How to remove child support from your credit

Will Paying Back Child Support Remove It from Your Credit Report?

Through December 31, 2023, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Dear Experian,

About a month or more ago I paid a back child support account I owed. I am trying to purchase a vehicle and it still shows I owe this amount. How can I get this removed?

- RNF

Dear RNF,

When you pay off a child support account appearing on your credit report, the creditor will automatically update the account to show it has been paid in full. However, sometimes it can take a month or two for that update to be reported to the credit reporting agencies and reflected on your credit reports.

How to Dispute a Child Support Account as Paid

Past-due child support is sometimes reported to Experian as an account on your credit report. If you or your lender obtained a recent copy of your Experian credit report and your child support account is still appearing with a past-due balance owed, you can dispute the information quickly and easily online at Experian's Dispute Center. You can also submit your dispute over the phone or by mail using the contact information provided on your credit report.

To dispute, simply select the account in question and provide an explanation stating that the debt has been paid in full and should be updated. You will also have the option to upload any documentation you may have that shows the account as paid.

You may also wish to directly contact the child support enforcement agency or the office reporting the account to make sure their records are updated to reflect that the account has been paid in full.

Paid Accounts Remain on Credit Report

Keep in mind that paying off a debt will not remove it from the credit report. An account that was delinquent prior to being paid in full will remain on the credit report for seven years from the original delinquency date.

Accounts closed in good standing remain on the credit report for 10 years from the date they are closed.

How Can I Improve My Scores Going Forward?

Payment history is the most important factor in your FICO® Scores☉. If you have a past-due account on your credit report, paying it off or bringing the account current is the first step to rehabilitating your credit scores, so you are already on the right track.

Going forward, the key to improving your credit scores will be to make sure all payments are made on time on all accounts. Although late payments remain on your credit reports for seven years, they'll typically affect your credit less as more time passes. You can help your credit recover as you continue to make on-time payments and manage your credit responsibly, despite past credit troubles.

The next most important factor is your credit utilization rate, which looks at your credit card balances relative to your credit card limits. Keeping your utilization rate as low as possible is good for credit scores. Experts recommend keeping your utilization rate below 30%, but below 10% is ideal. You can get a copy of your credit report from all three credit bureaus for free through AnnualCreditReport.com, which can help you keep tabs on your credit usage.

Keeping your utilization rate as low as possible is good for credit scores. Experts recommend keeping your utilization rate below 30%, but below 10% is ideal. You can get a copy of your credit report from all three credit bureaus for free through AnnualCreditReport.com, which can help you keep tabs on your credit usage.

When you order your free credit score from Experian, it will come with a list of risk factors unique to your credit history. Reviewing these risk factors can help you gain even more insight into what changes you can make to help improve your credit scores going forward.

Experian also now offers a free tool called Experian Boost®ø that allows you to increase your score instantly by adding your on-time utility, cellphone and streaming service payments to your credit report.

Thanks for asking.

Jennifer White, Consumer Education Specialist

Can You Remove Paid-Off Child Support From Your Credit Report?

Credit Repair

How Does LendingTree Get Paid?

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Written by

Updated on: December 11th, 2020

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Missed child support payments can tarnish your records with the credit bureaus like any other missed debt payment. Even if you pay off delinquent child support accounts, those negative marks don’t just disappear.

Overdue child support payments are required to be included on your credit report, and they remain there for up to seven years. That being said, if you have paid off your entire child support obligation and the account still appears in bad standing on your credit file, you can file a dispute with the credit bureaus to potentially have it updated. We’ll explain how it works.

That being said, if you have paid off your entire child support obligation and the account still appears in bad standing on your credit file, you can file a dispute with the credit bureaus to potentially have it updated. We’ll explain how it works.

How does child support affect your credit score?

In short, child support only affects your credit score if you’re late on your child support payments. If your child support account was never late, it will never appear on your credit report, explained Miranda Vance, a financial coach for AAA Fair Credit.

“Credit is only built by borrowing money and paying it back on time and in full,” said Vance.

That means monthly payments on things like auto insurance, utilities and phones do not typically build your score because you never actually borrowed money. But if you miss a payment on these accounts, they can appear on your credit report and drag down your score. Child support works the same way.

Once you miss a child support payment, that late payment can be reported to the credit bureaus and can remain on your credit report for seven years.

It’s also worth noting that even if you’re on time with child support payments, having to pay child support can make it more difficult for you to get approved for a mortgage or other loan. That’s because it contributes to your debt-to-income ratio, and signals you might have difficulty meeting the loan payments.

What happens when you pay off a child support account

Paying off a late child support payment won’t remove the derogatory mark from your credit report. However, it can help improve your credit score because the account should be marked on your reports as paid in full.

And because lenders care most about your recent credit activity, according to Martin Lynch, director of education and compliance manager at Cambridge Credit Counseling, recent marks showing an account was paid in full can offset the negative impact of older marks showing it was once overdue.

Can you remove paid-off child support from your credit report?

You cannot remove accurate information from your credit report. However, if you’ve paid off child support and it’s still showing up on your credit report as delinquent, you can dispute that error with the credit bureaus. Child support collections agencies collect and track your payments, but they sometimes fail to report your payments properly.

However, if you’ve paid off child support and it’s still showing up on your credit report as delinquent, you can dispute that error with the credit bureaus. Child support collections agencies collect and track your payments, but they sometimes fail to report your payments properly.

McKenzie Walsh, a certified financial counselor at the nonprofit AAA Fair Credit Foundation, said some credit reports she’s pulled don’t show updated child support payments from years ago. If that happens, she advised contacting the credit bureaus right way.

“It’s up to the consumer to report their payments” to all three credit bureaus, Walsh said.

In that situation, here’s what you should do to get the error fixed on your credit report:

Get proof that the account was paid off.

Before you reach out to the bureaus, get in touch with the child support collections agency you’ve been paying to ensure that the account is actually paid off. Then gather proof of those payments.

“Meticulous record-keeping is key,” said Val Kleyman, divorce lawyer and founding member of Kleyman Law Firm, as you’ll be required to provide documentation of your payments when it comes time to dispute incorrect information on your credit report.

If you haven’t been keeping receipts of your payments, you can request a report from your child support collections agency showing what you’ve paid.

file a dispute WITH THE CREDIT BUREAUS.

Once you have documents proving the account is paid off, it’s time to dispute the delinquent account with the credit reporting agencies. You’ll need to notify all three major credit bureaus of the issue and contest it with them, which you can do through their websites, over the phone or by mail.

It’s wise to communicate with them in writing whenever possible so that you can keep records of those communications. When providing documentation to the credit bureaus, always send copies rather than originals.

In most cases, these credit reporting agencies will have 30 days to investigate your claim, after which you’ll receive a written statement of the results. If the dispute resulted in changes to your credit report, you’ll receive a free and updated copy.

The credit reporting agencies are also required to give you the contact information for the lender or collections agency that provided them with information regarding your account during the investigation. If you feel that your dispute wasn’t resolved correctly, you can contact this information provider — likely your child support collections unit — to go over your payment records.

If you feel that your dispute wasn’t resolved correctly, you can contact this information provider — likely your child support collections unit — to go over your payment records.

Once the issue is resolved and the account is paid in full, any late payments will still show up on your credit report for seven years from the date of the original delinquency, but the child support account will now show up as paid in full. If you never actually missed any child support payments, then that account should come off of your credit report altogether once your dispute is properly resolved.

Improving your credit score

Two of the best things you can do to repair your credit are disputing inaccurate information and paying off delinquent accounts. Even if your credit history shows that you’ve missed payments on child support in the past, turning that around and showing that you’ve since paid off that account will undoubtedly help your credit by showing future lenders that you’re ready to be financially responsible.

Share Article

Looking for ways to increase your credit score? Get a free credit consultation today!

Advertising Disclosures

Recommended Reading

What is the Best Credit Utilization Ratio?

Updated November 2, 2022

Credit utilization ratio compares your current debt to your credit limits. Learn how to lower high utilization to protect your credit score.

READ MORE

Fair Credit Reporting Act: Understand Your Rights

Updated October 27, 2020

The Fair Credit Reporting Act is a federal law put into place in 1970 and amended extensively in 1996 and 2003. Learn more about FCRA here at LendingTree!

READ MORE

How a Missed Payment Affects Your Credit Score

Updated October 27, 2022

Missing one payment probably won’t kill your score, but it depends on how late that payment is. In this guide, we’ll cover the effects of a late payment.

In this guide, we’ll cover the effects of a late payment.

READ MORE

Alimony pass by - Newspaper Kommersant No. 167 (6888) dated 09/15/2020

As Kommersant found out, the amendments to the legislation that came into force in June, giving executive immunity in relation to social benefits in case of forced collection, work intermittently. Customers continue to complain that banks write off alimony against debts. Market participants and human rights activists explain the situation by the technical problems associated with the labeling of such transfers by the sender. But there is also a misunderstanding on the part of citizens - restrictions do not apply under standard loan agreements, banks have every right to write off any funds that come to the account.

Photo: Roman Yarovitsyn, Kommersant / buy photo

Photo: Roman Yarovitsyn, Kommersant / buy photo

Citizens complain about the write-offs of alimony coming to a bank account during the forced collection of accounts payable, although this is prohibited by amendments to the law that came into force on June 1 "On Enforcement Proceedings". Appropriate appeals appeared on the banki.ru forum.

Appropriate appeals appeared on the banki.ru forum.

Evgenia Lazareva, the head of the ONF project "For the Rights of Borrowers", confirms the appearance of complaints about alimony write-offs, although he notes their irregularity. According to her, the complaints may be related to a gap in the labeling of such receipts. According to the law, during the forced collection of debts, payments of a social nature are inviolable.

“However, if the sender of funds does not inform the bank that the incoming payments are benefits or alimony, the banks themselves will not be able to recognize their social nature,” explains Ms. Lazareva.

The Association of Banks of Russia (ADB) has already drawn the attention of relevant departments to the problem of labeling in the enforcement of debts. The Ministry of Justice and the FSSP, in their responses, did not provide clarification on issues related to the problem with banks tracking receipts to accounts that should be subject to collection restrictions, the ADB emphasizes.

The Offices refer in particular to the lack of enforcement practice. As a result, “situations may arise when writing off debt will be carried out at the expense of alimony, if their transfer was carried out by the individual himself without specifying the required code,” notes Sergey Klimenko, head of the ADB legal department. The Ministry of Justice only reported that they sent a response to the ADB in the prescribed manner. The FSSP was sent a link to the entry into force of the relevant amendments.

According to Yevgeny Korchago, chairman of the Korchago and Partners Moscow Bar Association, the regulatory gap with the lack of marking has developed due to the lack of a mechanism that would allow unscrupulous citizens to avoid receiving other funds under the guise of alimony payments. As noted in the Central Bank, in accordance with the law "On Enforcement Proceedings", the obligation to mark payments is assigned to the persons paying them. They can be, among other things, citizens transferring alimony. In turn, banks must provide customers with the opportunity to indicate the codes for the types of income established by the Central Bank's order of October 14, 2019year No. 5286-U. Tinkoff Bank notes that banks should be guided "only by the presence of an indication of the income code, they have no other grounds for conducting additional checks on the source of funds."

In turn, banks must provide customers with the opportunity to indicate the codes for the types of income established by the Central Bank's order of October 14, 2019year No. 5286-U. Tinkoff Bank notes that banks should be guided "only by the presence of an indication of the income code, they have no other grounds for conducting additional checks on the source of funds."

To avoid such problems, human rights activists recommend creating a separate account for alimony or social benefits, since confusion can also arise due to the fact that receipts, including salary, go to one account, on which the debt also hangs.

But even the creation of a separate special account does not solve the problem, since an unscrupulous citizen will still be able to transfer other funds to this account, Mr. Korchago points out. And since most often alimony is transferred from individual to individual, this is especially true.

However, if the write-off was not under a writ of execution, but, for example, under a bank loan agreement, then these markings are not applicable, explains Roman Malovitsky, adviser to the law office Egorov Puginsky Afanasiev and Partners. So, for example, it happened with a complaint from a VTB client. The bank explained that in this case it was about “writing off funds for debt on loans”, and in order to repay it, on the basis of the law “On Consumer Credit” and a standard loan agreement, banks have the right to “write off any funds received on the client’s account”.

So, for example, it happened with a complaint from a VTB client. The bank explained that in this case it was about “writing off funds for debt on loans”, and in order to repay it, on the basis of the law “On Consumer Credit” and a standard loan agreement, banks have the right to “write off any funds received on the client’s account”.

In fact, this is a write-off of funds with the consent of the borrower, which was given at the time of the conclusion of the contract, and here “there is no question of forced collection,” Mr. Malovitsky explains. At the same time, the client of the bank may revoke the consent given by him at any time. The issue of the delay period, in which direct debiting is allowed, is decided depending on the terms of a particular contract, the expert explains. Nevertheless, the alimony already written off - on a voluntary, not compulsory basis - the borrower can try to return, Ms. Lazareva points out. However, the bank is not obliged to meet halfway, since the client has demonstrated a violation of payment discipline, she notes.

Olga Sherunkova

Alfa-Bank - credit and debit cards, cash loans, car loans, mortgages and other banking services for individuals and legal entities - Alfa-Bank

Why did the bank seize or collect my money?

The bank may seize or foreclose on the funds in your account on the basis of a writ of execution or a decision of a bailiff within the framework of enforcement proceedings. The bank is obliged to execute an executive document, a decision of a bailiff or an act of another state body in accordance with the requirements of the legislation of the Russian Federation.

What if I do not agree with the arrest?

In order to suspend, cancel the execution and (revoke) the executive document / decision of the bailiff / act of the state body, which seized the funds, you must apply to the court, to the exactor or to the bailiff and provide justifying the need to cancel the arrest documentation. Upon subsequent receipt by the bank of the relevant documents, the established restrictions are canceled or their execution is suspended. The bank cannot unilaterally cancel the seizure of funds.

Upon subsequent receipt by the bank of the relevant documents, the established restrictions are canceled or their execution is suspended. The bank cannot unilaterally cancel the seizure of funds.

What should I do if I was arrested or charged by mistake?

In case of an erroneous decision of the bailiff, if you are not a debtor, you must contact the bailiff. You can send a written claim (fssp.gov.ru/ip_docs/) or personally come to the appointment with an identity document (in addition, take SNILS, TIN).

If the arrest is established or the recovery is carried out, file a complaint with the Federal Bailiff Service of Russia (fssp.gov.ru/ip_docs/).

What should I do to get back the money already written off?

If the recovery was carried out by a bailiff, use the service Submission of complaints, petitions to the bailiff on the State Services portal, select the Life situations section: “I want to return the funds that have been withheld or paid in excess” or “I want to complain about the actions of the bailiff”. If the money was recovered by a court decision, then contact the court or the recoverer. The bank cannot return the funds to the account: after debiting, the funds are credited to the claimant or to the deposit account of the bailiff service.

If the money was recovered by a court decision, then contact the court or the recoverer. The bank cannot return the funds to the account: after debiting, the funds are credited to the claimant or to the deposit account of the bailiff service.

What should I do if the money has been recovered even though the debt has been paid?

Contact the authority that issued the writ of execution. In the statement of the account from which the debit was made, the column "Purpose of payment" contains the relevant details. When applying, you will need to provide proof of payment.

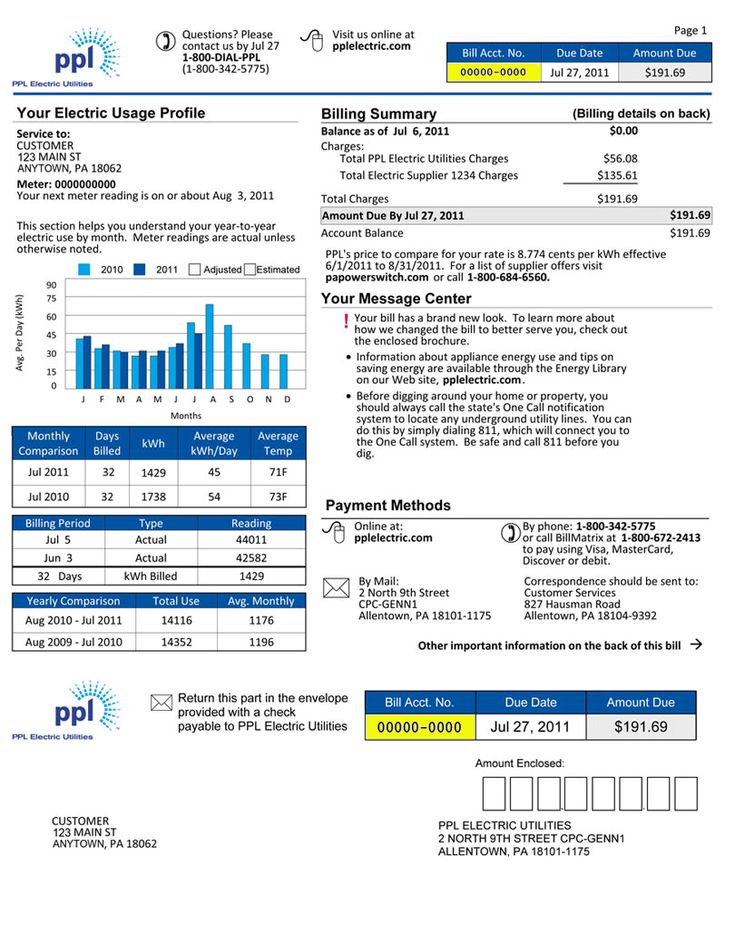

How much money can be deducted from my account?

Own funds: can be recovered in 100% amount, these include: depositing cash, transferring between own accounts, paying interest on deposits, transferring money from other banks, transfers from individuals.

If there is a lack of own funds, periodic payments are collected.

You can recover up to 50% of the amount of the last periodic payment, these include: salary, pension, scholarship, unemployment benefits and other periodic income received on the account.

They can recover up to 70% of the amount of the last periodic payment if there is a debt for alimony for minor children or compensation for harm (damage).

Social payments are not subject to arrest or collection, they include: alimony, lump sum payments to pensioners, maternity capital, child care payments, payments to the disabled and veterans, as well as other social payments.

! But, if you transfer social payments from account to account, the money will be automatically assigned to the “Other income” category, which is subject to arrest or recovery in full without restrictions.

A complete list of social payments is provided for in Art. 101 of Federal Law No. 229-FZ “On Enforcement Proceedings.

229-FZ “On Enforcement Proceedings.

Social payments also include amounts paid to compensate for harm caused to life and health, compensation payments to victims of radiation or man-made disasters. But they can also be collected to pay off the debt on the payment of alimony for minor children or to pay compensation for harm in connection with the death of the breadwinner.

How to protect the subsistence minimum from a penalty under an executive document?

If the recovery is by order of the bailiff

-

Choose one account in one bank to which periodic payments (salary, bonus, insurance pension) are received.

-

Submit an application to the bailiff indicating the selected account (you must first make an appointment). If the application is satisfied, the bailiff will send a resolution to the bank to maintain the subsistence level.

Upon receipt of the decision, the bank will monthly save the amount of the subsistence minimum from incoming periodic transfers (salary, bonus, insurance pension, etc.). Other payments will be available for collection in full.

Upon receipt of the decision, the bank will monthly save the amount of the subsistence minimum from incoming periodic transfers (salary, bonus, insurance pension, etc.). Other payments will be available for collection in full.

If the recovery under a writ of execution is from the recoverer (court order, writ of execution)

-

Choose one account in one bank that receives periodic payments (salary, bonus or insurance pension).

-

If the account you have chosen is opened with Alfa-Bank, send an application to the Bank via the Russian Post at: 107 078, Moscow, Kalanchevskaya street 27.

-

The bank will process your application and after that it will save the amount every month living wage from incoming periodic payments (salary, bonus, insurance pension, etc.). Other payments will be available for collection in full.

How much of the subsistence minimum will be kept on the account?

The subsistence minimum depends on the place of residence (stay)

View the subsistence minimum in your region

the minimum will be equal to the amount established in the whole of the Russian Federation.