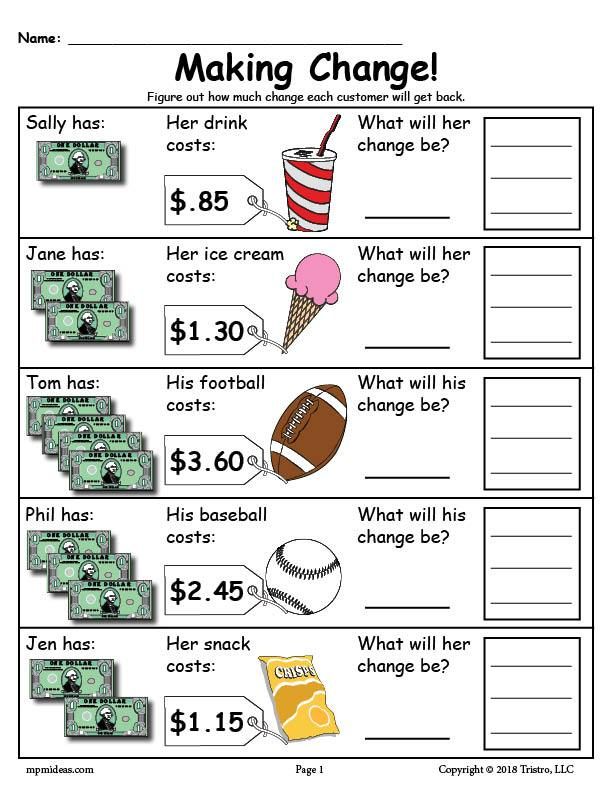

How much do you get back for a child

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

2021 Child Tax Credit: Definition, FAQs & How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Here is a list of our partners.

The child tax credit has grown to up to $3,600 for the 2021 tax year. Here’s a primer on who qualifies, when to expect Letter 6419 and how to reconcile the advance credit on your taxes.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

- What is the child tax credit?

- Who qualifies for the child tax credit?

- How much you can get per child

- How the child tax credit will affect your taxes

- Will you have to pay back the child tax credit?

Table of Contents

- What is the child tax credit?

- Who qualifies for the child tax credit?

- How much you can get per child

- How the child tax credit will affect your taxes

- Will you have to pay back the child tax credit?

- Estimate your child tax credit amount

What is the child tax credit?

The child tax credit, or CTC, is an annual tax credit available to taxpayers with qualifying dependent children. It was first introduced as part of the Taxpayer Relief Act of 1997 and has played an important role in providing financial support for American taxpayers with children.

It was first introduced as part of the Taxpayer Relief Act of 1997 and has played an important role in providing financial support for American taxpayers with children.

The tax credit — normally up to $2,000 per qualifying dependent — was expanded to a maximum of $3,600 in 2021 as part of the American Rescue Plan (the coronavirus relief package that took effect in March). And, for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December of 2021.

🤓Nerdy Tip

By the end of January, all recipients of the advance child tax credit payments should receive Letter 6419, which will provide a breakdown of all the advance payments disbursed to you. The IRS has asked taxpayers to use the letter to reconcile the credit on their 2021 returns. If you suspect your Letter 6419 states an inaccurate advance payment total, the IRS advises visiting your IRS online account for the most up-to-date information.

Who qualifies for the child tax credit?

For the 2021 tax year, you can take full advantage of the expanded credit if your modified adjusted gross income is under $75,000 for single filers, $112,500 for heads of household, and $150,000 for those married filing jointly.

The credit begins to phase out above those thresholds.

First phaseout: Income exceeds the above thresholds but is below $400,000 (married filing jointly) or $200,000 (all other filing statuses). Your total credit per child can be reduced by $50 for each $1,000 (or a fraction thereof). This phaseout will not reduce your credit below $2,000 per child.

Second phaseout: Income exceeds $400,000 (married filing jointly) or $200,000 (other filing statuses). The phaseout will continue docking $50 per each $1,000 and begin to reduce your credit per child below $2,000. You may be disqualified from the credit altogether.

Some of the other eligibility requirements for the child tax credit include:

You must have provided at least half of the child’s support during the last year, and the child must have lived with you for at least half the year (there are some exceptions to this rule; the IRS has the details here).

The child cannot file a joint tax return.

You must have lived in the U.S. for more than half the year (or, if filing jointly, one spouse must have had a main home in the U.S. for more than half the year).

The IRS has a tool to check your eligibility.

How much you can get per child

For the 2021 tax year, the child tax credit offers:

Up to $3,000 per qualifying dependent child 17 or younger on Dec. 31, 2021.

Up to $3,600 per qualifying dependent child under 6 on Dec. 31, 2021.

If you took advantage of the advance payments, the IRS most likely sent half of the credit in the form of monthly payments from July through December of 2021. Those with qualifying dependents 17 or younger might have received up to $250 monthly per qualifying dependent and those with children 5 or younger might have received up to $300 monthly per qualifying dependent.

» MORE: See who qualifies as a tax dependent

How the child tax credit will affect your taxes

For the 2021 tax year, the CTC is fully refundable — that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to get a tax refund check for anything left over. How much of the credit you claim on your 2021 return will depend on whether you opted in for advance payments, how much you received as an advance, as well as your tax-filing circumstances.

If you received advance payments

Letter 6419 contains a detailed summary of the money you received from the advance CTC payments. It also confirms the number of qualifying dependents the IRS used to calculate those advance payments. This information will help you to reconcile the credit when you file your return.

If you opted out of advance payments

If you opted out of the advance payments before the first one was disbursed in July, claiming the credit on your return will likely be much simpler. When you file, you'll simply confirm that you're eligible for the credit and then claim the full amount you're entitled to based on your 2021 income and number of qualifying dependents.

When you file, you'll simply confirm that you're eligible for the credit and then claim the full amount you're entitled to based on your 2021 income and number of qualifying dependents.

If you don't normally file taxes

Low-income families who may not normally file a tax return had the option to sign up for advance payments using the IRS's non-filers sign-up tool. To claim the balance (or the full credit if you didn't receive the advance payments), you'll need to file a return this year.

» MORE: Learn more about IRS Free File — plus other ways to get free tax prep or help

Will you have to pay back the child tax credit?

First, some good news. The child tax credit is not considered taxable income. It's a credit, which means it can lower your tax bill or potentially result in a refund. However, things get a little tricky if it turns out that you were overpaid on your advance payment.

The advance payments were a prepayment of the 2021 tax credit you would normally claim in full during filing season. But because half of the credit was sent out early, the IRS likely used your most recent tax return (2020 or older) to determine how much of an advance to send you each month. So, if your financial or personal circumstances (such as your filing status, income, custody arrangements or residency status) have changed in 2021, there's a chance you might have received more of an advance than you're actually eligible for. A few ways this could play out:

But because half of the credit was sent out early, the IRS likely used your most recent tax return (2020 or older) to determine how much of an advance to send you each month. So, if your financial or personal circumstances (such as your filing status, income, custody arrangements or residency status) have changed in 2021, there's a chance you might have received more of an advance than you're actually eligible for. A few ways this could play out:

Let's say you received advance payments totaling $1,500 for your qualifying dependent based on your 2020 income. However, your income has increased significantly in 2021, making you eligible only for a reduced credit. The excess paid out to you is considered an overpayment.

Another example: You're a single filer with one dependent who lived in the U.S. in 2020. The IRS then sent you advance payments based on that information, which you accepted. However, in 2021, you actually lived outside of the U.

S. for more than half the year, making you ineligible for the child tax credit. Accepting the payment would also be considered an overpayment.

S. for more than half the year, making you ineligible for the child tax credit. Accepting the payment would also be considered an overpayment.

If it turns out that you were given more of an advance than you were eligible for, you’ll need to report it as additional income tax to the IRS on your 2021 return. That additional income tax will either reduce your refund or potentially increase your tax bill.

Some people who were overpaid may also be eligible for repayment protection, meaning they won't need to repay the IRS. You can learn more about who qualifies on the IRS website. If you're unsure how to reconcile your credit or believe you may have been overpaid, quality tax software or working with a professional tax preparer can help you to reconcile your credit before the tax-filing deadline.

» MORE: How to find a tax preparer near you

Frequently asked questions

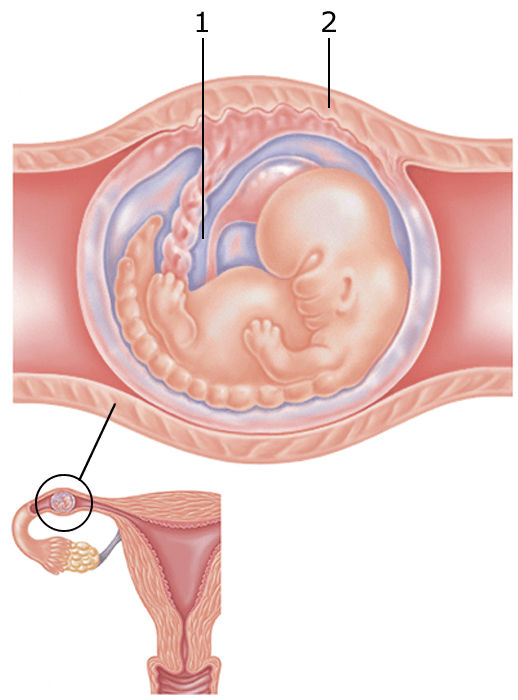

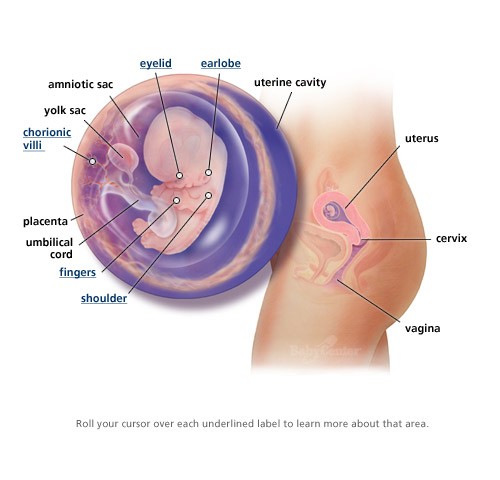

I had a baby in 2021. Am I eligible for the CTC?

Yes. Parents of newborns in 2021 are eligible for the child tax credit. You can claim the credit when you file your 2021 return.

Parents of newborns in 2021 are eligible for the child tax credit. You can claim the credit when you file your 2021 return.

The child tax credit update portal shows that a payment was issued, but I didn't receive it. What steps do I take?

If the child tax credit update portal and your IRS online account show that you were issued a payment that you did not actually receive, you can call the IRS to report the missing payment and request a trace at 800-908-4184 (7 am to 7 pm local time).

The agency urges you to have the following information on hand when you call: the payment date, payment method, status, and the amount listed in the CTC update portal.

If the IRS determines that the payment was not received by you or returned to the agency, the IRS will update its records, and those who are eligible can claim the missing amount on their 2021 return.

Are the advance child tax credit payments permanent?

No. Legislation to extend the enhanced credit amount and advance payment structure has not been passed. For now, the child tax credit for the 2022 tax year will revert back to its original max of $2,000 per qualifying dependent.

For now, the child tax credit for the 2022 tax year will revert back to its original max of $2,000 per qualifying dependent.

Is the child tax credit taxable?

No, the child tax credit is not considered income and therefore is not taxable. However, if the IRS overpaid you (i.e., the amount you received is more than you can claim), you may need to reconcile the overpayment on your 2021 tax return.

Estimate your child tax credit amount

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

|

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

How to return the money transferred by mistake?

Vyacheslav Manatskov

Lawyer of the Chamber of Advocates of the Rostov Region, branch "DIKE" of the Rostov Regional Bar Association named after. D.P. Baranova

D.P. Baranova

01 November 2021

Tips

The Internet will advise you to file a lawsuit for unjust enrichment if the recipient decides to keep the sudden "gift" for himself. Allegedly, in this way you will return your money, achieve payment of interest, compensation for non-pecuniary damage and reimbursement of expenses for a representative. But everything is not so simple0003

Instant payments and transfers have become our daily routine, but even 15-20 years ago it would have been surprising. But this convenience has a downside: there is a high probability of making a mistake when sending money. They mixed up the number in the phone number or bank card, did not check the recipient - and the money from your account was immediately transferred to the account of a stranger. What to do?

There are many recommendations on the Internet. Basically, they come down to one thing: if the recipient does not want to voluntarily return the money, you need to go to court with a statement of claim for the recovery of unjust enrichment. Allegedly, in this way you will not only return the funds transferred by mistake, but also achieve the payment of interest for their illegal use, compensation for non-pecuniary damage and reimbursement of expenses for a representative. However, not all so simple.

Allegedly, in this way you will not only return the funds transferred by mistake, but also achieve the payment of interest for their illegal use, compensation for non-pecuniary damage and reimbursement of expenses for a representative. However, not all so simple.

Who will be the defendant?

The statement of claim is filed with the court at the place of residence of the defendant (Article 28 of the Code of Civil Procedure of the Russian Federation). In it, among other data, information about the defendant is indicated: F.AND.Oh. and place of residence, as well as date and place of birth, place of work (if known) and one of the identifiers (insurance number of an individual personal account, taxpayer identification number, series and number of an identity document, main state registration number of an individual entrepreneur, series and number driver's license, series and number of the vehicle registration certificate) (subclause 3, clause 2, article 131 of the Code of Civil Procedure of the Russian Federation).

Read also

How to return the money debited from the account due to someone else's debt?

It is necessary to appeal against the erroneous debt collection, because the funds from your bank account can be debited repeatedly and in a larger amount

07 July 2020 Tips

That is, when applying to the court, you need to know at least your full name. and place of residence of the defendant. To draw up a statement of claim, there is not enough information that the funds were transferred to Ivan Ivanovich P. using such and such a mobile phone number or bank card. And the bank and the police will not tell you the personal data of the citizen.

There is an opinion on the Internet that in the statement of claim it is possible to indicate the fictitious name and address of the defendant. The court itself will establish his personal data when he accepts the case for proceedings and receives information from the bank. But in my opinion, it is more correct to apply with a claim to the bank. Simultaneously with the claims, it is necessary to file a petition to demand from the credit institution information about the payee. Further, as part of the consideration of the case, the court will replace the improper defendant with the proper one - the credit institution with the payee (Article 41 of the Code of Civil Procedure of the Russian Federation).

Simultaneously with the claims, it is necessary to file a petition to demand from the credit institution information about the payee. Further, as part of the consideration of the case, the court will replace the improper defendant with the proper one - the credit institution with the payee (Article 41 of the Code of Civil Procedure of the Russian Federation).

What evidence to present to the court?

Property acquired at the expense of another person without any justification is unjust enrichment and is subject to return, including when such enrichment was the result of the actions of the victim (Article 1102 of the Civil Code of the Russian Federation). Therefore, if the fact of the transfer is proven, but there were no legal grounds, i.e. the funds are transferred by mistake, then they are recovered from the defendant (recipient) in favor of the plaintiff (sender).

Such cases are considered by the courts in the order of action proceedings. This imposes obligations on the parties, including those provided for in Art. 56 Code of Civil Procedure of the Russian Federation: each party must prove the circumstances to which it refers as the basis for its claims and objections.

56 Code of Civil Procedure of the Russian Federation: each party must prove the circumstances to which it refers as the basis for its claims and objections.

So, the plaintiff is obliged to prove the fact of transferring money. To do this, you will need a bank statement on the account, reflecting the movement of funds. In addition, other evidence must be presented to the court.

- In order to form an evidence base, you should contact the bank with an application to cancel the money transfer. Most likely, by this time the money will already be credited to the recipient's account, and the bank will not be able to cancel the transaction. But we are collecting evidence for the court. The assessment of the information provided, including the request to cancel the transfer, the court will give in the deliberation room.

The fact of making such a request can be confirmed by the telephone company's information about the connection with the bank's hotline specialists, if you asked to cancel the transfer by phone. But you need to understand that in court, written evidence will have greater probative force. Therefore, do not limit yourself to a phone call.

But you need to understand that in court, written evidence will have greater probative force. Therefore, do not limit yourself to a phone call.

When contacting the bank in person, you must have two copies of the application with you. You give one to the bank employee, and on the second copy he must put down the date of receipt of the application, his position, surname, initials and signature. The application can also be sent by registered mail. The track number in the receipt will allow you to track its movement. But to send an application by e-mail, verification of the sender is required in accordance with the rules of the bank. You can use a qualified electronic signature. In this case, the bank's response to it will be proof of the application.

- It would be useful to provide evidence of an error in the transfer of funds. For example, this may be information that the phone number of your friend differs by only one digit from the number of the person to whose account the funds were credited.

Or you can report that every month you transfer money to the same account, but this time you made a mistake in the details. Detailing the connections of your phone number will allow you to establish that you called the recipient of money only after an erroneous transfer.

Or you can report that every month you transfer money to the same account, but this time you made a mistake in the details. Detailing the connections of your phone number will allow you to establish that you called the recipient of money only after an erroneous transfer. - In order to be able to confirm information about signs of fraud in the actions of a stranger, you will have to contact the police with a statement. Moreover, it must be registered within a reasonable time. Appeal to the police two years after the transaction will cause the court reasonable doubts about the good faith of the plaintiff.

When contacting the police, the officer on duty is obliged to draw up and hand over to the applicant a notification coupon, which will indicate the date of registration of the message and the number in the register of reports of crimes (KUSP). Three days are given to check such reports. But usually from the moment of contacting the police until a decision is made, much more time passes. Based on the results of the check, a decision will be made whether to initiate a criminal case or not. There is no need to wait for a final decision to file a lawsuit. If necessary, the court may request the audit materials and examine them at the court session.

Based on the results of the check, a decision will be made whether to initiate a criminal case or not. There is no need to wait for a final decision to file a lawsuit. If necessary, the court may request the audit materials and examine them at the court session.

When the court considers the case on the recovery of unjust enrichment, the defendant, in turn, is obliged to prove the existence of grounds for the transfer of funds. For example, he can provide evidence that the plaintiff transferred money for a service rendered by the defendant, then just changed his mind and went to court. In the absence of such grounds, the defendant will be obliged to return the money to the plaintiff.

Read also:

How to get a tax deduction for training a brother or sister: we return personal income tax

My sister studies at a paid university for 80,000 R per year. We plan to pay another 50,000 R for her education at a driving school. Formally, parents give money, we pay in cash. Mom officially receives a pension and works part-time as a self-employed person, and her father is a simplified businessman. Only I pay personal income tax from my salary. Can I or my parents refund the tax for my sister's education at the university? And the sister herself?

Mom officially receives a pension and works part-time as a self-employed person, and her father is a simplified businessman. Only I pay personal income tax from my salary. Can I or my parents refund the tax for my sister's education at the university? And the sister herself?

How to arrange everything?

Julia

Julia, you can get a deduction for your sister's education and return 15,600 R per year at the indicated cost.

Ekaterina Miroshkina

economist

Author profile

Conditions for siblings' tuition deduction

You can receive a social tax deduction when paying for your tuition, regardless of age. For example, even if you decide to study at a driving school at the age of 30 or get a second degree at 37. You can study at least full-time, even in absentia. The main thing is that an educational institution - a university and a driving school - has a license.

para. 6 sub. 2 p. 1 art. 219Tax Code of the Russian Federation

Also, this deduction can be used when paying for the education of brothers or sisters - with at least one common parent. In this case, the requirements are stricter:

In this case, the requirements are stricter:

- At the time of payment, the brother or sister must be under 24 years old. That is, they may be 23, but not yet 24 years old.

- Training takes place on a full-time basis. Part-time is not suitable, but distance learning is considered.

How much can be refunded

When paying for the education of a brother or sister, the maximum amount of deduction for tuition is 120,000 R per year. This limit also includes other types of social deductions - in the amount of expenses that you can incur for your treatment, education, VHI or insurance. But the expensive treatment and education of children is not taken into account.

It turns out that when you pay for your sister's education, you can return 13% of the expenses for the year, but not more than 15,600 R. In the year when the year of study at the university and the driving school are paid, the expenses will amount to 130,000 R - this is more than the limit, therefore 15,600 R is due for refund. If you also pay for your treatment in the same year, you can no longer use these expenses to return additional tax amounts.

If you also pay for your treatment in the same year, you can no longer use these expenses to return additional tax amounts.

Next year, at the same tuition fee, you will return 13% of R 80,000 - R 10,400.

But in any case, you can return no more than the amount of personal income tax that you actually paid to the budget. If you have the right only to a social deduction, there are no problems: you can take the maximum with a salary of more than 10,000 R. But if there is still a property deduction, first use those deductions for which the balance is not transferred, that is, for studies. And only then - for buying an apartment.

What to do? 07/21/20

How much money can be returned for the education of a child in a paid university and how to arrange everything?

Take what is yours from the state!

How to receive deductions, benefits and allowances, we tell in our newsletter once a month. Subscribe!

How to apply for a deduction for a sister or brother

In an ideal world of tax deductions, the training contract and payment documents need to be drawn up for someone who wants to receive a deduction and return the tax. It would be nice to conclude an agreement with you and indicate in it that the sister will study, and you will pay.

It would be nice to conclude an agreement with you and indicate in it that the sister will study, and you will pay.

If the contract has already been concluded in the name of the sister, there is still a chance to receive a deduction. The main thing is the payment documents. Since you paid in cash, you will need a check or receipt. Such documents will fully confirm your expenses.

Letter of the Ministry of Finance of the Russian Federation dated August 24, 2015 No. 03-04-05/48662PDF, 43.5 KB

Here is the complete list of documents:

- Copy of the training agreement

- Copies of licenses of the university and driving school, if the numbers are not specified in the contract.

- A copy of the document that confirms full-time education. Usually this is a certificate from the university. If the form of training is specified in the contract, nothing else is needed.

- Copies of payment documents.

- Copies of documents confirming kinship - your birth certificates with your sister.

This will also be a confirmation of age.

This will also be a confirmation of age. - Statement of income in the form 2-NDFL. Next year it will be available for download from your personal account.

What to do? 08/07/18

Is it possible to pay for education abroad and get a tax refund in Russia?

How to get a deduction and return personal income tax

There are two ways to get a deduction for sister's education.

According to the declaration next year. If you paid for your sister's studies at a university in 2020, you can file a declaration in 2021. The easiest way is to fill it out in the taxpayer's personal account. Attach copies of documents right there. The deadline for issuing a tax refund for 2020 is December 31, 2023. The tax office will check the documents for about three months, and then return the tax within a month. If you submit a declaration in January, you can actually receive money in April-May.

Through the employer in the current year. It's easier and faster, but at the end of the year it may not be very convenient. Submit a notice of the right to a deduction at the tax office. A declaration is not needed, and the document will be issued within a month. It must be taken to the accounting department. Starting next month, personal income tax will no longer be deducted from your salary.

It's easier and faster, but at the end of the year it may not be very convenient. Submit a notice of the right to a deduction at the tax office. A declaration is not needed, and the document will be issued within a month. It must be taken to the accounting department. Starting next month, personal income tax will no longer be deducted from your salary.

If the salary is more than 60,000 R, it is possible to return the entire tax in two months. If less, most likely, part of the personal income tax will have to be collected according to the declaration. For example, with a salary of 40,000 R, personal income tax will be 5200 R. If you receive a notification in October, the tax will no longer be withheld from November. Until the end of the year, you can withdraw no more than 10,400 R. The remaining amount of the deduction must be declared in the declaration in 2021.

/zapolneno/

How to fill out a declaration for treatment deduction

Can parents receive deductions if they do not pay personal income tax

Parents can receive deductions for the education of their children, but they have a limit of 50,000 R per year per child. At the same time, parents must be payers of personal income tax, otherwise they have nothing to return from the budget.

At the same time, parents must be payers of personal income tax, otherwise they have nothing to return from the budget.

Your parents do not pay personal income tax. He is not withheld from his mother's pension, his father pays another tax, which cannot be returned. But there are situations when even the self-employed, individual entrepreneurs or pensioners can use deductions:

- How an individual entrepreneur can receive personal income tax deductions

- How a self-employed person can receive a deduction for education and treatment

- When can deductions be received without income

Can a sister herself return the tax for her education

if he receives income subject to personal income tax. She will have her own personal deduction limit, and fewer documents will be needed. But the contract and payments must be in her name. This must be taken into account at the next payment.