How to report someone claiming your child on taxes

Someone Claimed Your Kid, Dependent, What Can You Do?

There are situations when multiple parties claim the same dependent. For example, in the case of divorced parents, a child may be claimed as a dependent by more than one person. You may alternate years, but you may not both claim the dependent in a single tax year. Generally, only one person (or a married couple filing jointly) may receive the tax benefits derived from claiming any one dependent. To further protect your family's identities, consider getting an IP-PIN for yourself and your dependents.

These tax benefits include:

- The Child Dependency Exemption

- The Earned Income Tax Credit

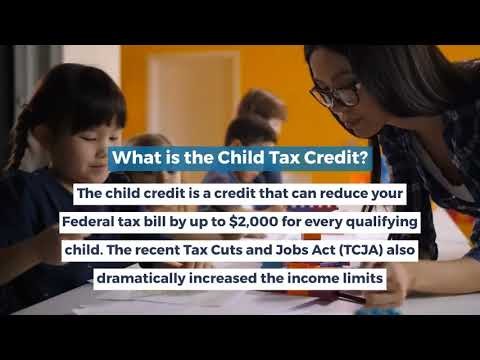

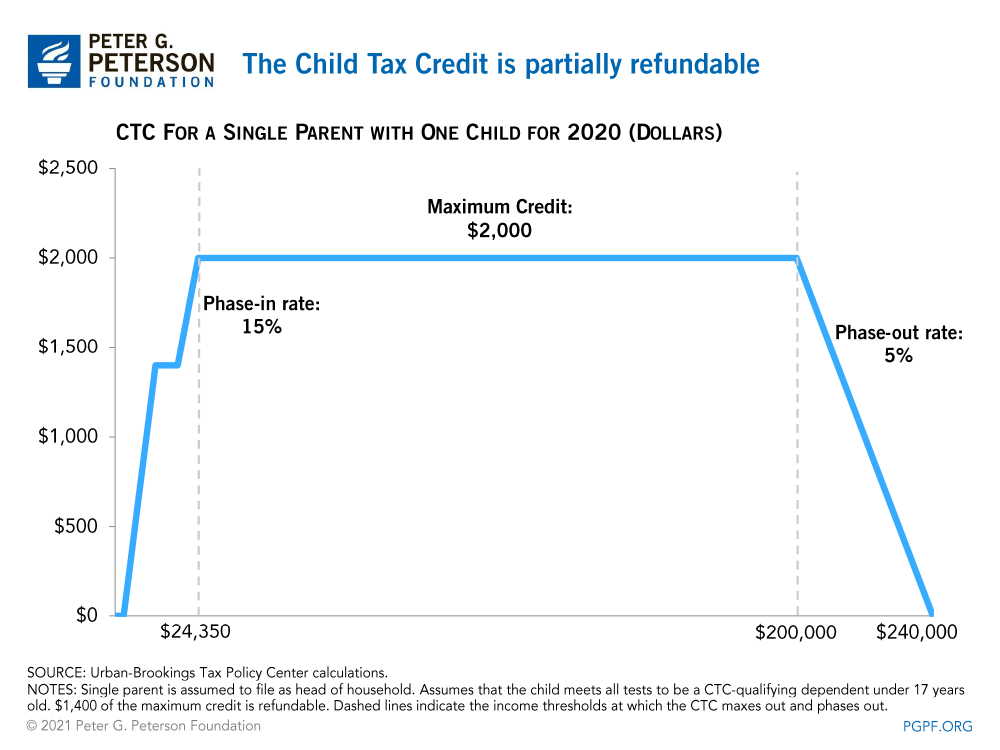

- The Child Tax Credit

- The Credit for Other Dependents

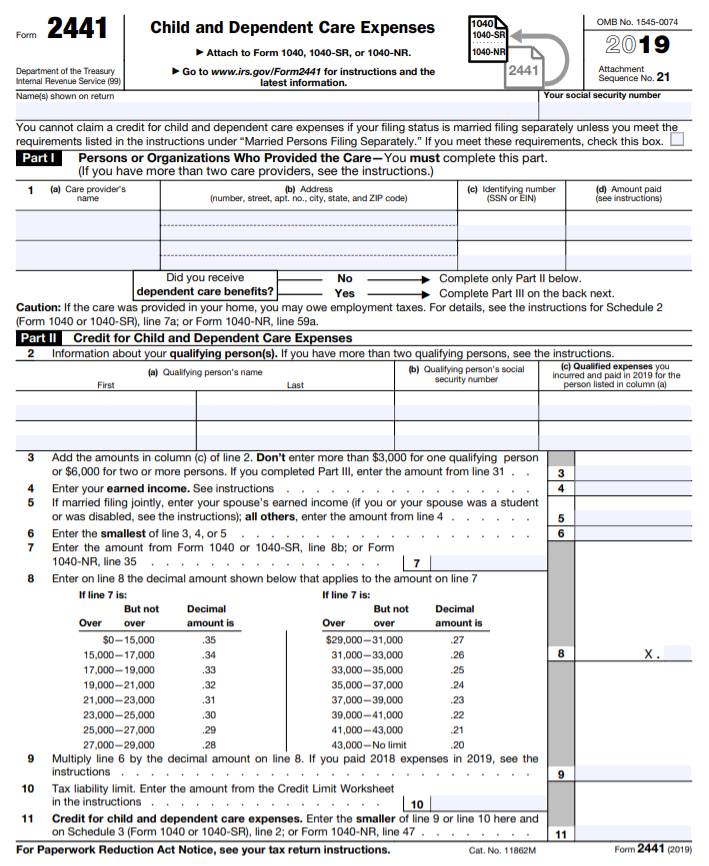

- The Child and Dependent Care Tax Credit

- The Head of Household tax return filing status

- The Exclusion for Employer-provided Child Care benefits.

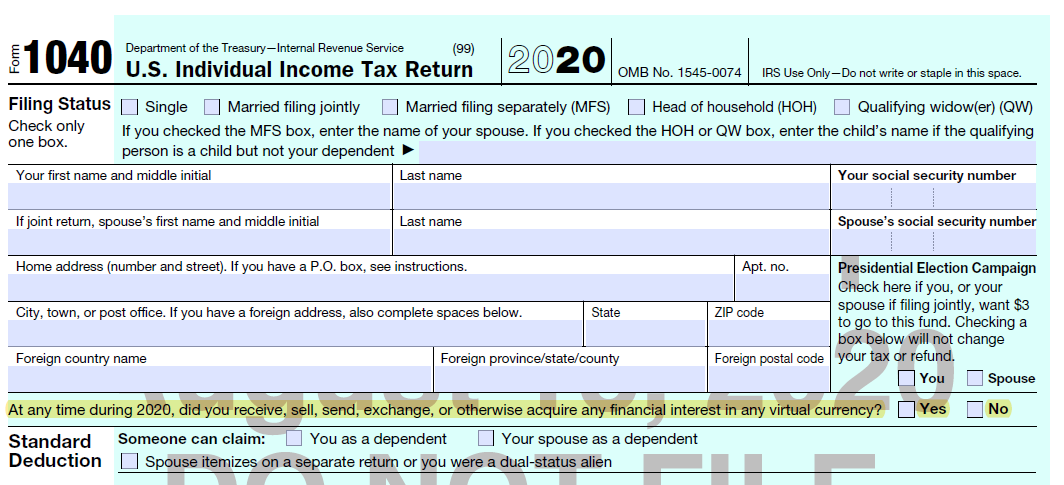

Generally, only one taxpayer may claim any one person as a dependent on a tax return (except, of course, in the case of a married couple filing jointly). If you file your tax return and someone else has already claimed your dependent, then the IRS will apply the tiebreaker rules - see details below. To avoid any of this conflict, utilize the eFile.com DEPENDucator to determine if you are eligible to claim someone on your 2021 Tax Return, due on Tax Day. You can also eFileIT, including the Multiple Support Declaration Form 2120 - see below.

TaxTip: This is a good reason to e-File early. After a return claiming a particular dependent is accepted, any subsequent return that is electronically filed claiming the dependent will be rejected by the IRS. However, having an IRS accepted return with a dependent is not a confirmation that this taxpayer is qualified to claim this dependent. In other words, if you e-Filed your return with the dependents listed on your return, anybody else e-filing their return after you claiming the same dependent(s) will have their return rejected. However, if another return claiming the same dependent(s) is filed manually (mailed in), then the IRS will apply the tie-breaker rules (see details below).

However, if another return claiming the same dependent(s) is filed manually (mailed in), then the IRS will apply the tie-breaker rules (see details below).

There may be an exception when the splitting of tax benefits for a dependent is detailed in a legal divorce decree. If you have such a decree that was issued after December 31, 2008, you will need to file your tax return on paper and attach the relevant pages of the divorce decree, including the first page and the signature page. If the decree was issued before January 1, 2009, the IRS will not accept it. However, if you are a noncustodial parent claiming the child as a dependent, you have two options:

- Multiple Support Declaration: To identify any other eligible person who can claim the dependent, you will need a signed statement from the eligible person waiving his or her right to claim that person as a dependent before you can add Form 2120, Multiple Support Declaration, when you prepare and eFile your tax return on eFile.

com. If you already filed your return, you may need to submit Form 2120 via postal mail to the IRS. For situations where the same child may be eligible to be claimed as a dependent or qualifying child by more than one person, the IRS will apply a set of tiebreaker rules to determine who has the right to claim the dependent. Once the IRS receives both returns claiming the same dependent, they will use the tie-breaker rules below.

com. If you already filed your return, you may need to submit Form 2120 via postal mail to the IRS. For situations where the same child may be eligible to be claimed as a dependent or qualifying child by more than one person, the IRS will apply a set of tiebreaker rules to determine who has the right to claim the dependent. Once the IRS receives both returns claiming the same dependent, they will use the tie-breaker rules below. - Release of Claim to Exemption for Child: You or the other party can transfer the right to claim a child as a dependent. To release a claim of a child as a dependent so that a non-custodial parent can claim the child, or to revoke a previous release to claim a child as a dependent, you can complete Form 8332, Release Revocation of Release of Claim to Exemption for Child by Custodial Parent. The Form 8332 can NOT be eFiled with your tax return on eFile.com. The non-custodial parent in this situation should also obtain a copy of the completed form from the custodial parent and attach it to their tax return, which they will need to paper file.

If you change your mind at any time and wish to revoke your release of claim, you can simply file another Form 8332. Include Form 8453, U.S. Individual Income Tax Transmittal when you mail in your tax return with Form 8332 to the IRS.

If you change your mind at any time and wish to revoke your release of claim, you can simply file another Form 8332. Include Form 8453, U.S. Individual Income Tax Transmittal when you mail in your tax return with Form 8332 to the IRS.

Should these options not apply to you, please consider the following steps.

What If Your Dependent(s) Have Been Claimed

Review these steps if you e-Filed your tax return and it got rejected by the IRS because somebody, such as an ex-spouse or as a result of identity theft, has already claimed one or more of your dependents on his or her tax return. Keep in mind, an accepted tax return is not a guarantee to have the right to claim the dependents on that return.

Steps to Take After Somebody Incorrectly or Fraudulently Claimed Your Dependent(s)

Let's say you prepared and e-Filed your tax return and the IRS rejected it with the message that one or more dependents have been claimed on another taxpayer's tax return. Or, you received IRS Notice CP87A or CP75A because the IRS received a tax return from somebody claiming a qualifying child as a dependent with the same social security number as a dependent listed on your tax return.

Or, you received IRS Notice CP87A or CP75A because the IRS received a tax return from somebody claiming a qualifying child as a dependent with the same social security number as a dependent listed on your tax return.

General information on fraudulent tax returns: If you think you are a victim of identify theft, you can request a copy of a fraudulent return via Form 4506-F.

The steps below apply if a tax return incorrectly claimed your dependent(s) or if you claimed dependents incorrectly.

- Find out who qualifies as your dependent by using our free DEPENDucator tool.

- If you used eFile.com when you completed your taxes, a PDF copy of your return is stored in your eFile.com account. Sign in and click on My Account before you download, print, and sign your IRS and state tax returns.

- Gather dependent supporting documents about your dependent(s) and complete Form 866-H-Dep.

- If you have a divorce decree, attach the relevant pages of the decree (including the first and signature pages) to your mailed return.

- For example, you might also have to include copies of (have them notarized) daycare records, school records on official letterhead from a school, medical records from the medical provider, social service records from the social service agency, information from the place of worship that shows names, and common addresses and dates. Include a letter with any other information you think would assist the IRS.

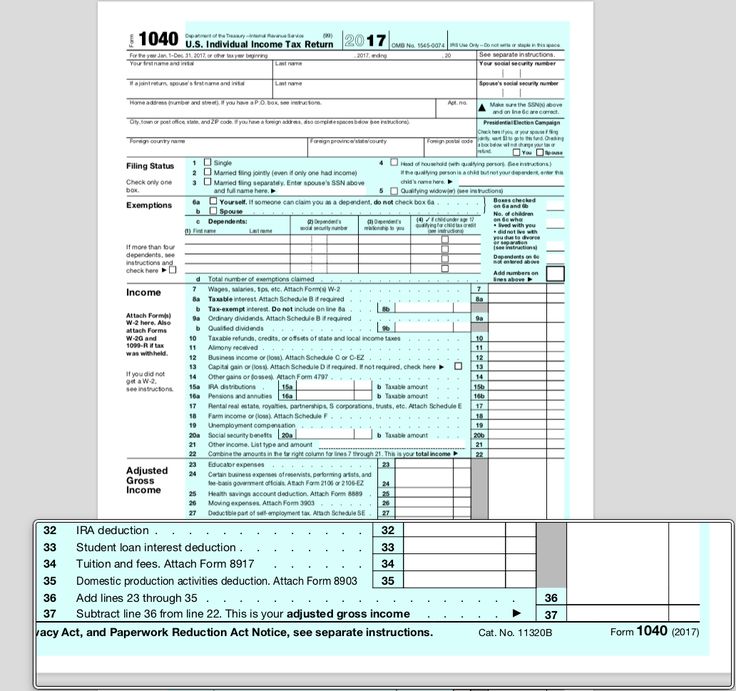

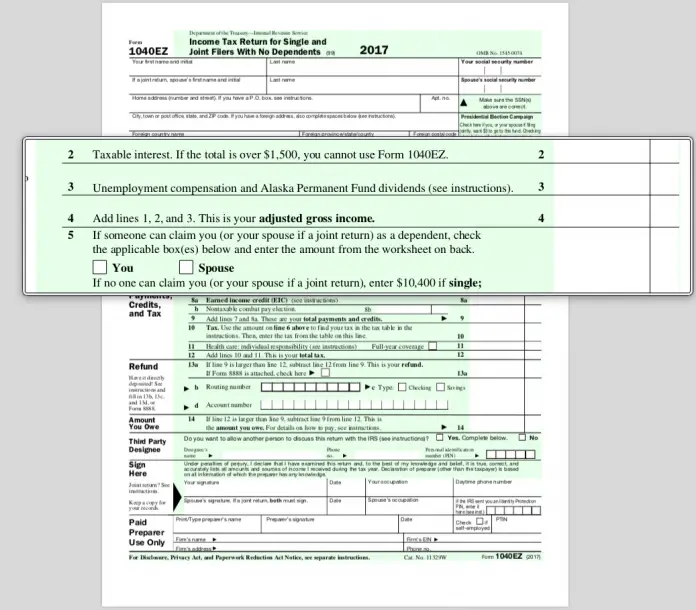

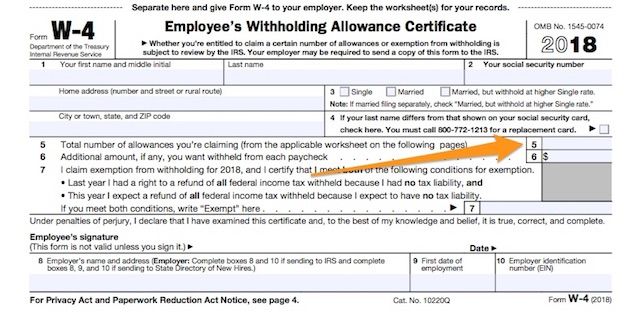

- Gather your printed tax return, income and deduction forms (W-2, 1099, etc.), and Form 866-H-Dep. Then, mail in all your documents to the IRS based on the address on your tax return. If you also have to send your return to one or more state tax agencies, find the state mailing address here. TaxTip: It is best if you use a U.S. Postal Office tracker to confirm that the IRS has received your documents.

- If you only claimed the Earned Income Tax Credit for your child, but the IRS has sent you an audit letter requesting more information from you, you will need to mail Form 886-H-EIC and attach any documents in the form supporting your EITC claim.

Use this EICucator tool.

Use this EICucator tool. - Once the IRS has received your documents, they will examine both returns - the return with the claimed dependent(s) and yours - and apply the tiebreaker rules based on the criteria listed below. The process might take 8-12 weeks, or longer.

If you found out that you claimed a dependent incorrectly on an IRS accepted tax return, you will need to file a tax amendment or form 1040-X and remove the dependent from your tax return.

At any time, contact us here at eFile.com or call the IRS support line at 1-800-829-1040 and inform them of the situation. Or, take advantage of low income tax clinics if this applies to you.

IRS Tiebreaker Rules

Under the IRS tiebreaker rules, the child is generally considered a qualifying child if the following apply:

- A married couple or parents prepare and eFile or file a married joint tax return and claim the child a qualifying dependent.

- Only one parent of the couple, who is also the child's parent, claims the child as a qualifying child or dependent.

- If the child has two persons as parents and the two persons do NOT file a married joint return, then the parent with whom the child lived or resided with for the longer time period during a tax year will be qualified to claim the dependent.

- If the child lived or resided with each parent the same amount of time during the tax year, the parent with the highest adjusted gross income or AGI will be able to claim the dependent, if there is no married joint return and both parents claim the child on their respective return.

- If no parent claims the child as a qualifying child, then the person with the highest AGI qualifies over any parent who may have been able to claim the child, such as a qualifying step-parent or relative.

- Because of the second tiebreaker rule (residence), the parent who has legal custody of a child is generally the parent who gets to claim the child in cases of divorced or separated parents. If you are the custodial parent and you wish to relinquish your dependency exemption and assign it to the non-custodial parent, you may do so by filing Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent.

What if I was Falsely Claimed as a Dependent?

If you e-filed a return and it was rejected by the IRS who stated your social security number has been claimed on a tax return for that year, there are some steps to take, depending on the situation.

If you know who claimed you: You should get in contact with them as soon as possible. If a parent or guardian, for example, claimed you on their return when they were not supposed to, they would have to amend their return. The IRS will have to process their amended return before your SSN can be used on your own return. Likely, to meet the tax day deadline, you will have to prepare and mail your return so you do not face any late penalties. If they amend their return, this goes much quicker than if they refuse.

If you do not know who claimed you or they will not cooperate: You will have to paper file your return. Use your identity as normal and mail in your prepared return. You will want to gather documents that show you do not qualify as a dependent (rent payments showing you pay for your expenses, residency statements, etc.) because, once processed, the IRS will contact you via letter requesting additional information - they will also write to the taxpayer who claimed you. The IRS will request that the return(s) be amended to reflect the actual situation. If the wrongdoing party does not comply, this may result in an IRS audit for both returns. You and the taxpayer who claimed you will have to prove your dependency status.

You will want to gather documents that show you do not qualify as a dependent (rent payments showing you pay for your expenses, residency statements, etc.) because, once processed, the IRS will contact you via letter requesting additional information - they will also write to the taxpayer who claimed you. The IRS will request that the return(s) be amended to reflect the actual situation. If the wrongdoing party does not comply, this may result in an IRS audit for both returns. You and the taxpayer who claimed you will have to prove your dependency status.

The simplest way to prepare all your 2021 forms is by completing your 2021 Tax Return with eFile.com. You can eFile your return or mail it in case it got rejected due to another person claiming your dependents. Make sure you include the appropriate forms with your mail package to the IRS. TaxTip: It is best if you use a U.S. Postal Office tracker to confirm that the IRS has received your documents.

Should you require further assistance, please contact eFile.com support or call the IRS at 1-800-829-1040. You might also be able to take advantage of a low income taxpayer clinic. More details on how low income taxpayer clinics work.

Additional resources regarding dependents and alimony payments:

- How to claim a dependent on a tax return

- Qualifying for the Child Tax Credit and your personal tax situation

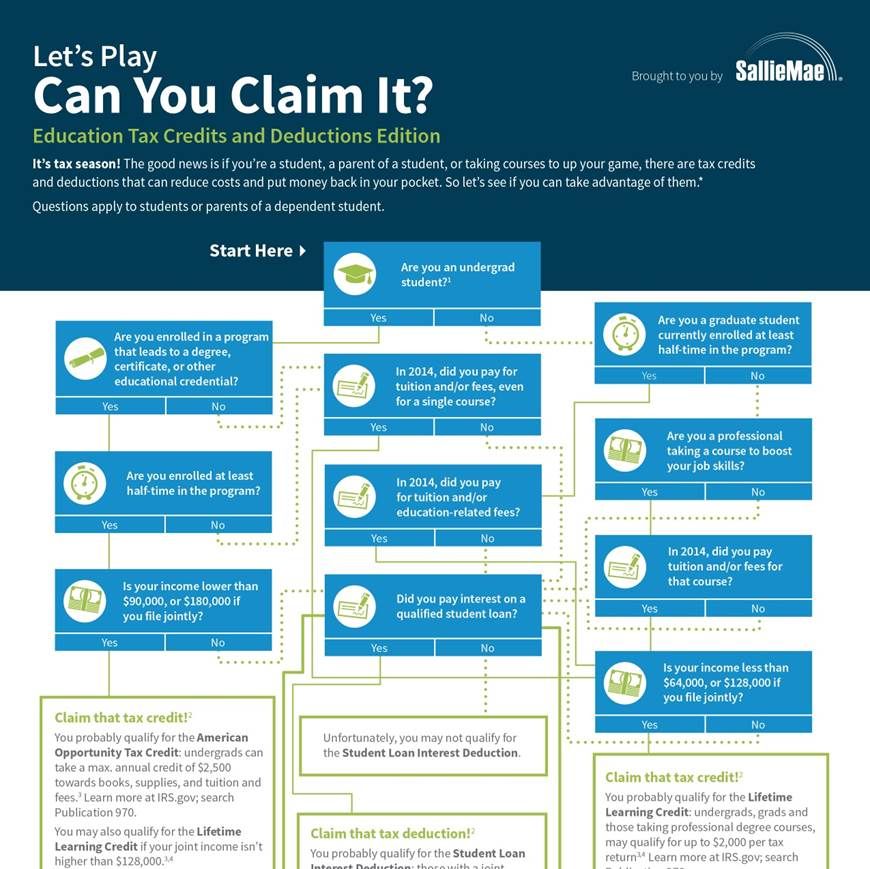

- Qualifying education tax deductions for your dependent

- Education tax credits for your dependent

- Alimony and taxes

- For state tax returns, select the respective state.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

What to Do If Someone Claimed Your Dependent

You may have tried to file your tax return and got an e-file rejection message.

Something like: “A dependent on your return has already been claimed (or claimed themselves) on another return.”

Assuming you entered your dependent’s information correctly, it looks like someone else claimed your dependent. Because the IRS processes the first return it receives, if another person claims your dependent first, the IRS will reject your return.

The IRS won’t tell you who claimed your dependent. Usually, you can identify the possibilities and ask (commonly, a former spouse). But if you don’t suspect anyone who could have claimed the dependent, your dependent may be a victim of tax identity theft. Learn how to handle tax identity theft.

If you don’t think that the other person was eligible to claim your dependent, you’ll need to take some steps to protect your right to claim the dependent and your refund.

Here’s what to do

Don’t panic. This doesn’t mean that you can’t correct the situation. First, double check that you meet all of the requirements to claim the dependent. Then, take these steps:

Then, take these steps:

1. File a paper return.

Print out and mail your return, claiming your dependent, to the IRS. The IRS may delay your refund while the IRS looks into the issue, but you should still receive your refund. Note that when you file a paper return, it can take six to eight weeks for the IRS to process.

2. Document your case.

The IRS rules for claiming a dependent can get complicated.

The most important thing to remember is to prove with proper documentation that you are entitled to claim the dependent. This includes things like birth certificates and proof of identity, but also documents that show that your dependent lived with you at the same address for more than half of the year.

Examples are:

- School, medical, daycare, or social service records

- A letter on official letterhead from a school, medical provider, social service agency, or place of worship that shows names, common address and dates

The IRS will ask you to complete this document.

3. Answer when the IRS contacts you.

About two months after you file a paper return, the IRS will begin to determine who is entitled to claim the dependent.

You may receive a letter (CP87A) from the IRS, stating that your child was claimed on another return. It will tell you that if you made a mistake, to file an amended tax return, and if you didn’t make a mistake, do nothing.

The other person who claimed the dependent will get the same letter. If one of you doesn’t file an amended return that removes the child-related benefits, then the IRS will audit you and/or the other person to determine who can claim the dependent.

You’ll get a letter in a few months to begin the audit. In the audit, the IRS will require you to provide proof that you are entitled to claim the dependent. Be sure to reply completely and by the IRS deadline. After the IRS decides the issue, the IRS will charge (or, “assess”) any additional taxes, penalties, and interest on the person who incorrectly claimed the dependent.

You can appeal the decision if you don’t agree with the outcome, or you can take your case to U.S. Tax Court.

It’s always a good idea to discuss claiming children with your family members before a situation like this arises, if possible.

For any dependent dispute, know your options and your rights

Dependent disputes can cause many types of tax problems. Learn more about how to handle an IRS audit – or what to do about tax refund holds and other tax return problems resulting from dependent-related credits.

And for any IRS issue, remember that you have the right to representation. You can outsource the work to a tax pro, who can look into the cause of the issue and deal with the IRS for you.

Learn more about how to research your IRS account or get help from a trusted IRS expert. Or make an appointment for a free consultation with a local tax professional by calling 855-536-6504 or finding a local tax pro.

Taxes: theft of money from the population or public property?

Photo from prof-accontant. ru

ru

The state collects taxes from us, withholding a certain amount every month from wages and other income. Is this "legitimate theft" fair? After all, this is honestly earned money that belongs to us. Phillip Goff, a professor at the Central European University in Budapest, tried to answer this question in an essay published in Aeon magazine.

Translation: Irina Fedorova

Can taxes be called theft?

Some radical libertarians (adherents of political philosophy against violence) believe that taxation is fundamentally immoral. This opinion is based on the fact that the state simply takes, steals from citizens part of their money. Many people have this feeling. Former British Prime Minister David Cameron, for example, repeatedly advocated tax cuts, he considered the moral side of the issue to be important, that it is necessary to return as much “their money” to people as possible. Those who believe that high taxes are necessary start from the premise that the state has a moral right to take a portion of their income to provide someone else with a benefit or finance public services. And outside of academia, almost everyone assumes that the money I get before taxes is in some morally significant sense "mine".

And outside of academia, almost everyone assumes that the money I get before taxes is in some morally significant sense "mine".

This opinion is almost universal, but in fact there is no serious political theory that my pre-tax income is "mine" in any morally meaningful sense. Moreover, this assumption of "my" income is one of the main obstacles to economic reform, forcing low-wage and middle workers to vote against their economic interests. The notion that pre-tax income is “mine” makes it virtually impossible to correct the economic injustices that pervade the modern world.

"Only death and taxes are inevitable in this world."

Benjamin Franklin (1706–1790)

In asking whether taxation is theft, it is important to distinguish between two kinds of "theft": legal and moral. In 18th-century North America it was possible to "own" a slave in the legal sense as property. If someone deprived me of my slave in order to free him, then this was "theft" in the legal sense. But, of course, the laws underlying slavery were morally repugnant, and consequently, few today would consider freeing a slave "theft." And, conversely, we can have cases of moral theft, which by law will not be called that. The laws of Nazi Germany allowed the authorities to seize the property of Jews who were deported, although, strictly speaking, such actions did not legally constitute "theft", they were theft in a moral sense.

But, of course, the laws underlying slavery were morally repugnant, and consequently, few today would consider freeing a slave "theft." And, conversely, we can have cases of moral theft, which by law will not be called that. The laws of Nazi Germany allowed the authorities to seize the property of Jews who were deported, although, strictly speaking, such actions did not legally constitute "theft", they were theft in a moral sense.

And so, when we ask ourselves whether taxation is theft, we must determine whether we are talking about the moral or the legal sense. If we were to say that a tax is theft in a legal sense, then we must argue that people have legal claims on their pre-tax income, and therefore the government commits a legal theft when it takes its citizens' pre-tax income. This can be quickly refuted. Clearly, if Mrs. Jones is legally required to pay a certain amount of tax on her income, then she is not legally entitled to keep all of her pre-tax income. It follows from this that the state does not commit legal theft when it ensures the payment of this tax.

"A citizen should pay taxes with the same feeling with which a lover gives gifts to his beloved."

Novalis (1772–1823), German poet and philosopher

A more interesting question: Does the state commit a moral theft when it takes taxes? The answer to it depends on whether citizens have a moral right to their income.

Your pre-tax income is the money you earn in the labor market. Why do you think that you can have a moral requirement for this money? You can answer that you deserve them: you have worked hard and done a good job, and therefore you deserve all the income as a reward for your work. If this is so, then it turns out that the state is taking away your honestly deserved money.

But this is not plausible enough, because it would mean that the market distributes to people exactly what they deserve for the work they do. But no one believes that a top manager deserves many times more than a scientist working on a cure for cancer, and few people think that current salaries in companies reflect this. You may be working very hard and making an important contribution. But then most people are clearly not rewarded in proportion to their contribution.

You may be working very hard and making an important contribution. But then most people are clearly not rewarded in proportion to their contribution.

"To collect taxes and be pleasant at the same time is just as impossible as to love and be wise."

Winston Churchill (1874–1965), British Prime Minister

If we have moral requirements for income, then this is not because we deserve it, but because we have the right to it. What is the difference? What you deserve is what you should have as a result of hard work or social contribution; and what you are entitled to is the result of your property rights. Libertarians believe that every person has rights to natural property that it would be immoral for the government to violate. According to right-libertarians such as Robert Nozick and Murray Rothbard, taxation is morally wrong, not because the state takes what the people deserve, but because it takes what the people are entitled to.

Therefore, if taxes are theft, then it is directly related to people's rights to property. But do we have these rights? And even if there are, are they really violated? Before looking for answers, we need to think more carefully about the nature of property and its essence.

“I am proud to pay taxes in the United States. True, I would be proud of no less and for half the amount.

Arthur Godfrey (1903 - 1983), American radio host

The French anarchist Pierre-Joseph Proudhon declared in 1840 that all property had been stolen from someone. But even among those who agree with the legitimacy of the right to property, there are different opinions about what exactly it is. Libertarians believe that property rights are natural as basic and natural. Others believe that property rights are simply legal, social constructs that are created by humans and can be modified to suit human purposes. We can call the latter opinion "social constructivism" about property. (Note that the focus here is on social constructivism with regard to property, we are not considering the more general proposition that morality in general is a social construct.)

(Note that the focus here is on social constructivism with regard to property, we are not considering the more general proposition that morality in general is a social construct.)

To see the difference, ask yourself: "Which comes first: the property itself or the right to own it?" For a social constructivist, property is not a natural, sacred property that exists independently of man-made conventions and legal practices. Rather, we create property rights by creating legal institutions for people to have certain legal rights in the material world. For libertarians, by contrast, the facts about property exist independently of human laws and conventions, and indeed human laws and conventions must be formed as a reflection of the natural right to property.

This distinction is crucial to our question. Suppose we accept the social constructivist view that property rights are man-made. Now we ask the question, "Do I have a moral claim on all of my pre-tax income?" We cannot claim that I am entitled to my pre-tax income on the basis of my natural property rights, since there is no such thing as "natural" property rights (according to the social constructivist position we are now considering). So, if I have a moral requirement for all pre-tax income, it must be because that's exactly the amount of money I deserve for my hard work and social contributions. Because in general, the market delivers to each person what he deserves. But we have already refuted this assertion. Hence, without a belief in natural property rights that exist independently of human laws and conventions, there is no way to understand the idea that market emancipation is inherently just. Therefore, it does not make sense to think that the income belongs to someone by right.

So, if I have a moral requirement for all pre-tax income, it must be because that's exactly the amount of money I deserve for my hard work and social contributions. Because in general, the market delivers to each person what he deserves. But we have already refuted this assertion. Hence, without a belief in natural property rights that exist independently of human laws and conventions, there is no way to understand the idea that market emancipation is inherently just. Therefore, it does not make sense to think that the income belongs to someone by right.

“You may not notice that everything is going well for you. But the IRS will notice."

Pierre Daninos (1913–2005), French writer and journalist

Here we must understand the idea that taxation can only be considered theft if property rights are natural and not just man-made. Therefore, we need to defend the theory of natural property rights. Our next task is to study the philosophical theories of property rights.

We can divide the philosophical theories of property rights into three categories: right libertarian, left libertarian and social constructivism. Let's look at each in turn.

All libertarians hold that man has full natural property rights over himself and the fruits of his labor. However, the views of right and left libertarians differ on the issue of property rights that people can have in nature, that is, rights over land and resources.

Right-libertarians believe that the material world - the whole earth and everything that stands on it - once belonged to no one. The first people who discover something in the natural world begin to have an inalienable natural right. If I am the first to find some land and cultivate it, I will have natural property rights to this land, so it is morally wrong if someone takes the land or its fruits from me.

Now we can understand how anyone can think that taxation is a moral theft. If we think of the market as a free market and an exchange of goods between individuals who have natural rights to property, then any state intervention in the market will constitute a violation of their rights. Taxation will take from citizens what is rightfully theirs.

Taxation will take from citizens what is rightfully theirs.

Left libertarians agree with right libertarians that every person has full ownership of himself and the fruits of his labor. Nevertheless, they believe that nature belongs to everyone: it is impossible for one person to acquire exclusive rights to land or resources in such a way as to exclude the equal moral demands of other people.

There are different forms of this point of view. In a more extreme version, nature is jointly owned by everyone, so that no one has the right to own anything without the explicit consent of every other living person (compare: if we jointly own a house, you cannot sell a room in it without my consent). The libertarian left principle is that each of us has an equal moral claim to the resources of the world.

Left libertarianism certainly considers some forms of taxation to be immoral. If I acquired land or natural resources in such a way that it corresponded to the equal moral requirements of other people and the value of these resources increased by my own labor, then the state has no right to take these riches from me. But left-libertarian theories leave considerable leeway for the state to change the distribution of wealth, perhaps through taxation as well. It is also critical to consider the demands of future generations, which naturally leads to inheritance taxes (or at least restrictions on the right to bequeath) to ensure that every future person has a fair share of the natural resources.

But left-libertarian theories leave considerable leeway for the state to change the distribution of wealth, perhaps through taxation as well. It is also critical to consider the demands of future generations, which naturally leads to inheritance taxes (or at least restrictions on the right to bequeath) to ensure that every future person has a fair share of the natural resources.

As already discussed, social constructivists do not deny the right to property itself, but consider it to be a social or legal structure shaped by man. Jesus said that "the Sabbath was made for man, not man for the Sabbath." Similarly, for the social constructivist, property rights are created to satisfy the interests of the individual, and not vice versa.

“I don't pay taxes. I let the state take them."

Chris Rock, contemporary American actor

It is plausible that a person needs certain legally protected rights to property, and therefore most social constructivists will defend a system of property rights. At the same time, there are other values: perhaps equality, perhaps rewards for hard work or social contributions (which, as we have understood, are not sufficiently protected by the market), and to promote these values, most social constructivists propose to legitimize the property rights to pay taxes. In the absence of pre-existing natural property rights, there is no moral reason to respect the market distribution of wealth (of course, this would be pragmatic, economic reason, but that is another matter).

At the same time, there are other values: perhaps equality, perhaps rewards for hard work or social contributions (which, as we have understood, are not sufficiently protected by the market), and to promote these values, most social constructivists propose to legitimize the property rights to pay taxes. In the absence of pre-existing natural property rights, there is no moral reason to respect the market distribution of wealth (of course, this would be pragmatic, economic reason, but that is another matter).

Many people start from the assumption that every citizen has some kind of moral requirement for income. To think so, one must accept the libertarian view that property is natural and independent of laws or conventions. And it also requires a rejection of the left-libertarian claim that each of us has equal moral demands on natural resources. As far as the right libertarian view is concerned, it is only natural that one person can claim a huge unequal share of land and resources for himself, with the result that his ownerless neighbors are forced to work for him in order to avoid starvation. What right can the natural world be appropriated in this way? One thing can be said that man has exclusive natural rights over himself, but how can we justify exclusive natural rights over nature? And if this cannot be justified, right-libertarianism does not stand up to scrutiny.

What right can the natural world be appropriated in this way? One thing can be said that man has exclusive natural rights over himself, but how can we justify exclusive natural rights over nature? And if this cannot be justified, right-libertarianism does not stand up to scrutiny.

Moreover, as I will now attempt to show, even if right-sided libertarians are right, even if there are rights to natural property, even if such rights allow individuals to carve out for themselves a huge unequal share of natural resources, even then we cannot grasp the idea that that people living today have a moral claim to their pre-tax earnings.

The reason is that the world that Libertarian Right Theory talks about is very different from the world we live in today. (It is no coincidence that Nozick's book 1974 is called "Anarchy, the State, and Utopia.") According to right-libertarianism, the distribution of wealth in the marketplace is morally significant because it is a distribution that respects the voluntary choice people have made with property to which they are naturally entitled. But this only works if the market is completely free, that is, if the state does not influence the distribution of wealth. But there are very few countries in the world where this is the case. Almost every country has some amount of taxation, at least for roads and infrastructure, if not for education and healthcare. But even the smallest such government intervention suggests that the distribution of wealth in the marketplace no longer reflects the free choice of citizens, and therefore, by the lights of right-wing libertarianism, the citizens of these countries have no moral claim on pre-tax income.

But this only works if the market is completely free, that is, if the state does not influence the distribution of wealth. But there are very few countries in the world where this is the case. Almost every country has some amount of taxation, at least for roads and infrastructure, if not for education and healthcare. But even the smallest such government intervention suggests that the distribution of wealth in the marketplace no longer reflects the free choice of citizens, and therefore, by the lights of right-wing libertarianism, the citizens of these countries have no moral claim on pre-tax income.

This will become clearer with examples. Consider the example of Professor Schmidt, a right-wing libertarian academic working at a German university who is very unhappy that the state is taking 42% of "his" income from him. Where does the professor's salary come from? German universities are state-funded, and so Schmidt's salary comes from general taxation, from money that the German state has forcibly taken from its citizens. But, according to righteous libertarianism, this is an immoral act of the state that violates the natural rights of its citizens; he is essentially stealing from people to pay Professor Schmidt. It follows that Professor Schmidt has no right to his salary and therefore no right to complain that the state only allows him to have 58 percent of this stolen money.

But, according to righteous libertarianism, this is an immoral act of the state that violates the natural rights of its citizens; he is essentially stealing from people to pay Professor Schmidt. It follows that Professor Schmidt has no right to his salary and therefore no right to complain that the state only allows him to have 58 percent of this stolen money.

Now consider the example of Ms. Jones, a libertarian British businesswoman who resents the payment of tax on dividends from her profitable company. Although she is not directly paid by the government, the profits made from Jones' business depend on many things that are funded by the government: she may receive government subsidies, but even if not, her company's success will certainly depend on infrastructure, roads, an educated and healthy work force. These conditions are provided by the state and funded by taxes. According to right-libertarianism, these things were paid for by theft, and therefore Jones is not entitled to the profits thus made.

"The state stops the war of all against all, and taxes are the price by which public peace is bought."

Thomas Hobbes (1588–1679), English philosopher

In theory, right libertarianism could argue that people have a moral right to pre-tax income and therefore taxation is theft, but this would only be true in hypothetical societies where there is zero or minimal government intervention in the economy.

It's hard to shake the feeling that the state is constantly "taking" from you. But it turns out that not a single fact justifies this. Even if the most radical forms of right-libertarianism are true, it turns out that you have no moral rights to your income.

Yet the vast majority are happy to vote for low taxes, happy that they are able to keep "their" piece, when in fact all they have done is protect the booty of a tiny minority at the top. As a result, we cannot create what we really need: a tax system as part of a larger economy creates a just society.

- Courts and Judges

How not to fall for scammers

Skip listen and sharing tools

Fraudulent methods (scams) are invented by dishonest people in order to extort money or personal information from you.

Fraudsters can contact potential victims by phone, email, text messages and letters. The following information will help you recognize and protect yourself from the most common scams.

Lottery scam

Scammers may send you plausible mail, email, text messages, or social media notifications saying you've won a lottery. This prize can be money, a trip, a smartphone, or a voucher for purchasing goods in a store. In order to claim your winnings, you are asked to pay a tax, pay a service fee, or provide details of your bank account.

Here are some of the red flags of these scams:

- you are being told you won a lottery or contest that you did not enter

- you are asked to provide your personal details by phone or email

- in order to receive the winnings, you are invited to pay a fee or send data about your bank account

- PO Box number (PO), email address or mobile phone number is given as contact information (no actual postal address is given).

Money Back Fraud

Fraudsters pretend to be employees of a government agency, bank or other well-known institution and tell you that you are owed some amount of money, for which you need to pay an administrative fee or some other type of payment . Fraudsters may tell you that you have not been paid a pension or benefit supplement, or that you have overpaid your utility bills, resulting in you being entitled to a supplement or a refund of the overpayment.

A real bank, business or government agency will never charge you for money owed to you.

Fraud on dating sites

Fraudsters are looking for their victims on legitimate dating sites. Having achieved interest from a potential victim, the scammer transfers all contacts to a personal email address, phone calls and text messages. Over time, he establishes a relationship with the victim online, using all means to gain trust and favor from her.

Eventually the scammer will invent a story that he needs the money, often because of a family member's illness or injury, or for an investment deal. By this time, the victim is usually under his charm and willingly sends money, despite warnings from relatives and friends that this is probably a scam trap. Money sent by mail or transferred to a bank account is almost impossible to return.

By this time, the victim is usually under his charm and willingly sends money, despite warnings from relatives and friends that this is probably a scam trap. Money sent by mail or transferred to a bank account is almost impossible to return.

What you need to remember in order not to fall for the bait of scammers

- if the offer is too attractive to be believed, then it should not be believed

- be very careful about e-mails, phone calls and letters from strangers saying that you are owed some money

- never send money or your bank account details in order to receive winnings or money owed to you

- check if you entered a lottery or prize draw and remember that in a real lottery you will never be asked to pay a fee to claim your winnings

- Never pay by postal order - always use a more secure payment method - credit card or PayPal

- beware of false websites using plausible-looking logos of well-known banks or other organizations - if in doubt, contact the bank or organization directly and make inquiries

- Do not use links in an email to contact an organization.

Always find contact information using a search engine, telephone directory, or other independent source

Always find contact information using a search engine, telephone directory, or other independent source - never send money to a person you have not met in person, even if you have spoken to him or received gifts from him

- listen to family and friends if they have concerns about someone you met online

- Be careful if pictures on dating sites don't match descriptions or look like they were taken from a magazine.

Measures against fraudsters

If you think you have been the victim of a scam, you should contact us immediately and let us know what happened. In some situations, the money can be returned through the company that issued the credit card, or through the bank.

If you can't get your money back, it's still important to let us know as this information will help us prevent others from being scammed.

For more information on how to avoid being scammed, see our Stevie's Scam School videos for consumers and small businesses.