers buying longevity annuities," she pointed out that sales of longevity annuities have grown from $50 million in 2010 to over $1 billion annually, and I think is sure to continually increase because of its simplicity and efficient design.

Being a loud and proud annuity critic, I recently wrote about this need for less complex products in one of my past MarketWatch columns. The annuity industry needs to respond for the public's demand for annuities that are easy to understand and that are low in fees and commissions.

The annuity industry needs to respond for the public's demand for annuities that are easy to understand and that are low in fees and commissions.

So if you are considering the future pension plan for yourself, you might also think about setting one up for your children or grandchildren. It's hard to put a bow on a pension, but what a gift a future lifetime income stream could be.

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Put your teen’s lawn-mowing money into a Roth IRA

Helping teens get a head start on saving for retirement can be a great strategy, provided the parents’ own retirement savings are on track.

Advertisement

Search

Advanced Search

Advertisement

Retirement annuity: how it works

Receive pension payments without waiting for the official retirement - such an opportunity is provided by the pension annuity. Although the name contains the word "pension", this instrument belongs to the field of insurance. Fingramota . kz will tell you more about it.

Pension annuity is a product offered by life insurance companies, and which allows contributors to the Unified Accumulative Pension Fund (hereinafter referred to as the UAPF, the fund) to start receiving a “pension” ahead of schedule, but subject to the sufficiency of pension savings.

Some statistics

As you know, the retirement age for men comes at 63 years old, for women in 2021 - at 60 years old, and it will increase every year by 6 months until 2027 until it reaches 63 years.

But you can not wait so long for your pension and take out a pension annuity. However, for this you need to have a sufficient amount of savings in the UAPF. This amount varies depending on the sex and age of the contributor. The older the person, the lower the amount of sufficiency will be.

For example, men can start receiving pension annuity payments from an insurance company from the age of 55; And women - from the age of 52, the cost of a pension annuity for a 52-year-old woman in 2021 is 90,004 9 million 90,005 tenge. By the way, since the current year, the pension annuity has fallen significantly in price. For comparison, in 2020, its cost for a 55-year-old man was 11.3 million tenge, and for a 52-year-old woman - 15.5 million tenge.

There is also a deferred annuity, the so-called "deferred" annuity, which can be purchased from the age of 45, but the payments for which start at the age of 55. To do this, a 45-year-old man needs to have at least 6. 1 million tenge of savings in the UAPF, and a woman of the same age - 7.7 million tenge.

1 million tenge of savings in the UAPF, and a woman of the same age - 7.7 million tenge.

Today, according to the Agency of the Republic of Kazakhstan for the regulation and development of the financial market, over 61 thousand people have valid pension annuity agreements in life insurance companies for a total amount of more than 300 billion tenge, thereby guaranteeing lifelong pension payments.

In order to expand the line of pension annuity products, joint annuities are considered, which imply the participation in the pension annuity agreement of not one person, but a married couple or close relatives. A joint annuity will allow you to combine the pension savings of close relatives and redistribute income under an annuity agreement. For example, if one spouse does not have enough pension savings to buy an annuity from a life insurance company, and the other has a surplus, then through a joint retirement annuity, lifetime payments are provided to both of them.

These innovations will make the pension annuity agreement an effective pension planning tool, similar to pension plans in countries with a developed pension system. This will allow citizens to choose the option of pension payments based on their goals and needs.

Payments from UAPF and from an insurance company: what is the difference?

The main difference is related to the timing of pension payments.

When receiving a pension directly from the UAPF, payments are made until the contributor's pension savings are exhausted. While payments from the insurance organization are made for life, regardless of whether the depositor's pension savings have run out or not. That is, the payment period is not limited to the amount of savings transferred from the UAPF to the insurance company.

Monthly pension payments from the UAPF depend on regularity, income and investment income, which are not predetermined, while the pension annuity is a financial instrument with certain lifetime payments with clearly defined amounts and guaranteed returns.

In particular, annuity payments are made by the life insurance company on a monthly basis throughout the life of the insured, with annual indexation. This means that subsequent payments will increase every year by at least 5%.

Another difference between a pension annuity agreement and a pension agreement is that the savings in the UAPF are inherited, but the pension annuity funds are not. However, it is possible to include the option of a “guaranteed payment period”, during which payments under a pension annuity agreement are made regardless of whether the insured (beneficiary) is alive or not.

You should be aware that if the contributor completely transferred all his pension savings from the UAPF to an insurance company and no further pension contributions were made to the UAPF, then upon reaching retirement age he will not receive any payments from the fund. Citizens who have a surplus in the UAPF account can leave part of the funds in the fund, and those who have no funds left in the account after concluding a pension annuity agreement can then save up there while continuing to work, then they will also receive an insurance payment from an insurance company, and a traditional pension from the UAPF.

It should be noted that currently the method of returning savings under a pension annuity agreement from an insurance company back to UAPF is not provided for by law.

How is the process of registering a pension annuity?

Knowing now all the above nuances, you have decided to draw up a pension annuity agreement. First you need to choose your insurer. Carefully study the websites of life insurance companies offering this service, analyze the reviews of other buyers, check with the insurer that the insurer has a license from the Agency of the Republic of Kazakhstan for Regulation and Development of the Financial Market. This can be done on the Internet resource of the financial regulator www.gov.kz.

Before signing a contract, carefully read its terms. The insurance company must calculate the future payment for you. Also decide for yourself whether you need to set a "guaranteed payout period". For example, a situation may arise when a contributor has acquired a pension annuity with a guaranteed period of 15 years and passes away after 5 years. Payments for the remaining 10 years on the same terms will be received by his heirs specified in the contract, but after the guaranteed period, the payments will stop. If the owner of the pension annuity survived the established guaranteed period, in the event of his death, the heirs will receive nothing.

Payments for the remaining 10 years on the same terms will be received by his heirs specified in the contract, but after the guaranteed period, the payments will stop. If the owner of the pension annuity survived the established guaranteed period, in the event of his death, the heirs will receive nothing.

By signing the contract, you automatically agree to all its terms. The contract is concluded in three copies: for the depositor, the insurance company and the UAPF. You will have to notify the Fund of the conclusion of the pension annuity agreement within 10 calendar days from the date of its conclusion. UAPF, in turn, transfers your funds to the insurance company. This amount will be called the insurance premium. That is, it is more correct to say that now you will receive not a pension, but an insurance payment. From now on, the insurance company will manage the insurance premium by investing in financial instruments. This means that you should choose your insurer very carefully and carefully. By the way, if you want to change the insurance company, and you have the right to do so by law, you can do this only two years after the conclusion of the contract.

By the way, if you want to change the insurance company, and you have the right to do so by law, you can do this only two years after the conclusion of the contract.

What will happen to the savings if the insurance company goes bankrupt?

The safety of pension savings and the guarantee of pension payments are the most important issues for the state and the population, especially for people of retirement and pre-retirement age, since pension payments are the only income for many citizens in the "golden" period of their lives. In order to ensure the safety of pension savings transferred to insurance companies, the Agency of the Republic of Kazakhstan for the regulation and development of the financial market, being a financial regulator, exercises control and supervision over the solvency and financial stability of insurance companies by establishing:

- capital adequacy requirements;

- requirements for the formation of reserves necessary for the payment of pension payments;

- requirements for investing assets in reliable financial instruments.

If factors that worsen the financial situation of an insurance company are identified, the financial regulator requests a detailed plan of measures necessary to improve financial stability. And in case of violations of the law in relation to the insurance company, limited measures of influence and sanctions are applied.

In addition, the Fund for Guaranteeing Insurance Benefits (FGSV) operates in Kazakhstan, which provides guarantee payments to policyholders in the event of an insured event under insurance contracts concluded with a liquidated insurance company.

Thus, in the event of forced liquidation of an insurance organization, the FGSV will assume obligations to make pension payments to policyholders to ensure the continuity and timeliness of payments from the date of appointment of an interim administration until the transfer of the insurance portfolio to another insurance organization.

Tips from Fingramota .

kz for those who care about their future pension:

1) Work where your income will be official. The more the amount of contributions is fixed on your account with the UAPF, the greater the pension will be.

2) Control whether the employer pays contributions to the UAPF. Remember that periods of work when you do not accrue contributions are not included in the seniority required for a pension.

3) Always carefully study the statement on the status of your IP in the UAPF. By comparing each new statement with the previous one, you can track whether the amount of your savings for old age has increased or not.

Choose a pension plan that is beneficial for you and improve your financial literacy with Fingramota.kz!

How much do you need to earn to retire early?

Why is the threshold of sufficiency for registration of a pension annuity higher for women than for men.

According to statistics, representatives of the weaker sex earn less than representatives of the strong half of humanity. Nevertheless, there are many nuances when calculating the cost of an annuity. Read more about the possibility of early retirement and receiving annuity payments in the material of the correspondent of inbusiness.kz.

"In general, I think that they should not have raised the retirement age of women. I have been working for 30 years, but in order to save 8 million tenge and be able to retire early, I need to work for the same number of years. And I'm already all sick" , - says Aliya Zhandosova, a resident of the Republic of Kazakhstan.

For reference: a pension annuity is a product offered by life insurance companies and which allows contributors to the Unified Accumulative Pension Fund (UAPF) to start receiving a “pension” ahead of schedule, but subject to the sufficiency of pension savings.

The UAPF notes that the decision on the amount sufficient to issue a pension annuity is made by life insurance companies.

"Women retire earlier, from 52.5 years old, therefore, in order to open an annuity, they must have more savings, that is, the cost of an annuity goes higher. The second point is that when calculating the minimum amount for opening an annuity, the average life expectancy in the country is taken into account "And in our country, women live longer than men, according to statistics. This also affects the cost of an annuity. Annuity payments when opening a pension annuity program are carried out for life," says Asyl Turgaev, head of the marketing and public relations service of the State Innuity Company (SAC).

It should be noted that according to WHO data for 2021, life expectancy in our country is 66.8 years for men and 75.3 years for women.

According to Asyl Turgaev, there are many who want to conclude an annuity agreement.

"Since last year, the sufficiency threshold has been recalculated, and it has become more accessible, and people are coming.

For example, those who have sufficient work experience, they have worked stably, all their lives, made regular contributions, did not take wages in envelopes," - noted Asyl Turgaev.

In total, 7 life insurance companies deal with pension annuities in Kazakhstan. In 2020, pension annuities in the life insurance market were sold for 71 billion tenge, in 2021 - for 130 billion tenge. These amounts include the funds of those who transferred money from the UAPF to the insurance company, and those who transferred money from one insurance organization to another.

In Kazakhstan, men retire at the age of 63, as before. And women, if they used to retire at 58, now they can only retire at 60.6, gradually this threshold will increase to 63. But you can retire early by entering into a pension annuity with insurance companies.

This year, men can take early retirement at the age of 55, but for this you need to have at least 7,089,986 tenge on your UAPF account. Women, in order to get a pension annuity at the age of 55 and start receiving insurance payments, need to have at least 8,873,440 tenge in their account. This year, women can apply for a pension annuity from the age of 52.5. But then more savings will be required for this.

Women, in order to get a pension annuity at the age of 55 and start receiving insurance payments, need to have at least 8,873,440 tenge in their account. This year, women can apply for a pension annuity from the age of 52.5. But then more savings will be required for this.

There is one interesting point here - when this amount is reached, a minimum payment of 70% of the subsistence minimum is made, or 25,213 tenge in the current year with an annual indexation of 5%. And the more transferred savings, the higher the insurance pension will be.

At the same time, Kazakhstanis will also receive a pension from the state budget, which is paid for life upon reaching retirement age. For example, from the age of 55, Kazakhstanis will receive 25 thousand tenge from a pension annuity with the minimum allowable accumulation, and from the age of 63 (60 years and 6 months for women) additionally from the state budget.

By the way, according to data from open sources, in 2016, in order to retire at the age of 55, a man had to save 6.