How to get proof of address for a child

What is a Proof of Address and how can you get one?

Opening a bank account is normally a straightforward process.

The entire application can be sorted in a day as long as you make sure to bring all the right documentation with you.

Usually, it begins with a piece of government-issued identification, followed by a proof of address to confirm where you live.

There are different types of valid documents you can use as proof of address; these vary depending on which country you reside in and which bank you are applying for an account with.

Not procuring the right document for your application can delay getting your account up and running.

Read on to find out more about the different types of documents that can be used as proof of address.

What is proof of address?

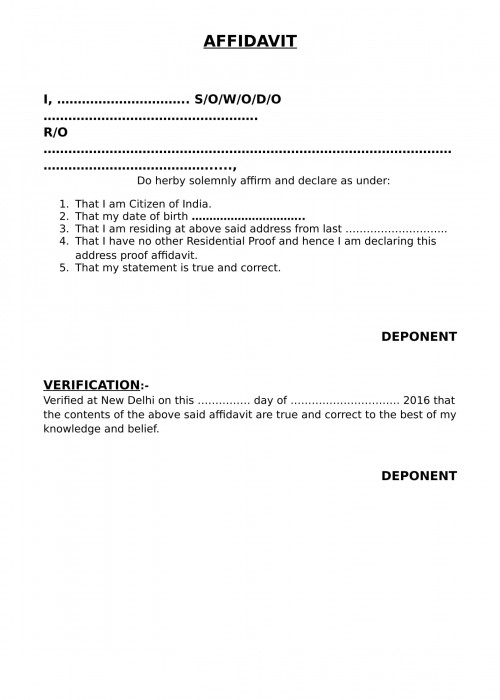

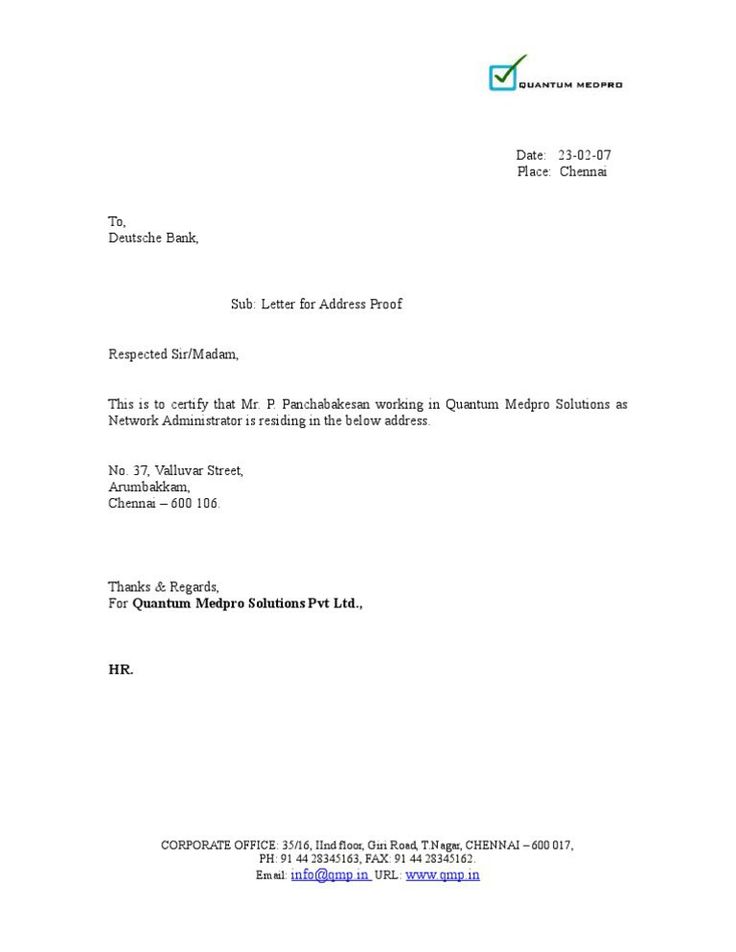

The term proof of address is pretty self-explanatory: refers to a document that verifies where you live.

Also known as proof of residence, it is required by banks as a security measure to make sure that you are not lying about where you live.

They essentially want to be sure that they are able to send communications to you via regular post and be able to find you if necessary.

Certain criteria are essential to make sure that your proof of address is valid and will be accepted by your bank:

- It should be issued in your name and match your government-issued identification

- The proof of address must contain your current residential address

- The document needs to be sent by a recognized authority and shows their logo, name, and information

- Your proof of address needs to be clearly dated. Generally, banks will request that the document provided is dated within the last three months, but this rule can differ depending on the bank or the type of document you are submitting.

This system isn’t flawless, someone could produce this document and not be living where they say they are.

In a bid to minimize fraud, banks will sometimes ask for two different pieces of proof of residence.

In a similar way, someone living at the correct address may not have their name on any document.

This will be the case if they are a child or dependent partner.

But worry not as there are ways around this, we discuss solutions further below.

What is accepted as proof of address?

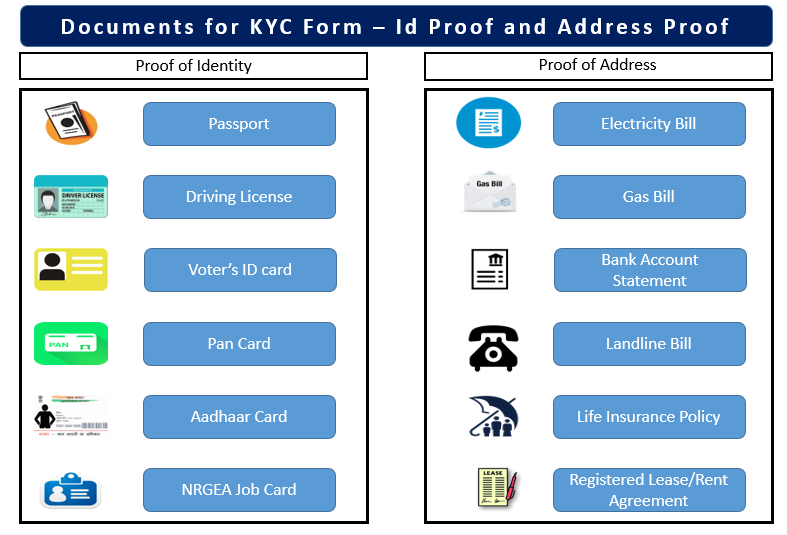

Proof of address can be one of the following documents:

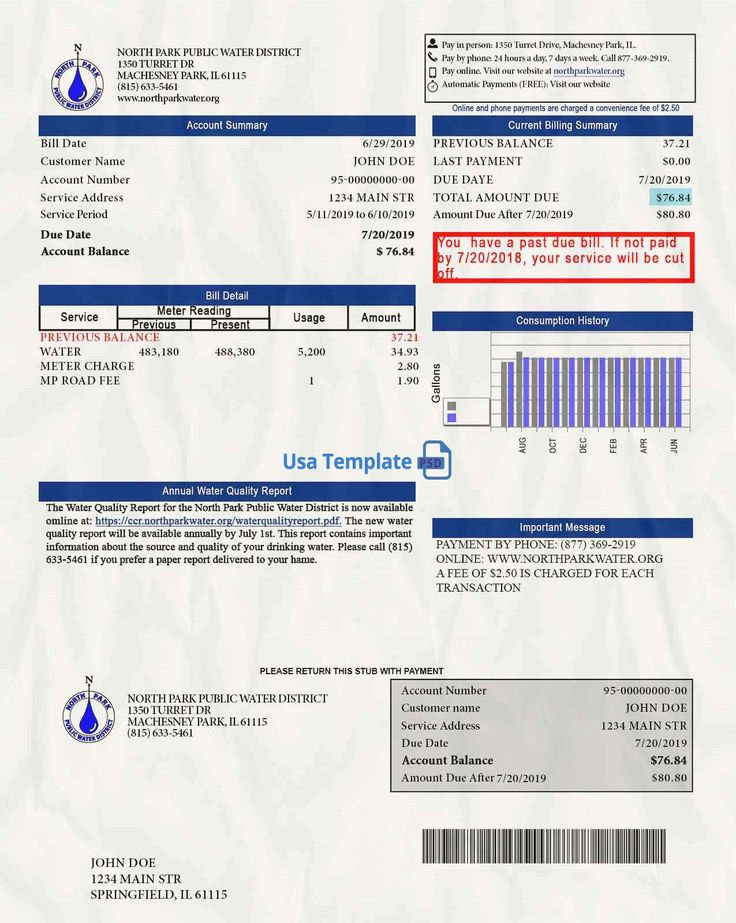

- Water, electricity, gas, telephone, or Internet bill

- Credit card bill or statement

- Bank statement

- Bank reference letter

- Mortgage statement or contract

- Letter issued by a public authority (e.g. a courthouse)

- Company payslip

- Car or home insurance policy

- Car registration

- Authorized change of address form

- Letter of employment

- Official letter from an educational institution

- Municipality bill or government tax letter

- Driver’s license

- Residence permit

- Lease agreement for your residence

Each bank will have a specific list of documents and rules to validate proof of address.

Check with your local branch before applying for your bank account to get the right document ready.

We also recommend looking out for ambiguous rules!

For example, when a bank says they accept utility bills as proof of address they may have certain stipulations over what type of utility bill is valid.

What is not an acceptable document for proof of address?

It is always advisable to check with your local bank to get detailed information on which documents are valid and the rules they follow to authorize proof of address.

However, there are some commonly followed rules that you should keep in mind:

- Your ID can only be used to verify your identity. Even if it contains your address, it will not be accepted as proof of address.

- Any document that is too old will probably not make the cut!

- Bring originals, not copies! Banks need to check the authenticity of documents before approving them.

Generally, any document that is not listed on the bank’s official list of required documents will be rejected.

Therefore, it is always a good idea to check with your local branch in advance so that you are able to prepare the right documentation and get your bank account up and running as quickly as possible!

If you are still having doubts, turn up to the bank with several documents so the banking official can choose for you.

This will prevent you from having to delay your application and return to your bank branch a second time to finish off the process.

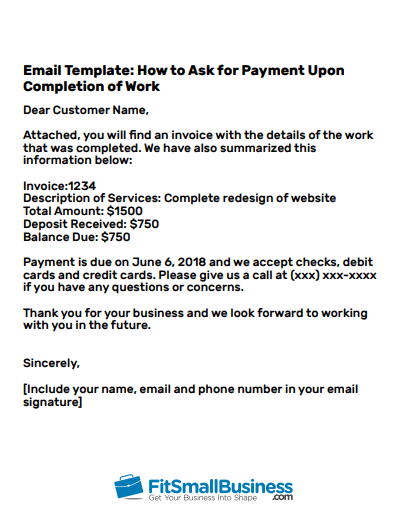

How to find valid proof of address?

Depending on your current situation there are different courses of action you can take to find an appropriate proof of address.

Setting #1: Bills arriving at your home are in your name

In this case, finding a valid proof of address is simple!

It is very probable that you already have some form of proof of address lying around your home, you just don’t know it yet!

First things first have a browse through the pile of mail sitting in your mailbox.

You are likely to find:

- A recent bank or credit card statement

- Various utility bills

- Your payslips

Any one of these documents will do, just be sure to bring the original copy to the bank when applying for your bank account!

Setting #2: Bills arriving at your home are not in your name or you are unemployed

If you find yourself in this situation then worry not, there are other documents you can source that will work just as well

We recommend digging out your lease agreement or finding a recent insurance policy taken out in your name.

Another method is to get your name on a mobile phone bill.

Visit your local provider to take out a basic phone plan.

Be sure to register the contract at the correct address.

You will receive a bill or service contract from the service provider within a month of registering the plan, with your full name and address on it.

Some banks will accept a document in a relative’s name as long as you can prove your family relation.

It’s worth checking with your local bank if they will authorize this as a valid proof of address.

Setting #3: You’ve gone paperless, you need to print online!

If all else fails, you can get hold of a proof of address online through a service or company you already have a history with.

Before doing so, we advise you to check with your bank if this method is accepted.

Once you have the green light from your bank, contact the right authority to get hold of a copy and then simply print it off to present to your bank.

Alternatively, you can also make a request for a paper copy online and then wait for it to arrive at your doorstep before going ahead with your application.

Getting your hands on a proof of address can seem tricky but as long as you actually live where you say you do then it will be possible to get validated by your bank!

Should you happen to be located in Hong Kong, check out our recommendations on how to get a proof of address, curated specifically for Hong Kong residents. If you live in the UK, check out this article instead. And if you're in Singapore, read this article.

If you are looking to open a business bank account, then the list of documents required will be different. We go through this list in detail in our guide to opening a business bank account in Hong Kong.

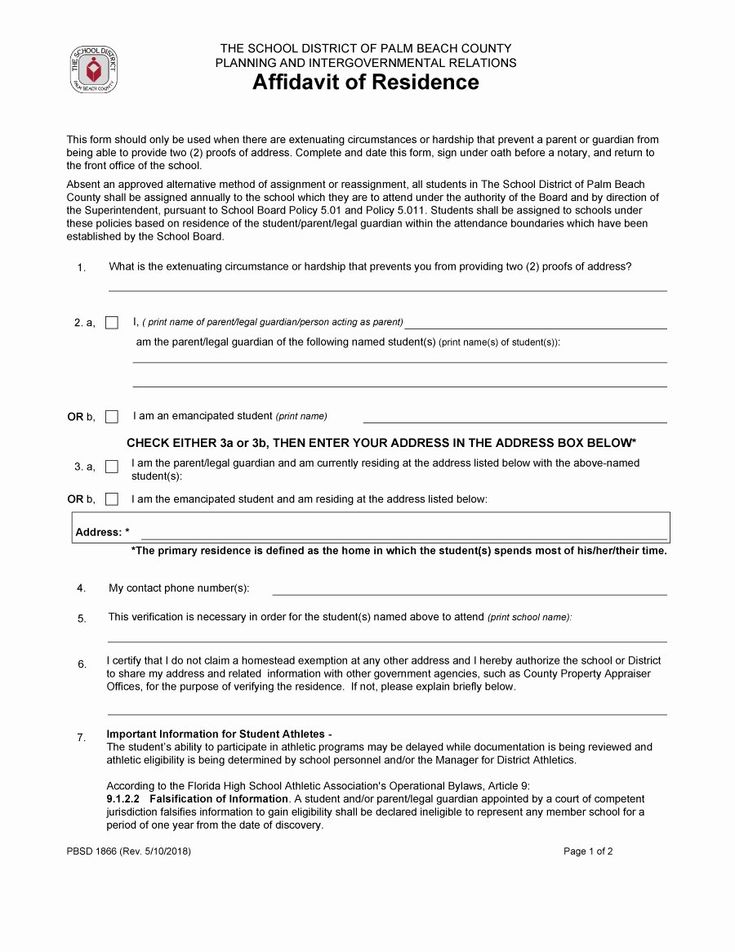

Checklist for dependent relationship

What you need to reply quickly and completely to your letter using our Respond to Department Notice online service:

- a digital copy—scanned or uploaded from your phone—of the documentation below, and

- an Individual Online Services account.

(Log in or create an account.)

(Log in or create an account.)

For every child or dependent you're claiming a credit for, you must send us:

- proof of your relationship to the child or dependent, and

- proof that the child or dependent lived with you for more than half of the year shown on your letter.

| Proof of relationship | |

|---|---|

| If you’re listed on the child’s birth certificate, include a copy of the birth certificate. | |

| If you're not listed on the child's birth certificate, include documentation showing your relationship to the child or dependent. If you're claiming a credit for your grandchild, send us:

If you're claiming a credit for your niece or nephew, send us:

| |

| If you’re claiming a foster child, include a copy of the decree or other court order naming you as the foster parent. | |

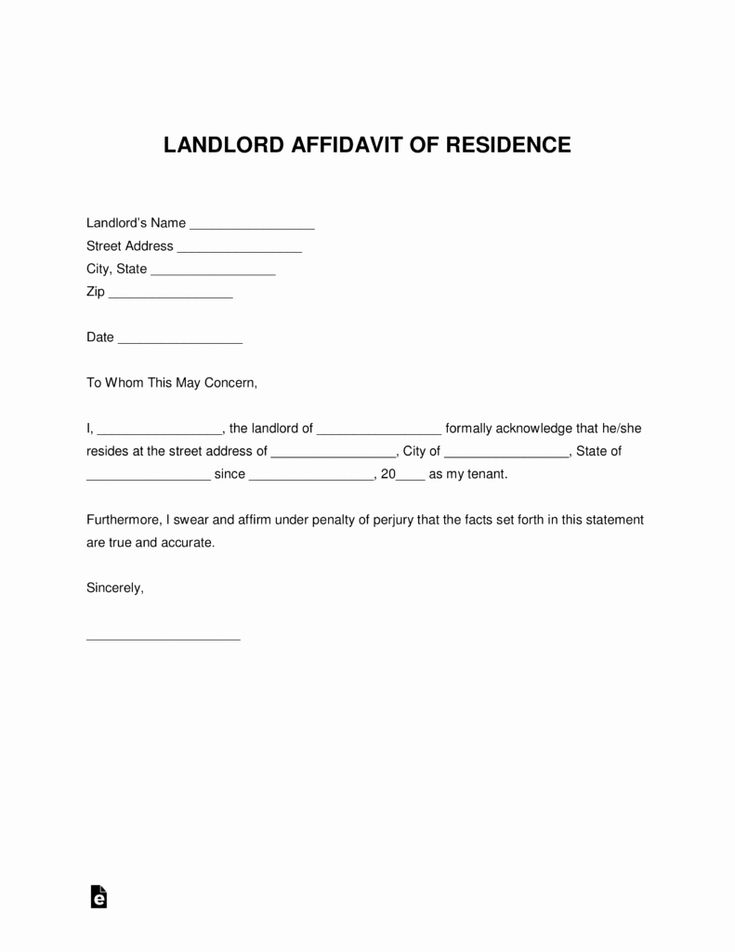

| Proof of residence | |

We will accept a letter from the child's doctor or school—on the doctor’s or school’s letterhead—if it includes:

For example, “From January 1, through June 30, 2016, Amy Jones (b. 10/08/2010) attended Maple Greenleaf school. Her address was 123 Lincoln Park Dr. Note: If the document has the child’s name and your address but not your name, you need to send in another document with your name showing the same address. | |

| Alternate proof of residence | |

| If you are unable to obtain the documents listed above, we may accept the following:

| |

We will accept a statement from a homeless shelter, signed by a case worker, if it includes:

| |

We will accept a copy of the child’s birth certificate if it includes:

| |

| If you changed your address during the tax year on your letter, give us the address of each place you lived during the year. | |

Updated:

Proof of address in England

How to get proof of address in the UK 2021-2022

If you want the UK, you will be asked to verify your identity and place of residence. This means showing a valid photo ID, such as a passport, and another proof of where you live. This is a bank security measure that helps prevent the opening of accounts for criminal purposes.

However, for some customers, getting proof of UK address can be difficult. Especially if you have just arrived and do not yet have accounts or a bank account registered in your name.

In this case, you have several options. Some banks accept a limited set of alternative documents. You may also want to consider creating a multi-currency account with Wise which allows you to choose how you verify your identity.

Send money to and from the UK at the real mid-market exchange rate.

Before we start, a few words.

When you make an international transfer, banks and money transfer providers usually charge you a fee. It is hidden and built into their exchange rate, allowing them to earn additional profits.

VisaSales.Ru

Simply put, address confirmation - is a document proving your identity and current address . As the name suggests, it shows where you currently live.

Banks in the UK require proof of the identity and residence of their customers for security reasons. This means that they ask customers to prove who they are before allowing them to manage a bank account. This process often includes presenting a valid photo ID and proof of address.

This process often includes presenting a valid photo ID and proof of address.

They have a duty to limit the chances of people using accounts for illegal activities. These include fraud, money laundering or crime financing. One way to do this is to make sure that accounts are not opened under false names. Instead, it's important that each account can be associated with an individual.

So, if you're asking yourself, "What can I use as proof of address ?", here's the answer. Each bank has a slightly different process, but in general the steps are the same.

VisaSales.Ru

In addition to a kind of personal identity card, various documents can serve this purpose. Some of them are recent utility bills, mortgage statements, council tax bills, etc. But more on that in a moment.

What documents are considered proof of address in the UK?

Each bank has its own list of acceptable documents and its own set of processes, which may differ slightly from the following. Some will allow copies of documents or printouts from electronic sources .

Some will allow copies of documents or printouts from electronic sources .

For example, a printed copy of your bank statement taken from online banking can do the job. Other banks accept only original documents. But they are united by the fact that these documents must be from official sources.

Different documents have different validity periods . For example, in most cases, a bank or credit card statement or utility bill is only valid if it is 3 to 4 months old. And the council tax or water bill must be issued within the last 12 months².

Before submitting any documents, it is worth checking with a specific bank what their rules for the validity of documents are.

If you are unable to provide any of the documents listed below, most banks advise you to contact them. In these specific cases, they may accept an alternative document. ᐩ²

VisaSales.Ru

Most UK banks accept the following documents as proof of address: ⁴

- Valid UK driving license

- Recent utility bill (gas, electricity, water, or landline)

- Council Tax Bill

- Most recent credit card or bank statement

- A recent statement from the Building Society or Credit Union

- Lease agreement

It is worth calling the bank of your choice to confirm what you need as proof of address in the UK. It is also possible to send the necessary documents instead of bringing them in person. For example, if you are physically unable to go to the bank, here is a list of what NatWest accepts as proof of address by mail : ⁵

It is also possible to send the necessary documents instead of bringing them in person. For example, if you are physically unable to go to the bank, here is a list of what NatWest accepts as proof of address by mail : ⁵

- Council tax bill/letter of demand/tax exemption certificate issued within 12 months

- Bank / Building Society Application

- Letter of eligibility for benefits issued within the last 12 months

- Credit Union Application

- Tax Notices and Correspondence HMRC

- UK utility bill (gas, electricity, water, landline phone)

- UK / EU / EEA Mortgage Statement / Mortgage Correspondence Questions within 12 months

- Lease agreement from local council or housing association issued within 12 months.

VisaSales.Ru

What if you are new to the UK and want to open a bank account?

Getting proof of address can be a bit tricky if you've just arrived here to live, work or study and want the UK. For example, you may not have been in the country long enough to have accounts in your name.

For example, you may not have been in the country long enough to have accounts in your name.

However, some large banks offer a solution. You will need to check what your preferred bank can accept. But some common options include the following ¹⁺²:

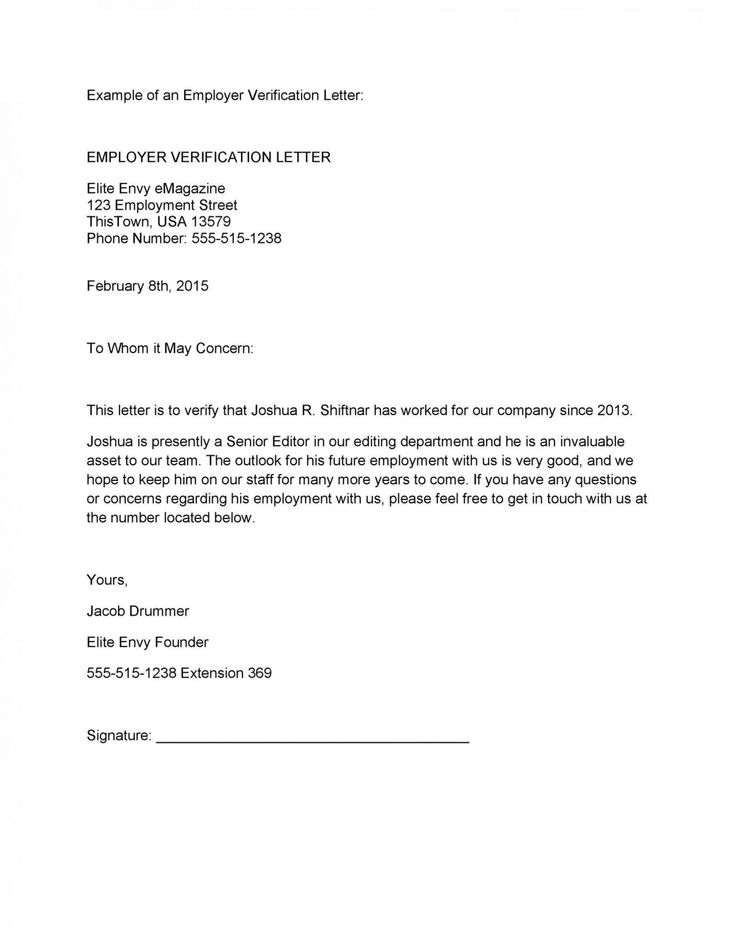

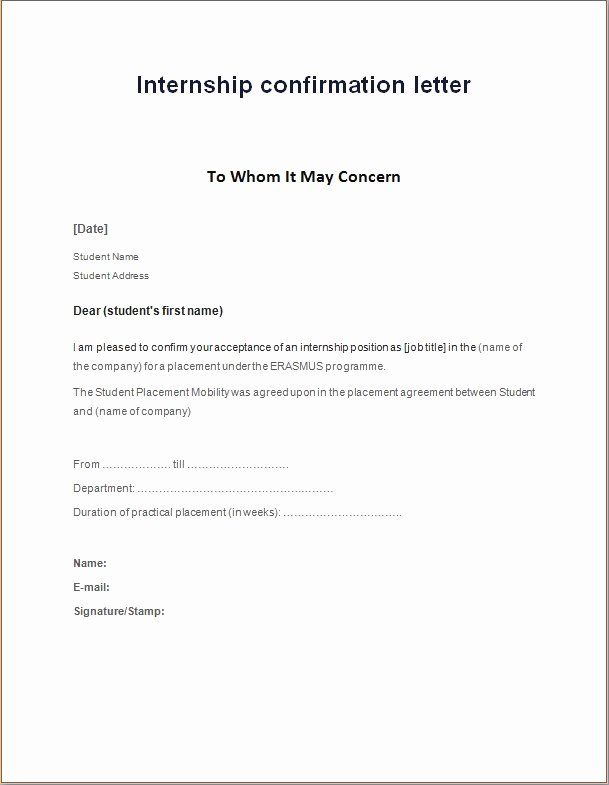

- A letter from your university, college or language school if you are in the UK to study. In this case, your UCAS details or a letter from the Student Loan Company may also be acceptable.

- Letter from your employer confirming your address

- Letter referring to you from an existing customer of this bank who can verify your address.

Some banks, such as Barclays, used to allow EU citizens to open a restricted basic bank account. Due to Brexit the situation has changed and most of these accounts have been closed. So, since recently, when opening a bank account, you must be a resident of the UK. Be sure to check for the latest updates when it comes to this situation.

Are there any banks that do not require proof of address in England?

All major UK banks require proof of address in order to open a bank account. Here's what you need to know to get an address confirmation for these big big banks :

- HSBC address confirmation

- Barclays Address Verification

- Natwest Address Confirmation

- Lloyds Address Confirmation

- Halifax Address Verification

- Santander Address Confirmation

- Countrywide Address Verification

VisaSales.Ru

But, if you can't provide anything from their usual list of acceptable documents, there may still be a solution. Good to know that most banks encourage you to call them to discuss your options.

The Financial Conduct Authority (FCA) regulates banking in the UK. They publish a list of document ideas that the bank may accept depending on the situation.

They publish a list of document ideas that the bank may accept depending on the situation.

This could be a letter from the hostel or shelter, from a probation officer or, for example, confirmation of your status as an asylum seeker. In addition, international students in the UK can use their passports along with their Letters of Acceptance. Full FCA guidance can be found on website .⁷

Wise is an easy and inexpensive way to manage your money in the UK

Another great option is to get a multi-currency account from Wise . This allows you to store money in more than 50 currencies. You can switch between them whenever you want, as well as make and receive payments in different currencies. In addition, you will receive a linked Wise debit card which you can use in 200 countries for all your daily expenses.

There is no subscription fee and you will need to provide proof of identity, such as a copy of your passport, to get started. You can then choose from two address verification options.

You can then choose from two address verification options.

You either provide proof from the standard list of documents or send a selfie in which you have an identity document. This can be a great alternative if you are still waiting for to move to the UK or have not yet received invoices and other documents registered in your name.

So there you have it, everything you need to know about the UK address verification process. It's good to know that there are alternatives if you can't provide some of the more common documents.

Check out Wise multi-currency account as a great way to manage your money while in the UK. This allows you to choose how to verify your identity and get started with a convenient and flexible account.

Sources:

- HSBC - Basic Bank Account Identification and Address Verification

- Barclays - identification for bank accounts

- Lloyds - ID

- Statrys - how to get proof of UK address

- NatWest - proof of identity and address

- Barclays - Brexit and EEA

- FCA - opening a bank account

VisaSales. Ru

Ru

Verifying your identity for a UK bank

When you apply to open a bank account, you will need to verify your identity. You usually also need to verify your address.

The bank must tell you what kind of identification you need to provide, such as a passport, driver's license, utility company statement or bill, or proof of tenancy or ownership of the property.

If you are unable to provide the documents required by the bank, you can ask if they will consider other documents in certain situations, for example: local authority

The bank is not required to accept these other forms of identification, but if it is not, you should ask the bank to explain why. You can complain to the bank if you are not satisfied with the way they deal with it. Learn more about how to file a complaint.

You can complain to the bank if you are not satisfied with the way they deal with it. Learn more about how to file a complaint.

The bank or building society will also check to see if you have been denied permission to stay in the UK. If you have been denied permission to stay, you will not be able to open a new current account or add your name to an existing one.

If you think you have been mistakenly denied a current account on these grounds, you can visit the website of the Ministry of the Interior, which has more information

If you are concerned that a bank or building society is not checking necessary under this immigration law, you can contact the bank.

Checking your financial history for a bank in the UK

The bank may want to see what other accounts you have and what your borrowings and repayments are. This check will be made on the basis of what is known as a credit report.

While it helps the bank understand your financial history, having too many checks on your credit report could affect your future applications.

Ask the bank if they will check your credit report as part of the application process and how.

VisaSales.Ru

Checklist for a bank account

When you open an account, the bank must provide you with basic information about how it will work, usually in conditions. If you are not sure about any of these details, please contact your bank for more information.

Interest rate

The bank must tell you the interest rate on your account and how and when it will be calculated.

UK Account Fees

All fees and charges for the normal operation of an account must be clearly stated - it is not enough for your bank to direct you to a website or posters at the branch.

Transaction details

Your bank must provide you with details of each transaction to and from your account. Depending on the type of account you have, you should be able to keep track of it through a passbook, monthly statement, online banking, telephone or mobile banking.

Making and receiving payments

You can make payments using your card, online banking, phone and/or mobile banking. Your bank should explain how to use each of the available payment methods and ensure they are secure.

The bank must also clearly understand what you need to do to authorize the payment. This can be a signature, online authorization or a PIN code.

Basic bank accounts in England

If you are not eligible to open a standard bank account, you will usually be able to open a basic bank account.

Basic bank account does not include an overdraft but should allow you to:

- pay money to

- withdraw money from account

- set up direct debit and credit transfers

- make card payments (in stores and online)

Basic bank accounts are offered by a number of UK banks and building societies. A list of those who are required by law to offer these accounts free of charge (apart from fees for using them overseas) can be found on the UK Treasury website.

Other banks may offer basic bank accounts, but these may not include all of the features of those listed by the Treasury or may include fees.

For complete information on access to basic bank accounts and eligibility requirements, please visit the Money Advice Service website.

https://wikivisa.ru

British student visas types and types of visas 2021-2022: UK student visas, British work visas, visitor visas, family visas, fiancé visa to England, student visas for courses, wife visa to England

WikiVisa.Ru

WikiVisa telegram channel https://t.me/wikivisa

me/wikivisa_chat

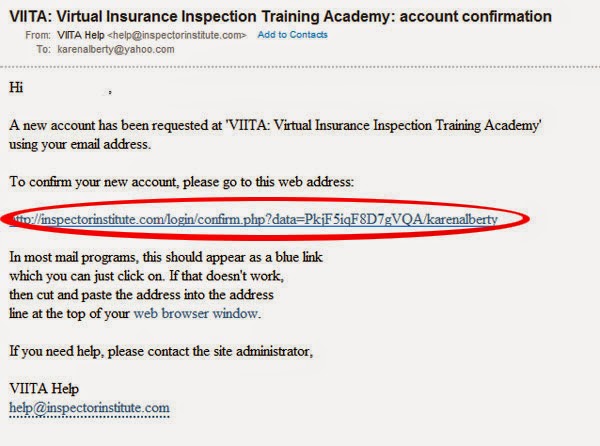

Registration on the public service portal and account confirmation

| Registration on the public service portal and account confirmation | |

| get a service on the portal of the State Service |

To get full access to electronic government services, you need a verified account on the State Services portal

STEP 1. REGISTRATION ON THE PORTAL

REGISTRATION ON THE PORTAL

1. On the State Services portal (gosuslugi.ru) click the "Register" button

2. In the registration form that appears, enter your last name, first name, mobile phone and email address, then click on the "Register" button

3. Wait for SMS with confirmation code

4. Enter the confirmation code received from the SMS and click "Continue" for

completion of registration

STEP 2. FILLING IN PERSONAL DATA

1. Log in to your personal account. After successful registration, the status of your account will be "Simplified"

2. Fill out the user profile - indicate your SNILS and the details of the identity document (passport of a citizen of the Russian Federation, for foreign citizens - a document of a foreign state)

3. Wait until the verification of your entered data is completed (the data is being verified by the Ministry of Internal Affairs of Russia and the Pension Fund of the Russian Federation), this may take from several hours to several days

Wait until the verification of your entered data is completed (the data is being verified by the Ministry of Internal Affairs of Russia and the Pension Fund of the Russian Federation), this may take from several hours to several days

Upon completion of the verification, a notification will be sent to your email address. In case of successful verification of your data, the status of your account will change from "Simplified" to "Standard"

Provided that you are a client of one of the banks - Sberbank, Tinkoff or Post Bank, you can register and (or) confirm your account in the web versions of Internet banks or mobile applications without the need to visit the MFC or service centers. If you are not a client of one of the banks - Sberbank, Tinkoff or Post Bank, you need to visit the MFC or service center to confirm your account.

STEP 3. IDENTITY CONFIRMATION THROUGH Post Bank.

1. On the main page of the "Post Bank" application, click the "Pay and transfer" button

On the main page of the "Post Bank" application, click the "Pay and transfer" button

2. From the list of services and providers, select "Public Services"

3. Click "Government Services Account Verification"

4. In the form that appears, enter your SNILS and click "Confirm"

5. Wait for the confirmation code (will come in the form of an SMS or Push notification)

6. Indicate the received confirmation code in the line "Enter the confirmation code" and click "Confirm"

In case of technical problems, please contact the Post Bank hotline: 8-800-550-07-70 or the State Services portal hotline: 8 800 100-70-10.

ID CONFIRMATION THROUGH Sberbank

1. On the main page of the Sberbank application, select the Payments section

2. From the list, select the category "Registration for Public Services"

3.

, Rome, NY, from January 1 through July 3, 2016, and Amanda Jones is listed as her mother during that time.”

, Rome, NY, from January 1 through July 3, 2016, and Amanda Jones is listed as her mother during that time.”