How to pay child support in wisconsin

Payments & Fees

Payment and Collection Information

Find 24-hour payment and collection information on your child support case on the State of Wisconsin Child Support website.

You may also call the KIDS Information Line for payment and collection information on your child support case, account balances, copies of payment records or replacement of checks that are lost or stolen. Operators are available from 8 a.m. to 5 p.m., Monday through Friday. Automated operators are available 24 hours/7 days.

Outside Milwaukee: (800) 991-5530

TDD: (877) 209-5209

Pay by Mail

Payments may be sent by a payer with a personal check, cashier's check or money order to the Wisconsin Support Collection Trust Fund (WI SCTF). Include a payment coupon when mailing a support payment. This ensures that your payment will be applied to your account.

When mailing your support payment:

- Be sure to include the right coupon (regular coupon or R&D fee coupon)

- Write your KIDS Pin or Social Security number on your check or money order

- Make check or money order payable to: WI SCTF

- Send your payment and coupon to:

WI SCTF

P. O. Box 74200

Milwaukee, WI 53274-0200

Use these payment coupons to pay current support, past-due support and interest:

- Quick print payment coupon. These coupons do not contain your personal information, so you will have to fill in your information

- Coupon downloaded from Child Support Online Services (registration required)

- A coupon that comes with your Monthly Statement of Account (monthly statements are not sent to all support payers)

Coupons are not accepted at the child support office.

Use this payment coupon to pay R&D fees:

- R&D fee coupon

- View a sample R&D coupon

If you have a question about your coupons, call the KIDS Information Line at (800) 991-5530, (877) 209-5209 TDD.

AllPaid - formerly known as GovPayNet

How does it work?

- Pay with credit, debit or pre-paid debit card brands (or any combination).

Visit the website to see which cards are accepted

Visit the website to see which cards are accepted - Payments accepted 24 hours a day, 7 days a week

Fees

- There are fees charged for using AllPaid/GovPayNet

Timing

- Your payment may take up to seven days to reach the trust fund

Please read Terms of Service for more information. For answers to general questions, please visit AllPaid/GovPayNet FAQ.

ExpertPay

How does it work?

- Pay with money transferred from your checking or savings account

- Pay with PayPal, VISA, MasterCard or Discover

Fees

- There is a $2.50 registration fee to set-up payments directly from a bank account and no additional fees for transactions

- There is a 2.95% fee for payments using PayPal, VISA, MasterCard or Discover

Timing

- Your payment may take up to seven days to reach the trust fund

Visit ExpertPay

e-ChildsPay Operated by ExpertPay

Payers who used e-ChildsPay to make payments will now be redirected to ExpertPay. Payer information was not migrated to ExpertPay, so users must re-register to make a payment.

Payer information was not migrated to ExpertPay, so users must re-register to make a payment.

Pay by Phone

A convenient way to pay for those who are self-employed. You can make a support payment anytime, from anywhere, by using a touch-tone phone.

- Print and complete the authorization form

- After the form is completed and returned, you will receive a four-digit access code to use the pay-by-phone service

Find more information and instructions for pay-by-phone.

Pay With Cash Using MoneyGram

A convenient way to pay child support with cash. You can make a support payment anytime, by visiting any MoneyGram location.

- Flat fee ($3.99) regardless of child support payment amount

- Available at many national retail stores (e.g., Walmart and CVS)

- Safe, fast and reliable

- Payments post to your child support account within five days

- You'll need your child support PIN and receive code (14692) for payments to the Trust Fund

Example of Wallet Card

Information Flyer

Custodial Parent Payment Information

The Child Support Online Services website gives information about all payments and/or collections, as well as balances for the last 60 days. Information is updated every night except Sunday.

Information is updated every night except Sunday.

Direct Deposit

- To have support payments deposited into a checking or savings account, you must fill out a direct deposit form and return it to the Wisconsin Support Collection Trust Fund for processing. You can also call the Trust Fund at (800) 991-5530, (877) 209-5209 TDD and request that a direct deposit form be mailed to you

Debit Card - New Way2Go Debit MasterCard replacing EPPIC Debit Card

- Custodial parents who are 18 years of age or older and have not enrolled in direct deposit will automatically be enrolled in the Wisconsin Way2Go Debit MasterCard program when a support collection is received. Custodial parents must keep their address current with the both the child support agency and with Way2Go. New debit cards will be mailed to the address in the child support agency’s system

- Current payees will be issued the new Way2Go Debit MasterCard near the expiration date of their current EPPIC Debit MasterCard.

Payees will receive the new card in the mail.

Payees will receive the new card in the mail. - Child Support Customers can call the toll-free customer service number (877) 253-3686 for issues with their debit cards.

- For more information click on Wisconsin Way2Go Debit MasterCard.

KIDS Information Line

- The KIDS Information Line provides information on the last two payments and/or collections

- Information is updated every night except Sunday.

- Operators are available from 8 a.m. to 5 p.m., Monday through Friday. IVR is available 24 hours/7 days

- To use the KIDS Information line, call: (800) 991-5530, (877) 209-5209 TDD

Income Withholding

Notices to withhold support are sent to employers. Your employer then deducts the support amount from your paycheck and sends the money to the trust fund for processing. Employers may charge a fee to cover their costs to withhold support.

Child support may also be withheld from:

- Unemployment payments

- Workers compensation checks

- Pension payments

- Social Security Disability Income benefits

Income Withholding Timelines

New income withholdings may take up to 30 days for support payments to start coming out of your paycheck. Here's how it works:

- The child support agency sends a notice to the employer to withhold for support. This notice is usually mailed within two business days of a new court order, or after a reported change in employment

- The notice tells employers they must start withholding support in the first pay period after getting the withholding notice

- After the payment is withheld from the paycheck, the employer must send the payment to the trust fund within five business days from the withholding date. Mailing time may take one to three days

- The payment is processed on the same date it is received at the trust fund.

The payment will be posted to the child support system overnight, and it can be seen on the Child Support Online Services website by the next morning

The payment will be posted to the child support system overnight, and it can be seen on the Child Support Online Services website by the next morning

After a payment is posted in the child support system, it may take another two business days to get to the family.

Once income withholding starts, payments should start coming in according to when the paying parent gets paid. Almost all employers issue paychecks weekly, every two weeks or monthly. Keep in mind the employer has up to five business days to send the payment, so support payments will not always post the same day of the week.

Income withholding is also used to collect receipt and disbursement (R&D) fees. Withholding for R&D fees is only used when a parent does not pay the yearly fee in full or still owes R&D fees from previous years.

Additional questions parents ask about income withholding can be found on the State of Wisconsin Child Support website.

How Child Support Gets Paid in Wisconsin

All child support payments must be paid through the Wisconsin Support Collections Trust Fund. WI law requires support orders to include income withholding. If you're self-employed, between jobs, or past due, support can be paid online, direct deposit, by mail, or by phone.

WI law requires support orders to include income withholding. If you're self-employed, between jobs, or past due, support can be paid online, direct deposit, by mail, or by phone.

Book My Consult

Ways to Pay Child Support

All child support is paid to the Wisconsin Support Collections Trust Fund (WI SCTF) which then gives it to the receiving party. Paying it through the WI SCTF is the only way to be certain that your payments count towards child support. So, do NOT just pay the other party directly.

You can pay child support through–

- Income Withholding

- Paying Online

- Paying with Cash

- Paying by Phone

- Mailing Payments

Most child support is paid through income withholding, but there are circumstances when other options are necessary. Income withholding may not be the best option if the payer isn’t currently employed, is self-employed, or is trying to pay extra to pay off arrears. [1]

[1]

Child support cases heavily impact both parties and can be hard to modify until years later. To get a fair child support order from the beginning, use a family law attorney such as one from Sterling Law Offices.

1. Income Withholding

Income withholding is similar to garnishing wages in that it pulls directly from the payer’s paycheck. This is the best option in most cases because the paying party can’t forget to pay or pay late.

For this to happen, the child support agency sends a notice to the payer’s employer. The employer then deducts the allotted portion from each paycheck. The money goes to the WI SCTF to then be distributed to the other party. Also, the employer can charge their employee a fee for any costs associated with this process.

Child support can also withhold income from unemployment, worker’s compensation, pension payments, and SSDI benefits.[2] Payments come as often as the payer gets paid.

2. Paying Online

The second most convenient option for most people is to pay online by credit or debit card or by transfer from a checking or savings account. When paying online, there are fees which vary depending on the website and payment method.

When paying online, there are fees which vary depending on the website and payment method.

The three websites you can use are ExpertPay, MoneyGram, and GovPayNet. ExpertPay also allows payments through PayPal. Before using any of the options in this article, it is best to contact your local child support agency to confirm they allow these methods.

3. Paying with Cash

Paying in person is a safe and reliable option, and you can pay at any MoneyGram location. Many retail stores such as Pick-N-Save, CVS, and Wal-Mart are MoneyGram locations. Payments can be made with cash or a card if you prefer in-person credit or debit card transactions, and there is a set fee of $3.99 per payment.

To pay at one of these locations, you will need your child support pin and the receive code (the receive code for WI SCTF is 14692).

4. Paying by Phone

Paying over the phone is another convenient option that is great for self-employed people because you can pay from anywhere. To use this method, you first file the authorization form, found in the first link in the references section below.

To use this method, you first file the authorization form, found in the first link in the references section below.

5. Mailing Payments

Mailing is another reliable method to pay child support, but there needs to be a payment coupon included with the payment. There are a few different coupons, and all types can be found by following the link in the first reference below titled Ways to Pay Support.

Mailed payments need to include the correct coupon, the KIDS pin or social security number, a cash or a check payable to WI SCTF, and addressed to WI SCTF / PO Box 74200 / Milwaukee, WI 53274.

For Immediate help with your family law case or answering any questions please call (262) 221-8123 now!

Considerations

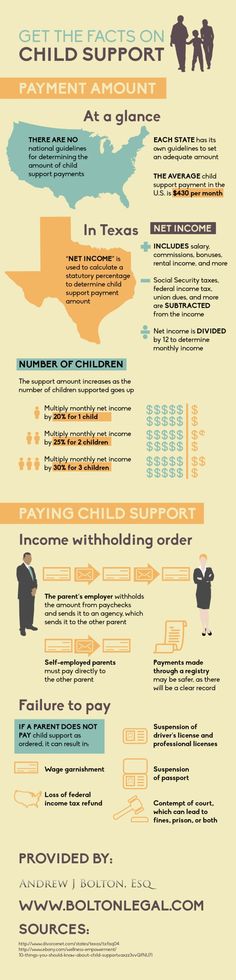

How Much Child Support Do I Have to Pay in Wisconsin?

Wisconsin child support is based on the number of overnights each party has with the child and each party’s income. To calculate child support, use our child support calculator.

What if I Can’t Pay Child Support?

If you can no longer pay child support because you lost your job or have some other extenuating circumstance, then you may be able to modify your child support. Unpaid child support is known as back child support or arrears.

Frequently Asked Questions

Can you pay child support online in Wisconsin?

Yes, you are able to pay child support online through ExpertPay, MoneyGram, and GovPayNet. Which website to use depends on which county the case is in and what that county accepts.

Where can I pay my child support?

If you are looking to pay in person, you can pay child support at any MoneyGram location such as in a Pick-N-Save or a CVS. Otherwise, child support can be paid online, over the phone, or by mail.

How long do I have to pay child support in Wisconsin?

You pay child support until the child turns 18 or graduates from high school, whichever comes last. There are a few other possibilities, but generally, it is difficult to

end child support payments if the child has not aged out.

How do I find out how much child support I owe in Wisconsin?

The easiest way to figure out how much you owe in child support is to check on the Child Support Online Services website.

How do I get rid of child support interest in Wisconsin?

Unpaid child support becomes arrears and arrears gain interest. This interest needs to be paid off, but there is a chance it can be forgiven by the state upon request. Arrears can be forgiven with the consent of the other party or if you can prove there was a time you should not have been paying.

References: 1. Ways to Pay Support. Wisconsin Department of Children and Families. (n.d.) | 2. Wis. Admin Code, DCF § 150.2 (13)(a)1-9. Child Support Percentage of Income Standard.

Book My Consult

X

Call for Immediate Assistance

(262) 221-8123

or fill out the form below

Type of Matter

AnnulmentDe NovoDivorceLegal SeparationPaternityRestraining OrderPrenuptial AgreementAlimonyChild SupportCustody / PlacementProperty DivisionCollege ContributionGuardianship--ChipsCivilCriminalEmancipationEmploymentEstate Planning ImmigrationLiensOtherPersonal Injury Postnuptial AgreementReal EstateTax LawTPR/AdoptionTribal Law Tell Us More - Optional

How to pay alimony if parents divided children during a divorce - Legal advice

Alexander Krylov (Moscow) 07/26/2022 Heading: Family

What is the scheme for calculating alimony when parents have two children and after the termination of marriage, each parent has a child left?

Alimony

Tatyana Sayapina

Consultations: 53

Based on paragraph 1 of Art. 80 of the RF IC, parents are obliged to support their minor children. The procedure and form of providing maintenance to minor children are determined by the parents independently. Parents have the right to conclude an agreement on the maintenance of their minor children (agreement on the payment of alimony) in accordance with Sec. 16 RF IC.

80 of the RF IC, parents are obliged to support their minor children. The procedure and form of providing maintenance to minor children are determined by the parents independently. Parents have the right to conclude an agreement on the maintenance of their minor children (agreement on the payment of alimony) in accordance with Sec. 16 RF IC.

What types of expenses are used to reduce the child support debt?

If a notarial agreement on the payment of alimony is not concluded, then the issue must be resolved in court. So, according to paragraph 3 of Art. 83 of the RF IC, if children remain with each of the parents, the amount of alimony from one of the parents in favor of the other, less well-off, is determined in a fixed amount of money collected monthly and determined by the court.

The calculation of alimony in this case is the same as according to the general rule provided for in Art. 81 RF IC:

- in the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents on a monthly basis in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of earnings and (or) other income parents;

- the size of these shares may be reduced or increased by the court, taking into account the financial or marital status of the parties and other noteworthy circumstances.

Thus, the more affluent parent pays child support in order to maintain a normal level of maintenance for the child.

This position is also supported by the Supreme Court of the Russian Federation. The Ruling of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated August 30, 2016 No. 5-KG16-100 states that when resolving disputes about the recovery of child support in the case when each of the parents has a child, the plaintiff parent is obliged to provide evidence of the fact that he is less well off compared to the respondent parent. In this case, the court takes into account the income of each of the parents, their financial and marital status.

You can also read the article posted on our website for details on child support.

Thank you:

Similar questions

My daughter had a daughter in a civil marriage. The father of the child did not appear at the registry office when issuing a birth certificate. How can I get child support from him?

The father of the child did not appear at the registry office when issuing a birth certificate. How can I get child support from him?

I pay alimony for the maintenance of my wife, as she does not work, she sits with a young child. However, it turned out that she went to work.

My child is 3 years old. My husband and I have not lived for a long time, I sued for divorce and alimony. The husband does not help the child and is not interested in him.

Cancellation of an annulled court order

Read also

Who is obliged to pay child support?

home

Free legal assistance and legal information for the population

Legal information and legal education of citizens

Alimony obligations

Who is required to pay child support?

1. Parents

In accordance with Article 80 of the Family Code of the Russian Federation, parents are required to support their minor children.

Parents must pay child support

- minor children;

- children left without their care;

- Disabled adult children who need help.

Parents have the right to conclude an agreement on the maintenance of their minor children ( agreement on the payment of alimony ), which must be notarized. The agreement establishes the amount of alimony at the discretion of the parties, but it cannot be less than the amount that can be recovered in court.

If parents do not provide maintenance for their minor children, funds for the maintenance of minor children (alimony) are collected from parents in court order.

In the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents monthly in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other parental income.

In accordance with article 83 of the Family Code of the Russian Federation p in the absence of an agreement between the parents on the payment of alimony for minor children and in cases where the parent obliged to pay alimony has irregular, fluctuating earnings and (or) other income, or if this parent receives earnings and (or) other income in whole or in part in kind or in foreign currency, or if he has no earnings and (or) other income, as well as in other cases, if the recovery of alimony in a share of earnings and (or) other income of the parent is impossible, difficult or materially violates the interests of one of the parties, the court has the right to determine the amount of alimony collected on a monthly basis, in a fixed amount of money or simultaneously in shares (in accordance with Article 81 of this Code) and in a fixed amount of money.

The amount of a fixed amount of money based on is determined by the court from the maximum possible preservation of the child's previous level of his security, taking into account the financial and marital status of the parties and other noteworthy circumstances.

Article 84 of the Family Code of the Russian Federation fixes that alimony for children left without parental care are collected only through the court . The court determines the amount of alimony in the same manner as the amount of alimony for minor children. They are paid to the guardian or custodian of the child, his adoptive parents or transferred to the account of the organization in which the child is (educational, medical organizations, social service organizations, etc.).

In accordance with article 85 of the Family Code of the Russian Federation, alimony in favor of disabled adult children who need assistance can be obtained on the basis of a notarized child support agreement. In the absence of an agreement, alimony can be collected through the court. In this case, their amount in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied.

In the absence of an agreement, alimony can be collected through the court. In this case, their amount in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied.

2. Able-bodied adult children

In accordance with article 87 of the Family Code of the Russian Federation, able-bodied adult children are required to support their disabled parents who need help. An exception is made by parents deprived of parental rights, to whom children are not obliged to pay alimony.

Alimony can be paid either on the basis of a notarized agreement between parents and children, or on the basis of a court decision. The court sets the amount of alimony in a fixed amount of money , payable monthly, taking into account all the circumstances of the case, including taking into account the financial and marital status of parents and children.

3. Spouses, including former spouses

This issue is regulated by chapter 14 of the Family Code of the Russian Federation.

Spouses or ex-spouses may enter into an agreement on the payment of alimony, which must be certified by a notary. In this case, the amount of alimony is determined in the agreement at the discretion of the parties.

If such support is refused and there is no agreement between the spouses on the payment of alimony, the right to demand the provision of alimony in court from the other spouse who has the necessary means for this, have:

- disabled needy spouse;

- wife during pregnancy and within three years from the date of birth of a common child;

- a needy spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I.

In accordance with Article 90 of the Family Code of the Russian Federation, the right to demand the provision of alimony in court from a former spouse who has the necessary funds for this has:

- ex-wife during pregnancy and within three years from the date of birth of a common child;

- a needy ex-spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I;

- a disabled needy ex-spouse who became disabled before the dissolution of the marriage or within a year from the date of the dissolution of the marriage;

- a needy ex-spouse who has reached retirement age no later than five years after the dissolution of the marriage, if the spouses have been married for a long time.

In the absence of an agreement between the spouses (former spouses) on the payment of alimony, the amount of alimony collected on the spouse (former spouse) in a judicial proceeding is determined by the court based on the financial and marital status of spouses (former spouses) and other noteworthy interests of the parties in a fixed amount of money payable monthly.

4. Other family members who may be required to pay child support

- able-bodied adult brothers and sisters

In accordance with Article 93 of the Family Code of the Russian Federation, able-bodied adult brothers and sisters may be payers of alimony to the following persons:

- minor brothers and sisters, provided that they do not have the opportunity to receive maintenance from their parents;

- disabled adult brothers and sisters, provided that they are unable to receive maintenance from their able-bodied adult children, spouses (former spouses) or parents.

- grandparents

In accordance with Article 94 of the Family Code of the Russian Federation, the following have the right to receive alimony in court:

- minor grandchildren in need of assistance in case of impossibility to receive maintenance from their parents;

- adult disabled grandchildren in need of assistance, if they cannot receive maintenance from their spouses (former spouses) or from their parents.

- tons able-bodied adult grandchildren

In accordance with Article 95 of the Family Code of the Russian Federation, able-bodied adult grandchildren may be payers of alimony disabled grandparents in need of assistance , provided that the latter are not able to receive maintenance from their adult able-bodied children or spouses.

- t able-bodied adult pupils

In accordance with Article 96 of the Family Code of the Russian Federation, able-bodied adult pupils (except for those who were under guardianship or guardianship, as well as being raised in foster families) may be payers of alimony to disabled persons who carried out the actual upbringing and maintenance of pupils until they reach 18 years of age with provided that they do not have the opportunity to receive maintenance from their adult able-bodied children or from spouses (former spouses).