How much is the child credit for 2023

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

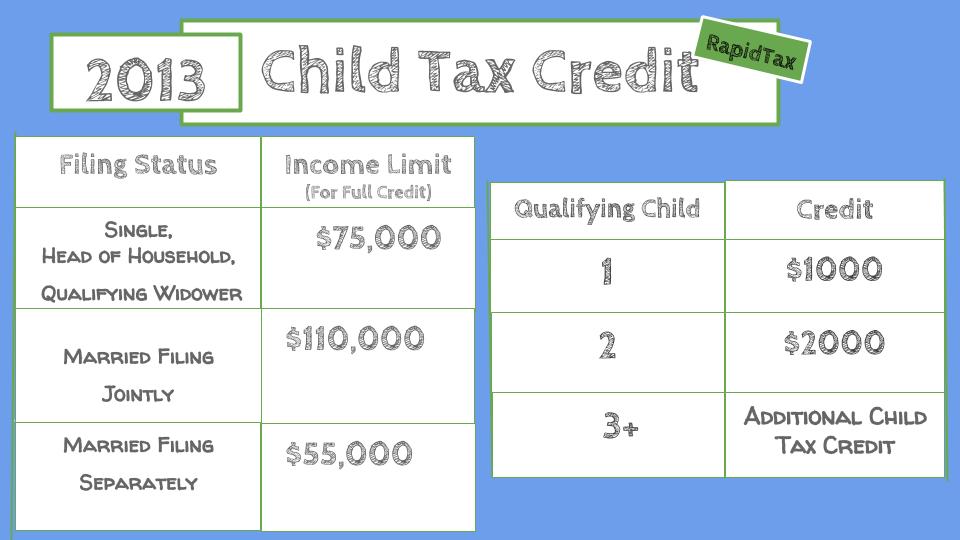

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Will child tax credit payments continue in 2023? The fight is not over.

As the ink dries on the Inflation Reduction Act — the landmark federal law that tackles climate change, drug pricing, health insurance, and tax enforcement — advocates for the expanded child tax credit have been quietly mourning their loss.

The expansion, passed as part of President Joe Biden’s pandemic relief program, delivered hundreds of dollars into parents’ bank accounts every month in 2021, ultimately helping 65 million children and keeping 3.7 million of them out of poverty. A year ago, the expanded CTC was heralded as one of the most significant policy achievements of the Biden era, so important to the broader Build Back Better negotiations that House Speaker Nancy Pelosi described its upcoming expiration as “really important leverage” for getting the rest of their agenda through.

It wasn’t enough. By January 2022, it was clear that any attempt to pass Biden’s agenda would likely exclude the child tax credit due to irreconcilable differences between West Virginia Sen. Joe Manchin and his Democratic colleagues over whether tax credit recipients should be required to work. When the Inflation Reduction Act passed last month, it didn’t include the CTC.

Now advocates for the CTC say they’re looking ahead to next steps. The first opportunity for new legislation could come at the end of the year, when Congress negotiates extensions on expiring business tax breaks. Advocates are also looking at new administrative solutions at the IRS, and thinking more seriously about state-level reform, amid state budget surpluses and new research detailing just how much families benefited from the now-expired expanded federal credit.

“It was very unfortunate that we didn’t get the expansion that we wanted in reconciliation, but it still is a very live issue,” said Brayan Rosa-Rodríguez, a senior policy analyst at UnidosUS, a national Latino advocacy group. “We’re going to focus on it over the next couple months to see if we can get it included in a tax extender bill.”

“We’re going to focus on it over the next couple months to see if we can get it included in a tax extender bill.”

During the past year, as inflation wreaked havoc on bank accounts and eroded the value of existing family benefits, lawmakers have faced pressure to offer relief. In the wake of the Supreme Court overturning Roe v. Wade, conservatives have also been facing more pressure to support families, and a proposal introduced in June by Republican Sens. Mitt Romney (UT), Richard Burr (NC), and Steve Daines (MT) to distribute monthly cash payments to parents has garnered a lot of attention. Notably, this Republican proposal includes a requirement that families earn at least $10,000 to receive its full benefit, the kind of work requirement progressives rejected during reconciliation. Virtually every Republican has said that some “connection to work” is essential for any family policy they’d vote for.

Sens. Richard Burr, left, and Mitt Romney chat on an elevator in the US Capitol during a Senate vote on February 16. Tom Williams/CQ-Roll Call, Inc via Getty Images

Tom Williams/CQ-Roll Call, Inc via Getty Images To reach a bipartisan deal at the end of the year, advocates recognize they will have to entertain terms they rejected with Manchin.

“It’s obviously easier to get to 50 votes than it is to get to 60 votes, and that’s what it is,” said Zach Tilly, a policy associate with the Children’s Defense Fund, which co-led a coalition that pushed for the expanded CTC. “I think the way we’re looking at this opportunity at the end of the year is basically just as one where we may still have some leverage to get something done.”

Progressives are looking to an end-of-the-year compromise

Romney’s new child tax credit proposal — the Family Security Act 2.0 — is a modified version of a child allowance policy he introduced in 2021. One of the major differences between the two proposals is that the new one has a work requirement, something his Republican colleagues demand and which Manchin demanded last year during reconciliation.

The FSA 2.0 would increase the maximum annual child tax credit from $2,000 to $4,200 for each child under age 6 and $3,000 for each child ages 6 through 17, paid out in monthly installments. Expecting parents could also qualify for an additional $2,800 credit during the final four months of pregnancy. The “phase-in” of Romney’s plan — meaning the time at which families could start receiving their benefit — is much faster compared to the status quo. Right now the first $2,500 of earnings does not count toward CTC eligibility, while Romney’s plan would phase in the credit beginning with a family’s first earned dollar. This expansion would all be financed by consolidating other tax benefits, including a significant revamp of the earned income tax credit.

The left-leaning Center on Budget and Policy Priorities estimates that the number of children living in poverty would decline by 1.3 million under the Romney proposal, and that roughly 20 million children in families making less than $50,000 would be better off. But the CBPP also argues that roughly 10 million children would be worse off under the Romney plan, due in part to its proposed cuts to the EITC and its elimination of the “head of household” tax filing status, which millions of single parents use when they file their income tax returns.

But the CBPP also argues that roughly 10 million children would be worse off under the Romney plan, due in part to its proposed cuts to the EITC and its elimination of the “head of household” tax filing status, which millions of single parents use when they file their income tax returns.

The Niskanen Center, a centrist think tank that helped Romney craft his new proposal, pushed back on the CBPP’s analysis and defended the elimination of the “head of household” filing option, something conservatives have long argued disincentivizes marriage by imposing financial penalties on couples who tie the knot.

Niskanen agreed some families would be worse off, but said some of CBPP’s concerns could be addressed by increasing the phase-in and phase-out rate of the Romney proposal, to account for inflation. Niskanen also said the CBPP understates the benefit of making tax refunds administratively simpler for both recipients and the government.

As recently as this spring, progressive tax wonks and the Biden administration told Democrats in Congress that they should not consider any possible work requirement for expanding the child tax credit in reconciliation. But left-leaning groups are now acknowledging a compromise on this will likely be needed.

But left-leaning groups are now acknowledging a compromise on this will likely be needed.

The Family Security Act doesn’t include any of the more politically popular exceptions to work requirements, such as exempting families with very young children, or families where the primary caregiver is disabled, elderly, or a student.

“If policymakers move toward a compromise on a Child Tax Credit expansion, the highest priority should be to make the credit fully refundable,” the CBPP said, meaning eligible to all regardless of whether they’re earning a certain amount of income. “But if that isn’t politically possible,” the CBPP concedes, “and an earnings requirement is included, important exemptions should be included as well.”

Melissa Roberts, who lost her job at an insurance company at the start of the pandemic, prepares dinner for her children in January. Roberts struggled to find employment and relied on the federal child tax credit to help provide for her 5- and 7-year-old children. Andrea Morales for The Washington Post via Getty Images

Andrea Morales for The Washington Post via Getty Images Writing earlier this month in The Hill, University of California Berkeley public policy professor Bruce Fuller urged Biden to step up and find a compromise with Romney, such as a work requirement that starts when children enter school. “Romney’s bid has drawn deafening silence from the White House and leading Democrats,” Fuller wrote.

Josh McCabe, a family policy analyst at the Niskanen Center, thinks most advocacy groups were waiting for reconciliation negotiations to finally be over and are now starting new discussions. “I think people are more open to things that they weren’t before, and everyone’s feeling out what’s possible,” he told Vox. “So with the FSA 2.0 there’s a more generous phase-in, which is unattractive relative to the fully refundable CTC from 2021, but it’s very attractive relative to the status quo.”

Tilly, of the Children’s Defense Fund, acknowledged that it will take 60 votes to get anything done on the child tax credit at the end of the year. “So that limits what’s possible,” he said, though he emphasized that advocates have some leverage, as they recognize it will be politically difficult for Republicans to extend federal business tax cuts without offering any economic relief to families. An open letter published in March from 133 economists also made the case that an expanded CTC would be too small to meaningfully increase inflation, but large enough to help offset inflation’s toll, particularly for lower-income households.

“So that limits what’s possible,” he said, though he emphasized that advocates have some leverage, as they recognize it will be politically difficult for Republicans to extend federal business tax cuts without offering any economic relief to families. An open letter published in March from 133 economists also made the case that an expanded CTC would be too small to meaningfully increase inflation, but large enough to help offset inflation’s toll, particularly for lower-income households.

“There’s a big gap between where we and most Democrats are and where the most CTC-sympathetic Republicans in the Senate are,” Tilly said. “So that’s obviously going to be the focus for us and a lot of the people that we work with in the fall, to try to bridge that gap and make improvements.”

New ideas for reform are cropping up at the state level

While Democrats and activists were not successful in expanding the federal CTC, the flurry of organizing, research, and media coverage on the policy’s success has had spillover effects, prompting more local policymakers to think about opportunities for state-level CTC reform.

In 2021, Colorado passed a new state child tax credit, which families will get to claim for the first time next year. Maryland recently passed a new child tax credit for families with children with disabilities, and New Mexico recently created a fully refundable tax credit worth up to $175 per child.

Last year, Massachusetts also converted two existing tax deductions for dependents into fully refundable child tax credits, and this year the state’s Republican Gov. Charlie Baker proposed doubling the value of those credits. In Vermont, Republican Gov. Phil Scott just signed a tax cut package that will send $1,000 for every child 5 and under to Vermont households making $125,000 or less, a program state lawmakers say was modeled on the expanded federal CTC.

McCabe, of the Niskanen Center, says the big difference between state CTCs and the expanded federal CTC right now is the states have tended to target their aid toward lower-income families, though exceptions exist, as in Massachusetts and Vermont. States are also tending to focus their CTCs on families with younger children, whereas the federal CTC supported families with older teens, too. One reason for this is means-testing state CTCs and limiting them to younger children helps keep the overall cost of the program down. Another reason is that there’s mounting evidence that the cost of raising younger children, compared to older teens, is more difficult for parents to afford.

States are also tending to focus their CTCs on families with younger children, whereas the federal CTC supported families with older teens, too. One reason for this is means-testing state CTCs and limiting them to younger children helps keep the overall cost of the program down. Another reason is that there’s mounting evidence that the cost of raising younger children, compared to older teens, is more difficult for parents to afford.

The CBPP recently put out an analysis encouraging states to create their own CTCs, and noted that the cost of enacting or improving existing ones is “typically small enough that states may be able to absorb them without raising additional revenue.”

In a new report published by the People’s Policy Project, a crowdfunded leftist think tank, founder Matt Bruenig proposes reforming state-level tax credit programs (both CTCs and EITCs) to counteract the exclusion of low-income children from the federal tax credits. In other words, states could step up to push for what advocates were not able to get passed on the federal level during reconciliation negotiations.

In other words, states could step up to push for what advocates were not able to get passed on the federal level during reconciliation negotiations.

“Minor and inexpensive tweaks to state tax credit programs could effectively extend the federal child benefit regime to poor families,” Bruenig writes. “This kind of state-level policymaking is where child benefit advocates should focus their attention over the next few years.”

Bruenig notes 29 states currently have these kinds of programs, and there will be 32 states that have them beginning in 2023. He identifies 14 states and Washington, DC, that have full Democratic control and could be more easily persuaded to make progressive tax policy reforms.

Bruenig told Vox there could also be a scenario where Romney’s proposed child tax credit was passed but gave states the option to effectively opt out of the work requirement, by allowing states to contribute money to the federal government so that the federal benefit would not phase in for their own residents.

“This would make the state supplement more administratively simple since you wouldn’t have to administer a separate state CTC,” Bruenig added, noting that the supplemental security income (SSI) program also works like this.

Rodriguez, from UnidosUS, said he thinks it’s a good time for state legislators to try to plug weaknesses in state versions of federal programs, particularly as states are experiencing historical budget surpluses from Covid-era investments. Rodriguez says he and his colleagues have also been encouraging states to allow immigrant workers with Individual Taxpayer Identification Numbers (an alternative to Social Security numbers) to collect state EITC benefits, something eight states currently allow. Eighteen percent of US citizen children in poverty — more than 1.63 million kids — are currently excluded from the EITC because they live in mixed-status families with undocumented members.

“This is a moment where we could have an inclusive and generous EITC at the state level, and the same goes for state-level CTCs,” Rodriguez said.

McCabe said one issue with Bruenig’s proposal is states may be hesitant to design their CTC programs around federal policy, as federal policy can change pretty quickly. States may also not want to wait around for federal enabling legislation if they were to opt for the idea that more closely resembles how SSI is administered. Moreover, if Republicans in Congress opposed the expanded CTC last year for being fully refundable, they very well may oppose making it easier for states to blunt the pain of their federal work incentives.

“I think states might be better off with creating entirely new infrastructure,” McCabe said. “I think Massachusetts is right to do it much broader, more limited by age, and then slowly grow their credit over time.”

The expiring Trump tax cuts present opportunities for CTC advocates through 2025

Advocates for the expanded child tax credit see opportunities to build on and improve the child tax credit as Trump-era tax cuts expire over the next few years. “We’re looking at the tax extenders at the end of the year, and as we’re doing that, we’re trying to think through what we need to do to really build momentum to pass something more permanent,” said Elisa Minoff, a senior policy analyst with the Center for the Study of Social Policy.

“We’re looking at the tax extenders at the end of the year, and as we’re doing that, we’re trying to think through what we need to do to really build momentum to pass something more permanent,” said Elisa Minoff, a senior policy analyst with the Center for the Study of Social Policy.

Advocates also see opportunities to push for administrative improvements at the IRS, to make the tax filing process easier and less costly for families. The IRS will have a new Biden-tapped commissioner next year, and the agency will have new money flowing in from the Inflation Reduction Act, some of which can be used to upgrade the agency’s technology.

Much of what CTC advocates say they will push for next in Congress depends on how the elections shake out this November. If Democrats win deeper majorities in the midterms, then they might be able to pass a more generous expanded federal CTC, like the House passed in its $1.85 trillion Build Back Better package last fall.

If Democrats win deeper majorities in the midterms, then they might be able to pass a more generous expanded federal CTC, like the House passed in its $1.85 trillion Build Back Better package last fall.

If Democrats lose seats in Congress, or even if they hold their number of seats steady, advocates may have to rethink their strategy around negotiating with Republicans or Manchin. Manchin’s demands for the CTC included limiting the number of affluent families who could claim the credit and having some form of work requirement. He also disliked the idea of only expanding the credit for one year, but worried about the cost of a big permanent expansion.

Climate advocates were able to win big priorities in the reconciliation deal this year only by ceding to all the main legislative priorities of the West Virginia Democratic senator.

“I think if we wound up in a position where now the entire future of the CTC turns on Joe Manchin’s approval, then I think the lesson of this reconciliation bill is that you have to tailor the process to him,” said Tilly. “Because he obviously has no qualms about letting it die.”

“Because he obviously has no qualms about letting it die.”

Our goal this month

Now is not the time for paywalls. Now is the time to point out what’s hidden in plain sight (for instance, the hundreds of election deniers on ballots across the country), clearly explain the answers to voters’ questions, and give people the tools they need to be active participants in America’s democracy. Reader gifts help keep our well-sourced, research-driven explanatory journalism free for everyone. By the end of September, we’re aiming to add 5,000 new financial contributors to our community of Vox supporters. Will you help us reach our goal by making a gift today?

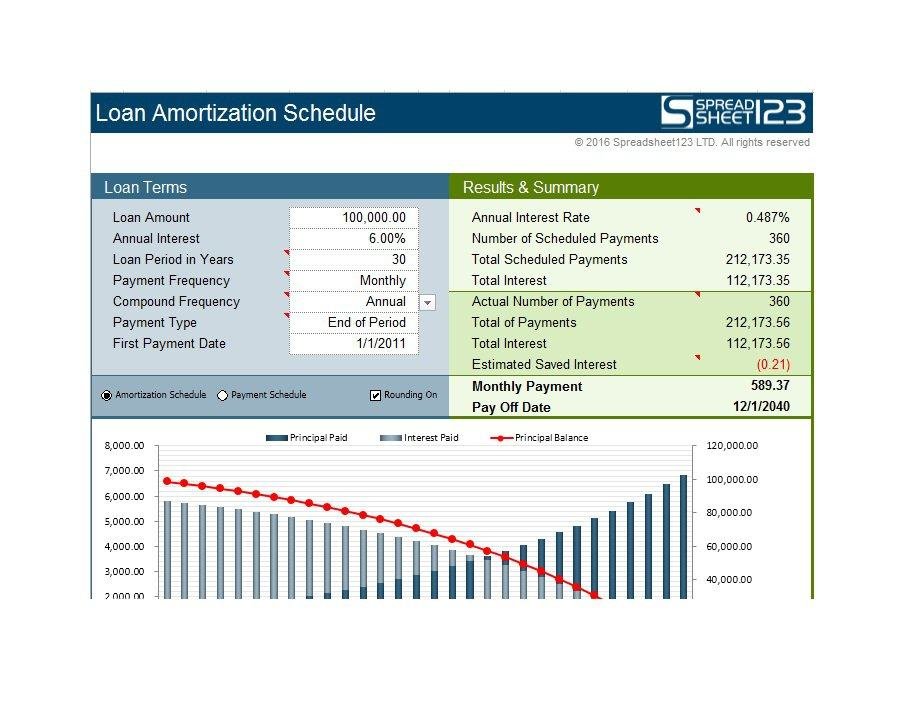

Mortgages with state support in 2022 - conditions for obtaining, preferential mortgage lending programs

The state helps borrowers reduce the loan rate, and gives subsidies from the budget to some apartment buyers. Here are a few state support programs that are currently in place for the purchase of new buildings in Bryansk.

Preferential mortgage from 6.35%

This program will run until December 31, 2022. It is suitable for all citizens of the Russian Federation - including those who are not married and without children.

Basic terms of preferential mortgage:

- You can only buy a new building from the developer. Not suitable for secondary housing.

- Down payment - from 15%.

- The maximum loan amount is 6 million rubles. The limit can be increased to ₽15 million through a combination of preferential and market mortgages.

The difference between the preferential and the market rate is reimbursed to the bank by the state.

Family mortgage from 5.1%

The program has been extended until the end of 2023 and has become more accessible.

Family mortgage basic terms:

- Suitable for families with a child born since 2018. Or a child with a disability, regardless of age.

- You can buy a new building, secondary housing from individuals - no.

- Down payment - from 15%.

- The maximum loan amount for Bryansk is 6 million rubles.

The bank receives compensation from the budget to reduce the rate.

Maternity capital

A family with children who are eligible for maternity capital can use it to pay for a mortgage or an apartment. The right to mother capital is confirmed by a certificate - it comes to the personal account at the State Services after the child is registered in the registry office.

If you want to use your mother's capital for a mortgage, this can be done immediately after the birth of a child - as a down payment or on account of a debt.

If you use maternity capital without a mortgage to pay a developer, the child must be 3 years old.

Maternal capital in 2022:

- 524 527 ₽ — for the first child or for the second child born before 2020

- 693 144 ₽ — for the second child born since 2020

- 168,616 ₽ — for the second child, if the first was born since 2020

When using maternity capital, it will be necessary to allocate shares to children: when the mortgage is repaid and the house is completed.

Subsidy for large families

If the borrower has had a third or subsequent child since 2019, you can receive a mortgage repayment subsidy of 450,000 ₽. A mortgage can also be issued before the birth of a child, including for secondary housing. Children do not need to allocate shares.

The subsidy is issued at the bank that issued the loan for the purchase of an apartment. He sends the borrower's application to the operator of the DOM.RF program. In a few days, the payment will go to the bank and pay off part of the borrower's debt.

Young family allowance

Under the Young Family program, you can receive a social benefit for a mortgage or home purchase without a loan. It is not as accessible as other programs, but it works - first of all, the money is directed to support large families.

Main conditions of the program:

- Spouses or single parent of a child under 36 years old.

- The family needs to improve their living conditions.

- Have money to pay the balance or mortgage payments.

- The amount of the payment is 30% for spouses without children, 35% for families with children.

- The amount depends on the estimated cost of housing and the area norm: for a family of two - 42 sq.m, for three or more people - 18 sq.m per person.

- The payment can be used for a mortgage, a new building or a second home. Including it can be credited to the escrow account.

First you need to become a member of the program. Then wait for your turn for payment - this can take several years. The right to state support is confirmed by a personal certificate, which is sent to the bank. An account is opened for the program participant, where money from the budget is transferred for targeted payment of housing.

What housing can be bought with state support

Preferential mortgages and subsidies are suitable for paying for apartments in any Atmosfera residential complex. Choose an apartment, and we will show you how to buy it profitably.

Choose an apartment, and we will show you how to buy it profitably.

Buy an apartment from a developer in Bryansk

Mortgage calculator

Get advice on a mortgage

Message sent successfully!

Read more

The calculator is suitable for an approximate calculation at a reduced rate. The results are for informational purposes and do not constitute an offer. Additional information is needed to draw up an accurate payment schedule. Leave a request - the manager will call you back and calculate everything.

Personal finance navigator - Portal MOIFINANCE.RF

Site search

Income and taxes

Credits

Risks and security

Consumer Rights

Situation

Expenses, October 7, 2022

How and on what can you save when paying through "Gosuslugi"?

You can pay state fees with a 30% discount on "Gosuslugi" until the end of this year. From January 1, 2023, the discount will be canceled. At the same time, it will remain possible to pay some fines with a 50% savings. We'll tell you what the special offers are for.

From January 1, 2023, the discount will be canceled. At the same time, it will remain possible to pay some fines with a 50% savings. We'll tell you what the special offers are for.

September 26, 2022

Can unused vacation be burned off?

Income and taxes

September 23, 2022

Digest MyFinance No. 15. NIFI experts comment on the key topics of the week

Economy

September 20, 2022

Not a loan or an installment: what is BNPL?

Expenses

Economy, October 7, 2022

Mikhail Kotyukov: Citizens' interest in financial literacy is growing

Economy, September 28, 2022

From September 1, 2023, financial literacy will become a mandatory element of the school curriculum for high school students

Situation, September 23, 2022

It is proposed to increase maternity capital by 12. 4%

4%

Be civil with money

The joint project of NIFI of the Ministry of Finance and Post Bank includes self educational video podcasts and competition.

The project aims to develop financial culture teenagers.

The video tag is not supported by your browser.

- Mon

- Tue

- Wed

- Thu

- ПТ

- СБ

- ВС

- ПН

- ВТ

- СР

- ЧТ

- ПТ

- СБ

- ВС

-

26

-

27

-

28

-

29

-

30

-

1

-

2

-

3

- 4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19,0003

-

014

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

1

-

2

-

3

-

4

-

5

-

6

Cameral events

All-Russian online marathon "Mortgage-2022. New rules and opportunities”

New rules and opportunities”

10 October 9:00

Loans

Final of the International Financial Security Olympiad

October 10 9:00

Economy

Regional family financial festival in the Krasnoyarsk Territory

10 October 10:00

Economy

Tracker of bad financial habits

Diagnose your habits that negatively affect your personal and family budget

Financial health tracker

A special tracker will help you check your financial health

VI All-Russian competition of initiative budgeting projects

Competition of the best Russian initiative budgeting projects 2021

Mortgage

We tell you about all the non-obvious details of a mortgage loan, knowing which will help you live comfortably with long-term financial obligations

Unified Competence Framework for Financial Literacy

The document was developed in order to implement the Strategy for Improving Financial Literacy in the Russian Federation for 2017-2023

Basic knowledge of financial literacy

The textbook was developed by the Faculty of Economics of Moscow State University named after M.