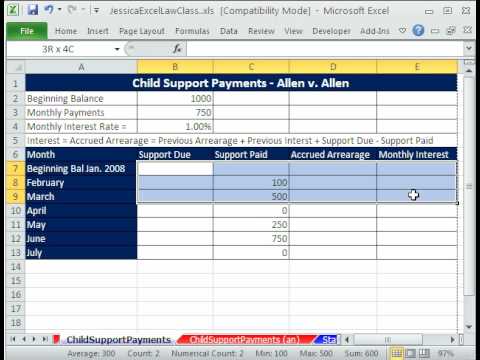

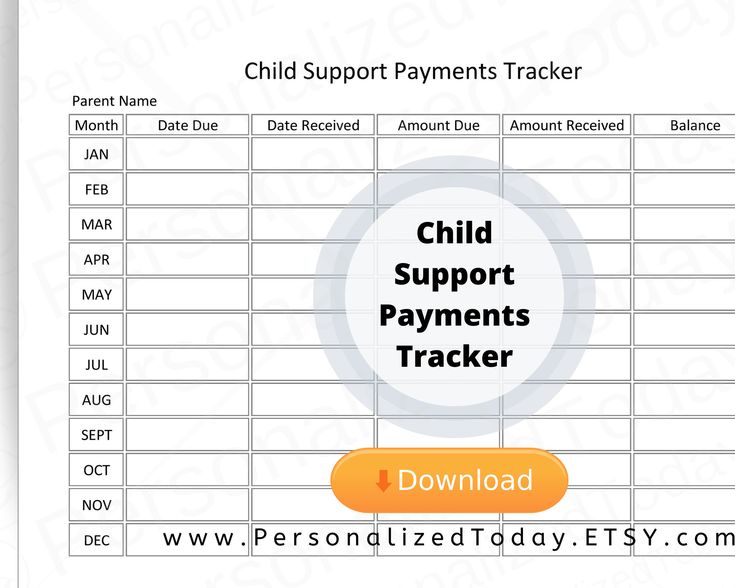

How to estimate child support payments

Easy-to-use Wisconsin Child Support Calculator 2022

Easy-to-use Wisconsin Child Support Calculator 2022 | Divergent Family Law WisconsinFREE INITIAL CONSULT

Child Support Rates

According to the United States Census Bureau, the national average child support payment was $430 per month in 2010. This means you could end up spending around $100,000 or more over the course of your child’s adolescence. Other factors unique to your situation could inflate that number even higher, such as number of children, the parents’ incomes, placement schedules, and more.

Minimize the cost spent on child support payments by contacting the professional Milwaukee Family law firm, Divergent Law. Our attorneys specialize in child support and child custody laws in Wisconsin. Use our free 2022 Wisconsin child support calculator for primary or shared placement schedules to estimate your monthly Wisconsin child support payments. Our child maintenance calculator uses statistics and rates found in DCF 150. Select different child custody arrangements to see how 50/50, 60/40 and 70/30 placement schedules would affect the child support amount.

Child support is just one of the many aspects to consider when determining the cost of divorce in Wisconsin. Our Milwaukee divorce attorneys offer flat-fee quotes & flexible payment plans. See also: How much does a divorce cost in Wisconsin?

Divorce Cost Calculator

How Wisconsin Calculates Child Support Rates

Child custody and child support laws in Wisconsin are complex and hard to follow at times. Many factors can play into determining child support rates such as joint vs sole placement, the yearly gross income of the parents, special needs of the child(ren), and more. A 50:50 placement schedule would result in a very different child support payment than a 70:30 child custody schedule.

Guidelines exist for given situations for the courts to follow. The courts are required to follow these child support guidelines but they can deviate from them and increase or decrease payments based on other factors.

The courts are required to follow these child support guidelines but they can deviate from them and increase or decrease payments based on other factors.

Divergent Law attorneys can help you navigate the complex landscape of Wisconsin child support and placement laws, codes, regulations, and violations to make sure your child support payments are fair.Contact Milwaukee child support attorneys at Divergent Law today for a free initial consultation.

FREEInitial Consult Get started now! Because it's worth it. KNOWThe Real Costs

Guidelines for the following placement situations are suggested for use by the courts:

Primary Placement

Shared Placement

Low-Income

High-Income

How Wisconsin Calculates Primary Placement Child Support Rates

When the non-residential parent has less than 92 (less than 25% of the time) overnight visits with the child(ren), Wisconsin considers the case to be of primary placement to the residential parent. The child(ren)’s primary residence and supervision are provided by the residential parent, while the non-residential parent is entitled to visitation, which may or may not include overnights.

The child(ren)’s primary residence and supervision are provided by the residential parent, while the non-residential parent is entitled to visitation, which may or may not include overnights.

Wisconsin uses the standard percentage formula, set by DCF 150 of our State Legislature. The percentage is based on the number of kids to be in primary placement of a parent. The paying parent will make child support payments based on the following percentages:

- For 1 child, it's 17% of gross income

- For 2 children, it's 25% of gross income

- For 3 children, it's 29% of gross income

- For 4 children, it's 31% of gross income

- For 5+ children, it's 34% of gross income

In Wisconsin, the courts may use their discretion in evaluating other factors to increase or decrease monthly child support payments. Additionally, percentages vary based on low or high-income of either party.

Use Divergent Law’s Wisconsin child support calculator with overnights to estimate child support payments for shared custody, split custody or full custody situations. These calculations should only be used as estimates to determine your monthly child support based on time spent with the child(ren).

These calculations should only be used as estimates to determine your monthly child support based on time spent with the child(ren).

Wisconsin Child Support Percentage Conversion (Examples)

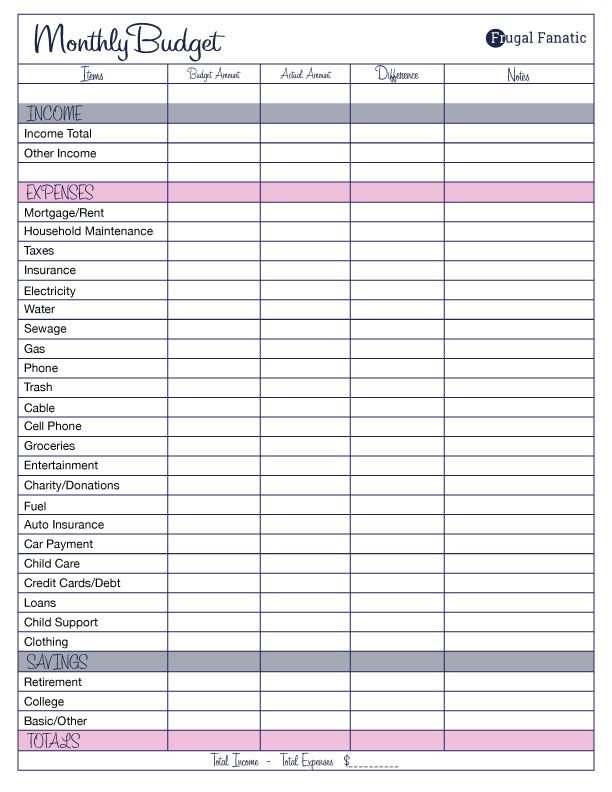

| Monthly Income | 1 child (0.17) | 2 children (0.17) | 3 children (0.17) | 4 children (0.17) | 5+ children (0.17) |

|---|---|---|---|---|---|

| $2,000.00 | $340.00 | $500.00 | $580.00 | $620.00 | $680.00 |

| $2,100.00 | $357.00 | $525.00 | $609.00 | $651.00 | $714.00 |

| $2,300.00 | $391.00 | $575.00 | $667.00 | $713.00 | $782.00 |

| $2,500.00 | $425.00 | $625.00 | $725.00 | $775.00 | $850.00 |

| $2,900.00 | $493.00 | $725.00 | $841.00 | $899.00 | $986.00 |

View the WI Child Support Percentage Conversion Table (Chapter DCF 150 APPENDIX A) for more examples.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

How Wisconsin Calculates Shared Placement Child Support Rates

To qualify for shared placement in Wisconsin, both parents are required to have at least 92 (25% of the time) overnight visits with the child(ren). Both parents have a significant amount of contact and time with their child(ren).

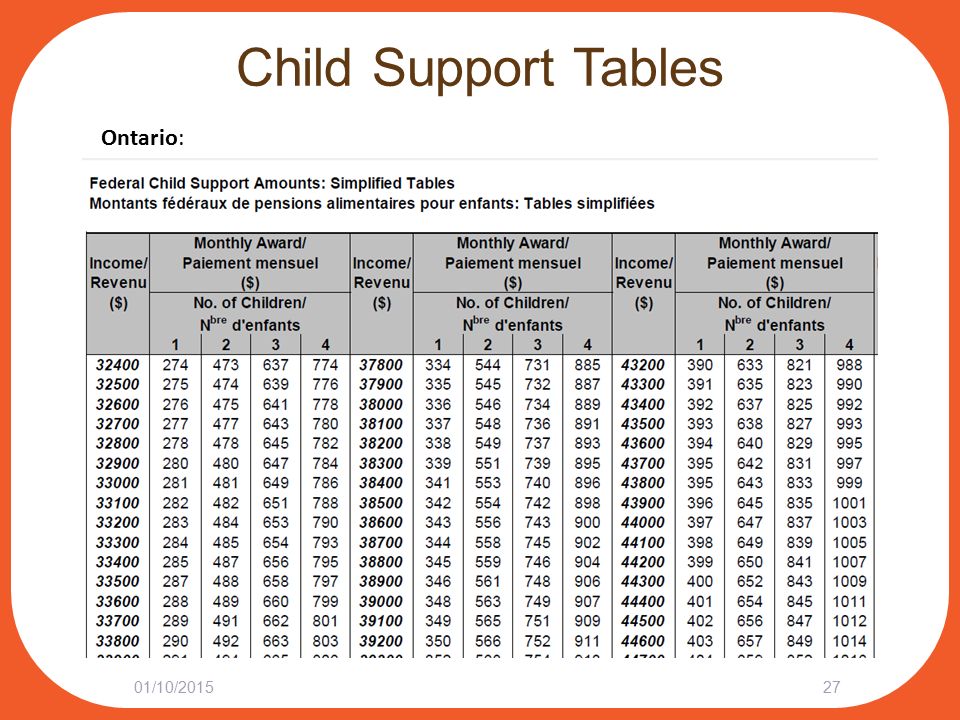

Wisconsin uses a Shared Placement formula based on the percentage standard as well as time spent with each parent. Child support in Wisconsin is determined by each parent’s gross monthly income, the standard percentage based on the number of children (see table below), and the percentage of time each parent spends with the child(ren).

In Wisconsin, the use of the shared placement formula for shared placement is at the discretion of the courts. The courts may also use other factors in increasing or decreasing monthly child support payments.

Use Divergent Law’s free online Wisconsin child support calculator for joint custody to determine an estimate of your monthly child support payments. These calculations should only be used as estimates to determine your monthly child support cost.

Wisconsin Child Support Standard Percentage

| 1 child | 2 children | 3 children | 4 children | 5+ children |

|---|---|---|---|---|

| 17% of gross income | 25% of gross income | 29% of gross income | 31% of gross income | 34% of gross income |

View the WI Shared Placement Worksheet.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

How Wisconsin Calculates Low-Income Child Support Rates

If you’re gross monthly income is less than $1,485/month (75% to 150% of the 2022 Federal Poverty Guidelines), your child support obligation may be based off the low-income formula for primary placement or shared placement.

In Wisconsin, the use of the low-income formula for primary placement or shared placement is at the discretion of the courts. The courts may also use other factors in increasing or decreasing monthly child support payments.

Use Divergent Law’s easy-to-use online Wisconsin child support calculator to determine an estimate of your monthly child support payments. Our child support formula should only be used as estimates to determine your monthly child support cost.

Child Support Obligation of Low−Income Payers (Examples)

| Gross Monthly Income Up To: | Child Support for 1 child | Child Support for 2 kids | Child Support for 3 kids | Child Support for 4 Kids | Child Support for 5+ children | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Percent | Child Support Amount | Percent | Child Support Amount | Percent | Child Support Amount | Percent | Child Support Amount | Percent | Child Support Amount | |

| $781. | 11.22% | $88 | 16.50% | $129 | 19.14% | $149 | 20.46% | $160 | 22.44% | $175 |

| $808.00 | 11.43% | $92 | 16.80% | $136 | 19.49% | $157 | 20.84% | $168 | 22.85% | $185 |

| $889.00 | 12.05% | $107 | 17.71% | $157 | 20.55% | $183 | 21.97% | $195 | 24.09% | $214 |

| $1,057.00 | 13.28% | $140 | 19.54% | $206 | 22.66% | $240 | 24.22% | $256 | 26. | $281 |

| $1,309.00 | 15.14% | $198 | 22.27% | $291 | 25.83% | $338 | 27.61% | $361 | 30.28% | $396 |

| $1,485.00 or higher | – No longer eligible for Low Income formula – | |||||||||

View the WI Low-Income Payer Guidelines (Chapter DCF 150 – APPENDIX C) for more examples.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

How Wisconsin Calculates High-Income Child Support Rates

If the paying parent’s gross income is $7000/month ($84,000/year) or more, your child support obligation may be based on the high-income payer worksheet for primary placement or shared placement.

In Wisconsin, the use of the high-income formula for primary placement or shared placement is at the discretion of the courts. The courts may also use other factors in increasing or decreasing monthly child support payments.

Use Divergent Law’s free online Wisconsin child support calculator to determine an estimate of your monthly child support amount per child.

Child Support Obligation of High-Income Payers

|

| 1 child | 2 children | 3 children | 4 children | 5+ children |

|---|---|---|---|---|---|

| The first $7,000/month of income | 17% of gross income | 25% of gross income | 29% of gross income | 31% of gross income | 34% of gross income |

| Portion of income between $7,000/month and $12,500/month | 14% of gross income | 20% of gross income | 23% of gross income | 25% of gross income | 27% of gross income |

| Portion of income that is more $12,500/month | 10% of gross income | 15% of gross income | 17% of gross income | 19% of gross income | 20% of gross income |

View the WI High-Income Payer Worksheet.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

Frequently Asked Child Support Questions in Wisconsin

I don’t think my child(ren)’s parent is using the child support the way it should be. What can I do?

Child support is intended to go toward your child(ren)’s welfare, which includes rent, food, clothes, etc. Some of these things such as rent and food overlap where the other parent may benefit from. If you are concerned your child(ren) is being neglected, you could try to contact the Department of Health and Human Services to see what can be done. However, the paying parent does not have the right to decide how the support is spent on the child(ren).

If the other parent is refusing to let me see our child(ren), can I stop paying child support?

Your obligation first and foremost is to care for your child(ren), so do not stop paying. The issue of placement of the child(ren) and child support are considered two entirely different issues with the court and if you stop paying your child support, you could be held in contempt of court. If your court-ordered child placement schedule is being violated, you can file a motion to enforce physical placement against the other parent. Contact our attorneys today to find out all your options going forward.

The issue of placement of the child(ren) and child support are considered two entirely different issues with the court and if you stop paying your child support, you could be held in contempt of court. If your court-ordered child placement schedule is being violated, you can file a motion to enforce physical placement against the other parent. Contact our attorneys today to find out all your options going forward.

Can I just use the Child Support Calculator to determine the monthly child support payment?

Using the Child Support Calculator can give a calculated estimate to determine the monthly child supported cost. Though the calculator is based on guidelines determined by the State of Wisconsin courts, specifically DCF 150. The courts can deviate from these guidelines and increase or decrease payments based on other factors. A child support lawyer in Wisconsin can help you determine more accurate child support payment estimations.

How is child support determined?

Child support determination is based on the needs of the child, income and needs of the custodial parent, the paying parent's ability to pay and the child's standard of living before divorce or separation.

How many overnights is every other weekend?

Custody of your child(ren) every other weekend results in 52 overnights per year.

How many overnights is joint custody?

To qualify for joint physical custody, Wisconsin requires that each parent host more than 92 overnights per year. Use our child support shared custody calculator to see how many overnights for various joint custody arrangments.

How much child support will I pay for one child?

For one child, you will pay 17% of your gross income in child support. Percentages vary for low-income payers.

How do I apply for child support in Wisconsin?

To apply for child support in Wisconsin, you should visit your local child support agency. Filing for child support in Wisconsin can take place by downloading an application form online at the Wisconsin DCF website and returning the completed application to the child support agency.

How do I determine the first weekend of the month?

To determine the first weekend of the month, look at the first Friday of the month. If the 1st of the month is on or before Friday, that is the first weekend. However, if the 1st of the month is on Saturday, the following weekend will be the first weekend of the month.

If the 1st of the month is on or before Friday, that is the first weekend. However, if the 1st of the month is on Saturday, the following weekend will be the first weekend of the month.

What percentage of income do you pay for child support?

Wisconsin uses the standard percentage formula, set by DCF 150 of our State Legislature. The percentage is based on the number of kids to be in primary placement of a parent: For 1 child, it's 17% of gross income; For 2 children, it's 25% of gross income; For 3 children, it's 29% of gross income; For 4 children, it's 31% of gross income; For 5+ children, it's 34% of gross income.

BROKENHEARTED?

USE YOUR BRAIN.

WE'LL HANDLE THE DETAILS

GET STARTED NOW!Wisconsin Child Support Calculators & Worksheets 2022

Wisconsin uses overnights, or where the children sleep, to determine how much child support should be paid by the non-residential parent. Joint custody payments vary depending on overnights, but for sole custody, the court uses the standard percentage model based on the number of children.

Joint custody payments vary depending on overnights, but for sole custody, the court uses the standard percentage model based on the number of children.

- For 1 child, it is 17%

- For 2 children, it is 25%

- For 3 children it is 29%

- For 4 children, it is 31%

- For 5 children, it is 34%

Book My Consult

Calculate Child Support

Use the calculators below to estimate child support payments.

Shared Custody Child Support Calculator

Sole Custody Child Support Calculator

Be aware when using the phrase, child custody, legally we are not talking about spending time with the child(ren) nor does child custody impact child support payments. The phrase child custody from the court's perspective is defined as decision-making responsibility. The correct legal term for time with the child(ren) is placement. Placement or time spent with the child(ren) does directly impact child support obligations, while child custody or decision-making does not impact child support obligations.

How To Calculate Child Support in Wisconsin

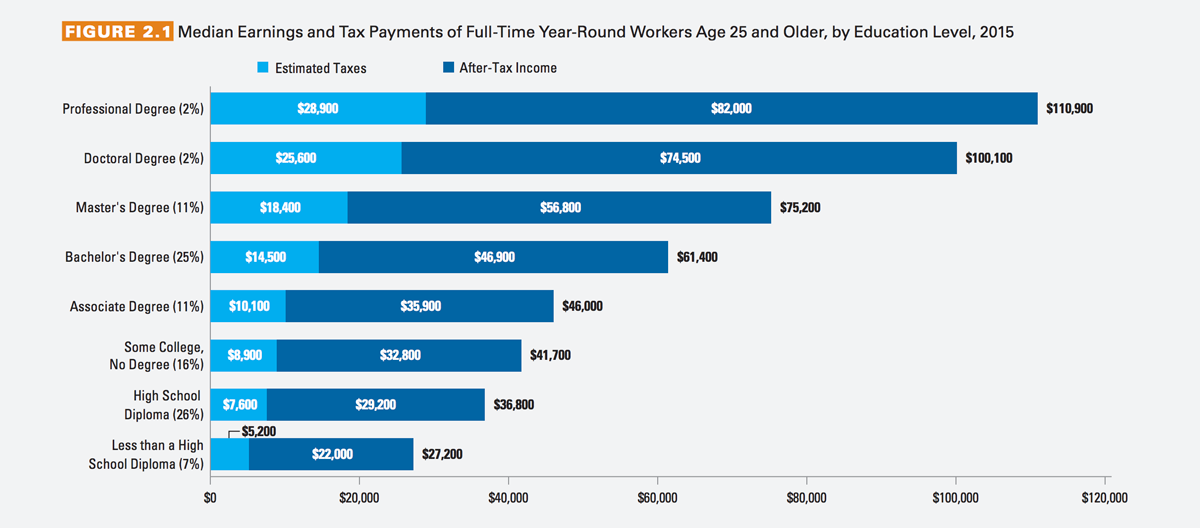

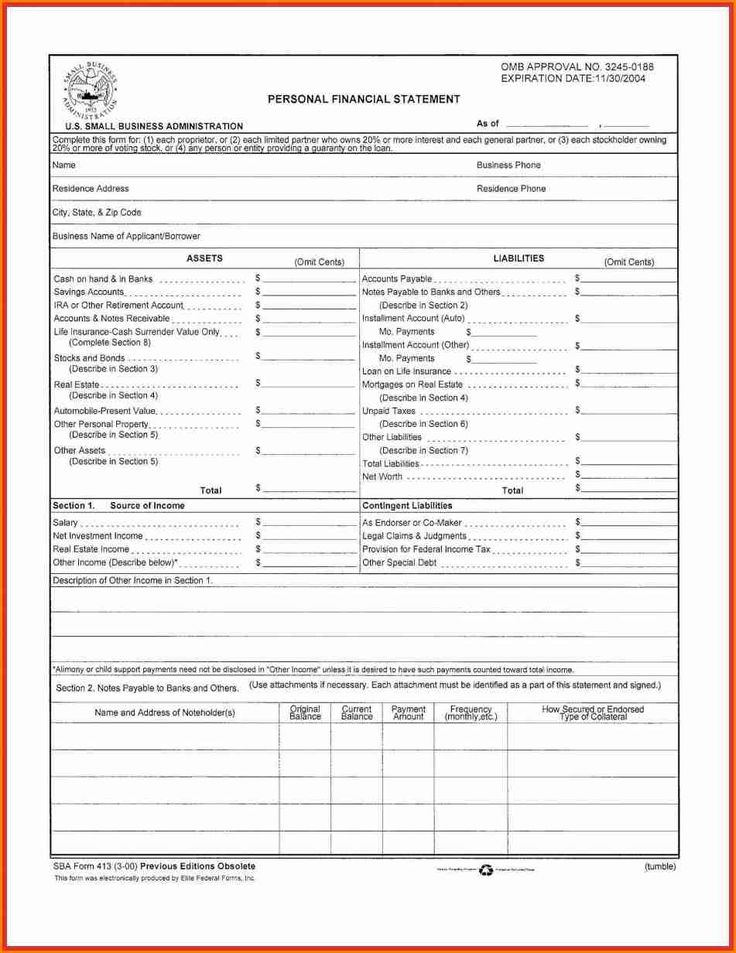

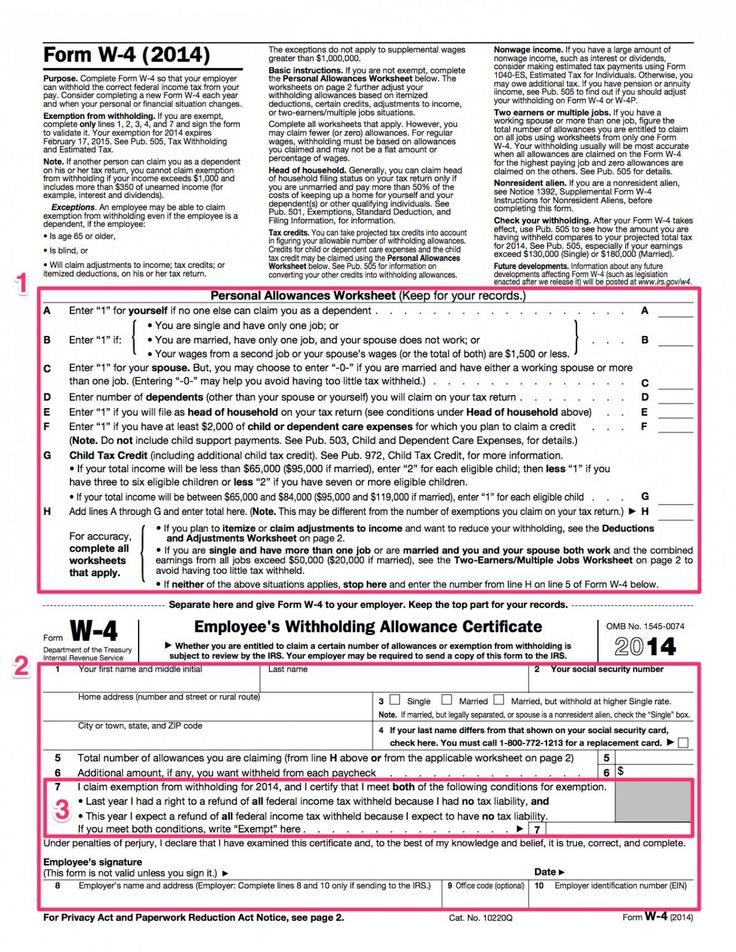

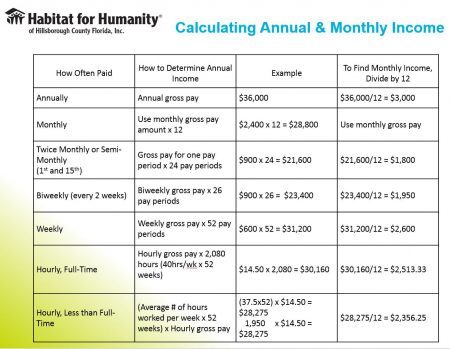

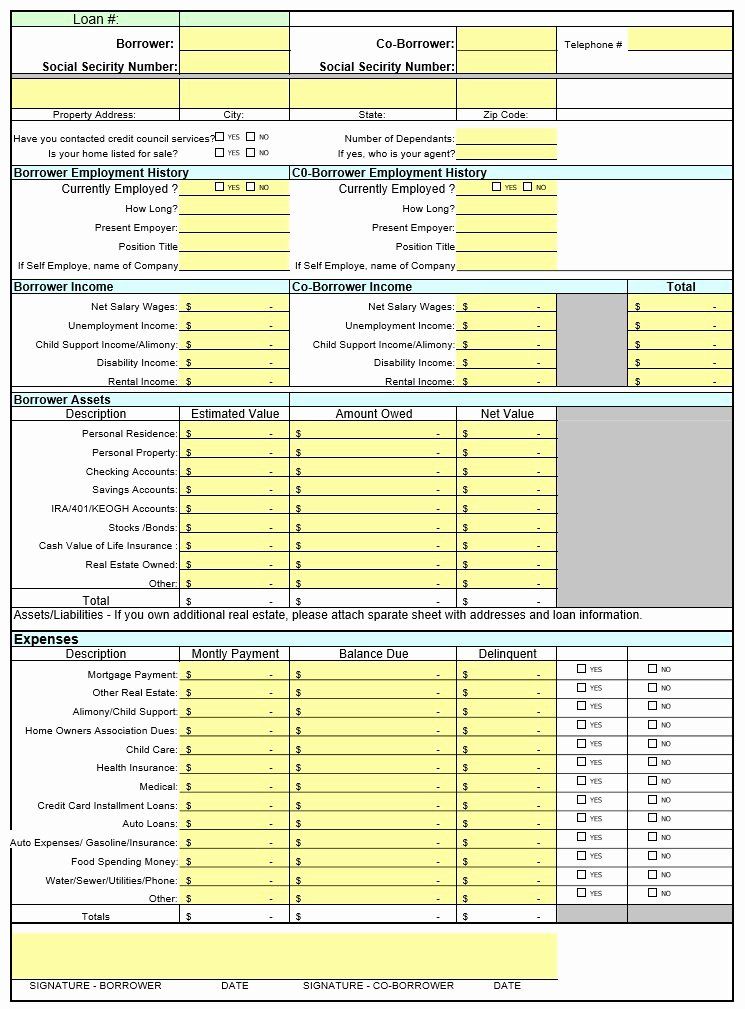

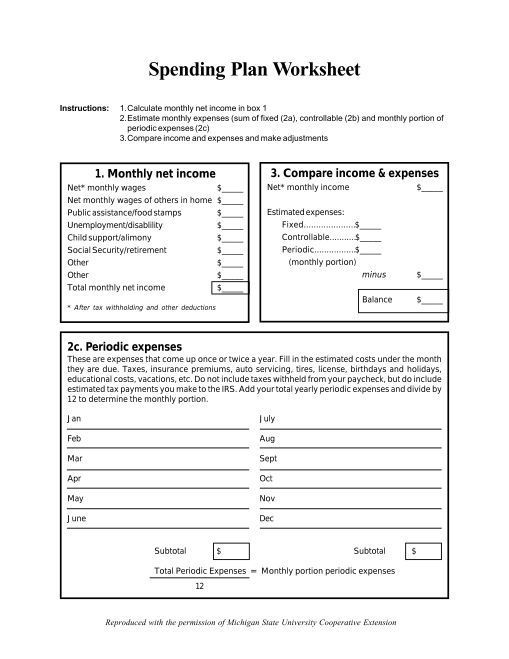

Every state has set child support guidelines as well as several different child support worksheets you can fill out. There are also options when determining child support. In Wisconsin, our support order guidelines help determine the amount due from one spouse to the other in the event of a divorce or legal separation. Below you will find the type of information you need to as well as the percentages required for payment based on Wisconsin DCF 150. First, we need to calculate the paying party's net income. To determine net income we need to add up monies considered income like the following:

- Wages

- Overtime work

- Commissions

- Tips

- Bonuses

- Rental income

- Interest income

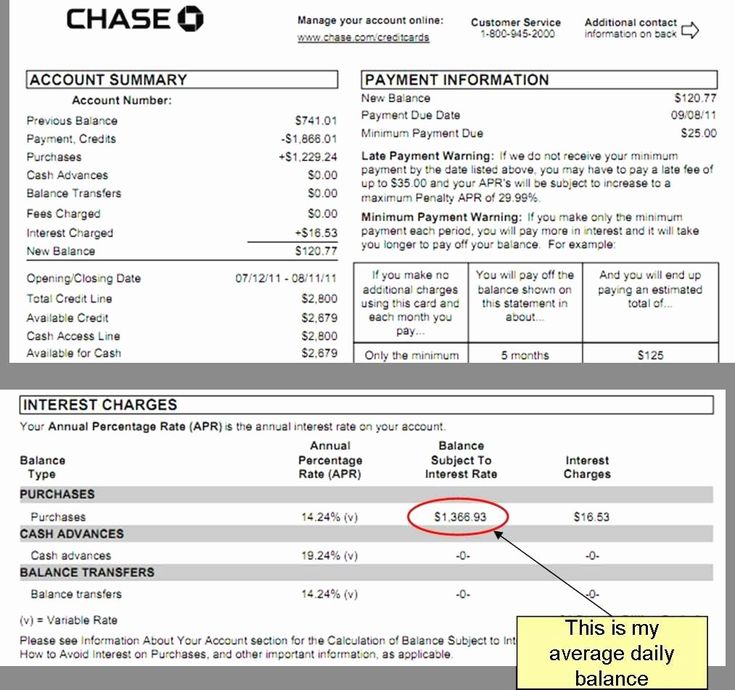

Once the gross income is determined the court will determine the net income of the paying party. This is not done by using tax returns rather the court will deduct social security taxes, federal income taxes based on the tax rate for a single person claiming one personal exemption and the standard deduction, state income tax, union dues, and expenses for the cost of health insurance for the child. It is also worth mentioning that child support is not taxable by the spouse receiving it, so it will not be a tax-related issue for the recipient of it.

It is also worth mentioning that child support is not taxable by the spouse receiving it, so it will not be a tax-related issue for the recipient of it.

Wisconsin Child Support Guidelines for Shared Custody

Yes, one parent will be obligated to pay child support unless both parents spend the exact amount of time with the child and earn the exact same income, which is rare. Wisconsin child support laws say that a shared placement formula can be used if certain guidelines are met. Typically the court will approve the use of this formula when:

- if the parenting plan states that both parents will have the children at least 92 overnights per year

- if the parenting plan states each parent will pay for the child’s basic needs proportionately to the time each parent has placement of the child.

The Wisconsin 50/50 Child Support formula is based on the Percentage Standard guideline in conjunction with the time spent with each parent. The Percentage Standards guidelines are as follows:

For a detailed worksheet on how the Wisconsin Shared-Placement formula works download the worksheet here.

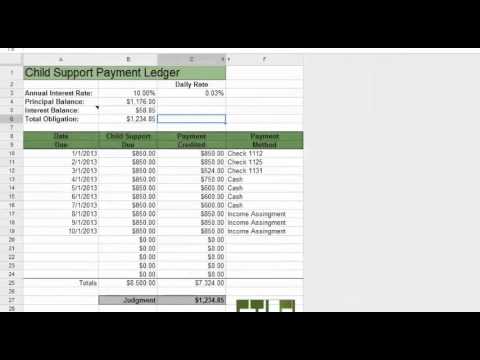

To refer directly to DCF 150 review the section labeled DCF 150.035(2)(b) Support Orders. Above is a worksheet we put together to help calculate the amount child support payers will pay in child support. If you need further assistance please contact us we would be happy to help.

For Immediate help with your family law case or answering any questions please call (262) 221-8123 now!

Wisconsin Shared Custody Child Support Calculator

These are estimates based on the statutory guidelines. Please also note child support payments may be different than displayed below based on the circumstances of your individual case.

Loading...

Enter Parent A's YEARLY gross income (before taxes)

Income Parent A *

Enter Parent B's YEARLY gross income (before taxes)

Income Parent B *

Parent A Zero Out Subtotal

Parent A Child Support Percentage

Parent A Obligation Subtotal

Parent B Zero Out Subtotal

Parent B Child Support Percentage

Parent B Obligation Subtotal

How many minor children? * 1 Child2 Children3 Children4 Children5+ Children

Percent of time the Children spend with Parent A * 25%30%35%40%45%50%55%60%65%70%75%

Percent of time the Children spend with Parent B * 75%70%65%60%55%50%45%40%35%30%25%

150 Multiplier

Parent A: 274 Overnights

Parent B: 91 Overnights

Example: Forty six weekends (Friday night & Saturady night) throughout the year.

Parent A: 255 Overnights

Parent B: 110 Overnights

Example: Every weekend (Friday night & Saturady night) throughout the year.

Parent A: 237 Overnights

Parent B: 128 Overnights

Example: Every weekend (Friday night & Saturady night) plus one weekday night every other week (i.e. Wednesday night) throughout the year.

Parent A: 219 Overnights

Parent B: 146 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights twenty two weeks (i.e. Wednesday night & Thursday night) throughout the year.

Parent A: 200 Overnights

Parent B: 165 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights every other week (i. e. Wednesday night & Thursday night) throughout the year.

e. Wednesday night & Thursday night) throughout the year.

Parent A: 183 Overnights

Parent B: 182 Overnights

Example: Alternating weeks where the first week parent A has three overnights (i.e. Wednesday, Thursday & Friday night) and during the second week four overnights (i.e. Wednesday, Thursday, Friday & Saturday night).

Parent A: 165 Overnights

Parent B: 200 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights every other week (i.e. Wednesday night & Thursday night) throughout the year.

Parent A: 146 Overnights

Parent B: 219 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights twenty two weeks (i. e. Wednesday night & Thursday night) throughout the year.

e. Wednesday night & Thursday night) throughout the year.

Parent A: 128 Overnights

Parent B: 237 Overnights

Example: Every weekend (Friday night & Saturady night) plus one weekday night every other week (i.e. Wednesday night) throughout the year.

Parent A: 110 Overnights

Parent B: 255 Overnights

Example: Every weekend (Friday night & Saturady night) throughout the year.

Parent A: 91 Overnights

Parent B: 274 Overnights

Example: Forty six weekends (Friday night & Saturady night) throughout the year.

Parent A's Estimated Payment to Parent B

Parent B's Estimated Payment to Parent A

Subtotal A-B Zero Out

Subtotal A-B

Estimated Monthly Support Payment

Subtotal B-A Zero Out

Subtotal B-A

Estimated Monthly Support Payment

* Required

Are you ready to move forward? Call

(262) 221-8123

to schedule a strategy session with one of our attorneys.

Wisconsin Child Support Guidelines for Sole Custody

The court will then use a standard percentage model based on the number of children when one parent has the children for less than than 92 overnights throughout the year. A typical example of this type of arrangement is every other weekend. When these placement arrangements are in place the court will use the percentage standard model shown below.

- For 1 child, it is 17%

- For 2 children, it is 25%

- For 3 children it is 29%

- For 4 children, it is 31%

- For 5 children, it is 34%

Sole Custody Child Support Examples

| Monthly Income | 1 child (17%) | 2 children (25%) | 3 children (29%) | 4 children (31%) | 5 children (34%) |

|---|---|---|---|---|---|

| $1,500 | $255 | $375 | $435 | $465 | $510 |

| $2,000 | $340 | $500 | $580 | $620 | $680 |

| $2,500 | $425 | $625 | $725 | $775 | $850 |

| $3,000 | $510 | $750 | $870 | $930 | $1,020 |

| $3,500 | $595 | $875 | $1,015 | $1,085 | $1,190 |

| $4,000 | $680 | $1,000 | $1,160 | $1,240 | $1,360 |

For more examples download the pdf here.

To refer directly to DCF 150 review the section labeled DCF 150.03 Support Orders. Above is a worksheet we put together to help calculate the amount child support payers will pay in child support. If you need further assistance please contact us we would be happy to help.

Wisconsin Sole Custody

Child Support Calculator

These are estimates based on the statutory guidelines. Please also note child support payments may be different than displayed below based on the circumstances of your individual case.

Loading...

Enter the non-custodial parent's YEARLY gross income (before taxes) *

How many minor children with the custodial parent? * 1 Child2 Children3 Children4 Children5+ Children

Subtotal1

Subtotal

Subtotal

Monthly Support Payments

$0

* Required

For Immediate help with your family law case or answering any questions please call (262) 221-8123 now!

Frequently Asked Questions

How do you calculate child support in Wisconsin?

To calculate child support in Wisconsin first the type of custody needs to be determined. If each parent has more than 92 overnights per year, then the State of Wisconsin has determined those parents are in a joint custody scenario and they must use a joint custody calculator to determine child support payments. If both parents do not have 92 overnights per year then the State of Wisconsin has determined the parent with the greater number of overnights has sole custody of the child. To determine child support in a sole custody scenario the parents must use a percentage standard to determine child support payments.

If each parent has more than 92 overnights per year, then the State of Wisconsin has determined those parents are in a joint custody scenario and they must use a joint custody calculator to determine child support payments. If both parents do not have 92 overnights per year then the State of Wisconsin has determined the parent with the greater number of overnights has sole custody of the child. To determine child support in a sole custody scenario the parents must use a percentage standard to determine child support payments.

What is child support percentage in Wisconsin?

The percentage of child support paid in Wisconsin is determined by the type of custody arrangement. If the custody arrangement is sole custody, then the following are the percentages used to calculate child support payments.

- 17 percent of gross income for 1 child

- 25 percent of gross income for 2 children

- 29 percent of gross income for 3 children

- 31 percent of gross income for 4 children

- 34 percent of gross income for 5 or more children

If the custody arrangement is joint custody, meaning both parents have the child more than 92 overnights a year, then child support payments are determined based on gross income and time spent with both parents. The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

Does a father pay child support with 50/50 custody?

In a shared custody scenario, where both parents have the children 182.5 overnights per year and both parents make the same gross income no child support payments would be required. However, if one parent makes substantially more than the other parent in the same scenario where both parents have 182.5 overnights then the higher-earning parent will pay child support to the other parent. The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

Is child support based on gross income or net income?

In the State of Wisconsin, child support is determined using estimated annual gross income.

Can child support take your whole paycheck?

In the State of Wisconsin, law limits the amount that can be garnished for a child support order as follows. 50% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has no arrears 55% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has arrears 60% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has no arrears 65% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has arrears The State of Wisconsin defines gross income as all of the employee’s income from all sources before mandatory deductions for federal, state, local, and Social Security taxes are deducted. Gross income also includes employee contributions to any employee benefit program or profit-sharing and voluntary contributions to any pension or retirement account whether or not the account provides for tax deferral or avoidance. The State of Wisconsin defines disposable income as the part of the earnings of the employee remaining after deducting federal, state, and local withholding taxes, and Social Security taxes.

50% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has no arrears 55% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has arrears 60% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has no arrears 65% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has arrears The State of Wisconsin defines gross income as all of the employee’s income from all sources before mandatory deductions for federal, state, local, and Social Security taxes are deducted. Gross income also includes employee contributions to any employee benefit program or profit-sharing and voluntary contributions to any pension or retirement account whether or not the account provides for tax deferral or avoidance. The State of Wisconsin defines disposable income as the part of the earnings of the employee remaining after deducting federal, state, and local withholding taxes, and Social Security taxes. Deductions for Individual Retirement Accounts, medical expense accounts, etc. do not reduce disposable income.

Deductions for Individual Retirement Accounts, medical expense accounts, etc. do not reduce disposable income.

References: Child Support Guidelines Wisconsin, DCF 150.03 Support Orders, DCF 150.035(2)(b) Support Orders

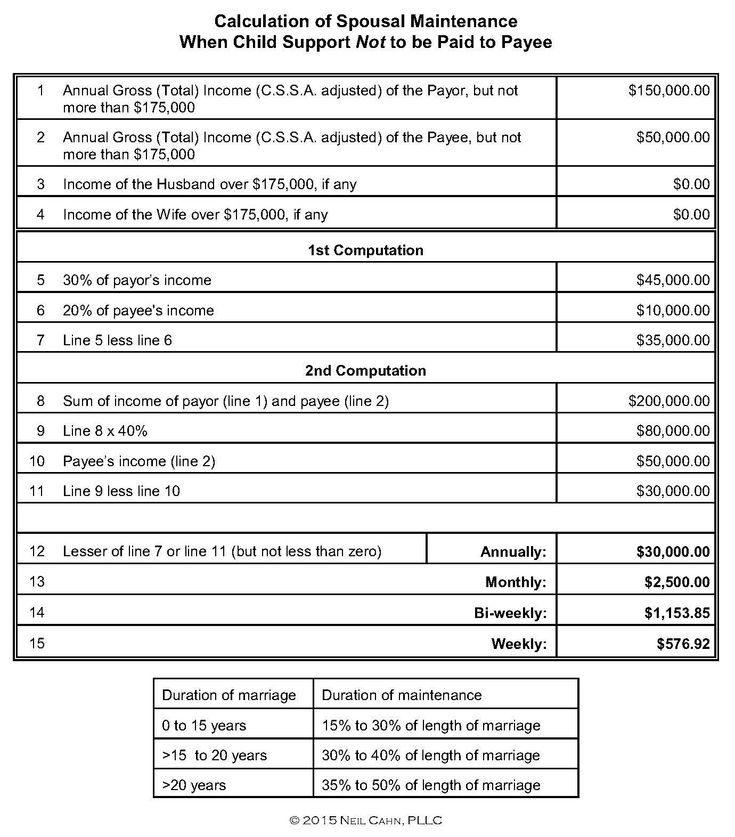

Alimony: how to calculate who pays and what is the responsibility

Love lives for 3 years, and the obligation to support a child - until he comes of age. After all, the legislation provides for financial protection of children in the event that the parents did not agree on the characters. At the same time, the child has the right to financial assistance under any circumstances, even if the parents are still married, but for some reason do not live together. Financial support must be provided by the parent who lives separately.

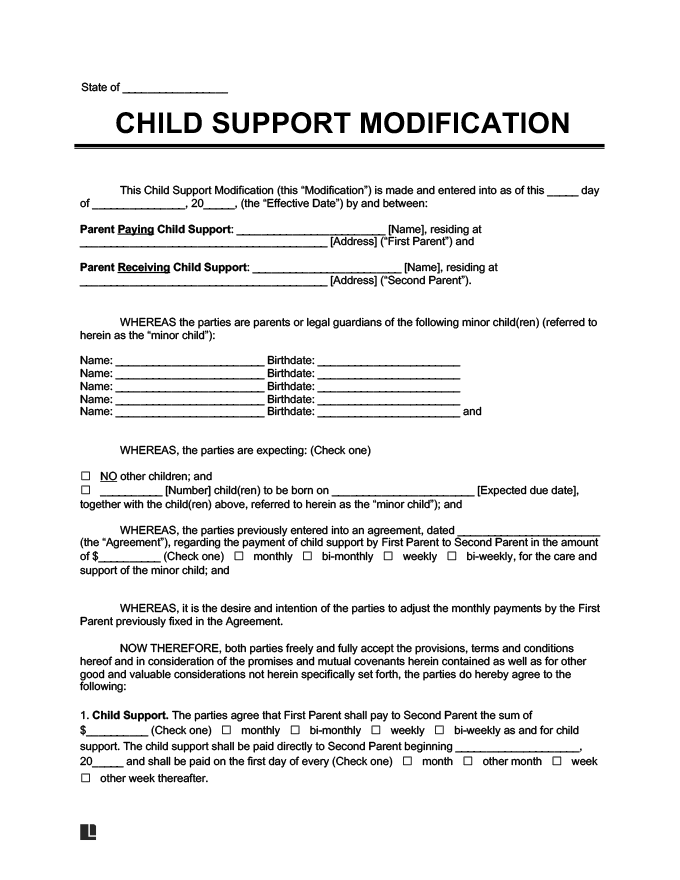

The issue of alimony can be resolved amicably: former spouses independently agree on the amount of alimony, draw up an agreement and certify it with a notary. It’s not worth negotiating “on parole” - if relations with the ex-partner deteriorate, it will be very difficult to prove that you helped the child. If the issue cannot be resolved peacefully, alimony can be collected through the court.

If the issue cannot be resolved peacefully, alimony can be collected through the court.

Determine the amount of alimony in 2021

The amount of alimony depends on many factors. Some of them are permanent, others change every year. Let's figure out how to calculate the amount of alimony.

What income is the child support paid from?

The court takes into account the income that is documented:

- basic salary;

- premiums;

- payment for work outside of working hours;

- compensation for unused vacation;

- additional remuneration;

- seniority bonuses;

- unemployment assistance;

- pension;

- scholarship;

- business income;

- income from deposits;

- rent and other.

Child support cannot be less than half the subsistence minimum. So, in January 2021, these amounts were:

So, in January 2021, these amounts were:

- for a child under six years old - UAH 960;

- from six to eighteen years old - 1198 UAH.

Only the unemployed will pay the minimum amount. In other cases, the amount of alimony depends on the official income and the number of children:

- one child - 25% of income;

- two children - 33% of income;

- three children - 50% of income.

For example, if the salary is UAH 10,000, then maintenance for two children is UAH 3,300. Having children from multiple marriages with a parent does not affect the eligibility of those children for financial assistance.

Child support cannot be replaced by other types of financial assistance. For example, a man refused to pay child support because he opened a bank account and transferred money there for the child's future. The court decided that financial expenses for children occur on a monthly basis, therefore, it did not count the alternative in the form of saving money, including on a deposit.

The amount of child support is not constant. If the financial situation of the payer has changed, the court may adjust the amount. For example, a girl filed a lawsuit to increase the amount of alimony. The reason is that the ex-husband moved to work in London, his income increased. Please note: in this case, in the statement of claim, you can indicate the amount of alimony in pounds sterling, and not in hryvnia.

As a general rule, alimony cannot be collected retrospectively. An exception - you can prove that before going to court you already tried to collect alimony, and the other parent avoided payments.

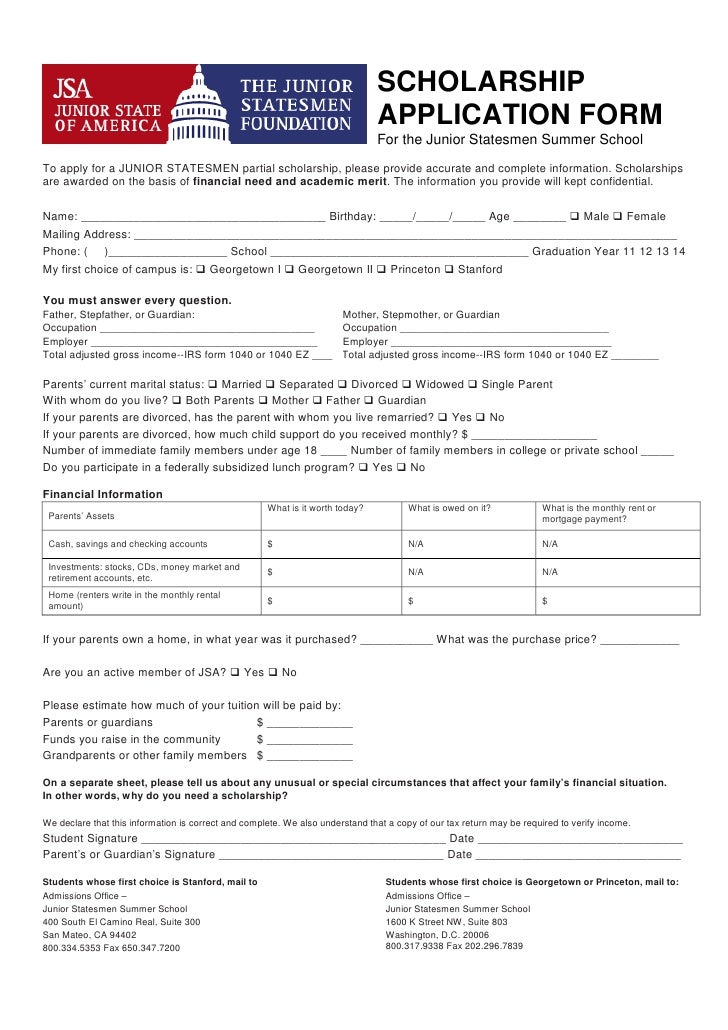

Submitting a claim

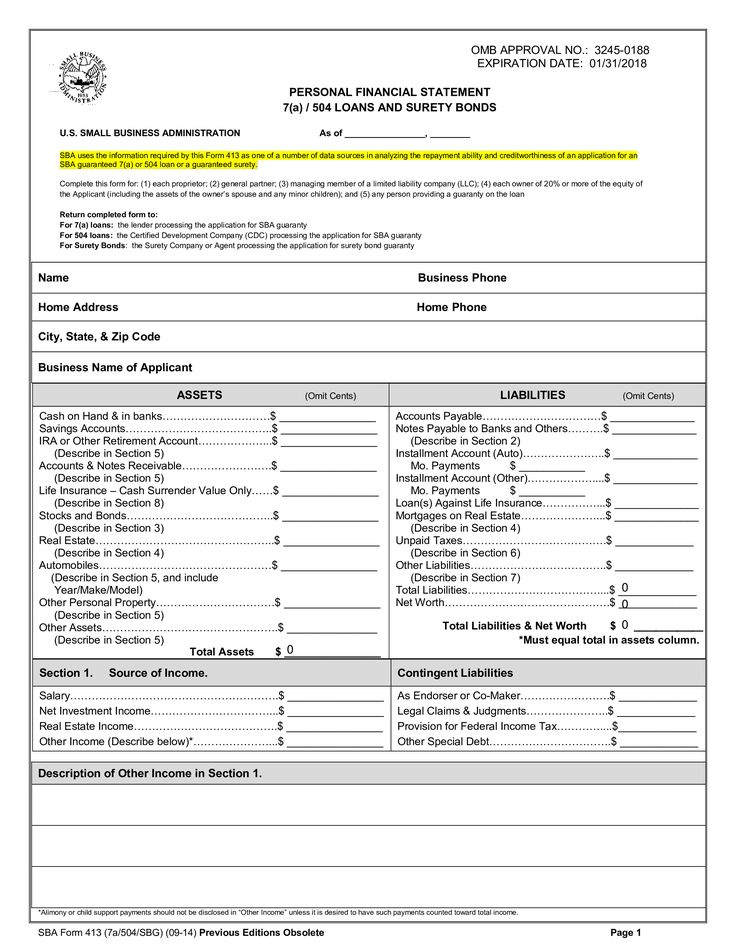

In order for the application to be accepted, it is important to complete it correctly. In the claim, indicate:

- the name of the court. You should apply to the court at the place of registration of the defendant - that of the parents from whom it is required to collect alimony, or at the place of registration of the child.

- information about the respondent: full name, place of registration, passport number and series, identification code.

- claims. It is important not only to ask the court to collect alimony, but also to indicate their amount;

- the amount of the claim. In addition to the amount of alimony, this may include compensation for the costs of a lawyer. Remember that the amount must be substantiated: attach acts of work performed and an agreement with a lawyer to the statement of claim.

- substantiation of the position.

- information about whether you tried to negotiate with your ex-spouse before going to court. You also need to indicate that your dispute has not previously been considered in another court.

- list of documents attached to the claim.

There is no court fee to file a child support claim. But this fact still needs to be indicated in the statement of claim, otherwise it can be returned. The same fate awaits a claim if you forget to attach a copy of your passport and identification code to it; a copy of the child's birth certificate; certificate of registration of the place of residence of the child; copies of the divorce decree or marriage certificate. Difficulties may arise with the defendant's income statement. A lawyer or a judge will help with it, who will request an extract from the place of work.

The same fate awaits a claim if you forget to attach a copy of your passport and identification code to it; a copy of the child's birth certificate; certificate of registration of the place of residence of the child; copies of the divorce decree or marriage certificate. Difficulties may arise with the defendant's income statement. A lawyer or a judge will help with it, who will request an extract from the place of work.

Until what age is child support paid?

As a general rule, the obligation of parents to support a child ends when the child reaches 18 years of age. But there is an exception - if an adult child continues his studies and needs financial assistance. In this case, the parents must support him until he reaches the age of 23 or until the end of his studies. Please note that enrolling in an educational institution does not automatically extend child support - you need to go to court again. This can be done by the child himself, and by the parent with whom he lives.

Additional expenses for the child

The other parent must financially participate in the additional expenses for the child, which are caused by exceptional circumstances: development of the child's abilities, illness, disability.

But be careful, not all circumstances are considered exceptional. For example, in 2020 the Supreme Court ruled that the purchase of a tablet was not such a circumstance. Spending should be a necessity, not a whim. Another court case: the child studies at a private school and studies music. Mom bought him a musical instrument for 20,000 UAH. And then she went to court to recover additional costs from her father. But the court decided that this purchase was not essential.

Subscribe to blog articles

Get the latest articles to your email

Congratulations, you have successfully subscribed to blog articles!

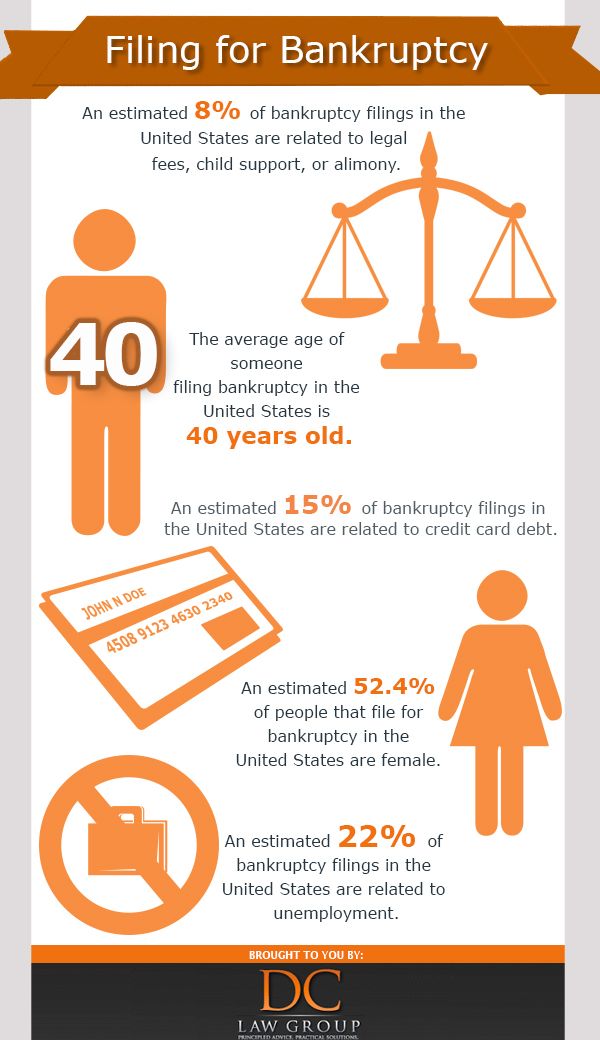

Liability for non-payment of alimony

If the father or mother of the child does not pay alimony, a fine is charged on the amount of the debt. Penalties amount to 1% of the debt and are calculated taking into account the number of days in a month. After 2019year, the court changed the calculation algorithm, and now the penalty is charged on the entire amount of the debt. For example, you did not pay 1000 UAH each for November and December in 2020. We consider:

Penalties amount to 1% of the debt and are calculated taking into account the number of days in a month. After 2019year, the court changed the calculation algorithm, and now the penalty is charged on the entire amount of the debt. For example, you did not pay 1000 UAH each for November and December in 2020. We consider:

(1000 + 1000) * 61 * 0.01 = UAH 1220

where 61 is the total number of days in November and December, 0.01 - 1% penalty.

Total we get 1220 hryvnia. It is wrong to calculate the penalty separately for each month.

Penalty is far from the only and not the worst consequence for a non-payer. A debt on alimony can be a reason for a ban on leaving the country. Malicious non-payment of alimony is also the basis for criminal liability. It occurs if the payer hides income, changes his place of residence and does not inform the contractor about this, or simply does not pay alimony for three months.

How can I find out about child support arrears?

You can find the list of debtors in the Register. To find out the exact amount of the debt, you will have to call the executive service.

To find out the exact amount of the debt, you will have to call the executive service.

What you need to remember:

- the amount of alimony in Ukraine depends on the parent's income and the number of children;

- the unemployed pay alimony in the minimum amount: 50% of the subsistence minimum for a child;

- if the alimony payer starts earning more, you can apply to the court again and increase the amount of alimony;

- if the former spouse evades payments, the debt can be collected from him;

- if children continue to study after the age of majority, you will have to pay child support until the age of 23;

- you can claim additional costs for a child if they are due to exceptional circumstances.

Attorney Yuriy Babenko, Mitrax's leading specialist in resolving family disputes, will help resolve problems that arose during the collection of alimony.

How to calculate child support

The family code clearly states the duty of parents to support their children until they reach adulthood. This is where the clear instructions end and the confusion caused by the "technical" side of the matter begins. This material provides information that explains the process of accruing alimony from the parental agreement to the transfer of funds to a bank card.

Parental agreement

Many people associate everything related to alimony with a lawsuit, but this is far from the case, because the family code first of all provides for an amicable agreement between the parties on the amount and timing of alimony payments, and only then, if it was not possible to agree, - the solution of the issue in court.

First, in order for the agreement to have full legal force, it must be properly executed and notarized. Secondly, the agreement must contain the following parameters without fail:

- rules governing the procedure and methods for paying alimony;

- amount of alimony;

- procedure providing for indexation of the amount of alimony.

Thirdly, alimony can be paid:

- based on a share of the payer's salary;

- in a certain amount of funds, both at a specified frequency and at a time;

- based on the provision of movable and immovable property;

- by agreement.

Fourthly, this agreement provides for the possibility of changing the parameters up to termination of the agreement, subject to mutual agreement.

If an agreement could not be reached

If the parties fail to reach an agreement, the order of payments and the amount of alimony are established by the court. As a rule, the court in most cases obliges the payer to pay alimony on a monthly basis based on the following shares:

- one child - 25% of wages or other income;

- two children - 33% of salary or other income;

- three children - 50% of salary or other income.

If the payer does not have a steady income, the court may consider other ways to pay child support. Thus, the court may oblige the payer to make a lump sum payment or transfer movable or immovable property as alimony.

Thus, the court may oblige the payer to make a lump sum payment or transfer movable or immovable property as alimony.

Who withholds maintenance and how

After the parties have reached an agreement or the court has made a decision on the imposition of obligations, the obligation to withhold maintenance falls on the employer of the payer. The obligations of the employer include not only the deduction of alimony, but also the transfer of funds to the recipient's account. According to Article 109 of the Family Code of the Russian Federation, the employer must act in accordance with the established rules governing the timing of such payments. So, the organization where the payer is employed is obliged to withhold alimony from the payer on a monthly basis and transfer them to the addressee. In addition, the transfer of funds should not exceed three days from the date of payment of wages or other payments to the payer.

If the child support payer quit his job, the employer must notify the recipient of this three days before the employee's dismissal. Otherwise, quite significant fines will be imposed on the organization.

Otherwise, quite significant fines will be imposed on the organization.

Under what circumstances are alimony obligations terminated

The Family Code provides for the termination of alimony obligations in a number of cases:

- in the event of the death of the recipient or payer;

- if the agreement has expired;

- if the child has reached the age of majority;

- in the case of adoption or adoption of a child-recipient of alimony.

From what income are alimony withheld

Alimony is withheld from all types of income. If the payer works in several organizations, then the alimony will be withheld both from the main place of work and from part-time work. Also, since alimony is deductible from all widows' income, both bonuses and cash awards are counted. Pension accruals are also included in the calculation of alimony, except for the pension, which is issued in the event of the loss of a breadwinner. If the payer is a student of a higher educational institution, then the scholarship will also be taken into account. Even an unemployed citizen receiving temporary disability benefits will not be able to avoid the alimony payments that will be withheld from this benefit if the court decides that such a measure is in place. Also, funds received as a result of entrepreneurial activity will be accepted for calculation. You can not avoid payments to those funds that are received from the rental of real estate or have arisen as a result of dividend payments, if the alimony payer has a stake in any organization (share participation).

If the payer is a student of a higher educational institution, then the scholarship will also be taken into account. Even an unemployed citizen receiving temporary disability benefits will not be able to avoid the alimony payments that will be withheld from this benefit if the court decides that such a measure is in place. Also, funds received as a result of entrepreneurial activity will be accepted for calculation. You can not avoid payments to those funds that are received from the rental of real estate or have arisen as a result of dividend payments, if the alimony payer has a stake in any organization (share participation).

Important to know. Support funds are deducted from income only after a 13% income tax withholding has been made from this amount. Thus, when calculating the amount of alimony, income tax must be deducted first.

The receipt of alimony is not considered by law as income, so income tax is not levied on the amount.

The law also provides for income that is not subject to calculations for the payment of alimony.

00

00 57%

57%