How to make a child paypal account

PayPal Setup for Kids ⋆ How Kids Can Earn Money

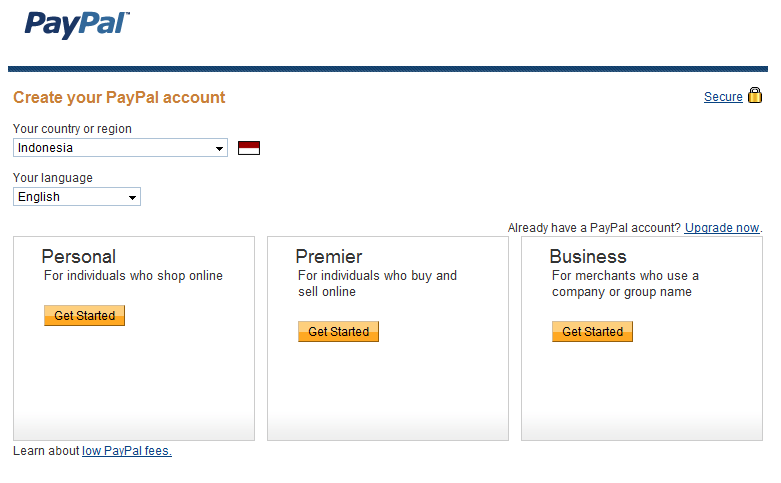

Setting up Paypal is nearly a MUST for any kids who want to earn money online. Generally money is transferred through payment processing sites such as Paypal when dealing with cyber purchases. Kids need to have a payment processor if they are working online. There is one small obstacle to this though: parents have to help you. Unless you’re 18, you cannot create your own Paypal account, as per the PayPal user agreement. This is not a huge issue though!

Getting Your Parents to Help Setup Your Kid’s Paypal Account

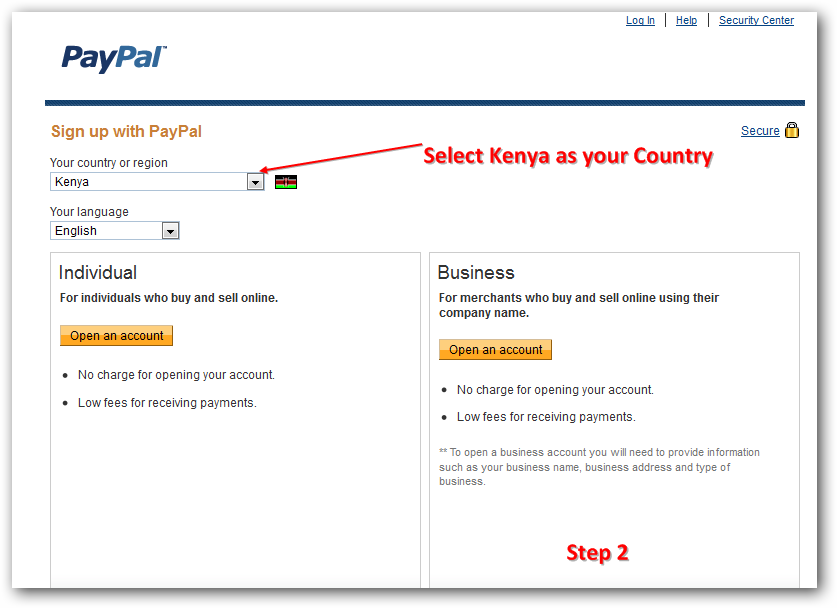

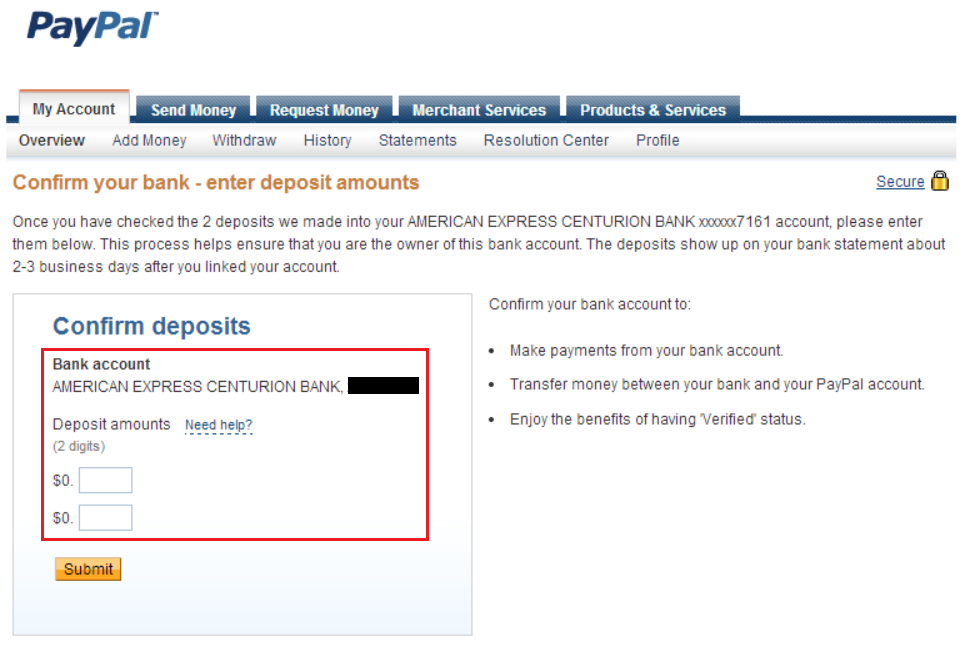

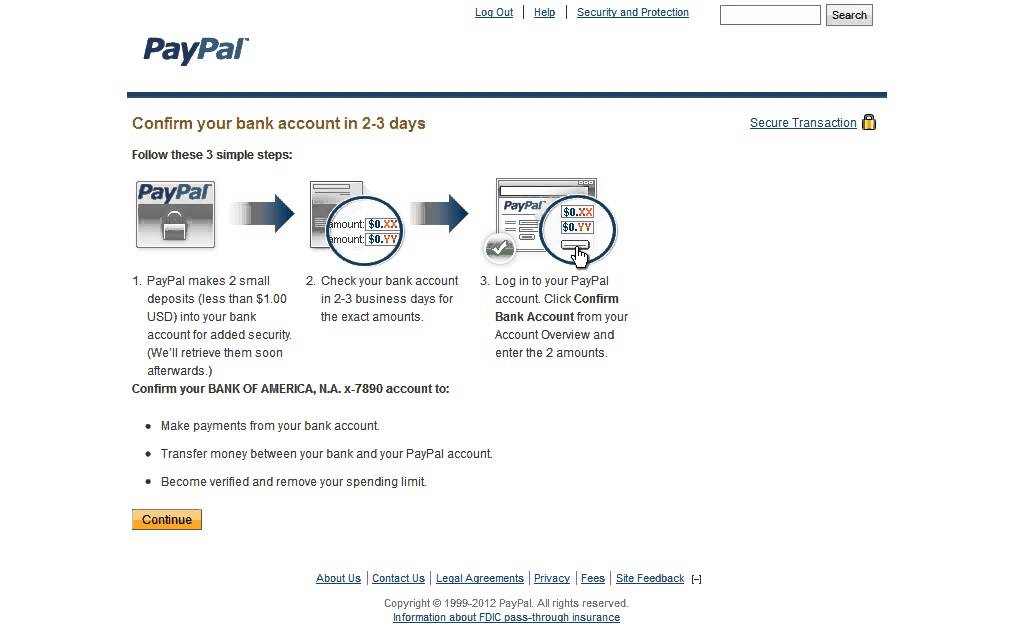

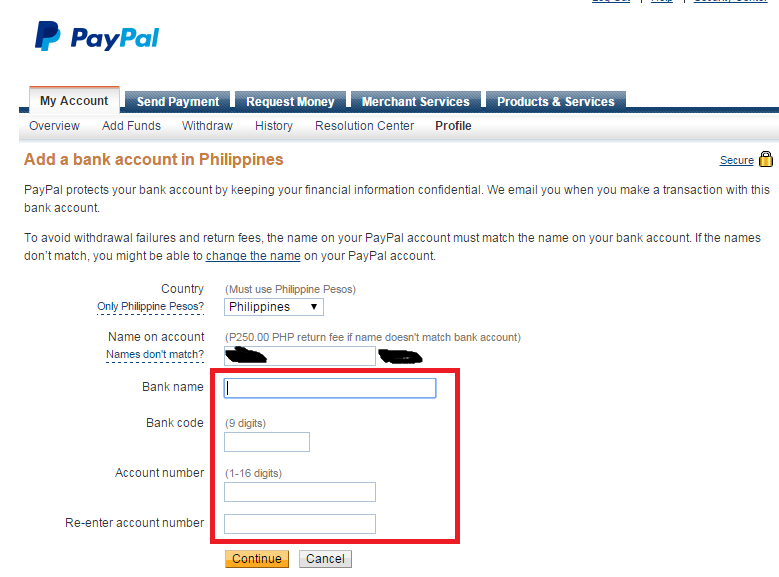

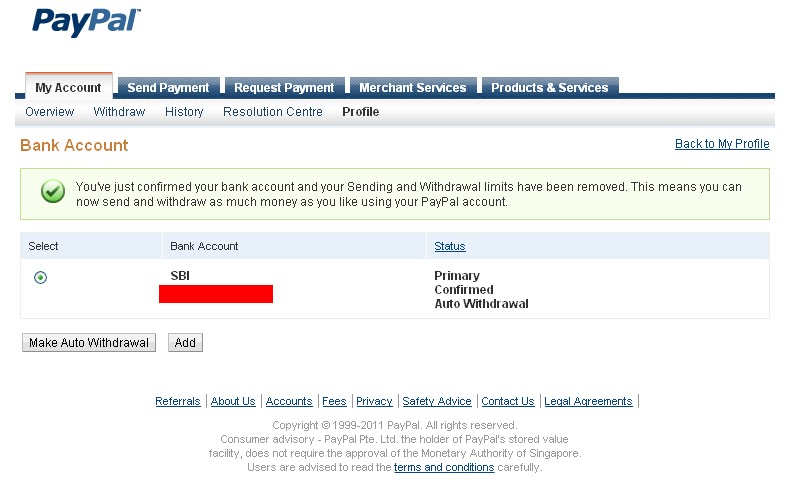

Once you have the need to get a Paypal account, you will need to get your parents to sign up. They will need to have a bank account as well, because this is how you get your money from Paypal. It takes about 3 days to wire the funds to the bank in order to use them. Your parents can report all of this income themselves, and simply monitor your account activity on Paypal as needed.

What Can Kids Do with Paypal?

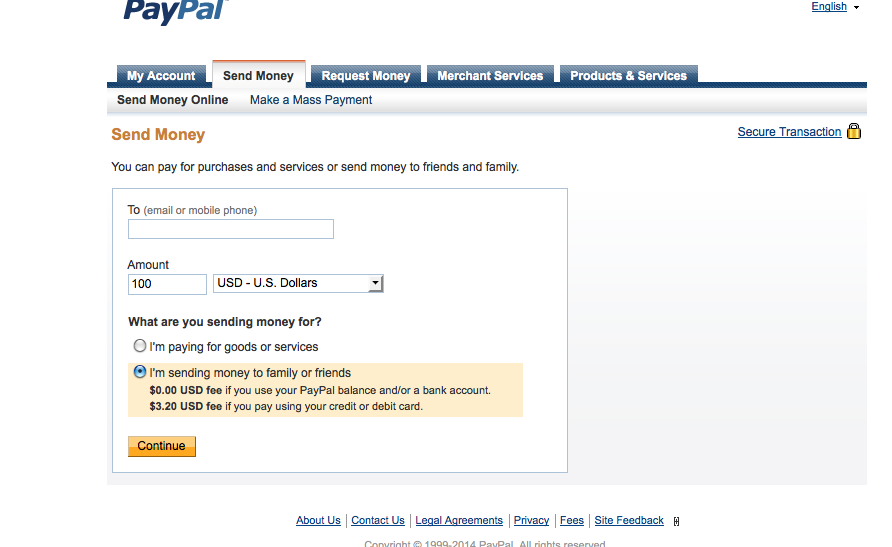

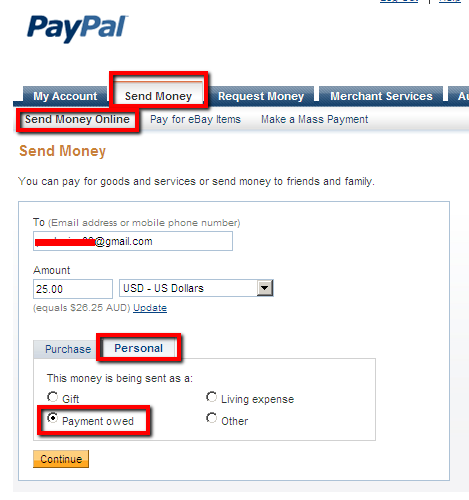

If you are the only one using the Paypal account, you can use your funds as you wish. Of course you will need to receive your earnings first in order to spend money. You can wire the money into the bank account, you can purchase that awesome iPhone 6 or the newest Samsung Galaxy, maybe you want a new video game for your Playstation 3 or for your X-Box One, or you could even reinvest the money and pay for services online. The options are limitless!

Using PayPal with Ebay

If you intend on selling things on Ebay, you will definitely need a payment processor account. Ebay will charge fees for the items you sell, from movies and books to decor and pet supplies. Everything will have a fee based upon the sale price. Ebay seriously comes in handy though as you have access to one of the biggest masses of online consumers that has ever existed. It’s a powerful platform, and no kid should underestimate its ability.

What Else Needs Paypal?

For the most part, you will find that many buyers tend to send payment via Paypal. End consumers (individuals like you and me) will almost always use this service to pay people for goods and services. While kids will need to use their parents’ account, anyone over the age of 18 can quickly and easily use this service to transfer money between themselves and others, as well as between their bank accounts and the account that they have on Paypal. The service is well advertised, trusted by hundreds of millions of people, and it has been around for quite a long time. Therefore, you can expect most people to pay through this avenue. Checks and money orders? Those days are almost long gone as it takes days to successfully transfer a payment that way; this service provider makes it instantaneous. It’s also a great way for people to make impulse buys online, especially for that cool, handcrafted pair of earrings or repurposed clothing that you have made to give to their family members for Christmas!

While kids will need to use their parents’ account, anyone over the age of 18 can quickly and easily use this service to transfer money between themselves and others, as well as between their bank accounts and the account that they have on Paypal. The service is well advertised, trusted by hundreds of millions of people, and it has been around for quite a long time. Therefore, you can expect most people to pay through this avenue. Checks and money orders? Those days are almost long gone as it takes days to successfully transfer a payment that way; this service provider makes it instantaneous. It’s also a great way for people to make impulse buys online, especially for that cool, handcrafted pair of earrings or repurposed clothing that you have made to give to their family members for Christmas!

The Best PayPal Alternatives for Teenagers Under 18

Teaching children to be financially responsible isn't always easy when sites like PayPal ban those under 18 years old from using their services. Thankfully, there are many financial alternatives to PayPal, which you can use to teach kids about saving and managing money.

Thankfully, there are many financial alternatives to PayPal, which you can use to teach kids about saving and managing money.

Some of the best PayPal alternatives for minors give you “custodial” control, meaning that you can monitor how your kids are doing and step in if you see them getting into trouble. For starters, consider the following options.

Why Does PayPal Have an Age Limit?

A few years ago, it was possible to set up a PayPal Student account, but that service was discontinued.

According to PayPal's website, individuals under 18 years old are not allowed to open an account, regardless of their location:

"If you are an individual, you must be a resident of one of the countries/regions listed on the PayPal Worldwide page and at least 18 years old, or the age of majority in your country/region of residence to open a PayPal account and use the PayPal services."

But PayPal isn't your only option. Feel free to learn how to use PayPal in full, but there are several other banks and financial services that get around this age restriction by offering teen accounts linked to parental custodial accounts. Some of them are free and require no minimum balance.

Some of them are free and require no minimum balance.

Online Banking Accounts for Teens

Opening a checking or savings account for your kids can be a good opportunity to teach them about budgeting and other aspects of personal finance. After all, they don't get the chance to learn these things in school.

If they have their own bank accounts, they might find it easier to save for the future and set financial goals. Your children will also learn about the value of maximizing their savings.

Since you can no longer set up a PayPal Student account, you'll need to look for alternative options. One solution is to open a custodial account and let them take ownership of it when they turn 18. Meanwhile, you can keep an eye on their account activity and help them make sound decisions.

Capital One Money Teen Checking Account

Capital One Money is a zero-fee checking account designed for children and teens ages eight to 18. It requires no minimum balance and includes free online and mobile banking.

Here's what you'll get when you register for an account:

- No monthly fees.

- A free Mastercard debit card.

- A joint account with mobile app login credentials for parents and kids.

- Parental controls.

- Deposit checks with the Capital One Mobile app.

- Access to over 70,000 fee-free ATMs across the country.

- Accounts earn interest (0.10 percent annual percentage yield).

An actual bank account puts your teen on the path of understanding how banking works, how interest accumulates as he saves money, and how to manage his finances from month to month.

Since the account includes parental controls, you can always step in and assist your teen. There is also the option to transfer money in and out of his account from your own bank account.

Other Online Banking Alternatives

Capital One isn't the only company to get into the teen banking game. A few other banks have stepped up to help out with student banking accounts.

- Bank of America Student Banking: No monthly maintenance fees (for eligible students), online/mobile banking, zero liability guarantee, and the ability to make mobile check deposits.

- Alliant: Available for kids ages 13 to 17 years old, start a joint account for your child with no minimum balance, no monthly fees, online/mobile banking, and interest rates more than twice that of other teen bank accounts.

- Chase High School Checking: A “high school checking” account is available for students 13- to 17 years old, without a monthly fee if linked to a parent's bank account. Chase tends to have ATM and overdraft fees, but this is a good opportunity to teach your teen how to avoid such “big bank” fees.

- Huntington Bank: Children and teens under 18 years old can register for a checking account as long as someone over 18 is willing to open it as a co-signer or as a joining account. Huntington Bank doesn't provide account details online, so make sure to read the fine print when you sign up.

- Wells Fargo Clear Access Banking: If your teen is between 13 and 16 years old, you can open a checking account in his name. This option requires a $25 minimum deposit and a $5 monthly fee. Account holders can make mobile deposits, withdraw cash from over 13,000 fee-free ATMs nationwide, and pay their bills online. Your teen will also get a contactless debit card with zero liability protection.

National banks are not the only ones offering student accounts. Your local bank or credit union may have some options for students as well. Take a look at their website or contact them by phone to see what's available.

Prepaid Debit Cards for Teenagers

A prepaid debit card is one of the best PayPal alternatives for minors. With this option, your teen will have access to a limited amount of money for daily expenses or emergencies, Plus, you won't have to go through the hassle of opening a bank account.

You can stop at any pharmacy or supermarket and purchase a refillable prepaid card for your child to use, one of many ways to give money as a gift.

1. American Express: Bluebird

Bluebird by American Express is a hybrid between a bank account and a credit card.

The cool thing about it is that each “family account” includes up to four prepaid cards for other family members. You can quickly transfer money to those cards from your central account, set spending limits, and monitor your teen's account activity.

It's probably one of the best solutions for parents who want to dole out allowances to children and get them started learning how to use credit cards responsibly.

Download: Bluebird for Android | iOS (Free)

2. MyVanilla Card

An even simpler solution is to get a Vanilla prepaid card, which can be found at Walmart and other supermarkets.

Teenagers under 18 years old can't purchase these cards. However, parents need to purchase the card, sign the agreement, and then add the minor as a registered user.

Some features of the MyVanilla Card include:

- A mobile app to check and manage your account.

- Choose between Visa and Mastercard.

- Make free direct deposits.

- Transfer funds between MyVanilla Card accounts.

- No credit check required.

- Visa cards have zero liability protection for unauthorized transactions.

Note that this service isn't available in Vermont. The standard ATM fee in other states is $1.95 per transaction. If your teen uses the card when traveling abroad, they'll pay $4.95 per cash withdrawal.

3. FamZoo Family Accounts

One of the easiest ways to manage multiple accounts via a single-family management platform is FamZoo.

This service is like Bluebird on steroids. It offers everything the American Express Bluebird account offers, including a prepaid card for each child. However, what it lacks are most of the fees you'll find when you sign up for a student account with any of the big banks.

The best feature here is automation. You can set up allowance amounts for each child and then have the funds automatically transferred to their cards at whatever interval you want.

Users can also set savings goals, request money, split payments, and create separate accounts for different purposes—all from one platform. For example, you could encourage your kids to set up a savings account and another one for donations.

You can even connect scheduled chores and jobs to payments or penalties. This is a great way to teach kids about the relationship between work and income.

If you're a really strict parent, you can set up “billing”, where you charge your kids for their share of the mobile phone bill and other expenses!

4. Google Pay

Google Pay (formerly Google Wallet but now combined with Android Pay) is an interesting alternative to PayPal.

It's available for any teenager over 13 as long as a parent provides permission and accepts the terms. After that, parents can connect a bank or credit card to the Google Pay account to transfer money into it.

There are no bells and whistles. It's probably the simplest, most inexpensive way to give your kids a place to save and spend their money. Google Pay users can easily split their expenses with friends or family members, transfer money online, and make group payments.

Google Pay users can easily split their expenses with friends or family members, transfer money online, and make group payments.

You can even save your other credit or debit cards in one place for easy access. The great news is that many retailers nowadays accept Google Pay without the need for a credit card.

Download: Google Pay for Android | iOS (Free)

Teaching Children Financial Responsibility

It isn't easy to learn financial responsibility. Unfortunately, schools don't teach it. So, it's up to parents and families to give kids a solid financial education. Opening a checking or savings account for your child can be a good starting point.

And if they want to learn more, there are several ways kids can earn money online. This is a great first step toward building good financial health.

How to transfer funds for the Children's Hospice. CloudPayments and PayPal

November 29, 2017

Dear friends, we want to tell you how to help the Children's Hospice using a bank card.

We know that the most convenient way for many people to transfer money is a card-to-card transfer from Sberbank.

Unfortunately, we do not always have the opportunity to indicate the card number of this bank.

Without your help, we definitely can't do it. The Children's Hospice exists only thanks to your donations. nine0007 That is why we kindly ask you to take a minute of your time and look at the instructions on how to transfer funds for hospice from a bank card.

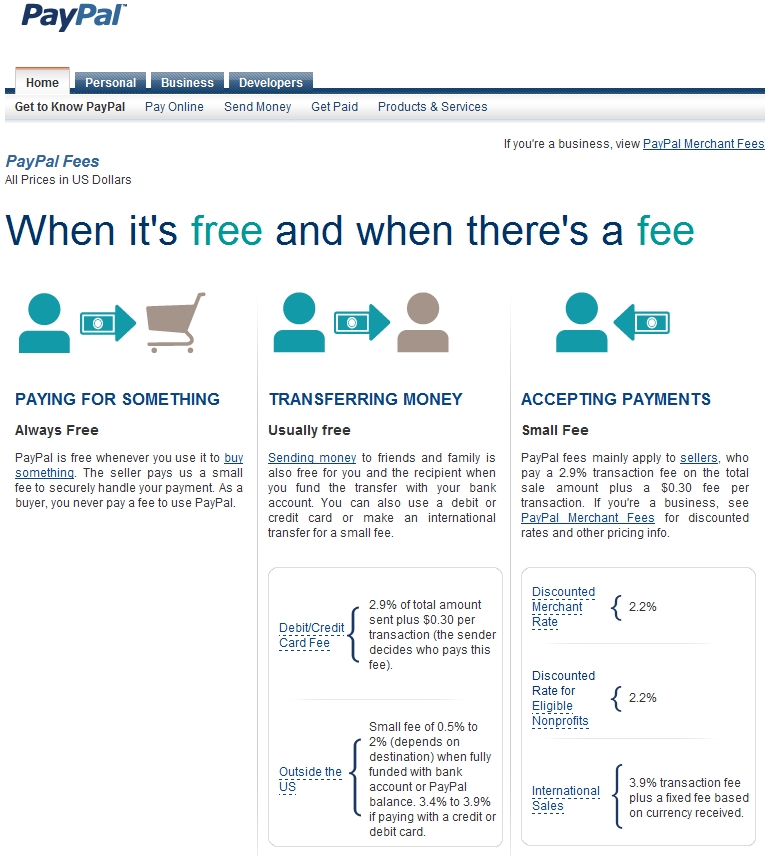

We use the CloudPayments system, it is safe and convenient to use it.

To transfer money from the card, you need:

1. Go to the page http://mayak.help/cloudpayments/ (On the website, this is a red button on the top left "Help right now" -> "Transfer from a bank card" )

2. Select the transfer amount or fill in field “Other amount”.

3. It is obligatory to fill in the field "E-mail" and check the box that you agree with the offer agreement. Without this, the payment will not go through.

Without this, the payment will not go through.

4. Thanks to our partner CloudPayments , we have implemented regular payments in favor of the hospice. Regular payments are when the payment intermediary debits funds from the card on a monthly basis for the amount of the first transfer with the obligatory consent of the donor. If you are ready to transfer a certain amount of donations every month, then select "Monthly" , if not, then "One time" . If you decide to cancel your subscription, you can do so by clicking on the link https://my.cloudpayments.ru/ru/Unsubscribe (the same link is on the Children's Hospice payment page)

opens payment widget CloudPayments:

6. As usual, you will be asked to enter funny details: card number, expiration date, First name Last name, CVV code, e-mail field will be filled in automatically. nine0007 7. After pressing the button "Pay" , if 3ds authorization is installed on your card (transaction confirmation via sms or bank application), a bank page will be displayed with a one-time password.

8. After entering the password, the payment is processed and funds are debited.

Currently, the payment intermediary that processes card transfers for the Children's Hospice is CloudPayments. A feature of CloudPayments is a payment widget that we have placed on the Hospice website. The details that you enter on the widget form are transferred directly to processing via a secure TLS channel. nine0003

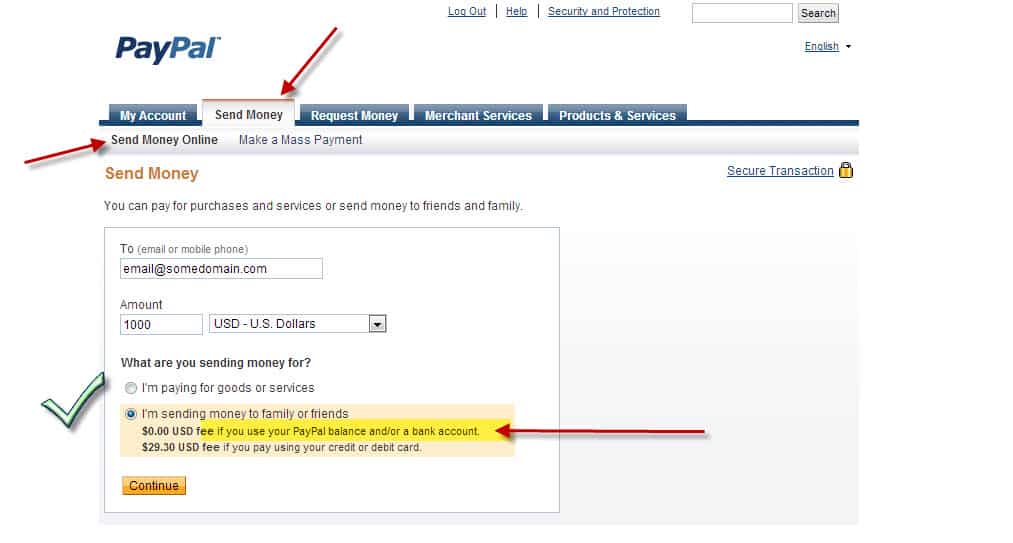

Instructions for making donations using the PayPal payment instrument

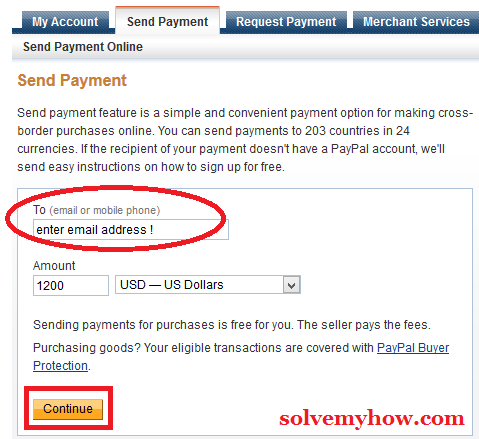

PayPal" ), enter the donation amount.

If you would like to subscribe to regular donations to the hospice, please check the box “Monthly” .

2. Press button "Help with PayPal" .

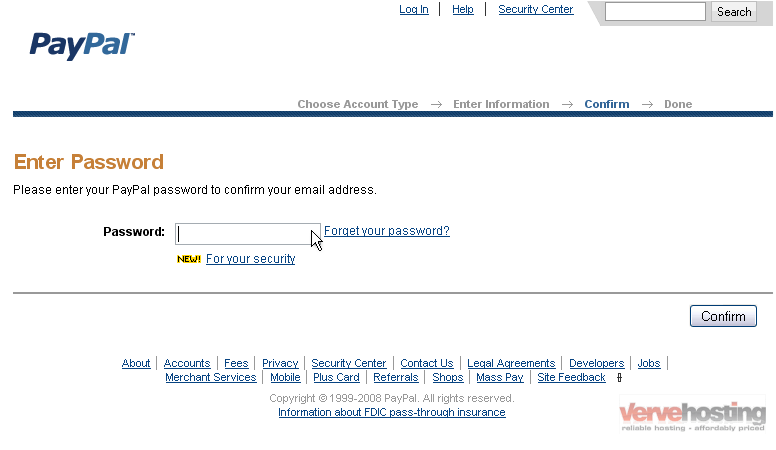

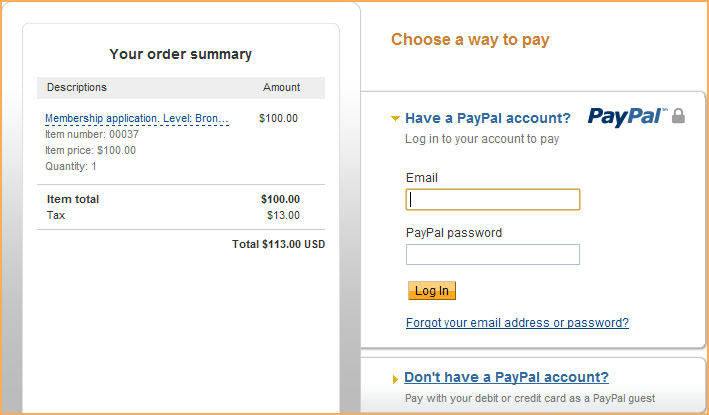

3. You will be redirected to our partner site PayPal to complete your payment. If you have a PayPal account, then click "Login" , enter your PayPal login and password, complete your donation.

If there is no account, then when you go to the page, you can go through a simple registration by clicking on the link "Pay with a bank card" .

After registration, you will be able to make a donation. nine0003

Even small, regular donations mean a lot for the operation of the Children's Hospice.

Thank you!

For the rest of my life

Moscow Hospice

November 28, 2017

November 28, 2017

Generous Tuesday. About good people

Moscow Hospice

November 28, 2017

November 28, 2017

Can a parent create a PayPal account for my child? – Wiki Reviews

PayPal launched a student program that allows parents to create an additional account for their children that they can transfer money and control. Parents transfer funds to the sub-account when necessary, either at a time or periodically, while children can only spend what is on it.

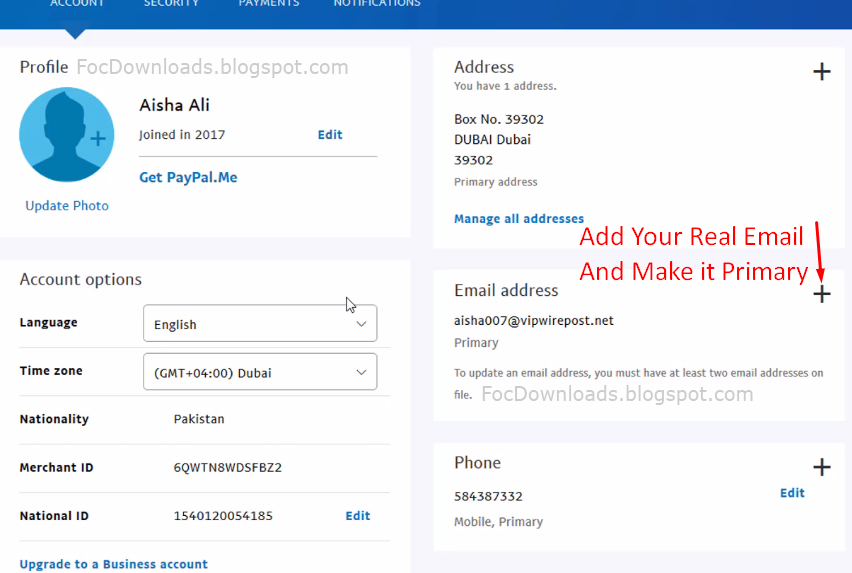

How does PayPal know your age? You should be able to update the date of birth registered in your PayPal account by clicking on the "Profile" option on your account overview page. From here, you can click on the "Business Information" icon under the "Account Information" column. nine0003

From here, you can click on the "Business Information" icon under the "Account Information" column. nine0003

Can a 12-year-old child have a bank account?

Underage children are not legally allowed to open a savings account . They need a parent or guardian to open a custodial or joint account. The custody account is owned by the child but managed by the parent until the child is 18... And just like with your money, make sure your child's account is protected by the FDIC.

Can I get a PayPal account at 16? nine0117

Why does PayPal have an age limit? A few years ago it was possible to create a PayPal Student account, but this service has been discontinued. According to the PayPal website, under 18s are not allowed to open a account, no matter where they are:… But PayPal isn't the only option.

How can I get money with PayPal if I'm under 18?

No, they don't . Since the "account" was created illegally, the funds are equal, so BEFORE this person is 18 years old, they can legally open a PayPal account and transfer funds from their other restricted account. nine0003

nine0003

Can I use a fake birth date with PayPal?

Sorry, PayPal doesn't have a special option to change your date of birth. . One way to submit the correct documents and correct the mistake is to use the name change page. … This also works for changing your date of birth; then you just wait for PayPal to verify the information.

What happens if you put a fake birthday on PayPal? nine0006

Paypal does not allow account holders under the age of 18. PayPal asks for a date of birth when registering so you can create a PayPal account with false information. the account will be subject to sending and receiving limits .

What happens if I enter my age in PayPal?

Is it illegal to create a PayPal account if you are under 18? Answer: No, this is NOT illegal, but against their policies and rules. nine0106 . Registering with PayPal is NOT against your bank's policy.

How can I get a job at 12?

Jobs that 12 year olds can get

- Newspaper delivery.

Children as young as 11 can start delivering newspapers with a work permit. ...

Children as young as 11 can start delivering newspapers with a work permit. ... - Babysitting. Your 12 year old can also babysit for part-time work under child labor laws.

- Recreational work. ... nine0164

- Making evergreen wreaths. ...

- I work in a family business.

Can I get a debit card for my child?

While regulations vary by financial institution, some do not allow minors to have debit cards in their own name. to age 16 . Others prefer to offer them to children 13 and younger. But even if you can get a card from your current bank, you don't want to just give your child a debit card. nine0003

Should a 13 year old have a debit card?

While many debit cards are only available to teens 13 and over , many children's debit cards are available to children aged six and over. Regardless of the age limit for a child debit card, in the US, a child under the age of 18 must have a parent or guardian who is (at least) 18 years old in the account.

How do I verify if PayPal is under 18?

Bottom line: If you are asked to verify , simply send a bank statement or proof of address to . You can also call them to make things easier, but just make sure you are at least puberty so you can sound like someone over 18 haha.

Do you have to be 18 years old to use PayPal?

This only applies to US PayPal accounts. If you are an individual, you must be a resident of the United States or one of its territories and At least 18 years of age , or the age of majority in your state of residence, to open a US PayPal account and use PayPal services.

Can I get a cash application for under 18s?

Can a child have the Cash app? According to the rules of the Cash App, minors cannot have their own Cash App account . If a minor wishes to use the Cash app, they must do so through their parent's account, although this is not recommended. nine0003

nine0003

Is it possible to withdraw money before the age of 18?

You You will need permission from your parent or legal guardian to withdraw money if you are under 18 years of age.

Can you change your age with PayPal?

Sorry, PayPal doesn't have a special option to change your date of birth. . One way to submit the correct documents and correct the mistake is to use the name change page. … This also works for changing your date of birth; then you just wait for PayPal to verify the information. nine0003

Do you have to be 18 to use PayPal?

This only applies to US PayPal accounts. If you are an individual, you must be a resident of the United States or one of its territories and At least 18 years of age , or the age of majority in your state of residence, to open a US PayPal account and use PayPal services.

Is there a student at PayPal?

If the student is over 18, we invite them to register a PayPal account so they can enjoy the benefits that PayPal offers, such as sending, receiving, and spending money online and in stores. We appreciate your business and apologize for any inconvenience caused.

We appreciate your business and apologize for any inconvenience caused.

Do I have to be 18 years old to use PayPal?

This only applies to US PayPal accounts. If you are an individual, you must be a resident of the United States or one of its territories and At least 18 years of age , or the age of majority in your state of residence, to open a US PayPal account and use PayPal services. nine0003

Is it illegal to lie about your age?

No. This is not legal . And it's not moral.

Can you lie about your age?

You can say whatever you want, they reason, because you shouldn't have asked that question at all. Lying about your age is considered socially acceptable as declaring the fact that your age is no one's business.

What job can an 11 year old have? nine0006

Best jobs for children under 13

- out of 10.

Nanny. Teenagers and teenagers can earn money by babysitting younger children for neighbors and friends. ...

Nanny. Teenagers and teenagers can earn money by babysitting younger children for neighbors and friends. ... - out of 10. Nanny for pets. This is often a great starter job for young children. ...

- of 10. Lemonade stand. ...

- of 10. Mowing the lawn. ...

- 10. Yard work. ...

- out of 10. Dog walking. ...

- out of 10. Paper route. ...

- out of 10. Operating retail.

Can children aged 12 work at McDonald's?

Depending on each store's policy, the minimum age to work at McDonald's is 14 but what kind of jobs can teenagers apply for at McDonald's? Brigade members are divided into kitchen brigade, counter brigade and maintenance brigade. The minimum age is usually 14 years old.

What job can 9 geta year old teenager?

Doing housework on welfare

Age-appropriate chores around the house may include helping with laundry, hauling trash cans to the curb to pick them up , or washing the family car.