How to remove child support from credit

Can You Remove Paid-Off Child Support From Your Credit Report?

Credit Repair

How Does LendingTree Get Paid?

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Written by

Updated on: December 11th, 2020

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Missed child support payments can tarnish your records with the credit bureaus like any other missed debt payment. Even if you pay off delinquent child support accounts, those negative marks don’t just disappear.

Overdue child support payments are required to be included on your credit report, and they remain there for up to seven years. That being said, if you have paid off your entire child support obligation and the account still appears in bad standing on your credit file, you can file a dispute with the credit bureaus to potentially have it updated. We’ll explain how it works.

How does child support affect your credit score?

In short, child support only affects your credit score if you’re late on your child support payments. If your child support account was never late, it will never appear on your credit report, explained Miranda Vance, a financial coach for AAA Fair Credit.

“Credit is only built by borrowing money and paying it back on time and in full,” said Vance.

That means monthly payments on things like auto insurance, utilities and phones do not typically build your score because you never actually borrowed money. But if you miss a payment on these accounts, they can appear on your credit report and drag down your score. Child support works the same way.

Once you miss a child support payment, that late payment can be reported to the credit bureaus and can remain on your credit report for seven years.

It’s also worth noting that even if you’re on time with child support payments, having to pay child support can make it more difficult for you to get approved for a mortgage or other loan. That’s because it contributes to your debt-to-income ratio, and signals you might have difficulty meeting the loan payments.

What happens when you pay off a child support account

Paying off a late child support payment won’t remove the derogatory mark from your credit report. However, it can help improve your credit score because the account should be marked on your reports as paid in full.

And because lenders care most about your recent credit activity, according to Martin Lynch, director of education and compliance manager at Cambridge Credit Counseling, recent marks showing an account was paid in full can offset the negative impact of older marks showing it was once overdue.

Can you remove paid-off child support from your credit report?

You cannot remove accurate information from your credit report. However, if you’ve paid off child support and it’s still showing up on your credit report as delinquent, you can dispute that error with the credit bureaus. Child support collections agencies collect and track your payments, but they sometimes fail to report your payments properly.

McKenzie Walsh, a certified financial counselor at the nonprofit AAA Fair Credit Foundation, said some credit reports she’s pulled don’t show updated child support payments from years ago. If that happens, she advised contacting the credit bureaus right way.

“It’s up to the consumer to report their payments” to all three credit bureaus, Walsh said.

In that situation, here’s what you should do to get the error fixed on your credit report:

Get proof that the account was paid off.

Before you reach out to the bureaus, get in touch with the child support collections agency you’ve been paying to ensure that the account is actually paid off. Then gather proof of those payments.

“Meticulous record-keeping is key,” said Val Kleyman, divorce lawyer and founding member of Kleyman Law Firm, as you’ll be required to provide documentation of your payments when it comes time to dispute incorrect information on your credit report.

If you haven’t been keeping receipts of your payments, you can request a report from your child support collections agency showing what you’ve paid.

file a dispute WITH THE CREDIT BUREAUS.

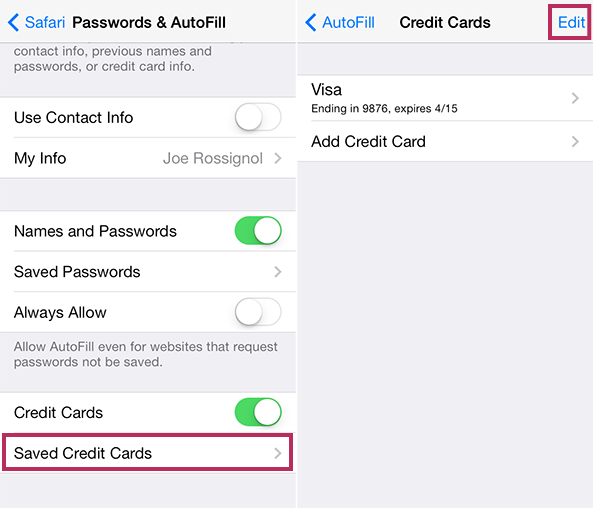

Once you have documents proving the account is paid off, it’s time to dispute the delinquent account with the credit reporting agencies. You’ll need to notify all three major credit bureaus of the issue and contest it with them, which you can do through their websites, over the phone or by mail.

It’s wise to communicate with them in writing whenever possible so that you can keep records of those communications. When providing documentation to the credit bureaus, always send copies rather than originals.

In most cases, these credit reporting agencies will have 30 days to investigate your claim, after which you’ll receive a written statement of the results. If the dispute resulted in changes to your credit report, you’ll receive a free and updated copy.

The credit reporting agencies are also required to give you the contact information for the lender or collections agency that provided them with information regarding your account during the investigation. If you feel that your dispute wasn’t resolved correctly, you can contact this information provider — likely your child support collections unit — to go over your payment records.

Once the issue is resolved and the account is paid in full, any late payments will still show up on your credit report for seven years from the date of the original delinquency, but the child support account will now show up as paid in full. If you never actually missed any child support payments, then that account should come off of your credit report altogether once your dispute is properly resolved.

If you never actually missed any child support payments, then that account should come off of your credit report altogether once your dispute is properly resolved.

Improving your credit score

Two of the best things you can do to repair your credit are disputing inaccurate information and paying off delinquent accounts. Even if your credit history shows that you’ve missed payments on child support in the past, turning that around and showing that you’ve since paid off that account will undoubtedly help your credit by showing future lenders that you’re ready to be financially responsible.

Share Article

Looking for ways to increase your credit score? Get a free credit consultation today!

Advertising Disclosures

Recommended Reading

What is the Best Credit Utilization Ratio?

Updated November 2, 2022

Credit utilization ratio compares your current debt to your credit limits. Learn how to lower high utilization to protect your credit score.

Learn how to lower high utilization to protect your credit score.

READ MORE

Fair Credit Reporting Act: Understand Your Rights

Updated October 27, 2020

The Fair Credit Reporting Act is a federal law put into place in 1970 and amended extensively in 1996 and 2003. Learn more about FCRA here at LendingTree!

READ MORE

How a Missed Payment Affects Your Credit Score

Updated October 27, 2022

Missing one payment probably won’t kill your score, but it depends on how late that payment is. In this guide, we’ll cover the effects of a late payment.

READ MORE

How To Get Child Support On Credit Report Removed

Time to get that child support on your credit report removed ASAP. The divorce and child custody process is already a grueling and, sometimes, brutal process.

The divorce and child custody process is already a grueling and, sometimes, brutal process.

The last thing you want to deal with is a financial burden due to child support arrears.

Related: Boost Your FICO Score By 200 Points

But…

It happens doesn’t it.

Maybe your child support case wasn’t properly closed, a past due- maybe couple - or some sort of mistake that led to another, another and then more.

Again, it happens.

Now it’s time to clean up the mess, stop you loan interest rates from increasing and stop you credit score from decreasing. Especially, if it’s been on your report over 7 years.

So...

Related: How To Raise Your Score by 10 points fast

How Do You Get Child Support On Credit Report Removed?

Here are a few steps to getting this done, you’ll need debt validation letter for child support

If it’s simply an error because your account wasn’t closed properly, you should get a letter from the child support office, contact the credit bureau and ask to place the letter in your report.

That will let other creditors know that you are disputing the debt and allow them to read the explanation for the debt.

Then you must do the practical thing.

Work with the child support office to get the debt removed ASAP. Depending on what state you’re in, you may be able to get arrearages waived by consent of the parties or an order from the court.

Ask you local child support offices for the proper information/procedures in your state and get child support on credit report removed

Related: Can Lexington Law Remove Paid Collections?

Here are a few steps to get those Child Support Remove From Your Credit History

1. You have to contact your local child support agency. Do a quick google search, agency names are different depending where you’re located.

Share all the information, documents, files, emails, etc. that provide that the information that shows that the debt is incorrect.

Once proven that it is incorrect to get it in writing and if it has been over 7 years, make sure that is stated as well.

Need to clean up errors on your credit report? Click here to use this form to ask a creditor to take the necessary steps in order to clear up errors on your credit report.

2. Now, if your agency is unhelpful, appeal the child support amount. Every agency has their way about dealing with child-support arrears. So, you may have to:

- File an administrative appeal through the child-support enforcement agency

- Appeal to the court in the county in which the original child-support order was issued.

You may have to hire a lawyer to maximize your chances for success in your appeal if things get a little sticky

3. Get your credit history printed Experian, Transunion and Equifax (or some sort of copy). You may have to pay for it if you’ve gotten a copy in recent times.

You may have to pay for it if you’ve gotten a copy in recent times.

You are allowed one free credit report each year. Different bureaus may report slightly different information, and the child- support arrears may not appear on each bureau's report.

4. Fill out a dispute form on each site that reports the inaccurate information.

Provide any documentation you have from the child-support enforcement agency indicating that the debt does not exist or it has been 7 years or more (which is too old to be on your credit report).

It can take up to 30 days to have the information removed from your credit report.

Related: 101 Best Personal Finance Blogs

Alimony pass by - Newspaper Kommersant No. 167 (6888) dated 09/15/2020

As Kommersant found out, the amendments to the legislation that came into force in June, giving executive immunity in relation to social benefits in case of forced collection, work intermittently. Customers continue to complain that banks write off alimony against debts. Market participants and human rights activists explain the situation by the technical problems associated with the labeling of such transfers by the sender. But there is also a misunderstanding on the part of citizens - restrictions do not apply under standard loan agreements, banks have every right to write off any funds that come to the account. nine0003

Customers continue to complain that banks write off alimony against debts. Market participants and human rights activists explain the situation by the technical problems associated with the labeling of such transfers by the sender. But there is also a misunderstanding on the part of citizens - restrictions do not apply under standard loan agreements, banks have every right to write off any funds that come to the account. nine0003

Photo: Roman Yarovitsyn, Kommersant / buy photo

Photo: Roman Yarovitsyn, Kommersant / buy photo

Citizens complain about the write-offs of alimony coming to a bank account during the forced collection of accounts payable, although this is prohibited by amendments to the law that came into force on June 1 "On Enforcement Proceedings". Appropriate appeals appeared on the banki.ru forum.

Evgenia Lazareva, the head of the ONF project "For the Rights of Borrowers", confirms the appearance of complaints about alimony write-offs, although he notes their irregularity. According to her, the complaints may be related to a gap in the labeling of such receipts. According to the law, during the forced collection of debts, payments of a social nature are inviolable. nine0003

“However, if the sender of funds does not inform the bank that the incoming payments are benefits or alimony, the banks themselves will not be able to recognize their social nature,” explains Ms. Lazareva.

The Association of Banks of Russia (ADB) has already drawn the attention of relevant departments to the problem of labeling in the enforcement of debts. The Ministry of Justice and the FSSP, in their responses, did not provide clarification on issues related to the problem with banks tracking receipts to accounts that should be subject to collection restrictions, the ADB emphasizes. nine0003

The Offices refer in particular to the lack of enforcement practice. As a result, “situations may arise when writing off debt will be carried out at the expense of alimony, if their transfer was carried out by the individual himself without specifying the required code,” notes Sergey Klimenko, head of the ADB legal department. The Ministry of Justice only reported that they sent a response to the ADB in the prescribed manner. The FSSP was sent a link to the entry into force of the relevant amendments.

The Ministry of Justice only reported that they sent a response to the ADB in the prescribed manner. The FSSP was sent a link to the entry into force of the relevant amendments.

According to Yevgeny Korchago, chairman of the Korchago and Partners Moscow Bar Association, the regulatory gap with the lack of marking has developed due to the lack of a mechanism that would allow unscrupulous citizens to avoid receiving other funds under the guise of alimony payments. As noted in the Central Bank, in accordance with the law "On Enforcement Proceedings", the obligation to mark payments is assigned to the persons paying them. They can be, among other things, citizens transferring alimony. In turn, banks must provide customers with the opportunity to indicate the codes for the types of income established by the Central Bank's order of October 14, 2019year No. 5286-U. Tinkoff Bank notes that banks should be guided "only by the presence of an indication of the income code, they have no other grounds for conducting additional checks on the source of funds. "

"

To avoid such problems, human rights activists recommend creating a separate account for alimony or social benefits, since confusion can also arise due to the fact that receipts, including salary, go to one account, on which the debt also hangs.

But even the creation of a separate special account does not solve the problem, since an unscrupulous citizen will still be able to transfer other funds to this account, Mr. Korchago points out. And since most often alimony is transferred from individual to individual, this is especially true.

However, if the write-off was not under a writ of execution, but, for example, under a bank loan agreement, then these markings are not applicable, explains Roman Malovitsky, adviser to the law office Egorov Puginsky Afanasiev and Partners. So, for example, it happened with a complaint from a VTB client. The bank explained that in this case it was about “writing off funds for debt on loans”, and in order to repay it, on the basis of the law “On Consumer Credit” and a standard loan agreement, banks have the right to “write off any funds received on the client’s account”. nine0003

nine0003

In fact, this is a write-off of funds with the consent of the borrower, which was given at the time of the conclusion of the contract, and here “there is no question of forced collection,” Mr. Malovitsky explains. At the same time, the client of the bank may revoke the consent given by him at any time. The issue of the delay period, in which direct debiting is allowed, is decided depending on the terms of a particular contract, the expert explains. Nevertheless, the alimony already written off - on a voluntary, not compulsory basis - the borrower can try to return, Ms. Lazareva points out. However, the bank is not obliged to meet halfway, since the client has demonstrated a violation of payment discipline, she notes. nine0003

Olga Sherunkova

Banks were banned from writing off social payments for debts May 2, 2022 | 59.ru

All news"It turned out that she met both of us." The story of a guy whose first relationship turned into hell

Opposite the Perm Watch Factory, they want to build a 16-storey building. The change of zoning will be considered at public hearings

The change of zoning will be considered at public hearings

Permyak Ilya Ilyinykh played the main role in the series "I'm watching you"

Break your head: 10 logical tasks that you can't cope with

What about garlic? Doctors explained what would happen if you eat lemons and garlic every day

Perm authorities published a photo of the new illumination of the Communal Bridge

How long does it take to pay for a communal apartment so that Perm residents can turn off gas, electricity and other services at home? Answer

“Heavy luxury is in the past”: why Russian women are left without mink coats and are offered to wear green eco-fur coats

Basketball player's wife, face of Nina Ricci, prototype of the Dunyasha robot. How did the life of Perm beauty queens

Will telecommuting be banned? How will those who have gone abroad be able to work? What and how much they sell in Perm's Svetofor and Chizhik economy markets

A window to Europe: how to buy a new iPhone and Nike sneakers now through parallel imports

Winter aggravation: how to enter the new year as a healthy person - instructions

" A very strong fire”: a bath complex caught fire in Perm0003

“The chicken has turned into a beautiful girl”: Vera Brezhneva’s daughter has grown up and is ready to outshine her star mother — see photo debts for electricity, although the house was demolished three years ago

The Ministry of Emergency Situations named the reason for the smoke in the Perm shopping center Coliseum Cinema, because of which 200 people were evacuated

“All the trees were blown away”: unidentified flying objects crashed in the Volgograd region0003

“The sounds were very scary”: all that is known about the fall of unidentified flying objects near Volgograd

Photo fact: lights were lit on the main Christmas tree of Perm

In Perm, 200 people were evacuated from the Coliseum Cinema shopping center due to smoke

Perm business was offered an alternative to lending

Minus 20 cm without diets and sports: the model revealed the secret of how to quickly get rid of a protruding belly

At the Perm II station, it will be forbidden to go directly to the trains. Passengers will have to go through security at the station building

Passengers will have to go through security at the station building

The Perm City Hall reported on checking 6,000 yards for snow removal — but complaints (with photos!) continue to come in

A three-year-old boy with a shovel went out to dig a bus stuck in the snow — watch the cutest video of this year

100 best goods of Russia”

Residents of the Perm Territory received the recommended payment for hot water: what does it mean

“There is a choice, no need to persuade anyone”. Who pays for sex and why women choose this job - honest monologues

Senator Andrei Klimov in Perm announced the need for “general civil mobilization”

Perm hospitals will pay 300 thousand for the death of a pensioner with coronavirus

Forecasters: even more heavy snowfall is expected in the Kama region than last weekend sexual abuse of a stepdaughter under 14 years old

The Central Bank did not raise the key rate

The Ministry of Emergency Situations warns of black ice and possible utility accidents in the Kama region

More than a billion people were scammed all over Russia. How the administration of Sochi breeds deceived equity holders

How the administration of Sochi breeds deceived equity holders

In Perm, a new microdistrict will be built on the territory of the former meat processing plant on Dzerzhinsky Street

All news

Share

Banks can no longer automatically write off lump-sum payments and social benefits from the state in order to repay loans and mortgages with their help. To do this, they need to obtain written permission from the person. If the payment is monthly, then consent can be taken in advance for the entire period. But the borrower has 14 days from the date of submission of permission to change his mind and take the money back - for this you need to write an application to the bank. The bank has three days to return the money written off from payments and benefits. nine0003

Banks are not allowed to write off travel allowances, alimony, survivors' pensions, one-off payments for families with children and pregnant women, maternity capital funds without permission.

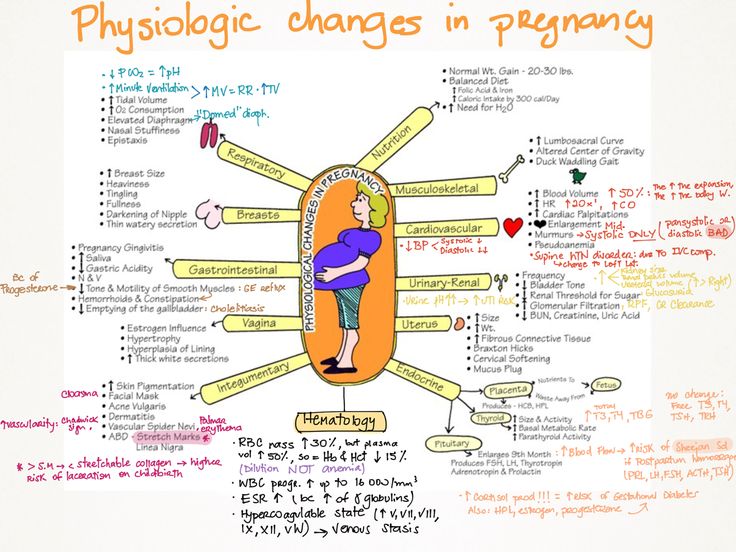

This is how the full list of payments and benefits that banks are prohibited from writing off looks like

Infographics: Vitaly Kalistratov / City portals

". nine0003

- What's the problem? The fact that banks write off social support funds from the state to pay off debts,” the president said. - I can say right away that this is absolutely unacceptable, because these payments are for children, to support families, to help people who find themselves in a difficult life situation, without any exaggeration.

Starting February 1, debtors have the right to keep funds in the amount of the subsistence minimum on their accounts every month. But this does not apply to some debts. Bailiffs will be able to withhold the amount without taking into account the minimum income in the following cases:

- recovery of alimony;

- compensation for damage caused by a crime and harm to health;

- non-pecuniary damages;

- compensation for damages in connection with the death of the breadwinner;

- administrative and judicial fines.