How to find social security number for child

Social Security Card for Newborn

Classes & EventsNewsGet

UpdatesDonate

Your New Baby

- Conditions & Treatments

- Maternity

- Your New Baby

- Social Security Card

The physicians and team members at Atlantic Health System Maternity Centers are committed to helping expectant parents safely and comfortably welcome their newborns while COVID-19 is in our communities. Read COVID-19 FAQs and a message for expectant parents>

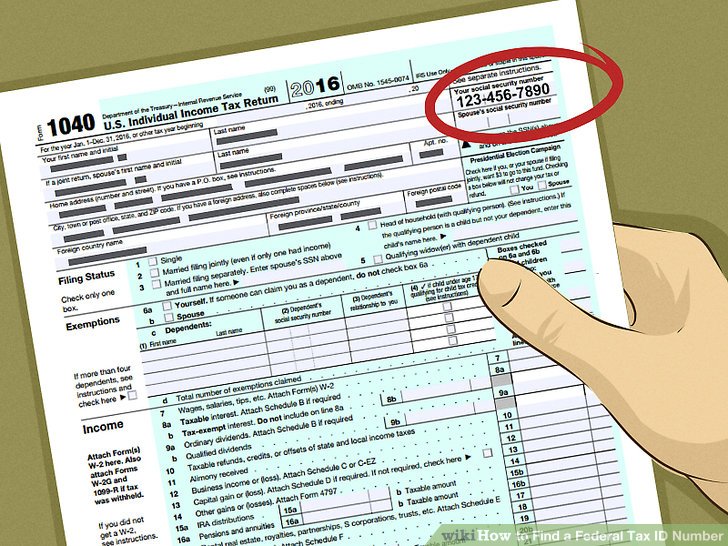

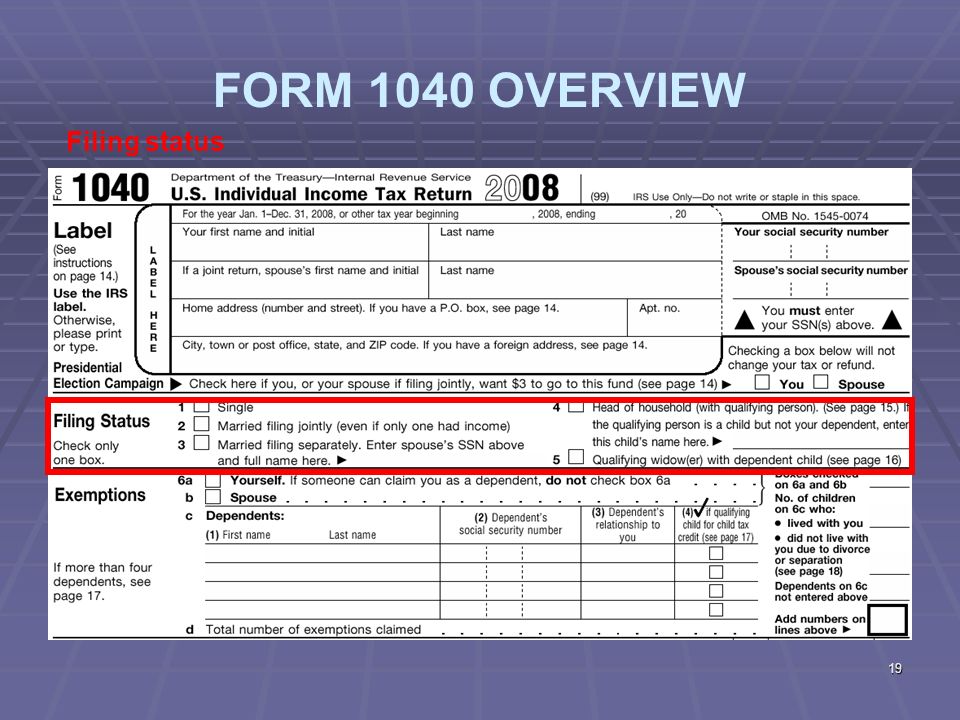

You can apply for a Social Security number for your baby when you apply for your baby’s birth certificate. Just check the box on the birth certificate worksheet. The state agency that issues birth certificates will share your child’s information with Social Security, and they will mail the Social Security card to you. This process will take approximately six to eight weeks. If you cannot wait that long, please call the Social Security Office at 1-800-772-1213.

You can also apply at any Social Security office. If you wait to apply until after you leave the hospital, you must provide evidence of your child’s age, identity and U.S. citizenship status, as well as proof of your identity. Social Security must verify your child’s birth record, which can add up to 12 weeks to the time it takes to issue a card. To verify a birth record, Social Security will contact the office that issued it.

-

Chilton Medical Center

-

Maternity Center

- 97 West Parkway

Pompton Plains, NJ 07444 - 973-831-5122

- 97 West Parkway

-

Morristown Medical Center

-

Maternity Center

- 100 Madison Avenue

Morristown, NJ 07960 - 973-971-5290

- To register: 973-971-5732

- 100 Madison Avenue

-

Newton Medical Center

-

Maternity Center

- 175 High Street

Newton, NJ 07860 - 973-579-8555

- 175 High Street

-

Overlook Medical Center

-

Maternity Center

- 99 Beauvoir Avenue

Summit, NJ 07901 - 908-522-4838

- To register: 908-522-2304

- 99 Beauvoir Avenue

Related Links

- Social Security

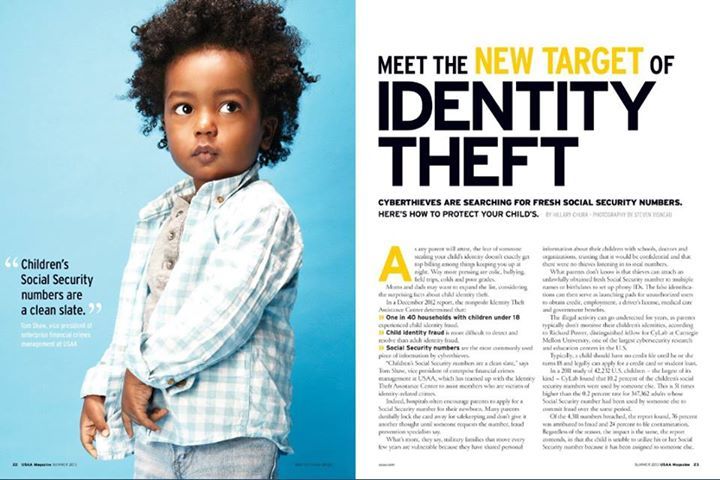

How To Protect Your Child From Identity Theft

Learn what child identity theft is, how to detect it, how to protect your child’s personal information, and what to do if someone steals your child’s identity.

- What Is Child Identity Theft?

- How To Protect Your Child’s Personal Information

- How To Know if Someone Is Using Your Child’s Personal Information

- What To Do if Someone Is Using Your Child’s Personal Information

What Is Child Identity Theft?

Child identity theft happens when someone takes a child’s sensitive personal information and uses it to get services or benefits, or to commit fraud. They might use your child’s Social Security number, name and address, or date of birth. They could use the stolen information to

- apply for government benefits, like health care coverage or nutrition assistance

- open a bank or credit card account

- apply for a loan

- sign up for a utility service, like water or electricity

- rent a place to live

How To Protect Your Child’s Personal Information

Here’s what you can do to protect your child from identity theft.

Ask questions before giving anyone your child’s Social Security number

If your child’s school asks for your child’s Social Security number, ask these questions:

- Why do you need it?

- How will you protect it?

- Can you use a different identifier?

- Can you use just the last four digits of the Social Security number?

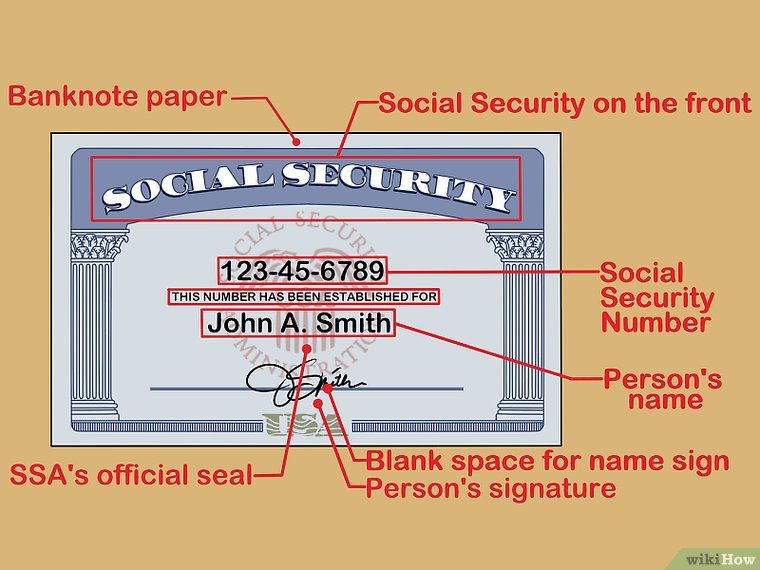

Protect documents with personal information

If you have documents with your child’s personal information, like medical bills or their Social Security card, keep them in a safe place, like a locked file cabinet.

When you decide to get rid of those documents, shred them before you throw them away. If you don’t have a shredder, look for a local shred day.

Delete personal information before disposing of a computer or cell phone

Your computer and phone might contain personal information about your child. Find out how to delete that information before you get rid of a computer or a cell phone.

How To Know if Someone Is Using Your Child’s Personal Information

In addition to taking steps to safeguard your child’s personal information, keep an eye out for warning signs that someone is using your child’s personal information. Here are a few:

- You’re denied government benefits (like health care coverage or nutrition assistance) because someone is already using your child’s Social Security number to get those benefits.

- Someone calls you and says your child has an overdue bill, but it’s not an account you opened for the child.

- You get a letter from the IRS that says your child didn’t pay income taxes.

This could happen if someone used your child’s Social Security number on tax forms for a new job.

This could happen if someone used your child’s Social Security number on tax forms for a new job. - You’re denied a student loan because your child has bad credit. This could happen if someone used your child’s Social Security number to get a credit card, open a cell phone account, or set up a utility service and has not paid the bills on time or at all.

Signs of Child Identity Theft

- Turned down for government benefits

- Calls about bills in your child’s name

- Letter from the IRS about taxes your child owes

- Child’s student loan application is denied

Check if your child has a credit report

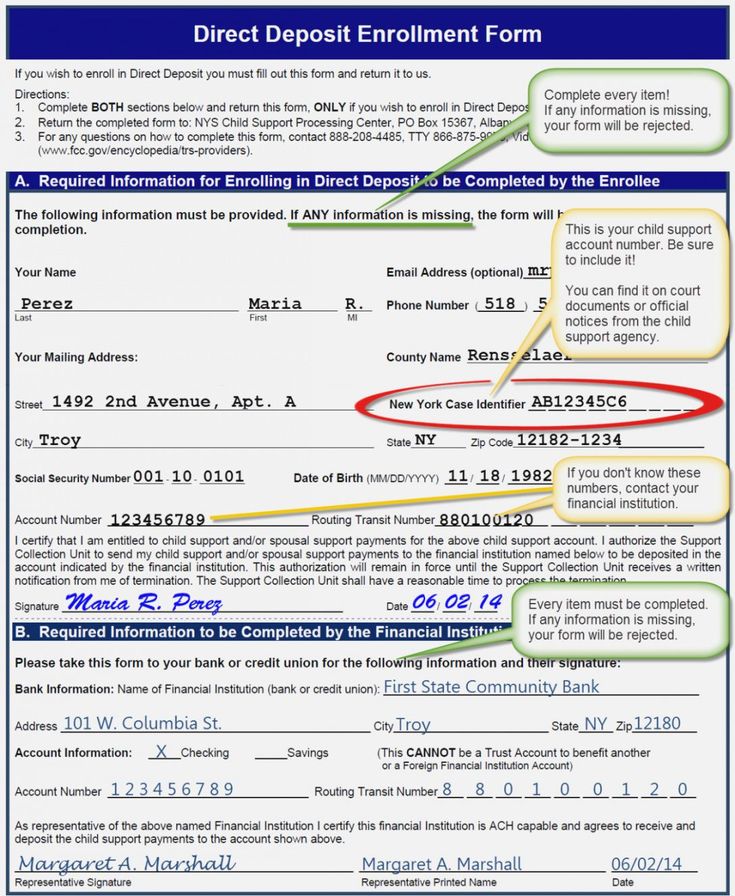

Generally, a child under 18 won’t have a credit report unless someone is using his or her information for fraud. A good way to find out if someone is using your child’s information to commit fraud is to check if your child has a credit report. To do that, contact the three credit bureaus (find their contact information at IdentityTheft. gov) and ask for a manual search for your child's Social Security number. You may have to give the credit bureaus a copy of

gov) and ask for a manual search for your child's Social Security number. You may have to give the credit bureaus a copy of

- your driver’s license or other government-issued identification card

- proof of your address, like a utility bill, or a credit card or insurance statement

- your child’s birth certificate

- your child’s Social Security card

If you’re not the child’s parent, you may have to give the credit bureaus a copy of documents that prove you are the child’s legal guardian.

When Your Child Turns 16

When your child turns 16, you may want to check if there’s a credit report in his or her name. This could help you spot identity theft, since children under 18 usually don’t have a credit report. If there’s inaccurate information in your child’s credit report, you’ll have time to correct it before he or she applies for a job, a college loan, a car loan, or a credit card, or tries to rent a place to live.

What To Do if Someone Is Using Your Child’s Personal Information

If you discover that someone is using your child’s personal information, here’s what to do right away:

Step 1: Report and close the fraudulent accounts

Contact the companies where fraud happened. Tell each company’s fraud department that someone opened an account using your child’s information, and ask them to close the account. Ask for written confirmation that says that your child isn’t responsible for the account.

Contact the three credit bureaus. Tell each credit bureau that someone opened an account using your child’s information. Ask them to remove any fraudulent accounts from your child’s credit report.

Step 2: Freeze your child’s credit report

If your child is under 16, you can request a free credit freeze, also known as a security freeze, to make it harder for someone to open new accounts in your child's name. The freeze stays in place until you tell the credit bureaus to remove it. (Minors who are 16 or 17 can request and remove a security freeze themselves.)

(Minors who are 16 or 17 can request and remove a security freeze themselves.)

To activate a credit freeze, contact each of the three credit bureaus. Find their contact information at IdentityTheft.gov.

Step 3: Report child identity theft

Report the child identity theft to the Federal Trade Commission at IdentityTheft.gov. Include as many details as possible.

Child Identity Theft - What to Know, What to Do

This brochure for parents explains what child identity theft is and what to do if it happens to your child.

Order free copies

What to do if a Social Security Number (SSN) is provided

If your Social Security number is in a breach or leak, it's important to act quickly to prevent more damage being done to attackers.

Tip: As you progress through this process, it is a good idea to keep documentation of any steps you take, call, fill out forms, or emails you send. If you need to poke fun at fraudulent payments or activities, having these records can help smooth the job by claiming you're dealing with actual identity theft.

An ID that has your social security number and other personal information can do a number of things with it, including:

-

Open new credit accounts, such as credit cards or car loans, in your name

-

Request a refund of taxes that are rightfully yours

-

Create a dummy identity to receive a job, department, or other services

-

Request fraudulent benefits in name

-

Receive benefits such as healthcare while pretending to be you

-

Create a bogus identity to decipher other people or capture other activities in your name

The first step is to post a temporary fraud alert on loan

Also known as an "Initial Security Alert", this alerts major credit providers that you have caused identity theft. If a business attempts to verify your credit, it is notified that a fraud alert has been placed on the account and that it must verify the identity of anyone attempting to open an account or obtain credit with a social security number.

You can place a temporary fraud alert on your account, it does not affect your credit score, and the temporary fraud alert will automatically expire after 1 year, although you can cancel earlier if necessary.

You want to do this right away to reduce the ability to open new accounts in your name.

Posting a Temporary Fraud Alert on Account

Go to the website of any of the three main credit windows and select that you want to add a fraud alert.

Note: This only needs to be done in one credit office. Once you place a fraud alert in any of the three controls, they automatically notify the other two.

-

Experian

-

TransUnion

-

Equivalence

Temporary fraud alert does not require a reason or any documentation other than proof of identity.

Removing a fraud alert is a little more difficult than placing one. To display an alert, you need to contact all three of them, and each of them will need to verify your identity. In most cases, it's probably easier to just let the alert expire after one year.

Extended Fraud Alert does the same thing as Temporary Fraud Alert, just for a longer period of time. It usually stays active for 7 years unless you cancel it sooner.

Also, getting an extended alert is a bit more difficult than a temporary one. It usually requires a policy report showing that you have been the target of identity theft.

This does not prevent the consolidation of the loan, but complicates it. Any business that has been shown how to open an account in your name must take additional steps to verify the identity of the user opening the account. This means that you can still open accounts. You just need to take a few extra steps to confirm that you are the person you claim to be.

Any business that has been shown how to open an account in your name must take additional steps to verify the identity of the user opening the account. This means that you can still open accounts. You just need to take a few extra steps to confirm that you are the person you claim to be.

You could also open fraudulent accounts, but impersonation would require more effort.

Second step. Getting a copy of the credit report

Under US federal law, you are entitled to a free copy of your credit report every 12 months from each of the three credit report companies. To request a free copy of your credit report, go to https://annualcreditreport.com. It usually takes only a minute or two to get a report that you can save or print, so you can study it carefully.

Tip: You can request up to 3 copies of your credit report, but we recommend that you request only 1 first. Federal law allows you to receive 3 copies per year, and you will need to review your credit report once or twice in the coming weeks or months to see if new items have appeared.

When you check your credit report, you first look for any unfamiliar accounts or activities. These could be credit cards you didn't recognize, or loans for cars or properties you never applied for.

If you find unrecognized accounts

Fraud alert escalation before loan freeze

If there is fraudulent activity on your credit report, this means that scammers are trying to use your social security number to come in and secure your credit report. This will make it much harder for them to inflict any additional damage.

For more information about placing a credit freeze, see "Placing a Credit Freeze".

Report it to Federal Trade Commission (FTC)

If you have fraudulent activity in your name, the FTC wants to know about it. Go to https://IdentityTheft.gov and follow the steps to report fraudulent activity.

Go to https://IdentityTheft.gov and follow the steps to report fraudulent activity.

Contact companies with fraudulent accounts

Contact companies for accounts you don't recognize. Let them know that you have been the target of identity theft and suspect that the account is fraudulent. Find out when and how an account was opened, what information they can provide, when and how it was used. This information will be useful when creating a policy report.

Tips:

-

Always remember that the company you contacted does not understand that the account is fraudulent and they are almost as interested in resolving this problem as you are. They are unlikely to get paid for a fraudulent account.

-

If they're having trouble resolving fraudulent accounts, ask if it would make things easier if you have a policy report.

If they agree that this is the case, write them down so you can refer back to them after step 3 (create a policy report).

If they agree that this is the case, write them down so you can refer back to them after step 3 (create a policy report).

Third step - generating a policy report

Even if you think a politician is unlikely to reveal his identity, it is still important to file a policy report to establish an official record of identity theft.

Contact your local policy department and let them know that your identity has been stolen and that you want to generate a report. They should give you a copy of the report when it's done, but if it's not offered to you, be sure to ask for it. This is an important tool to fix this problem and protect against any future fraudulent activities.

Fourth step. Submitting a Complaint to the Internet Attack Complaint Center

Internet Crime Complaint Center (IC3) is a division of the Federal Crisis Division (CEO) that handles reports of online theft such as identity theft. When filing a complaint, they may share this information with other relevant law enforcement agencies.

When filing a complaint, they may share this information with other relevant law enforcement agencies.

To file a complaint, go to https://www.ic3.gov.

Tip: Sometimes it's not very convenient to fill out so many reports, but if attackers open fraudulent accounts or work with your SSN that you need to work with, it can be very useful to show that you have submitted reports to all relevant authorities.

Fifth step. Internal Revenue Service (IRS) Notice

It is now common for scammers to file false tax refunds with a Social Security number and claim the tax refund themselves. There are two things you can do to reduce the risk of this. The first is as early as possible in the tax file, and the second is for iRS to know that your social security number has been stolen.

You will want to complete and complete Form 14039. This is a short form and will likely take no more than a minute or two to complete. Start here: https://www.irs.gov/individuals/how-irs-id-theft-victim-assistance-works

Start here: https://www.irs.gov/individuals/how-irs-id-theft-victim-assistance-works

This alerts the IRS to any suspicious tax claims with a social security number, and if a bogus tax refund is filed in your name, it will be easier for you to protest and clear it.

Obtain a PIN from the IRS website.

The IRS offers a free six-digit identity protection PIN that can be obtained through the website. When submitting tax returns, you must provide this PIN (which only you and the IRS should know) for identity verification. This makes it much more difficult to send tax refunds in your name, because even if he has your social security number, he does not need to have a pin number.

To get a PIN, simply go to https://www.irs.gov/identity-theft-fraud-scams/get-an-identity-protection-pin. You will need to go through a short identity verification process and then you will receive a PIN.

It is not recommended to do this ahead of time, just to limit the damage that attackers can do later.

Moving on

Unfortunately, once your SSN already exists, attackers can use it at any time, so it pays to take some reasonable steps to protect itself from future problems.

Filing taxes

Sometimes scams spoof fake tax refunds with the name and social security number of an unintentional person, and then they request a tax refund associated with that person. When a real user later submits their taxes, they will have to go through a complex process to get a refund that would be the right way.

To reduce the risk of this, try filing your tax return as early as possible. If your legitimate return reaches the IRS before the fraudulent data is returned, it will be the scammers, not you.

Monitor credit rating

Unexpected changes in credit score may indicate unauthorized activity using a social security number. Most banks and credit card companies these days offer you a credit score as an additional metric for doing business with them. Log in to the website and write down your rating.

Most banks and credit card companies these days offer you a credit score as an additional metric for doing business with them. Log in to the website and write down your rating.

Small changes a few dots up or down are common, but if they suddenly change or suddenly stop working, you should get a new copy of your credit report to find out why it has changed.

View Social Security Application

One of the actions of attackers with a stolen social security number is to set a false name. This often happens if the attacker is not allowed to receive the job using their real identity, or if they are not allowed by US law.

Advice: It's also possible that someone is working under your social security number as an obvious mistake. They just wrongly influenced their social security number or overwritten several numbers and accidentally assigned their number to your employer.

If they are doing an assignment using your SSN, their employee must report their income to the Social Security Administration (SSA) and that income will appear on your Social Security application. Go to https://www.ssa.gov/myaccount/ and sign in (or create) a free account to check your Social Security claim. Creating an account can be a bit of a process, but after creating an account, it only takes a few seconds to view your social security application online.

All instructions show that you have earned total annual profit for a particular year, but if the displayed profit is significantly greater than what you know you have earned that year, this is probably good enough to contact SSA and investigate further. He takes identity theft seriously and is happy to work with you.

Check your Social Security application every year to make sure everything looks right.

Tip: If reported income looks too low, that's something else to look into. The income reported by your employees is a factor in the amount of Social Security payments you make on deregistration to make sure you get what you need.

The income reported by your employees is a factor in the amount of Social Security payments you make on deregistration to make sure you get what you need.

Keep checking this credit report

Even if everything looks fine, it's a good idea to go to https://annualcreditreport.com every few months and request another copy of your credit report to make sure everything still looks the way it should.

Yes, you can, but it's a rather complicated process that requires you to personally apply at the Social Security office and provide a valid reason for changing your Social Security number. Identity theft is considered a valid reason, but only if the theft results in persistent and persistent problems and you need to provide documentation to support your claim. You will also be asked to provide proof of your age and child status (such as a birth certificate).

If you receive a new number, the old number is not deleted. The new number is connected to the old number, which will often result in background checks, which can lead to additional questions.

The new number is connected to the old number, which will often result in background checks, which can lead to additional questions.

If you have been issued a new number, you need to make sure that your administrator correctly displays the income information for the new SSN.

Additional information

Online Identity Theft Protection

The danger of over-disclosure

Microsoft security help and training

Social Security in the European Union

You are here

Home Social Security in the E...

In order for a person in the EU to freely choose the state of residence and the state of place of work, he must be provided with social protection. For example, the right to receive free medical care, compensation and benefits, as well as pensions.

By applying the laws of only one state, this cannot always be ensured. Therefore, the EU has adopted rules for the coordination of social insurance systems. They are set out in Regulation (EC) 883/2004 of the European Parliament and of the Council and Regulation (EC) 987/2009 implementing it.

Therefore, the EU has adopted rules for the coordination of social insurance systems. They are set out in Regulation (EC) 883/2004 of the European Parliament and of the Council and Regulation (EC) 987/2009 implementing it.

The Coordination Rules apply to the European Economic Area (EEA) – ie all EU Member States, Norway, Liechtenstein, Iceland and Switzerland. The rules apply to citizens of all EU Member States and to non-citizens legally residing in the European Union.

NB! A non-EU citizen (third country citizen) legally residing in the territory of the European Union

cannot stay in the Estonian insurance system on the basis of an A1 certificate if they go to work:

to Norway, Iceland, Liechtenstein, Switzerland, Denmark, UK.

Regulation (EC) no. 1231/2010, which extends regulation (EC) no. 883/2004 for third-country nationals does not apply to countries outside the European Union.

If a person, when applying for a job in these countries, wishes to have Estonian social insurance valid, he must apply to the country providing the job for permission, the relevant legislation and the possibilities of this country, to make exceptions allowing him to leave the social Estonian insurance.

Exceptions to the general rules

Posting and work/activity as a FIE in two or more countries

If a person is associated with more than one EU Member State due to work or activity as a sole proprietor (FIE), an A1 certificate must be applied for to determine which country's social insurance applies to him.

A business trip is a temporary assignment of an employee to a foreign state for a period of up to 24 months. During the posting, the employee must pay the social insurance payments prescribed by the laws of the state from which he is posted, and the employee will continue to be covered by the health insurance, pension insurance and unemployment insurance of his state of residence. This is valid provided that the expected duration of employment does not exceed 24 months and that the employee is not sent to replace another employee.

The same rules apply to a FIE that is sent to carry out its main activity in another EU Member State, provided that the expected duration of this activity does not exceed 24 months.

Multi-country work

is considered to be a situation in which the employee usually works in two or more EU Member States. This applies both to persons who work for the benefit of their employer in the territory of more than one EU Member State, and to persons who simultaneously have more than one valid employment contract in several EU Member States.

In determining the insuring state, the decisive factor will be where a significant part of the worker's activity takes place.

Also in the case of an FIE, which usually operates simultaneously or alternately in two or more Member States, the decisive factor in determining the insuring State will be where a significant part of its activities or its center of interest is located. If a significant part of its activities takes place in the country of residence , the social insurance scheme of the state in the place of residence is applied. If the FIE does not substantially operate in its country of residence, it is subject to the social insurance scheme of the EU Member State in which its center of interest is located .

Simultaneous work for wages and activity as an FIE in different countries

Social insurance applies to a person who usually works for a salary and acts as an FIE in different countries states at the place of work for a salary of .

Civil servant who is also a paid employee or FIE

A person who is a civil servant in one EU Member State and works or acts as an FIE in another EU Member State is subject to the social insurance of that state, of which he is a civil servant.

Social insurance for contract workers of the European Communities

A contract worker of the European Communities can choose which country's social insurance system will apply to him:

- the social insurance system of the EU Member State in whose territory he works;

- the social security system of the EU Member State last applied to him; or

- the social security system of the Member State of which he is a citizen.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/3419302/Screen_Shot_2015-02-17_at_2.45.02_PM.0.png)