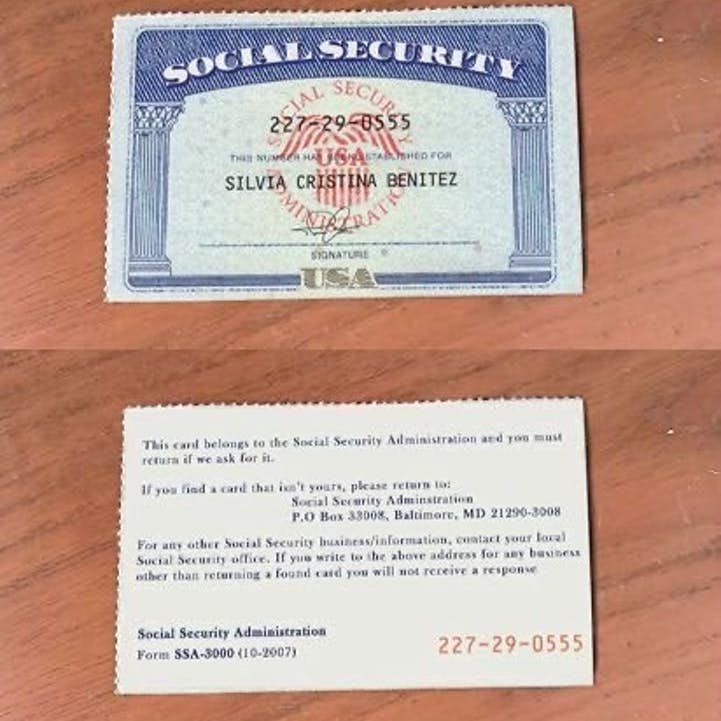

How to get a social security card for your child

How to Get a Social Security Number For Your Child

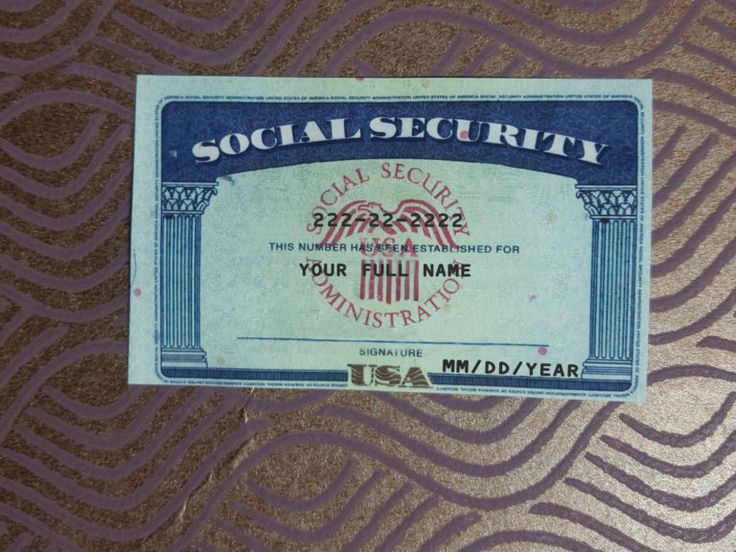

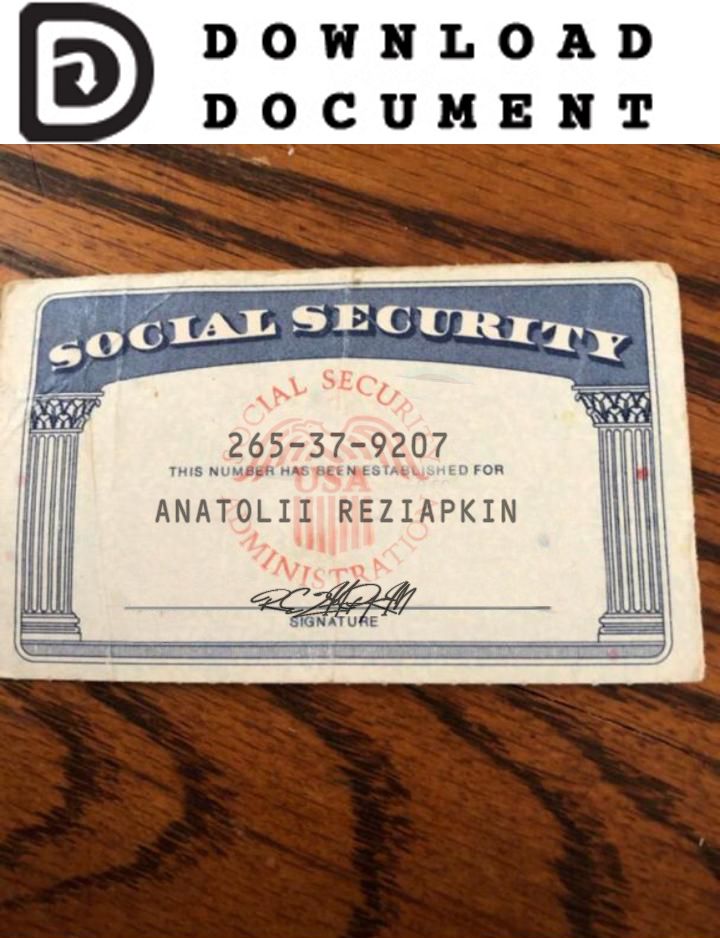

A Social Security number is the federal government's way of identifying your child. Your child will need a Social Security number in order for you to claim child-related tax breaks—such as the dependent exemption and the child tax credit—on your income taxes. You will also need the number to add your new baby to your health insurance plan, to set up a college savings plan or bank account for your child, or to apply for government benefits that could help your little one.

Here's how to get a Social Security number for your baby.

How to Apply for a Social Security Number

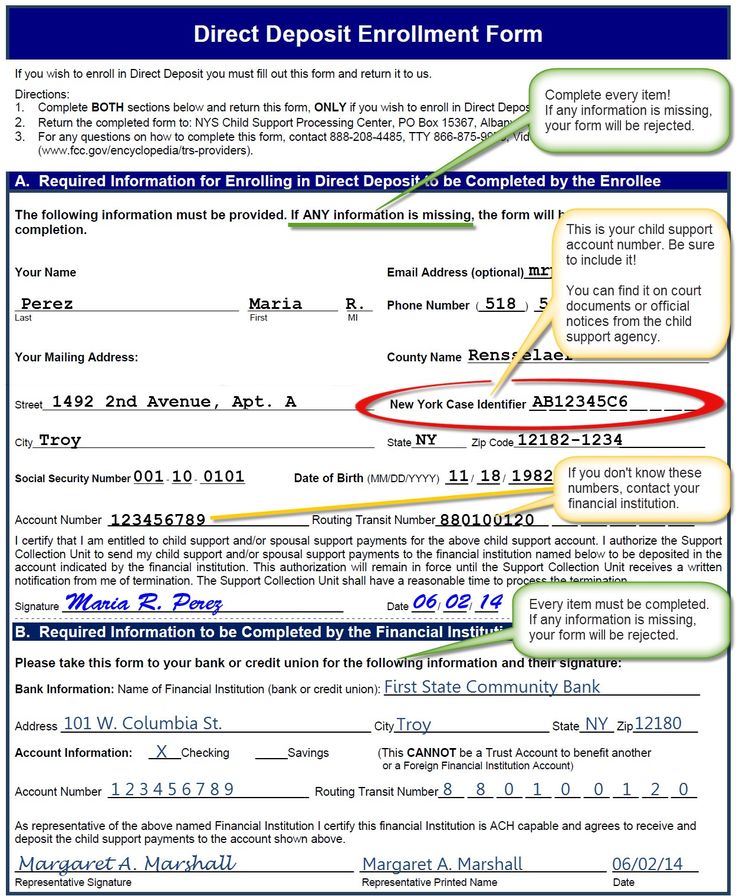

The easiest way to apply for a Social Security number for your child is to complete a birth registration form, which has a box you can check to request a number for your child. To complete the form, you will need to provide both parents' Social Security numbers.

For most new parents, it's easy to obtain the birth registration form, because hospitals usually distribute them while the mother is still a patient.

But if you didn't deliver your baby in the hospital or if for some other reason you were never given a birth registration form to complete, you can visit your local Social Security Administration (SSA) office and request a number in person. This process requires you to do three things:

- Complete Form SS-5 (Application for Social Security Number) and provide both parents' Social Security numbers on the form. To save time, download and complete Form SS-5 from the SSA website (www.socialsecurity.gov/online/ss-5.pdf) before you go.

- Provide at least two documents proving your baby's age, identity, and citizenship status. One document should ideally be your child's birth certificate. The other document can be your child's hospital birth record or other medical record.

- Provide proof of your own identity. Your driver's license and passport are both acceptable.

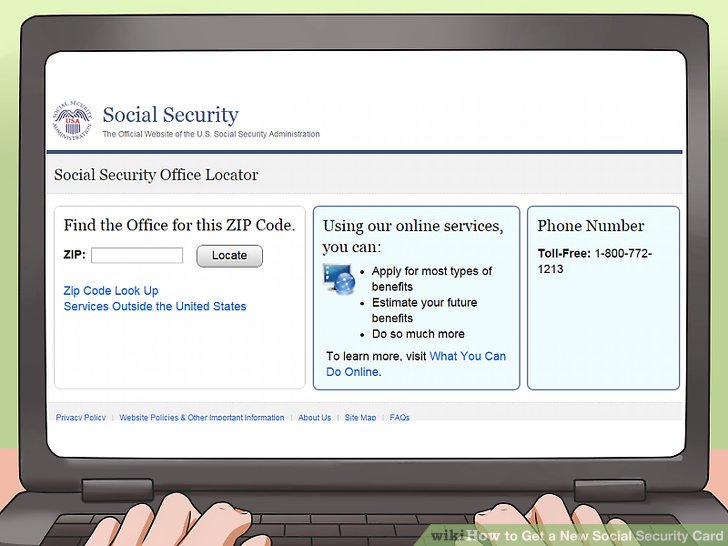

Find the SSA office nearest you by logging on to the SSA's Office Locator at www. socialsecurity.gov/locator. If you'd prefer, you can send in a completed Form SS-5 along with your identification documents to your local SSA office by mail. Most people apply in person, however, because you'll need to provide the SSA with originals or certified copies of all identification documents.

socialsecurity.gov/locator. If you'd prefer, you can send in a completed Form SS-5 along with your identification documents to your local SSA office by mail. Most people apply in person, however, because you'll need to provide the SSA with originals or certified copies of all identification documents.

Once you've submitted your application, you should receive a Social Security card in six to 12 weeks. It may take substantially longer to process your application if your child is one year of age or older, because the SSA will contact your state's department of vital statistics to confirm that the birth certificate you have provided is valid.

If You Are Adopting a Child

If the child you are adopting is a United States citizen, your child may have a Social Security number already. But if you are adopting domestically and your child does not have one, you can obtain an Adoption Taxpayer Identification Number (ATIN) to claim child-related tax breaks while your child's adoption is pending. To apply for one, complete IRS Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions. The ATIN will be valid for only two years, at which point you can extend it if your child's adoption is still not final. Once the adoption is final, you must stop using the ATIN and get a Social Security number for your child following the process described above.

To apply for one, complete IRS Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions. The ATIN will be valid for only two years, at which point you can extend it if your child's adoption is still not final. Once the adoption is final, you must stop using the ATIN and get a Social Security number for your child following the process described above.

If you are adopting a child from another country, you will have to wait until the adoption is final and your child has entered the United States before you can obtain a Social Security number for your child. Once that happens, you can use the process described above.

To Learn More

To find out more about child-related tax breaks, see Tax Breaks Every Parent Should Know About.

Social Security Card for Newborn

Classes & EventsNewsGet

UpdatesDonate

Your New Baby

- Conditions & Treatments

- Maternity

- Your New Baby

- Social Security Card

The physicians and team members at Atlantic Health System Maternity Centers are committed to helping expectant parents safely and comfortably welcome their newborns while COVID-19 is in our communities. Read COVID-19 FAQs and a message for expectant parents>

Read COVID-19 FAQs and a message for expectant parents>

You can apply for a Social Security number for your baby when you apply for your baby’s birth certificate. Just check the box on the birth certificate worksheet. The state agency that issues birth certificates will share your child’s information with Social Security, and they will mail the Social Security card to you. This process will take approximately six to eight weeks. If you cannot wait that long, please call the Social Security Office at 1-800-772-1213.

You can also apply at any Social Security office. If you wait to apply until after you leave the hospital, you must provide evidence of your child’s age, identity and U.S. citizenship status, as well as proof of your identity. Social Security must verify your child’s birth record, which can add up to 12 weeks to the time it takes to issue a card. To verify a birth record, Social Security will contact the office that issued it.

-

Chilton Medical Center

-

Maternity Center

- 97 West Parkway

Pompton Plains, NJ 07444 - 973-831-5122

- 97 West Parkway

-

Morristown Medical Center

-

Maternity Center

- 100 Madison Avenue

Morristown, NJ 07960 - 973-971-5290

- To register: 973-971-5732

- 100 Madison Avenue

-

Newton Medical Center

-

Maternity Center

- 175 High Street

Newton, NJ 07860 - 973-579-8555

- 175 High Street

-

Overlook Medical Center

-

Maternity Center

- 99 Beauvoir Avenue

Summit, NJ 07901 - 908-522-4838

- To register: 908-522-2304

- 99 Beauvoir Avenue

Related Links

- Social Security

- Social Security

European Health Insurance Card | Health Insurance Fund

Don't forget to take your European Health Insurance Card with you when you travel. It will help you in case of health problems during your stay abroad. By issuing a European Health Insurance Card, persons insured by the Estonian Health Insurance Fund receive the necessary medical care in the countries of the European Union, as well as in Liechtenstein, Norway, Iceland and Switzerland on equal terms with insured persons residing in these countries. nine0003

It will help you in case of health problems during your stay abroad. By issuing a European Health Insurance Card, persons insured by the Estonian Health Insurance Fund receive the necessary medical care in the countries of the European Union, as well as in Liechtenstein, Norway, Iceland and Switzerland on equal terms with insured persons residing in these countries. nine0003

- You can order the European Health Insurance Card or its replacement certificate here

Necessary medical care is the treatment of an unexpected health problem that occurred during a stay in a Member State of the European Union. The necessary medical care must be medically justified and the doctor must take into account the expected length of stay in the country and the nature of the medical service. Such situations include, for example, high fever, abdominal pain, heart attack or injuries following an accident. nine0003

Necessary medical care also includes visits related to pregnancy, as well as childbirth in another country for family reasons or in an emergency. It also includes medical services needed by patients with chronic diseases - such as kidney dialysis, oxygen treatment, special treatment for asthma, echocardiography in case of chronic autoimmune diseases, chemotherapy. It is up to the doctor to decide whether exactly the necessary medical care is provided. European Health Insurance Card options are not available for those traveling to another country for medical treatment. nine0003

It also includes medical services needed by patients with chronic diseases - such as kidney dialysis, oxygen treatment, special treatment for asthma, echocardiography in case of chronic autoimmune diseases, chemotherapy. It is up to the doctor to decide whether exactly the necessary medical care is provided. European Health Insurance Card options are not available for those traveling to another country for medical treatment. nine0003

In order to receive medical care, you must present your European Health Insurance Card or its replacement certificate, as well as an identity document, at the medical institution. The right to receive medical services on the basis of the European Health Insurance Card can only be used in those medical institutions that are included in the national health insurance system of the country. It is up to the doctor to decide whether the necessary medical care is available. nine0007

NB! Please note that the European Health Insurance Card does not cover all costs associated with the provision of necessary medical care. The patient must cover the costs of mandatory self-financing fees (visit fee, bed-day fee, self-financing share of the purchase of medicines, etc.), in the amount established in the country of residence. The health insurance card does not cover international travel expenses or private doctor expenses. When going on a trip, we also recommend concluding a travel insurance contract with a private health insurance company, which, depending on the insurance conditions, compensates for the expenses incurred by the client himself. nine0003

The patient must cover the costs of mandatory self-financing fees (visit fee, bed-day fee, self-financing share of the purchase of medicines, etc.), in the amount established in the country of residence. The health insurance card does not cover international travel expenses or private doctor expenses. When going on a trip, we also recommend concluding a travel insurance contract with a private health insurance company, which, depending on the insurance conditions, compensates for the expenses incurred by the client himself. nine0003

The European Health Insurance Card can be applied for at the Health Insurance Fund and can be received within 10 days from the date of application. We therefore recommend that you order your European Health Insurance Card at the right time before your trip. The European Health Insurance Card can be ordered if the card recipient's health insurance is valid for at least three months.

What should you do if you are in a Member State of the European Union and you have an unexpected need for medical care, but do not have your European Health Insurance Card with you? nine0007

In this case, you can order a replacement certificate from the Health Insurance Fund.

To obtain a replacement certificate, you have the following options:

- via the State Portal eesti.ee, order section of the European Health Insurance Card

- send an application to info [at] haigekassa.ee. In the application submitted by e-mail, it is necessary to indicate personal data (personal code, name) and a contact telephone number.

- call the helpline +372 6696630 Mon - Thu 8.30-16.30; Fri 8.30-14.00.

The certificate ordered from the State Portal will be sent to your State Portal mailbox.

Substitute certificate ordered by e-mail or by phone can be received on request or by post or mail.

With the European Health Insurance Card or its replacement certificate, you can get the necessary medical care in the following countries:

Austria, Belgium, Bulgaria, Spain, Holland, Croatia, Ireland, Iceland, Italy, Greece, Cyprus, Lithuania, Liechtenstein, Luxembourg, Latvia, Malta, Norway, Poland, France, Portugal, Sweden, Romania, Germany, Slovakia , Slovenia, Finland, UK, Switzerland, Denmark, Czech Republic, Hungary.

How to apply for a card?

You can only apply for the European Health Insurance Card and its replacement certificate if you have valid health insurance from the Health Insurance Fund. nine0003

You can apply:

- through the state portal www.eesti.ee;

- by sending an application with a digital signature by e-mail to info [at] haigekassa.ee.

- by sending an application by post to Lastekodu 48, Tallinn 10113.

The application form is available on the website of the Health Insurance Fund.

The European Health Insurance Card can be ordered either by a simple letter to the address of your choice or to the address in the population register. nine0007

A person who is at least 15 years of age can apply for the European Health Insurance Card. A parent or representative of the child may also apply for a card for a child under the age of 19. The card can be ordered for a person's legal representative by submitting a digitally signed application or a paper application form to the Health Insurance Fund. The application must be accompanied by a document confirming the right of representation.

The application must be accompanied by a document confirming the right of representation.

For persons under the age of 19, a health insurance card is issued with a validity period of 5 years, but no more than until the end of the health insurance. Person over the age of 19years, a health insurance card is issued with a validity period of 3 years.

PLEASE NOTE!

Non-EU citizens and stateless persons cannot use the European Health Insurance Card for treatment in Denmark, Iceland, Liechtenstein, Norway or Switzerland. Before starting a trip, we recommend that you conclude a health insurance contract with private travel companies.

STATE INSTITUTION - LENINGRAD REGIONAL BRANCH OF THE SOCIAL INSURANCE FUND OF THE RUSSIAN FEDERATION

REMINDER ON COMPLETING ELECTRONIC REGISTERS AND INFORMATION ABOUT THE INSURED PERSON (EMPLOYEE)

the moment of occurrence of the insured event in accordance with the identity document. Do not forget about the period for replacing a passport at 20 and 45 years. nine0008

Do not forget about the period for replacing a passport at 20 and 45 years. nine0008

09.2020 No. 925n).

09.2020 No. 925n).

nine0008

nine0008  1 of Art. 14 of Law No. 255-FZ. nine0008

1 of Art. 14 of Law No. 255-FZ. nine0008  " nine0008

" nine0008